Global Vehicle Subscription Market

Market Size in USD Billion

CAGR :

%

USD

8.21 Billion

USD

23.75 Billion

2025

2033

USD

8.21 Billion

USD

23.75 Billion

2025

2033

| 2026 –2033 | |

| USD 8.21 Billion | |

| USD 23.75 Billion | |

|

|

|

|

Vehicle Subscription Market Size

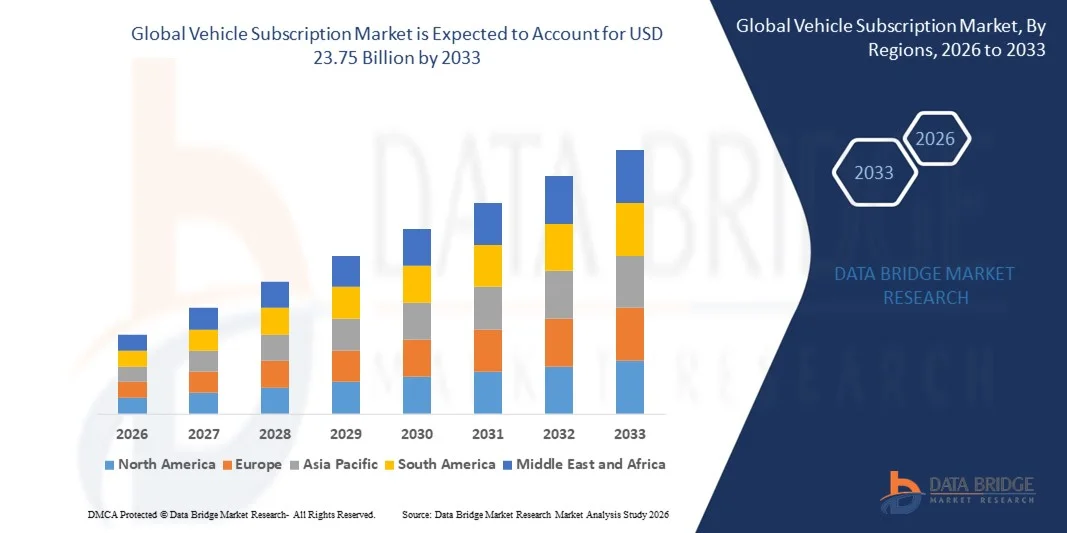

- The global vehicle subscription market size was valued at USD 8.21 billion in 2025 and is expected to reach USD 23.75 billion by 2033, at a CAGR of 14.2% during the forecast period

- The market growth is largely fueled by the increasing shift away from traditional vehicle ownership toward flexible, usage-based mobility models, supported by rising digitalization across the automotive and mobility ecosystem

- Furthermore, growing consumer preference for cost transparency, bundled services, and short-term commitments is positioning vehicle subscriptions as an attractive alternative for both private and business users, accelerating overall market expansion

Vehicle Subscription Market Analysis

- Vehicle subscription services, offering flexible access to vehicles through a single recurring payment covering insurance, maintenance, and support services, are becoming an integral part of modern mobility solutions for individual and corporate users

- The rising demand for vehicle subscriptions is primarily driven by changing urban mobility patterns, increasing acceptance of app-based services, and a strong preference for convenience, flexibility, and reduced long-term financial obligations

- North America dominated the vehicle subscription market with a share of 38.9% in 2025, due to changing consumer preferences toward flexible vehicle access and reduced long-term ownership commitments

- Asia-Pacific is expected to be the fastest growing region in the vehicle subscription market during the forecast period due to

- OEM/captives segment dominated the market with a market share of 64.5% in 2025, due to their direct access to vehicle supply chains, established dealer networks, and brand trust. OEM-led subscriptions benefit from optimized pricing, integrated aftersales support, and bundled insurance and maintenance services

Report Scope and Vehicle Subscription Market Segmentation

|

Attributes |

Vehicle Subscription Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Vehicle Subscription Market Trends

Increasing Shift Toward Flexible and Usage-Based Vehicle Access

- A major trend in the vehicle subscription market is the growing shift toward flexible, usage-based access to vehicles, driven by changing consumer attitudes toward ownership and rising demand for convenience-oriented mobility solutions. Consumers are increasingly favoring subscriptions that allow short-term use without long-term financial or contractual commitments, particularly in urban environments

- For instance, Volvo Car Corporation’s Care by Volvo program enables customers to access vehicles through a fixed monthly fee covering insurance, servicing, and maintenance, reinforcing the appeal of simplified and flexible vehicle usage. Such offerings are reshaping how consumers perceive vehicle access by prioritizing ease, adaptability, and bundled services

- Automakers are increasingly positioning subscriptions as an extension of digital mobility ecosystems, integrating app-based onboarding, vehicle swaps, and account management. This is strengthening user engagement and enhancing the overall customer experience across subscription platforms

- The trend is also gaining traction among younger consumers who prefer access over ownership and value predictable monthly costs. Subscription models align closely with lifestyle-driven mobility preferences, particularly in densely populated cities

- Businesses are adopting vehicle subscriptions to support short-term operational needs and dynamic workforce mobility. This is expanding the relevance of subscriptions beyond private users and reinforcing their role in modern mobility strategies

- The continued expansion of subscription offerings across multiple vehicle categories and regions is reinforcing this trend. Flexible vehicle access is increasingly becoming a core component of the evolving global mobility landscape

Vehicle Subscription Market Dynamics

Driver

Rising Preference for Cost-Transparent and All-Inclusive Mobility Solutions

- A key driver of the vehicle subscription market is the rising preference for cost-transparent mobility solutions that bundle insurance, maintenance, roadside assistance, and servicing into a single recurring payment. This structure eliminates unexpected ownership costs and simplifies vehicle usage for consumers and businesses

- For instance, Volkswagen Group of America, through its VW Flex program, offers subscribers a single monthly fee covering insurance, maintenance, and roadside assistance. This approach directly addresses consumer demand for predictable expenses and simplified vehicle management

- Corporate users are increasingly drawn to subscriptions as they reduce capital expenditure and administrative complexity associated with traditional fleet ownership. This is driving adoption among businesses seeking flexible and scalable mobility solutions

- Private consumers are responding positively to subscription models that remove long-term financing commitments and depreciation risks. The clarity and convenience of bundled pricing are strengthening trust and accelerating adoption

- As consumers increasingly prioritize simplicity and financial predictability, all-inclusive subscription models continue to act as a strong catalyst for market growth

Restraint/Challenge

High Operational and Fleet Management Costs

- The vehicle subscription market faces significant challenges due to high operational and fleet management costs associated with maintaining, insuring, and rotating vehicles across subscriber bases. These costs place pressure on profitability, particularly for providers operating large and diverse fleets

- For instance, mobility providers such as Lyft, Inc. incur substantial expenses related to vehicle acquisition, maintenance, insurance, and asset depreciation when supporting flexible access models. Managing these cost structures remains a key operational challenge

- Frequent vehicle turnover and short subscription cycles increase wear and tear, raising maintenance and refurbishment costs. This impacts operational efficiency and complicates fleet optimization efforts

- Insurance premiums and regulatory compliance requirements further add to the financial burden for subscription providers operating across multiple regions. These factors limit pricing flexibility and margin expansion

- These challenges continue to influence provider strategies, encouraging investments in operational optimization, digital fleet management tools, and partnerships to improve cost control and long-term sustainability

Vehicle Subscription Market Scope

The market is segmented on the basis of subscription type, service provider, package, and end user.

- By Subscription Type

On the basis of subscription type, the vehicle subscription market is segmented into single brand and multi brand offerings. The single brand segment dominated the market in 2025, driven by strong OEM-backed programs, better control over vehicle quality, and consistent brand experience. Automakers leverage single brand subscriptions to improve customer retention and monetize idle inventory while offering predictable pricing and maintenance coverage. Consumers often prefer these plans for assured service standards, warranty continuity, and seamless integration with OEM financing and insurance ecosystems. The dominance is further supported by growing OEM focus on direct-to-consumer mobility models.

The multi brand segment is expected to register the fastest growth from 2026 to 2033, fueled by rising consumer demand for flexibility and vehicle variety under a single subscription. Multi brand platforms attract urban users seeking short-term access to different vehicle types without long-term ownership commitments. The ability to switch between brands and models enhances perceived value, supporting rapid adoption across metro regions.

- By Service Provider

On the basis of service provider, the market is segmented into OEM/Captives, mobility providers, and technology companies. The OEM/Captives segment held the largest revenue share of 64.5% in 2025 due to their direct access to vehicle supply chains, established dealer networks, and brand trust. OEM-led subscriptions benefit from optimized pricing, integrated aftersales support, and bundled insurance and maintenance services. These providers use subscriptions as a strategic tool to manage residual values and extend customer lifecycle engagement. Strong financial backing and regulatory familiarity further reinforce their market leadership.

Mobility providers are anticipated to witness the fastest growth rate during the forecast period, supported by asset-light models and data-driven fleet optimization. Their focus on app-based access, flexible tenure options, and competitive pricing appeals strongly to younger and corporate users. Rapid expansion into tier-1 and tier-2 cities accelerates their growth trajectory.

- By Package

On the basis of package, the vehicle subscription market is segmented into budget, standard, and premium plans. The standard package segment dominated the market in 2025, driven by its balanced pricing structure and inclusion of essential services such as maintenance, insurance, and roadside assistance. Standard packages cater to a broad consumer base seeking convenience without the higher costs of premium offerings. They are widely adopted by both private users and small businesses due to predictable monthly expenses. The segment benefits from high scalability across passenger vehicle categories.

The premium package segment is projected to grow at the fastest pace from 2026 to 2033, supported by rising demand for luxury vehicles and personalized mobility experiences. High-income consumers increasingly value access to premium models without ownership risks. Enhanced features such as concierge services, vehicle upgrades, and shorter replacement cycles further drive adoption.

- By End User

On the basis of end user, the market is segmented into business and private users. The business segment accounted for the largest market share in 2025, driven by increasing corporate focus on flexible fleet management and cost optimization. Vehicle subscriptions enable businesses to avoid capital expenditure while ensuring operational agility and predictable mobility costs. Companies across consulting, logistics, and sales functions favor subscriptions for employee transportation and short-term projects. Tax efficiency and simplified fleet administration strengthen segment dominance.

The private segment is expected to experience the fastest growth during the forecast period, supported by changing consumer attitudes toward vehicle ownership. Urban consumers increasingly prefer access-based mobility solutions that reduce long-term financial commitments. Convenience, bundled services, and the ability to upgrade vehicles periodically make subscriptions attractive to private users.

Vehicle Subscription Market Regional Analysis

- North America dominated the vehicle subscription market with the largest revenue share of 38.9% in 2025, driven by changing consumer preferences toward flexible vehicle access and reduced long-term ownership commitments

- Consumers in the region increasingly value all-inclusive pricing models that bundle insurance, maintenance, and roadside assistance, offering predictability and convenience

- The strong presence of OEM-led subscription programs, high vehicle penetration, advanced digital infrastructure, and a mature mobility ecosystem continue to position vehicle subscriptions as an attractive alternative for both individual and corporate users

U.S. Vehicle Subscription Market Insight

The U.S. vehicle subscription market captured the largest revenue share within North America in 2025, supported by high consumer awareness of subscription-based mobility and strong participation from major automakers and mobility providers. Consumers are increasingly drawn to subscription models that offer flexibility to switch vehicles and avoid depreciation risks. The growth of urban populations, rising acceptance of app-based mobility solutions, and strong demand from corporate fleets are accelerating market expansion. In addition, the integration of digital platforms for seamless onboarding and vehicle management continues to strengthen adoption.

Europe Vehicle Subscription Market Insight

The Europe vehicle subscription market is projected to grow at a notable CAGR during the forecast period, driven by shifting attitudes toward car ownership and increasing regulatory pressure on emissions and sustainability. Consumers across the region are favoring flexible mobility solutions that align with urban living and environmental considerations. The growing adoption of electric vehicles within subscription models is further supporting market growth. Strong OEM involvement and expanding mobility service providers are enhancing accessibility across major European cities.

U.K. Vehicle Subscription Market Insight

The U.K. vehicle subscription market is anticipated to grow steadily during the forecast period, fueled by rising demand for short-term vehicle access and cost transparency. Consumers are increasingly opting for subscriptions to avoid upfront payments and long-term financing obligations. The presence of digitally advanced mobility platforms and a well-established automotive retail ecosystem supports adoption. Corporate demand for flexible fleet solutions is also contributing to sustained market growth.

Germany Vehicle Subscription Market Insight

The Germany vehicle subscription market is expected to expand at a considerable CAGR, supported by strong automotive manufacturing capabilities and high consumer trust in OEM-backed programs. German consumers value reliability, vehicle quality, and service assurance, which aligns well with structured subscription offerings. The increasing focus on electric mobility and sustainability is encouraging automakers to introduce EV-based subscription plans. The market benefits from a technologically advanced infrastructure and a growing preference for flexible mobility solutions.

Asia-Pacific Vehicle Subscription Market Insight

The Asia-Pacific vehicle subscription market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and evolving mobility preferences. The region is witnessing increasing acceptance of subscription-based models among younger consumers seeking convenience and flexibility. Expanding digital ecosystems and smartphone penetration are supporting app-based vehicle access. The growing presence of regional mobility providers and OEM initiatives is further accelerating adoption.

Japan Vehicle Subscription Market Insight

The Japan vehicle subscription market is gaining traction due to the country’s strong digital adoption, urban density, and preference for efficient mobility solutions. Consumers are increasingly attracted to subscription models that simplify vehicle usage and ownership-related complexities. The integration of advanced technology, connected vehicle systems, and seamless digital interfaces is supporting market growth. In addition, demand from corporate users and urban residents continues to strengthen adoption.

China Vehicle Subscription Market Insight

The China vehicle subscription market accounted for the largest revenue share in Asia Pacific in 2025, driven by rapid urbanization, a growing middle class, and high acceptance of digital mobility platforms. Consumers are increasingly opting for subscription services to access vehicles without long-term financial commitments. Strong government support for shared mobility and electric vehicles is encouraging OEMs and mobility providers to expand subscription offerings. The availability of competitively priced vehicles and advanced digital ecosystems continues to propel market growth in China.

Vehicle Subscription Market Share

The vehicle subscription industry is primarily led by well-established companies, including:

- Fair Financial Corp. (U.S.)

- Clutch Technologies, LLC (U.S.)

- CarNext (Netherlands)

- FlexDrive (U.S.)

- Cluno GmbH (Germany)

- DriveMyCar Rentals Pty Ltd (Australia)

- BMW AG (Germany)

- Daimler AG (Germany)

- General Motors (U.S.)

- Hyundai Motor India (India)

- Tata Motors (India)

- Tesla (U.S.)

- Volkswagen (Germany)

- Volvo Car Corporation (Sweden)

- ZoomCar (India)

- Cox Automotive (U.S.)

- Wagonex Limited (U.K.)

- LeasePlan (Netherlands)

- Lyft, Inc. (U.S.)

Latest Developments in Global Vehicle Subscription Market

- In October 2024, Volkswagen Group of America, together with Volkswagen Financial Services, launched the VW Flex vehicle subscription program in the Atlanta metro area, marking a strategic move to strengthen OEM-led participation in the vehicle subscription market. By offering a month-to-month model with a single payment covering insurance, maintenance, and 24/7 roadside assistance, the initiative lowers entry barriers for consumers hesitant about long-term ownership. This development reinforces the market shift toward flexible, bundled mobility solutions and enhances competitive pressure on independent mobility providers

- In January 2023, FINN expanded its car subscription service for businesses into the U.S. market, building on the proven success of its B2B model in Germany. The launch strengthened FINN’s international footprint while accelerating adoption of subscription-based fleet solutions among corporate users. By emphasizing flexibility, full-service coverage, and continuous customer support, this move contributed to growing acceptance of subscriptions as a viable alternative to traditional corporate leasing

- In October 2022, Carvolution secured USD 16.12 million in Series D funding from Redalpine to scale its car subscription operations. The investment enabled the company to expand its subscription fleet and improve digital processes, enhancing overall service efficiency. This funding round highlighted strong investor confidence in subscription-based mobility models and supported market maturity through improved access and operational scalability

- In March 2022, Arval introduced its flexible subscription solution, Arval Adaptiv, targeting private customers seeking customizable mobility options. By allowing subscribers to select from a range of ICE and EV models with adjustable contract durations, the launch supported rising demand for personalized and sustainable vehicle access. This development strengthened the private end-user segment and aligned subscription offerings with evolving consumer mobility preferences

- In February 2022, Avis partnered with FlexClub to deliver competitively priced vehicle subscriptions in South Africa, expanding the subscription model into emerging markets. The collaboration focused on long-term yet flexible contracts through an online marketplace, improving affordability and accessibility. This initiative broadened the geographical reach of vehicle subscriptions and demonstrated the model’s adaptability beyond mature automotive markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.