Global Stuffed Animals And Plush Toys Market

Market Size in USD Billion

CAGR :

%

USD

11.97 Billion

USD

22.15 Billion

2025

2033

USD

11.97 Billion

USD

22.15 Billion

2025

2033

| 2026 –2033 | |

| USD 11.97 Billion | |

| USD 22.15 Billion | |

|

|

|

|

Stuffed Animals and Plush Toys Market Size

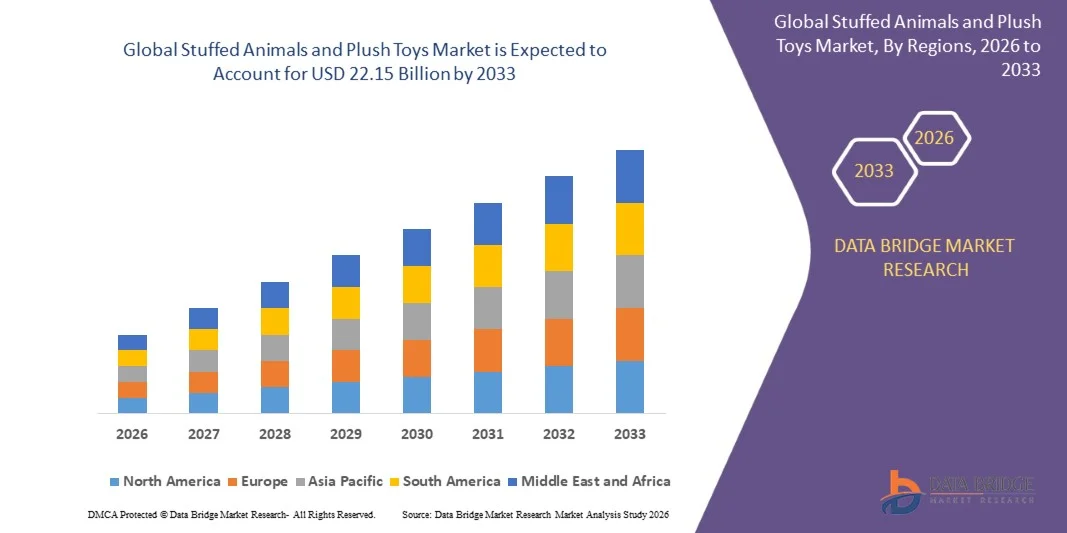

- The global stuffed animals and plush toys market size was valued at USD 11.97 billion in 2025 and is expected to reach USD 22.15 billion by 2033, at a CAGR of 8.00% during the forecast period

- The market growth is largely fuelled by rising consumer spending on toys, increasing demand for character-based and licensed plush products, and growing popularity of gifting culture among children and adults

- In addition, expanding e-commerce penetration, continuous product innovation in materials and designs, and increasing focus on sustainability and eco-friendly plush toys are supporting market expansion

Stuffed Animals and Plush Toys Market Analysis

- The market is characterised by strong emotional appeal and nostalgia-driven purchasing behaviour, making plush toys popular across multiple age groups beyond children

- Manufacturers are increasingly focusing on premiumisation, customisation, and the use of safe, non-toxic, and recycled materials to enhance brand differentiation and consumer trust

- North America dominated the stuffed animals and plush toys market with the largest revenue share of 38.07% in 2025, driven by strong consumer spending on toys, a well-established gifting culture, and high demand for licensed and character-based plush products

- Asia-Pacific region is expected to witness the highest growth rate in the global stuffed animals and plush toys market, driven by increasing birth rates in select economies, rising consumer spending on children’s products, rapid e-commerce expansion, and strong manufacturing capabilities across the region

- The Stuffed Animals segment held the largest market revenue share of 40.35% in 2025, driven by increasing consumer preference for personalised and unique gifting options. Custom name embroidery, design selection, and special themes are gaining traction across online platforms, particularly among millennials and gifting-focused consumers

Report Scope and Stuffed Animals and Plush Toys Market Segmentation

|

Attributes |

Stuffed Animals and Plush Toys Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Stuffed Animals and Plush Toys Market Trends

“Rising Demand For Character-Based And Emotional Comfort Toys”

- The increasing emotional attachment to plush toys is significantly shaping the stuffed animals and plush toys market, as consumers across age groups seek products that offer comfort, nostalgia, and emotional well-being. Plush toys are increasingly viewed not only as play items for children but also as companions, collectibles, and stress-relief products for teenagers and adults. This trend is strengthening demand for soft, high-quality, and aesthetically appealing designs, encouraging manufacturers to expand their portfolios with innovative themes and materials

- Growing influence of popular entertainment franchises, animated characters, and digital media is accelerating demand for licensed and character-based plush toys. Consumers are increasingly attracted to familiar characters from movies, television shows, games, and online content, driving higher sales of branded plush products. This has encouraged collaborations between toy manufacturers and media companies to create exclusive collections that enhance brand visibility and consumer engagement

- Social media platforms and online gifting culture are influencing purchasing behaviour, with plush toys frequently featured as personalized gifts for occasions such as birthdays, anniversaries, and celebrations. Manufacturers are leveraging online marketing, influencer promotions, and direct-to-consumer channels to reach wider audiences. In addition, visually appealing and themed plush toys are gaining traction as decorative and lifestyle products, further expanding their consumer base

- For instance, in 2024, Disney in the U.S. and Sanrio in Japan expanded their plush toy portfolios by introducing new character-based and limited-edition collections. These launches were driven by rising fan engagement and demand for collectible plush toys, with distribution across online platforms, specialty toy stores, and theme parks. The products were marketed as premium and emotionally engaging items, supporting repeat purchases and brand loyalty

- While demand for plush toys continues to grow, sustained market expansion depends on continuous product innovation, quality assurance, and alignment with changing consumer preferences. Manufacturers are focusing on improving material safety, durability, and design creativity while balancing production costs and supply chain efficiency to remain competitive

Stuffed Animals and Plush Toys Market Dynamics

Driver

“Growing Popularity Of Character-Based, Gifting, And Comfort Toys”

- Rising consumer interest in character-based and emotionally comforting products is a major driver for the stuffed animals and plush toys market. Parents, collectors, and adult consumers are increasingly purchasing plush toys for emotional support, décor, and gifting purposes. This shift is encouraging manufacturers to diversify offerings with licensed characters, themed designs, and premium collections

- Expanding gifting culture across festivals, celebrations, and personal milestones is contributing to market growth. Plush toys are widely preferred as thoughtful and expressive gifts due to their universal appeal and emotional value. Their suitability for all age groups and occasions is reinforcing consistent demand across retail and online channels

- Toy manufacturers and brands are actively promoting plush toys through seasonal launches, limited editions, and collaborations with entertainment franchises. These efforts are supported by strong marketing campaigns, influencer partnerships, and e-commerce expansion, enabling brands to connect with global audiences and enhance product visibility

- For instance, in 2023, Hasbro in the U.S. and Bandai in Japan reported increased sales of plush toys linked to animated series and gaming franchises. This growth was driven by strong fan bases, digital promotions, and cross-merchandising strategies, resulting in higher consumer engagement and brand differentiation

- Despite strong demand drivers, long-term growth relies on maintaining product quality, safety standards, and affordability. Investment in sustainable materials, efficient manufacturing, and innovative design will be essential to meet evolving consumer expectations and sustain competitive advantage

Restraint/Challenge

“Rising Raw Material Costs And Intense Market Competition”

- Fluctuating prices of raw materials such as cotton, polyester fibres, and eco-friendly fabrics remain a key challenge for the stuffed animals and plush toys market. Increased costs associated with sustainable and certified materials can impact profit margins, particularly for small and mid-sized manufacturers. These cost pressures may also limit pricing flexibility in highly competitive markets

- Intense competition from unbranded and low-cost manufacturers affects brand positioning and market share. Price-sensitive consumers may opt for cheaper alternatives, making it challenging for established brands to maintain premium pricing. This competition is further intensified by the presence of counterfeit and imitation plush products in certain markets

- Supply chain disruptions and compliance with stringent toy safety regulations also pose challenges for manufacturers. Ensuring adherence to quality, safety, and child protection standards increases operational complexity and costs. Delays in sourcing materials and logistics can impact product availability and seasonal sales cycles

- For instance, in 2024, plush toy manufacturers in China and Vietnam supplying global brands such as Mattel and TY reported margin pressure due to higher fabric costs and stricter safety compliance requirements. Increased competition from local low-cost producers also affected pricing strategies and retail negotiations

- Addressing these challenges will require cost optimisation, efficient sourcing strategies, and stronger brand differentiation. Manufacturers are expected to focus on supply chain resilience, innovation in materials, and enhanced marketing efforts to communicate quality, safety, and emotional value, supporting sustainable growth in the global stuffed animals and plush toys market

Stuffed Animals and Plush Toys Market Scope

The market is segmented on the basis of product type, stuffing filling, and distribution.

• By Product Type

On the basis of product type, the global stuffed animals and plush toys market is segmented into Cartoon Toys, Traditional Stuffed Animals, Battery Operated, Action Figures and Model Play, Dolls and Play Sets, Stuffed Animals, and Special Feature Plush and Puppets. The Stuffed Animals segment held the largest market revenue share of 40.35% in 2025, driven by increasing consumer preference for personalised and unique gifting options. Custom name embroidery, design selection, and special themes are gaining traction across online platforms, particularly among millennials and gifting-focused consumers.

The Cartoon Toys segment is expected to witness the fastest growth rate from 2026 to 2033 driven by strong demand for licensed and character-based products linked to popular movies, television shows, and digital media. Cartoon plush toys benefit from high brand recognition, emotional attachment, and repeat purchases among children and collectors, supporting sustained demand.

• By Stuffing Filling

On the basis of stuffing filling, the market is segmented into Synthetic Toy Fillings, Natural Toy Fillings, Eco-friendly Toy Stuffing, Organic Toy Stuffing, and Blended Materials. The Synthetic Toy Fillings segment dominated the market in 2025 due to its cost-effectiveness, durability, and wide availability, making it suitable for mass production and large-scale distribution. Synthetic fillings offer consistent quality and long shelf life, supporting their extensive use across various plush toy categories.

The Eco-friendly Toy Stuffing segments is projected to witness the fastest growth from 2026 to 2033, driven by rising consumer awareness regarding sustainability, child safety, and environmental impact. Manufacturers are increasingly adopting recycled and organic materials to align with clean and sustainable product positioning.

• By Distribution

On the basis of distribution, the global stuffed animals and plush toys market is segmented into Hyper/Supermarkets, E-commerce, Toy Stores, Discount Stores, Hobby and Craft Stores, and Other Sales Channels. The Hyper/Supermarket segment accounted for the largest revenue share in 2025 supported by high product visibility, wide assortment availability, and impulse purchasing behaviour among consumers. These retail formats continue to attract families seeking convenient and one-stop shopping experiences.

The E-commerce segment is projected to witness the fastest growth from 2026 to 2033, driven by increasing internet penetration, expanding online gifting culture, and availability of customised and exclusive plush toy collections. Online platforms offer wider choices, competitive pricing, and doorstep delivery, making them increasingly preferred by global consumers.

Stuffed Animals and Plush Toys Market Regional Analysis

- North America dominated the stuffed animals and plush toys market with the largest revenue share of 38.07% in 2025, driven by strong consumer spending on toys, a well-established gifting culture, and high demand for licensed and character-based plush products

- Consumers in the region highly value product quality, safety standards, emotional appeal, and brand recognition, with plush toys widely purchased for children, collectors, and as comfort or décor items

- This widespread adoption is further supported by high disposable incomes, strong presence of leading toy manufacturers, and extensive retail and e-commerce networks, establishing plush toys as a popular category across multiple age groups

U.S. Stuffed Animals And Plush Toys Market Insight

The U.S. stuffed animals and plush toys market captured the largest revenue share in 2025 within North America, fuelled by high demand for character-based, collectible, and premium plush toys. Consumers increasingly prioritize emotional value, brand licensing, and customisation in toy purchases. The strong influence of entertainment franchises, combined with robust e-commerce penetration and seasonal gifting trends, continues to propel market growth. In addition, the popularity of personalised and limited-edition plush toys is supporting sustained consumer engagement.

Europe Stuffed Animals And Plush Toys Market Insight

The Europe stuffed animals and plush toys market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by rising demand for sustainable, eco-friendly, and ethically produced toys. Increasing awareness of product safety, material sourcing, and environmental impact is influencing purchasing decisions. European consumers are also drawn to high-quality craftsmanship and innovative designs. Growth is observed across children’s toys, collectibles, and gift segments, with plush toys gaining popularity in both traditional retail and online channels.

U.K. Stuffed Animals And Plush Toys Market Insight

The U.K. stuffed animals and plush toys market is expected to witness strong growth from 2026 to 2033, driven by a growing gifting culture and increasing preference for character-based and nostalgic plush toys. Parents and young adults are actively purchasing plush products for celebrations, collectibles, and emotional comfort. The expansion of online retail platforms and availability of customised plush toys are further supporting market development in the country.

Germany Stuffed Animals And Plush Toys Market Insight

The Germany stuffed animals and plush toys market is expected to witness notable growth from 2026 to 2033, fuelled by strong consumer emphasis on product quality, safety, and sustainability. German consumers prefer durable, eco-conscious plush toys made from certified and child-safe materials. The country’s well-developed retail infrastructure and focus on responsible manufacturing support steady demand, particularly in premium and organic plush toy categories.

Asia-Pacific Stuffed Animals And Plush Toys Market Insight

The Asia-Pacific stuffed animals and plush toys market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising disposable incomes, rapid urbanisation, and expanding middle-class populations in countries such as China, Japan, and India. Increasing exposure to global entertainment content and growing e-commerce adoption are boosting demand for licensed and affordable plush toys. The region’s strong manufacturing base also supports large-scale production and competitive pricing.

Japan Stuffed Animals And Plush Toys Market Insight

The Japan stuffed animals and plush toys market is expected to witness significant growth from 2026 to 2033 due to the country’s strong character culture, high demand for cute and collectible products, and growing interest in emotional comfort items. Plush toys linked to anime, gaming, and pop culture franchises are particularly popular. In addition, Japan’s aging population is contributing to demand for plush toys used for companionship and stress relief.

China Stuffed Animals And Plush Toys Market Insight

The China stuffed animals and plush toys market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rapid urbanisation, a large consumer base, and strong domestic manufacturing capabilities. Rising household incomes and increasing demand for branded and character-based plush toys are driving market expansion. The growth of online retail platforms and export-oriented production further strengthens China’s position as a key market and manufacturing hub for stuffed animals and plush toys.

Stuffed Animals and Plush Toys Market Share

The Stuffed Animals and Plush Toys industry is primarily led by well-established companies, including:

- Mattel (U.S.)

- Bandai Namco Group (Japan)

- Hasbro (U.S.)

- The LEGO Group (Denmark)

- Simba Dickie Group (Germany)

- Spin Master (Canada)

- BUDSIES CO LLC (U.S.)

- Giantmicrobes, Inc. (U.S.)

- Ty (U.S.)

- TOMY (Japan)

- Steiff Retail GmbH (Germany)

- MGA Entertainment, Inc. (U.S.)

- SANRIO CO., LTD. (Japan)

- Melissa & Doug (U.S.)

- Build-A-Bear Workshop, Inc. (U.S.)

- Aurora World, Inc. (U.S.)

- Teddy Hermann (Germany)

- Gund (U.S.)

Latest Developments in Global Stuffed Animals and Plush Toys Market

- In November 2025, Bandai Spirits announced a product launch initiative to develop licensed plush toy merchandise for the One Piece and NBA crossover, combining a globally popular anime franchise with an international sports league. This development is expected to expand the consumer base, strengthen cross-industry collaborations, and boost demand for character-based plush collectibles in the global market

- In November 2025, Labubu introduced a new product innovation by launching mystery-box plush toys in Mexico, where the character is revealed only after purchase. This surprise-driven format is designed to encourage repeat purchases, attract collectors, and enhance engagement among children and young adults, supporting wider market adoption

- In November 2025, FC Barcelona unveiled a branding and merchandising expansion by introducing a new cat mascot along with an associated plush toy offering. The initiative leverages the club’s extensive global fan base, increasing demand for sports-themed plush collectibles and strengthening the role of licensed merchandise in market growth

- In September 2025, Ty Inc. (U.S.) entered a strategic partnership to strengthen its e-commerce capabilities and digital distribution network. The initiative aims to improve product accessibility, streamline online sales, and adapt to shifting consumer purchasing behaviour, reinforcing the company’s competitiveness in the digital retail landscape

- In August 2025, Build-A-Bear Workshop (U.S.) launched an eco-friendly product line featuring plush toys made from recycled materials. This sustainability-focused development aligns with rising consumer demand for environmentally responsible products, enhances brand positioning, and accelerates adoption of sustainable practices within the plush toys market

- In July 2025, Jellycat (U.K.) expanded its portfolio through product innovation by introducing interactive plush toys with integrated sound and movement features. This development targets tech-savvy consumers, enhances play value, and highlights the growing convergence of traditional plush toys with interactive technology, contributing to product differentiation and market expansion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.