Global Vehicle Armor Market

Market Size in USD Billion

CAGR :

%

USD

23.73 Billion

USD

37.85 Billion

2024

2032

USD

23.73 Billion

USD

37.85 Billion

2024

2032

| 2025 –2032 | |

| USD 23.73 Billion | |

| USD 37.85 Billion | |

|

|

|

|

Armored Vehicle Market Size

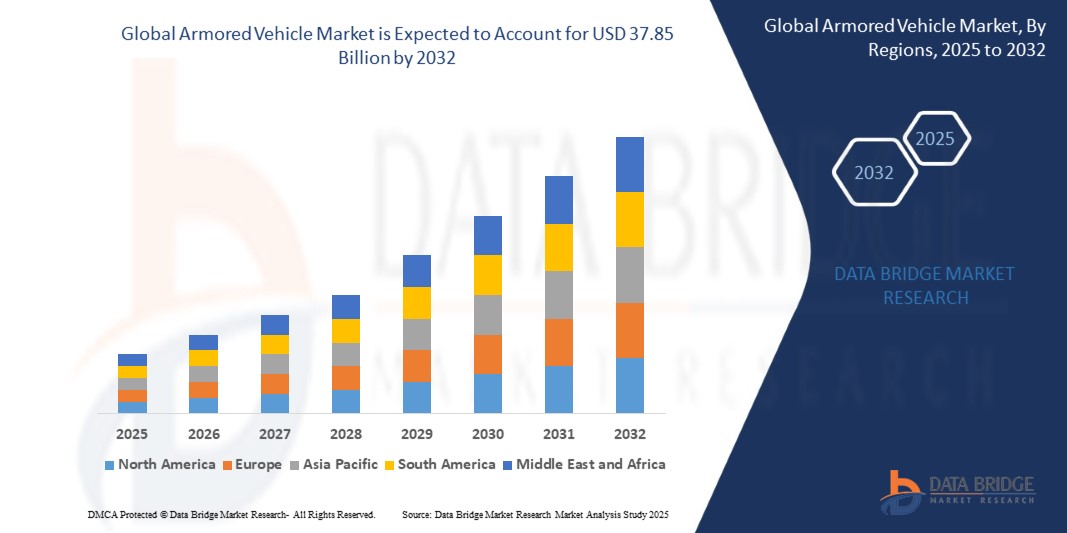

- The global armored vehicle market was valued at USD 23.73 billion in 2024 and is projected to reach USD 37.85 billion by 2032, growing at a steady CAGR of 6.89% during the forecast period.

- Growth is driven by rising geopolitical tensions, increasing defense modernization programs, and the integration of advanced technologies such as active protection systems, unmanned ground capabilities, and enhanced mobility solutions across military and law enforcement applications.

Armored Vehicle Market Analysis

- Global Armored Vehicles refer to combat, tactical, or transport vehicles reinforced with armor plating to provide protection against bullets, shrapnel, mines, and explosive threats across defense and security operations.

- As geopolitical tensions intensify and cross-border threats increase, the demand for advanced armored vehicles is rising across military modernization programs, homeland security forces, and peacekeeping missions.

- Major defense industries are integrating next-gen technologies such as active protection systems (APS), remote weapon stations, and battlefield connectivity in armored vehicles to enhance mobility, survivability, and mission versatility.

- Wheeled armored vehicles are increasingly preferred for urban warfare and logistics roles due to their operational speed, cost-efficiency, and multi-terrain adaptability.

- The global push toward unmanned and AI-integrated defense platforms is accelerating the development of robotic combat vehicles, autonomous reconnaissance units, and hybrid-electric armored systems.

- Government investments in indigenous production, defense offset policies, and joint ventures with OEMs are strengthening domestic manufacturing capabilities and transforming the armored vehicle supply chain.

Report Scope and Armored Vehicle Market Segmentation

|

Attributes |

Armored Vehicle Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated for the Global Armored Vehicle Market – Industry Trends and Forecast to 2032 also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter’s Five Forces Analysis, and regulatory framework.. |

Armored Vehicle Market Trends

Emergence of advanced, connected, and sustainable armored vehicle technologies

- Proliferation of Modular and Mission-Adaptable Platforms: Modern armored vehicles are increasingly designed with modular architectures that support rapid configuration changes for combat, reconnaissance, peacekeeping, or disaster response missions, enhancing operational flexibility across military forces.

- Adoption of Hybrid and Electric Propulsion Systems: The industry is steadily transitioning toward hybrid-electric and fully electric armored vehicles to reduce fuel dependency, enhance silent mobility, and align with global decarbonization goals without compromising power or performance.

- Integration of AI-Powered Situational Awareness and Active Protection: The deployment of AI-driven analytics, sensor fusion, and machine learning in vehicle systems is improving real-time threat detection, autonomous maneuvering, and survivability through active protection systems (APS).

- Rise of C4ISR and Network-Centric Capabilities: Armored platforms are evolving into connected nodes within battlefield networks, integrating Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) systems for enhanced decision-making and interoperability.

- Sustainability and Lightweight Composite Materials: Global armored vehicle manufacturers are focusing on sustainable manufacturing processes and advanced lightweight materials—including ceramic composites and high-strength polymers—to improve fuel efficiency and reduce lifecycle emissions.

- Expansion of Unmanned Ground Vehicles (UGVs): Autonomous and semi-autonomous armored UGVs are gaining traction for surveillance, logistics, and high-risk operations, enabling force multiplication while minimizing personnel exposure in conflict zones.

- Digital Twin and Predictive Maintenance Integration: The adoption of digital twin technology and predictive analytics is optimizing fleet readiness by enabling real-time diagnostics, lifecycle monitoring, and proactive maintenance across defense fleets.

Armored Vehicle Market Dynamics

Driver

Rising Defense Modernization and Tactical Mobility Requirements

- The increasing frequency of asymmetric warfare, border tensions, and geopolitical instability is compelling defense agencies to invest in modern armored platforms capable of rapid deployment and multi-mission functionality.

- Armored vehicles with enhanced survivability, all-terrain mobility, and modular design are being prioritized to meet evolving battlefield requirements, especially in urban and hybrid combat scenarios.

- Military programs across the U.S., China, India, and EU nations are shifting toward next-generation armored fleets with integrated C4ISR, active protection systems (APS), and remote-controlled weapon stations.

- The surge in joint ventures, technology transfers, and localized manufacturing initiatives is accelerating procurement cycles and reducing import dependency, particularly in emerging defense markets.

- Governments are also emphasizing lightweight armor materials and hybrid/electric drivetrains to improve fuel efficiency, strategic maneuverability, and overall mission readiness across terrain-diverse regions..

Restraint/Challenge

Weight Constraints, Mobility Trade-Offs, and Integration Complexities in Advanced Armored Platforms

- Armored vehicles often face a critical trade-off between enhanced protection and mobility, as additional armor significantly increases vehicle weight, leading to reduced speed, fuel efficiency, and maneuverability—especially in complex terrains or urban settings.

- The absence of standardized global specifications for armor grades, protection levels, and interoperability across allied defense forces complicates procurement, joint deployment, and long-term maintenance strategies.

- Small- and medium-sized defense manufacturers encounter challenges in adopting next-generation materials (e.g., composites, reactive armor) due to high R&D costs and limited access to defense funding or public-private innovation pipelines.

- Integrating advanced systems such as active protection systems (APS), AI-based navigation, or unmanned functionalities introduces electronic warfare vulnerabilities, cybersecurity risks, and system compatibility issues with legacy platforms.

- The complexity of maintaining a balance between survivability, payload capacity, and modular design in evolving combat environments presents engineering and tactical dilemmas that slow down rapid deployment or battlefield adaptability..

Armored Vehicle Market Scope

The global armored vehicle market is segmented across multiple dimensions including platform, drive type, vehicle type, application, component, and end user reflecting the sector’s complexity and strategic significance in both defense and civilian domain.

- By Platform

Includes Combat Vehicles, Combat Support Vehicles, Unmanned Armored Ground Vehicles, and Others. Combat vehicles such as main battle tanks (MBTs) and infantry fighting vehicles (IFVs) dominate the market in 2025 due to their essential role in front-line operations and national defense strategies. Combat support vehicles—including MRAPs and engineering platforms—are gaining traction for tactical mobility and survivability. Unmanned armored ground vehicles represent a rapidly evolving segment, driven by advancements in autonomy, AI, and remote operations.

- By Drive Type

Divided into Wheeled and Tracked armored vehicles.

Wheeled armored vehicles hold the largest market share in 2025 owing to their greater speed, road mobility, and cost-efficiency—especially useful in urban warfare, peacekeeping, and border patrol. Tracked vehicles, while typically more expensive and maintenance-intensive, are favored for their off-road endurance, heavy armor integration, and battlefield performance..

- By Vehicle Type

Includes Armored Personnel Carrier (APC), Infantry Fighting Vehicle (IFV), Main Battle Tank (MBT), Mine-Resistant Ambush Protected (MRAP) Vehicle, Light Protected Vehicle (LPV), and Others.

APCs and IFVs collectively dominate the volume share due to their versatility in troop deployment, patrol, and low-intensity conflict zones. MBTs continue to be a priority in high-intensity conflicts for firepower and armor superiority. MRAPs are critical in asymmetric warfare zones with high mine and IED risks. LPVs are increasingly adopted for reconnaissance and convoy protection missions..

- By Application

Segmented into Military, Commercial, and Law Enforcement.

The military segment leads the market due to continuous modernization efforts, rising geopolitical tensions, and procurement of advanced systems. Law enforcement agencies are increasingly adopting armored vehicles for riot control, border security, and anti-terror operations. Commercial demand is rising in sectors like private security, cash-in-transit, and VIP protection, particularly in high-risk regions..

- By Component

Covers Engine, Drive System, Turret Drives, Ammunition Handling Systems, Fire Control Systems, Armaments, Ballistic Armor, Countermeasures, Communication Systems, Navigation Systems, Power Systems, and Others.

Ballistic armor constitutes the largest share, essential for vehicle survivability and crew protection. Fire control and communication systems are rapidly evolving with the integration of advanced targeting, surveillance, and C4ISR capabilities. Turret drives, navigation units, and countermeasure systems are witnessing growing demand due to the need for responsive, tech-enabled armored platforms.

- By End User

Includes Defense, Homeland Security, VIP & Civilian Protection, and Others.

Defense remains the primary end user, driven by defense modernization, joint operations readiness, and increasing cross-border threats. Homeland security forces are expanding their armored fleets for domestic protection, anti-insurgency, and disaster response. VIP and civilian protection is emerging as a niche yet important segment, especially in politically unstable and conflict-prone regions.

Armored Vehicle Market Regional Analysis

- North America leads the global armored vehicle market in 2025, driven by substantial defense budgets, advanced R&D capabilities, and continuous procurement of next-generation combat and support vehicles. The U.S. remains a central hub for armored vehicle innovation, with key programs focusing on unmanned systems, active protection technologies, and hybrid-electric propulsion. Strong partnerships between defense agencies and private manufacturers further strengthen the region’s global leadership.

- Europe follows closely, with demand fueled by increased defense modernization, NATO obligations, and regional security concerns. Countries like Germany, France, and the U.K. are investing in indigenous manufacturing and collaborative platforms, such as the Main Ground Combat System (MGCS). Emphasis on hybrid mobility, cyber-secure systems, and autonomous vehicle integration is shaping procurement strategies across the continent.

- Asia-Pacific is the fastest-growing region, with nations like China, India, South Korea, and Japan significantly boosting armored vehicle procurement to enhance military capabilities amid rising geopolitical tensions. The region benefits from robust industrial ecosystems, domestic manufacturing capacities, and strategic collaborations. Indigenous programs and increased investment in AI-integrated and unmanned platforms are fueling regional growth..

- The MEA region is witnessing steady growth, driven by rising security challenges and modernization efforts across countries such as Saudi Arabia, UAE, Israel, and Egypt. Investments are directed toward acquiring multi-role and mine-resistant vehicles to support both internal security and regional stability missions. Local assembly initiatives and defense offset programs are gaining momentum.

- South America, led by Brazil and Colombia, is gradually adopting armored vehicles to bolster border security, peacekeeping operations, and crime control initiatives. Budgetary constraints are balanced by the procurement of cost-effective platforms and regional partnerships. Growth is also supported by local production capacities and modernization of legacy fleets..

United States

The U.S. dominates the global armored vehicle market in 2025, underpinned by cutting-edge R&D, consistent defense funding, and large-scale deployment across all military branches. Programs like the Optionally Manned Fighting Vehicle (OMFV) and Joint Light Tactical Vehicle (JLTV) drive innovation and export potential..

Germany

Germany’s armored vehicle industry is driven by strategic investments in next-gen tanks, infantry fighting vehicles, and autonomous combat platforms. With a strong industrial base and leading players like Rheinmetall, the country emphasizes sustainability, digitization, and cross-border European defense collaboration..

China

China is aggressively expanding its armored vehicle fleet, supported by state-sponsored defense initiatives and local technology development. Emphasis is placed on modular designs, unmanned ground vehicles, and hybrid-electric mobility systems, aligning with broader military modernization goals.

India

India is emerging as a key growth market, with strong government backing for domestic manufacturing under the “Make in India” and “Atmanirbhar Bharat” defense initiatives. Procurement focuses on armored personnel carriers, light combat vehicles, and indigenous combat support solutions for border security.

South Korea

South Korea is investing heavily in high-tech armored platforms, including wheeled infantry vehicles and smart combat systems. Backed by firms like Hyundai Rotem and Hanwha Defense, the country is strengthening its domestic manufacturing base and expanding its global export footprint.

Armored Vehicle Market Share

The Global Armored Vehicle industry is primarily led by well-established companies, including:

- General Dynamics Corporation

- BAE Systems plc

- Rheinmetall AG

- Lockheed Martin Corporation

- Oshkosh Corporation

- Northrop Grumman

- Elbit Systems Ltd.

- Hanwha Corporation

- Mitsubishi Heavy Industries, Ltd.

- Thales

Latest Developments in Global Armored Vehicle Market

- In May 2025, Arquus secured a contract to deliver 12 Sherpa Light Station Wagon armored vehicles equipped with Akeron missile systems to the Cypriot National Guard, enhancing their mobile firepower and anti-armor capabilities.

- April 2025, Axon Vision partnered with CZECHOSLOVAK GROUP a.s. to integrate EdgeSA AI-driven situational awareness systems into PANDUR 8×8 EVO and TADEAS 6×6 armored vehicles, improving battlefield visibility and target detection.

- March 2025, General Motors Defense introduced the Suburban HD armored SUV variant for Qatar’s armed forces, offering high-level protection, tactical mobility, and a reinforced chassis design for VIP transport.

- March 2025, Renk Group announced a €500 million investment to expand its armored vehicle production capabilities in Germany, targeting next-generation tracked and wheeled platforms to meet NATO demand.

- February 2025, Tata Motors unveiled India’s first NATO-standard Light Armored Multi-role Vehicle (LAMV) at IDEX 2025, engineered for rapid deployment, enhanced crew protection, and multi-theater combat operations.

- January 2025, Patria invested €40 million to scale up armored vehicle manufacturing capacity at its Hämeenlinna facility in Finland, aiming to double output by 2027 to support domestic and international defense programs.

- December 2024, Rheinmetall began pre-series testing of its KF51 Panther main battle tank, featuring an unmanned turret and 130mm smoothbore gun, designed for increased lethality and networked combat operations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.