Global Thermal Imaging Market

Market Size in USD Billion

CAGR :

%

USD

6.75 Billion

USD

12.77 Billion

2023

2031

USD

6.75 Billion

USD

12.77 Billion

2023

2031

| 2024 –2031 | |

| USD 6.75 Billion | |

| USD 12.77 Billion | |

|

|

|

|

Global Thermal Imaging Market Segmentation, By Offering (Hardware, Software, and Services), Product Type (Thermal Cameras, Thermal Scopes, Thermal Goggles, and Others), Resolution (320 X 240, 160 X 120, 640 X 480, and Others), Technology (Uncooled and Cooled), Color Palette (White Hot, Ironbow, Rainbow HC, Artic, and Others), Application (Security & Surveillance, Monitoring & Inspection, Detection & Measurement, Search & Rescue, and Others), Wavelength (Long-Wave Infrared (LWIR), Mid-Wave Infrared (MWIR), and Short-Wave Infrared (SWIR)), Focusing Mechanism (Manual Focus, Fixed Focus, and Auto Focus), End-Use (Aerospace and Defense, Automotive, Residential, Energy & Utilities, Healthcare, Life Sciences, and Others) - Industry Trends and Forecast to 2032

Thermal Imaging Market Size

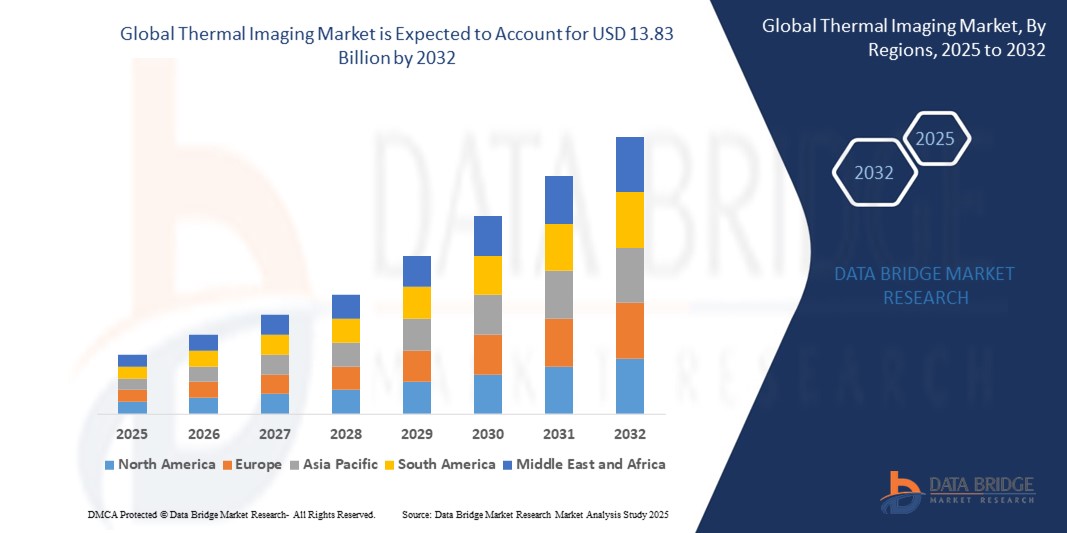

- The global thermal imaging market size was valued at USD 7.31 billion in 2024 and is expected to reach USD 13.83 billion by 2032, at a CAGR of 8.30% during the forecast period

- Market growth is primarily driven by the increasing adoption of thermal imaging technologies across various sectors, including security, industrial, and healthcare, along with advancements in infrared sensor technology

- The growing demand for predictive maintenance and energy efficiency in industries such as manufacturing and construction is further boosting the use of thermal imaging solutions. These factors, combined with the expanding integration of thermal cameras in smartphones and other portable devices, are accelerating market growth

Thermal Imaging Market Analysis

- Thermal imaging technologies, which provide enhanced visibility and temperature measurement capabilities, are becoming essential in various applications, including security, automotive, industrial inspections, and healthcare, owing to their ability to detect heat signatures and identify potential issues that are invisible to the naked eye

- The growing demand for thermal imaging solutions is largely driven by advancements in infrared sensor technology, the need for energy-efficient solutions, and increasing awareness of the benefits of predictive maintenance in industries such as manufacturing, construction, and oil & gas

- North America dominates the thermal imaging market with the largest revenue share of 32.7%, supported by strong demand across military, security, and industrial applications, along with significant technological advancements from leading companies in the U.S.

- Asia-Pacific is expected to experience the fastest growth in the thermal imaging market during the forecast period, driven by rapid industrialization, increased investment in smart infrastructure, and growing demand for thermal cameras in sectors such as manufacturing, construction, and automotive

- Aerospace and defense segment is expected to dominate the thermal imaging market with a largest market share of 46.2%, driven by the rising demand for unmanned aerial vehicles (UAVs) or drones in military operations has significantly boosted the adoption of thermal imaging technology. Drones with thermal cameras offer valuable capabilities such as aerial surveillance, target tracking, and reconnaissance in day and night conditions

Report Scope and Thermal Imaging Market Segmentation

|

Attributes |

Thermal Imaging Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Thermal Imaging Market Trends

“Growing Adoption Across Various Industries”

- A significant and accelerating trend in the global thermal imaging market is the growing adoption of thermal cameras across multiple industries such as security, automotive, healthcare, and energy, driven by their ability to detect heat signatures and provide critical insights for preventive maintenance and safety

- For instance, thermal imaging cameras are increasingly used in security systems for surveillance, enabling the detection of intruders in low-light conditions and providing enhanced monitoring capabilities. Similarly, in the automotive industry, thermal imaging is being integrated into driver assistance systems for improved safety and navigation in poor visibility conditions

- Advancements in thermal imaging technology, such as the development of high-resolution sensors and compact, cost-effective devices, are making these solutions more accessible for both commercial and consumer applications. This is driving adoption across sectors like construction, where thermal cameras are used to detect insulation issues and energy inefficiencies in buildings

- The integration of thermal imaging with AI and machine learning is enabling the development of smarter systems that can automatically detect anomalies and predict potential failures, further enhancing its value in predictive maintenance. For example, AI-powered thermal cameras in industrial applications are able to monitor the health of machinery and provide early warnings about overheating components

- The expanding use of thermal imaging in consumer electronics, including smartphones, is helping to increase the overall market penetration. Companies such as FLIR Systems and Seek Thermal are making thermal imaging accessible to a wider audience, thereby transforming how everyday users interact with the technology

- As industries across the globe continue to focus on energy efficiency, safety, and predictive maintenance, the demand for advanced thermal imaging solutions is expected to grow exponentially, further driving market expansion. The growth is particularly prominent in regions such as North America and Asia-Pacific, where technological advancements and industrial expansion are rapidly increasing

Thermal Imaging Market Dynamics

Driver

“Rising Demand for Safety, Efficiency, and Predictive Maintenance”

- The growing need for safety, energy efficiency, and predictive maintenance in various industries is a significant driver of the global thermal imaging market

- For example, in December 2023, FLIR Systems announced the launch of advanced thermal cameras for industrial applications that can detect early signs of equipment failure, contributing to the rise of predictive maintenance in sectors like manufacturing and energy. Such innovations are expected to accelerate the adoption of thermal imaging in the coming years

- As industries worldwide seek to improve operational efficiency and reduce downtime, thermal imaging offers invaluable insights into equipment health, enabling early detection of potential faults and minimizing costly repairs

- Furthermore, the increasing focus on energy efficiency in buildings, transportation, and industrial processes is driving the demand for thermal imaging solutions. Thermal cameras are used to detect heat loss, insulation issues, and energy inefficiencies, making them an essential tool for identifying areas for improvement in energy consumption

- The rise in security concerns across residential and commercial spaces is also fueling the adoption of thermal imaging systems for surveillance, as these cameras can detect intruders in complete darkness, offering enhanced security solutions

- The increasing integration of thermal imaging with AI and machine learning technologies is enabling smarter, automated systems that can analyze thermal data and provide actionable insights, further boosting its adoption across multiple sectors

Restraint/Challenge

“High Cost of Technology and Regulatory Limitations”

- The high initial cost of thermal imaging devices, particularly advanced systems with high-resolution sensors and AI capabilities, remains a significant restraint to broader market penetration, especially in cost-sensitive markets and small- to mid-sized enterprises

- For example, while compact thermal cameras for mobile devices are becoming more accessible, industrial-grade thermal imaging systems still require substantial investment, making them less attainable for smaller firms or developing regions

- The lack of standardized regulatory frameworks across countries regarding the use of thermal imaging, particularly in public surveillance and healthcare, poses another challenge. Regulatory hurdles can delay implementation or limit usage in certain sectors, impacting market expansion

- Additionally, thermal imaging systems require specialized training for proper interpretation of data and imagery, which can further limit adoption in sectors without the necessary technical expertise or workforce

- In some industries, thermal imaging is still seen as a complementary rather than a core technology, leading to underutilization despite its potential benefits. Bridging this gap in perception and educating end-users on the technology’s ROI will be essential for driving wider adoption

- To overcome these challenges, manufacturers must focus on cost optimization, user-friendly designs, and increased awareness about the practical and long-term value of thermal imaging technology across diverse applications

Thermal Imaging Market Scope

The market is segmented on the basis of offering, product type, resolution, technology, color palette, application, wavelength, focusing mechanism, and end-use

- By Offering

On the basis of offering, the thermal imaging market is segmented into hardware, software, and services. The hardware segment dominates the largest market revenue share in 2025, driven by the widespread use of thermal cameras, sensors, and modules across key industries such as defense, industrial inspection, automotive, and healthcare. Organizations prioritize thermal imaging hardware for its ability to provide real-time, non-contact temperature measurement and visibility in challenging environments, contributing to safety, efficiency, and operational reliability.

The software segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by advancements in image processing, analytics, and AI-based data interpretation. Software solutions are becoming increasingly integral for extracting actionable insights from thermal imaging data, particularly in applications such as predictive maintenance, medical diagnostics, and automated surveillance. The increasing demand for cloud-based platforms and integration with IoT ecosystems is further enhancing the adoption and innovation of thermal imaging software globally.

- By Product Type

On the basis of product type, the thermal imaging market is segmented into thermal cameras, thermal scopes, thermal goggles, and others. The thermal cameras segment is expected to hold the largest market revenue share in 2025, driven by their widespread use across industries such as healthcare, manufacturing, automotive, and security. Thermal cameras offer high-resolution imaging and real-time temperature measurement, which is essential for applications ranging from industrial inspections to medical diagnostics and firefighting operations. Their versatility, accuracy, and ease of integration with various systems make them highly popular in both commercial and residential sectors.

The thermal scopes segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by their increasing adoption in defense and hunting applications. Thermal scopes provide enhanced vision in low-visibility environments, offering an advantage in security, surveillance, and outdoor recreational activities. The demand for portable, durable, and reliable thermal scopes is expected to drive growth, particularly in military and law enforcement sectors, where advanced technology is critical for operations in diverse conditions.

- By Resolution

On the basis of resolution, the thermal imaging market is segmented into 320 X 240, 160 X 120, 640 X 480, and others. The 320 X 240 resolution segment is expected to hold the largest market revenue share in 2025, driven by its widespread use in various applications such as building inspections, automotive diagnostics, and general industrial applications. This resolution offers a good balance between cost and functionality, making it ideal for many commercial and residential users seeking affordable yet effective thermal imaging solutions.

The 640 X 480 resolution segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by its ability to provide higher image quality and accuracy. With the increasing demand for precision in sectors such as medical diagnostics, military, and security, the higher resolution offers enhanced detail, critical for identifying temperature variations with greater clarity. The growing need for more advanced, high-definition thermal imaging technology is expected to drive the adoption of 640 X 480 resolution devices in industries requiring high-performance imaging solutions.

- By Technology

On the basis of technology , the thermal imaging market is segmented into uncooled, and cooled. The uncooled segment is expected to dominate the largest market revenue share in 2025, driven by its cost-effectiveness, compact design, and low maintenance requirements. Uncooled thermal cameras are widely used in applications such as security surveillance, building inspection, and automotive diagnostics, offering a practical and affordable solution for various industries.

The cooled segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the increasing demand for high-precision and high-performance thermal imaging in critical applications such as military, defense, and industrial process monitoring. Cooled thermal imaging systems provide superior sensitivity and image quality, making them essential for more demanding sectors where accuracy and reliability are paramount. This growth is also driven by advancements in cooling technology, which have improved performance while reducing costs.

- By Color Palette

On the basis of color palette, the thermal imaging market is segmented into white hot, ironbow, rainbow HC, artic, and others. The white hot segment is expected to hold the largest market revenue share in 2025, driven by its simplicity and ease of use, providing clear and high-contrast images that are ideal for general-purpose thermal imaging applications such as security surveillance, building inspections, and firefighting.

The rainbow HC segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the increasing demand for thermal imaging systems with more vivid and detailed color schemes that enhance the analysis of heat patterns. Rainbow HC palettes are often preferred for advanced applications such as industrial inspections, medical diagnostics, and research, where more accurate temperature gradients and high sensitivity are required for precise decision-making. This growth is driven by the expanding need for high-resolution thermal imaging and color differentiation across various industries.

- By Application

On the basis of application, the thermal imaging market is segmented into security & surveillance, monitoring & inspection, detection & measurement, search & rescue, and others. The security & surveillance segment is expected to hold the largest market revenue share in 2025, driven by the growing demand for enhanced security solutions across residential, commercial, and industrial sectors. Thermal imaging plays a crucial role in monitoring and detecting potential security threats, especially in low-light or no-light conditions, making it a preferred tool for surveillance purposes.

The search & rescue segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by increasing adoption of thermal imaging technology for life-saving operations in emergency situations. Thermal imaging systems are essential for detecting heat signatures in challenging environments, making them invaluable for locating missing persons or survivors in disaster scenarios or in hazardous terrains. The rise in natural disasters, industrial accidents, and the growing focus on improving rescue operations are key drivers behind the rapid adoption of thermal imaging in search & rescue applications.

- By Wavelength

On the basis of wavelength, the thermal imaging market is segmented into long-wave infrared (lwir), mid-wave infrared (MWIR), and short-wave infrared (SWIR). The long-wave infrared (LWIR) segment is expected to hold the largest market revenue share in 2025, driven by its widespread use in a variety of applications, such as security surveillance, building inspections, and industrial diagnostics. LWIR systems are highly effective for detecting heat signatures in environments with varying levels of temperature contrast, making them the most commonly used thermal imaging technology in security and monitoring.

The mid-wave infrared (MWIR) segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by its increasing use in military and defense applications where higher resolution and greater sensitivity to thermal contrasts are required. MWIR systems offer superior image quality compared to LWIR systems, making them ideal for precision tasks such as targeting, navigation, and detecting heat signatures in more complex or long-range scenarios. The growing demand for high-performance thermal imaging in defense, surveillance, and industrial sectors is expected to drive the growth of MWIR-based systems.

- By Focusing Mechanism

On the basis of focusing mechanism, the thermal imaging market is segmented into manual focus, fixed focus, and auto focus. The manual focus segment is expected to hold the largest market revenue share in 2025, driven by its reliability and control in various industrial and professional applications. Manual focus systems are preferred for tasks that require precise and specific image adjustments, such as detailed inspections and diagnostics in building, automotive, and industrial environments. This segment is particularly favored in sectors where high-quality, customized imaging is necessary, and users can adjust the focus based on the varying conditions of the application.

The auto focus segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the increasing demand for user-friendly, efficient thermal imaging solutions in consumer electronics, security, and surveillance applications. Auto focus systems offer the advantage of quick and accurate focusing with minimal user input, making them ideal for dynamic environments where objects of interest are frequently changing distances. As thermal imaging technology becomes more integrated into everyday consumer and industrial applications, the demand for automated, easy-to-use systems is expected to drive significant growth in the auto focus segment.

- By End-Use

On the basis of end-use, the thermal imaging market is segmented into aerospace and defense, automotive, residential, energy & utilities, healthcare, life sciences, and others. The aerospace and defense segment is expected to hold the largest market revenue share of 46.2%, driven by the increasing demand for advanced imaging systems in military and defense applications. Thermal imaging is essential for surveillance, targeting, navigation, and search and rescue operations, making it indispensable for modern defense strategies. The need for high-precision, long-range, and reliable thermal imaging systems for defense applications is propelling the market growth in this segment.

The healthcare segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the growing adoption of thermal imaging technology in medical diagnostics, particularly for detecting abnormalities in the human body such as inflammation, infection, or tumors. As the healthcare sector seeks non-invasive diagnostic tools, thermal imaging is becoming a critical tool for early detection and patient monitoring. The expanding use of thermal cameras in medical imaging, patient care, and even in surgical procedures is driving significant growth in this sector.

Thermal Imaging Market Regional Analysis

- North America dominates the thermal imaging market with the largest revenue share of 32.7% in 2024, driven by robust demand across various sectors such as security, defense, healthcare, and industrial applications. The region's high adoption rate of advanced technologies and growing awareness of the benefits of thermal imaging technology contribute to this dominance

- The increasing need for advanced security and surveillance systems, along with significant investments in defense and aerospace technologies, further supports the growth of the thermal imaging market in North America. Additionally, the expanding use of thermal cameras in energy and utilities, particularly in energy efficiency assessments, also plays a key role in the market's expansion

- With a highly developed infrastructure, high disposable incomes, and an inclination towards adopting cutting-edge technologies, North America remains a critical hub for the advancement and deployment of thermal imaging solutions. This trend is expected to continue, positioning the region as a leader in the global thermal imaging market

U.S. Thermal Imaging Market Insight

The U.S. thermal imaging market is expected to dominate the market with largest market share of approximately 89%, driven by the increasing adoption of thermal cameras in security, surveillance, and industrial applications. Thermal imaging technology is gaining widespread traction in sectors like building inspection, energy audits, and defense. The demand for high-precision, real-time imaging in areas such as firefighting, healthcare, and law enforcement further supports the market’s growth. The U.S. market is poised to remain a leader, driven by technological advancements and growing demand for enhanced visibility and safety in various professional fields.

Europe Thermal Imaging Market Insight

The European thermal imaging market is forecast to grow steadily throughout the forecast period, primarily due to the increasing need for energy efficiency, security, and industrial monitoring. The demand for thermal imaging solutions in construction, energy audits, and infrastructure inspection is on the rise, as European nations prioritize sustainability and environmental initiatives. Additionally, the market is driven by the expanding use of thermal imaging in industrial process monitoring and predictive maintenance, as well as growing concerns over security in both residential and commercial applications. The integration of thermal cameras with smart home systems and building automation also contributes to this growth.

U.K. Thermal Imaging Market Insight

The U.K. thermal imaging market is set to expand at a significant CAGR during the forecast period. This growth is driven by increased demand in industrial applications, particularly for preventive maintenance, building inspections, and security monitoring. The integration of thermal imaging systems into smart infrastructure and energy efficiency programs is expected to accelerate market growth. Additionally, the U.K.'s focus on adopting advanced technologies in public safety and healthcare further fuels demand, particularly in applications related to disaster response and medical diagnostics.

Germany Thermal Imaging Market Insight

Germany is expected to witness considerable growth in the thermal imaging market during the forecast period, owing to the country's strong industrial base and a growing emphasis on innovation and automation. The rising demand for energy-efficient solutions and the integration of thermal imaging technology in predictive maintenance, manufacturing, and quality control systems are key factors driving this growth. Germany’s robust healthcare sector, coupled with the increasing use of thermal cameras in medical diagnostics and safety inspections, adds to the market's expansion. The country's commitment to sustainability and smart technologies further propels the demand for thermal imaging systems.

Asia-Pacific Thermal Imaging Market Insight

The Asia-Pacific region is expected to witness the fastest growth in the global thermal imaging market, driven by rapid urbanization, industrial expansion, and the increasing adoption of thermal cameras across various sectors such as security, manufacturing, and energy. Countries like China, Japan, and India are leading this growth, as technological advancements and increased government investments in smart city projects are propelling the demand for thermal imaging solutions. Thermal imaging is increasingly used for energy audits, preventive maintenance, and security in both residential and commercial settings, with expanding access to affordable systems fueling market penetration across the region.

Japan Thermal Imaging Market Insight

Japan’s thermal imaging market is seeing significant growth, spurred by the country’s high-tech infrastructure and emphasis on safety and security. The growing adoption of thermal imaging technology for industrial inspections, healthcare, and disaster response applications contributes to this expansion. Japan's focus on energy efficiency, combined with an aging population and the demand for medical diagnostic solutions, further drives the use of thermal imaging in healthcare and residential applications. Additionally, Japan’s advanced technological ecosystem supports the integration of thermal imaging into smart city infrastructure, leading to increased demand.

China Thermal Imaging Market Insight

China remains the largest market for thermal imaging in the Asia-Pacific region, driven by its rapid urbanization, technological adoption, and expansion of industrial sectors. The demand for thermal cameras in security, building inspections, and industrial applications is growing, along with the development of smart city initiatives. China's government support for sustainable development, energy efficiency, and smart infrastructure further accelerates the market's growth. The country’s leading position in manufacturing and technological innovation enables local players to produce affordable thermal imaging systems, expanding access to thermal solutions across a wide consumer base in both urban and rural areas.

Thermal Imaging Market Share

The thermal imaging industry is primarily led by well-established companies, including:

- BAE Systems (U.K.)

- 3M (U.S.)

- Leonardo DRS (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Axis Communications AB (Sweden)

- Fluke Corporation (U.S.)

- Testo SE & Co. KGaA (Germany)

- Drägerwerk AG & Co. KGaA (Germany)

- Teledyne FLIR LLC (U.S.)

- Avon Protection (U. K.)

- Zhejiang Dali Technology Co.,Ltd (China)

- Cox & Company Ltd. (Japan)

- Seek Thermal (U.S.)

- Xenics nv (Belgium)

- Tonbo Imaging (India)

- UNI TREND TECHNOLOGY (CHINA) CO., LTD. (China)

- Opgal (Israel)

- Wuhan Guide Sensmart Tech Co., Ltd. (China)

- ATN (U.S.)

Latest Developments in Global Thermal Imaging Market

- In October 2023, Teledyne FLIR introduced the FLIR FC-Series AI, an advanced thermal security camera incorporating onboard AI analytics for human and vehicle classification. This innovation enhances early detection of intrusions, providing enhanced perimeter protection and remote site monitoring capabilities. The integration of AI analytics in thermal imaging systems reflects the growing trend of incorporating artificial intelligence for more precise, automated threat detection, supporting the industry's broader shift toward smarter, more efficient security technologies

- In September 2023, BAE Systems unveiled upgraded features for its TWV640 thermal camera core, powered by the Athena 640 focal plane array. These enhancements, which include contrast enhancement, spotlight mode, field pixel kill, and improved Noise Equivalent Temperature Difference (NETD), deliver more flexible and customizable imaging capabilities with enhanced threat detection, particularly in challenging environments. This innovation is highly relevant to the global thermal imaging market, as it reflects the industry's ongoing focus on improving imaging precision, operational flexibility, and performance, especially in demanding military, defense, and security applications

- In June 2023, SatVu introduced its groundbreaking thermal imaging satellite, HOTSAT-1. Upon deployment into orbit, this advanced climate technology provides exceptional insights into economic activities and energy efficiency across a wide range of industries. This development underscores the expanding application of thermal imaging in space technology, further enhancing the global thermal imaging market by introducing new opportunities for remote sensing, environmental monitoring, and industrial efficiency across sectors

- In January 2023, Multi Radiance Medical announced an exclusive global distribution partnership with Digatherm Thermal Imaging, aimed at integrating laser therapy with thermal imaging technologies. This collaboration is designed to harness the complementary benefits of both technologies, providing veterinarians with a powerful toolset. This development further strengthens the position of thermal imaging within the healthcare sector, particularly in veterinary applications, contributing to the ongoing expansion of the global thermal imaging market

- In November 2022, RealWear, Inc. introduced its hands-free, voice-activated thermal imaging solution. This cutting-edge innovation empowers frontline workers to capture detailed visible-spectrum images and leverage various thermal and color modes by integrating the newly developed RealWear thermal camera module with the RealWear Navigator 500 headset, which features advanced voice recognition capabilities. This development is particularly relevant to the growing global Thermal Imaging Market, which is driven by increasing demand for advanced diagnostic and predictive maintenance tools across various industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.