Global Viscosity Index Improvers Market

Market Size in USD Billion

CAGR :

%

USD

5.48 Billion

USD

7.81 Billion

2025

2033

USD

5.48 Billion

USD

7.81 Billion

2025

2033

| 2026 –2033 | |

| USD 5.48 Billion | |

| USD 7.81 Billion | |

|

|

|

|

What is the Global Viscosity Index Improvers Market Size and Growth Rate?

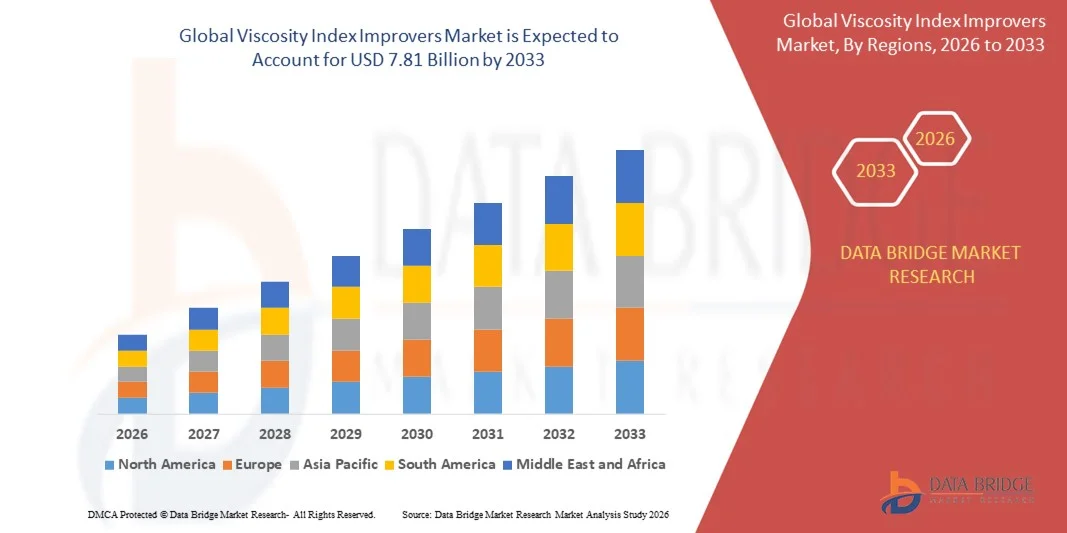

- The global viscosity index improvers market size was valued at USD 5.48 billion in 2025 and is expected to reach USD 7.81 billion by 2033, at a CAGR of4.50% during the forecast period

- Rise in application of viscosity index improvers for automotive applications is the root cause fuelling up the market growth rate

- Rising industrialization coupled with growth in the demand for industrial lubricants for industrial machinery will also directly and positively impact the growth rate of the market

What are the Major Takeaways of Viscosity Index Improvers Market?

- Growth and expansion of various end user verticals especially in the developing economies coupled with surge in the need for improvement in the fuel economy will further carve the way for the growth of the market. Growth in the manufacturing activities and surge in the demand for chemicals to improve the shelf life of machinery will also foster the market growth rate

- However, sluggish growth of automotive sector as a result of coronavirus outbreak will pose a major challenge to the growth of the market. Also, rise in the oil drain interval reduce the consumption of engine oil and this will dampen the market growth rate. Fluctuations in the prices of raw materials will further derail the market growth rate

- Asia-Pacific dominated the viscosity index improvers market with a 39.36% revenue share in 2025, driven by rapid industrialization, expanding automotive and lubricant manufacturing sectors, and growing adoption of advanced energy-efficient engines across China, Japan, India, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 7.45% from 2026 to 2033, fueled by expanding automotive aftermarket, adoption of synthetic and low-viscosity lubricants, and stringent fuel-efficiency and emission standards across the U.S. and Canada

- The Polymethacrylate (PMA) segment dominated the market with a 41.2% share in 2025, supported by its high shear stability, excellent thermal performance, and compatibility with low-viscosity and fully synthetic engine oils

Report Scope and Viscosity Index Improvers Market Segmentation

|

Attributes |

Viscosity Index Improvers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Viscosity Index Improvers Market?

Increasing Focus on High-Performance, Environmentally Friendly, and Multi-Functional Viscosity Index Improvers

- The viscosity index improvers market is witnessing strong adoption of advanced polymer-based additives designed to enhance engine oil performance, improve fuel efficiency, and maintain viscosity across temperature extremes

- Manufacturers are introducing multi-functional polymers that combine viscosity improvement with shear stability, oxidation resistance, and compatibility with low-SAPS formulations, meeting modern engine requirements

- Growing demand for energy-efficient and environmentally compliant lubricants is driving the adoption of Viscosity Index Improvers across automotive, industrial, and marine applications

- For instance, leading companies such as BASF SE, Lubrizol, Evonik Industries, Afton Chemical, and Infineum have upgraded their VI improver portfolios with high-performance polyisobutylene, olefin copolymers, and associative polymers to enhance thermal and oxidative stability

- Increasing need for improved fuel economy, reduced emissions, and extended oil life is accelerating the shift toward multi-functional, high-performance VI additives

- As automotive and industrial engines evolve toward higher efficiency and lower emissions, viscosity index improvers will remain essential for lubricant formulation and performance optimization

What are the Key Drivers of Viscosity Index Improvers Market?

- Rising demand for engine oils that deliver better fuel efficiency, extended oil drain intervals, and compliance with stringent emission norms is driving market growth

- For instance, in 2025, companies such as Lubrizol, BASF SE, and Evonik Industries launched next-generation VI improvers compatible with fully synthetic and low-viscosity oils to meet modern engine specifications

- Growing automotive production, increasing fleet electrification, and rising industrial lubrication needs are boosting VI improver demand across U.S., Europe, and Asia-Pacific

- Advancements in polymer chemistry, shear-stable formulations, and additive synergism have strengthened oil performance, engine protection, and long-term reliability

- Rising awareness of environmental regulations and the push for fuel economy improvements is creating demand for VI improvers with low volatility and reduced environmental impact

- Supported by steady investments in R&D for next-gen lubricants, the Viscosity Index Improvers market is expected to witness robust long-term growth

Which Factor is Challenging the Growth of the Viscosity Index Improvers Market?

- High costs associated with premium, multi-functional VI additives limit adoption among small lubricant manufacturers and regional players

- For instance, during 2024–2025, fluctuations in raw material prices, polymer supply constraints, and longer lead times increased manufacturing costs for several global suppliers

- Complexity in formulating VI improvers compatible with diverse base oils and additive packages increases the need for specialized chemical expertise and testing

- Limited awareness in emerging markets regarding VI additive benefits, oil performance standards, and formulation best practices slows adoption

- Competition from generic VI improvers, low-cost substitutes, and regional polymer suppliers creates pricing pressure and reduces product differentiation

- To address these challenges, companies are focusing on cost-optimized polymer blends, sustainable additive chemistries, technical support, and advanced formulation solutions to increase global adoption of viscosity index improvers

How is the Viscosity Index Improvers Market Segmented?

The market is segmented on the basis of product type and end-user industry.

- By Product Type

On the basis of product type, the viscosity index improvers market is segmented into Polymethacrylate (PMA), Ethylene Propylene Copolymer (OCP), Hydrostyrene Diene Copolymer (HSD) and Polyisobutylene (PIB), and Others. The Polymethacrylate (PMA) segment dominated the market with a 41.2% share in 2025, supported by its high shear stability, excellent thermal performance, and compatibility with low-viscosity and fully synthetic engine oils. PMA-based VI improvers are extensively used in automotive lubricants, industrial oils, and high-performance machinery due to their ability to maintain optimal viscosity across wide temperature ranges.

The Polyisobutylene (PIB) segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for lightweight engine oils, enhanced fuel efficiency, and multi-functional additive formulations in modern automotive and industrial applications. Continuous innovation in polymer chemistry is further fueling adoption of high-performance, environment-friendly VI improvers across global markets.

- By End User Industry

On the basis of end-user industry, the market is segmented into Automotive, Industrial Machinery, and Other End User Industries. The Automotive segment dominated the market with a 38.6% share in 2025, driven by stringent emission regulations, growing production of passenger vehicles and commercial fleets, and increasing adoption of fuel-efficient engine oils. Viscosity Index Improvers are critical in meeting OEM specifications, extending oil drain intervals, and ensuring optimal engine performance under high load and varying temperature conditions.

The Industrial Machinery segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing industrialization, expansion of heavy machinery operations, and rising demand for high-performance lubricants in sectors such as construction, mining, and manufacturing. Continuous development of multi-functional VI improvers for industrial applications is further strengthening long-term market growth.

Which Region Holds the Largest Share of the Viscosity Index Improvers Market?

- Asia-Pacific dominated the viscosity index improvers market with a 39.36% revenue share in 2025, driven by rapid industrialization, expanding automotive and lubricant manufacturing sectors, and growing adoption of advanced energy-efficient engines across China, Japan, India, South Korea, and Southeast Asia. Rising demand for high-performance base oils, synthetic lubricants, and long-lasting engine oils continues to fuel the adoption of viscosity index improvers across automotive OEMs, industrial plants, and lubricant formulation facilities

- Leading companies in Asia-Pacific are introducing high-performance polymer-based and multifunctional viscosity index improvers designed for extreme temperature stability, improved fuel efficiency, and extended oil life, strengthening the region’s technological leadership. Continuous investments in electric and hybrid vehicle manufacturing, industrial automation, and engine optimization programs are driving long-term market growth

- Strong government support for sustainable manufacturing, local polymer production, and expanding automotive R&D centers further reinforce Asia-Pacific’s dominance in the Viscosity Index Improvers market

China Viscosity Index Improvers Market Insight

China is the largest contributor in Asia-Pacific due to massive automotive production, extensive lubricant manufacturing facilities, and strong governmental incentives for green and fuel-efficient engines. Increasing use of synthetic and semi-synthetic lubricants, coupled with rising demand for high-temperature and multi-grade oils, drives demand for advanced viscosity index improvers. Local production capabilities, competitive pricing, and export potential further strengthen market adoption.

Japan Viscosity Index Improvers Market Insight

Japan shows steady growth, supported by high-precision automotive and industrial manufacturing, robust R&D in high-performance engine oils, and focus on fuel efficiency. Rising demand for hybrid vehicles, low-viscosity oils, and premium lubricants reinforces adoption of specialized viscosity index improvers across the country.

India Viscosity Index Improvers Market Insight

India is emerging as a high-growth hub due to increasing automotive production, expanding industrial and construction sectors, and growing awareness of engine longevity and fuel efficiency. Rising adoption of synthetic lubricants, government-backed “Make in India” initiatives, and expansion of lubricant formulation plants accelerate the market penetration of viscosity index improvers.

South Korea Viscosity Index Improvers Market Insight

South Korea contributes significantly due to strong automotive, electronics, and heavy machinery manufacturing sectors. Development of high-performance passenger vehicles, industrial engines, and EV components drives demand for polymer-based and multifunctional viscosity index improvers. Innovation in additive technology, high local production, and growing export potential support sustained growth.

North America Viscosity Index Improvers Market

North America is projected to register the fastest CAGR of 7.45% from 2026 to 2033, fueled by expanding automotive aftermarket, adoption of synthetic and low-viscosity lubricants, and stringent fuel-efficiency and emission standards across the U.S. and Canada. Rising demand for premium engine oils, industrial machinery maintenance, and high-performance lubricant formulations accelerates the adoption of viscosity index improvers in the region.

Which are the Top Companies in Viscosity Index Improvers Market?

The viscosity index improvers industry is primarily led by well-established companies, including:

- Evonik Industries AG (Germany)

- Infineum International Limited (U.K.)

- The Lubrizol Corporation (U.S.)

- Chevron Corporation (U.S.)

- BASF SE (Germany)

- Afton Chemical (U.S.)

- SANYO CHEMICAL INDUSTRIES, LTD. (Japan)

- Nanjing Runyou Chemical Industry Additive Co., Ltd. (China)

- Shenyang The Great Wall Lubricating Oil Manufacturing Co., Ltd. (China)

- Asian Oil Company (India)

- BARIYAN’S GROUP (India)

- BPT Chemicals Co Ltd (India)

- Chetas Biochem (India)

- Croda International Plc (U.K.)

- Innov Oil Pte Ltd. (Singapore)

- IPAC, Inc. (U.S.)

- Jilin Xingyun Chemical Co., Ltd. (China)

- LANXESS (Germany)

- PXL Chemicals (India)

- TRiiSO (India)

What are the Recent Developments in Global Viscosity Index Improvers Market?

- In October 2025, LCY Chemical Corp., a Taiwan-based material science company, showcased its thermoplastic elastomer portfolio at K 2025, highlighting its innovative approach toward sustainable material solutions backed by a strong global distribution network, reflecting the company’s commitment to eco-friendly industrial growth

- In July 2025, Chevron Phillips Chemical announced an expansion of its viscosity index improvers (VII) production capacity to meet the rising demand in automotive and industrial sectors, strengthening its market position and addressing the growing global need for high-performance lubricants

- In July 2025, Chevron Phillips Chemical further confirmed the scaling of its VII production lines to satisfy the increasing industrial and automotive demand, ensuring enhanced supply continuity and supporting long-term market growth

- In April 2025, Lubrizol launched a new line of viscosity index improvers (VIIs) for automotive lubricants, offering superior performance with improved oxidation and thermal stability, providing formulators with advanced options for high-performance engine oils

- In March 2025, ABB successfully completed the Marunda 2.0 oil blending plant expansion project, doubling its production capacity within three years despite pandemic-related challenges, reinforcing its manufacturing resilience and long-term operational efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Viscosity Index Improvers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Viscosity Index Improvers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Viscosity Index Improvers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.