Global Stationery Wireless Ev Charging Market

Market Size in USD Million

CAGR :

%

USD

22.86 Million

USD

667.56 Million

2024

2032

USD

22.86 Million

USD

667.56 Million

2024

2032

| 2025 –2032 | |

| USD 22.86 Million | |

| USD 667.56 Million | |

|

|

|

|

What is the Global Stationary Wireless Electric Vehicle (EV) Charging Market Size and Growth Rate?

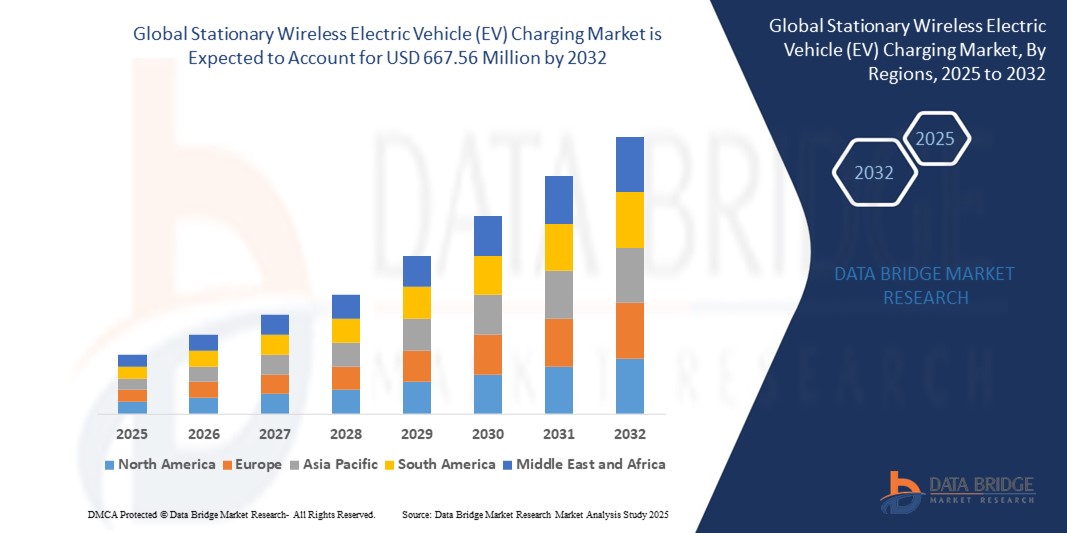

- The global stationary wireless electric vehicle (EV) charging market size was valued at USD 22.86 million in 2024 and is expected to reach USD 667.56 million by 2032, at a CAGR of 52.46% during the forecast period

- Market expansion is being driven by growing EV adoption, increasing demand for convenient charging infrastructure, and advancements in resonant inductive and capacitive wireless power transfer technologies

- In addition, support from government initiatives, rising investments in smart mobility infrastructure, and the need for automated, hassle-free charging are contributing to the acceleration of this market segment’s growth globally

What are the Major Takeaways of Stationary Wireless Electric Vehicle (EV) Charging Market?

- Stationary Wireless EV Charging systems enable contactless, pad-based charging for parked electric vehicles, offering a safe, efficient, and user-friendly alternative to plug-in methods, particularly for urban, residential, and fleet applications

- The market is witnessing increased traction due to enhanced convenience, maintenance-free operation, and integration potential with autonomous parking and vehicle-to-grid (V2G) technologies

- The upward trend is further supported by OEM partnerships, smart city initiatives, and growing consumer preference for seamless charging experiences as part of the next-gen electric mobility ecosystem

- Europe dominated the stationary wireless electric vehicle (EV) charging market with the largest revenue share of 38.7% in 2024, driven by robust infrastructure development, stringent carbon emission regulations, and strong government support for sustainable mobility

- Asia-Pacific stationary wireless electric vehicle (EV) charging market is projected to grow at the fastest CAGR of 15.23% from 2025 to 2032, driven by rising urbanization, rapid EV adoption, and increased government spending on smart transportation infrastructure

- The Base Charging Pad (Transmitter) segment dominated the market with the largest revenue share of 41.5% in 2024, driven by its essential role in initiating power transfer and its deployment flexibility across residential garages and public spaces

Report Scope and Stationary Wireless Electric Vehicle (EV) Charging Market Segmentation

|

Attributes |

Stationary Wireless Electric Vehicle (EV) Charging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Stationary Wireless Electric Vehicle (EV) Charging Market?

“Integration with Smart Infrastructure and Fleet Management Systems”

- A key emerging trend in the global stationary wireless electric vehicle (EV) charging market is the increasing integration of these systems into smart city infrastructure and automated fleet management platforms, streamlining energy delivery and vehicle utilization

- For instance, Electreon’s wireless charging technology has been deployed in urban public transportation projects in cities such as Tel Aviv, enabling dynamic and stationary wireless charging of electric buses. This initiative supports real-time energy optimization and reduces vehicle downtime

- The fusion with cloud-based fleet management systems allows for predictive maintenance, optimized charging schedules, and seamless data exchange between vehicles and grid infrastructure. This facilitates higher energy efficiency and operational cost savings for both municipal and private operators

- In addition, integration with renewable energy sources such as solar power and vehicle-to-grid (V2G) networks enables dynamic load balancing, reinforcing the sustainability of wireless charging solutions

- Companies such as WiTricity and Momentum Wireless Power are actively developing and piloting these integrated charging ecosystems, targeting logistics, delivery fleets, and commercial EV users

- As urban mobility evolves, this trend will play a critical role in positioning Stationary Wireless EV Charging as a backbone of smart transportation networks, ensuring efficient energy use and minimal environmental impact

What are the Key Drivers of Stationary Wireless Electric Vehicle (EV) Charging Market?

- The rising demand for hassle-free and cable-free EV charging is a major factor driving market growth, especially in urban environments where ease-of-use and space optimization are critical

- For instance, in February 2024, WiTricity launched an enhanced wireless charging system with higher efficiency and broader EV compatibility, reinforcing convenience and deployment scalability for residential and commercial users

- Government initiatives promoting zero-emission transportation, including subsidies for EV infrastructure and mandates for fleet electrification, are fueling adoption across multiple sectors

- The growing adoption of electric fleets in logistics, public transport, and rideshare services further propels demand for stationary wireless systems, which offer reduced maintenance and enhanced automation compared to traditional wired setups

- In addition, the shift toward premium consumer experiences is encouraging automotive OEMs to integrate wireless charging capabilities into next-generation EV models, making wireless charging a key differentiator in vehicle sales

Which Factor is challenging the Growth of the Stationary Wireless Electric Vehicle (EV) Charging Market?

- One of the major challenges facing this market is the high initial cost of wireless EV charging infrastructure, particularly for large-scale deployment across public or commercial settings

- For instance, the installation of wireless charging pads for buses or logistics fleets requires substantial groundwork, power management systems, and specialized receivers in vehicles, making upfront investment a key concern

- Furthermore, interoperability limitations between different OEMs and charging platform providers can hinder widespread adoption, especially in regions with fragmented EV standards

- Safety regulations and technical concerns about electromagnetic field (EMF) exposure in densely populated areas also lead to regulatory hesitations in some markets

- To overcome these challenges, manufacturers must focus on cost reduction through scale, standardized protocols, and transparent communication about health and safety compliance

- As industry players such as Qualcomm Technologies and Electreon work on improving charging efficiency and establishing common standards, overcoming these barriers will be crucial to unlocking the full market potential of stationary wireless EV charging

How is the Stationary Wireless Electric Vehicle (EV) Charging Market Segmented?

The market is segmented on the basis of type, application, charging system, distribution channel, power supply, vehicle type, and propulsion type.

• By Type

On the basis of type, the stationary wireless electric vehicle (EV) charging market is segmented into Base Charging Pad (Transmitter), Power Control Unit, and Vehicle Charging Pad (Receiver). The Base Charging Pad (Transmitter) segment dominated the market with the largest revenue share of 41.5% in 2024, driven by its essential role in initiating power transfer and its deployment flexibility across residential garages and public spaces. With technological improvements enhancing energy transfer efficiency and safety standards, the transmitter pad remains a critical component of stationary charging setups.

The Vehicle Charging Pad (Receiver) is projected to witness the fastest CAGR from 2025 to 2032, as EV manufacturers increasingly integrate receivers during vehicle assembly. This growth is supported by rising consumer demand for factory-installed wireless charging compatibility.

• By Application

On the basis of application, the stationary wireless electric vehicle (EV) charging market is categorized into Home Charging Unit and Public Charging Station. The Home Charging Unit segment held the largest market share of 56.2% in 2024, driven by growing residential EV ownership and consumer preference for the convenience of overnight charging without manual cable handling.

The Public Charging Station segment is anticipated to register the fastest CAGR from 2025 to 2032, supported by smart city initiatives, fleet electrification programs, and the integration of wireless pads in parking facilities and transport terminals to support short dwell-time charging.

• By Charging System

On the basis of charging system, the market is segmented into Magnetic Power Transfer, Inductive Power Transfer, and Capacitive Power Transfer. The Inductive Power Transfer segment dominated in 2024 with a market share of 48.7%, attributed to its established use, high efficiency, and safety in diverse environmental conditions. Its compatibility with both residential and commercial charging setups has made it the preferred technology among current adopters.

The Capacitive Power Transfer segment is expected to grow at the highest CAGR from 2025 to 2032 due to ongoing R&D aimed at achieving compact form factors and cost-effective scalability.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Aftermarket and OEM. The OEM segment held the largest market share of 61.4% in 2024, owing to increased partnerships between EV manufacturers and wireless charging technology providers. Factory integration ensures better system compatibility and appeals to tech-savvy consumers seeking turnkey solutions.

The Aftermarket segment is forecast to grow at the highest CAGR from 2025 to 2032, driven by the retrofitting of existing EVs and the demand from fleet operators seeking flexible installation options.

• By Power Supply

On the basis of power supply, the market is divided into 3–<11 kW, 11–50 kW, and >50 kW. The 3–<11 kW segment led the market in 2024 with a dominant share of 46.3%, primarily due to its suitability for residential charging and lower installation costs. It is widely used in homes and apartment complexes for overnight charging applications.

The >50 kW segment is expected to witness the fastest CAGR, fueled by the expansion of high-capacity public and commercial charging stations aimed at rapid recharging of EV fleets.

• By Vehicle Type

On the basis of vehicle type, the market is segmented into Passenger Car (PC) and Commercial Vehicle (CV). The Passenger Car segment captured the largest share of 64.8% in 2024, driven by the growing adoption of EVs among individual consumers, rising disposable incomes, and increased awareness of wireless charging benefits.

The Commercial Vehicle segment is projected to register the fastest CAGR from 2025 to 2032 due to logistics providers adopting EVs to meet emission regulations and operational efficiency goals.

• By Propulsion Type

On the basis of propulsion type, the market is segmented into Battery Electric Vehicle (BEV) and Plug-In Hybrid Electric Vehicle (PHEV). The BEV segment dominated the market with a market share of 71.5% in 2024, supported by the growing availability of long-range electric cars and favorable government incentives.

The PHEV segment is expected to grow steadily, especially in markets where infrastructure for fully electric vehicles is still under development.

Which Region Holds the Largest Share of the Stationary Wireless Electric Vehicle (EV) Charging Maret?

- Europe dominated the stationary wireless electric vehicle (EV) charging market with the largest revenue share of 38.7% in 2024, driven by robust infrastructure development, stringent carbon emission regulations, and strong government support for sustainable mobility

- The region’s emphasis on deploying smart, eco-friendly transportation solutions has accelerated the adoption of wireless EV charging, particularly in urban hubs and high-traffic public zones.

- Consumers and municipalities across Europe are prioritizing convenience, safety, and aesthetics, leading to widespread installation of stationary wireless EV chargers in commercial buildings, residential complexes, and transport terminals

- Ongoing smart city initiatives, especially in countries such as Germany, the U.K., and the Netherlands, are further fueling growth and solidifying Europe’s leading market position

Germany Stationary Wireless Electric Vehicle (EV) Charging Market Insight

Germany holds a significant share in the European market, driven by its engineering excellence, strong automotive sector, and focus on environmental sustainability. The presence of leading automakers and a well-established EV infrastructure network is accelerating the integration of wireless charging systems in both private and public transportation settings. Germany also leads in pilot programs and government-supported initiatives promoting wireless charging roads and fleet solutions.

U.K. Stationary Wireless Electric Vehicle (EV) Charging Market Insight

The U.K. market is witnessing notable growth due to increasing investment in green mobility infrastructure and rising demand for hassle-free charging among urban EV users. With growing public awareness of environmental concerns and government incentives for EV adoption, the U.K. continues to integrate wireless charging solutions in residential developments, parking facilities, and commercial sites.

Which Region is the Fastest Growing in the Stationary Wireless Electric Vehicle (EV) Charging Market?

Asia-Pacific stationary wireless electric vehicle (EV) charging market is projected to grow at the fastest CAGR of 15.23% from 2025 to 2032, driven by rising urbanization, rapid EV adoption, and increased government spending on smart transportation infrastructure. Countries such as China, Japan, South Korea, and India are witnessing high demand for convenient, maintenance-free EV charging options, supporting large-scale deployment in residential and public spaces. The region’s dominance in EV production and its role as a manufacturing hub for wireless charging components ensure cost efficiency and scalability, making the technology more accessible to a broader consumer base.

China Stationary Wireless Electric Vehicle (EV) Charging Market Insight

China led the Asia-Pacific market in 2024, owing to a strong domestic EV industry, government-driven smart city initiatives, and rapid technological adoption. With increasing integration of wireless charging pads in parking lots and residential complexes, the country is setting benchmarks in the deployment of large-scale wireless EV charging infrastructure.

Japan Stationary Wireless Electric Vehicle (EV) Charging Market Insight

Japan’s market is gaining traction due to its high-tech innovation environment and preference for space-efficient, seamless EV charging. The aging population’s need for user-friendly, low-effort solutions and the rise of smart buildings are boosting demand for stationary wireless charging systems across both residential and commercial applications.

Which are the Top Companies in Stationary Wireless Electric Vehicle (EV) Charging Market?

The stationary wireless electric vehicle (EV) charging industry is primarily led by well-established companies, including:

- Qualcomm Technologies, Inc. (U.S.)

- WiTricity Corporation (U.S.)

- Momentum Wireless Power (U.S.)

- ELIX Wireless (Canada)

- Continental AG (Germany)

- Bombardier (Canada)

- WAVE INC. (U.S.)

- Fortum (Finland)

- Hyundai Motor India (India)

- ElectReon (Israel)

- Opconnect (U.S.)

- ZTE Corporation (China)

- HELLA GmbH & Co. KGaA (Germany)

- Robert Bosch GmbH (Germany)

- Toshiba Corporation (Japan)

- TOYOTA MOTOR CORPORATION (Japan)

- Plugless Power Inc. (U.S.)

What are the Recent Developments in Global Stationary Wireless Electric Vehicle (EV) Charging Market?

- In July 2023, WiTricity Corporation introduced the FastTrack Integration Program aimed at automotive OEMs, allowing them to begin evaluation and testing of electric vehicles with wireless charging capabilities within just 90 days. The program includes WiTricity’s Halo receiver and 11kW charger, enabling full wireless charging functionality on the EV platform. This initiative is expected to accelerate wireless charging adoption across major automotive brands

- In June 2023, Dutch commercial vehicle manufacturer GINAF Trucks entered a collaboration with Electreon to equip a 50-ton GINAF truck model with Electreon’s wireless charging system. The partnership also explores the possibility of aftermarket wireless charging installations on additional GINAF trucks and Mercedes-Benz chassis. This collaboration marks a significant step toward wireless charging in heavy-duty electric transport

- In April 2023, WiTricity Corporation partnered with Germany-based ABT e-Line to introduce wireless EV charging across Europe. Initially, ABT e-Line plans to retrofit the VW ID.4 model with WiTricity’s wireless charging system, with availability expected by early 2024. This move highlights the growing focus on integrating wireless charging in mainstream European EVs

- In February 2023, HEVO Inc. announced a partnership with global automaker Stellantis NV to incorporate wireless charging technology into Stellantis electric vehicle models. The collaboration aims to enhance the EV user experience by offering safer, more efficient, and durable wireless charging solutions. This development positions HEVO and Stellantis at the forefront of next-gen EV infrastructure

- In May 2022, WAVE Charging secured a second order for its 250kW wireless charging systems from Twin Transit, intended for integration into new Gillig battery-electric buses expected to be delivered by late 2023. This order reflects growing demand for high-power wireless charging solutions in the public transit sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.