Global Surgical Booms Market

Market Size in USD Million

CAGR :

%

USD

303.63 Million

USD

422.29 Million

2025

2033

USD

303.63 Million

USD

422.29 Million

2025

2033

| 2026 –2033 | |

| USD 303.63 Million | |

| USD 422.29 Million | |

|

|

|

|

Surgical Booms Market Size

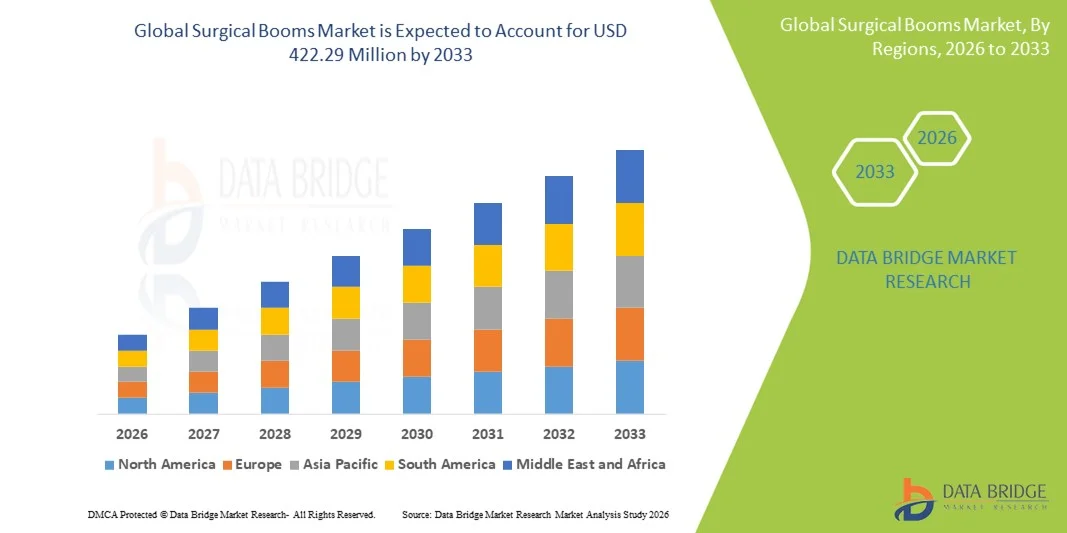

- The global surgical booms market size was valued at USD 303.63 Million in 2025 and is expected to reach USD 422.29 Million by 2033, at a CAGR of 4.21% during the forecast period

- The market growth is largely fueled by the rising number of surgical procedures and continuous technological advancements in operating room infrastructure, leading to increased adoption of integrated and ergonomically designed surgical booms across hospitals and ambulatory surgical centers

- Furthermore, growing demand for efficient space utilization, improved workflow management, and enhanced patient safety in modern operating rooms is establishing surgical booms as a critical component of advanced surgical environments. These converging factors are accelerating the uptake of Surgical Booms solutions, thereby significantly boosting the industry’s growth

Surgical Booms Market Analysis

- Surgical booms are advanced ceiling- or wall-mounted infrastructure systems designed to support and organize critical medical equipment, power units, medical gases, and IT components within operating rooms, thereby enabling safer procedures, improved infection control, and streamlined clinical workflows across modern surgical environments

- The market growth is primarily driven by the global shift toward hybrid and digitally integrated operating rooms, increasing demand for space-efficient infrastructure, rising surgical volumes linked to aging populations, and hospitals’ focus on improving staff ergonomics and patient safety standards

- North America led the surgical booms market with a revenue share of approximately 38.7% in 2025, supported by high adoption of smart operating room technologies, strong capital expenditure by hospitals, and continuous upgrades of surgical infrastructure, particularly in the U.S. and Canada

- Asia-Pacific is projected to be the fastest growing region in the surgical booms market during the forecast period, recording a CAGR of around 10.2%, driven by large-scale hospital construction, expansion of tertiary care facilities, growing private healthcare investments, and increasing penetration of advanced surgical systems across emerging economies

- The roof-mounted segment dominated the largest market revenue share of approximately 62.4% in 2025, driven by its widespread adoption in modern operating rooms and advanced surgical suites

Report Scope and Surgical Booms Market Segmentation

|

Attributes |

Surgical Booms Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Skytron (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Surgical Booms Market Trends

Increasing Adoption of Advanced Operating Room Infrastructure

- A significant and accelerating trend in the global Surgical Booms market is the growing adoption of advanced operating room (OR) infrastructure designed to improve workflow efficiency, space utilization, and clinical outcomes in hospitals and ambulatory surgical centers worldwide

- For instance, in recent years, several large tertiary-care hospitals across North America, Europe, and Asia-Pacific have invested in ceiling-mounted surgical boom systems to support the integration of medical gases, power supply, imaging equipment, and surgical devices within modern hybrid operating rooms

- The rising focus on minimally invasive surgeries and technologically advanced procedures is increasing demand for flexible and ergonomic surgical boom solutions that enhance equipment accessibility and reduce clutter in critical care environments

- Surgical booms are increasingly being integrated with modular OR designs, allowing healthcare facilities to customize layouts based on surgical specialty requirements and evolving clinical needs

- This trend toward more efficient, organized, and technologically equipped operating rooms is reshaping expectations for surgical infrastructure. Consequently, manufacturers are developing innovative surgical boom systems with improved load-bearing capacity, enhanced maneuverability, and compatibility with advanced medical equipment

- The demand for high-performance surgical booms is growing globally across hospitals, specialty clinics, and outpatient surgical centers as healthcare providers prioritize patient safety, procedural efficiency, and optimized clinical workflows

Surgical Booms Market Dynamics

Driver

Rising Surgical Volumes and Modernization of Healthcare Facilities

- The increasing number of surgical procedures worldwide, driven by aging populations, rising prevalence of chronic diseases, and expanding access to healthcare services, is a key driver supporting growth in the surgical booms market

- For instance, in 2024, multiple healthcare systems across Asia-Pacific and the Middle East announced large-scale hospital expansion and modernization projects that included upgrades to operating rooms with advanced surgical boom installations

- The global push toward hospital infrastructure modernization and the establishment of new healthcare facilities is significantly boosting demand for integrated OR equipment, including surgical booms

- In addition, the growing emphasis on infection control, improved ergonomics for surgical staff, and streamlined equipment management is encouraging hospitals to replace traditional floor-mounted systems with ceiling-mounted surgical boom solutions

- The expansion of ambulatory surgical centers and the rising adoption of advanced surgical technologies are further contributing to sustained demand for surgical booms across both developed and emerging healthcare markets

Restraint/Challenge

High Capital Investment and Installation Complexity

- The high initial cost associated with surgical boom systems, including procurement, installation, and integration with existing operating room infrastructure, remains a major challenge for market growth

- For instance, smaller hospitals and healthcare facilities in developing regions often postpone or limit investments in advanced surgical boom systems due to budget constraints and competing priorities for capital expenditure

- The complexity of installing surgical booms, particularly in existing facilities with space or structural limitations, can result in extended downtime and higher implementation costs

- Ongoing maintenance requirements, periodic upgrades, and the need for skilled technical personnel to manage advanced surgical infrastructure further add to the total cost of ownership

- Addressing these challenges through cost-effective product offerings, modular designs, flexible installation solutions, and improved return-on-investment awareness will be critical for sustained growth in the global Surgical Booms market

Surgical Booms Market Scope

The market is segmented on the basis of installation, product type, mobility, and end-use.

- By Installation

On the basis of installation, the Surgical Boom market is segmented into roof-mounted and floor-mounted systems. The roof-mounted segment dominated the largest market revenue share of approximately 62.4% in 2025, driven by its widespread adoption in modern operating rooms and advanced surgical suites. Roof-mounted surgical booms allow optimal utilization of floor space, enabling better movement of medical staff and equipment during complex surgical procedures. These systems support high load-bearing capacity, making them suitable for integrating anesthesia machines, monitors, imaging systems, and surgical lights. Hospitals increasingly prefer roof-mounted booms due to improved infection control, as ceiling installations reduce floor clutter and ease cleaning. Their compatibility with hybrid operating rooms and minimally invasive surgeries further strengthens demand. Additionally, strong investments in hospital infrastructure upgrades across North America and Europe contribute to dominance. Integration with digital OR systems also enhances workflow efficiency and surgical precision.

The floor-mounted segment is expected to witness the fastest CAGR of around 7.9% from 2026 to 2033, driven by demand from small hospitals, outpatient facilities, and cost-sensitive healthcare providers. Floor-mounted booms offer easier installation, lower upfront costs, and flexibility for facilities with structural limitations. These systems are particularly attractive in emerging markets where retrofitting older hospitals is common. The growing number of ambulatory surgical centers (ASCs) globally further supports adoption. Manufacturers are improving mobility and stability features, making floor-mounted booms more versatile. Rising healthcare infrastructure investments in Asia-Pacific and Latin America are expected to accelerate growth of this segment over the forecast period.

- By Product Type

On the basis of product type, the Surgical Boom market is segmented into equipment boom, utility boom, anesthesia boom, and custom boom. The equipment boom segment accounted for the largest market revenue share of about 38.6% in 2025, driven by its critical role in supporting surgical equipment such as monitors, imaging devices, and endoscopy systems. Equipment booms enhance ergonomic positioning, reducing physical strain on surgeons and staff during lengthy procedures. Their ability to support heavy loads and multiple articulated arms makes them essential in advanced surgical environments. Rising adoption of minimally invasive and image-guided surgeries has significantly boosted demand. Hospitals prioritize equipment booms to improve workflow efficiency and ensure precise equipment placement. Continuous technological advancements, including motorized arms and integrated cable management, further support segment dominance. High replacement demand in developed markets also contributes to sustained revenue growth.

The custom boom segment is projected to grow at the fastest CAGR of approximately 8.5% from 2026 to 2033, driven by increasing demand for tailored operating room solutions. Custom booms allow hospitals to configure layouts based on specific surgical specialties such as neurosurgery, cardiology, or orthopedics. The growing trend toward hybrid operating rooms significantly fuels demand for customized systems. Healthcare facilities seek flexible designs that can adapt to evolving technology requirements. Manufacturers are increasingly collaborating with hospitals to deliver bespoke solutions, enhancing adoption. The expansion of premium healthcare infrastructure and specialty surgical centers globally further accelerates growth in this segment.

- By Mobility

On the basis of mobility, the Surgical Boom market is segmented into free-standing and mobile systems. The free-standing segment dominated the market with a revenue share of nearly 55.1% in 2025, owing to its stability, high load-bearing capability, and suitability for complex surgical procedures. Free-standing booms are widely used in large hospitals and tertiary care centers where advanced surgeries are performed. These systems offer superior positioning accuracy and long-term durability. Hospitals favor free-standing booms for permanent operating room setups, ensuring consistency and safety. Integration with ceiling and wall systems enhances operational efficiency. High adoption in developed healthcare systems, combined with strong regulatory compliance, reinforces dominance. Continuous product innovation further strengthens market leadership.

The mobile segment is anticipated to register the fastest CAGR of around 9.2% from 2026 to 2033, driven by rising demand for flexibility and space optimization. Mobile surgical booms enable easy repositioning across operating rooms, making them ideal for ambulatory surgical centers and temporary setups. The growth of day-care surgeries and modular hospitals significantly supports this segment. Mobile systems also appeal to facilities seeking cost-effective solutions with minimal infrastructure modifications. Technological improvements in mobility, braking systems, and stability are enhancing safety and usability. Emerging economies are expected to be key contributors to rapid growth due to expanding outpatient care services.

- By End-Use

On the basis of end-use, the Surgical Boom market is segmented into hospitals and ambulatory surgical centers. The hospitals segment held the largest market revenue share of approximately 71.8% in 2025, driven by high surgical volumes and continuous investment in operating room modernization. Hospitals perform a wide range of complex and critical surgeries that require advanced surgical boom systems. The presence of specialized departments and hybrid operating rooms further boosts demand. Government funding and private investments in hospital infrastructure globally support adoption. Hospitals also prioritize integrated solutions that enhance safety, efficiency, and compliance with infection control standards. Replacement of legacy systems in developed markets contributes to sustained dominance. Growing patient inflow further reinforces segment leadership.

The ambulatory surgical centers segment is expected to grow at the fastest CAGR of nearly 8.8% from 2026 to 2033, driven by the rapid shift toward outpatient and minimally invasive procedures. ASCs focus on cost-efficiency, faster patient turnaround, and compact infrastructure, increasing demand for space-saving surgical booms. Rising preference for same-day surgeries among patients supports growth. Expansion of ASCs in North America, Europe, and Asia-Pacific is a key driver. Manufacturers are offering customized and mobile solutions tailored to ASC requirements. Favorable reimbursement policies and lower operational costs further accelerate adoption.

Surgical Booms Market Regional Analysis

- North America dominated the surgical booms market with the largest revenue share of 38.7% in 2025, supported by high adoption of smart operating room technologies, strong capital expenditure by hospitals, and continuous upgrades of surgical infrastructure, particularly in the U.S. and Canada

- Healthcare providers in the region are increasingly investing in advanced surgical systems, enhancing operating room efficiency, and improving patient outcomes

- Growth is observed across public and private hospitals, surgical centers, and specialty clinics, with a focus on integrating advanced surgical technologies into both new and existing facilities

U.S. Surgical Booms Market Insight

The U.S. surgical booms market captured the largest revenue share in North America in 2025, driven by early adoption of smart operating room technologies, robust hospital infrastructure investments, and continuous upgrades in surgical suites. The market growth is further propelled by increasing demand for advanced surgical lighting, integration with robotic-assisted systems, and rising capital expenditure in tertiary care hospitals.

Europe Surgical Booms Market Insight

The Europe surgical booms market is projected to expand at a substantial CAGR during the forecast period, driven by increasing modernization of hospital infrastructure, adoption of advanced surgical systems, and growing investments in healthcare technology across Western European countries.

U.K. Surgical Booms Market Insight

The U.K. surgical booms market is expected to grow steadily during the forecast period, supported by rising adoption of smart operating rooms, healthcare digitization initiatives, and ongoing investments in hospital infrastructure.

Germany Surgical Booms Market Insight

The Germany surgical booms market is anticipated to record significant growth during the forecast period, fueled by government support for healthcare modernization, increasing investments in high-tech surgical solutions, and the integration of advanced operating room equipment across public and private hospitals.

Asia-Pacific Surgical Booms Market Insight

The Asia-Pacific surgical booms market is projected to grow at the fastest CAGR of around 10.2% during the forecast period, driven by large-scale hospital construction, expansion of tertiary care facilities, growing private healthcare investments, and increasing penetration of advanced surgical systems across emerging economies.

Japan Surgical Booms Market Insight

The Japan surgical booms market is gaining momentum due to high adoption of advanced surgical technologies, modernization of hospital infrastructure, and integration of operating room systems with robotic-assisted surgeries and advanced lighting solutions.

China Surgical Booms Market Insight

The China surgical booms market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by rapid expansion of hospital infrastructure, rising investments in tertiary care facilities, and increasing adoption of advanced surgical systems and technologies.

Surgical Booms Market Share

The Surgical Booms industry is primarily led by well-established companies, including:

• Skytron (U.S.)

• Steris (U.S.)

• Getinge (Sweden)

• Trumpf Medical (Germany)

• ALVO Medical (Slovakia)

• Berchtold (Germany)

• STERIS AST (U.S.)

• Dräger (Germany)

• Mediland (China)

• Medifa (Germany)

• Medicraft (U.S.)

• Chirana (Slovakia)

• Surgical Innovations (U.K.)

Latest Developments in Global Surgical Booms Market

- In January 2024, HoloCare, a UK‑based healthcare technology provider, announced plans to deploy its commercial mixed‑reality and AI‑enabled platform for pre‑surgical planning across multiple hospitals in the United Kingdom and Europe. While the announcement focuses on surgical planning technologies, the initiative reflects broader integration of digital systems with operating‑room infrastructure where surgical booms play a central role in organizing monitors and displays that support such technologies

- In November 2022, SurgiBox Inc. (U.S.) reported that its SurgiField portable operating room systems completed CE marking for use in European healthcare settings, enabling portable sterile surgical environments that interact with OR infrastructure, including boom‑mounted systems in hybrid theatre setups. This supports adoption of flexible OR configurations globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.