Global Smart Weapons Market

Market Size in USD Billion

CAGR :

%

USD

17.82 Billion

USD

28.62 Billion

2025

2033

USD

17.82 Billion

USD

28.62 Billion

2025

2033

| 2026 –2033 | |

| USD 17.82 Billion | |

| USD 28.62 Billion | |

|

|

|

|

Smart Weapons Market Size

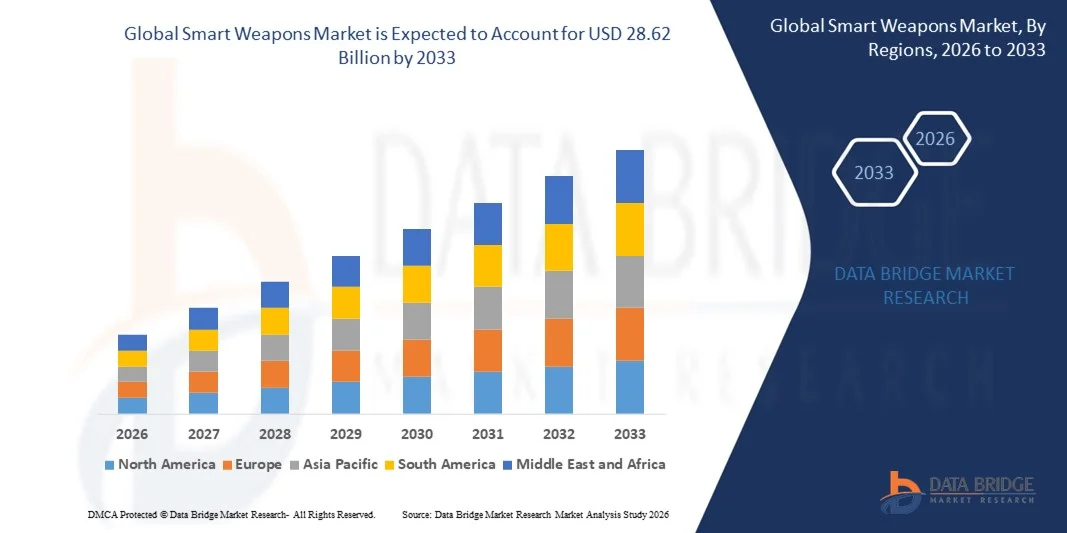

- The global smart weapons market size was valued at USD 17.82 billion in 2025 and is expected to reach USD 28.62 billion by 2033, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled by increasing defense modernization programs, rising adoption of autonomous and precision-guided weapon systems, and advancements in AI and sensor technologies, which are enhancing operational efficiency and accuracy on the battlefield

- Furthermore, growing global security concerns, the need for rapid response capabilities, and rising defense budgets in both developed and emerging economies are driving investment in smart weapons. These converging factors are accelerating the deployment of advanced weapon systems, thereby significantly boosting the industry’s growth

Smart Weapons Market Analysis

- Smart weapons, including precision-guided munitions, autonomous combat systems, and AI-enabled drones, are increasingly vital for modern military operations due to their enhanced accuracy, reduced collateral damage, and ability to integrate with advanced command-and-control networks

- The escalating demand for smart weapons is primarily fueled by global defense modernization initiatives, technological advancements in autonomous and guided systems, and the strategic focus on improving combat readiness and operational effectiveness

- North America dominated the smart weapons market with a share of 39.6% in 2025, due to the region’s strong defense budgets, technological advancements, and continuous modernization of military arsenals

- Asia-Pacific is expected to be the fastest growing region in the smart weapons market during the forecast period due to rising defense budgets, regional tensions, and modernization initiatives in countries such as China, India, and Japan

- Air segment dominated the market with a market share of 47.1% in 2025, due to the extensive use of airborne smart weapons for strategic strikes, surveillance, and rapid deployment operations. Air-launched weapons offer operational flexibility, enhanced targeting precision, and the ability to engage enemy assets in contested zones while minimizing risk to personnel

Report Scope and Smart Weapons Market Segmentation

|

Attributes |

Smart Weapons Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Smart Weapons Market Trends

Adoption of Autonomous and Precision-Guided Weapons

- A significant trend in the smart weapons market is the rising adoption of autonomous systems and precision-guided munitions, driven by the need for higher accuracy, reduced collateral damage, and enhanced operational efficiency in modern military operations. These weapons are becoming critical for national defense strategies and are increasingly integrated into advanced combat platforms, including aerial, naval, and land-based systems

- For instance, Lockheed Martin and Raytheon Technologies are supplying precision-guided missiles and loitering munitions to enhance the strike capabilities of armed forces worldwide. These systems improve mission success rates while reducing the risk to personnel, positioning smart weapons as essential tools for modern defense

- The integration of AI and advanced sensors in smart weapons is accelerating, enabling autonomous targeting, real-time threat assessment, and coordinated multi-platform operations. This trend is shaping the development of next-generation combat systems capable of operating effectively in complex and contested environments

- The demand for unmanned combat aerial vehicles (UCAVs) and autonomous naval systems is increasing, as these platforms rely heavily on smart weapons to execute precision strikes and reconnaissance missions. This growth is driving further investment in research and development of fully autonomous engagement capabilities

- Modern militaries are focusing on upgrading legacy systems with smart weapons to maintain strategic advantage, which is creating opportunities for interoperability between existing platforms and emerging technologies. The integration of these systems ensures more efficient command-and-control and situational awareness

- The growing geopolitical tensions and regional security concerns are further propelling the adoption of smart weapons, particularly in regions such as North America, Europe, and Asia-Pacific. Governments are prioritizing the procurement of technologically advanced systems to strengthen defense readiness and maintain military superiority

Smart Weapons Market Dynamics

Driver

Rising Defense Modernization and Security Needs

- The increasing modernization of armed forces and the growing emphasis on strategic defense capabilities are key drivers of the smart weapons market. Nations are investing heavily in precision-guided munitions, autonomous combat systems, and AI-enabled platforms to improve mission effectiveness and reduce operational risks

- For instance, the U.S. Department of Defense is expanding programs for AI-enabled loitering munitions and advanced missile systems to maintain technological dominance in defense operations. These programs drive innovation and increase demand for smart weapons across multiple branches of the military

- The rising geopolitical instability and security threats worldwide are pushing governments to acquire advanced weaponry capable of precision targeting and rapid engagement. This need is intensifying procurement of smart weapons systems across both developed and emerging markets

- Technological advancements in guidance systems, sensors, and autonomous targeting software are enabling the deployment of smart weapons with higher accuracy and lower operational costs. These innovations are supporting military modernization programs and boosting the overall market growth

- Growing military budgets and investments in research and development are supporting the continuous evolution of smart weapons capabilities. The demand for superior precision, autonomous engagement, and rapid response is influencing procurement strategies globally

Restraint/Challenge

High Costs and Strict Regulations

- The smart weapons market faces challenges due to the high cost of research, development, and production of precision-guided and autonomous systems. These costs include advanced sensor technologies, AI algorithms, and complex integration with existing defense platforms

- For instance, companies such as MBDA and BAE Systems encounter significant expenses in designing and testing next-generation missile systems that meet stringent safety, accuracy, and operational standards. These financial and regulatory demands limit flexibility in scaling production and introducing new innovations

- Compliance with international arms regulations, export controls, and national defense standards further complicates the development and sale of smart weapons. These regulations impact timelines, limit potential markets, and require rigorous documentation and approvals

- The reliance on specialized materials, advanced electronics, and precision manufacturing processes increases vulnerability to supply chain disruptions and cost fluctuations. Maintaining performance standards while controlling expenses remains a major challenge for manufacturers

- Balancing technological advancement with affordability and operational feasibility is an ongoing restraint. Companies must optimize production, invest in R&D efficiently, and navigate regulatory environments to sustain market growth while delivering high-performance smart weapons

Smart Weapons Market Scope

The market is segmented on the basis of product, technology, and platform.

- By Product

On the basis of product, the smart weapons market is segmented into missiles, munitions, guided projectiles, guided rockets, and precision-guided firearms. The missiles segment dominated the market with the largest market revenue share in 2025, driven by their long-range capabilities, advanced targeting accuracy, and strategic role in modern warfare. Military forces increasingly prioritize missile systems due to their ability to engage high-value targets with precision while minimizing collateral damage. In addition, the integration of smart guidance systems and real-time tracking enhances operational effectiveness, making missiles a cornerstone of defense arsenals.

The precision-guided firearms segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising demand for targeted engagements in asymmetrical warfare and urban combat scenarios. Precision-guided firearms offer enhanced accuracy, reduced ammunition wastage, and increased operational safety for soldiers in complex combat environments. Their adoption is further supported by advancements in micro-guidance technologies and lightweight smart targeting systems, making them increasingly attractive for special forces and tactical units.

- By Technology

On the basis of technology, the smart weapons market is segmented into laser, radar, GPS, infrared, and others. The GPS segment held the largest market revenue share in 2025, driven by its wide applicability in navigation, targeting, and tracking systems across various weapon platforms. GPS-enabled smart weapons provide high accuracy over long distances, ensuring mission success and minimizing unintended damage. Military organizations continue to rely on GPS guidance due to its interoperability with other systems and compatibility with advanced command and control frameworks, enhancing strategic deployment capabilities.

The laser segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by technological advancements in directed-energy systems and the rising need for counter-drone and precision strike capabilities. Laser-guided smart weapons offer rapid targeting, low operational costs, and minimal logistical burden, making them increasingly attractive for both offensive and defensive operations. In addition, continuous improvements in beam control and energy efficiency expand their tactical applications across land, air, and naval platforms.

- By Platform

On the basis of platform, the smart weapons market is segmented into air, land, and naval. The air platform segment dominated the market with the largest market revenue share of 47.1% in 2025, driven by the extensive use of airborne smart weapons for strategic strikes, surveillance, and rapid deployment operations. Air-launched weapons offer operational flexibility, enhanced targeting precision, and the ability to engage enemy assets in contested zones while minimizing risk to personnel. In addition, integration with modern fighter jets, UAVs, and bombers ensures seamless coordination with command networks, enhancing overall mission effectiveness.

The land platform segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the rising adoption of smart artillery, guided rockets, and autonomous combat systems by ground forces. Land-based smart weapons improve accuracy, reduce collateral damage, and enable rapid tactical responses in dynamic combat scenarios. The growing use of robotic and automated platforms further accelerates deployment, making smart land-based systems critical for modern defense strategies.

Smart Weapons Market Regional Analysis

- North America dominated the smart weapons market with the largest revenue share of 39.6% in 2025, driven by the region’s strong defense budgets, technological advancements, and continuous modernization of military arsenals

- Armed forces in the region prioritize precision, long-range capabilities, and advanced targeting systems, fostering the adoption of smart weapons across air, land, and naval platforms

- This widespread deployment is further supported by government initiatives, strategic defense collaborations, and a focus on maintaining technological superiority, establishing North America as a key market for smart weapon systems

U.S. Smart Weapons Market Insight

The U.S. smart weapons market captured the largest revenue share in 2025 within North America, fueled by strong defense spending and the deployment of advanced combat technologies. Armed forces are increasingly prioritizing precision strike capabilities and reduced human exposure in hostile environments. For instance, Raytheon Technologies is expanding its portfolio of precision-guided munitions and autonomous systems to meet military modernization requirements. The integration of smart weapons with advanced targeting systems, drones, and command-and-control networks further drives market growth. Moreover, ongoing R&D in AI-enabled weapons systems is strengthening operational effectiveness and strategic advantage.

Europe Smart Weapons Market Insight

The Europe smart weapons market is projected to expand at a significant CAGR throughout the forecast period, primarily driven by the modernization of defense forces and the adoption of advanced autonomous systems. For instance, MBDA is developing next-generation missile systems that enhance precision and reduce collateral damage. European nations are investing in interoperable smart weapon platforms across NATO operations, promoting collaborative development. The emphasis on defense readiness, coupled with growing demand for cost-efficient precision solutions, fosters market adoption. Increased geopolitical tensions and the need for rapid response capabilities are further supporting the uptake of smart weapons across the region.

U.K. Smart Weapons Market Insight

The U.K. smart weapons market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by modernization programs and investments in autonomous and precision-guided systems. For instance, BAE Systems is enhancing smart munition capabilities for both land and aerial operations. Heightened security concerns and the need for operational flexibility are encouraging defense agencies to adopt advanced weapon systems. The U.K.’s focus on domestic R&D, combined with collaborative projects with NATO partners, is expected to continue stimulating market expansion. Adoption of digital command and control platforms further supports the integration of smart weapons into modern combat scenarios.

Germany Smart Weapons Market Insight

The Germany smart weapons market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s emphasis on defense modernization and technological innovation. For instance, Rheinmetall is advancing precision-guided artillery and missile systems to strengthen national defense capabilities. Germany’s robust defense infrastructure and focus on sustainability in military operations promote the deployment of smart weapons. Integration with advanced surveillance and targeting technologies is becoming increasingly prevalent, meeting both national and NATO operational standards. The country’s strategic investments in autonomous and remotely controlled weapon systems further drive market growth.

Asia-Pacific Smart Weapons Market Insight

The Asia-Pacific smart weapons market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising defense budgets, regional tensions, and modernization initiatives in countries such as China, India, and Japan. For instance, China is rapidly expanding its precision-guided missile and unmanned systems programs to enhance strategic capabilities. Growing military modernization programs, coupled with technological advancements in autonomous and AI-enabled weaponry, are driving adoption. Furthermore, increasing domestic manufacturing capabilities and government support for defense innovation are improving accessibility and deployment across the region.

Japan Smart Weapons Market Insight

The Japan smart weapons market is gaining momentum due to rising defense modernization efforts, regional security concerns, and technological sophistication. For instance, Mitsubishi Heavy Industries is advancing smart missile and UAV systems to strengthen defense readiness. Japan’s focus on autonomous weapon systems and integrated defense networks is increasing demand. Strategic collaborations with allied nations and investments in AI-enabled targeting and surveillance solutions further fuel market growth. The integration of smart weapons into Japan’s maritime, aerial, and ground defense operations is expected to continue driving adoption.

China Smart Weapons Market Insight

The China smart weapons market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rising defense expenditures, rapid technological development, and regional security initiatives. For instance, China Aerospace Science and Technology Corporation is expanding precision-guided munitions and smart UAV programs to enhance operational capabilities. The country is focusing on modernizing its armed forces with autonomous, AI-enabled, and precision-strike weaponry. Growing investments in domestic R&D and defense manufacturing are supporting cost-effective deployment. The push towards integrated smart combat systems and strategic defense readiness is a key factor propelling market growth in China.

Smart Weapons Market Share

The smart weapons industry is primarily led by well-established companies, including:

- Lockheed Martin Corporation (U.S.)

- Raytheon Technologies Corporation (U.S.)

- MBDA Inc. (France)

- General Dynamics Corporation (U.S.)

- BAE Systems (U.K.)

- Boeing (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Thales Group (France)

- Textron Inc. (U.S.)

- Rheinmetall AG (Germany)

- Israel Aerospace Industries (IAI) (Israel)

- Denel Dynamics (South Africa)

- Northrop Grumman (U.S.)

- Saab AB (Sweden)

- Airbus S.A.S. (France)

- Aselsan (Turkey)

- Rafael Advanced Defense Systems Ltd. (Israel)

- Diehl Stiftung & Co. KG (Germany)

- Leonardo (Italy)

Latest Developments in Global Smart Weapons Market

- In February 2026, U.S. defense tech firm Anduril Industries initiated plans to raise up to $8 billion in new funding, a move expected to significantly accelerate the development of autonomous and sensor‑driven smart weapons and establish a major weapons manufacturing facility to meet rising global demand for advanced defense systems. This substantial capital effort would strengthen Anduril’s competitive position in the autonomous weapons sector, support expansion of its drone‑borne systems and advanced sensors, and enable faster innovation across future smart weapons platforms, marking a major private‑sector investment trend in defense technology

- In September 2023, EDGE Group, a UAE‑based defense contractor, acquired a 50% stake in Brazil’s SIATT, empowering the company to advance intelligent weaponry development and fostering collaboration that could enhance smart weapons technological capabilities across both the UAE and Brazilian defense markets. This strategic acquisition broadened EDGE’s global footprint and verified the increasing role of international partnerships in expanding smart weapons R&D and production capacity

- In July 2021, startup Biofire Technologies raised USD 17 million in seed funding to advance its smart gun technology that unlocks via fingerprint recognition, with only authorized users able to fire the weapon. This funding milestone supported the company’s efforts to innovate user‑verified smart weapons, demonstrating early investor confidence in safety‑oriented smart weapon systems and signaling growing interest in biometric control technologies within defense and security markets

- In February 2022, India announced plans to test domestic smart air‑launched weapons under the “Make in India” initiative, focusing on missiles, anti‑radar missiles, and glide bombs to boost indigenous capabilities. This initiative emphasized the strategic importance of developing homegrown smart weapon systems, enhancing national defense autonomy, and accelerating market growth within India’s defense industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.