Global Titanium Oxide Tio2 Market

Market Size in USD Billion

CAGR :

%

USD

3.20 Billion

USD

4.48 Billion

2025

2033

USD

3.20 Billion

USD

4.48 Billion

2025

2033

| 2026 –2033 | |

| USD 3.20 Billion | |

| USD 4.48 Billion | |

|

|

|

|

Titanium Oxide (TiO2) Market Size

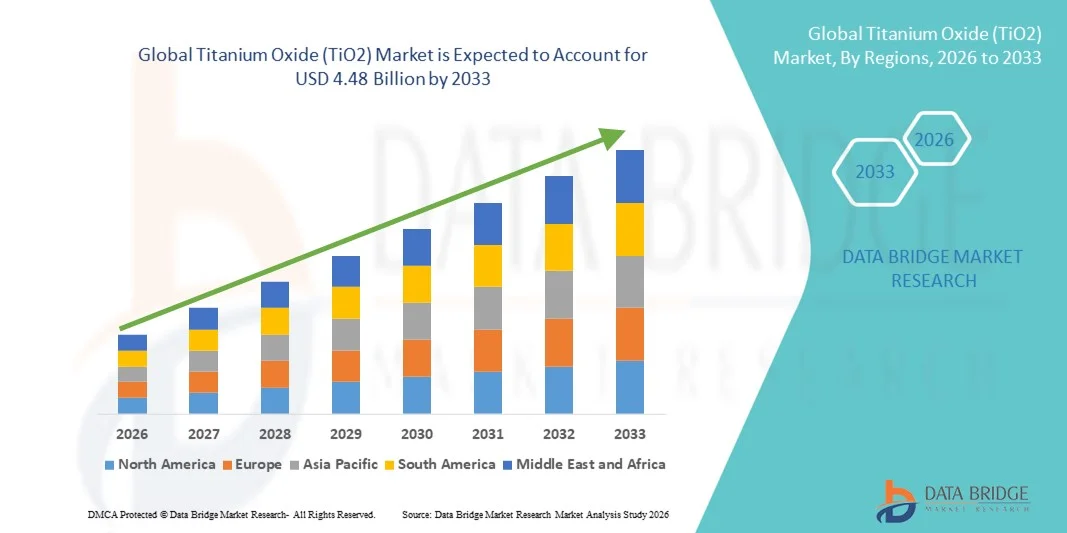

- The global Titanium Oxide (TiO2) market size was valued at USD 3.20 billion in 2025 and is expected to reach USD 4.48 billion by 2033, at a CAGR of 4.30% during the forecast period

- The market growth is largely driven by expanding demand for high-performance pigments across paints and coatings, plastics, and construction materials, supported by rapid urbanization, infrastructure development, and rising industrial production worldwide

- Furthermore, increasing focus on product durability, UV resistance, and aesthetic quality in end-use applications is reinforcing the adoption of Titanium Oxide (TiO₂). These combined factors are accelerating consumption across both mature and emerging economies, thereby strengthening overall market growth

Titanium Oxide (TiO2) Market Analysis

- Titanium Oxide (TiO₂), widely used as a white pigment and functional additive, plays a critical role in enhancing opacity, brightness, and durability in coatings, plastics, paper, and personal care products across industrial and consumer applications

- The rising demand for TiO₂ is primarily supported by growth in construction activities, expanding automotive and packaging industries, and increasing preference for high-quality, long-lasting materials, positioning Titanium Oxide as a core component in multiple value chains

- Asia-Pacific dominated the Titanium Oxide (TiO2) market with a share of 43.7% in 2025, due to rapid expansion of construction activities, strong growth in paints and coatings production, and increasing plastic manufacturing across the region

- North America is expected to be the fastest growing region in the Titanium Oxide (TiO2) market during the forecast period due to strong demand from construction, automotive, and plastics industries

- Rutile segment dominated the market with a market share of 78.10% in 2025, due to its superior opacity, higher refractive index, and excellent durability across end-use industries. Rutile TiO₂ is widely preferred in paints, coatings, and plastics due to its enhanced weather resistance and long-term color stability. Strong demand from construction and automotive coatings further reinforces the dominance of this grade

Report Scope and Titanium Oxide (TiO2) Market Segmentation

|

Attributes |

Titanium Oxide (TiO2) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Titanium Oxide (TiO2) Market Trends

Sustainability-Focused Titanium Oxide Production

- A key trend in the Titanium Oxide (TiO₂) market is the increasing shift toward sustainable and environmentally responsible production practices, driven by stricter regulations and rising customer preference for low-impact materials across coatings, plastics, and consumer goods industries. Manufacturers are focusing on reducing emissions, improving energy efficiency, and developing cleaner production processes to align with global sustainability goals

- For instance, The Chemours Company has introduced advanced TiO₂ grades with lower carbon footprint and improved environmental performance for coatings applications. These products support customers in meeting regulatory compliance while maintaining high opacity and durability standards

- Major producers are also investing in process optimization to minimize waste generation and water usage during TiO₂ manufacturing. This is improving operational efficiency while supporting long-term sustainability commitments across global production sites

- The use of chloride-based processes is gaining traction as manufacturers seek cleaner alternatives to traditional sulfate methods. This transition is supporting the production of high-purity TiO₂ with reduced environmental impact and stronger acceptance in regulated markets

- End-use industries are increasingly prioritizing suppliers that demonstrate strong environmental stewardship, which is influencing procurement strategies. This trend is positioning sustainability-driven TiO₂ producers more favorably in competitive bidding and long-term supply agreements

- Overall, the growing emphasis on sustainable Titanium Oxide production is reshaping manufacturing priorities and strengthening alignment between producers and environmentally conscious end users

Titanium Oxide (TiO2) Market Dynamics

Driver

Rising Demand from Paints and Coatings Industry

- The expanding paints and coatings industry is a primary driver for the Titanium Oxide (TiO₂) market, as TiO₂ remains essential for achieving opacity, brightness, and durability in architectural, automotive, and industrial coatings. Growth in construction, infrastructure renovation, and vehicle production is sustaining high-volume demand for TiO₂ pigments

- For instance, Tronox supplies pigmentary TiO₂ grades extensively used in architectural and industrial coatings to enhance weather resistance and color stability. These products support long service life and performance consistency in demanding applications

- Rising urbanization and infrastructure development across emerging economies are increasing consumption of decorative and protective coatings. This is directly translating into higher demand for Titanium Oxide as a core formulation component

- Automotive manufacturers are also relying on TiO₂-based coatings to meet aesthetic and durability requirements for exterior and interior finishes. This continued reliance is reinforcing stable demand from the automotive coatings segment

- The preference for premium, long-lasting coatings in residential and commercial buildings is further supporting market growth. This sustained demand from paints and coatings continues to anchor Titanium Oxide as a critical industrial material

Restraint/Challenge

Volatility in Raw Material and Energy Prices

- The Titanium Oxide (TiO₂) market faces significant challenges due to fluctuations in raw material and energy prices, which directly impact production costs and profit margins. Titanium feedstock availability and energy-intensive processing make cost stability difficult for manufacturers

- For instance, KRONOS Worldwide, Inc. has highlighted energy and raw material cost pressures as key factors influencing operating performance in its TiO₂ production operations. These cost variations affect pricing strategies and supply planning

- Energy price volatility, particularly in Europe, has increased operational expenses for TiO₂ producers with energy-intensive facilities. This has created challenges in maintaining competitive pricing while complying with environmental regulations

- Raw material supply disruptions and price fluctuations also limit manufacturers’ ability to forecast costs accurately. This uncertainty impacts long-term contracts and can lead to cautious capacity utilization decisions

- The combined effect of unstable input costs continues to constrain market growth by pressuring margins and complicating production planning. Addressing these challenges remains critical for sustaining profitability and long-term market stability

Titanium Oxide (TiO2) Market Scope

The market is segmented on the basis of grade, end user, application, process, and product.

- By Grade

On the basis of grade, the Titanium Oxide (TiO₂) market is segmented into rutile and anatase. The rutile segment dominated the market with the largest revenue share of 78.10% in 2025, driven by its superior opacity, higher refractive index, and excellent durability across end-use industries. Rutile TiO₂ is widely preferred in paints, coatings, and plastics due to its enhanced weather resistance and long-term color stability. Strong demand from construction and automotive coatings further reinforces the dominance of this grade.

The anatase segment is expected to witness the fastest CAGR of 4.82% from 2026 to 2033, supported by its lower production cost and high brightness characteristics. Increasing usage in paper, cosmetics, and specialty applications where extreme durability is not required is accelerating its adoption. Growth in emerging economies and expanding personal care consumption are further supporting this segment’s momentum.

- By End User

On the basis of end user, the Titanium Oxide (TiO₂) market is segmented into agriculture, automotive, personal care, pharmaceutical, food and beverages, construction industry, and others. The construction industry segment accounted for the largest market share in 2025, driven by extensive use of TiO₂ in paints, coatings, and cement for enhanced whiteness and UV resistance. Rapid urbanization, infrastructure development, and renovation activities across residential and commercial buildings continue to sustain high demand.

The personal care segment is anticipated to register the fastest growth during the forecast period, owing to rising consumption of cosmetics, sunscreens, and skincare products. Titanium Oxide is widely used for its UV-blocking and non-toxic properties, aligning with growing consumer preference for safe and high-performance personal care formulations. Expansion of premium cosmetic brands is further fueling this growth.

- By Application

On the basis of application, the Titanium Oxide (TiO₂) market is segmented into paints and coatings, pulp and paper, plastics, cosmetics, ink, plant growth enhancers, and others. Paints and coatings dominated the market in 2025, supported by TiO₂’s ability to provide high opacity, brightness, and durability. Strong demand from construction and industrial maintenance coatings continues to drive large-volume consumption in this application.

The cosmetics application is projected to witness the fastest growth from 2026 to 2033, driven by increasing use of Titanium Oxide in sunscreens, foundations, and skincare products. Rising awareness regarding UV protection and growing demand for mineral-based cosmetic ingredients are accelerating adoption. Regulatory support for safe inorganic pigments further strengthens this segment’s outlook.

- By Process

On the basis of process, the Titanium Oxide (TiO₂) market is segmented into sulfate and chloride. The sulfate process segment held the largest market share in 2025 due to its widespread adoption and ability to process a broad range of raw materials. This process remains dominant in regions with established production facilities and cost-sensitive markets.

The chloride process is expected to grow at the fastest rate during the forecast period, driven by its ability to produce high-purity TiO₂ with lower environmental impact. Increasing regulatory pressure for cleaner production technologies and rising demand for premium-grade pigments in coatings and plastics are accelerating the shift toward chloride-based production.

- By Product

On the basis of product, the Titanium Oxide (TiO₂) market is segmented into pigmentary and ultrafine. The pigmentary segment dominated the market in 2025, driven by its extensive use in paints, coatings, plastics, and paper applications. Its superior opacity and color performance make it indispensable across high-volume industrial uses.

The ultrafine segment is anticipated to witness the fastest growth from 2026 to 2033, supported by increasing applications in cosmetics, sunscreens, and advanced functional materials. Growing demand for nano-sized TiO₂ for UV protection and photocatalytic properties is expanding its adoption across high-value specialty applications.

Titanium Oxide (TiO2) Market Regional Analysis

- Asia-Pacific dominated the Titanium Oxide (TiO2) market with the largest revenue share of 43.7% in 2025, driven by rapid expansion of construction activities, strong growth in paints and coatings production, and increasing plastic manufacturing across the region

- The region’s cost-competitive production environment, availability of raw materials, and large-scale manufacturing capacity are supporting high-volume consumption of TiO₂ across multiple end-use industries

- Rising urbanization, infrastructure development, and increasing demand for consumer goods are accelerating TiO₂ usage in construction, automotive, and packaging applications

China Titanium Oxide (TiO₂) Market Insight

China held the largest share in the Asia-Pacific Titanium Oxide (TiO₂) market in 2025, supported by its strong chemical manufacturing base and large-scale production of paints, coatings, and plastics. The country’s extensive industrial ecosystem, export-oriented pigment production, and continuous capacity expansions by domestic manufacturers are key growth drivers. Strong demand from construction and automotive sectors further reinforces China’s leading position.

India Titanium Oxide (TiO₂) Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by rapid infrastructure development, rising housing construction, and expanding paints and coatings consumption. Government initiatives supporting domestic manufacturing and increasing investments in chemical processing are strengthening local TiO₂ demand. Growth in personal care, plastics, and paper industries is also contributing to robust market expansion.

Europe Titanium Oxide (TiO₂) Market Insight

The Europe Titanium Oxide (TiO₂) market is growing steadily, supported by strong demand for high-quality pigments, stringent environmental regulations, and emphasis on sustainable production practices. The region focuses on premium-grade TiO₂ for advanced coatings, automotive finishes, and specialty plastics. Increasing use of TiO₂ in energy-efficient and eco-friendly applications is further supporting market growth.

Germany Titanium Oxide (TiO₂) Market Insight

Germany plays a key role in the regional market due to its well-established chemical industry, advanced manufacturing technologies, and strong demand from automotive and industrial coatings sectors. The country’s emphasis on innovation, quality standards, and export-oriented production supports consistent consumption of high-performance TiO₂ pigments. Strong R&D capabilities further enhance Germany’s market position.

U.K. Titanium Oxide (TiO₂) Market Insight

The U.K. Titanium Oxide (TiO₂) market is supported by steady demand from construction, packaging, and specialty coatings industries. Focus on high-value formulations, sustainability-driven product development, and renovation activities is sustaining TiO₂ consumption. The presence of established coatings and material manufacturers continues to support market stability.

North America Titanium Oxide (TiO₂) Market Insight

North America is projected to grow at a notable pace from 2026 to 2033, driven by strong demand from construction, automotive, and plastics industries. Increasing emphasis on durable, high-performance coatings and growing renovation activities are boosting TiO₂ consumption. Technological advancements and steady replacement demand are further supporting regional growth.

U.S. Titanium Oxide (TiO₂) Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by a mature construction sector, strong automotive production, and high consumption of paints and coatings. The country’s focus on product performance, regulatory compliance, and sustainable material usage is encouraging continued demand for TiO₂ pigments. Presence of major manufacturers and a well-developed supply chain further strengthens the U.S. market position.

Titanium Oxide (TiO2) Market Share

The Titanium Oxide (TiO2) industry is primarily led by well-established companies, including:

- ISHIHARA SANGYO KAISHA, LTD. (Japan)

- TAYCA (Japan)

- Huntsman International LLC. (U.S.)

- The Chemours Company (U.S.)

- Tronox Holdings plc (U.S.)

- KRONOS Worldwide, Inc. (U.S.)

- Evonik Industries AG (Germany)

- CINKARNA Celje d.d. (Slovenia)

- LB Group (China)

- Ishihara Corporation (U.S.A.) (U.S.)

- Grupa Azoty (Poland)

- Precheza (Czech Republic)

- Argex Titanium Inc. (Canada)

- Apollo Colours Ltd. (U.K.)

- BASF SE (Germany)

- DuPont (U.S.)

- Dow (U.S.)

Latest Developments in Global Titanium Oxide (TiO2) Market

- In January 2026, The Chemours Company agreed to sell its former titanium dioxide site land in Taiwan, generating around USD 360 million in gross proceeds, a move aimed at strengthening its financial position through debt reduction and improving capital efficiency. This divestment supports Chemours’ broader strategy of optimizing its global asset portfolio, allowing the company to reallocate resources toward higher-margin TiO₂ products and core growth markets, thereby improving long-term competitiveness and operational focus

- In September 2025, Tronox introduced a new titanium dioxide product line tailored for the coatings industry, emphasizing lower environmental impact and enhanced performance. This launch aligns with increasing customer demand for sustainable coating materials and positions Tronox to capture higher-value segments, strengthening its market presence as regulations and sustainability standards continue to tighten across major regions

- In July 2025, Lomon Billions entered a strategic partnership with a leading European coatings manufacturer to co-develop specialized titanium dioxide formulations. This collaboration enhances Lomon Billions’ access to advanced application expertise and established distribution channels in Europe, supporting market penetration and reinforcing its competitive position in premium and specialty TiO₂ applications

- In March 2025, Tronox announced the idling of its 90,000 tons per year titanium dioxide plant in Botlek, Netherlands, following a strategic site review. This decision reflects efforts to rebalance global supply, reduce operating costs, and improve overall asset utilization, which is expected to support pricing discipline and profitability across the global TiO₂ market

- In February 2025, The Chemours Company launched Ti-Pure TS-6706, a TMP- and TME-free evolution of its established Ti-Pure R-706 grade for appearance-critical coatings. This product innovation addresses growing regulatory and sustainability requirements while maintaining high performance, enabling Chemours to strengthen customer loyalty and reinforce its leadership in premium coatings applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.