Global Trichoderma Viride Biofungicides Market

Market Size in USD Million

CAGR :

%

USD

929.60 Million

USD

1,352.65 Million

2025

2033

USD

929.60 Million

USD

1,352.65 Million

2025

2033

| 2026 –2033 | |

| USD 929.60 Million | |

| USD 1,352.65 Million | |

|

|

|

|

Trichoderma Viride Biofungicides Market Size

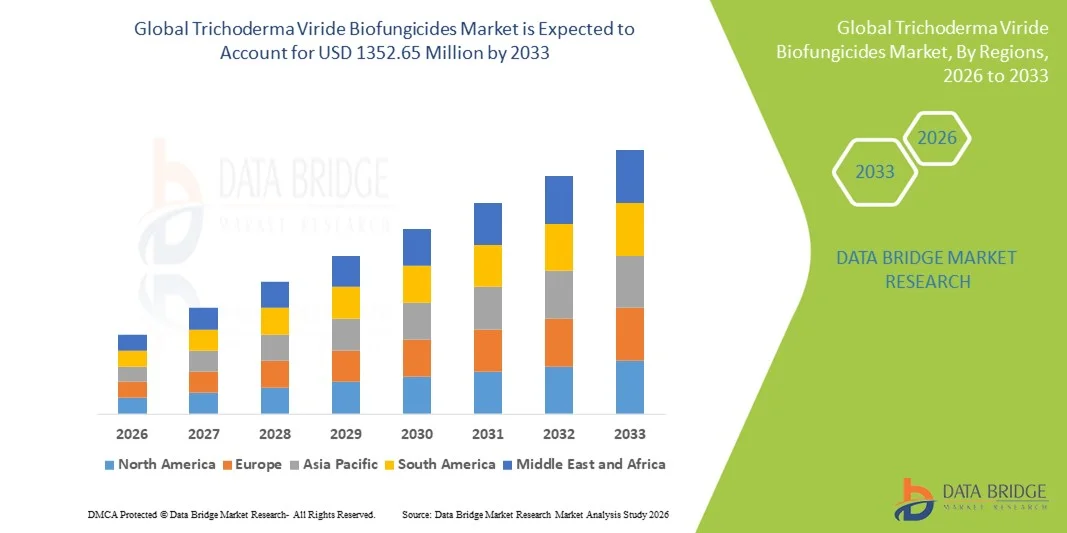

- The global trichoderma viride biofungicides market size was valued at USD 929.60 million in 2025 and is expected to reach USD 1352.65 million by 2033, at a CAGR of 4.80% during the forecast period

- The market growth is largely driven by the increasing shift toward sustainable and eco-friendly agricultural practices, along with rising awareness of the harmful environmental impact of chemical fungicides on soil health and crop quality

- Furthermore, growing regulatory restrictions on synthetic agrochemicals and increasing demand for residue-free food products are accelerating the adoption of Trichoderma viride biofungicides, thereby significantly supporting overall market expansion

Trichoderma Viride Biofungicides Market Analysis

- Trichoderma viride biofungicides, offering biological control of soil-borne and foliar fungal diseases, are becoming essential components of integrated pest management systems across conventional and organic farming due to their effectiveness, safety, and soil-enriching properties

- The rising demand for these biofungicides is primarily fueled by expanding organic farming acreage, increasing focus on long-term crop productivity, and growing farmer awareness regarding biological disease management as a reliable alternative to chemical fungicides

- North America dominated the trichoderma viride biofungicides market with a share of over 35% in 2025, due to the strong adoption of sustainable agricultural practices and increasing regulatory restrictions on chemical fungicides

- Asia-Pacific is expected to be the fastest growing region in the trichoderma viride biofungicides market during the forecast period due to expanding agricultural activities, rising awareness of soil-borne diseases, and growing demand for sustainable crop protection

- Microbial species segment dominated the market with a market share of around 70% in 2025, due to the well-established efficacy of Trichoderma viride strains in suppressing soil-borne and foliar fungal pathogens. Farmers widely prefer microbial-based products due to their proven biocontrol performance, consistency across different agro-climatic conditions, and compatibility with integrated pest management programs. Strong research backing, wide commercial availability, and higher shelf stability further support the dominance of microbial species-based biofungicides

Report Scope and Trichoderma Viride Biofungicides Market Segmentation

|

Attributes |

Trichoderma Viride Biofungicides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Trichoderma Viride Biofungicides Market Trends

Rising Adoption of Biological and Sustainable Crop Protection Solutions

- A major trend in the Trichoderma viride biofungicides market is the accelerating shift toward biological and sustainable crop protection solutions, driven by increasing concerns over soil degradation, environmental safety, and long-term agricultural productivity. Farmers and agribusinesses are progressively integrating biofungicides into routine crop management to reduce dependence on synthetic chemicals and support regenerative farming practices

- For instance, UPL Ltd. has expanded its biological portfolio through its Natural Plant Protection platform, promoting Trichoderma-based solutions as part of sustainable crop protection programs across multiple regions. Such initiatives strengthen farmer confidence in biological inputs and encourage wider adoption across diverse crop segments

- The use of Trichoderma viride is gaining traction due to its ability to improve soil microbial balance while effectively suppressing soil-borne fungal pathogens. This dual benefit is positioning biofungicides as both disease management and soil health enhancement tools within modern farming systems

- Organic and export-oriented farming systems are increasingly adopting Trichoderma viride to meet strict residue standards imposed by global food supply chains. This trend is particularly visible in high-value fruits, vegetables, and horticultural crops where quality and compliance are critical

- Agricultural input companies are investing in formulation improvements to enhance field performance and stability of Trichoderma viride products. These advancements are helping overcome traditional adoption barriers and supporting broader commercial use

- Overall, the rising emphasis on sustainable agriculture and environmentally responsible inputs is reinforcing the long-term integration of Trichoderma viride biofungicides into mainstream crop protection strategies

Trichoderma Viride Biofungicides Market Dynamics

Driver

Increasing Regulatory Restrictions on Chemical Fungicides

- The growing number of regulatory restrictions on chemical fungicides is a key driver for the Trichoderma viride biofungicides market, as governments and regulatory bodies tighten controls on synthetic agrochemicals to protect environmental and human health. These policies are accelerating the transition toward biologically derived alternatives

- For instance, the European Commission has implemented stringent regulations under its sustainable agriculture and pesticide reduction initiatives, limiting the use of several synthetic fungicides. This regulatory environment has significantly increased demand for approved biological solutions such as Trichoderma viride

- Regulatory pressure is encouraging farmers to adopt biofungicides that comply with residue limits and environmental safety standards. Trichoderma viride products align well with these requirements due to their natural origin and low toxicity profile

- Food retailers and export markets are also enforcing stricter residue compliance, indirectly reinforcing regulatory-driven adoption of biofungicides. Growers increasingly rely on Trichoderma viride to maintain market access while ensuring effective disease control

- Agrochemical manufacturers are responding to regulatory shifts by expanding their biological product lines, further strengthening market availability. This sustained regulatory momentum continues to support long-term growth for Trichoderma viride biofungicides

Restraint/Challenge

Limited Shelf Life and Sensitivity to Storage Conditions

- A significant challenge in the Trichoderma viride biofungicides market is the limited shelf life and sensitivity of microbial formulations to storage and environmental conditions. Unlike chemical fungicides, these products require controlled conditions to maintain microbial viability and field efficacy

- For instance, Koppert Biological Systems emphasizes specific storage temperature and handling guidelines for its microbial products to ensure performance consistency. Deviation from these conditions can reduce effectiveness and impact farmer satisfaction

- Transportation and distribution in regions with limited cold-chain infrastructure further complicate product handling. Exposure to high temperatures and humidity can negatively affect spore viability, particularly in developing agricultural markets

- Farmers may also face challenges related to shorter product usability periods, requiring careful inventory management and timely application. These factors can influence purchasing decisions and slow adoption in price-sensitive regions

- Manufacturers continue to invest in improved formulations and packaging technologies to address these limitations. However, shelf life and storage sensitivity remain key constraints that the market must overcome to achieve wider penetration and consistent performance at scale

Trichoderma Viride Biofungicides Market Scope

The market is segmented on the basis of source, formulation, pest, application, and crop type.

- By Source

On the basis of source, the Trichoderma Viride biofungicides market is segmented into microbial species and botanical. The microbial species segment dominated the market with the largest revenue share of around 70% in 2025, driven by the well-established efficacy of Trichoderma viride strains in suppressing soil-borne and foliar fungal pathogens. Farmers widely prefer microbial-based products due to their proven biocontrol performance, consistency across different agro-climatic conditions, and compatibility with integrated pest management programs. Strong research backing, wide commercial availability, and higher shelf stability further support the dominance of microbial species-based biofungicides.

The botanical segment is anticipated to witness the fastest growth during the forecast period, fueled by rising demand for plant-derived and residue-free crop protection solutions. Increasing adoption of organic farming practices and growing regulatory support for botanical inputs encourage manufacturers to develop combined formulations with natural extracts. Enhanced consumer awareness regarding chemical-free food production also contributes to accelerating demand for botanical-based Trichoderma viride products.

- By Formulation

On the basis of formulation, the market is segmented into wettable powder, water dispersible granules, suspension concentrates, soluble powder, powder for dry seed treatment, and others. The wettable powder segment dominated the market in 2025, driven by its cost-effectiveness, longer shelf life, and ease of storage and transportation. Wettable powder formulations are widely used due to their flexibility in application methods and compatibility with conventional spraying equipment, making them suitable for both small and large-scale farming operations.

The water dispersible granules segment is expected to register the fastest growth from 2026 to 2033, supported by improved handling safety, reduced dust formation, and better dispersion in water. Farmers increasingly prefer granule-based formulations due to precise dosing, enhanced field application efficiency, and lower operator exposure. These advantages drive rapid adoption in modern and mechanized agricultural practices.

- By Pest

On the basis of pest, the Trichoderma Viride biofungicides market is segmented into Phytophthora, Botrytis, Alternaria, Botrytis and Venturia, Botrytis and Phytophthora, Pythium and Rhizoctonia, and others. The Pythium and Rhizoctonia segment dominated the market in 2025, driven by the widespread occurrence of these soil-borne pathogens across major crops. Trichoderma viride is highly effective in controlling root rot and damping-off diseases caused by these fungi, leading to strong farmer adoption for soil health management and yield protection.

The Phytophthora segment is projected to witness the fastest growth during the forecast period, fueled by increasing crop losses associated with Phytophthora-related diseases in fruits, vegetables, and plantation crops. Rising awareness of biological disease management and the limitations of chemical fungicides accelerate demand for Trichoderma viride solutions targeting Phytophthora infections.

- By Application

On the basis of application, the market is segmented into foliar spray, soil treatment, seed treatment, and other. The soil treatment segment dominated the market with the highest revenue share in 2025, driven by the primary role of Trichoderma viride in improving soil microbial balance and suppressing soil-borne pathogens. Soil application enhances root colonization and long-term disease protection, making it a preferred method for sustainable crop production systems.

The seed treatment segment is expected to grow at the fastest rate from 2026 to 2033, supported by increasing emphasis on early-stage crop protection and improved seed vigor. Seed treatment with Trichoderma viride offers cost-efficient disease control, uniform application, and reduced dependency on chemical fungicides, encouraging its rapid adoption among farmers and seed producers.

- By Crop Type

On the basis of crop type, the Trichoderma Viride biofungicides market is segmented into fruits and vegetables, cereals and grains, oilseeds and pulses, and other. The fruits and vegetables segment dominated the market in 2025, driven by the high susceptibility of these crops to fungal diseases and the strong demand for residue-free produce. Intensive cultivation practices and higher economic value of fruits and vegetables support widespread use of Trichoderma viride biofungicides.

The oilseeds and pulses segment is anticipated to witness the fastest growth during the forecast period, fueled by expanding cultivation areas and increasing disease pressure in these crops. Growing adoption of sustainable farming practices and government initiatives promoting biological inputs accelerate demand for Trichoderma viride in oilseeds and pulses cultivation.

Trichoderma Viride Biofungicides Market Regional Analysis

- North America dominated the trichoderma viride biofungicides market with the largest revenue share of over 35% in 2025, driven by the strong adoption of sustainable agricultural practices and increasing regulatory restrictions on chemical fungicides

- Farmers across the region increasingly prefer biological crop protection solutions due to growing awareness of soil health, residue-free food production, and long-term yield sustainability

- This widespread adoption is further supported by advanced farming practices, high awareness of integrated pest management, and strong presence of bio-input manufacturers, establishing Trichoderma viride as a key component in conventional and organic farming systems

U.S. Trichoderma Viride Biofungicides Market Insight

The U.S. captured the largest revenue share within North America in 2025, fueled by the rapid expansion of organic farming and increasing use of biofungicides in high-value crops. Growers are prioritizing environmentally safe disease control solutions to meet stringent food safety standards and consumer demand for chemical-free produce. Strong government support for sustainable agriculture and extensive research activities further accelerate market growth.

Europe Trichoderma Viride Biofungicides Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, primarily driven by strict regulations limiting synthetic agrochemicals and strong policy support for biological inputs. Rising adoption of organic farming and increasing emphasis on soil biodiversity are encouraging the use of Trichoderma viride across multiple crop types. The market is witnessing steady growth in both open-field and greenhouse cultivation.

U.K. Trichoderma Viride Biofungicides Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, driven by increasing focus on sustainable crop protection and compliance with evolving environmental regulations. Farmers are increasingly shifting toward biofungicides to reduce chemical dependency and improve long-term soil fertility. The growing organic food market further supports adoption across fruits, vegetables, and cereals.

Germany Trichoderma Viride Biofungicides Market Insight

Germany is expected to expand at a considerable CAGR during the forecast period, supported by strong awareness of eco-friendly agricultural inputs and advanced agronomic practices. The country’s emphasis on sustainable farming and precision agriculture promotes the use of biological disease management solutions. Increasing investments in bio-based agricultural research further strengthen market growth.

Asia-Pacific Trichoderma Viride Biofungicides Market Insight

Asia-Pacific is poised to grow at the fastest CAGR during 2026 to 2033, driven by expanding agricultural activities, rising awareness of soil-borne diseases, and growing demand for sustainable crop protection. Government initiatives promoting biofertilizers and biofungicides, coupled with increasing export-oriented farming, are accelerating market adoption across the region.

India Trichoderma Viride Biofungicides Market Insight

India is emerging as the fastest-growing country in Asia-Pacific, supported by large-scale agricultural production and rising adoption of biological inputs. Increasing farmer awareness, government subsidies for bio-agriculture, and the need to improve soil productivity drive strong demand for Trichoderma viride products. The growing organic and residue-free farming movement further contributes to market expansion.

China Trichoderma Viride Biofungicides Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2025, attributed to extensive cultivation areas and rising emphasis on reducing chemical pesticide usage. Strong government support for green agriculture and rapid adoption of bio-based crop protection solutions are key growth drivers. The presence of domestic manufacturers and increasing focus on sustainable food production continue to propel the market.

Trichoderma Viride Biofungicides Market Share

The trichoderma viride biofungicides industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bayer AG (Germany)

- Corteva, Inc. (U.S.)

- Syngenta AG (Switzerland)

- FMC Corporation (U.S.)

- UPL Ltd. (India)

- Sumitomo Chemical Co., Ltd. (Japan)

- ADAMA Agricultural Solutions Ltd. (Israel)

- Nissan Chemical Corporation (Japan)

- Marrone Bio Innovations, Inc. (U.S.)

- Koppert Biological Systems (Netherlands)

- Bioworks, Inc. (U.S.)

- STK Bio-ag Technologies (Israel)

- Verdesian Life Sciences (U.S.)

- Seipasa S.A. (Spain)

- Ishihara Sangyo Kaisha, Ltd. (Japan)

Latest Developments in Global Trichoderma Viride Biofungicides Market

- In September 2024, Valent BioSciences expanded its microbial fermentation manufacturing facility to enhance production capacity for biofungicides, including Trichoderma viride. This development strengthens supply chain stability and supports the growing global demand for biological crop protection products. The expansion also enables faster commercialization and wider geographic reach, reinforcing the company’s position in the biofungicides market

- In August 2024, Certis USA entered a partnership with a precision agriculture drone service provider to improve large-scale application of microbial biofungicides. This collaboration enhances application efficiency, reduces labor dependency, and promotes uniform field coverage, making Trichoderma viride products more accessible for large and commercial farming operations. The initiative supports broader adoption by aligning biofungicides with modern precision farming practices

- In June 2024, DuPont launched a Trichoderma viride-based biofungicide as part of its expanding biologicals portfolio. This product introduction increases market competition and provides growers with an additional sustainable alternative to chemical fungicides. The launch also reflects growing investment by multinational companies in bio-based disease management solutions, supporting overall market growth

- In April 2024, Syngenta partnered with the Indian Agricultural Research Institute to co-develop and field-test Trichoderma viride formulations for major crops. This collaboration enhances product credibility through scientific validation and supports formulation optimization under local agronomic conditions. The partnership accelerates farmer acceptance and strengthens market penetration in a high-growth agricultural region

- In January 2024, Marrone Bio Innovations received expanded regulatory approval for its Trichoderma viride granular formulation across multiple Indian states. This approval enables broader commercial distribution and increases product accessibility for farmers adopting biological crop protection. The development significantly boosts the company’s market presence in one of the fastest-growing biofungicides markets globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.