Global Vitamin K Market

Market Size in USD Billion

CAGR :

%

USD

959.80 Billion

USD

1,624.62 Billion

2024

2032

USD

959.80 Billion

USD

1,624.62 Billion

2024

2032

| 2025 –2032 | |

| USD 959.80 Billion | |

| USD 1,624.62 Billion | |

|

|

|

|

Vitamin K Market Size

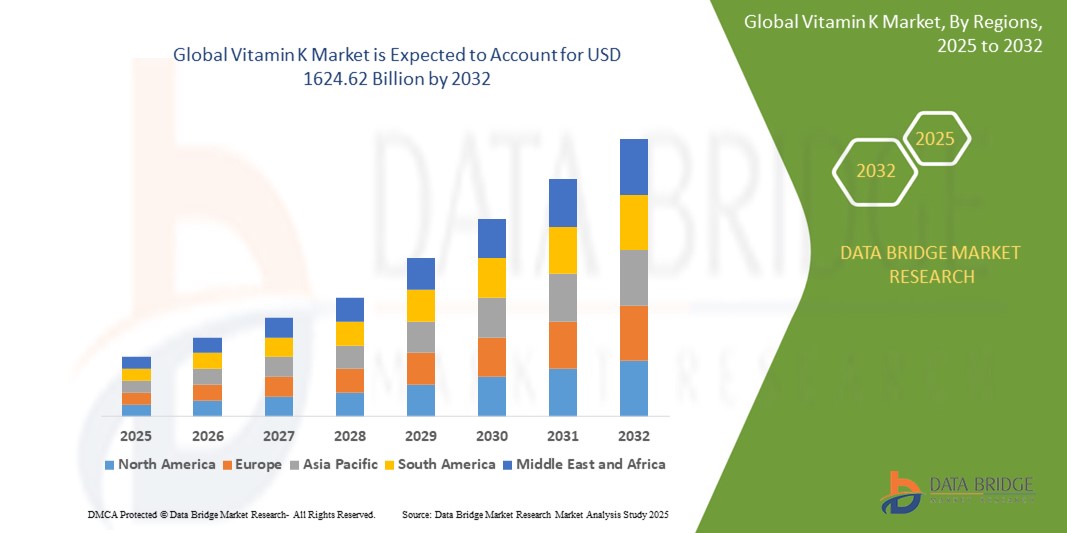

- The global vitamin K market size was valued at USD 959.80 billion in 2024 and is expected to reach USD 1624.62 billion by 2032, at a CAGR of 6.8% during the forecast period

- The market growth is primarily driven by increasing awareness of Vitamin K’s role in bone health, blood clotting, and skin health, coupled with rising consumer demand for dietary supplements and functional foods

- Growing prevalence of osteoporosis and vitamin deficiency disorders, along with advancements in pharmaceutical and nutraceutical formulations, is further propelling market expansion

Vitamin K Market Analysis

- Vitamin K, essential for blood clotting and bone metabolism, is gaining traction in pharmaceutical, nutraceutical, and cosmetic industries due to its diverse applications in treating osteoporosis, VKCFD, VKDB, and dermal conditions

- The surge in demand is fueled by rising health consciousness, aging populations, and increasing adoption of preventive healthcare measures, particularly in dietary supplements and topical skincare products

- Asia-Pacific dominated the Vitamin K market with the largest revenue share of 42.5% in 2024, driven by high consumption of Vitamin K-rich diets, robust nutraceutical industries, and growing awareness of bone and cardiovascular health in countries such as China, Japan, and India

- North America is expected to be the fastest-growing region during the forecast period, attributed to rising health supplement adoption, advanced healthcare infrastructure, and increasing research into Vitamin K2’s benefits for cardiovascular and bone health

- The Vitamin K1 segment dominated the largest market revenue share of 62.3% in 2024, driven by its widespread use in medical applications for blood clotting disorders and its availability in dietary sources such as leafy greens

Report Scope and Vitamin K Market Segmentation

|

Attributes |

Vitamin K Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vitamin K Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global Vitamin K market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics to enhance product development and consumer engagement

- These technologies enable advanced analysis of consumer health data, dietary patterns, and deficiency trends, providing insights into personalized supplementation needs and optimal formulations

- AI-driven platforms are being developed to analyze individual health profiles and recommend tailored Vitamin K supplements, such as Vitamin K2 for bone health or Vitamin K1 for coagulation support, based on specific consumer needs

- For instance, companies are leveraging AI to optimize supply chain logistics for Vitamin K products, predicting demand in regions such as Asia-Pacific, which dominates the market, and North America, the fastest-growing region

- Big Data analytics is also used to monitor clinical trial outcomes, improving the efficacy of Vitamin K supplements for applications such as osteoporosis and Vitamin K Deficiency Bleeding (VKDB)

- This trend enhances the precision and appeal of Vitamin K products, making them more effective for both individual consumers and healthcare providers

Vitamin K Market Dynamics

Driver

“Rising Demand for Nutritional Supplements and Preventive Healthcare”

- Increasing consumer awareness of Vitamin K’s benefits, particularly for bone health (osteoporosis) and blood clotting (VKCFD, prothrombin deficiency, VKDB), is a major driver for the global Vitamin K market

- Vitamin K supplements, available in oral forms (pills, powders, liquids) and topical creams, are gaining popularity due to their role in supporting cardiovascular health and preventing deficiency-related disorders

- Government initiatives and healthcare recommendations, especially in Asia-Pacific, which dominates the market, promote Vitamin K supplementation, particularly for newborns to prevent VKDB

- The rise of e-commerce and direct-to-consumer platforms, particularly in North America, the fastest-growing region, enhances accessibility to Vitamin K products, driving market growth

- The aging global population and increasing prevalence of chronic diseases, such as osteoporosis and cardiovascular issues, further fuel demand for Vitamin K1 and K2 supplements and fortified foods

Restraint/Challenge

“High Production Costs and Data Privacy Concerns”

- The high costs associated with manufacturing, quality control, and distribution of Vitamin K products, particularly for pharmaceutical-grade injectables (parenteral) and organic-certified formulations, pose a significant barrier to market adoption, especially in cost-sensitive emerging markets

- Developing and scaling specialized Vitamin K2 products, such as MK-7 for bone health, requires substantial investment in research and development

- Data privacy concerns arise from the use of AI and Big Data to collect and analyze consumer health data for personalized Vitamin K supplementation, raising risks of breaches or misuse of sensitive information

- Compliance with varying regional regulations, such as data protection laws in North America and Asia-Pacific, complicates operations for global manufacturers and increases costs

- These challenges may deter smaller manufacturers and limit market expansion in regions with high cost sensitivity or stringent data privacy regulations

Vitamin K market Scope

The market is segmented on the basis of type, application, route of administration, and mode of consumption.

- By Type

On the basis of type, the global vitamin k market is segmented into vitamin k1 and vitamin k2. The vitamin k1 segment dominated the largest market revenue share of 62.3% in 2024, driven by its widespread use in medical applications for blood clotting disorders and its availability in dietary sources such as leafy greens. Vitamin K1 is critical in pharmaceutical formulations for treating conditions such as Vitamin K Deficiency Bleeding (VKDB) and prothrombin deficiency.

The vitamin k2 segment is expected to witness the fastest growth rate from 2025 to 2032, with a CAGR of 15.8%, fueled by increasing awareness of its benefits in bone health and cardiovascular health. Vitamin K2’s role in directing calcium to bones and preventing arterial calcification is driving its adoption in supplements and functional foods.

- By Application

On the basis of application, the global vitamin k market is segmented into osteoporosis, vitamin-K dependent clotting factor deficiency (VKCFD), dermal applications, prothrombin deficiency, and vitamin k deficiency bleeding (VKDB). The Osteoporosis segment accounted for the largest market revenue share of 38.7% in 2024, driven by the rising prevalence of osteoporosis, particularly in aging populations, and the critical role of Vitamin K in bone mineralization and fracture prevention.

The vitamin k deficiency bleeding (VKDB) segment is anticipated to experience the fastest growth from 2025 to 2032, driven by increasing neonatal screening programs and rising awareness of VKDB prevention in newborns. The growing adoption of Vitamin K prophylaxis in healthcare systems globally further supports this segment’s growth.

- By Route of Administration

On the basis of route of administration, the global vitamin k market is segmented into oral, topical, and parenteral. The Oral segment dominated the market with a revenue share of 65.4% in 2024, owing to the widespread availability of oral Vitamin K supplements, such as tablets and capsules, and their ease of consumption for both medical and dietary purposes.

The parenteral segment is expected to witness the fastest growth rate of 16.2% from 2025 to 2032, driven by its critical use in clinical settings for rapid treatment of severe Vitamin K deficiencies, such as VKCFD and VKDB. The increasing adoption of injectable Vitamin K in hospitals and clinics is a key growth driver.

- By Mode of Consumption

On the basis of mode of consumption, the global vitamin k market is segmented into pills, powders, creams, and liquids. The pills segment held the largest market revenue share of 55.8% in 2024, due to their convenience, precise dosage, and widespread use in both over-the-counter and prescription-based Vitamin K supplements.

The liquids segment is anticipated to register the fastest growth from 2025 to 2032, with a CAGR of 17.1%, driven by increasing demand for liquid Vitamin K formulations in pediatric and geriatric populations. Liquids offer ease of administration and better absorption, making them a preferred choice for specific consumer groups.

Vitamin K Market Regional Analysis

- Asia-Pacific dominated the Vitamin K market with the largest revenue share of 42.5% in 2024, driven by high consumption of Vitamin K-rich diets, robust nutraceutical industries, and growing awareness of bone and cardiovascular health in countries such as China, Japan, and India

- Consumers prioritize Vitamin K products for supporting bone density, blood clotting, and skin health, particularly in regions with aging populations and rising health consciousness.

- Growth is supported by advancements in product formulations, such as bioavailable Vitamin K2 variants, and increasing adoption in pharmaceuticals, nutraceuticals, and cosmetic applications

U.S. Vitamin K Market Insight

The U.S. vitamin K market is expected to witness significant growth, fueled by strong demand for dietary supplements and growing consumer awareness of Vitamin K’s role in osteoporosis prevention and cardiovascular health. The trend towards preventive healthcare and increasing use of Vitamin K in clinical settings for Vitamin K Deficiency Bleeding (VKDB) and prothrombin deficiency further boost market expansion. The rise in demand for oral and parenteral Vitamin K products supports a robust market ecosystem.

Europe Vitamin K Market Insight

The Europe Vitamin K market is experiencing significant growth, driven by a focus on bone health and regulatory support for nutraceuticals. Consumers seek Vitamin K1 and K2 supplements for osteoporosis management and cardiovascular benefits. Growth is prominent in pharmaceutical and dermal applications, with countries such as Germany and France showing notable adoption due to rising health awareness and aging populations.

U.K. Vitamin K Market Insight

The U.K. market for Vitamin K is expected to grow steadily, driven by increasing demand for supplements targeting bone health and blood clotting disorders. Consumers are drawn to Vitamin K2 for its cardiovascular benefits and Vitamin K1 for VKDB prevention. Evolving regulations on health supplements and growing interest in topical Vitamin K creams for skin health further encourage market growth.

Germany Vitamin K Market Insight

Germany is a key player in the Europe Vitamin K market, with strong growth attributed to its advanced pharmaceutical industry and consumer focus on preventive healthcare. German consumers prefer high-quality Vitamin K2 supplements for bone and heart health, alongside Vitamin K1 for clotting factor deficiencies. The integration of Vitamin K in both medical and cosmetic applications supports sustained market expansion.

Asia-Pacific Vitamin K Market Insight

The Asia-Pacific region dominates the global Vitamin K market, driven by increasing health awareness, rising disposable incomes, and growing demand for dietary supplements in countries such as China, India, and Japan. The focus on osteoporosis prevention, cardiovascular health, and VKDB management fuels demand for Vitamin K1 and K2 products. Government initiatives promoting nutritional health and expanding pharmaceutical industries further enhance market growth.

Japan Vitamin K Market Insight

Japan’s Vitamin K market is expected to grow rapidly, driven by strong consumer preference for high-quality Vitamin K2 supplements that support bone and cardiovascular health. The presence of major pharmaceutical and nutraceutical manufacturers accelerates market penetration. Rising demand for oral supplements and topical Vitamin K products for dermal applications also contributes to market expansion.

China Vitamin K Market Insight

China holds the largest share of the Asia-Pacific Vitamin K market, propelled by rapid urbanization, increasing health consciousness, and a growing aging population. The demand for Vitamin K1 for VKDB prevention and Vitamin K2 for osteoporosis and cardiovascular health drives market growth. Strong domestic manufacturing capabilities and competitive pricing enhance accessibility to Vitamin K products across pills, powders, creams, and liquids.

Vitamin K Market Share

The vitamin K industry is primarily led by well-established companies, including:

- DSM (Netherlands)

- BASF SE (Germany)

- Lonza Group (Switzerland)

- Glanbia Plc (Ireland)

- ADM (U.S.)

- Farbest Brands (U.S.)

- SternVitamin GmbH & Co. K.G. (Germany)

- Adisseo (France)

- BTSA Biotechnologias Aplicadas S.L. (Spain)

- Rabar Pty Ltd (Australia)

- Kappa Bioscience AS (U.S.)

- Viridis BioPharma (India)

- GeneFerm Biotechnology Co., Ltd. (Taiwan)

- Goodscend Pharm. Sci & Tech. Co,Ltd (China)

- SEEBIO BIOTECH (SHANGHAI) CO.,LTD. (China)

What are the Recent Developments in Global Vitamin K Market?

- In June 2025, Daesang's global kimchi brand Jongga unveiled a gourmet kimchi line in the U.S. through a collaboration with Michelin 3-star chef Corey Lee. Named San Ho Won Kimchi, the line features two premium varieties that blend Jongga’s 38 years of fermentation expertise with Chef Lee’s culinary artistry. This partnership highlights kimchi’s evolving role in global cuisine, offering bold, refined flavors. As kimchi undergoes fermentation, it can also become a source of vitamin K2 (menaquinone), a nutrient produced by certain bacteria during the process

- In March 2025, SunWay Biotech and Gnosis by Lesaffre announced a strategic partnership to launch MenaQ7® Metabolic, their first joint product targeting the global vitamin K2 market. This innovative formulation combines MenaQ7® Vitamin K2 as MK-7, known for its clinically proven benefits for bone and heart health, with ANKASCIN® 568-R, a red yeast rice fermentation ingredient uniquely free of Monacolin K (statin). The collaboration aims to deliver high-quality, science-backed nutraceutical ingredients to meet growing global demand and support metabolic health through advanced fermentation technologies

- In October 2023, Smidge® Small Batch Supplements introduced a new premium product: grass-fed Australian Emu Oil softgels. Sustainably sourced from heritage-bred emus in Southeast Australia, this small-batch supplement delivers vitamin K2 (MK-4) in its most bioavailable form. Each serving contains 1,500 mg of pure emu oil, including 6.4 mcg of vitamin K2, along with naturally occurring omega fatty acids. The oil is gently rendered at low temperatures to preserve its nutritional integrity, supporting collagen production, as well as skin, bone, and dental health

- In November 2023, Abbott introduced a new formulation of PediaSure featuring its proprietary Nutri-Pull System—a blend of vitamin K2, vitamin D, vitamin C, and casein phosphopeptides (CPPs). This innovative system is designed to enhance nutrient absorption and support catch-up growth in children, particularly those facing nutritional gaps. By improving the bioavailability of essential nutrients, the product aims to address undernutrition and promote healthy development during critical growth phases

- In June 2022, Balchem Corporation signed a definitive agreement to acquire Kappa Bioscience AS, a Norwegian manufacturer renowned for its science-based vitamin K2 (MK-7) solutions. The deal, valued at approximately USD 338 million, was finalized later that month. This strategic acquisition enhances Balchem’s footprint in the human nutrition and health sector by integrating Kappa’s flagship K2VITAL® brand—recognized for its purity, stability, and clinical backing—into its portfolio. The move also expands Balchem’s global reach and research capabilities, reinforcing its commitment to delivering high-quality, specialty nutrients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Vitamin K Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Vitamin K Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Vitamin K Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.