Global Sphygmomanometer Aneroid Bp Monitor Market

Market Size in USD Billion

CAGR :

%

USD

3.10 Billion

USD

6.99 Billion

2025

2033

USD

3.10 Billion

USD

6.99 Billion

2025

2033

| 2026 –2033 | |

| USD 3.10 Billion | |

| USD 6.99 Billion | |

|

|

|

|

Sphygmomanometer/Aneroid BP Monitor Market Size

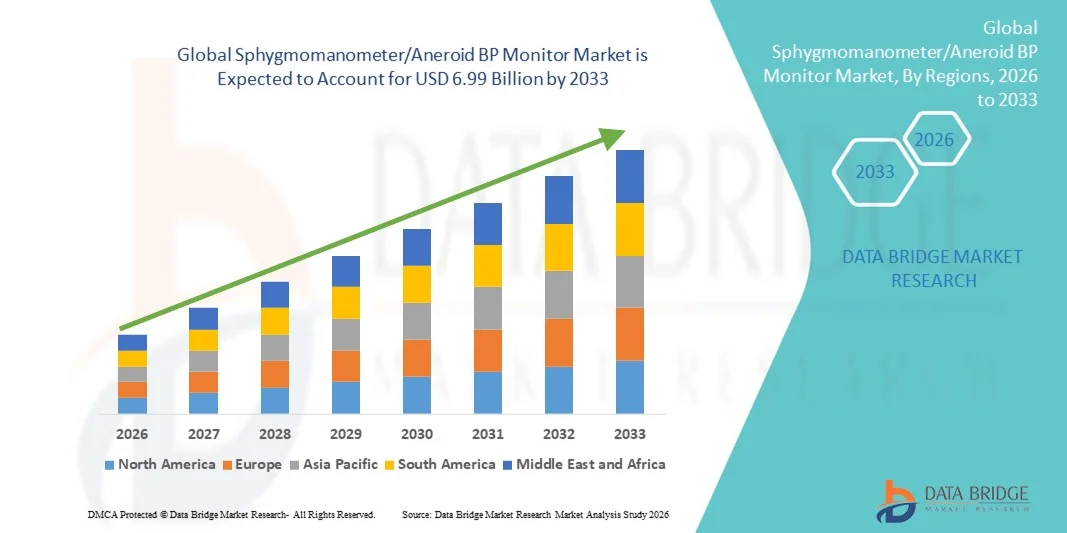

- The global sphygmomanometer/aneroid BP monitor market size was valued at USD 3.10 billion in 2025 and is expected to reach USD 6.99 billion by 2033, at a CAGR of 10.70% during the forecast period

- The market growth is largely fueled by the increasing prevalence of hypertension and cardiovascular disorders, along with the growing emphasis on regular health monitoring and early diagnosis of blood pressure-related conditions

- Furthermore, rising awareness among healthcare professionals and patients about the benefits of accurate, reliable, and easy-to-use blood pressure monitoring devices is driving the adoption of Sphygmomanometer/Aneroid BP Monitor solutions, thereby significantly boosting the industry's growth

Sphygmomanometer/Aneroid BP Monitor Market Analysis

- Sphygmomanometers/Aneroid BP Monitors, providing accurate and reliable measurement of blood pressure, are increasingly vital devices in both clinical and home healthcare settings due to their ease of use, portability, and precision in monitoring cardiovascular health

- The escalating demand for these devices is primarily fueled by the rising prevalence of hypertension, increasing health awareness, and growing emphasis on preventive healthcare and regular blood pressure monitoring

- North America dominated the sphygmomanometer/aneroid BP Monitor market with the largest revenue share of approximately 42% in 2025, supported by advanced healthcare infrastructure, high adoption of home and clinical monitoring devices, and the presence of key medical device manufacturers. The U.S. accounted for the majority of regional demand due to growing cardiovascular health awareness, favorable reimbursement policies, and the expansion of remote patient monitoring programs

- Asia-Pacific is expected to be the fastest-growing region in the sphygmomanometer/aneroid BP Monitor market during the forecast period, registering a CAGR from 2026 to 2033, driven by rising hypertension prevalence, increasing healthcare expenditure, improving healthcare infrastructure, and growing awareness about early detection and management of blood pressure-related disorders in countries such as China, India, and Japan

- The electronic sphygmomanometer segment dominated the largest market revenue share of 48.5% in 2025, driven by its ease of use, digital accuracy, and ability to store and transmit readings

Report Scope and Sphygmomanometer/Aneroid BP Monitor Market Segmentation

|

Attributes |

Sphygmomanometer/Aneroid BP Monitor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Omron Healthcare (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Sphygmomanometer/Aneroid BP Monitor Market Trends

Rising Adoption of Home-Based and Remote Monitoring Devices

- A key trend in the global sphygmomanometer/aneroid BP monitor market is the increasing preference for home-based blood pressure monitoring, driven by the growing prevalence of hypertension and cardiovascular diseases worldwide

- For instance, in March 2024, Omron Healthcare launched its portable wireless BP monitor designed for home use, enabling users to track blood pressure and heart rate easily

- Consumers and healthcare providers are increasingly relying on home monitoring to detect early signs of blood pressure fluctuations and to manage chronic conditions effectively

- The expansion of telemedicine and remote patient monitoring services is accelerating the adoption of reliable and portable BP monitoring devices

- Healthcare providers are recommending regular home measurements to reduce hospital visits and to improve patient engagement and compliance

- Portable and user-friendly sphygmomanometers, especially devices with digital displays, are witnessing growing demand across both developed and emerging markets

- Rising health awareness campaigns and initiatives by governments and NGOs are further boosting the adoption of home-based BP monitoring solutions

Sphygmomanometer/Aneroid BP Monitor Market Dynamics

Driver

Increasing Prevalence of Cardiovascular Diseases and Hypertension

- The global rise in cardiovascular diseases, hypertension, and other lifestyle-related disorders is a major driver of the Sphygmomanometer/Aneroid BP Monitor market

- For instance, in October 2023, Omron Healthcare reported a significant rise in sales of its advanced home BP monitors in the U.S., reflecting growing consumer demand driven by cardiovascular health awareness

- The demand is further fueled by the increasing geriatric population, who are more prone to cardiovascular complications and require consistent blood pressure tracking

- Healthcare providers are recommending the use of home and clinic-based BP monitors to ensure timely interventions and medication adjustments

- Awareness campaigns highlighting the risks of untreated high blood pressure encourage individuals to adopt regular monitoring routines

- Growing adoption of health checkup programs by corporate institutions and health insurers is also boosting market demand

Restraint/Challenge

Concerns Regarding Device Accuracy and Cost

- Challenges regarding the accuracy and reliability of BP monitors pose a restraint to broader market adoption, particularly in emerging markets where calibration and quality control may be inconsistent

- For instance, in January 2022, the FDA issued a warning regarding discrepancies in blood pressure readings from some uncertified home-use devices, highlighting accuracy concerns

- High-quality digital BP monitors with advanced features such as memory storage, connectivity, or multi-user support often come at higher price points, limiting accessibility for price-sensitive consumers

- In developing regions, lack of awareness and limited availability of certified BP monitoring devices further constrains growth

- Healthcare professionals emphasize the need for proper user training to avoid measurement errors, which can slow market penetration

- Overcoming these challenges through standardized device certifications, affordable pricing strategies, and consumer education is critical for sustained market growth

Sphygmomanometer/Aneroid BP Monitor Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the Sphygmomanometer/Aneroid BP Monitor market is segmented into electronic sphygmomanometer, aneroid sphygmomanometer, and mercury sphygmomanometer. The electronic sphygmomanometer segment dominated the largest market revenue share of 48.5% in 2025, driven by its ease of use, digital accuracy, and ability to store and transmit readings. Hospitals, clinics, and home users prefer electronic devices for automated measurement, convenience, and compatibility with telemedicine platforms. The segment benefits from rising adoption in chronic disease management and growing awareness of hypertension monitoring. Electronic sphygmomanometers are increasingly integrated with Bluetooth and cloud-based platforms for data tracking. Patient-friendly designs, portability, and low training requirements further boost demand. Growing health consciousness and government initiatives for regular BP monitoring reinforce market growth. Frequent updates in software and user-friendly interfaces also contribute to the segment’s dominance. High adoption in developed regions such as North America and Europe strengthens market leadership. Furthermore, electronic sphygmomanometers reduce human error, enhancing reliability.

The aneroid sphygmomanometer segment is anticipated to witness the fastest growth, registering a CAGR of 12.3% from 2026 to 2033, driven by demand for cost-effective, durable, and portable solutions. These devices are widely preferred in clinics, ambulatory settings, and field healthcare programs due to their low maintenance and robustness. Increasing adoption in emerging markets with growing healthcare infrastructure fuels growth. Aneroid devices are favored for manual use and professional training in clinical settings. Their mechanical operation ensures reliability even in areas with limited power supply. Government health programs promoting affordable monitoring devices support market expansion. Ease of portability makes them suitable for home care visits and rural healthcare initiatives. Growing awareness of cardiovascular health and hypertension screening programs further accelerates adoption. Manufacturers are focusing on ergonomic and lightweight designs to improve user experience. The segment’s appeal in educational and training institutions also supports its fast growth trajectory.

- By Application

On the basis of application, the Sphygmomanometer/Aneroid BP Monitor market is segmented into hospital, clinic, family, and others. The hospital segment accounted for the largest market revenue share of 45% in 2025, driven by increasing patient inflow, chronic disease management, and integration of electronic monitoring solutions. Hospitals require reliable and rapid BP measurement for inpatient monitoring and emergency care. The rising prevalence of hypertension and cardiovascular disorders increases device demand. Hospitals are increasingly adopting advanced electronic sphygmomanometers for continuous monitoring and integration with patient data management systems. Staff-friendly features, accuracy, and automated measurement enhance workflow efficiency. Government hospital initiatives and healthcare infrastructure investments further reinforce market dominance. The segment benefits from recurring purchases for replacements and upgrades. High adoption in developed regions ensures consistent demand. Multi-use compatibility across departments strengthens the segment’s market leadership.

The family/home use segment is expected to witness the fastest CAGR of 13.1% from 2026 to 2033, driven by rising health awareness, telemedicine growth, and the convenience of at-home monitoring. Increasing prevalence of hypertension and cardiovascular risk factors encourages consumers to monitor blood pressure regularly. Affordable, portable, and easy-to-use electronic devices fuel adoption. Growth of wellness programs and insurance coverage incentives supports home monitoring. Awareness campaigns by healthcare providers promote self-measurement practices. Digital integration with smartphones and apps facilitates health tracking and sharing with physicians. Rising preference for proactive health management and chronic disease monitoring further drives growth. The trend toward remote patient monitoring in aging populations accelerates segment expansion. Manufacturers are introducing compact, user-friendly devices tailored for home use.

Sphygmomanometer/Aneroid BP Monitor Market Regional Analysis

- North America dominated the sphygmomanometer/aneroid BP monitor market with the largest revenue share of approximately 42% in 2025, supported by advanced healthcare infrastructure, high adoption of home and clinical monitoring devices, and the presence of key medical device manufacturers. The U.S. accounted for the majority of regional demand due to growing cardiovascular health awareness, favorable reimbursement policies, and the expansion of remote patient monitoring programs

- Rising prevalence of hypertension and cardiovascular diseases has increased the demand for accurate and reliable BP monitoring devices. Hospitals, clinics, and home healthcare setups are adopting electronic sphygmomanometers for ease of use and integration with patient records. Government initiatives promoting preventive healthcare and regular blood pressure screening further reinforce market growth

- High disposable income and a technologically aware population facilitate the adoption of advanced monitoring devices. Continuous product innovations and user-friendly designs also contribute to North America’s market leadership. The presence of leading manufacturers and established distribution channels ensures wide device availability and sustained demand

U.S. Sphygmomanometer/Aneroid BP Monitor Market Insight

The U.S. sphygmomanometer/aneroid BP monitor market captured the largest share in North America in 2025, driven by growing awareness of cardiovascular health and widespread adoption of home and clinical monitoring solutions. Increasing prevalence of hypertension, expansion of telemedicine, and home healthcare programs are key growth factors. Hospitals, clinics, and diagnostic centers are investing in electronic and aneroid devices to enhance monitoring efficiency. Rising geriatric population and focus on early detection of blood pressure-related disorders further propel demand. Government programs and health insurance coverage supporting home BP monitoring encourage consumer uptake. Additionally, continuous product development, portability, and ease of use enhance market penetration.

Europe Sphygmomanometer/Aneroid BP Monitor Market Insight

The Europe sphygmomanometer/aneroid BP monitor market is projected to expand at a substantial CAGR during the forecast period, driven by rising prevalence of hypertension, increasing healthcare expenditure, and well-developed medical infrastructure. The demand for accurate, reliable, and easy-to-use BP monitors in hospitals and clinics is growing. Adoption is further supported by increasing geriatric population and government initiatives promoting preventive cardiovascular care. Major markets include Germany, the U.K., France, and Italy, with growing awareness among end users about home monitoring. Regulatory frameworks promoting safe and accurate devices encourage adoption of electronic and aneroid devices. Healthcare providers are increasingly integrating BP monitoring in routine check-ups and patient management programs.

U.K. Sphygmomanometer/Aneroid BP Monitor Market Insight

The U.K. sphygmomanometer/aneroid BP monitor market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing awareness of cardiovascular diseases and hypertension. Clinics, hospitals, and home healthcare sectors are increasingly using BP monitors for regular patient monitoring. Growing preventive healthcare programs and government initiatives to reduce cardiovascular risk encourage adoption. Rising demand for portable and accurate devices, combined with technological advancements in electronic sphygmomanometers, supports growth. The trend of remote patient monitoring and telemedicine adoption further accelerates market expansion.

Germany Sphygmomanometer/Aneroid BP Monitor Market Insight

The Germany sphygmomanometer/aneroid BP monitor market is expected to expand at a considerable CAGR during the forecast period, driven by rising healthcare expenditure, high prevalence of hypertension, and increasing adoption of advanced monitoring solutions in hospitals and clinics. Government policies promoting preventive care and chronic disease management support market growth. Clinics and hospitals are replacing traditional devices with electronic sphygmomanometers for accuracy and convenience. The aging population further encourages home and outpatient monitoring solutions. Manufacturers focusing on durable, accurate, and user-friendly devices strengthen market penetration.

Asia-Pacific Sphygmomanometer/Aneroid BP Monitor Market Insight

The Asia-Pacific sphygmomanometer/aneroid BP monitor market is poised to grow at the fastest CAGR of around 11.8% from 2026 to 2033, driven by rising hypertension prevalence, increasing healthcare expenditure, and improving healthcare infrastructure in countries such as China, India, and Japan. Growing awareness about early detection and management of blood pressure-related disorders encourages adoption of home and clinical BP monitors. Expansion of hospitals, clinics, and telemedicine services supports market penetration. Government initiatives promoting preventive healthcare and increasing disposable incomes also contribute to growth. Electronic devices are gaining popularity due to convenience, portability, and integration with digital health platforms.

Japan Sphygmomanometer/Aneroid BP Monitor Market Insight

The Japan sphygmomanometer/aneroid BP monitor market is growing due to increasing cardiovascular disease prevalence, rapid urbanization, and focus on preventive healthcare. Hospitals and clinics are increasingly adopting electronic and aneroid devices for accurate monitoring. The aging population drives demand for easy-to-use home BP monitors. Technological advancements and portable device availability support market expansion. Government programs and insurance incentives for preventive care further encourage adoption.

China Sphygmomanometer/Aneroid BP Monitor Market Insight

China sphygmomanometer/aneroid BP monitor market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, rising healthcare awareness, and growing middle-class population. Hospitals, clinics, and home healthcare setups are adopting BP monitoring devices for early detection and management of hypertension. Government initiatives for chronic disease management, along with improving healthcare infrastructure, are driving demand. Affordable devices and local manufacturing support wide accessibility. Rising telemedicine adoption and preventive health programs further propel growth.

Sphygmomanometer/Aneroid BP Monitor Market Share

The Sphygmomanometer/Aneroid BP Monitor industry is primarily led by well-established companies, including:

• Omron Healthcare (Japan)

• A&D Medical (Japan)

• Microlife (Switzerland)

• Rossmax (Switzerland)

• SunTech Medical (U.S.)

• Beurer (Germany)

• Trivitron Healthcare (India)

• AND Systech (Japan)

• Citizen Systems (Japan)

• Contec Medical Systems (China)

• iHealth Labs (U.S.)

• Guangdong Biolight Meditech (China)

• Rossmax International (Switzerland)

• Creatix Medical (Germany)

• HuBDIC (South Korea)

• Medline Industries (U.S.)

• Infopia (South Korea)

• EDAN Instruments (China)

• BPL Medical Technologies (India)

Latest Developments in Global Sphygmomanometer/Aneroid BP Monitor Market

- In September 2025, Omron Healthcare announced that cumulative worldwide sales of its blood pressure monitors surpassed 400 million units — a major milestone that underscores the widespread adoption of BP monitors globally in both home and clinical settings

- In September 2025, Sky Labs launched CART BP — a ring‑type, cuffless blood pressure monitor worn on the finger that enables 24‑hour BP monitoring including during sleep. This represents a notable shift toward continuous and more convenient BP tracking beyond traditional cuff‑based arm monitors

- In October 2025, Omron introduced a new generation of BP monitors with built‑in AI‑powered atrial fibrillation (AFib) detection (e.g., models such as 10 Series, Platinum, Gold, 7 Series). These devices — recognized by the 2025 Digital Health Awards — automatically screen for AFib during each BP measurement, expanding the functionality of BP monitors from simple pressure measurement to early cardiac risk detection

- In January 2024 (CES 2024), Valencell unveiled Fingertip Blood Pressure Monitor — a cuffless, calibration‑free BP monitor that measures blood pressure from the finger using optical sensors, targeting over‑the‑counter use without the need for traditional arm‑cuff setups. This introduces a potential new form factor for BP measurement aimed at increased user comfort and compliance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.