Global Therapeutic Medical Guidewire Market

Market Size in USD Billion

CAGR :

%

USD

2.60 Billion

USD

4.01 Billion

2025

2033

USD

2.60 Billion

USD

4.01 Billion

2025

2033

| 2026 –2033 | |

| USD 2.60 Billion | |

| USD 4.01 Billion | |

|

|

|

|

Global Therapeutic Medical Guidewire Market Segmentation, By Type (Solid Guidewire and Wrapped Guidewire), Shape (J-Shape, Straight, and Angled), Application (Peripheral Artery Disease, Neurovascular Diseases, Cardiovascular Diseases, and Urological Disease), End-User (Hospitals, Academic Institutes, and Clinics) - Industry Trends and Forecast to 2033

Therapeutic Medical Guidewire Market Size

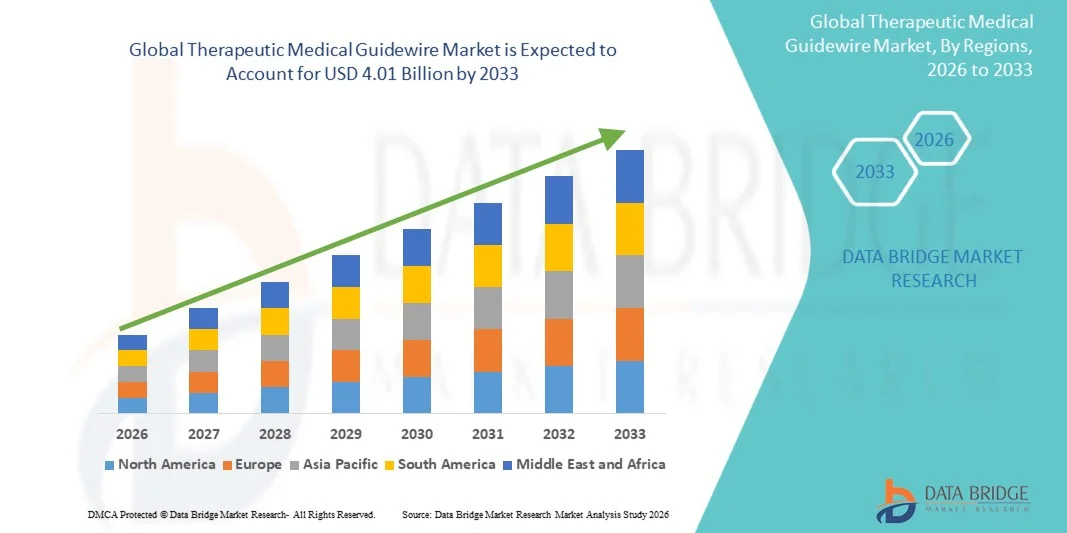

- The global therapeutic medical guidewire market size was valued at USD 2.60 billion in 2025 and is expected to reach USD 4.01 billion by 2033, at a CAGR of 5.59% during the forecast period

- The market growth is largely fueled by the rising prevalence of cardiovascular and peripheral vascular diseases, increasing demand for minimally invasive procedures, and continuous advancements in interventional cardiology and endovascular technologies

- Furthermore, growing adoption of catheter-based therapies, rising awareness of early intervention benefits, and the development of innovative guidewire technologies—such as hydrophilic coatings, torque control, and improved flexibility—are accelerating the uptake of Therapeutic Medical Guidewire solutions, thereby significantly boosting the industry's growth

Therapeutic Medical Guidewire Market Analysis

- Therapeutic medical guidewires, which are essential tools used to navigate blood vessels and other anatomical pathways during minimally invasive procedures, play a critical role in interventional cardiology, radiology, and peripheral vascular interventions due to their precision, flexibility, and torque control

- The increasing demand for therapeutic medical guidewires is primarily driven by the rising prevalence of cardiovascular diseases, growing preference for minimally invasive procedures, and continuous technological advancements such as hydrophilic coatings, improved steerability, and enhanced safety profiles

- North America dominated the therapeutic medical guidewire market with the largest revenue share of 38.4% in 2025, supported by a well-established healthcare infrastructure, high adoption of advanced interventional procedures, strong presence of leading medical device manufacturers, and a high volume of cardiac and endovascular interventions, with the U.S. accounting for the majority of regional revenue

- Asia-Pacific is expected to be the fastest-growing region in the therapeutic medical guidewire market during the forecast period, driven by rapidly improving healthcare infrastructure, increasing incidence of cardiovascular disorders, rising healthcare expenditure, growing medical tourism, and expanding access to advanced interventional treatments in countries such as China and India

- The solid guidewire segment dominated the largest market revenue share of 57.6% in 2025, driven by its superior torque transmission, high pushability, and strong shaft integrity required for complex interventional procedures

Report Scope and Therapeutic Medical Guidewire Market Segmentation

|

Attributes |

Therapeutic Medical Guidewire Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Therapeutic Medical Guidewire Market Trends

“Technological Advancements and Increasing Use in Minimally Invasive Procedures”

- A major and accelerating trend in the global therapeutic medical guidewire market is the growing adoption of technologically advanced guidewires designed to improve precision, safety, and procedural outcomes in minimally invasive intervention

- Continuous innovation in materials, coatings, and structural design is enhancing flexibility, torque control, and navigation through complex vascular and non-vascular anatomies

- Manufacturers are increasingly developing guidewires with advanced hydrophilic and hydrophobic coatings that reduce friction, improve trackability, and facilitate smoother device delivery during procedures such as angioplasty, urology interventions, and neurovascular treatments

- The rising preference for minimally invasive and image-guided procedures across cardiology, gastroenterology, and interventional radiology is driving demand for high-performance therapeutic guidewires. These procedures rely heavily on guidewires for accurate lesion access and device placement

- In addition, the trend toward procedure-specific guidewires—tailored for coronary, peripheral, biliary, or urological applications—is gaining traction as clinicians seek optimized solutions for different anatomical challenges

- Increasing investments in research and development by leading medical device companies are further accelerating product innovation and expanding the clinical applicability of therapeutic medical guidewires

- This focus on performance enhancement and procedural efficiency is reshaping clinician expectations and influencing purchasing decisions across hospitals and catheterization laboratories

Therapeutic Medical Guidewire Market Dynamics

Driver

“Rising Prevalence of Cardiovascular and Urological Disorders and Growth of Minimally Invasive Surgeries”

- The increasing global burden of cardiovascular diseases, urological conditions, and gastrointestinal disorders is a primary driver for the Therapeutic Medical Guidewire market

- These conditions frequently require interventional procedures where guidewires play a critical role in accessing target sites and delivering therapeutic devices

- For instance, the growing number of angioplasty, stent placement, and endoscopic procedures worldwide has significantly increased the demand for reliable and high-quality guidewires

- The shift from open surgeries to minimally invasive techniques is further fueling market growth, as such procedures offer reduced recovery time, lower complication rates, and shorter hospital stays, making them the preferred choice for both patients and healthcare providers

- In addition, the expansion of catheterization laboratories, ambulatory surgical centers, and interventional radiology units—particularly in emerging economies—is contributing to higher procedure volumes and sustained demand for therapeutic guidewires

- Continuous improvements in healthcare infrastructure and increased access to advanced interventional treatments are expected to support long-term market expansion

Restraint/Challenge

“High Cost of Advanced Guidewires and Risk of Procedure-Related Complications”

- The relatively high cost of technologically advanced therapeutic medical guidewires presents a notable challenge, particularly for cost-sensitive healthcare systems and facilities in developing regions. Premium guidewires with specialized coatings and enhanced performance characteristics can significantly increase procedural expenses

- In addition, the risk of guidewire-related complications—such as vessel perforation, dissection, or entrapment—can limit adoption, especially among less experienced operators or in complex clinical cases

- Strict regulatory requirements and lengthy approval processes for new guidewire designs may also delay product launches and increase development costs for manufacturers

- Furthermore, limited reimbursement coverage for certain interventional procedures in some regions can restrict the use of advanced guidewire technologies

- Addressing these challenges through cost-effective product development, clinician training, and improved safety profiles will be essential for ensuring sustained growth of the global Therapeutic Medical Guidewire market.

Therapeutic Medical Guidewire Market Scope

The market is segmented on the basis of type, shape, application, and end user.

• By Type

On the basis of type, the Global Therapeutic Medical Guidewire market is segmented into Solid Guidewire and Wrapped Guidewire. The solid guidewire segment dominated the largest market revenue share of 57.6% in 2025, driven by its superior torque transmission, high pushability, and strong shaft integrity required for complex interventional procedures. Solid guidewires are widely used in cardiovascular and peripheral artery interventions where stability and precision are critical. Their enhanced control enables physicians to navigate through chronic total occlusions and calcified lesions effectively. Increasing adoption in angioplasty and stent delivery procedures supports dominance. Compatibility with a wide range of catheters improves procedural efficiency. Hospitals prefer solid guidewires for high-risk interventions. Rising prevalence of cardiovascular diseases globally fuels demand. Technological advancements in stainless steel and nitinol cores improve performance. Growing procedural volumes in emerging markets further strengthen segment leadership. High physician familiarity also contributes to sustained adoption.

The wrapped guidewire segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033, owing to its enhanced flexibility, reduced vessel trauma, and improved tactile feedback during procedures. Wrapped guidewires are increasingly preferred in neurovascular and urological applications requiring delicate navigation. Advances in polymer coating and hydrophilic surfaces improve maneuverability. Rising adoption of minimally invasive procedures supports growth. Increased use in complex anatomical pathways accelerates demand. Expansion of neuro-interventional procedures contributes significantly. Growing preference for atraumatic devices among clinicians boosts uptake. Improved safety outcomes further drive adoption. Emerging markets show rising demand for flexible guidewire solutions.

• By Shape

On the basis of shape, the Therapeutic Medical Guidewire market is segmented into J-Shape, Straight, and Angled. The J-shape guidewire segment accounted for the largest market revenue share of 48.9% in 2025, primarily due to its reduced risk of vessel perforation and ease of navigation through tortuous vascular anatomy. J-shaped tips are widely preferred for initial vessel access in cardiovascular procedures. Their safety profile makes them suitable for both diagnostic and therapeutic interventions. High usage in elderly patients supports dominance. Physicians favor J-shape guidewires for smoother lesion crossing. Increased cardiovascular catheterization procedures boost demand. Compatibility with multiple intervention techniques strengthens adoption. Availability across product portfolios supports market penetration. High procedural success rates reinforce segment leadership. Consistent clinical reliability further sustains dominance.

The angled guidewire segment is projected to grow at the fastest CAGR of 10.4% from 2026 to 2033, driven by increasing demand for precision steering in complex and bifurcated vascular anatomies. Angled guidewires offer superior directional control in challenging lesions. Rising neurovascular and peripheral artery procedures support growth. Technological improvements enhance tip responsiveness. Increasing physician training in advanced interventions accelerates adoption. Use in difficult access cases boosts demand. Growth of specialized interventional centers supports expansion. Improved imaging guidance enhances outcomes. Rising procedural complexity drives faster uptake globally.

• By Application

On the basis of application, the market is segmented into Peripheral Artery Disease, Neurovascular Diseases, Cardiovascular Diseases, and Urological Disease. The cardiovascular diseases segment dominated the market with a revenue share of 54.2% in 2025, driven by the high global burden of coronary artery disease and rising interventional cardiology procedures. Guidewires are essential components in angioplasty, stent placement, and catheter-based cardiac interventions. Increasing adoption of minimally invasive cardiac treatments supports dominance. Aging populations significantly increase cardiovascular case volumes. Technological advancements improve procedural outcomes. High hospitalization rates drive consistent demand. Availability of advanced catheterization labs supports usage. Favorable reimbursement policies strengthen adoption. Rising awareness of early cardiac intervention contributes to growth. High procedural frequency sustains market leadership.

The neurovascular diseases segment is expected to register the fastest CAGR of 11.1% from 2026 to 2033, due to rising incidence of stroke, aneurysms, and cerebral vascular disorders. Increasing use of endovascular treatment approaches supports growth. Expansion of neuro-interventional centers boosts demand. Advancements in imaging and navigation technologies enhance adoption. Growing preference for minimally invasive neuro procedures accelerates growth. Improved clinical outcomes increase physician confidence. Rising healthcare investment supports expansion. Increasing awareness and early diagnosis further drive market growth.

• By End User

On the basis of end user, the market is segmented into Hospitals, Academic Institutes, and Clinics. The hospitals segment held the largest market revenue share of 62.8% in 2025, driven by high procedural volumes and availability of advanced interventional infrastructure. Hospitals perform the majority of cardiovascular and neurovascular interventions globally. Presence of skilled specialists supports dominance. Access to advanced imaging and catheterization labs increases guidewire usage. Emergency and critical care requirements boost demand. Favorable reimbursement structures support adoption. Continuous hospital infrastructure expansion sustains growth. High patient inflow reinforces leadership. Strong procurement capacity strengthens hospital dominance.

The clinics segment is anticipated to witness the fastest CAGR of 8.7% from 2026 to 2033, driven by growth of outpatient and day-care interventional procedures. Increasing preference for cost-effective treatment settings supports expansion. Technological advancements allow complex procedures in clinics. Rising number of specialized interventional clinics accelerates demand. Shorter hospital stays favor clinic adoption. Growing healthcare decentralization boosts growth. Expansion in emerging economies supports uptake. Increasing physician-owned clinics contribute to rapid expansion.

Therapeutic Medical Guidewire Market Regional Analysis

- North America dominated the therapeutic medical guidewire market with the largest revenue share of 38.4% in 2025, supported by a well-established healthcare infrastructure, high adoption of advanced interventional procedures, and a strong presence of leading medical device manufacturers. The region benefits from a high volume of cardiac and endovascular interventions, increasing prevalence of cardiovascular diseases, and widespread availability of skilled interventional cardiologists and radiologists

- Healthcare providers in North America place strong emphasis on precision, safety, and procedural efficiency, which has accelerated the adoption of advanced therapeutic guidewires across hospitals and catheterization laboratories

- This dominance is further reinforced by high healthcare spending, favorable reimbursement policies for interventional procedures, and continuous technological advancements in guidewire materials, coatings, and steerability, making therapeutic medical guidewires a critical component in minimally invasive treatments

U.S. Therapeutic Medical Guidewire Market Insight

The U.S. therapeutic medical guidewire captured the largest revenue share within North America in 2025, driven by the country’s high burden of cardiovascular and peripheral vascular diseases and the widespread use of minimally invasive interventional procedures. The presence of major medical device manufacturers, rapid adoption of technologically advanced guidewires, and strong clinical preference for high-performance products are key factors supporting market growth. Additionally, increasing volumes of angioplasty, stent placement, and complex endovascular procedures continue to drive sustained demand across hospitals and ambulatory surgical centers.

Europe Therapeutic Medical Guidewire Market Insight

The Europe therapeutic medical guidewire market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising prevalence of cardiovascular disorders, growing adoption of minimally invasive procedures, and increasing investments in healthcare infrastructure. Countries across Europe are witnessing steady growth in interventional cardiology and radiology procedures, supported by favorable regulatory frameworks and expanding access to advanced medical technologies.

U.K. Therapeutic Medical Guidewire Market Insight

The U.K. therapeutic medical guidewire is anticipated to grow at a noteworthy CAGR over the forecast period, supported by the increasing incidence of cardiovascular diseases and the growing adoption of catheter-based interventions within the National Health Service (NHS). Continuous investments in modernizing catheterization labs and improving access to advanced interventional treatments are further contributing to market expansion.

Germany Therapeutic Medical Guidewire Market Insight

The Germany therapeutic medical guidewire is expected to expand at a considerable CAGR, driven by the country’s strong healthcare system, high procedural volumes, and emphasis on technological innovation. Germany’s leadership in medical device manufacturing and its growing focus on minimally invasive cardiovascular treatments are encouraging widespread adoption of advanced therapeutic guidewires across hospitals and specialty clinics.

Asia-Pacific Therapeutic Medical Guidewire Market Insight

The Asia-Pacific therapeutic medical guidewire is expected to grow at the fastest CAGR during the forecast period, driven by rapidly improving healthcare infrastructure, rising healthcare expenditure, and increasing incidence of cardiovascular disorders. The region is witnessing growing adoption of minimally invasive interventional procedures, supported by expanding access to advanced treatment facilities and a rising number of trained healthcare professionals.

Japan Therapeutic Medical Guidewire Market Insight

The Japan therapeutic medical guidewire is gaining momentum due to the country’s aging population and high prevalence of cardiovascular diseases. Strong adoption of advanced interventional technologies, coupled with a well-developed healthcare system and focus on procedural precision, is supporting steady market growth across hospitals and specialty cardiovascular centers.

China Therapeutic Medical Guidewire Market Insight

The China therapeutic medical guidewire accounted for a significant revenue share in Asia Pacific in 2025, driven by rapid expansion of healthcare infrastructure, increasing cardiovascular disease burden, and growing adoption of minimally invasive procedures. Government initiatives to improve access to advanced medical care, along with rising medical tourism and strong domestic manufacturing capabilities, are key factors propelling market growth in China.

Therapeutic Medical Guidewire Market Share

The Therapeutic Medical Guidewire industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland)

- Terumo Corporation (Japan)

- Cardinal Health (U.S.)

- B. Braun SE(Germany)

- Cook Medical (U.S.)

- Olympus Corporation (Japan)

- Merit Medical Systems (U.S.)

- Teleflex Incorporated (U.S.)

- Asahi Intecc Co., Ltd. (Japan)

- Nipro Corporation (Japan)

- Smiths Medical (U.K.)

- Integer Holdings Corporation (U.S.)

- Integer Medical (U.S.)

- Cordis (U.S.)

- Biotronik SE & Co. KG (Germany)

- Medline Industries (U.S.)

- Stryker Corporation (U.S.)

- Vascular Solutions (U.S.)

Latest Developments in Global Therapeutic Medical Guidewire Market

- In April 2025, Boston Scientific Corporation announced the launch of its next-generation Kinetix Guidewire, designed for percutaneous coronary intervention (PCI) procedures with a micro-cut nitinol sleeve and enhanced torque control, flexibility, and maneuverability, aimed at improving navigation in complex coronary anatomies and elevating procedural precision. This launch underscores the company’s commitment to advancing guidewire technology for cardiovascular interventions and reflects broader innovation in interventional device performance

- In October 2025, Medtronic plc unveiled the Stedi Extra Support Guidewire, a purpose-built guidewire engineered to enhance performance with the Evolut transcatheter aortic valve replacement (TAVR) system and compatible platforms, offering clinicians improved support and control during structural heart procedures. This introduction highlights continued efforts to tailor guidewire designs to specialized interventional applications in structural cardiology

- In February 2025, Asahi Intecc Co., Ltd. launched the ASAHI Miracle Neo 3 Guidewire, featuring a blunt tip for enhanced vessel protection, hydrophilic coating for smoother navigation, and proprietary ACT ONE technology for superior torque control and maneuverability in complex coronary interventions. This product development is aimed at supporting interventional cardiologists in treating challenging lesions with improved device delivery performance

- In January 2025, Olympus Latin America (OLA) completed the acquisition of the Sur Medical SpA distribution business in Chile, strengthening Olympus Corporation’s local presence and distribution capabilities for guidewires and related endoscopic and interventional devices in the Latin American market. This strategic move enhances product access and service efficiency in a key regional market

- In May 2024, Teleflex announced the U.S. FDA clearance and launch of the Spectre Guidewire, designed for use in percutaneous coronary and peripheral procedures with a proximal stainless steel core and distal nitinol design that combines pushability with flexibility for improved trackability and torque control in interventional settings. This regulatory clearance and market entry strengthens Teleflex’s product portfolio in mainstream guidewire offerings

- In June 2024, Medtronic introduced the Steerant Aortic Guidewire for abdominal and thoracic endovascular aneurysm repair (EVAR/TEVAR), featuring an atraumatic tip and gradual stiffness transition to support catheter placement and exchange, addressing procedural challenges in complex aortic repair interventions. This launch reflects advancements in guidewire design for structural vascular procedures

- In September 2024, Royal Philips announced FDA clearance for the expanded 160 cm version of its LumiGuide Navigation Wire incorporating Fiber Optic RealShape (FORS) technology, enabling real-time 3D visualization of guidewire and catheter systems with reduced radiation exposure during endovascular procedures, and marking a significant step in imaging-integrated guidewire navigation. This regulatory milestone demonstrates innovation at the intersection of imaging and interventional navigation

- In May 2023, Guangdong Hicicare Science (Hicicare) and Zylox-Tonbridge Medical Technology entered a partnership to co-brand and commercialize advanced vascular guidewire products in China, aimed at expanding access to innovative neurovascular and peripheral vascular guidewire solutions in the Chinese market. This collaboration highlights strategic regional commercialization efforts in Asia-Pacific

- In April 2023, the partnership between Guangdong Hicicare Science and Zylox-Tonbridge reflected increasing collaboration between domestic device developers to accelerate market entry of advanced guidewire models with improved design and performance characteristics for complex procedures. These joint initiatives support technology transfer and accelerate guidewire adoption in emerging markets

- In May 2023, market research reports noted that more than 50 new guidewire models were introduced globally between 2023 and 2025, with improvements such as hydrophilic coatings (reducing friction by up to 18%), hybrid nitinol-steel constructions (increasing by 22%), and enhanced radiopacity for better visualization during procedures — trends illustrating robust innovation in guidewire technology. The proliferation of new models underscores dynamic product development activity across major medical device manufacturers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.