Global Transparent Barrier Packaging Films Market

Market Size in USD Billion

CAGR :

%

USD

6.24 Billion

USD

10.57 Billion

2025

2033

USD

6.24 Billion

USD

10.57 Billion

2025

2033

| 2026 –2033 | |

| USD 6.24 Billion | |

| USD 10.57 Billion | |

|

|

|

|

Transparent Barrier Packaging Film Market Size

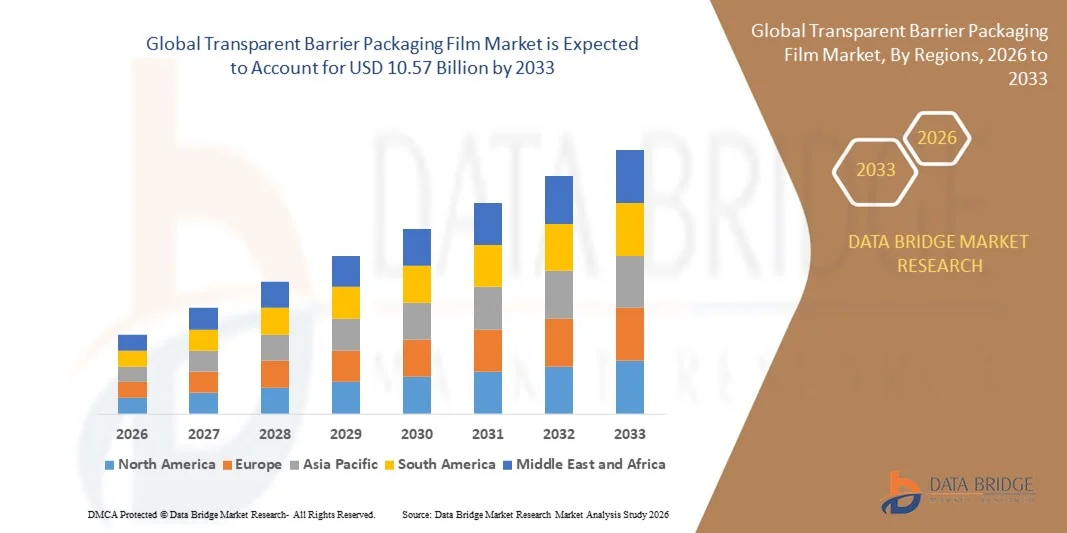

- The global transparent barrier packaging film market size was valued at USD 6.24 billion in 2025 and is expected to reach USD 10.57 billion by 2033, at a CAGR of 6.80% during the forecast period

- The market growth is largely fueled by the rising demand for packaged and processed food products, increasing pharmaceutical production, and the need for extended shelf life and product protection, which is accelerating the adoption of high-performance transparent barrier films across multiple industries

- Furthermore, growing emphasis on sustainable packaging, improved product visibility, and advancements in multilayer and coating technologies are positioning transparent barrier packaging films as a preferred solution for brand owners and manufacturers. These combined factors are significantly boosting overall market expansion

Transparent Barrier Packaging Film Market Analysis

- Transparent barrier packaging films are advanced flexible materials designed to provide protection against oxygen, moisture, and contaminants while maintaining high clarity and product visibility for food, pharmaceutical, and consumer goods packaging applications

- The increasing adoption of these films is primarily driven by the growth of convenience food consumption, stringent quality and safety requirements, and a strong shift toward lightweight, recyclable, and high-barrier packaging solutions across global markets

- Asia-Pacific dominated the transparent barrier packaging film market with a share of 38.16% in 2025, due to rapid growth in packaged food consumption, expanding pharmaceutical manufacturing, and rising demand for cost-efficient flexible packaging solutions

- North America is expected to be the fastest growing region in the transparent barrier packaging film market during the forecast period due to strong demand for high-barrier packaging in food, beverages, and pharmaceuticals

- Food and beverages segment dominated the market with a market share of 41.68% in 2025, due to increasing consumption of packaged and ready-to-eat food products globally. Transparent barrier films are widely used to enhance product visibility while providing protection against moisture, oxygen, and contamination. Brand owners favor these films to improve shelf appeal and meet stringent food safety and shelf-life requirements

Report Scope and Transparent Barrier Packaging Film Market Segmentation

|

Attributes |

Transparent Barrier Packaging Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Transparent Barrier Packaging Film Market Trends

Rising Demand for Recyclable and Bio-Based Packaging Films

- A key trend shaping the transparent barrier packaging film market is the increasing demand for recyclable and bio-based packaging solutions, driven by brand owners’ sustainability commitments and tightening environmental regulations across major economies. Packaging manufacturers are actively shifting toward mono-material structures and recyclable barrier films that maintain transparency while reducing environmental impact, supporting circular economy objectives across food, pharmaceutical, and consumer goods packaging

- For instance, companies such as Amcor have expanded their AmPrima recycle-ready transparent barrier film portfolio to support food and beverage brands seeking high barrier performance with improved recyclability. These solutions help brand owners meet sustainability targets without compromising shelf life, clarity, or packaging efficiency

- The push for bio-based and recyclable films is also encouraging innovation in advanced coating technologies that replace traditional metallized layers. This transition is improving material recovery rates and reducing dependency on complex multi-layer structures that are difficult to recycle

- Consumer preference for environmentally responsible packaging is reinforcing demand for transparent films that combine product visibility with sustainability credentials. This trend is strengthening collaboration between material suppliers, converters, and brand owners to accelerate commercialization of next-generation barrier films

- Regulatory pressure on plastic waste reduction and extended producer responsibility frameworks is further amplifying adoption of recyclable transparent barrier films. These developments are collectively reinforcing sustainability as a central trend influencing long-term market evolution

Transparent Barrier Packaging Film Market Dynamics

Driver

Growth in Packaged Food and Beverage Industry

- The rapid expansion of the packaged food and beverage industry is a primary driver of the transparent barrier packaging film market, as manufacturers increasingly rely on high-barrier films to preserve freshness, extend shelf life, and maintain product quality. Transparent barrier films enable visual appeal while offering protection against oxygen, moisture, and contaminants, making them essential for modern food packaging applications

- For instance, companies such as Nestlé have increased the use of high-barrier flexible packaging to support longer shelf life and improved product safety across ready-to-eat and dry food categories. This reliance on advanced barrier films is strengthening consistent demand from large-scale food producers

- Rising urbanization, changing dietary habits, and growing consumption of convenience and ready-to-eat foods are increasing the need for reliable packaging that supports extended distribution cycles. Transparent barrier films address these requirements while supporting branding and consumer trust through product visibility

- The beverage sector is also adopting transparent barrier films for powdered drinks, nutritional products, and specialty beverages where moisture and oxygen control is critical. This expansion across multiple food and beverage categories is reinforcing sustained market growth

- As global food supply chains become longer and more complex, the demand for packaging solutions that ensure safety, stability, and visual appeal continues to rise. This sustained growth in packaged food consumption remains a fundamental driver for the transparent barrier packaging film market

Restraint/Challenge

Complex Recycling Infrastructure and Material Recovery Challenges

- The transparent barrier packaging film market faces challenges related to complex recycling infrastructure and material recovery limitations, particularly for high-performance multilayer barrier films. Many transparent barrier structures combine multiple polymers and coatings, which complicates sorting, recycling, and reprocessing within existing waste management systems

- For instance, organizations such as the Ellen MacArthur Foundation have highlighted the difficulty of recycling multi-material flexible packaging within conventional recycling streams. These limitations slow large-scale adoption of certain barrier films despite their performance advantages

- Inconsistent recycling infrastructure across regions further restricts effective recovery of transparent barrier films, creating disparities in recyclability outcomes between developed and emerging markets. This inconsistency affects brand owners’ ability to implement uniform sustainable packaging strategies globally

- High costs associated with upgrading recycling systems and developing compatible barrier materials place additional pressure on packaging manufacturers. These factors increase compliance complexity and limit rapid scalability of advanced barrier film solutions

- The challenge of balancing high barrier performance with recyclability continues to restrain market progress in certain applications. Overcoming these constraints will require continued material innovation, infrastructure investment, and cross-industry collaboration to support sustainable growth of the transparent barrier packaging film market

Transparent Barrier Packaging Film Market Scope

The market is segmented on the basis of material, application, and coatings.

- By Material

On the basis of material, the transparent barrier packaging film market is segmented into polyvinylidene chloride (PVDC), ethylene vinyl alcohol (EVOH), polypropylene (PP), polyethylene terephthalate (PET), polyamide, polyethylene, biaxially oriented polypropylene (BOPP), and other materials. The EVOH segment dominated the largest market revenue share in 2025, driven by its superior oxygen and gas barrier properties, which are critical for extending shelf life of perishable food and pharmaceutical products. Manufacturers prefer EVOH due to its ability to maintain product freshness without compromising transparency, supporting premium packaging requirements. Its compatibility with multilayer film structures further strengthens adoption across high-performance packaging applications.

The BOPP segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising demand for lightweight, cost-effective, and recyclable packaging materials. BOPP films offer excellent clarity, moisture resistance, and mechanical strength, making them suitable for a wide range of food and consumer goods packaging. Growing focus on sustainability and downgauging strategies is accelerating the shift toward BOPP-based transparent barrier films.

- By Application

On the basis of application, the transparent barrier packaging film market is segmented into food and beverages, pharmaceutical packaging, personal care product packaging, household care product packaging, consumer goods, and other applications. The food and beverages segment accounted for the largest market revenue share of 41.68% in 2025, supported by increasing consumption of packaged and ready-to-eat food products globally. Transparent barrier films are widely used to enhance product visibility while providing protection against moisture, oxygen, and contamination. Brand owners favor these films to improve shelf appeal and meet stringent food safety and shelf-life requirements.

The pharmaceutical packaging segment is expected to grow at the fastest rate during the forecast period, driven by rising pharmaceutical production and increasing emphasis on product integrity and regulatory compliance. Transparent barrier films enable visual inspection of medicines while offering high protection against environmental factors. Expanding demand for blister packs, sachets, and unit-dose packaging is further accelerating adoption in this segment.

- By Coatings

On the basis of coatings, the transparent barrier packaging film market is segmented into silicon oxide, aluminium oxide, and ceramics. The aluminium oxide coating segment dominated the market revenue share in 2025, owing to its strong barrier performance against oxygen and moisture combined with high transparency. These coatings are extensively used in food and pharmaceutical packaging where extended shelf life and visual clarity are essential. Aluminium oxide-coated films also support lightweight and metal-free packaging solutions, aligning with evolving industry requirements.

The silicon oxide coating segment is projected to witness the fastest growth from 2026 to 2033, driven by increasing demand for sustainable and recyclable high-barrier packaging. Silicon oxide coatings provide excellent transparency and barrier properties while enabling easier recyclability compared to traditional metallized films. Growing investments in advanced coating technologies and eco-friendly packaging solutions are reinforcing the rapid adoption of silicon oxide–based transparent barrier films.

Transparent Barrier Packaging Film Market Regional Analysis

- Asia-Pacific dominated the transparent barrier packaging film market with the largest revenue share of 38.16% in 2025, driven by rapid growth in packaged food consumption, expanding pharmaceutical manufacturing, and rising demand for cost-efficient flexible packaging solutions

- The region’s strong manufacturing base, availability of low-cost raw materials, and increasing investments in advanced multilayer and high-barrier film technologies are accelerating market expansion

- Rising urbanization, changing consumer lifestyles, and supportive government policies promoting domestic packaging production are contributing to higher adoption across food, pharmaceutical, and consumer goods sectors

China Transparent Barrier Packaging Film Market Insight

China held the largest share in the Asia-Pacific transparent barrier packaging film market in 2025, owing to its position as a global hub for food processing, consumer goods manufacturing, and pharmaceutical production. The country’s large-scale packaging industry, strong supply chain integration, and continuous investments in high-barrier and recyclable film technologies are key growth drivers. Increasing exports of packaged food and consumer products are further strengthening demand for transparent barrier films.

India Transparent Barrier Packaging Film Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid expansion of the packaged food sector, rising pharmaceutical production, and increasing adoption of modern retail formats. Government initiatives supporting food processing and pharmaceutical manufacturing, along with growing demand for cost-effective and shelf-life-extending packaging, are driving market growth. The shift toward flexible and transparent packaging for consumer convenience is further boosting adoption.

Europe Transparent Barrier Packaging Film Market Insight

The Europe transparent barrier packaging film market is expanding steadily, supported by strong emphasis on sustainable packaging, stringent food safety regulations, and high demand for premium packaging solutions. Manufacturers in the region focus on advanced barrier coatings and recyclable materials to meet regulatory and environmental standards. Growth is further supported by consistent demand from food, pharmaceutical, and personal care packaging applications.

Germany Transparent Barrier Packaging Film Market Insight

Germany’s market is driven by its advanced packaging technology landscape, strong food and pharmaceutical industries, and leadership in sustainable packaging innovation. The country’s focus on high-performance, recyclable, and lightweight barrier films is encouraging adoption across multiple end-use sectors. Well-established R&D capabilities and collaboration between packaging manufacturers and brand owners continue to support market growth.

U.K. Transparent Barrier Packaging Film Market Insight

The U.K. market is supported by rising demand for packaged and convenience foods, growth in pharmaceutical packaging, and increasing focus on environmentally compliant materials. Investments in innovative coating technologies and flexible packaging formats are strengthening market adoption. The country’s emphasis on reducing food waste through improved barrier performance is also contributing to demand growth.

North America Transparent Barrier Packaging Film Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strong demand for high-barrier packaging in food, beverages, and pharmaceuticals. Increasing preference for transparent packaging that enhances product visibility, along with growing adoption of sustainable and recyclable films, is supporting market expansion. Technological advancements in coating and multilayer film structures are further accelerating growth.

U.S. Transparent Barrier Packaging Film Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its large packaged food industry, advanced pharmaceutical manufacturing, and strong focus on packaging innovation. High consumer demand for convenience foods and stringent quality standards are driving the use of advanced transparent barrier films. Presence of major packaging manufacturers and continuous investments in sustainable materials further reinforce the U.S.’s leading position.

Transparent Barrier Packaging Film Market Share

The transparent barrier packaging film industry is primarily led by well-established companies, including:

- Amcor plc (Switzerland)

- Bemis Manufacturing Company (U.S.)

- Berry Global Inc. (U.S.)

- Sealed Air (U.S.)

- Sonoco Metal Packaging EMEA (U.S.)

- DS Smith (U.K.)

- 3M (U.S.)

- Mitsubishi Chemical Group (Japan)

- TOPPAN Inc. (Japan)

- Daibochi Berhad (Malaysia)

- Klöckner Pentaplast (Germany)

- OIKE & Co., Ltd. (Japan)

- Mondi (U.K.)

- DuPont (U.S.)

- Celplast Metallized Products (Canada)

- Cosmo Films (India)

- UFlex Limited (India)

- WINPAK LTD. (Canada)

- Spoon Inc (Japan)

Latest Developments in Global Transparent Barrier Packaging Film Market

- In March 2025, Innovia Films strengthened its position in the European transparent barrier packaging film market by commissioning a new specialty BOPP film production line at its Schkopau facility near Leipzig, Germany. The 8.8-meter-wide line, with an annual capacity of 35,000 tons and capability to produce 15–50 micron films, enhances Innovia’s ability to supply high-performance, high-clarity barrier films to major European brand owners. This expansion directly supports rising regional demand for advanced and sustainable packaging films while improving supply chain responsiveness across Europe

- In December 2024, Cosmo First expanded its specialty film portfolio by entering the automotive segment with the launch of advanced Paint Protection Films, marking a strategic diversification beyond traditional packaging applications. This development reflects Cosmo First’s broader material science capabilities and strengthens its overall specialty film market presence, indirectly reinforcing its technological expertise and manufacturing scale relevant to high-performance transparent films used in packaging

- In March 2024, TOPPAN introduced its sustainable barrier film GL-SP, developed using biaxially oriented polypropylene as the base material, significantly impacting the transparent barrier packaging film market. The film delivers strong oxygen and moisture barrier performance while maintaining high transparency and reduced material thickness, making it suitable for dry food packaging. This launch underscores TOPPAN’s commitment to sustainability and lightweight packaging, aligning with brand owner demand for recyclable and resource-efficient barrier films

- In March 2024, Jindal Poly Films advanced sustainable packaging innovation with the launch of a mono-material polypropylene barrier film designed to replace conventional multi-layer flexible packaging. By improving recyclability without compromising barrier performance, this development addresses key environmental challenges in flexible packaging. The innovation strengthens Jindal Poly Films’ competitive positioning in the transparent barrier packaging film market, particularly among sustainability-focused food and consumer goods brands

- In January 2024, Amcor announced the commercial rollout of a high-barrier, recycle-ready transparent packaging film under its AmPrima platform, aimed at food and beverage applications. This development supports the market’s transition toward mono-material and recyclable structures while maintaining shelf-life performance and product visibility. Amcor’s innovation is accelerating adoption of sustainable transparent barrier films among global FMCG companies seeking to meet circular economy targets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Transparent Barrier Packaging Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Transparent Barrier Packaging Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Transparent Barrier Packaging Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.