Global Wet Scrubber Market

Market Size in USD Billion

CAGR :

%

USD

1.76 Billion

USD

3.46 Billion

2025

2033

USD

1.76 Billion

USD

3.46 Billion

2025

2033

| 2026 –2033 | |

| USD 1.76 Billion | |

| USD 3.46 Billion | |

|

|

|

|

Wet Scrubber Market Size

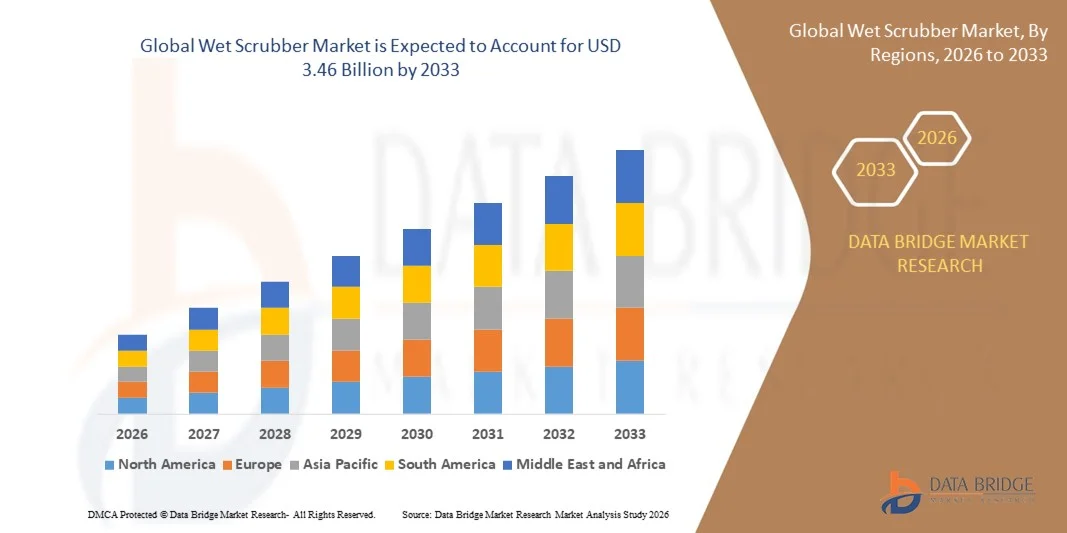

- The global wet scrubber market size was valued at USD 1.76 billion in 2025 and is expected to reach USD 3.46 billion by 2033, at a CAGR of 8.83% during the forecast period

- The market growth is primarily driven by the tightening of industrial emission regulations and increasing enforcement of air quality standards across power generation, chemical, cement, and refinery industries, compelling operators to adopt efficient gas cleaning technologies

- Furthermore, rising industrialization, expansion of power and refinery capacity, and growing awareness of environmental and worker safety are accelerating the deployment of wet scrubber systems, thereby significantly supporting overall market growth

Wet Scrubber Market Analysis

- Wet scrubbers, designed to remove particulate matter, acidic gases, and hazardous pollutants from industrial exhaust streams, have become critical components of air pollution control systems across heavy industries due to their high removal efficiency and ability to handle high-temperature and corrosive gases

- The increasing demand for wet scrubbers is largely fueled by stricter sulfur oxide and particulate emission limits, growth in retrofit and plant upgrade projects, and the need for reliable, proven technologies to ensure long-term regulatory compliance and operational sustainability

- Asia-Pacific dominated the wet scrubber market with a share of 36.6% in 2025, due to rapid industrialization, expanding power generation capacity, and strict emission control norms across major manufacturing economies

- North America is expected to be the fastest growing region in the wet scrubber market during the forecast period due to strict environmental regulations, refurbishment of aging industrial infrastructure, and rising investments in emission control technologies

- Packed bed scrubber segment dominated the market with a market share of 44.9% in 2025, due to their high efficiency in removing gaseous pollutants and soluble contaminants. These systems are extensively used in chemical processing and refinery operations where precise control of emissions is required. Their structured packing enhances mass transfer, enabling compliance with stringent emission norms. Lower operating costs and stable performance across varying load conditions further strengthen adoption

Report Scope and Wet Scrubber Market Segmentation

|

Attributes |

Wet Scrubber Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wet Scrubber Market Trends

Rising Adoption of Advanced and Energy-Efficient Wet Scrubber Systems

- A major trend shaping the wet scrubber market is the increasing adoption of advanced and energy-efficient systems as industries focus on reducing emissions while controlling operational costs. Modern wet scrubbers are being designed with improved gas–liquid contact efficiency, optimized pressure drops, and enhanced material durability to support long-term industrial operations

- For instance, ALFA LAVAL has developed high-efficiency wet scrubber solutions for marine and industrial applications that help operators meet sulfur emission limits while minimizing energy consumption and water usage. These systems are increasingly adopted across shipping, power generation, and refinery sectors to balance compliance and operational efficiency

- The power generation sector is progressively integrating upgraded wet flue gas desulfurization systems to reduce sulfur oxide emissions while improving energy performance. Utilities are prioritizing scrubber retrofits that enhance removal efficiency without significantly increasing auxiliary power demand

- Refinery and petrochemical operators are adopting energy-optimized wet scrubbers to manage corrosive and high-temperature exhaust streams more efficiently. This trend supports stable operations while aligning facilities with evolving emission regulations

- Technological improvements such as digital monitoring, automated flow control, and optimized reagent usage are becoming integral to next-generation wet scrubber systems. These advancements enable better process control and reduced downtime

- The growing emphasis on sustainability and energy efficiency across heavy industries is reinforcing this trend, positioning advanced wet scrubbers as preferred solutions for long-term emission control and regulatory compliance

Wet Scrubber Market Dynamics

Driver

Stringent Industrial Emission Regulations and Air Quality Compliance Requirements

- The primary driver of the wet scrubber market is the enforcement of stringent emission regulations targeting sulfur oxides, particulate matter, and acidic gases across industrial sectors. Governments and environmental agencies are mandating stricter compliance, compelling industries to adopt reliable pollution control technologies

- For instance, Babcock & Wilcox Enterprises supplies wet flue gas desulfurization systems that support power plants and refineries in meeting regulatory sulfur emission limits. These systems play a critical role in enabling large-scale industrial facilities to operate within permissible emission thresholds

- The cement and chemical industries face increasing pressure to control particulate and acidic gas emissions, driving consistent demand for wet scrubber installations. Regulatory audits and penalties for non-compliance are accelerating adoption across both new installations and retrofit projects

- Refineries and petrochemical plants are expanding their use of wet scrubbers to comply with sulfur recovery and exhaust gas treatment standards. These regulations require robust systems capable of handling variable gas compositions and high pollutant loads

- Environmental compliance requirements are also influencing investment decisions, with industries prioritizing proven technologies that ensure long-term regulatory adherence. This sustained regulatory pressure continues to act as a strong growth driver for the wet scrubber market

Restraint/Challenge

High Capital Investment and Operational Maintenance Costs

- The wet scrubber market faces challenges due to the high initial capital investment required for system installation, including equipment, structural modifications, and integration with existing exhaust systems. These costs can be a barrier for small and mid-sized industrial operators

- For instance, large-scale wet scrubber installations supplied by companies such as HAMON for power and industrial plants require significant upfront expenditure, particularly for corrosion-resistant materials and large absorber units. This limits adoption in cost-sensitive markets

- Operational and maintenance costs further add to the challenge, as wet scrubbers require continuous water supply, reagent consumption, and regular maintenance to prevent scaling and corrosion. These ongoing expenses increase the total cost of ownership

- Facilities operating in regions with limited water availability face additional constraints due to the water-intensive nature of wet scrubber systems. Managing wastewater and sludge disposal also contributes to operational complexity

- The challenge of balancing regulatory compliance with cost efficiency continues to influence purchasing decisions. These factors collectively restrain rapid adoption in certain regions, despite the proven effectiveness of wet scrubber technologies

Wet Scrubber Market Scope

The market is segmented on the basis of orientation, product type, application, and end use.

- By Orientation

On the basis of orientation, the wet scrubber market is segmented into vertical and horizontal systems. The vertical segment dominated the market with the largest revenue share in 2025, driven by its compact footprint, higher gas–liquid contact efficiency, and suitability for installations with space constraints. Vertical wet scrubbers are widely adopted in power plants, cement facilities, and chemical units due to their ability to handle high-temperature exhaust streams while ensuring effective particulate and gas removal. Their ease of integration with existing stack systems and lower structural modification requirements further support dominance. In addition, vertical designs support better drainage and reduced clogging risks, improving long-term operational reliability.

The horizontal segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption in large-scale industrial facilities with high gas flow volumes. Horizontal wet scrubbers offer extended residence time for pollutants, improving removal efficiency for complex emissions. Their suitability for handling sticky or corrosive particulates and ease of maintenance access makes them attractive for expanding industrial applications.

- By Product Type

On the basis of product type, the wet scrubber market is segmented into packed bed scrubbers, venturi scrubbers, spray scrubbers, and others. Packed bed scrubbers accounted for the largest market revenue share of 44.9% in 2025 due to their high efficiency in removing gaseous pollutants and soluble contaminants. These systems are extensively used in chemical processing and refinery operations where precise control of emissions is required. Their structured packing enhances mass transfer, enabling compliance with stringent emission norms. Lower operating costs and stable performance across varying load conditions further strengthen adoption.

Venturi scrubbers are anticipated to grow at the fastest rate during the forecast period, driven by their superior performance in capturing fine particulates and high dust loads. Their ability to handle fluctuating gas flows and high-temperature exhaust streams makes them ideal for cement and metallurgical industries. Increasing regulatory pressure on particulate emissions accelerates demand for venturi-based solutions.

- By Application

On the basis of application, the wet scrubber market is segmented into on-shore and off-shore installations. The on-shore segment dominated the market in 2025, supported by widespread deployment across power generation, cement manufacturing, and chemical processing facilities. On-shore wet scrubbers benefit from easier installation, routine maintenance access, and compatibility with large-scale emission control systems. Industrial expansion and modernization of existing plants further reinforce demand. The availability of skilled labor and established infrastructure enhances operational efficiency.

The off-shore segment is projected to register the fastest growth from 2026 to 2033, driven by rising investments in off-shore oil and gas exploration and production. Stringent marine emission regulations and the need for compact, corrosion-resistant pollution control systems support adoption. Off-shore platforms increasingly rely on wet scrubbers to meet environmental compliance while maintaining operational safety.

- By End Use

On the basis of end use, the wet scrubber market is segmented into power generation, chemical, cement, refinery and petrochemicals, pulp and paper, and others. Power generation emerged as the dominant end-use segment in 2025 due to high flue gas volumes and strict emission standards for sulfur oxides and particulate matter. Wet scrubbers play a critical role in enabling thermal power plants to comply with environmental mandates while maintaining operational efficiency. Continuous capacity additions and retrofitting of existing plants sustain demand.

The refinery and petrochemicals segment is expected to witness the fastest growth over the forecast period, driven by expanding refining capacity and tighter emission control regulations. Wet scrubbers are increasingly deployed to manage complex gaseous emissions and corrosive exhaust streams. Rising investments in cleaner fuel production and emission reduction technologies further accelerate market growth in this segment.

Wet Scrubber Market Regional Analysis

- Asia-Pacific dominated the wet scrubber market with the largest revenue share of 36.6% in 2025, driven by rapid industrialization, expanding power generation capacity, and strict emission control norms across major manufacturing economies

- The region’s strong presence of cement, chemical, and refinery industries, along with increasing investments in air pollution control infrastructure, is accelerating wet scrubber adoption

- Favorable government regulations on industrial emissions, availability of cost-effective manufacturing, and growing environmental awareness are contributing to widespread deployment of wet scrubber systems

China Wet Scrubber Market Insight

China held the largest share in the Asia-Pacific wet scrubber market in 2025, supported by its massive industrial base, high concentration of coal-fired power plants, and stringent emission reduction mandates. The country’s focus on reducing sulfur oxides and particulate emissions from cement, steel, and chemical facilities continues to drive demand. Ongoing upgrades of existing plants and investments in advanced pollution control technologies further strengthen market growth.

India Wet Scrubber Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding power generation capacity, rapid growth of cement and chemical industries, and tightening environmental regulations. Government initiatives targeting air quality improvement and industrial emission compliance are accelerating wet scrubber installations. Rising investments in industrial infrastructure and refinery expansions are also supporting strong market momentum.

Europe Wet Scrubber Market Insight

The Europe wet scrubber market is expanding steadily, driven by stringent environmental regulations, strong enforcement of emission standards, and a focus on sustainable industrial operations. The region emphasizes advanced air pollution control solutions across power generation, chemical processing, and refining industries. Increasing replacement of legacy systems with high-efficiency wet scrubbers is supporting consistent market growth.

Germany Wet Scrubber Market Insight

Germany’s wet scrubber market is driven by its advanced industrial ecosystem, strong chemical and manufacturing sectors, and strict compliance with emission regulations. The country’s focus on high-efficiency pollution control technologies and industrial sustainability supports steady adoption. Continuous investments in upgrading emission control systems across cement, chemical, and power facilities further enhance demand.

U.K. Wet Scrubber Market Insight

The U.K. market is supported by regulatory pressure to reduce industrial emissions, modernization of power and refining infrastructure, and increased focus on environmental compliance. Growing investments in cleaner industrial technologies and upgrades of existing plants are driving wet scrubber adoption. The emphasis on reducing sulfur and particulate emissions across multiple industries sustains market growth.

North America Wet Scrubber Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strict environmental regulations, refurbishment of aging industrial infrastructure, and rising investments in emission control technologies. Strong demand from power generation, refinery, and chemical sectors is boosting wet scrubber installations. Increased focus on compliance with air quality standards is further accelerating market expansion.

U.S. Wet Scrubber Market Insight

The U.S. accounted for the largest share in the North America wet scrubber market in 2025, supported by its extensive power generation capacity, large refinery base, and well-established chemical industry. Regulatory mandates on sulfur oxide and particulate emissions are driving consistent demand for wet scrubber systems. Ongoing investments in industrial upgrades and advanced pollution control solutions reinforce the U.S.’s leading position in the regional market.

Wet Scrubber Market Share

The wet scrubber industry is primarily led by well-established companies, including:

- Babcock & Wilcox Enterprises, Inc. (U.S.)

- ALFA LAVAL (Sweden)

- CECO Environmental (U.S.)

- DuPont (U.S.)

- Evoqua Water Technologies LLC (U.S.)

- Fuji Electric Co., Ltd. (Japan)

- GEA Group Aktiengesellschaft (Germany)

- Wärtsilä (Finland)

- HAMON (Belgium)

- KCH Engineered Systems (U.S.)

- Nederman Holding AB (Sweden)

- Tri-Mer Corporation (U.S.)

- Yara Marine Technologies (Norway)

- Croll Reynolds (U.S.)

- Continental Blower, LLC (U.S.)

Latest Developments in Global Wet Scrubber Market

- In September 2024, Wärtsilä secured a contract to supply carbon capture and storage-ready scrubbers for three containerships operated by Leonhardt & Blumberg, strengthening the wet scrubber market by linking exhaust gas cleaning with future decarbonization pathways. This development highlights rising demand for advanced scrubber systems in the maritime sector that ensure sulfur emission compliance today while supporting long-term carbon reduction strategies, expanding the market’s relevance beyond conventional air pollution control

- In December 2023, Metso launched its High Efficiency Scrubber Optimizer, enhancing the wet scrubber market by improving operational efficiency and reducing energy consumption in gas cleaning plants. The solution addresses growing industry focus on lowering operating costs and improving sustainability performance, thereby increasing adoption of digitally optimized wet scrubber systems across energy-intensive industries

- In February 2023, DuPont Clean Technologies introduced an advanced steam plume suppression solution for its MECS® DynaWave® scrubbers used in sulfur recovery unit applications, supporting the wet scrubber market through improved visual emission control and regulatory compliance. This innovation strengthens demand in refining and petrochemical facilities by addressing plume visibility concerns while maintaining high sulfur removal efficiency

- In January 2023, Babcock & Wilcox Enterprises, Inc. acquired Hamon Research-Cottrell, significantly expanding its emission control offerings and reinforcing its position in the wet scrubber market. The acquisition enabled delivery of comprehensive air quality control systems for oil and gas refineries and power facilities, accelerating market growth through integrated solutions and broader customer reach

- In May 2021, CECO Environmental secured a USD 3.5 million contract to supply high-efficiency HEE-Duall scrubber and exhaust systems to a global semiconductor manufacturer, underscoring expanding wet scrubber adoption in high-purity manufacturing environments. The project demonstrated increasing demand for advanced scrubber technologies capable of achieving high removal efficiency for acidic and gaseous emissions, broadening market application scope beyond traditional heavy industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wet Scrubber Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wet Scrubber Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wet Scrubber Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.