Global Software Defined Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

1.30 Billion

USD

10.74 Billion

2024

2032

USD

1.30 Billion

USD

10.74 Billion

2024

2032

| 2025 –2032 | |

| USD 1.30 Billion | |

| USD 10.74 Billion | |

|

|

|

|

Software Defined Vehicle Market Size

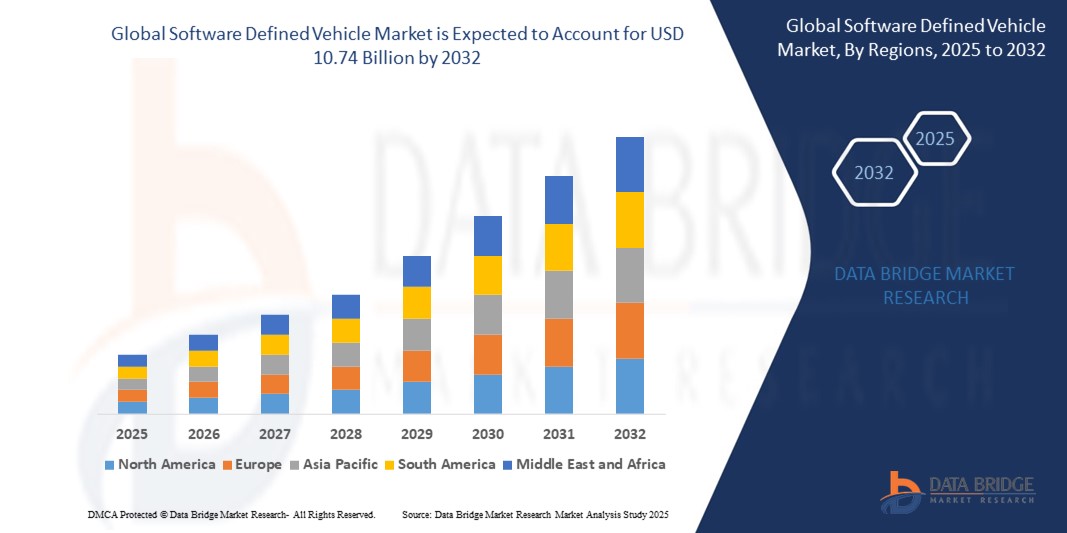

- The global software defined vehicle market size was valued at USD 1.3 billion in 2024 and is expected to reach USD 10.74 billion by 2032, at a CAGR of 30.20% during the forecast period

- This growth is driven by factors such as the demand for connected and autonomous vehicles, rising integration of advanced software in automotive systems, and growing consumer preference for personalized in-vehicle experiences

Software Defined Vehicle Market Analysis

- The software defined vehicle market is witnessing rapid transformation as automotive manufacturers increasingly shift toward flexible, software-centric architectures that support continuous feature updates and service enhancements

- This market is characterized by a growing collaboration between tech companies and automakers to develop modular platforms that enable faster deployment of digital services and advanced driving functions

- Asia-Pacific is expected to dominate the software defined vehicle market due to strong EV adoption, government support, and major investments by leading automakers

- Asia-Pacific is expected to be the fastest growing region in the software defined vehicle market during the forecast period due to rapid digitalization, increasing demand for connected vehicles, and expanding smart mobility infrastructure

- The SDV segment is expected to dominate the software defined vehicle market with the largest share in 2025 due to its ability to provide fully integrated, software-driven architectures that enable enhanced connectivity, real-time updates, and advanced in-vehicle services such as autonomous driving and personalized experiences.

Report Scope and Software Defined Vehicle Market Segmentation

|

Attributes |

Software Defined Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Software Defined Vehicle Market Trends

“Integration of Artificial Intelligence in Vehicle Software”

- A key trend in the software defined vehicle market is the increasing integration of artificial intelligence into vehicle control and user experience systems

- Automakers are using AI to enhance driver assistance features, such as predictive maintenance and adaptive cruise control

- For instance, Tesla and BMW use AI to analyze driving behavior and adjust vehicle functions in real-time

- AI enables advanced personalization, allowing vehicles to recognize individual users and customize settings such as seat position, temperature, and entertainment preferences; Mercedes-Benz’s MBUX system and Rivian’s in-car assistant are strong instances

- AI-powered software also facilitates efficient over-the-air updates by intelligently managing bandwidth and prioritizing critical updates for system security and performance

- The rise of AI is shaping the future of mobility by making vehicles smarter, safer, and more responsive, which aligns with the shift toward fully autonomous driving and seamless in-car digital experiences

Software Defined Vehicle Market Dynamics

Driver

“Growing Consumer Demand for Connected and Personalized Vehicle Experiences”

- Rising consumer demand for connected and personalized vehicle experiences is driving the shift toward software defined vehicles, as users expect their cars to offer real-time updates, seamless connectivity, and intelligent features similar to smartphones

- Automakers are transitioning to software-centric architectures that allow for dynamic updates and new feature deployment without requiring hardware modifications

- For instance, Tesla frequently releases over-the-air updates that enhance vehicle performance and safety

- Software defined vehicles support advanced capabilities such as voice recognition, adaptive user interfaces, and integration with cloud-based services such as navigation and music streaming

- For instance, Hyundai’s Bluelink and GM’s OnStar systems offer real-time diagnostics and infotainment updates

- Growing digital awareness among consumers and increased reliance on smart devices are encouraging automakers to deliver vehicles that evolve post-purchase, increasing long-term user engagement and loyalty

- This model also creates new revenue opportunities for manufacturers through feature unlocks, premium software upgrades, and subscription-based services, helping them diversify income streams beyond initial vehicle sales

Opportunity

“Collaboration Between Automakers and Technology Companies”

- Collaborations between automakers and technology companies are creating major opportunities in the software defined vehicle market by combining expertise in hardware, software, and cloud infrastructure

- These partnerships help reduce development time and costs while enabling the creation of modular, upgradeable platforms

- For instance, the Qualcomm-Google alliance focuses on AI-driven digital cockpits, and the Rivian-Volkswagen joint venture targets scalable EV software systems

- Tech firms contribute agility, innovation, and deep AI capabilities, while automakers provide manufacturing scale and vehicle integration knowledge, creating a balanced and effective development environment

- Co-developed platforms allow seamless over-the-air updates, improved connected services, and support for autonomous driving, which align with evolving consumer expectations and future mobility trends

- Such joint ventures help companies enter new markets faster and offer service-based business models, giving them a competitive edge in delivering safe, compliant, and high-performing software-defined vehicles

Restraint/Challenge

“Complexity of Integration and Standardization”

- Integrating modern software into traditional vehicle architectures is highly complex due to the need to meet rigorous safety, security, and regulatory requirements, making quick and uniform implementation difficult across platforms

- Unsuch as consumer electronics, vehicles rely on long development cycles and multiple electronic control units that must operate in harmony, which increases engineering complexity and the potential for costly delays

- Compatibility issues between legacy systems and new software solutions can raise integration costs and slow innovation, especially when automakers rely on outdated or proprietary infrastructures

- The absence of universal standards across manufacturers leads to fragmentation, reducing scalability and hindering collaboration

- For instance, closed ecosystems such as those used by some OEMs limit third-party innovation and platform compatibility

- As the industry shifts to zonal and centralized computing models, coordinated efforts among OEMs, suppliers, and regulators are essential to create common protocols that ensure safety, compliance, and innovation without compromising user experience

Software Defined Vehicle Market Scope

The market is segmented on the basis of SDV type, electrical and electronic architecture, vehicle type, propulsion, offering, and application.

|

Segmentation |

Sub-Segmentation |

|

By SDV Type |

|

|

By Electrical and Electronic Architecture |

|

|

By Vehicle Type |

|

|

By Propulsion |

|

|

By Offering |

|

|

By Application |

|

In 2025, the SDV is projected to dominate the market with a largest share in SDV type segment

The SDV segment is expected to dominate the software defined vehicle market with the largest share in 2025 due to its ability to provide fully integrated, software-driven architectures that enable enhanced connectivity, real-time updates, and advanced in-vehicle services such as autonomous driving and personalized experiences.

The zonal control architecture is expected to account for the largest share during the forecast period in electrical and electronic architecture market

In 2025, the zonal control architecture segment is expected to dominate the market with the largest market share due to its ability to simplify the vehicle’s electronic system by reducing wiring complexity, weight, and cost.

Software Defined Vehicle Market Regional Analysis

“North America Holds the Largest Share in the Software Defined Vehicle Market”

- Asia Pacific region is projected to dominate the software-defined vehicle market holding a market of 31.7% and due to its rapid adoption of electric vehicles and advancements in autonomous driving technologies

- Countries such as China, Japan, and South Korea are leading the way with strong investments in smart mobility and government support for digital transformation in the automotive industry

- China, in particular, is a key player with major companies such as NIO and XPENG driving the development of software-defined vehicles, including innovations in autonomous driving and connectivity

- The region's strong infrastructure, consumer demand for advanced features, and large automotive market contribute to its dominant position in the SDV market

- Supportive regulations and a focus on sustainable transportation are accelerating the shift towards software-defined vehicles in Asia Pacific

“Asia-Pacific is Projected to Register the Highest CAGR in the Software Defined Vehicle Market”

- Asia Pacific region is also expected to be the fastest-growing market for software-defined vehicles, driven by increasing consumer demand for advanced connectivity and safety features

- The region is seeing rapid technological advancements and a growing focus on electric and autonomous vehicles, making it a hotbed for SDV innovations

- Key players in the region, such as automotive giants and technology companies, are prioritizing the development of software-centric platforms, leading to faster adoption rates

- The fast-growing automotive market in China, Japan, and South Korea, combined with increased investment in AI and connectivity, is fuelling this growth

- The region's proactive stance on digitization and sustainability is accelerating the adoption of software-defined technologies in vehicles

Software Defined Vehicle Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- QUALCOMM Incorporated (U.S.)

- Li Auto Inc. (China)

- Tesla, Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Rivian Automotive, Inc. (U.S.)

- Volkswagen AG (Germany)

- Aptiv PLC (U.K.)

- General Motors Company (U.S.)

- NVIDIA Corporation (U.S.)

- Continental AG (Germany)

Latest Developments in Global Software Defined Vehicle Market

- In October 2024, Qualcomm and Google announced a multi-year strategic collaboration to develop generative AI-powered digital cockpit solutions for vehicles. This partnership combines Qualcomm's Snapdragon Digital Chassis with Google Cloud's AI capabilities to deliver personalized, voice-enabled in-car experiences. The collaboration will accelerate software-defined vehicle (SDV) development, improve driver engagement, and reduce time-to-market for automakers. It positions both companies as key players in the intelligent automotive technology space

- In November 2024, Rivian and Volkswagen Group launched a $5.8 billion joint venture to develop next-generation electric vehicle (EV) platforms and software. This collaboration aims to create scalable, modular architectures supporting over-the-air updates and advanced driver-assistance systems. The venture is expected to accelerate the rollout of Rivian’s R2 model in 2026 and new Volkswagen models by 2027, enhancing both companies' competitiveness in the EV market. The partnership combines Rivian's software expertise with Volkswagen's global manufacturing scale, aiming to reduce development costs and improve cost efficiency. The joint venture, led by executives from both companies, will operate independently with teams based in North America and Europe

- In January 2023, Qualcomm showcased its Snapdragon Digital Chassis at CES 2023, unveiling a concept vehicle that integrates advanced in-vehicle technologies. The platform combines AI-driven personalization, including facial recognition for user-specific settings, with immersive entertainment features such as zoned audio and gaming capabilities. Collaborations with partners such as SoundHound, Amazon Music, Bose, Zoom, and Vector Unit were highlighted, demonstrating a unified ecosystem for software-defined vehicles. This initiative aims to redefine in-car experiences, offering scalable, upgradeable solutions for automakers and enhancing user engagement through personalized, connected services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.