Global Ultrasound Devices Market

Market Size in USD Billion

CAGR :

%

USD

13.65 Billion

USD

22.76 Billion

2024

2032

USD

13.65 Billion

USD

22.76 Billion

2024

2032

| 2025 –2032 | |

| USD 13.65 Billion | |

| USD 22.76 Billion | |

|

|

|

|

Ultrasound Devices Market Size

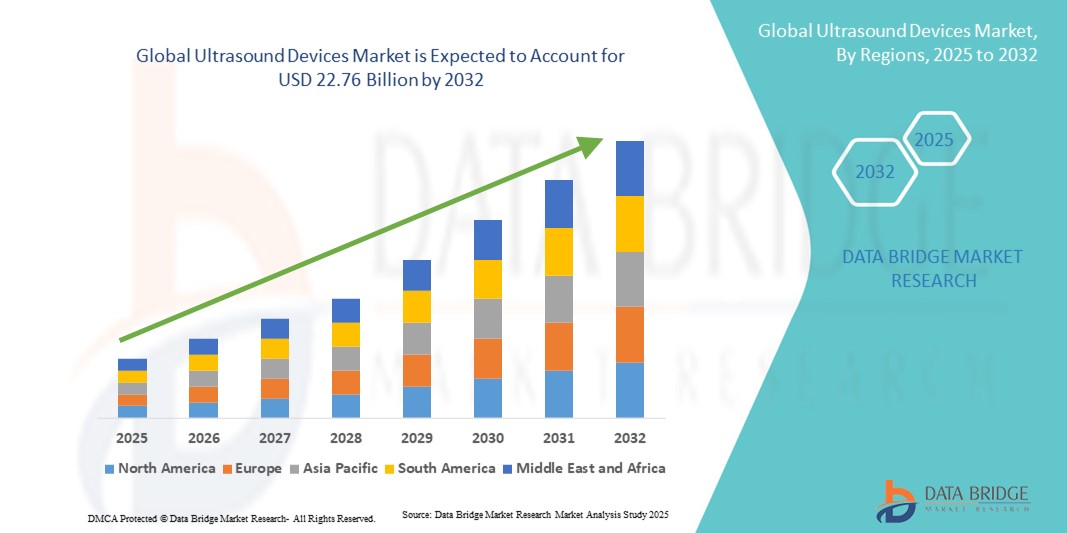

- The global ultrasound devices market size was valued at USD 13.65 billion in 2024 and is expected to reach USD 22.76 billion by 2032, at a CAGR of 6.60% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in medical imaging, leading to increased digitalization and precision diagnostics in both hospitals and clinics

- Furthermore, rising demand for non-invasive, accurate, and real-time diagnostic solutions is establishing ultrasound devices as a preferred choice across various medical specialties. These converging factors are accelerating the uptake of ultrasound devices, thereby significantly boosting the industry’s growth

Ultrasound Devices Market Analysis

- Ultrasound devices, offering non-invasive imaging and diagnostic capabilities, are increasingly vital components of modern healthcare systems in both hospitals and specialty clinics due to their enhanced accuracy, real-time imaging, and ease of integration with advanced medical technologies

- The escalating demand for ultrasound devices is primarily fueled by the growing prevalence of chronic diseases, rising awareness of early diagnostics, and an increasing preference for non-invasive and rapid imaging techniques among healthcare providers and patients

- North America dominated the ultrasound devices market with the largest revenue share of 45.5% in 2024, characterized by advanced healthcare infrastructure, high disposable incomes, and a strong presence of key industry players. The U.S. experienced substantial growth in ultrasound device installations, particularly in hospitals, diagnostic centers, and specialty clinics, driven by innovations from both established medical technology companies and startups focusing on AI-enabled imaging and portable ultrasound solutions

- Asia-Pacific is expected to be the fastest-growing region in the ultrasound devices market during the forecast period due to increasing urbanization, rising disposable incomes, expanding healthcare infrastructure, and growing adoption of modern diagnostic technologies across emerging economies

- The diagnostic ultrasound devices segment dominated the ultrasound devices market with the largest revenue share of 62% in 2024. This is primarily due to its broad clinical applications across radiology, cardiology, obstetrics, and general imaging, which require accurate, real-time visualization

Report Scope and Ultrasound Devices Market Segmentation

|

Attributes |

Ultrasound Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ultrasound Devices Market Trends

Rising Adoption Driven by Technological Advancements and Clinical Utility

- A significant and accelerating trend in the global ultrasound devices market is the increasing adoption of advanced imaging technologies that improve diagnostic accuracy and patient outcomes. Innovations in high-resolution imaging, portable systems, and 3D/4D ultrasound solutions are enhancing the versatility and clinical applicability of these devices across multiple medical specialties

- For instance, portable ultrasound devices are increasingly used in emergency medicine and point-of-care settings, enabling rapid diagnosis and immediate clinical decision-making. Similarly, 3D/4D systems provide detailed anatomical visualization, particularly useful in obstetrics, cardiology, and musculoskeletal imaging

- Modern ultrasound devices now offer improved image clarity, faster processing times, and enhanced user interfaces, making them more efficient for healthcare providers. These features allow clinicians to detect abnormalities earlier and with greater confidence, ultimately improving patient care

- The integration of Doppler imaging, elastography, and contrast-enhanced ultrasound in current systems has expanded the range of clinical applications, including vascular assessment, tumor characterization, and liver fibrosis evaluation. This is driving demand in both hospital and outpatient settings

- The growing preference for non-invasive diagnostic tools is further fueling ultrasound adoption, as it provides real-time imaging without exposure to ionizing radiation, making it safer for patients of all age groups

- The demand for portable, high-resolution, and multi-functional ultrasound systems is rising rapidly across both developed and emerging markets, supported by increasing healthcare infrastructure investments and the rising prevalence of chronic and acute medical conditions

Ultrasound Devices Market Dynamics

Driver

Growing Need Due to Rising Healthcare Demand and Advanced Diagnostics

- The increasing prevalence of chronic diseases, rising patient awareness, and the growing demand for accurate, real-time diagnostic solutions are significant drivers for the heightened demand for ultrasound devices

- For instance, in April 2024, GE Healthcare announced the launch of a next-generation portable ultrasound system with AI-assisted imaging, designed to enhance diagnostic accuracy and workflow efficiency. Such strategies by key companies are expected to drive the ultrasound devices industry growth in the forecast period

- As healthcare providers and patients become more aware of the benefits of non-invasive diagnostic imaging, ultrasound devices offer advanced features such as high-resolution imaging, portability, and real-time monitoring, providing a compelling alternative to traditional imaging modalities

- Furthermore, the growing adoption of point-of-care diagnostics and the integration of ultrasound systems with hospital IT infrastructure are making these devices an essential component of modern healthcare facilities, offering seamless integration with electronic medical records and telemedicine platforms

- The convenience of rapid diagnostics, ease of use, and the ability to perform bedside imaging are key factors propelling the adoption of ultrasound devices in hospitals, specialty clinics, and homecare settings. The trend toward portable and handheld systems, coupled with increasing availability of user-friendly options, further contributes to market growth

Restraint/Challenge

Concerns Regarding High Costs and Limited Skilled Workforce

- The relatively high cost of advanced ultrasound systems can pose a challenge to broader market penetration, particularly in developing regions or smaller healthcare facilities with budget constraints. High-end devices with AI-assisted features, 3D/4D imaging, or portable capabilities often come with premium pricing, which can limit adoption among price-sensitive users

- For instance, some mid-tier hospitals may delay purchases or prefer older-generation systems due to the initial investment required for modern ultrasound equipment

- Addressing these challenges through the development of more affordable, mid-range solutions and offering financing or leasing options is crucial for increasing accessibility. Companies such as Philips and Siemens focus on modular systems and training programs to help healthcare professionals maximize utilization and build trust

- In addition, the limited availability of skilled sonographers and training requirements can restrict effective deployment of ultrasound devices. Continuous education, certification programs, and intuitive AI-powered imaging tools are being emphasized to overcome workforce-related barriers

- While prices are gradually becoming more competitive and technology is becoming more user-friendly, the perceived complexity and cost of advanced ultrasound devices can still hinder widespread adoption, especially in smaller clinics or regions with limited healthcare infrastructure

- Overcoming these challenges through cost-effective solutions, workforce training, and enhanced education on diagnostic best practices will be vital for sustained growth of the ultrasound devices market

Ultrasound Devices Market Scope

The market is segmented on the basis of type, scan type, imaging modes, screen types, connectivity, functionality, probe frequency, device portability, application, end user, and distribution channel.

- By Type

On the basis of type, the ultrasound devices market is segmented into diagnostic ultrasound devices and therapeutic ultrasound devices. The diagnostic ultrasound devices segment dominated the market with the largest revenue share of 62% in 2024. This is primarily due to its broad clinical applications across radiology, cardiology, obstetrics, and general imaging, which require accurate, real-time visualization. Hospitals and diagnostic centers rely heavily on these devices for routine screening, chronic disease monitoring, and specialized procedures. Integration of advanced imaging technologies, including high-resolution B-mode and Doppler imaging, enhances clinical precision. Technological innovations, such as portable diagnostic systems, provide flexibility in clinical workflows. Rising awareness of early detection and increasing healthcare expenditure in developed regions further boost adoption. Its versatility across multiple imaging modes and clinical applications makes it the preferred choice for healthcare professionals.

The Therapeutic Ultrasound Devices segment is expected to witness the fastest CAGR of 11.5% from 2025 to 2032. Growth is driven by rising demand for non-invasive therapies in physiotherapy, musculoskeletal treatment, and targeted drug delivery. Its ability to provide localized treatment without surgery or medication makes it highly attractive for rehabilitation centers and outpatient clinics. Technological improvements such as focused ultrasound and portable devices further enhance adoption. Rising patient awareness of minimally invasive therapies and increasing investment in physiotherapy and sports medicine facilities support growth. The segment’s utility in chronic pain management and tissue healing boosts its market potential, creating a strong outlook for the coming years.

- By Scan Type

On the basis of scan type, the ultrasound devices market is segmented into A-scan, B-scan, Combined Scan, Pachymeter, Ultrasound Bio-Microscopy (UBM), and Others. The B-scan segment dominated with a 48% share in 2024, favored for producing clear two-dimensional cross-sectional images of tissues and organs. It is widely used across ophthalmology, obstetrics, and general imaging, ensuring high demand in hospitals and specialized clinics. The B-scan’s accuracy, ease of interpretation, and ability to integrate with other imaging modalities such as Doppler enhance diagnostic capability. Healthcare providers rely on it for prenatal monitoring, ophthalmic imaging, and abdominal studies. Technological advancements have improved image clarity and reduced scanning time. Its strong presence in both developed and emerging regions reflects its versatility and clinical value.

The Combined Scan segment is expected to witness the fastest CAGR of 12.8% from 2025 to 2032, driven by rising demand for multi-dimensional imaging solutions. These systems allow simultaneous measurement of multiple parameters, reducing examination time and improving workflow efficiency. Combined scans are increasingly preferred in complex diagnostic procedures where multiple scan types are required in one session. Integration with real-time analysis software enhances clinical value. The segment’s adoption is further boosted by patient comfort, operational efficiency, and growing use in advanced clinics and research institutions.

- By Imaging Modes

On the basis of imaging modes, the ultrasound devices market is segmented into Black and White (B/W) and Color Doppler. The Color Doppler segment dominated with a 53% share in 2024, due to its ability to visualize blood flow, detect vascular abnormalities, and assess cardiac function in real-time. Hospitals and specialty clinics prefer Color Doppler systems as they provide both anatomical and functional information in a single scan, improving diagnostic accuracy. Its non-invasive nature and applicability across cardiology, obstetrics, and vascular studies make it indispensable. Technological upgrades, including enhanced color sensitivity and improved frame rates, further strengthen its market position. Clinicians rely on it for detailed evaluation of circulatory disorders, fetal health, and surgical planning. Its precision in monitoring treatment progress ensures continued preference in modern imaging.

The B/W segment is expected to witness the fastest CAGR of 10% from 2025 to 2032. Growth is driven by affordability, simplicity, and reliable performance for basic diagnostic imaging. B/W systems are popular in outpatient clinics, rural hospitals, and smaller healthcare facilities where cost-effective imaging is needed. They provide adequate visualization for general scans and routine check-ups. Lower complexity, minimal maintenance, and suitability for emerging markets enhance adoption. Growing preventive healthcare awareness and increasing diagnostic center footfall also contribute to segment growth.

- By Screen Types

On the basis of screen types, the ultrasound devices market is segmented into Full HD, LCD, and Others. The Full HD segment dominated with a 57% share in 2024, driven by its superior image clarity and ability to provide detailed visualization for accurate diagnosis. Hospitals, advanced imaging centers, and specialized clinics prefer Full HD systems for critical applications such as cardiology, obstetrics, and radiology. The enhanced resolution supports better clinical decision-making, reduces diagnostic errors, and enables early detection of small anatomical structures. Compatibility with advanced imaging modes, multi-probe configurations, and sophisticated software tools further increases adoption. Continuous technological innovations and improved user experience reinforce its preference in high-volume healthcare facilities.

The LCD segment is expected to witness the fastest CAGR of 9.5% from 2025 to 2032. Growth in this segment is driven by its affordability, lightweight design, and suitability for portable or handheld devices. LCD screens are increasingly adopted in smaller clinics, mobile healthcare units, and remote or emerging regions where cost-effectiveness is critical. Their energy-efficient and user-friendly design makes them ideal for telemedicine applications and point-of-care diagnostics. Rising demand for portable diagnostic solutions in outpatient, emergency, and home healthcare settings is a major factor. Moreover, LCD systems support integration with compact multi-probe configurations and mobile applications, enhancing workflow efficiency. The combination of affordability, portability, and technological compatibility is expected to sustain high growth for this segment globally.

- By Connectivity

On the basis of connectivity, the ultrasound devices market is segmented into USB, Bluetooth, Ethernet, Dual-Band WiFi, and Others. The Ethernet segment dominated with a 45% revenue share in 2024, attributed to its reliable, high-speed data transfer and seamless integration with hospital information systems. Ethernet-enabled devices are preferred in hospitals and diagnostic centers for secure storage, rapid access to large imaging files, and stable transmission in busy clinical environments. This connectivity supports PACS integration, enhancing workflow efficiency. The growing demand for standardized and robust connectivity across large healthcare networks further strengthens the segment’s position.

The Bluetooth segment is expected to witness the fastest CAGR of 13% from 2025 to 2032. The growth of Bluetooth connectivity is driven by the rising adoption of wireless probe systems, which provide enhanced portability and enable point-of-care and bedside diagnostics. These systems reduce cable clutter, allow easy movement between examination rooms, and are increasingly used in outpatient and home healthcare settings. Integration with mobile devices and real-time monitoring software adds clinical value and improves patient workflow. The segment benefits from rising demand for compact, versatile, and user-friendly diagnostic devices. Increasing telemedicine adoption, technological advancements, and the need for seamless wireless communication in smaller clinics further fuel its rapid growth. Bluetooth-enabled ultrasound devices offer flexibility, cost-efficiency, and enhanced usability, positioning this segment as a key driver of market expansion globally.

- By Functionality

On the basis of functionality, the ultrasound devices market is segmented into touchscreen and analogue. The Touchscreen segment dominated the Ultrasound Devices market with a 62% share in 2024, owing to its intuitive user interface, faster operation, and seamless integration into hospital workflows. Hospitals and diagnostic centers prefer touchscreen systems due to their precise annotation capabilities, quick menu navigation, and efficient image adjustment features, which improve patient throughput and reduce operational errors. Touchscreen devices support multi-specialty applications and advanced software enhancements, making them highly versatile for general imaging, radiology, cardiology, and obstetrics. High-volume hospitals particularly benefit from comprehensive functionality, allowing efficient multi-department use. Clinicians also value the enhanced control over image acquisition, reporting tools, and compatibility with modern hospital systems. The segment’s dominance is reinforced by continued R&D improvements in gesture controls and user-friendly software interfaces, further boosting adoption.

The Analogue segment is expected to witness the fastest CAGR of 10.5% from 2025 to 2032, primarily in cost-sensitive regions and smaller clinics. Analogue systems are simple, reliable, and affordable, making them suitable for basic diagnostic imaging in rural hospitals and emerging markets. They require minimal technical support and maintenance, which increases accessibility. Clinics with limited budgets prefer analogue systems for routine screenings and preventive healthcare procedures. Growing awareness of non-invasive diagnostic methods and rising patient footfall in outpatient centers contribute to segment growth. The segment also benefits from technological improvements in image quality and portability, making analogue devices increasingly competitive.

- By Probe Frequency

On the basis of probe frequency, the ultrasound devices market is segmented into 8 MHz, 10 MHz, 12 MHz, 15 MHz, 20 MHz, 50 MHz, and Others. The 12 MHz segment dominated the market with a 41% revenue share in 2024, balancing penetration depth and image resolution for general imaging, musculoskeletal, and vascular applications. Hospitals and diagnostic centers prefer 12 MHz probes due to their versatility, compatibility with both trolley-based and portable systems, and ability to support multiple imaging types. These probes offer clear visualization of soft tissues and organs, improving diagnostic precision. Technological advancements in probe design enhance image clarity, patient comfort, and workflow efficiency. The segment’s widespread adoption is supported by strong presence in both developed and emerging markets. Clinicians value these probes for routine scans and specialized procedures due to their reliability and adaptability.

The 15 MHz segment is expected to witness the fastest CAGR of 11% from 2025 to 2032, driven by rising demand for high-resolution imaging in musculoskeletal, dermatological, and vascular applications. Specialty clinics, research institutions, and hospitals increasingly adopt 15 MHz probes for precise visualization of superficial structures. Higher-frequency probes enable early detection of abnormalities and improve diagnostic accuracy for delicate tissues. Technological innovations and growing awareness among healthcare professionals about advanced imaging benefits further boost growth. Adoption is also supported by improvements in portability and integration with software for real-time analysis, enhancing clinical value.

- By Device Portability

On the basis of device portability, the ultrasound devices market is segmented into trolley/cart-based and compact/handheld. The Trolley/Cart-Based segment dominated with a 55% share in 2024, preferred for high-performance imaging and multi-probe compatibility in hospitals and diagnostic centers. Cart-based systems support multiple imaging modalities, handle large patient volumes, and integrate seamlessly with advanced hospital IT systems. They provide stability, larger displays, and additional storage for clinical accessories. Adoption is driven by large hospitals requiring multi-department use, emergency care, and chronic disease monitoring. These systems offer robust performance, reliability, and multi-specialty application support. Technological upgrades continue to enhance operational efficiency, workflow management, and image quality, reinforcing their dominance.

The Compact/Handheld segment is expected to witness the fastest CAGR of 14% from 2025 to 2032, fueled by the rising need for point-of-care diagnostics, emergency medicine, and home healthcare. Handheld devices are lightweight, portable, and increasingly integrated with cloud storage. Their convenience, rapid deployment, and bedside scanning capability make them attractive for outpatient, remote, and emergency care. Technological improvements in battery life, connectivity, and image quality further enhance adoption. The segment’s flexibility and ease of operation make it ideal for mobile clinics and telemedicine applications.

- By Application

On the basis of application, the market is segmented into radiology/general imaging, women’s health, gastrointestinal (GI), cardiovascular, urology, orthopaedic and musculoskeletal, pain management, and others. The Radiology/General Imaging segment dominated the market with a 46% share in 2024, driven by its extensive utilization in routine diagnostics, early disease detection, and multi-specialty clinical applications. Hospitals and diagnostic centers rely on general imaging systems for versatility, reliability, and high patient volume management. These systems are critical for emergency care, outpatient screenings, and chronic disease monitoring. Advanced imaging software integration enhances diagnostic accuracy, streamlines workflow, and enables timely clinical decisions. Hospitals prefer these systems due to compatibility with multiple probes and imaging modes. The segment benefits from technological advancements in resolution, image processing, and operational efficiency, reinforcing its dominance.

The Women’s Health segment is expected to witness the fastest CAGR of 12.5% from 2025 to 2032, driven by rising demand for obstetric and gynecological imaging. Hospitals, maternity centers, and women’s health clinics increasingly adopt high-resolution ultrasound technologies for fetal and reproductive health assessment. Specialized clinical protocols and improved imaging accuracy contribute to growth. Initiatives promoting prenatal care, along with investments in women’s health infrastructure, support adoption. Rising awareness of maternal and reproductive health, combined with technological advancements in portable devices, further fuels market growth.

- By End User

On the basis of end user, the ultrasound devices market is segmented into hospitals, ambulatory surgical centers, diagnostic centers, surgical centers, maternity centers, research and academic institutions, and others. The Hospitals segment dominated the market with a 60% revenue share in 2024, attributed to advanced infrastructure, large patient volumes, and ability to deploy sophisticated ultrasound systems across multiple departments. Hospitals benefit from comprehensive imaging capabilities, enabling multi-specialty diagnostic and therapeutic services. High budgets allow investments in cutting-edge devices, advanced software, and staff training. Hospitals leverage ultrasound systems for emergency diagnostics, chronic disease monitoring, and high-throughput workflows. Their demand is further reinforced by adoption of multi-probe and multi-modality systems. Technological integration and workflow optimization strengthen the dominance of hospitals as the primary end user.

The Diagnostic Centers segment is expected to witness the fastest CAGR of 13% from 2025 to 2032, driven by growing outpatient diagnostic demand and proliferation of standalone imaging centers. Portable and compact ultrasound systems enable these centers to deliver hospital-grade imaging efficiently. Flexible service offerings and cost-effectiveness attract patients seeking convenient, rapid diagnostics. Expansion of healthcare access in urban and semi-urban areas supports growth. Technological advancements in connectivity, portability, and imaging accuracy enhance the segment’s appeal. Rising awareness of preventive healthcare and early detection further boost adoption.

- By Distribution Channel

On the basis of distribution channel, the ultrasound devices market is segmented into direct tenders, retail tender, and third-party distribution. The Direct Tenders segment dominated the market with a 48% share in 2024, fueled by bulk procurement by hospitals and large healthcare networks. Direct purchase agreements ensure long-term supply reliability, consistent after-sales service, and close manufacturer support. Large hospital chains and government institutions favor this model for transparency, quality assurance, and efficient deployment. Strategic partnerships between manufacturers and healthcare providers strengthen dominance. The segment benefits from predictable demand, contract stability, and alignment with hospital procurement policies.

The Third-Party Distribution segment is expected to witness the fastest CAGR of 11.5% from 2025 to 2032, driven by collaboration with local distributors and improved reach in tier-2 and tier-3 cities across emerging markets. Third-party channels facilitate penetration into areas with limited direct sales presence, providing cost-effective solutions, timely support, and flexible financing. Rising demand for ultrasound systems in smaller clinics and outpatient centers further fuels growth. Technological adoption, brand recognition, and regional distribution networks enhance market potential.

Ultrasound Devices Market Regional Analysis

- North America dominated the ultrasound devices market with the largest revenue share of 45.5% in 2024, characterized by advanced healthcare infrastructure, high disposable incomes, and a strong presence of key industry players

- The region experienced substantial growth in ultrasound device installations, particularly in hospitals, diagnostic centers, and specialty clinics, driven by innovations from both established medical technology companies and startups focusing on AI-enabled imaging, portable systems, and point-of-care devices

- The widespread adoption of advanced diagnostic technologies and strong investment in healthcare digitization further supports market growth in the region

U.S. Ultrasound Devices Market Insight

The U.S. ultrasound devices market captured the largest revenue share within North America in 2024, fueled by the rapid adoption of AI-enabled imaging systems, portable devices, and point-of-care diagnostics. Hospitals, diagnostic centers, and specialty clinics are increasingly integrating advanced ultrasound solutions to improve workflow, enhance diagnostic accuracy, and support telemedicine initiatives. The growing demand for non-invasive, real-time imaging and continuous advancements in imaging software and hardware are significantly contributing to market expansion.

Europe Ultrasound Devices Market Insight

The Europe ultrasound devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by advanced healthcare infrastructure, increasing investments in medical technology, and growing awareness of non-invasive diagnostic solutions. Adoption is further supported by government initiatives promoting early diagnostics and preventive healthcare. Countries across Western Europe are witnessing robust growth in hospitals, specialty clinics, and outpatient centers, with modern ultrasound devices being incorporated into both new installations and upgrades of existing systems.

U.K. Ultrasound Devices Market Insight

The U.K. ultrasound devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising demand for non-invasive diagnostics, advanced imaging technologies, and enhanced workflow efficiency in hospitals and clinics. Increasing investments in healthcare infrastructure, coupled with strong digital health adoption and telemedicine integration, are further supporting market expansion. The growing prevalence of chronic diseases and emphasis on preventive healthcare also contribute to adoption.

Germany Ultrasound Devices Market Insight

The Germany ultrasound devices market is expected to expand at a considerable CAGR during the forecast period, fueled by strong healthcare infrastructure, high adoption of advanced diagnostic technologies, and emphasis on precision medicine. Hospitals and diagnostic centers are increasingly integrating portable and AI-enabled ultrasound systems to improve patient care and workflow efficiency. Government support for healthcare modernization and investments in training programs for sonographers further promote market growth.

Asia-Pacific Ultrasound Devices Market Insight

The Asia-Pacific ultrasound devices market is expected to be the fastest-growing region during the forecast period, with a projected CAGR from 2025 to 2032, driven by increasing urbanization, rising disposable incomes, expanding healthcare infrastructure, and growing adoption of modern diagnostic technologies in emerging economies such as China, India, and Japan. Rising awareness of early disease detection, increasing hospital installations, and government initiatives promoting healthcare modernization are key growth factors.

Japan Ultrasound Devices Market Insight

The Japan ultrasound devices market is gaining momentum due to the country’s high-tech healthcare ecosystem, increasing adoption of portable and AI-assisted imaging systems, and growing demand for non-invasive diagnostics. Hospitals, specialty clinics, and outpatient centers are increasingly implementing advanced ultrasound devices to improve diagnostic efficiency and support telehealth services. The aging population further drives demand for user-friendly and accessible imaging solutions across both residential and clinical settings.

China Ultrasound Devices Market Insight

The China ultrasound devices market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, expanding healthcare infrastructure, rising disposable incomes, and high technological adoption. Hospitals, diagnostic centers, and specialty clinics are adopting AI-enabled and portable ultrasound devices to improve patient care, workflow efficiency, and telemedicine capabilities. Government initiatives supporting smart healthcare infrastructure and domestic manufacturing of advanced ultrasound systems further drive market growth.

Ultrasound Devices Market Share

The ultrasound devices industry is primarily led by well-established companies, including:

- Medgyn Products, Inc. (U.S.)

- SonoScape Medical Corp. (China)

- Trivitron Healthcare (India)

- Narang Medical Limited (India)

- Telemed Ultrasound (Lithuania)

- Clarius (Canada)

- Canon Medical Systems Corporation (Japan)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Koninklijke Philips N.V. (Netherlands)

- ESAOTE SPA (Italy)

- CHISON Medical Technologies Co., Ltd. (China)

- EDAN Instruments, Inc. (China)

- Konica Minolta, Inc. (Japan)

- Lumibird Medical (France)

- BenQ Medical Technology (Taiwan)

- Lanmage (China)

- Shenzhen Ricso Technology Co., Ltd. (China)

- Promed Technology Co. (China)

- ALPINION MEDICAL SYSTEMS Co., Ltd. (South Korea)

- GE HealthCare (U.S.)

- Hologic Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- FUJIFILM Holdings Corporation (Japan)

Latest Developments in Global Ultrasound Devices Market

- In March 2025, GE HealthCare announced the launch of the Vivid Pioneer, its most advanced AI-powered cardiovascular ultrasound system. Designed to enhance speed and image quality, the system aims to improve diagnostic confidence and workflow efficiency. The Vivid Pioneer received both CE Mark and U.S. FDA 510(k) clearance, underscoring its compliance with international medical device standards

- In June 2025, Philips introduced the Flash 5100 Point-of-Care (POC) Ultrasound System. This system features future-ready software and cross-platform transducer compatibility, including the award-winning mL26-8 transducer, ideal for musculoskeletal specialties. The Flash 5100 POC system is designed to meet the growing demand for fast, agile, high-performance POC ultrasound imaging in various clinical settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.