Global Tuna Fish Market

Market Size in USD Billion

CAGR :

%

USD

48.44 Billion

USD

65.12 Billion

2024

2032

USD

48.44 Billion

USD

65.12 Billion

2024

2032

| 2025 –2032 | |

| USD 48.44 Billion | |

| USD 65.12 Billion | |

|

|

|

|

Tuna Fish Market Size

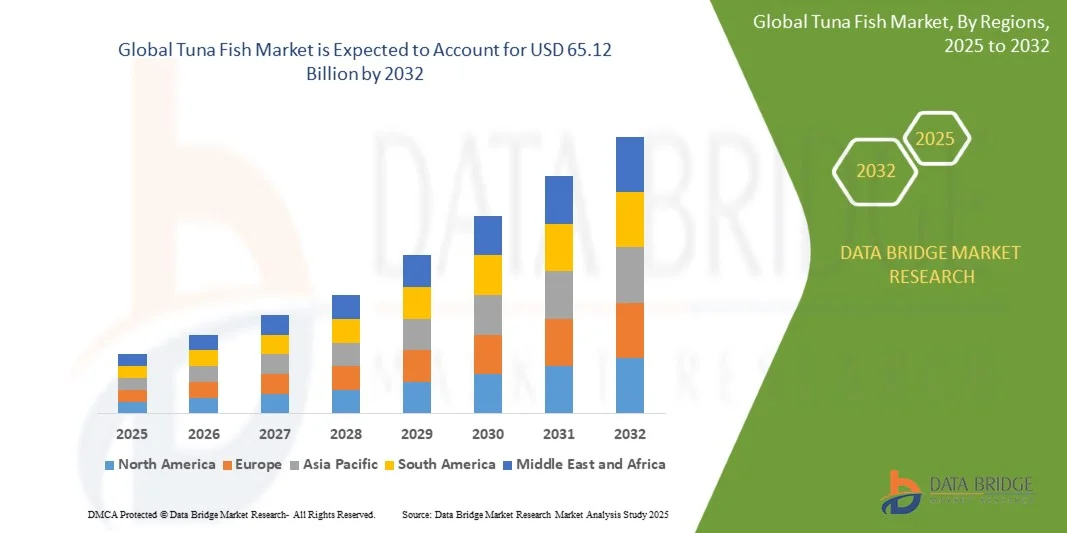

- The Tuna Fish Market size was valued at USD 48.44 billion in 2024 and is expected to reach USD 65.12 billion by 2032, at a CAGR of 3.77% during the forecast period

- The market growth is primarily driven by increasing consumer demand for healthy, protein-rich seafood in processed and fresh forms across retail, foodservice, and ready-to-eat segments

- Additionally, rising awareness of sustainable fishing practices and advancements in aquaculture technologies are supporting supply chain stability and product quality, thereby significantly accelerating market expansion

Tuna Fish Market Analysis

- Tuna fish, prized for its high protein content and rich omega-3 fatty acids, is widely consumed fresh, canned, and frozen across global markets, with significant demand in retail, foodservice, and ready-to-eat product segments due to its nutritional benefits and versatility

- Increasing health consciousness and preference for convenient, protein-rich seafood options, alongside advancements in sustainable fishing and aquaculture practices, are driving the accelerated adoption of responsibly sourced tuna products

- Europe Dominated the Tuna Fish Market with the largest revenue share of 37.7% in 2024, supported by strong domestic consumption, expanding aquaculture infrastructure, and growing export activities, with countries like Japan and Indonesia showing significant growth in tuna production and processing

- Asia-Pacific is projected to be the fastest-growing region in the Tuna Fish Market during the forecast period, fueled by rising consumer demand for sustainable seafood, innovation in ready-to-eat tuna products, and increasing awareness of health and wellness trends

- The skipjack segment dominated the market with the largest revenue share of 58.5% in 2024, driven by its wide availability, lower cost, and popularity in canned tuna products.

Report Scope and Tuna Fish Market Segmentation

|

Attributes |

Tuna Fish Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tuna Fish Market Trends

“Sustainable Growth and Innovation in the Tuna Fish Market”

- A significant and accelerating trend in the Tuna Fish Market is the increasing focus on sustainable fishing and aquaculture technologies that ensure responsible sourcing and maintain healthy tuna populations, while meeting growing consumer demand for high-quality seafood products.

- For instance, advanced aquaculture systems and selective fishing techniques allow producers to optimize yield, improve fish health, and reduce environmental impact. Companies such as Thai Union and Dongwon are leading efforts to implement traceability and sustainable practices throughout their supply chains.

- Innovation in processing and packaging technologies supports product freshness, extends shelf life, and enhances convenience for consumers, driving greater adoption of ready-to-eat and value-added tuna products in retail and foodservice markets.

- Integration of sustainability certifications such as MSC (Marine Stewardship Council) and BAP (Best Aquaculture Practices) across global supply chains promotes transparency and meets increasing regulatory and consumer expectations for eco-friendly seafood.

- This trend towards sustainable production, combined with product innovation, is reshaping the tuna industry. Major players like Bumble Bee and Starkist are investing heavily in improving supply chain sustainability and developing new product formats to capture evolving market preferences.

- The demand for responsibly sourced, nutritious, and convenient tuna products is growing rapidly across retail, foodservice, and export markets, driven by health-conscious consumers and increasing awareness of ocean conservation and sustainable fisheries management.

Tuna Fish Market Dynamics

Driver

Growing Need Due to Rising Demand for Sustainable and Convenient Tuna Products

- The increasing consumer preference for healthy, protein-rich seafood options, combined with growing awareness of sustainable fishing practices, is a significant driver for the heightened adoption of responsibly sourced tuna products across retail, foodservice, and ready-to-eat segments.

- For instance, in early 2024, Thai Union announced new initiatives to expand sustainable tuna sourcing and introduce eco-friendly packaging, supporting global sustainability goals. Such innovations by key companies are expected to fuel tuna market growth during the forecast period.

- As regulations around marine conservation tighten and consumers demand transparency, sustainably harvested tuna with certifications such as MSC and BAP provide a competitive advantage over conventional products.

- Furthermore, rising demand for convenient, ready-to-eat tuna meals and snack formats is driving product innovation and market expansion, particularly in North America and Europe.

- The trend toward responsible sourcing and increasing consumption in emerging markets is propelling the adoption of sustainable tuna practices worldwide. Investments in aquaculture advancements and supply chain traceability further support market growth.

Restraint/Challenge

“Concerns Over Supply Chain Sustainability and Cost Pressures”

- Challenges related to overfishing, stock depletion, and illegal fishing practices continue to pose risks to the long-term supply of wild tuna, raising concerns among producers, regulators, and consumers.

- For instance, fluctuating tuna catch volumes and regulatory restrictions can lead to supply inconsistencies and higher raw material costs, which impact pricing and availability.

- Additionally, sustainable fishing and aquaculture practices often incur higher operational costs, which can translate into premium pricing that may deter price-sensitive buyers, especially in developing markets.

- Companies such as Bumble Bee and Dongwon are investing in sustainable fisheries management and aquaculture innovation to address supply challenges and improve cost efficiencies.

- However, the perception of limited availability, combined with supply chain complexities and certification requirements, can slow widespread adoption of sustainably sourced tuna products.

- Addressing these challenges through improved resource management, cost-effective aquaculture technologies, and consumer education on the value of sustainability will be essential for sustained market growth.

Tuna Fish Market Scope

The market is segmented on the basis of species, type, and Distribution Channel.

• By Species

The Tuna Fish Market is segmented by species into skipjack and albacore tuna. The skipjack segment dominated the market with the largest revenue share of 58.5% in 2024, driven by its wide availability, lower cost, and popularity in canned tuna products. Skipjack tuna is favored for its milder flavor and suitability for various culinary uses, making it a staple in many regions worldwide. Additionally, sustainable fishing practices and certifications are increasingly applied to skipjack fisheries, supporting its market dominance.

The albacore segment is expected to witness the fastest CAGR of 18.2% from 2025 to 2032, propelled by rising consumer demand for premium tuna products with higher omega-3 content and firmer texture. Albacore tuna is often preferred in fresh and premium canned segments, particularly in developed markets where consumers seek healthier and gourmet seafood options.

• By Type

On the basis of type, the Tuna Fish Market is segmented into canned and fresh tuna. The canned tuna segment held the largest market revenue share of 67.4% in 2024, owing to its long shelf life, convenience, and widespread use in ready-to-eat meals. Canned tuna is a staple in many households and foodservice industries, supported by extensive distribution networks and diverse packaging formats.

The fresh tuna segment is anticipated to witness the fastest CAGR of 19.3% from 2025 to 2032, driven by increasing consumer preference for fresh and high-quality seafood, especially in premium restaurants and health-conscious markets. Growth in fresh tuna demand is also fueled by the rise of sushi and sashimi consumption globally, as well as enhanced cold chain infrastructure enabling wider availability.

• By Distribution Channel

The market is segmented by distribution channel into hypermarkets & supermarkets and specialty stores. Hypermarkets & supermarkets dominated the market with a revenue share of 54.7% in 2024, attributed to their wide reach, competitive pricing, and ability to stock a broad range of tuna products catering to diverse consumer needs. These outlets benefit from strong supply chain integration and promotional activities that drive high-volume sales.

Specialty stores are projected to witness the fastest CAGR of 16.8% from 2025 to 2032, fueled by consumer trends favoring premium, organic, and sustainably sourced tuna products. Specialty retailers often cater to niche markets focusing on quality, traceability, and gourmet selections, appealing to discerning customers and higher-income groups in urban areas.

Tuna Fish Market Regional Analysis

- Europe dominated the Tuna Fish Market with the largest revenue share of 37.7% in 2024, driven by rising consumer demand for high-quality, sustainable seafood across retail, foodservice, and ready-to-eat segments.

- Manufacturers and suppliers in the region prioritize sustainably sourced tuna products due to increasing health consciousness, environmental awareness, and stringent seafood traceability requirements from both regulators and consumers.

- This strong market position is further supported by robust investments in aquaculture technologies, advanced processing infrastructure, and comprehensive sustainability certification programs, fostering rapid adoption of responsible fishing practices and innovative tuna products in North America’s dynamic seafood industry.

U.S. Tuna Fish Market Insight

The U.S. tuna fish market captured the largest revenue share of 27% in North America in 2024, driven by growing consumer demand for healthy, protein-rich seafood and increasing preference for convenient, ready-to-eat tuna products. Rising awareness of sustainable fishing practices and traceability is fueling demand for responsibly sourced tuna. Additionally, the expanding foodservice sector and innovations in canned and fresh tuna packaging contribute to market growth.

Europe Tuna Fish Market Insight

The Europe tuna fish market is projected to expand at a steady CAGR throughout the forecast period, supported by stringent food safety regulations and increasing consumer focus on sustainable seafood. Urbanization and rising disposable incomes are fostering higher consumption of tuna across retail and foodservice channels. Demand for certified sustainable tuna and premium ready-to-eat products is driving growth across residential and commercial segments, including restaurants and catering services.

U.K. Tuna Fish Market Insight

The U.K. tuna fish market is expected to grow notably during the forecast period, fueled by growing health consciousness and a rising preference for convenient, nutritious seafood options. Increasing concerns over ocean sustainability and ethical sourcing encourage consumers and businesses to opt for certified tuna products. The U.K.’s mature retail and e-commerce infrastructure further supports the accessibility and popularity of a wide variety of tuna products.

Germany Tuna Fish Market Insight

The Germany tuna fish market is anticipated to expand steadily, driven by rising consumer awareness of health and sustainability issues. Strong regulations on seafood traceability and environmental impact, coupled with increasing demand for organic and responsibly sourced tuna, are shaping market trends. Integration of tuna products in ready meals and convenience foods is growing, especially in urban areas with busy lifestyles.

Asia-Pacific Tuna Fish Market Insight

The Asia-Pacific tuna fish market is poised to grow at the fastest CAGR of 6.8% during the forecast period of 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, and a growing middle class in countries such as China, Japan, and India. Rising seafood consumption and government initiatives promoting sustainable fisheries and aquaculture are accelerating market growth. The region’s expanding food processing and export capabilities further enhance accessibility to tuna products.

Japan Tuna Fish Market Insight

The Japan tuna fish market is gaining momentum due to the country’s deep-rooted seafood culture, high demand for fresh and high-quality tuna, and increasing smart fisheries practices. The growing number of health-conscious consumers and integration of tuna into ready-to-eat and premium meal kits are fueling market expansion. Moreover, Japan’s aging population supports demand for convenient, easy-to-prepare seafood products in both residential and commercial sectors.

China Tuna Fish Market Insight

The China tuna fish market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by rapid urbanization, expanding middle class, and increasing adoption of seafood in daily diets. The country’s focus on sustainable aquaculture, growing retail penetration, and strong domestic production capacity are key factors driving market growth. The rise of e-commerce platforms and modern cold-chain logistics is making tuna products more accessible across urban and rural areas.

Tuna Fish Market Share

The Tuna Fish industry is primarily led by well-established companies, including:

- Thai Union Group PCL (Thailand)

- StarKist Co. (U.S.)

- Dongwon Industries Co., Ltd. (South Korea)

- FCF Fishery Co., Ltd. (Taiwan)

- American Tuna Inc. (U.S.)

- Bolton Group (Italy)

- Century Pacific Food, Inc. (Philippines)

- Grupo Calvo (Spain)

- Ishihara Sangyo Kaisha, Ltd. (Japan)

- Pataya Food Group (Thailand)

- Jealsa Rianxeira S.A. (Spain)

- C-Food International Co., Ltd. (Thailand)

- Wild Planet Foods, Inc. (U.S.)

- Pacific Tuna Corporation (Philippines)

- Nippon Suisan Kaisha, Ltd. (Japan)

- Alliance Select Foods International, Inc. (Philippines)

- Maruha Nichiro Corporation (Japan)

- Ocean Brands GP (Canada)

- Karats (Japan)

What are the Recent Developments in Tuna Fish Market?

- In April 2023, Thai Union Group, a global leader in seafood production, launched its “SeaChange® 2030” sustainability strategy, aiming to ensure 100% of its tuna is responsibly sourced and traceable. This initiative underscores Thai Union’s commitment to environmental stewardship and transparency in the Tuna Fish Market, leveraging advanced digital traceability tools and collaborations with NGOs to address overfishing and illegal fishing practices while strengthening its global leadership in sustainable tuna supply chains.

- In March 2023, Bumble Bee Foods announced a strategic partnership with blockchain platform SAP to enhance end-to-end traceability in its tuna supply chain. This initiative allows consumers to trace the journey of their tuna from ocean to table, reinforcing trust and transparency. By integrating blockchain technology, Bumble Bee is setting a new standard in sustainable seafood sourcing and aligning with increasing consumer demand for ethically and sustainably harvested products.

- In March 2023, the Indian Ministry of Fisheries launched a national initiative to boost tuna fish production and exports through modernized fishing practices and investment in cold chain infrastructure. This government-backed program supports the development of tuna processing hubs and sustainability certifications, contributing to India’s growing role in the global tuna supply chain and fostering economic development in coastal communities.

- In February 2023, the World Wildlife Fund (WWF) and several European retailers, including Tesco and Lidl, expanded their joint initiative to support tuna fisheries improvement projects (FIPs) in the Western and Central Pacific. This collaboration aims to enhance the sustainability of tuna stocks through better management, monitoring, and compliance, reflecting growing industry alignment with environmental conservation goals and responsible sourcing across the European tuna market.

- In January 2023, Bolton Food, the seafood division of Bolton Group, announced a partnership with the Marine Stewardship Council (MSC) to increase the volume of MSC-certified sustainable tuna across its product lines. This initiative demonstrates the company’s commitment to sustainable fishing practices and aligns with rising consumer expectations for eco-friendly and responsibly sourced seafood in global markets, particularly within Europe and Latin America.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Tuna Fish Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Tuna Fish Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Tuna Fish Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.