Global Utility Tractors Market

Market Size in USD Billion

CAGR :

%

USD

77.39 Billion

USD

120.59 Billion

2025

2033

USD

77.39 Billion

USD

120.59 Billion

2025

2033

| 2026 –2033 | |

| USD 77.39 Billion | |

| USD 120.59 Billion | |

|

|

|

|

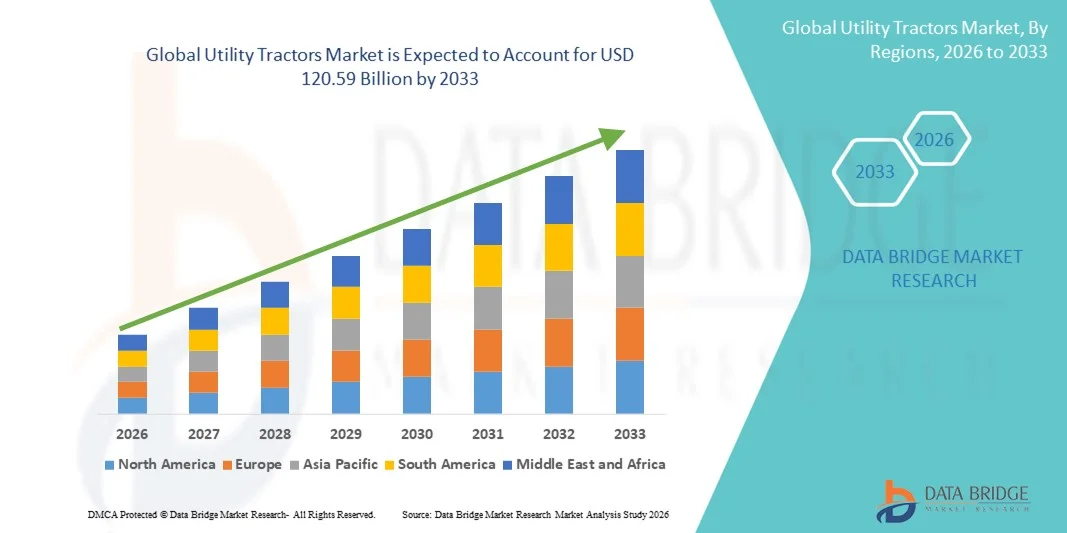

What is the Global Utility Tractors Market Size and Growth Rate?

- The global utility tractors market size was valued at USD 77.39 billion in 2025 and is expected to reach USD 120.59 billion by 2033, at a CAGR of5.70% during the forecast period

- Growing awareness about the benefits of compact utility tractors will emerge as the major factor fostering the growth of the utility tractors market

- Also, growing demand for effective and efficient irrigation and crop protection tools and techniques especially in the developing economies is another important factor fostering the growth of the utility tractors market

What are the Major Takeaways of Utility Tractors Market?

- Growth in the expenditure for research and development proficiencies and increasing personal disposable income will further create lucrative and remunerative growth opportunities for the utility tractors market

- Growth and expansion of agricultural industry especially in the developing economies, growing mechanization of agricultural sector and surging globalization will also carve the way for the growth of the utility tractors market

- Asia-Pacific dominated the utility tractors market with an estimated 46.3% revenue share in 2025, driven by large agricultural economies, rising farm mechanization, expanding rural infrastructure, and strong demand for compact and mid-sized tractors across China, India, Japan, South Korea, and Southeast Asia

- North America is expected to register the fastest CAGR of 10.02% from 2026 to 2033, driven by increasing adoption of advanced farming equipment, rising demand for compact tractors, and growing use of utility tractors in landscaping, construction, and municipal services

- The Manual Transmission segment dominated the market with an estimated 61.7% share in 2025, driven by its lower cost, mechanical simplicity, ease of maintenance, and widespread acceptance among small and mid-scale farmers

Report Scope and Utility Tractors Market Segmentation

|

Attributes |

Utility Tractors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Utility Tractors Market?

Increasing Shift Toward Compact, Multi-Purpose, and Technology-Enabled Utility Tractors

- The utility tractors market is witnessing strong adoption of compact and mid-horsepower tractors designed for versatile applications such as farming, landscaping, material handling, and municipal operations

- Manufacturers are introducing technology-enabled utility tractors equipped with advanced hydraulics, precision steering, telematics, and improved fuel efficiency to enhance productivity and ease of operation

- Growing demand for cost-efficient, fuel-efficient, and easy-to-maintain tractors is driving adoption among small and mid-sized farms, contractors, and rural infrastructure operators

- For instance, companies such as John Deere, CNH Industrial, AGCO, Kubota, and Mahindra have launched upgraded utility tractor models with improved transmissions, operator comfort, and smart monitoring systems

- Increasing need for multi-tasking equipment capable of handling plowing, hauling, mowing, and loader work is accelerating the shift toward versatile utility tractors

- As agriculture and rural operations become more mechanized and efficiency-focused, Utility Tractors will remain essential for productivity enhancement across diverse end-use applications

What are the Key Drivers of Utility Tractors Market?

- Rising demand for mechanization in agriculture, particularly among small and medium-scale farmers, is a primary growth driver

- For instance, in 2024–2025, leading manufacturers such as Mahindra, Kubota, CLAAS, and AGCO expanded their utility tractor portfolios with fuel-efficient and application-specific models

- Growing adoption of utility tractors in construction, landscaping, warehousing, and municipal services is expanding the market beyond traditional farming use

- Advancements in engine technology, emissions compliance, transmission systems, and hydraulic performance have improved reliability, durability, and operational efficiency

- Increasing use of precision farming tools, GPS guidance, and smart attachments is boosting demand for technologically advanced utility tractors

- Supported by government subsidies, rural infrastructure development, and rising farm incomes, the utility tractors market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Utility Tractors Market?

- High upfront costs of advanced utility tractors can restrict adoption among small farmers and cost-sensitive buyers

- For instance, during 2024–2025, rising steel prices, supply chain disruptions, and emission compliance costs increased manufacturing expenses for global tractor OEMs

- Limited availability of skilled operators and maintenance expertise in rural regions affects optimal equipment utilization

- Dependence on seasonal agricultural income creates demand volatility, particularly in emerging economies

- Competition from used tractors, rental equipment, and alternative mechanization solutions puts pressure on new tractor sales

- To address these challenges, manufacturers are focusing on affordable models, flexible financing, localization of production, and aftersales support to expand global adoption of Utility Tractors

How is the Utility Tractors Market Segmented?

The market is segmented on the basis of product, end use, type, and application.

- By Product

On the basis of product, the utility tractors market is segmented into Manual Transmission and Continuously Variable Transmissions (CVT). The Manual Transmission segment dominated the market with an estimated 61.7% share in 2025, driven by its lower cost, mechanical simplicity, ease of maintenance, and widespread acceptance among small and mid-scale farmers. Manual transmission utility tractors are preferred in emerging economies due to their durability, fuel efficiency, and suitability for varied agricultural tasks.

The Continuously Variable Transmission (CVT) segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for smoother operation, better fuel optimization, and reduced operator fatigue. Increasing adoption of precision farming, smart attachments, and premium utility tractors in developed markets is accelerating CVT penetration, particularly in North America and Europe.

- By End Use

On the basis of end use, the utility tractors market is segmented into Commercial, Domestic, and industrial applications. The Commercial segment dominated the market with a 45.3% share in 2025, supported by extensive use of utility tractors in farming services, landscaping contracts, infrastructure maintenance, and rental operations. High equipment utilization rates, multi-purpose functionality, and growing outsourcing of agricultural and municipal tasks drive strong commercial demand.

The Industrial segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing use of utility tractors in warehouses, logistics yards, construction support, and material handling operations. Expansion of industrial infrastructure, smart cities, and organized landscaping services is further boosting demand for industrial-grade utility tractors.

- By Type

On the basis of type, the utility tractors market is segmented into Compact Utility Tractors and Mid-Sized Utility Tractors. The Compact Utility Tractors segment dominated the market with a 52.6% share in 2025, owing to their versatility, lower price point, ease of operation, and suitability for small farms, landscaping, and municipal tasks. Compact tractors are widely adopted due to compatibility with multiple attachments and lower operating costs.

The Mid-Sized Utility Tractors segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for higher horsepower, greater lifting capacity, and improved performance in commercial farming and infrastructure applications. Growth in mechanized agriculture and larger farm operations is driving this trend.

- By Application

On the basis of application, the utility tractors market is segmented into Landscaping, Farming, Municipal, Mowing, Snow Clearing, and Others. The Farming segment dominated the market with a 41.9% share in 2025, driven by widespread use of utility tractors for plowing, tilling, hauling, and general farm operations. Rising mechanization in agriculture and government support programs continue to strengthen this segment.

The Municipal segment is expected to register the fastest CAGR from 2026 to 2033, propelled by increasing investments in urban infrastructure, road maintenance, parks management, and snow removal services. Growing adoption of compact and mid-sized utility tractors by local authorities and service providers is accelerating market growth.

Which Region Holds the Largest Share of the Utility Tractors Market?

- Asia-Pacific dominated the utility tractors market with an estimated 46.3% revenue share in 2025, driven by large agricultural economies, rising farm mechanization, expanding rural infrastructure, and strong demand for compact and mid-sized tractors across China, India, Japan, South Korea, and Southeast Asia. High reliance on agriculture, increasing labor shortages, and government-backed mechanization programs continue to fuel demand for utility tractors across farming, landscaping, and municipal applications

- The region benefits from cost-effective manufacturing, strong domestic OEM presence, and rising exports, supporting widespread adoption across both developing and developed economies

- Increasing focus on food security, productivity improvement, and sustainable farming practices further reinforces Asia-Pacific’s leadership in the global Utility Tractors market

U.S. Utility Tractors Market Insight

The U.S. leads the North American market due to high mechanization levels, strong presence of global tractor OEMs, and widespread use of utility tractors across agriculture, landscaping, construction, and snow clearing applications. Growing adoption of compact utility tractors by small farms, contractors, and municipalities, along with rising demand for technologically advanced and attachment-compatible models, is driving rapid market expansion.

Canada Utility Tractors Market Insight

Canada’s utility tractor market is supported by large farm sizes, high demand for durable equipment, and extensive use in snow management, municipal services, and commercial farming. Preference for high-power, all-weather-capable utility tractors drives adoption across rural and urban applications. Increasing investment in agricultural productivity, infrastructure maintenance, and landscaping services continues to support steady market growth.

Asia-Pacific Utility Tractors Market

North America is expected to register the fastest CAGR of 10.02% from 2026 to 2033, driven by increasing adoption of advanced farming equipment, rising demand for compact tractors, and growing use of utility tractors in landscaping, construction, and municipal services. Strong replacement demand, high preference for technologically advanced tractors, and increasing adoption of precision agriculture tools support rapid market expansion. Rising investments in smart farming, labor efficiency, and rural infrastructure further accelerate growth across the region.

China Utility Tractors Market Insight

China represents the largest market in Asia-Pacific, driven by large-scale agricultural operations, government subsidies for farm mechanization, and rising demand for utility tractors in farming, municipal maintenance, and rural infrastructure projects. Increasing labor shortages in agriculture and growing adoption of compact and mid-sized tractors for multi-purpose use are strengthening demand. Strong domestic manufacturing capabilities and competitive pricing further support widespread adoption across both domestic and export markets.

India Utility Tractors Market Insight

India is a major growth contributor, supported by a large agricultural workforce, small and medium landholdings, and strong government initiatives promoting farm mechanization. Utility tractors are widely used for plowing, hauling, irrigation, and rural construction activities. Rising rural incomes, increasing custom hiring services, and expanding use in non-agricultural applications such as landscaping and infrastructure maintenance are accelerating market growth across the country.

Japan Utility Tractors Market Insight

Japan shows steady demand for utility tractors due to aging farm labor, high mechanization levels, and preference for compact and efficient equipment. Utility tractors are widely adopted for precision farming, landscaping, horticulture, and municipal applications. Strong emphasis on reliability, advanced technology, and fuel efficiency drives demand for premium models. Continuous modernization of agricultural practices supports stable long-term growth in the Japanese market.

South Korea Utility Tractors Market Insight

South Korea contributes steadily to the market, driven by advanced farming practices, increasing use of mechanized equipment, and growing demand for utility tractors in landscaping and urban maintenance. Adoption is supported by government programs promoting smart agriculture and productivity improvement. Rising use of compact and mid-sized tractors for multi-purpose operations and infrastructure maintenance continues to strengthen market demand.

Which are the Top Companies in Utility Tractors Market?

The utility tractors industry is primarily led by well-established companies, including:

- Deere & Company (U.S.)

- CNH Industrial N.V. (U.K.)

- AGCO Corporation (U.S.)

- CLAAS KGaA mbH (Germany)

- Mahindra Tractors (India)

- TYM Corporation (South Korea)

- YANMAR HOLDINGS Co., Ltd. (Japan)

- KUBOTA Corporation (Japan)

- New Holland Agriculture (U.S.)

- JCB India Limited (India)

- Escorts Limited (India)

- Tractors and Farm Equipment Limited (India)

- SDF S.p.A. (Italy)

- Bucher Industries AG (Switzerland)

- Alamo Group Inc (U.S.)

What are the Recent Developments in Global Utility Tractors Market?

- In August 2023, New Holland Agriculture launched the T4 Electric Power, the first utility tractor to integrate electric propulsion with autonomous functionality, creating a new Utility Electric segment aimed at enhancing field operation efficiency and sustainability, highlighting the industry’s shift toward electrification and smart farming solutions

- In April 2022, Kubota expanded its R&D operations by developing a 280-acre facility in Georgia, investing over USD 85 million to better serve North American tractor demand through advanced research and digital platforms, strengthening the company’s regional innovation capabilities and long-term market presence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.