Global Visual Electrophysiology Testing Devices Market

Market Size in USD Million

CAGR :

%

USD

235.60 Million

USD

496.64 Million

2025

2033

USD

235.60 Million

USD

496.64 Million

2025

2033

| 2026 –2033 | |

| USD 235.60 Million | |

| USD 496.64 Million | |

|

|

|

|

Visual Electrophysiology Testing Devices Market Size

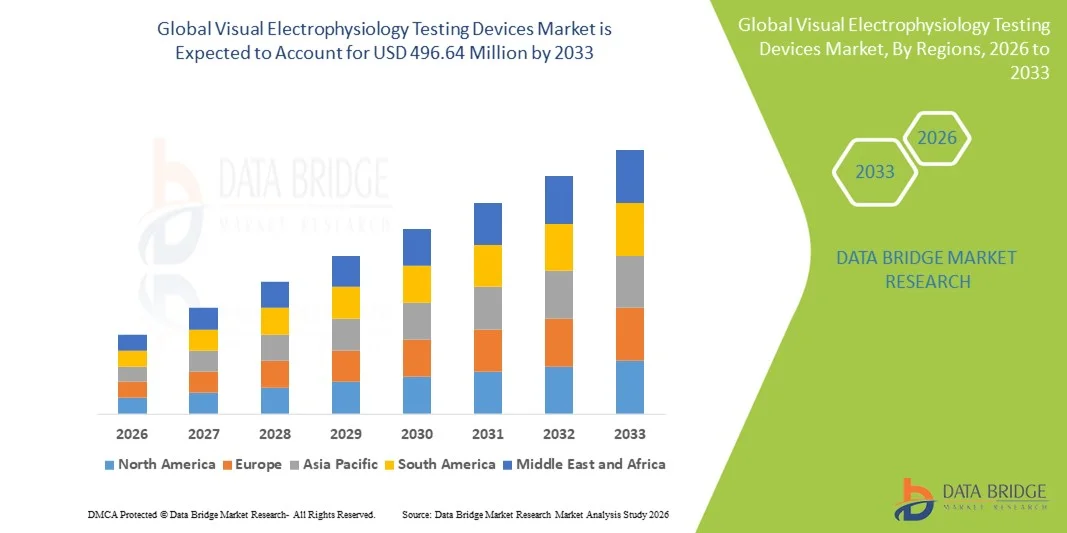

- The global visual electrophysiology testing devices market size was valued at USD 235.60 million in 2025 and is expected to reach USD 496.64 million by 2033, at a CAGR of 9.77% during the forecast period

- The market growth is largely fueled by the increasing prevalence of vision‑related disorders such as glaucoma, diabetic retinopathy, and age‑related macular degeneration, along with rising awareness of early diagnosis and technological advancements in diagnostic ophthalmic equipment that improve accuracy and clinical utility

- Furthermore, growing demand for non‑invasive, high‑precision diagnostic tools in ophthalmology clinics, hospitals, and research centers supported by expanding global healthcare infrastructure continues to establish visual electrophysiology testing devices as critical tools for comprehensive eye function assessment, thereby significantly boosting industry growth

Visual Electrophysiology Testing Devices Market Analysis

- Visual electrophysiology testing devices, such as electroretinography (ERG), visual evoked potential (VEP), and electrooculography (EOG) systems, are increasingly vital in modern ophthalmic diagnostics and research due to their non‑invasive nature, high precision, and ability to assist in early detection of retinal and visual pathway disorders

- The escalating demand for these devices is primarily fueled by the rising prevalence of vision‑related conditions, growing awareness of early diagnosis, and continuous technological advancements that enhance diagnostic accuracy and clinical workflows

- North America dominated the visual electrophysiology testing devices market with the largest revenue share of approximately 36.7% in 2025, driven by advanced healthcare infrastructure, high awareness of eye health diagnostics, and significant adoption of cutting‑edge diagnostic tools, with the U.S. contributing the highest share globally

- Asia‑Pacific is expected to be the fastest‑growing region during the forecast period due to rapid healthcare infrastructure development, increasing prevalence of ocular diseases, and expanding access to advanced diagnostic technologies

- The Electroretinogram (ERG) segment dominated the market with a share of 38.8% in 2025, driven by its established clinical utility in detecting retinal dysfunctions and widespread adoption across ophthalmology practices and research institutions

Report Scope and Visual Electrophysiology Testing Devices Market Segmentation

|

Attributes |

Visual Electrophysiology Testing Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Visual Electrophysiology Testing Devices Market Trends

Integration with AI and Advanced Imaging Platforms

- A significant and accelerating trend in the global visual electrophysiology testing devices market is the integration with artificial intelligence (AI) and advanced imaging platforms, enhancing diagnostic precision, predictive analysis, and clinical decision-making

- For instance, the RETeval system integrates AI-driven analytics with handheld ERG testing, enabling clinicians to detect early retinal dysfunction in diabetic and glaucoma patients rapidly

- AI integration in these devices allows automated signal analysis, pattern recognition for disease progression, and intelligent reporting, while advanced imaging synchronization offers a comprehensive view of retinal and optic nerve function

- The seamless integration of electrophysiology devices with electronic medical records (EMR) and hospital management systems facilitates centralized patient monitoring and longitudinal tracking of disease outcomes

- This trend towards more precise, automated, and interconnected diagnostic tools is reshaping clinical expectations, with companies such as Metrovision and LKC Technologies developing AI-enabled ERG and VEP devices with automated analysis and cloud-based reporting

- The demand for electrophysiology testing systems with AI integration and imaging compatibility is growing across hospitals, ophthalmic clinics, and research centers, as practitioners prioritize early detection and comprehensive patient assessment

- Another notable trend is the integration of electrophysiology data with telemedicine platforms, enabling specialists to remotely monitor patient retinal and visual function in real time

Visual Electrophysiology Testing Devices Market Dynamics

Driver

Rising Prevalence of Vision Disorders and Early Diagnosis Awareness

- The increasing incidence of retinal and optic nerve disorders, combined with rising awareness of early diagnosis and vision preservation, is a significant driver for heightened demand for electrophysiology testing devices

- For instance, in March 2025, LKC Technologies announced a portable ERG system for early glaucoma detection, aiming to improve accessibility in clinics and research institutions

- As patients and clinicians recognize the importance of early detection, electrophysiology devices offer non-invasive, accurate, and objective assessment of retinal and visual pathway functions

- Furthermore, the growing adoption of advanced ophthalmic diagnostic technologies and integration with other imaging modalities are making electrophysiology systems essential in both clinical and research settings

- The convenience of rapid, non-invasive testing, coupled with automated analysis and longitudinal tracking capabilities, is propelling adoption across hospitals, specialized eye clinics, and academic research centers

- Increasing investments in eye care infrastructure and the rising availability of portable and user-friendly devices further support the expansion of the electrophysiology testing market

- Rising government initiatives and public health programs for early vision screening in children and diabetic populations are driving demand for these devices

- The surge in collaborative research between hospitals, universities, and biotech firms to develop novel retinal diagnostics is creating additional opportunities for market growth

Restraint/Challenge

High Device Costs and Technical Expertise Requirement

- The relatively high cost of advanced electrophysiology testing devices, coupled with the need for trained personnel, poses a significant challenge to broader market adoption, particularly in developing regions

- For instance, smaller clinics or low-income healthcare facilities often cannot invest in full-featured ERG or VEP systems due to budget constraints

- Addressing affordability issues through portable, simplified, or lower-cost solutions, while ensuring high diagnostic accuracy, is critical for market expansion

- Furthermore, the complexity of operating and interpreting test results requires trained ophthalmologists or technicians, which can limit adoption in areas with workforce shortages

- While efforts to develop automated and AI-assisted reporting are underway, the need for skilled interpretation and clinical validation still represents a barrier to widespread deployment

- Overcoming these challenges through training programs, cost-effective device development, and AI-assisted interpretation will be vital for sustained growth of the electrophysiology testing devices market

- Regulatory hurdles and stringent compliance requirements across different countries can slow device approval and commercialization

- Limited awareness and adoption among general practitioners and smaller eye clinics, compared to specialized ophthalmology centers, continue to restrict market penetration

Visual Electrophysiology Testing Devices Market Scope

The market is segmented on the basis of test type, modality, and end-user.

- By Test Type

On the basis of test type, the visual electrophysiology testing devices market is segmented into Electroretinogram (ERG), Multifocal Electroretinogram (mfERG), Electro-Oculogram (EOG), and Visual-Evoked Responses (VER). The Electroretinogram (ERG) segment dominated the market with the largest market revenue share of 38.8% in 2025, driven by its widespread clinical adoption and established utility in detecting retinal dysfunctions across multiple ophthalmic conditions such as diabetic retinopathy, glaucoma, and macular degeneration. Hospitals and specialized eye clinics prefer ERG systems due to their ability to provide objective, quantitative retinal function assessment. The segment benefits from high compatibility with both fixed and portable systems, and manufacturers often enhance ERG devices with AI-based signal analysis to improve diagnostic accuracy. The strong demand is also supported by growing investments in eye care infrastructure and routine screening programs. ERG is often integrated into multimodal diagnostic workflows, making it a preferred choice for comprehensive ocular health assessment. Its reliability and versatility in research and clinical settings further consolidate its market dominance.

The Multifocal Electroretinogram (mfERG) segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing demand for localized retinal function mapping and early disease detection. mfERG provides high-resolution retinal topography, allowing clinicians to detect localized retinal dysfunctions before they are clinically apparent. Its adoption is expanding rapidly in academic research, ophthalmic specialty centers, and clinical trials focused on retinal disorders. The growth is also supported by the availability of portable mfERG systems, which facilitate point-of-care testing and teleophthalmology applications. Rising awareness among clinicians of the benefits of mfERG in diagnosing subtle macular diseases contributes to market expansion. Technological advancements improving testing speed and patient comfort further accelerate adoption.

- By Modality

On the basis of modality, the market is segmented into fixed and portable devices. The Fixed segment dominated the market with the largest revenue share in 2025, as these systems are widely used in hospitals, large eye clinics, and research institutions for comprehensive ophthalmic diagnostics. Fixed systems provide stable, high-precision recordings and allow integration with additional imaging technologies such as OCT and fundus cameras. They are preferred for high-volume clinical setups where multiple tests are conducted daily. Fixed devices often offer advanced features including multi-channel recording, automated signal processing, and long-term patient monitoring capabilities. Their reliability, reproducibility, and compatibility with complex clinical workflows drive continued investment in fixed systems. The segment’s dominance is further supported by long-term service contracts and upgrades offered by major manufacturers.

The Portable segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing demand for point-of-care diagnostics, teleophthalmology applications, and accessibility in remote or underserved regions. Portable devices allow clinicians to conduct ERG, mfERG, or VEP testing outside traditional hospital settings, such as community clinics or home visits. The growth is further fueled by compact design, battery operation, and user-friendly interfaces, which reduce the need for specialized training. Rising adoption in emerging markets, combined with telemedicine integration, positions portable devices as a high-growth subsegment. Manufacturers are increasingly developing AI-enabled portable solutions for faster and more accurate analysis.

- By End-User

On the basis of end-user, the market is segmented into hospitals, ambulatory surgical centers, clinics, diagnostic imaging centers, and others. The Hospital segment dominated the market with the largest revenue share in 2025, due to high patient volumes and the need for comprehensive ophthalmic diagnostics across inpatient and outpatient departments. Hospitals often invest in both fixed and portable electrophysiology systems to support screening, diagnosis, and monitoring of retinal and optic nerve diseases. This segment benefits from dedicated ophthalmology departments, specialist staff, and integrated EMR systems, enabling efficient use of electrophysiology devices. Hospitals also conduct research trials and collaborate with manufacturers, supporting adoption of advanced devices such as mfERG and AI-enabled systems. The availability of service and maintenance support from device providers further strengthens hospital dominance. Hospitals remain the primary buyers due to high budgets, long-term contracts, and demand for multi-modality systems.

The Clinics segment is expected to witness the fastest growth from 2026 to 2033, driven by the rising number of specialized eye clinics and ambulatory care centers offering advanced retinal diagnostics. Clinics increasingly adopt portable and compact ERG, mfERG, and VEP systems to provide rapid, non-invasive testing for diabetic, glaucoma, and macular disease patients. The growth is further accelerated by teleophthalmology trends, allowing clinics to offer remote monitoring and consultation services. Patient awareness of early diagnosis and convenience of visiting local clinics contribute to increased adoption. Manufacturers are targeting small-to-medium clinics with affordable and user-friendly devices. Technological advancements reducing setup complexity and improving test speed support rapid adoption in this segment.

Visual Electrophysiology Testing Devices Market Regional Analysis

- North America dominated the visual electrophysiology testing devices market with the largest revenue share of approximately 36.7% in 2025, driven by advanced healthcare infrastructure, high awareness of eye health diagnostics, and significant adoption of cutting‑edge diagnostic tools, with the U.S. contributing the highest share globally

- Clinicians and hospitals in the region highly value the precision, reliability, and non-invasive capabilities of electrophysiology testing devices such as ERG, mfERG, VEP, and EOG, which support early detection and monitoring of retinal and optic nerve disorders

- Widespread adoption is further supported by strong research initiatives, high healthcare expenditure, and integration with electronic medical records (EMR) systems, enabling efficient patient monitoring and long-term disease management, establishing these devices as essential tools in both clinical and research ophthalmology settings

U.S. Visual Electrophysiology Testing Devices Market Insight

The U.S. visual electrophysiology testing devices market captured the largest revenue share of 32% in 2025 within North America, fueled by advanced healthcare infrastructure and early adoption of innovative ophthalmic diagnostic technologies. Clinicians increasingly prioritize early detection of retinal and optic nerve disorders using ERG, mfERG, VEP, and EOG systems. The growing trend of integrating electrophysiology devices with EMR systems and teleophthalmology platforms further drives market expansion. Moreover, hospitals and specialized eye clinics are investing in AI-enabled and portable devices to improve diagnostic efficiency. Rising awareness among patients and healthcare providers regarding preventive eye care is supporting sustained market growth. In addition, research collaborations and clinical trials in ophthalmology are contributing to the uptake of advanced testing devices.

Europe Visual Electrophysiology Testing Devices Market Insight

The Europe visual electrophysiology testing devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the prevalence of age-related macular degeneration and diabetic retinopathy. Government initiatives promoting early vision screening and preventive eye care are fostering adoption across hospitals and clinics. European ophthalmologists value devices offering precise, non-invasive diagnostics combined with integration capabilities for research and clinical monitoring. Growing urbanization, rising disposable incomes, and the demand for high-quality ophthalmic care are further boosting the market. The adoption spans both new hospital setups and renovations with upgraded diagnostic capabilities. Cross-border collaborations and advanced imaging integration are encouraging the use of portable and fixed electrophysiology systems.

U.K. Visual Electrophysiology Testing Devices Market Insight

The U.K. visual electrophysiology testing devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing awareness of early diagnosis for retinal and optic nerve diseases. Hospitals and specialized clinics are adopting ERG, mfERG, and VEP systems to enhance patient care and support research initiatives. The U.K.’s robust healthcare infrastructure and e-health programs are promoting device integration with EMRs and telemedicine solutions. Rising concerns about vision-related disorders among the population are encouraging preventive diagnostic measures. The preference for non-invasive and portable testing systems is increasing in both private clinics and public hospitals. Moreover, technological advancements in automated analysis and cloud reporting are supporting broader adoption.

Germany Visual Electrophysiology Testing Devices Market Insight

The Germany visual electrophysiology testing devices market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of ocular health and technological innovation. Hospitals and eye clinics are increasingly investing in AI-enabled and multimodal electrophysiology devices for precise diagnostics. Germany’s well-developed infrastructure and focus on research in ophthalmology promote adoption of both fixed and portable systems. Integration with advanced imaging technologies and EMRs enhances workflow efficiency and clinical decision-making. Demand is also driven by a growing geriatric population requiring regular eye assessments. In addition, environmental consciousness and energy-efficient device designs are gaining traction in local clinical settings.

Asia-Pacific Visual Electrophysiology Testing Devices Market Insight

The Asia-Pacific visual electrophysiology testing devices market is poised to grow at the fastest CAGR of 12% from 2026 to 2033, driven by rising prevalence of diabetic retinopathy, glaucoma, and other retinal disorders. Countries such as China, Japan, and India are witnessing increasing investments in healthcare infrastructure and ophthalmic diagnostic centers. The growing adoption of portable and AI-enabled devices supports point-of-care diagnostics and teleophthalmology services. Government initiatives promoting early eye screening and digital health integration are facilitating market growth. Rising urbanization, disposable incomes, and technological awareness among healthcare providers are further contributing. The market is also benefiting from partnerships between global manufacturers and local distributors to expand access to affordable solutions.

Japan Visual Electrophysiology Testing Devices Market Insight

The Japan visual electrophysiology testing devices market is gaining momentum due to the country’s technologically advanced healthcare sector and emphasis on preventive eye care. Rapid urbanization and the growing elderly population drive demand for user-friendly, non-invasive diagnostic solutions. Integration of electrophysiology devices with other ophthalmic imaging systems enhances diagnostic accuracy. Hospitals and research centers are increasingly adopting AI-enabled ERG and mfERG devices for early disease detection. The popularity of teleophthalmology and remote patient monitoring supports portable device adoption. Moreover, strong government support for eye health programs is expected to continue driving market expansion.

India Visual Electrophysiology Testing Devices Market Insight

The India visual electrophysiology testing devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising prevalence of diabetes-related eye disorders and rapid urbanization. Growing awareness among patients and healthcare providers regarding early diagnosis is increasing demand for ERG, mfERG, and VEP systems. Hospitals, diagnostic centers, and specialized eye clinics are expanding their ophthalmic diagnostic capabilities, while portable and cost-effective devices are gaining traction in smaller clinics. Government initiatives for digital health and eye care programs support market growth. Availability of affordable devices from domestic and global manufacturers further drives adoption. Expansion of teleophthalmology services and point-of-care testing solutions is expected to continue bolstering the market.

Visual Electrophysiology Testing Devices Market Share

The Visual Electrophysiology Testing Devices industry is primarily led by well-established companies, including:

- LKC Technologies, Inc. (U.S.)

- Diagnosys LLC (U.S.)

- Metrovision (France)

- Roland Consult Stasche & Finger GmbH (Germany)

- Neurosoft (Russia)

- Electro Diagnostic Imaging, Inc. (EDI) (U.S.)

- CSO Italia S.p.A. (Italy)

- Phoenix Research Labs (U.S.)

- Natus Medical Incorporated (U.S.)

- Haag Streit AG (Switzerland)

- Topcon Corporation (Japan)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Heidelberg Engineering GmbH (Germany)

- Optos plc (U.K.)

- Carl Zeiss Meditec AG (Germany)

- Medmont International Pty Ltd (Australia)

- RetiVue, LLC (U.S.)

- Sonomed Escalon (U.S.)

- Ophthalmic Technologies Inc. (U.S.)

What are the Recent Developments in Global Visual Electrophysiology Testing Devices Market?

- In November 2025, Diagnosys LLC highlighted advancements in visual electrophysiology research, including improved preclinical ERG/VEP instruments, open‑source analytical tools such as ERGtools2 for processing and analysing complex data, and identification of potential new biomarkers for optogenetic vision prosthesis effectiveness, underscoring broader research and diagnostic utility of electrophysiology beyond standard clinical use

- In April 2025, researchers published the ERGtools2 package in Doc Ophthalmologica, an open‑source software tool to process, analyse, and store visual electrophysiology datasets, enabling more flexible and reproducible analysis workflows for preclinical and clinical studies, particularly handling complex ERG signals across conditions

- In January 2025, NASA and research partners began applying visual electrophysiology testing aboard the International Space Station (ISS) as part of studies on Spaceflight Associated Neuro‑Ocular Syndrome (SANS), incorporating PERG and PhNR testing to detect subtle optic nerve changes in microgravity, expanding electrophysiology into space medicine

- In March 2023, scientific literature highlighted evolving clinical and research landscapes for electrophysiology, noting development trends in portable, non‑mydriatic ERG/VEP devices and novel analytical methods that improve accessibility, functional assessment sensitivity, and integration with advanced imaging and machine learning workflows

- In August 2021, Metrovision received FDA clearance for its MonPackONE Vision Monitor, a modular vision electrophysiology platform capable of performing full‑field, pattern, and multifocal ERG and VEP testing compliant with ISCEV standards, offering clinicians and researchers a versatile solution for comprehensive visual pathway assessment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.