Global Wafer Testing Services Market

Market Size in USD Billion

CAGR :

%

USD

13.83 Billion

USD

22.22 Billion

2025

2033

USD

13.83 Billion

USD

22.22 Billion

2025

2033

| 2026 –2033 | |

| USD 13.83 Billion | |

| USD 22.22 Billion | |

|

|

|

|

What is the Global Wafer Testing Services Market Size and Growth Rate?

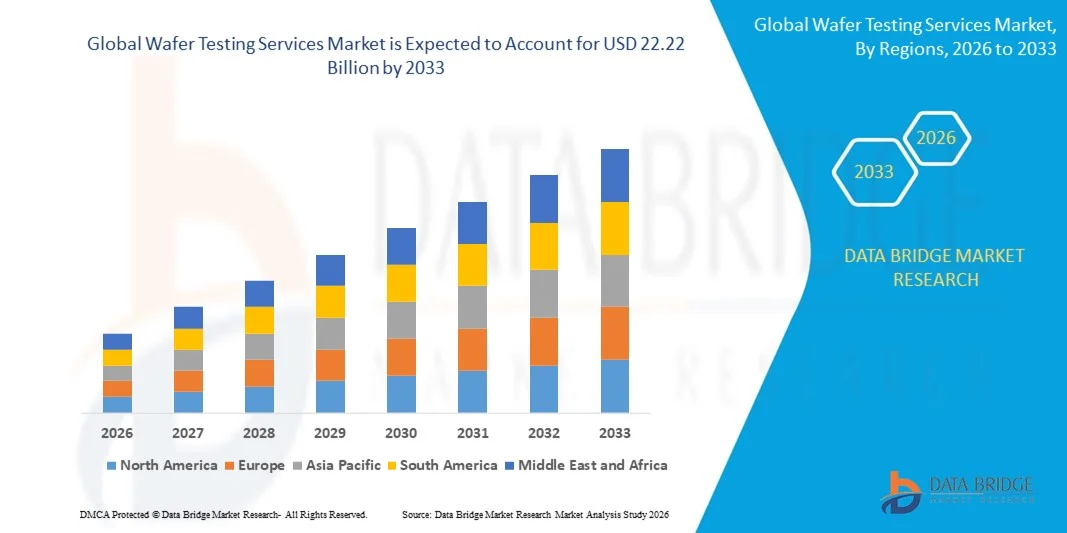

- The global wafer testing services market size was valued at USD 13.83 billion in 2025 and is expected to reach USD 22.22 billion by 2033, at a CAGR of12.30% during the forecast period

- Increasing demand of silicon on insulator (SOI) and glass wafers in consumer electronics, growing usages of silicon wafers in internet of things related devices, rising usages of multifunctional integrated circuits (IC), increasing growth of the semiconductor industry across the globe, increasing demand of light-emitting diode, CMOS image sensors, and microelectromechanical systems, among chipmaker, growing demand for semiconductors by the automotive industry are some of the major as well as vital factors which will such asly to augment the growth of the wafer testing services market

What are the Major Takeaways of Wafer Testing Services Market?

- Wafers are used for various applications within an autonomous cars including navigation control, infotainment systems, and collision detections, along with rising demand of MOSFETs, thyristors, varistors and diodes chips from the automotive industries which will further contribute by generating massive opportunities that will lead to the growth of the wafer testing services market

- Asia-Pacific dominated the wafer testing services market with a revenue share of around 41.36% in 2025, driven by the presence of leading semiconductor foundries, OSAT providers, and large-scale electronics manufacturing ecosystems across China, Taiwan, Japan, South Korea, and Southeast Asia

- North America is projected to register the fastest of 9.14% CAGR from 2026 to 2033, driven by growing semiconductor R&D, increasing fab investments, and rising demand for advanced testing in AI, automotive, aerospace, and defense applications

- The Services segment dominated the market with a share of around 41.6% in 2025, as semiconductor manufacturers increasingly outsource wafer testing to specialized OSATs and service providers to reduce capital expenditure and improve time-to-market

Report Scope and Wafer Testing Services Market Segmentation

|

Attributes |

Wafer Testing Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Wafer Testing Services Market?

Increasing Shift Toward Advanced, Automated, and High-Precision Wafer Testing Services

- The wafer testing services market is witnessing rising adoption of automated, high-throughput, and precision testing solutions designed to support advanced logic, memory, AI chips, and heterogeneous semiconductor architectures

- Service providers are integrating advanced probe cards, AI-driven analytics, and real-time defect detection systems to improve yield, accuracy, and test efficiency across wafer-level testing processes

- Growing demand for cost-efficient, scalable, and fast turnaround testing services is driving adoption across foundries, fabless companies, IDM manufacturers, and OSAT providers

- For instance, companies such as TSMC, ASE Group, Amkor Technology, JCET Group, and Powertech Technology are expanding advanced wafer test capabilities for leading-edge and mature-node semiconductors

- Increasing need for high-speed validation, yield optimization, and early defect identification is accelerating the shift toward automated and data-driven wafer testing services

- As semiconductor devices become smaller, more complex, and performance-intensive, Wafer Testing Services will remain critical for ensuring reliability, yield improvement, and faster time-to-market

What are the Key Drivers of Wafer Testing Services Market?

- Rising demand for advanced semiconductor devices across AI, 5G, automotive electronics, EVs, consumer electronics, and high-performance computing applications

- For instance, in 2024–2025, leading OSAT and foundry players such as ASE Group, Amkor Technology, and JCET Group invested in next-generation probe technologies and high-parallel wafer test platforms

- Growing complexity of advanced packaging, chiplets, 3D ICs, and heterogeneous integration is increasing the need for comprehensive wafer-level testing

- Advancements in test automation, data analytics, AI-driven yield analysis, and high-density probe cards have enhanced testing accuracy, speed, and scalability

- Rising production of AI processors, memory devices, and high-speed logic chips is driving demand for high-throughput and high-precision wafer testing services

- Supported by continuous investments in semiconductor fabrication, advanced nodes, and testing infrastructure, the Wafer Testing Services market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Wafer Testing Services Market?

- High costs associated with advanced wafer probing equipment, high-parallel test systems, and specialized probe cards limit adoption among smaller semiconductor manufacturers

- For instance, during 2024–2025, fluctuations in semiconductor equipment prices, material shortages, and longer lead times increased operational costs for several global wafer testing service providers

- Complexity in testing advanced nodes, mixed-signal ICs, RF devices, and high-speed interfaces increases dependence on skilled engineers and specialized expertise

- Limited availability of standardized testing methodologies for emerging technologies such as chiplets and 3D ICs creates operational challenges

- Competition from in-house testing by large IDMs and foundries, along with pricing pressure from global OSAT players, impacts service margins

- To address these challenges, companies are focusing on automation, AI-enabled analytics, cost-optimized testing flows, and strategic capacity expansion to enhance global adoption of wafer testing services

How is the Wafer Testing Services Market Segmented?

The market is segmented on the basis of component, type, and vertical.

- By Component

On the basis of component, the wafer testing services market is segmented into Wafer Testing Prober, Services, Integration and Deployment, Consulting, and Support and Maintenance. The Services segment dominated the market with a share of around 41.6% in 2025, as semiconductor manufacturers increasingly outsource wafer testing to specialized OSATs and service providers to reduce capital expenditure and improve time-to-market. Testing services offer high scalability, access to advanced probing technologies, and flexibility across different node sizes and device types.

The Wafer Testing Prober segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for advanced probers capable of handling fine-pitch wafers, high pin counts, and advanced packaging technologies such as chiplets and 3D ICs. Increasing investments in automation and precision probing further support segment growth.

- By Type

On the basis of type, the market is segmented into Parametric Test and Product Sort Test. The Parametric Test segment dominated the market with a 54.3% share in 2025, as it is essential for evaluating transistor performance, leakage currents, threshold voltages, and process stability during early manufacturing stages. Parametric testing plays a critical role in yield learning, process optimization, and defect identification, making it widely adopted across foundries and IDMs.

The Product Sort Test segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing semiconductor volumes and growing need to classify good and defective dies before packaging. Rising production of AI chips, memory devices, and automotive ICs is accelerating demand for high-throughput product sorting.

- By Vertical

On the basis of vertical, the wafer testing services market is segmented into Military & Defence, Consumer Electronics, Automotive, Manufacturing, and Others. The Consumer Electronics segment dominated the market with a share of approximately 38.9% in 2025, driven by high-volume production of smartphones, tablets, PCs, wearables, and smart devices. Frequent product refresh cycles and shrinking node sizes require extensive wafer-level testing to ensure performance and reliability.

The Automotive segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising adoption of EVs, ADAS, infotainment systems, and automotive-grade semiconductors. Stringent quality standards and safety requirements are significantly increasing reliance on advanced wafer testing services across the automotive electronics value chain.

Which Region Holds the Largest Share of the Wafer Testing Services Market?

- Asia-Pacific dominated the wafer testing services market with a revenue share of around 41.36% in 2025, driven by the presence of leading semiconductor foundries, OSAT providers, and large-scale electronics manufacturing ecosystems across China, Taiwan, Japan, South Korea, and Southeast Asia. High-volume production of logic ICs, memory devices, automotive semiconductors, and consumer electronics continues to fuel strong demand for wafer testing services across fabrication and packaging stages

- Leading companies in the region are expanding advanced wafer probing, parametric testing, and high-throughput sorting capabilities to support shrinking node sizes and advanced packaging technologies. Continuous investments in semiconductor fabs, testing infrastructure, and automation further strengthen Asia-Pacific’s market leadership

- Strong supply chain integration, skilled technical workforce, and government-backed semiconductor initiatives reinforce the region’s dominant position

China Wafer Testing Services Market Insight

China is the largest contributor in Asia-Pacific, supported by massive semiconductor investments, expanding domestic fabs, and strong government support for chip self-sufficiency. Rising production of AI chips, memory devices, and high-speed logic ICs drives demand for advanced wafer testing services with higher accuracy and throughput. Local OSAT capacity expansion and cost competitiveness further boost market adoption.

Japan Wafer Testing Services Market Insight

Japan shows steady growth driven by precision electronics manufacturing, strong semiconductor materials expertise, and continuous modernization of automotive and industrial electronics. High reliability standards and demand for advanced testing solutions support sustained market expansion.

South Korea Wafer Testing Services Market Insight

South Korea contributes significantly due to strong demand from memory, advanced processors, and 5G-related semiconductor production. Ongoing innovation in AI, automotive electronics, and high-performance computing supports rising wafer testing requirements.

India Wafer Testing Services Market Insight

India is emerging as a growth hub with expanding semiconductor design centers, OSAT investments, and government-backed manufacturing initiatives. Rising demand for automotive electronics, IoT devices, and telecom equipment accelerates wafer testing adoption.

North America Wafer Testing Services Market

North America is projected to register the fastest of 9.14% CAGR from 2026 to 2033, driven by growing semiconductor R&D, increasing fab investments, and rising demand for advanced testing in AI, automotive, aerospace, and defense applications. Expansion of domestic chip manufacturing, adoption of advanced nodes, and strong innovation ecosystems continue to accelerate market growth.

U.S. Wafer Testing Services Market Insight

The U.S. is the primary growth engine in North America, supported by rising investments in advanced semiconductor fabs, strong AI and HPC development, and increasing reliance on outsourced wafer testing services.

Canada Wafer Testing Services Market Insight

Canada supports regional growth through expanding semiconductor R&D activities, university-led innovation, and growing adoption of advanced electronics testing across telecom, automotive, and industrial applications.

Which are the Top Companies in Wafer Testing Services Market?

The wafer testing services industry is primarily led by well-established companies, including:

- Amkor Technology (U.S.)

- Taiwan Semiconductor Manufacturing Company Limited (Taiwan)

- ASE Group (Taiwan)

- JCET Group Co., Ltd. (China)

- Powertech Technology Inc. (Taiwan)

- Eg Systems Inc. (U.S.)

- MICRONICS JAPAN CO., LTD. (Japan)

- Synergie Cad (France)

- CriteriaLabs (U.S.)

- Integra Technologies (U.S.)

- Bluetest Testservice GmbH (Germany)

- Unisem (M) Berhad (Malaysia)

- Siliconware Precision Industries Co., Ltd. (Taiwan)

- Chipbond Technology Corporation (Taiwan)

- Integrated Micro-Electronics, Inc. (Philippines)

- King Yuan ELECTRONICS CO., LTD. (Taiwan)

- UTAC (Singapore)

- Tongfu Microelectronics Co., Ltd. (China)

- Tianshui Huatian Electronic Group CO., LTD. (HTME) (China)

What are the Recent Developments in Global Wafer Testing Services Market?

- In February 2024, U.S.-based semiconductor packaging and testing provider Amkor Technology announced plans to build a new advanced packaging and testing facility in Arizona to support growing domestic semiconductor demand and strengthen supply chain resilience, reinforcing Amkor’s long-term commitment to advanced packaging capacity expansion in North America

- In August 2023, Taiwan-based TSMC, in collaboration with Infineon Technologies AG, Robert Bosch GmbH, and NXP Semiconductors N.V., revealed a joint investment plan in the European Semiconductor Manufacturing Company to deliver advanced semiconductor manufacturing services in Europe, marking a strategic move to expand regional manufacturing capabilities and reduce supply chain dependencies

- In October 2022, Advanced Semiconductor Engineering, Inc. (ASE) introduced its Fan-Out Chip on Substrate packaging solution featuring an encapsulate-separated redistribution layer and chip-last architecture, enabling higher performance and design flexibility, strengthening ASE’s portfolio of next-generation advanced semiconductor packaging technologies

- In March 2022, Unisem expanded its semiconductor production facility in Gopeng, Malaysia, installing advanced equipment to meet rising market demand and doubling production capacity at its Ipoh operations, supporting Unisem’s growth strategy and increasing its ability to serve global semiconductor customers efficiently

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wafer Testing Services Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wafer Testing Services Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wafer Testing Services Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.