Global Superphosphate Market

Market Size in USD Billion

CAGR :

%

USD

1.92 Billion

USD

3.26 Billion

2025

2033

USD

1.92 Billion

USD

3.26 Billion

2025

2033

| 2026 –2033 | |

| USD 1.92 Billion | |

| USD 3.26 Billion | |

|

|

|

|

What is the Global Superphosphate Market Size and Growth Rate?

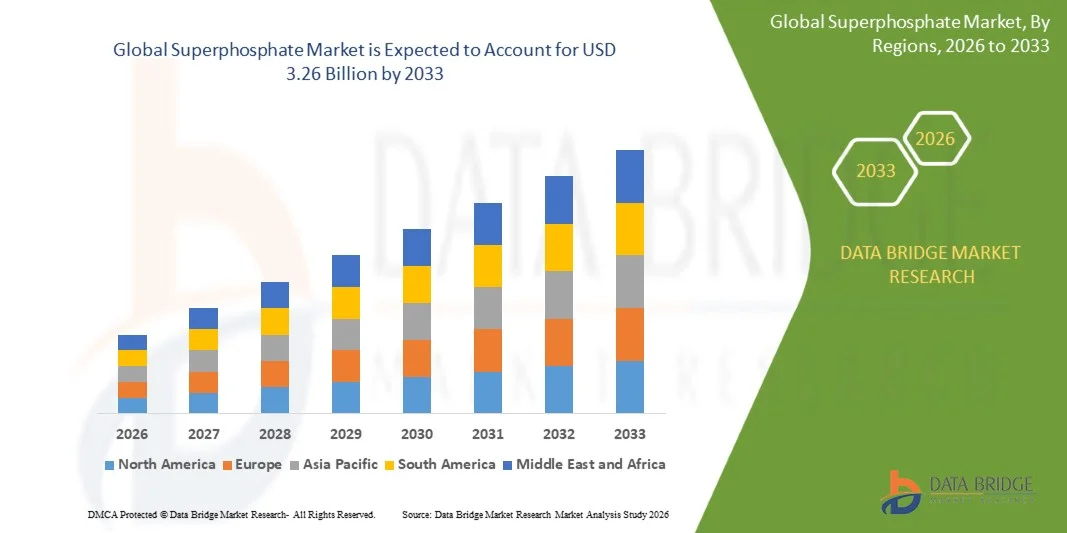

- The global superphosphate market size was valued at USD 1.92 billion in 2025 and is expected to reach USD 3.26 billion by 2033, at a CAGR of 6.80% during the forecast period

- The rise in the demand for fertilizer across the globe acts as one of the major factors driving the growth of superphosphate market

- The increase in emphasis on integrated pest management solutions, and high usage of phosphate fertilizers for increased crop yield owning to the large demand for food along with limited availability of arable land accelerate the market growth

What are the Major Takeaways of Superphosphate Market?

- The rise in the usage of phosphorous in chemical fertilizers and feed supplements to improve the nutrition of soil, and increase in demand for cereals and grains because of the rise in population further influence the market

- In addition, surge in investments, intervention of precision farming, rise in milk and meat consumption, and growth in the end user industries positively affect the superphosphate market

- Asia-Pacific dominated the Superphosphate market with the largest revenue share of 37.74% in 2025, driven by extensive agricultural activities, large arable land availability, and high fertilizer consumption across China, India, Indonesia, and Southeast Asian countries

- North America is projected to register the fastest CAGR of 9.14% from 2026 to 2033, driven by rising adoption of precision agriculture, increasing focus on soil health management, and growing demand for high-efficiency fertilizers across the U.S. and Canada

- The Single Super Phosphate segment dominated the market with a 55.4% share in 2025, owing to its cost-effectiveness, wide availability, and balanced nutrient composition containing phosphorus and sulfur

Report Scope and Superphosphate Market Segmentation

|

Attributes |

Superphosphate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Superphosphate Market?

“Increasing Shift Toward High-Efficiency, Customized, and Sustainable Superphosphate Fertilizers”

- The superphosphate market is witnessing strong adoption of enhanced-efficiency phosphate fertilizers designed to improve nutrient uptake, reduce soil fixation, and increase crop yield across diverse soil conditions

- Manufacturers are introducing fortified and blended superphosphate variants enriched with micronutrients such as zinc, boron, and sulfur to address soil nutrient deficiencies and improve agricultural productivity

- Growing emphasis on sustainable farming practices and balanced fertilization is driving demand for optimized phosphate application in cereals, oilseeds, fruits, and vegetable cultivation

- For instance, companies such as Nutrien Ltd, The Mosaic Company, Yara, EuroChem Group, and PhosAgro are expanding specialty phosphate portfolios to support precision agriculture and soil health improvement initiatives

- Increasing integration of digital farming tools and soil testing services is accelerating demand for customized fertilizer solutions tailored to regional crop requirements

- As global food demand rises and arable land availability declines, Superphosphates will remain essential for improving crop output, soil fertility management, and long-term agricultural sustainability

What are the Key Drivers of Superphosphate Market?

- Rising global population and increasing food consumption are driving higher agricultural output, thereby boosting demand for phosphate-based fertilizers

- For instance, in 2025, leading fertilizer producers expanded phosphate production capacity and strengthened distribution networks across Asia-Pacific, Latin America, and Africa to meet growing demand

- Increasing government support through fertilizer subsidies and agricultural modernization programs is supporting higher adoption rates among farmers

- Growing awareness regarding soil nutrient depletion and the need for phosphorus replenishment is strengthening superphosphate consumption

- Expansion of commercial farming, horticulture, and high-value crop cultivation is further fueling product demand

- Supported by advancements in fertilizer blending technology and precision agriculture practices, the Superphosphate market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Superphosphate Market?

- Volatility in raw material prices, particularly phosphate rock and sulfur, impacts production costs and profit margins for manufacturers

- For instance, during 2024–2025, supply chain disruptions and geopolitical tensions affected phosphate exports and increased global price fluctuations

- Environmental concerns related to phosphate runoff, eutrophication, and regulatory restrictions on fertilizer usage create compliance challenges

- Availability of alternative fertilizers such as compound NPK formulations and organic biofertilizers intensifies market competition

- Over-application risks and fluctuating agricultural commodity prices may discourage consistent fertilizer usage among farmers

- To address these challenges, companies are focusing on sustainable sourcing, development of enhanced-efficiency fertilizers, and farmer education programs to support balanced nutrient management and long-term market stability

How is the Superphosphate Market Segmented?

The market is segmented on the basis of product type, application, and end use.

• By Product Type

On the basis of product type, the superphosphate market is segmented into Single Super Phosphate (SSP) and Triple Super Phosphate (TSP). The Single Super Phosphate segment dominated the market with a 55.4% share in 2025, owing to its cost-effectiveness, wide availability, and balanced nutrient composition containing phosphorus and sulfur. SSP is extensively used across developing agricultural economies where affordability and soil sulfur supplementation are critical. It is particularly suitable for oilseeds, pulses, and cereal crops, supporting broad adoption among small and medium-scale farmers.

The Triple Super Phosphate segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by its higher phosphorus concentration, improved nutrient efficiency, and increasing demand in intensive farming systems that require concentrated fertilizer inputs for higher yield optimization.

• By Application

On the basis of application, the market is segmented into Chemical, Fertilizer, and Others. The Fertilizer segment dominated the market with a 68.7% share in 2025, supported by the primary use of superphosphate as a phosphorus-rich agricultural input to enhance crop productivity and soil fertility. Rising global food demand, expansion of commercial farming, and increased awareness of balanced nutrient management continue to strengthen fertilizer consumption worldwide.

The Chemical segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing utilization of phosphate compounds in industrial applications such as animal feed additives, water treatment chemicals, and specialty chemical production, expanding the product’s industrial relevance beyond agriculture.

• By End Use

On the basis of end use, the superphosphate market is segmented into Agricultural, Horticultural, Pasture Production, and Animal Feed. The Agricultural segment dominated the market with a 61.9% share in 2025, as large-scale crop cultivation remains the primary consumption channel for phosphate fertilizers. Growing cultivation of cereals, grains, oilseeds, and cash crops continues to drive demand for phosphorus supplementation to maintain soil productivity.

The Horticultural segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for fruits, vegetables, ornamental plants, and greenhouse cultivation, where controlled nutrient management and high-value crop production require efficient phosphate fertilization strategies.

Which Region Holds the Largest Share of the Superphosphate Market?

- Asia-Pacific dominated the Superphosphate market with the largest revenue share of 37.74% in 2025, driven by extensive agricultural activities, large arable land availability, and high fertilizer consumption across China, India, Indonesia, and Southeast Asian countries. Rapid population growth and rising food demand continue to increase phosphate fertilizer usage to enhance soil fertility and crop productivity across cereals, oilseeds, and horticultural crops

- Leading fertilizer producers in Asia-Pacific are expanding phosphate production capacity, strengthening distribution networks, and introducing fortified superphosphate variants to improve nutrient efficiency and crop yield, reinforcing the region’s supply leadership

- Strong government subsidy programs, agricultural modernization initiatives, and growing awareness regarding balanced nutrient management further strengthen regional dominance in the Superphosphate market

China Superphosphate Market Insight

China is the largest contributor in Asia-Pacific due to its vast agricultural output, strong phosphate rock reserves, and integrated fertilizer manufacturing base. Increasing focus on improving crop yield and soil nutrient replenishment supports high domestic consumption of superphosphate fertilizers.

India Superphosphate Market Insight

India demonstrates strong demand supported by government fertilizer subsidies, expanding crop cultivation, and rising need for phosphorus-based fertilizers in cereals, pulses, and oilseeds production. Growth in rural agricultural infrastructure further strengthens market expansion.

North America Superphosphate Market

North America is projected to register the fastest CAGR of 9.14% from 2026 to 2033, driven by rising adoption of precision agriculture, increasing focus on soil health management, and growing demand for high-efficiency fertilizers across the U.S. and Canada. Technological advancements in fertilizer application and sustainable farming practices accelerate product uptake.

U.S. Superphosphate Market Insight

The U.S. is the primary growth engine in North America, supported by large-scale commercial farming, strong distribution networks, and increasing use of advanced nutrient management programs to improve crop productivity and environmental compliance.

Canada Superphosphate Market Insight

Canada contributes steadily to regional growth, driven by expanding grain production, adoption of modern farming techniques, and rising emphasis on balanced fertilization to maintain soil productivity and long-term agricultural sustainability.

Which are the Top Companies in Superphosphate Market?

The superphosphate industry is primarily led by well-established companies, including:

- Nutrien Ltd (Canada)

- The Mosaic Company (U.S.)

- Yara (Norway)

- EuroChem Group (Switzerland)

- PhosAgro Group of Companies (Russia)

- Innophos (U.S.)

- ICL (Israel)

- Ma’aden (Saudi Arabia)

- YPH (China)

- Incitec Pivot Limited (Australia)

- Fertoz Agriculture Pty Ltd (Australia)

- Koch Fertilizer, LLC. (U.S.)

- Mississippi Phosphates Corporation (U.S.)

- Avantor, Inc (U.S.)

- Jordan Phosphate Mines (Jordan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.