Global Smartphones Market

Market Size in USD Billion

CAGR :

%

USD

520.95 Billion

USD

881.79 Billion

2024

2032

USD

520.95 Billion

USD

881.79 Billion

2024

2032

| 2025 –2032 | |

| USD 520.95 Billion | |

| USD 881.79 Billion | |

|

|

|

|

Smartphones Market Size

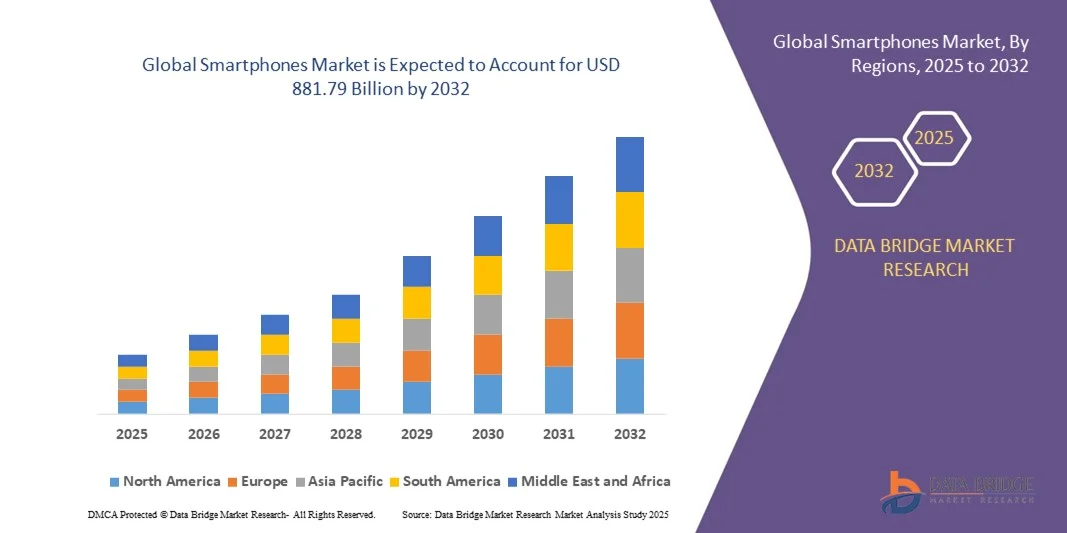

- The global smartphones market size was valued at USD 520.95 billion in 2024 and is expected to reach USD 881.79 billion by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is largely fueled by the increasing adoption of smartphones across both urban and rural populations, driven by expanding mobile internet infrastructure, rising digital literacy, and growing demand for connected devices that support communication, entertainment, and productivity

- Furthermore, rising consumer demand for high-performance, feature-rich, and cost-effective devices is establishing smartphones as an essential personal and professional tool. These converging factors are accelerating smartphone adoption, thereby significantly boosting the industry’s growth

Smartphones Market Analysis

- Smartphones are handheld devices that integrate computing, communication, and multimedia functionalities. They support applications ranging from social networking and video streaming to mobile banking, gaming, and enterprise productivity, serving as an indispensable tool for daily life and work

- The escalating demand for smartphones is primarily fueled by rising internet penetration, increasing consumer preference for mobile-first solutions, rapid technological advancements in processors, cameras, and display technologies, and growing availability of devices across multiple price ranges

- Asia-Pacific dominated smartphones market with a share of 48.2% in 2024, due to rising smartphone penetration, expanding mobile internet infrastructure, and growing demand for affordable and feature-rich devices

- North America is expected to be the fastest growing region in the smartphones market during the forecast period due to high consumer demand for innovative devices, widespread 5G rollout, and increasing preference for premium smartphones

- Android segment dominated the market with a market share of 61.9% in 2024, due to its wide device availability across various price points and strong customization features. Android smartphones cater to a broad user base with diverse hardware options, extensive app compatibility, and integration with multiple services and ecosystems. Their affordability, frequent innovation in camera and display technologies, and support for emerging connectivity standards further reinforce their dominance

Report Scope and Smartphones Market Segmentation

|

Attributes |

Smartphones Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smartphones Market Trends

Rising Adoption of 5G Smartphones

- The smartphones market is increasingly shaped by the growing adoption of 5G-enabled devices as consumers demand faster connectivity, seamless video streaming, and enhanced gaming experiences. 5G smartphones are becoming mainstream across multiple price segments, accelerating global device replacements and upgrades

- For instance, Samsung has expanded its Galaxy lineup with affordable 5G models to increase accessibility, while Apple’s iPhone series supports global 5G networks, driving premium adoption. These launches demonstrate how both high-end and mass-market players are fueling broad-based demand for 5G handsets

- 5G integration enables superior use of cloud services, virtual reality, and augmented reality applications. As telecom operators expand network coverage, more consumers are shifting to devices that can harness low-latency, high-speed connectivity for digital services

- In addition, 5G smartphones are supporting the transition toward stronger enterprise mobility solutions. Enhanced speed and security features allow businesses to adopt remote work tools and mobile-first strategies that optimize workforce productivity

- The adoption of 5G phones is also boosting innovation in chipsets, prompting companies such as Qualcomm and MediaTek to develop cost-efficient processors that cater to mass-market 5G adoption without compromising performance. This is broadening the appeal of 5G beyond premium devices

- The rising adoption of 5G smartphones reflects a pivotal market transformation. With expanding networks, falling device prices, and higher consumer expectations for performance, 5G handsets are positioned to become the industry standard, fueling long-term growth across global smartphone markets

Smartphones Market Dynamics

Driver

Growing Demand for High-Performance, Affordable Devices

- The growing consumer demand for smartphones that balance high performance with affordability is a significant driver of market growth. Consumers across emerging and developed markets are seeking devices that provide advanced features without premium costs, creating opportunities across multiple price tiers

- For instance, Xiaomi and Realme have increased their market penetration by offering feature-rich smartphones at mid-range prices, while brands such as OnePlus and Samsung cater to both value-conscious and premium customers. This strategy highlights how manufacturers meet growing consumer appetite for affordable performance

- High-performance smartphones equipped with multi-camera systems, gaming-grade processors, and enhanced battery life are no longer seen as exclusive to premium models. The democratization of technology has enabled affordable devices to deliver strong consumer experiences across photography, entertainment, and productivity

- In addition, expanding internet connectivity and digital lifestyles are accelerating demand for devices that combine processing power with affordability. This is particularly evident in Asia-Pacific, where cost-effective smartphones support widespread digital inclusion and mobile commerce adoption

- The growing demand for performance-driven yet affordable smartphones ensures sustained innovation across the market. As manufacturers compete on value as well as quality, smartphones are becoming more accessible to a larger global audience, driving continuous growth across consumer segments

Restraint/Challenge

Supply Chain and Component Shortages

- Supply chain disruptions and component shortages pose major challenges to the smartphones market, impacting production schedules, pricing, and global availability. Shortages of semiconductors, displays, and batteries have constrained the ability of manufacturers to meet rising demand

- For instance, Apple and Samsung have both reported impacts on smartphone shipments due to global semiconductor shortages, while smaller players such as Oppo and Vivo have faced delays in securing display panels. These constraints highlight the fragility of smartphone supply chains that rely heavily on timely component availability

- High demand for advanced chipsets including 5G processors and AI-enabled system-on-chips further intensifies competition among manufacturers. Smaller firms often face difficulties in securing critical supplies compared to established brands with stronger purchasing power, affecting market competitiveness

- In addition, geopolitical tensions, trade restrictions, and logistics disruptions exacerbate supply chain volatility. These unpredictable factors contribute to pricing instability and limit consistent availability of devices across regional markets

- Addressing supply chain and component shortages will be essential to sustaining smartphone industry growth. Building resilient supplier networks, diversifying sourcing strategies, and investing in semiconductor production capacity will remain critical strategies to overcome these challenges and ensure long-term market stability

Smartphones Market Scope

The market is segmented on the basis of operating system, distribution channel, price, and RAM size.

- By Operating System

On the basis of operating system, the smartphones market is segmented into Android, iOS, and Windows. The Android segment dominated the largest market revenue share of 61.9% in 2024, driven by its wide device availability across various price points and strong customization features. Android smartphones cater to a broad user base with diverse hardware options, extensive app compatibility, and integration with multiple services and ecosystems. Their affordability, frequent innovation in camera and display technologies, and support for emerging connectivity standards further reinforce their dominance.

The iOS segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by strong brand loyalty, regular software updates, and seamless integration with Apple’s ecosystem of devices and services. High security standards, exclusive applications, and premium user experience continue to attract both individual and enterprise users, supporting rapid adoption.

- By Distribution Channel

On the basis of distribution channel, the smartphones market is segmented into OEM, retailer, and e-commerce. The retailer segment held the largest market revenue share in 2024, driven by the trust consumers place in physical stores for hands-on experience, immediate purchase, and personalized assistance. Retailers also offer bundled promotions, after-sales support, and financing options, making them a preferred choice for a wide range of users.

The e-commerce segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing online shopping adoption, convenience, competitive pricing, and doorstep delivery. E-commerce platforms provide detailed product information, customer reviews, and comparison tools, enabling consumers to make informed purchasing decisions, which drives rapid growth in this channel.

- By Price

On the basis of price, the smartphones market is segmented into high range, medium range, and low range. The medium-range segment dominated the largest market revenue share in 2024, driven by the increasing demand for feature-rich smartphones at affordable prices. Consumers increasingly seek a balance between performance, camera capabilities, battery life, and design, which medium-range smartphones offer. This segment also benefits from frequent updates, broad availability, and strong brand offerings.

The high-range segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by premium features such as advanced cameras, foldable displays, AI-driven functionalities, and cutting-edge performance. Rising disposable incomes and a growing preference for luxury technology products among urban users contribute to the accelerated adoption of high-end smartphones.

- By RAM Size

On the basis of RAM size, the smartphones market is segmented into below 2GB, 2GB–4GB, and up to 8GB. The 2GB–4GB segment held the largest market revenue share in 2024, driven by its capability to handle everyday applications, social media, and multimedia tasks efficiently at an affordable cost. This RAM range offers a balanced performance for the majority of consumers, ensuring smooth multitasking and longer device usability.

The up to 8GB segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing demand for high-performance smartphones capable of handling gaming, video editing, and AI-driven applications. Enhanced multitasking ability, improved user experience, and the growing adoption of feature-heavy apps drive the expansion of this high-RAM segment.

Smartphones Market Regional Analysis

- Asia-Pacific dominated the smartphones market with the largest revenue share of 48.2% in 2024, driven by rising smartphone penetration, expanding mobile internet infrastructure, and growing demand for affordable and feature-rich devices

- The region’s cost-effective manufacturing ecosystem, availability of skilled labor, and strong presence of leading smartphone OEMs are accelerating market expansion

- Rapid urbanization, increasing disposable incomes, and supportive government initiatives promoting digital connectivity are contributing to higher adoption of smartphones across both urban and rural populations

China Smartphones Market Insight

China held the largest share in the Asia-Pacific smartphones market in 2024, owing to its position as a global hub for smartphone manufacturing and R&D. The country’s extensive supply chain, strong industrial base, and government support for technology innovation drive production efficiency and competitiveness. China also benefits from a large domestic consumer base demanding high-performance and mid-range smartphone, alongside growing exports to emerging markets, further reinforcing market leadership.

India Smartphones Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid smartphone adoption, rising internet penetration, and increasing preference for online purchases. Government initiatives such as "Digital India" and "Make in India," combined with local manufacturing incentives, are strengthening production capabilities. The expansion of e-commerce, growing youth population, and rising demand for affordable and feature-packed devices are contributing to robust market growth.

Europe Smartphones Market Insight

The Europe smartphones market is expanding steadily, supported by high consumer spending power, demand for premium devices, and growing adoption of innovative technologies such as 5G and foldable displays. Strong emphasis on design, quality, and data privacy regulations is shaping consumer preferences, particularly in developed markets. The market also benefits from mature distribution networks, established retail channels, and increasing interest in environmentally sustainable and energy-efficient smartphones.

Germany Smartphones Market Insight

Germany’s smartphones market is driven by strong consumer demand for premium and high-performance devices, coupled with significant investments in technology and innovation. The country has a well-developed electronics ecosystem and extensive R&D capabilities, fostering innovation in device features, user interfaces, and mobile security. German consumers prioritize quality, durability, and technological advancement, supporting steady growth in the market.

U.K. Smartphones Market Insight

The U.K. market is supported by a mature consumer electronics industry, high smartphone penetration, and strong adoption of the latest technologies. Growing e-commerce adoption, rising demand for premium smartphones, and continued focus on innovation and software ecosystem integration are driving market expansion. The U.K. also benefits from strong after-sales service infrastructure and active participation of leading global smartphone brands.

North America Smartphones Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by high consumer demand for innovative devices, widespread 5G rollout, and increasing preference for premium smartphones. The region benefits from strong purchasing power, early adoption of new technologies, and a large base of tech-savvy consumers. Partnerships between telecom operators and smartphone manufacturers, along with advanced e-commerce and retail networks, are accelerating adoption.

U.S. Smartphones Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by robust smartphone penetration, strong R&D infrastructure, and high demand for flagship devices. Consumer preference for devices integrated with advanced features, 5G connectivity, and app ecosystem compatibility drives growth. The presence of leading global brands, effective marketing strategies, and extensive distribution channels further solidify the U.S.'s dominance in the regional smartphones market.

Smartphones Market Share

The smartphones industry is primarily led by well-established companies, including:

- SAMSUNG (South Korea)

- Apple Inc. (U.S.)

- Lenovo (China)

- Huawei Technologies Co., Ltd. (China)

- Sony Corporation (Japan)

- Xiaomi (China)

- LG Electronics (South Korea)

- ZTE Corporation (China)

- TCL COMMUNICATION TECHNOLOGY HOLDINGS LIMITED (China)

- Vivo Communication Technology Co. Ltd. (China)

- Nokia (Finland)

- OPPO (China)

- HTC Corporation (Taiwan)

- OnePlus (China)

- Mobitech Creations (India)

- Google (U.S.)

- Reliance Retail Ltd. (India)

- ASUSTeK Computer Inc. (Taiwan)

- XOLO (India)

- Micromax (India)

- Koninklijke Philips N.V (Netherlands)

Latest Developments in Global Smartphones Market

- In August 2025, Qualcomm unveiled the Snapdragon 8 Elite Gen 5 chipset, setting a new benchmark for Android smartphones. This advanced SoC features a third-generation Oryon CPU, delivering up to 35% improved power efficiency and 16% better overall SoC efficiency. The upgraded Adreno GPU enhances gaming performance by 23% while reducing power consumption by 20%. Its Hexagon NPU supports faster and more efficient on-device AI capabilities, enabling smarter device behavior. The enhanced ISP supports Advanced Professional Video (APV) codecs and AI-powered computational video processing, improving autofocus, exposure, and color balance. Devices equipped with this chipset are expected to drive high-performance smartphone adoption across premium Android segments

- In July 2025, Apple Inc. launched AppleCare+ One, a unified subscription plan that consolidates coverage for iPhone, Mac, iPad, and Apple Watch into a single package. The plan simplifies device protection, includes theft and loss coverage, and offers priority support. By offering comprehensive protection across multiple devices, AppleCare+ One strengthens customer loyalty, encourages multi-device adoption, and positions Apple’s ecosystem as a more integrated and convenient solution for premium consumers

- In January 2025, Google LLC acquired part of HTC’s extended reality (XR) unit for approximately USD 250 million. The acquisition transferred select VIVE engineering talent and non-exclusive IP rights to Google, supporting the development of its Android XR platform. This move strengthens Google’s position in the XR ecosystem, accelerates innovation in AR/VR-enabled devices, and enables deeper partnerships with manufacturers leveraging Android XR, expanding the scope of immersive experiences on smartphones and connected devices

- In July 2024, Xiaomi Corporation partnered with Dixon, DBG, and other EMS companies to assemble smartphones and other devices in India. The initiative aims to reach 55% local component sourcing and double device shipments to 700 million units in India over the next decade. By localizing production, Xiaomi benefits from reduced import dependency, cost efficiency, and faster go-to-market timelines while supporting government initiatives such as “Make in India,” ultimately driving market share growth in one of the fastest-growing smartphone markets

- In September 2024, Back Market launched a global initiative to mainstream refurbished smartphones, promoting sustainability and eco-conscious consumption. The company’s campaign encourages consumers to choose refurbished devices as a cost-effective and environmentally friendly alternative to new smartphones. By tapping into the resale economy and addressing electronic waste, Back Market is reshaping market perceptions and creating a growth segment for refurbished devices, particularly in price-sensitive and environmentally aware consumer segments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.