Global Supplier Oriented Business To Business E Commerce Market

Market Size in USD Billion

CAGR :

%

USD

7.88 Billion

USD

12.56 Billion

2025

2033

USD

7.88 Billion

USD

12.56 Billion

2025

2033

| 2026 –2033 | |

| USD 7.88 Billion | |

| USD 12.56 Billion | |

|

|

|

|

Supplier Oriented Business-to-Business E-Commerce Market Size

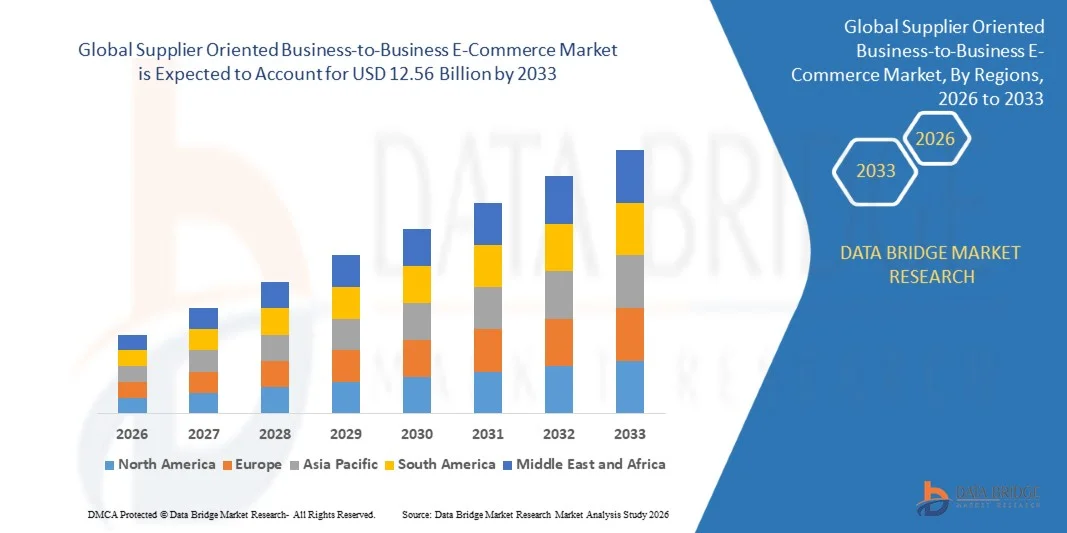

- The global supplier oriented business-to-business e-commerce market size was valued at USD 7.88 billion in 2025 and is expected to reach USD 12.56 billion by 2033, at a CAGR of 6.0% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital procurement solutions and technological advancements in cloud and mobile-based B2B platforms, leading to enhanced efficiency in supplier-buyer interactions and streamlined supply chain operations

- Furthermore, rising demand from enterprises for faster, secure, and automated procurement processes, along with the growing emphasis on cost reduction and operational efficiency, is establishing supplier oriented business-to-business e-commerce platforms as the preferred channel for business transactions. These converging factors are accelerating platform adoption, thereby significantly boosting the industry’s growth

Supplier Oriented Business-to-Business E-Commerce Market Analysis

- Supplier oriented business-to-business e-commerce platforms, offering digital solutions for procurement, supplier management, and transaction processing, are becoming essential tools for enterprises of all sizes to optimize supply chain efficiency, reduce operational costs, and improve supplier collaboration

- The escalating demand for these platforms is primarily driven by rapid digital transformation across industries, growing SME participation, increasing integration of cloud and mobile technologies, and a rising need for secure, scalable, and transparent business transactions

- Asia-Pacific dominated the supplier oriented business-to-business e-commerce market with a share of 71.1% in 2025, due to rapid digital adoption among enterprises, expanding manufacturing and industrial sectors, and the presence of cost-effective technology infrastructure

- North America is expected to be the fastest growing region in the supplier oriented business-to-business e-commerce market during the forecast period due to the increasing need for digital procurement, automation in supply chain management, and adoption of cloud-based B2B solutions

- Cloud segment dominated the market with a market share of 55.5% in 2025, due to its scalability, cost-efficiency, and minimal IT infrastructure requirements. Businesses favor cloud-based B2B platforms for their flexibility in handling dynamic procurement needs, centralized data management, and ease of supplier integration. Cloud platforms enable real-time analytics, streamlined order processing, and enhanced visibility across supply chains, making them attractive for large-scale enterprises. For instance, SAP Ariba has strengthened its cloud offerings to support global suppliers and buyers, reinforcing cloud dominance in B2B commerce. The growing trend of remote operations and global sourcing further supports the preference for cloud platforms over on-premise solutions

Report Scope and Supplier Oriented Business-to-Business E-Commerce Market Segmentation

|

Attributes |

Supplier Oriented Business-to-Business E-Commerce Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Supplier Oriented Business-to-Business E-Commerce Market Trends

“Growing Adoption of Cloud-Based and Mobile B2B Platforms”

- A significant trend in the supplier oriented business-to-business e-commerce market is the increasing adoption of cloud-based and mobile procurement platforms, driven by enterprises’ need for faster, more efficient, and automated sourcing processes. These platforms enable real-time supplier discovery, streamlined order management, and seamless transaction processing, strengthening operational efficiency across industries.

- For instance, companies such as Alibaba and IndiaMart provide cloud-enabled B2B marketplaces that allow enterprises to manage procurement, track orders, and process payments digitally. Such platforms improve transparency, reduce lead times, and enhance collaboration between buyers and suppliers

- The demand for mobile-accessible B2B solutions is rising rapidly as enterprises seek on-the-go procurement capabilities, simplified approvals, and integrated payment options. Mobile platforms allow purchasing managers and procurement teams to operate efficiently, even while remote, which is driving broader adoption across SMEs and large enterprises

- Industries focusing on manufacturing, retail, and consumer goods are increasingly integrating cloud-based B2B solutions to centralize supplier interactions and reduce operational complexity. This integration facilitates bulk ordering, inventory management, and automated invoicing, accelerating adoption rates

- The market is witnessing growing interest in hybrid cloud-mobile solutions that combine real-time analytics with supplier management dashboards. These systems enable data-driven decisions, optimize procurement workflows, and support enterprise scalability

- Enterprises are leveraging cloud and mobile platforms to improve supply chain visibility, reduce costs, and ensure compliance with contracts and regulatory requirements. This trend is reinforcing the overall shift toward digital-first procurement, faster supplier onboarding, and a more connected B2B ecosystem

Supplier Oriented Business-to-Business E-Commerce Market Dynamics

Driver

“Increasing Demand for Automated and Efficient Procurement Processes”

- The growing need for operational efficiency, cost reduction, and faster sourcing is driving enterprises to adopt automated B2B e-commerce solutions. These platforms streamline supplier selection, order processing, and payment management, allowing businesses to manage high-volume procurement with minimal manual intervention

- For instance, Flipkart B2B and Amazon Seller Services provide enterprise procurement tools that integrate AI-driven supplier recommendations, automated invoicing, and bulk ordering capabilities. These solutions reduce processing time, improve accuracy, and support enterprise growth

- The shift toward digital procurement across manufacturing, retail, and logistics industries is further fueling adoption. Automated platforms help enterprises maintain transparency, optimize spend, and track supplier performance

- Integration of cloud-based analytics and AI tools enhances decision-making, allowing procurement teams to forecast demand, optimize inventory, and negotiate better terms with suppliers

- The increasing complexity of supply chains and need for multi-location procurement management strengthens this driver. Enterprises are increasingly dependent on automated platforms to maintain competitiveness and improve procurement efficiency

Restraint/Challenge

“Data Security and Integration with Legacy Systems”

- The supplier oriented business-to-business e-commerce market faces challenges related to securing sensitive transactional data and integrating modern platforms with existing legacy enterprise systems. Enterprises must address cybersecurity threats while ensuring seamless connectivity across procurement, ERP, and financial management systems

- For instance, large corporations often require specialized security protocols and API integrations to connect cloud B2B platforms with legacy ERP solutions, which increases implementation complexity and costs

- Data privacy regulations across regions add an additional layer of compliance, requiring companies to safeguard supplier and buyer information while maintaining operational efficiency

- Ensuring interoperability between new digital solutions and traditional enterprise systems can slow adoption and increase project timelines. Enterprises need to carefully manage migration strategies to avoid disruptions in procurement workflows

- These challenges collectively place pressure on platform providers to enhance security features, simplify integration processes, and offer scalable solutions that meet both technological and regulatory requirements

Supplier Oriented Business-to-Business E-Commerce Market Scope

The market is segmented on the basis of payment method, platform type, application, and end users.

• By Payment Method

On the basis of payment method, the supplier oriented business-to-business e-commerce market is segmented into Net Banking, Credit Card, Debit Card, e-Wallet, and Others. The Net Banking segment dominated the market with the largest revenue share in 2025, driven by its widespread adoption among corporate buyers and the ease of processing high-value transactions securely. Businesses often prefer net banking due to direct integration with company accounts, facilitating bulk payments and automated reconciliation. The segment also benefits from established banking infrastructure, strong regulatory frameworks, and minimal transaction delays, making it a reliable choice for recurring B2B purchases. Corporate platforms increasingly support net banking as the primary payment method to streamline procurement processes and ensure real-time fund transfers.

The e-Wallet segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing digitization of payment processes and the need for quick, low-cost transactions. For instance, platforms such as Paytm and Razorpay have enhanced their B2B solutions, allowing SMEs to manage supplier payments efficiently. E-Wallets offer high convenience, immediate payment confirmation, and mobile accessibility, which is especially appealing to startups and mid-sized enterprises. The integration of e-wallets with procurement platforms reduces dependency on manual bank transfers and enhances cash flow management for businesses. Rising acceptance among suppliers and buyers across industries further accelerates the adoption of e-wallet payment methods.

• By Platform Type

On the basis of platform type, the market is segmented into Cloud and On-Premise. The Cloud segment dominated the market with the largest share of 55.5% in 2025 due to its scalability, cost-efficiency, and minimal IT infrastructure requirements. Businesses favor cloud-based B2B platforms for their flexibility in handling dynamic procurement needs, centralized data management, and ease of supplier integration. Cloud platforms enable real-time analytics, streamlined order processing, and enhanced visibility across supply chains, making them attractive for large-scale enterprises. For instance, SAP Ariba has strengthened its cloud offerings to support global suppliers and buyers, reinforcing cloud dominance in B2B commerce. The growing trend of remote operations and global sourcing further supports the preference for cloud platforms over on-premise solutions.

The On-Premise segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing concerns over data security, compliance requirements, and control over proprietary business processes. Companies with sensitive procurement data or strict regulatory obligations increasingly adopt on-premise platforms to maintain direct oversight. On-premise solutions allow customization tailored to enterprise-specific workflows and seamless integration with legacy ERP systems. Enhanced security features and reduced dependency on internet connectivity further drive the preference for on-premise platforms among large organizations. Rising awareness of cybersecurity risks in cloud deployments also contributes to the growth of on-premise solutions in the Supplier Oriented B2B market.

• By Application

On the basis of application, the supplier oriented business-to-business e-commerce market is segmented into Home and Kitchen, Consumer Electronics, Industrial and Science, Healthcare, Clothing, Beauty and Personal Care, Sports Apparels, Books and Stationery, Automotive, and Others. The Industrial and Science segment dominated the market in 2025, driven by extensive sourcing requirements, high-value procurement, and complex supply chains in sectors such as manufacturing, chemicals, and machinery. Businesses increasingly adopt B2B platforms for industrial products to automate purchase orders, manage supplier catalogs, and ensure compliance with quality standards. For instance, companies such as Grainger provide specialized industrial B2B marketplaces, offering seamless procurement solutions across multiple industries. The Industrial and Science segment benefits from centralized procurement, bulk order management, and integration with ERP systems, enhancing operational efficiency and cost savings.

The Healthcare segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for medical supplies, digital transformation in procurement processes, and urgent supply chain requirements. For instance, McKesson’s B2B platform has enabled hospitals and clinics to source products efficiently, reducing lead times and operational bottlenecks. The growth is supported by increasing adoption of online catalogs, secure payment methods, and automated reordering for critical supplies. The healthcare sector’s strict compliance and regulatory standards drive businesses to rely on B2B e-commerce platforms for accurate documentation and traceability. Rising investments in medical infrastructure across emerging economies further accelerate the expansion of B2B e-commerce in healthcare procurement.

• By End Users

On the basis of end users, the market is segmented into Small and Medium Enterprises (SMEs) and Large Enterprises. The Large Enterprise segment dominated the market in 2025, driven by extensive procurement volumes, global supplier networks, and high investment in technology infrastructure. Large organizations benefit from B2B platforms to optimize sourcing, consolidate supplier relationships, and leverage analytics for strategic decision-making. For instance, Walmart and Amazon Business utilize advanced B2B systems to streamline procurement, ensure compliance, and reduce operational costs across multiple geographies. Centralized procurement platforms allow large enterprises to maintain efficiency, track spend, and manage risk effectively, reinforcing their dominance in the Supplier Oriented B2B e-commerce market.

The SME segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing digital adoption, access to affordable cloud-based B2B solutions, and rising awareness of efficient procurement practices. For instance, TradeIndia and Udaan provide SMEs with simplified platforms for supplier discovery, bulk ordering, and secure payments. SMEs benefit from user-friendly interfaces, mobile accessibility, and integrated financial services, enabling them to compete with larger players. Government initiatives supporting digital business adoption and financial technology solutions further accelerate SME participation in B2B e-commerce. The segment growth is strengthened by the need for operational efficiency, cost reduction, and expanded market reach for small and medium-sized businesses.

Supplier Oriented Business-to-Business E-Commerce Market Regional Analysis

- Asia-Pacific dominated the supplier oriented business-to-business e-commerce market with the largest revenue share of 71.1% in 2025, driven by rapid digital adoption among enterprises, expanding manufacturing and industrial sectors, and the presence of cost-effective technology infrastructure

- The region’s growing SME ecosystem, increasing cloud and mobile platform penetration, and government initiatives promoting digital trade are accelerating market expansion

- The availability of skilled IT workforce, favorable policies for e-commerce, and rapid industrialization across developing economies are contributing to increased adoption of B2B e-commerce platforms across multiple industries

China Supplier Oriented Business-to-Business E-Commerce Market Insight

China held the largest share in the Asia-Pacific supplier oriented business-to-business e-commerce market in 2025, owing to its leadership in manufacturing, extensive supplier networks, and robust digital infrastructure. The country’s strong industrial base, supportive government policies, and widespread adoption of cloud-based procurement platforms are major growth drivers. Demand is further bolstered by the increasing need for automation in procurement and supply chain operations among enterprises of all sizes.

India Supplier Oriented Business-to-Business E-Commerce Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid digitalization of SMEs, expanding manufacturing and retail sectors, and rising investments in e-commerce infrastructure. Initiatives such as “Digital India” and “Make in India” are strengthening adoption of online B2B platforms. In addition, increasing integration of mobile payment solutions and cloud-based procurement systems is driving robust market expansion.

Europe Supplier Oriented Business-to-Business E-Commerce Market Insight

The Europe supplier oriented business-to-business e-commerce market is expanding steadily, supported by high technology adoption, strong regulatory compliance frameworks, and increasing demand for digital procurement solutions. The region emphasizes operational efficiency, data security, and integration with enterprise resource planning (ERP) systems, particularly among large corporations. Investments in cloud platforms and AI-driven supply chain solutions are further enhancing market growth.

Germany Supplier Oriented Business-to-Business E-Commerce Market Insight

Germany’s market is driven by its strong industrial base, advanced manufacturing sector, and extensive supplier networks. Enterprises focus on streamlining procurement, ensuring compliance, and optimizing supply chain operations through digital B2B solutions. The country’s emphasis on Industry 4.0 adoption, automation, and enterprise-level cloud integration fosters continuous growth in B2B e-commerce.

U.K. Supplier Oriented Business-to-Business E-Commerce Market Insight

The U.K. market is supported by mature financial and manufacturing sectors, high adoption of digital technologies, and focus on efficient supplier management. Enterprises are increasingly leveraging cloud and mobile procurement platforms to improve operational efficiency. Investments in secure payment solutions, analytics-driven sourcing, and integration with ERP systems strengthen the country’s position in the B2B e-commerce landscape.

North America Supplier Oriented Business-to-Business E-Commerce Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by the increasing need for digital procurement, automation in supply chain management, and adoption of cloud-based B2B solutions. Large enterprises are focusing on improving operational efficiency, reducing procurement costs, and enhancing supplier collaboration through digital platforms. Rising investments in AI, analytics, and secure payment integrations are further supporting market expansion.

U.S. Supplier Oriented Business-to-Business E-Commerce Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its strong industrial and retail sectors, advanced digital infrastructure, and high adoption of cloud-based B2B solutions. Enterprises benefit from automated procurement processes, seamless supplier integration, and analytics-driven decision-making. The presence of key B2B platforms and robust payment infrastructure further solidifies the U.S.’s leading position in the region.

Supplier Oriented Business-to-Business E-Commerce Market Share

The supplier oriented business-to-business e-commerce industry is primarily led by well-established companies, including:

- Alibaba Group Holding Limited (China)

- China‑ASEAN Free Trade Wang (China/ASEAN)

- DIYTrade (China)

- eBay Inc (U.S.)

- EC21 Inc (South Korea)

- eWorldTrade (U.S.)

- Flipkart Internet Private Limited (India)

- IndiaMart InterMesh Ltd (India)

- BigCommerce Pty. Ltd. (Australia)

- Amazon Seller Services Private Limited (India)

- Sana Commerce (Netherlands)

- B2W - Digital Company (Brazil)

- Kompass (France)

- Magento (U.S.)

- Brandloom (U.S.)

- iBrand Strategy Services LLP (India)

- Mercateo (Germany)

- Newegg International Inc (U.S.)

- PayPal Holdings, Inc (U.S.)

- W. W. Grainger, Inc. (U.S.)

Latest Developments in Global Supplier Oriented Business-to-Business E-Commerce Market

- In June 2025, Jumbotail raised USD 120 million in a Series D funding round and completed the acquisition of Solv India. This significant capital infusion and strategic acquisition strengthen Jumbotail’s position as a leading horizontal B2B platform in India, enabling it to expand its product portfolio across multiple categories and enhance its fintech and e‑commerce integration. The move also allows the company to better serve MSMEs, small retailers, and kiranas with streamlined procurement, faster delivery, and improved supplier connectivity, reinforcing its market dominance

- In April 2025, Ampivo AI acquired a 51 percent majority stake in Commerce Forever Solutions, a B2B operations firm. This acquisition allows Ampivo AI to integrate advanced AI capabilities into supplier‑oriented B2B operations, including procurement, supply chain optimization, and logistics management. The move is expected to improve operational efficiency for B2B e‑commerce platforms using Commerce Forever’s infrastructure, enhancing service quality and reducing transaction cycles for both buyers and suppliers

- In September 2025, MercadoLibre launched a dedicated B2B‑wholesale unit across Brazil, Argentina, Mexico, and Chile. This expansion marks the company’s strategic entry into the corporate and wholesale procurement segment, enabling large-order transactions and strengthening supplier networks. The initiative increases B2B market penetration in Latin America by providing enterprise clients with specialized digital platforms for efficient sourcing, bulk ordering, and streamlined payment processes

- In March 2025, Jumbotail formally completed the integration of Solv India into its operations. This consolidation expanded Jumbotail’s category coverage beyond food and grocery into electronics, apparel, and home‑furnishing sectors, enhancing value for both suppliers and enterprise buyers. The integration enables more efficient supplier discovery, improved inventory management, and better fulfillment capabilities, contributing to overall market growth and competitiveness in India’s B2B e‑commerce landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.