Global Wrist Replacement Orthopedic Devices Market

Market Size in USD Million

CAGR :

%

USD

363.66 Million

USD

487.08 Million

2025

2033

USD

363.66 Million

USD

487.08 Million

2025

2033

| 2026 –2033 | |

| USD 363.66 Million | |

| USD 487.08 Million | |

|

|

|

|

Wrist Replacement Orthopedic Devices Market Size

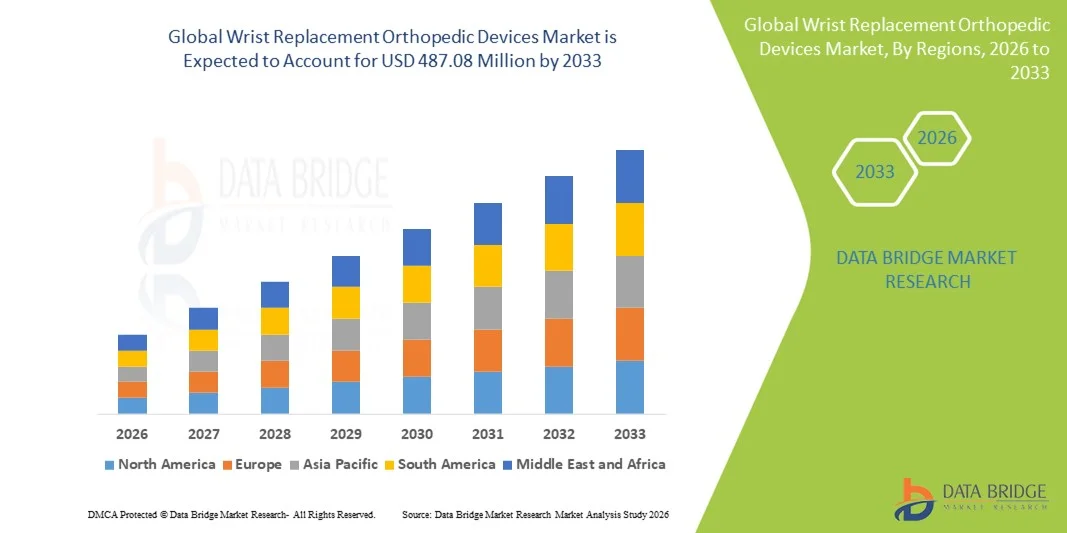

- The global wrist replacement orthopedic devices market size was valued at USD 363.66 million in 2025 and is expected to reach USD 487.08 million by 2033, at a CAGR of 3.72% during the forecast period

- The market growth is largely fueled by advancements in orthopedic implant technologies, increasing prevalence of wrist-related disorders such as osteoarthritis and traumatic injuries, and the expanding geriatric population requiring surgical intervention to restore joint function and mobility

- Furthermore, rising patient and clinician awareness of minimally invasive wrist replacement procedures, along with the growing availability of customized and total replacement solutions, are establishing wrist replacement devices as an effective orthopedic treatment option. These converging factors are accelerating the uptake of wrist replacement solutions, thereby significantly boosting the industry’s growth

Wrist Replacement Orthopedic Devices Market Analysis

- Wrist replacement orthopedic devices, used to restore wrist joint function and alleviate pain caused by arthritis and traumatic injuries, are gaining importance in orthopedic care due to their ability to improve functional outcomes and patient quality of life

- The increasing demand for wrist replacement orthopedic devices is primarily driven by the rising prevalence of degenerative wrist disorders, a growing geriatric population, and higher adoption of surgical treatment options for advanced wrist conditions

- North America dominated the wrist replacement orthopedic devices market with the largest revenue share of 41.2% in 2025, supported by advanced healthcare systems, strong public and private healthcare expenditure, and widespread adoption of technologically advanced orthopedic devices, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the wrist replacement orthopedic devices market during the forecast period due to rising healthcare investments, expanding private expenditure on orthopedic surgeries, and improving access to advanced medical technologies

- The instruments/equipment segment dominated the wrist replacement orthopedic devices market with a market share of 70.6% in 2025, driven by their essential role in wrist replacement procedures, higher average selling prices, and consistent demand across both public and private healthcare settings

Report Scope and Wrist Replacement Orthopedic Devices Market Segmentation

|

Attributes |

Wrist Replacement Orthopedic Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Wrist Replacement Orthopedic Devices Market Trends

Advancements in Implant Design and Material Innovation

- A significant and steadily emerging trend in the global wrist replacement orthopedic devices market is the advancement in implant design and biomaterials, aimed at improving joint durability, anatomical fit, and long-term functional outcomes for patients

- For instance, newer-generation wrist implants are increasingly incorporating cobalt-chromium alloys, titanium components, and polyethylene surfaces to enhance wear resistance and biocompatibility, reducing the risk of implant loosening and revision surgeries

- Technological innovation in wrist replacement devices is enabling better replication of natural wrist kinematics, allowing improved range of motion and load distribution. For instance, modular implant systems allow surgeons to tailor implant configuration based on patient anatomy and disease severity

- The integration of advanced manufacturing techniques such as precision machining and early-stage adoption of 3D printing is supporting the development of more anatomically accurate and patient-specific wrist replacement solutions

- This focus on innovation is reshaping surgeon and patient expectations regarding wrist arthroplasty outcomes, encouraging a shift away from wrist fusion toward motion-preserving replacement procedures. Consequently, companies such as Zimmer Biomet and Stryker are investing in next-generation wrist implant platforms to enhance clinical performance

- The demand for technologically advanced wrist replacement orthopedic devices is gradually increasing across developed healthcare markets, as surgeons prioritize implants that offer improved longevity, stability, and post-operative functionality

- Increasing collaboration between orthopedic surgeons and device manufacturers is further accelerating innovation, leading to faster refinement of implant systems based on real-world surgical feedback

Wrist Replacement Orthopedic Devices Market Dynamics

Driver

Increasing Burden of Degenerative Wrist Disorders and Surgical Adoption

- The rising prevalence of degenerative wrist conditions such as osteoarthritis and rheumatoid arthritis, along with an increasing incidence of trauma-related wrist injuries, is a key driver accelerating demand for wrist replacement orthopedic devices

- For instance, the growing elderly population worldwide is contributing to higher volumes of wrist degeneration cases, leading to increased utilization of surgical interventions aimed at pain relief and functional restoration

- As awareness among patients and clinicians regarding wrist arthroplasty outcomes improves, wrist replacement procedures are increasingly being preferred over wrist fusion due to their ability to preserve joint mobility

- Furthermore, advancements in surgical techniques, improved implant reliability, and expanding orthopedic specialization in hospitals are supporting higher adoption rates of wrist replacement procedures

- The expansion of public and private healthcare expenditure on orthopedic surgeries, particularly in developed regions, is further driving the uptake of wrist replacement orthopedic devices

- Rising participation in sports and physically demanding occupations is also increasing the incidence of complex wrist injuries, indirectly supporting demand for advanced wrist reconstruction solutions

- Improved diagnostic imaging and early disease detection are enabling timely surgical intervention, thereby increasing the eligible patient pool for wrist replacement procedures

Restraint/Challenge

High Procedure Costs and Limited Surgeon Expertise

- The relatively high cost associated with wrist replacement procedures, including implant pricing and surgical expenses, remains a significant challenge limiting widespread adoption of wrist replacement orthopedic devices

- For instance, compared to more established joint replacement procedures such as hip or knee arthroplasty, wrist replacement surgeries are less commonly performed and often concentrated in specialized centers, restricting accessibility

- Limited surgeon experience and training in wrist arthroplasty can result in hesitancy toward adopting wrist replacement procedures, particularly in emerging healthcare markets

- In addition, concerns related to implant longevity, revision risk, and long-term clinical outcomes continue to influence surgeon and patient decision-making

- Overcoming these challenges through improved surgeon training programs, broader clinical evidence generation, and cost optimization strategies will be essential for sustained growth in the wrist replacement orthopedic devices market

- Variability in reimbursement coverage across regions further constrains adoption, especially in markets where wrist replacement is not yet well-established

- Patient hesitation due to limited awareness and fear of surgical complications also acts as a barrier, slowing overall market penetration despite technological advancements

Wrist Replacement Orthopedic Devices Market Scope

The market is segmented on the basis of type of expenditure, product, and end-user.

- By Type

On the basis of type of expenditure, the wrist replacement orthopedic devices market is segmented into public and private. The private expenditure segment dominated the market in 2025, driven by higher adoption of advanced orthopedic surgical procedures in private hospitals and specialty orthopedic centers. Private healthcare providers are more likely to invest in technologically advanced wrist replacement implants and instruments to attract patients seeking faster treatment, shorter waiting times, and access to specialized surgeons. In addition, patients opting for private healthcare often prefer wrist replacement over conservative treatments due to better post-operative care and rehabilitation services. The growing penetration of private insurance coverage in developed economies further supports the dominance of this segment by reducing out-of-pocket costs for patients undergoing wrist replacement surgeries.

The public expenditure segment is expected to be the fastest growing from 2026 to 2033, supported by increasing government investments in healthcare infrastructure and orthopedic care. Many countries are expanding public funding for joint replacement procedures to address the rising burden of arthritis and age-related musculoskeletal disorders. Public hospitals are gradually adopting wrist replacement procedures as clinical evidence improves and surgeon familiarity increases. In addition, initiatives aimed at reducing disability and improving quality of life among elderly populations are expected to accelerate the uptake of wrist replacement devices within publicly funded healthcare systems.

- By Product

On the basis of product, the wrist replacement orthopedic devices market is segmented into instruments/equipment and disposables. The instruments/equipment segment dominated the market in 2025 with market share of 70.6%, owing to its critical role in wrist replacement procedures and its higher average selling price compared to disposables. This segment includes implants, surgical tools, and specialized equipment required for precise joint replacement surgeries. Hospitals and surgical centers consistently invest in high-quality instruments to ensure procedural accuracy, durability, and improved clinical outcomes. In addition, instruments and equipment are essential across both public and private healthcare settings, contributing to steady and recurring demand. Technological advancements in implant design and surgical instrumentation further reinforce the dominance of this segment.

The disposables segment is projected to be the fastest growing during the forecast period, driven by increasing surgical volumes and stricter infection control protocols. Disposables such as surgical drapes, gloves, and single-use components are increasingly preferred to reduce the risk of cross-contamination and post-operative infections. The growing emphasis on patient safety and compliance with regulatory standards is encouraging healthcare facilities to adopt single-use products. Moreover, the expansion of wrist replacement procedures in emerging markets is expected to drive consistent growth in demand for disposables alongside core surgical equipment.

- By End-User

On the basis of end-user, the wrist replacement orthopedic devices market is segmented into hospitals and clinics, diagnostic laboratories, and others. The hospitals and clinics segment dominated the market in 2025, as wrist replacement surgeries are primarily performed in hospital-based orthopedic departments and specialized clinics. These settings offer access to trained orthopedic surgeons, advanced surgical infrastructure, and post-operative rehabilitation services. Hospitals also handle a higher volume of complex wrist cases, including severe arthritis and trauma-related injuries, which require surgical intervention. The availability of multidisciplinary care and reimbursement coverage in hospital settings further supports the dominance of this segment.

The others segment is expected to witness the fastest growth from 2026 to 2033, driven by the gradual expansion of ambulatory surgical centers and specialized orthopedic centers. These facilities are increasingly performing select orthopedic procedures due to lower operational costs and faster patient turnaround times. As wrist replacement techniques become more standardized and less invasive, such centers are expected to handle a greater share of procedures. In addition, patient preference for shorter hospital stays and cost-effective treatment options is contributing to the growth of this segment over the forecast period.

Wrist Replacement Orthopedic Devices Market Regional Analysis

- North America dominated the wrist replacement orthopedic devices market with the largest revenue share of 41.2% in 2025, supported by advanced healthcare systems, strong public and private healthcare expenditure, and widespread adoption of technologically advanced orthopedic devices, particularly in the U.S.

- Healthcare providers in the region place strong emphasis on advanced surgical outcomes, implant durability, and motion-preserving solutions, leading to greater utilization of wrist replacement procedures over conservative treatment options

- This widespread adoption is further supported by high healthcare expenditure, favorable reimbursement policies, and the presence of leading orthopedic device manufacturers, establishing wrist replacement orthopedic devices as a preferred treatment option across hospitals and specialized orthopedic centers

U.S. Wrist Replacement Orthopedic Devices Market Insight

The U.S. wrist replacement orthopedic devices market captured the largest revenue share of 42% in 2025 within North America, fueled by high procedure volumes and advanced orthopedic care infrastructure. Patients and surgeons increasingly prefer wrist replacement over conservative treatments due to better functional outcomes and pain relief. The growing geriatric population, combined with rising incidence of trauma-related wrist injuries, further propels the market. Moreover, favorable reimbursement policies and strong adoption of innovative implants and surgical techniques are significantly contributing to market expansion. Increasing awareness among patients about minimally invasive wrist arthroplasty procedures is also boosting demand.

Europe Wrist Replacement Orthopedic Devices Market Insight

The Europe wrist replacement orthopedic devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising prevalence of degenerative wrist conditions and trauma-related injuries. Increasing healthcare expenditure, urbanization, and well-developed orthopedic infrastructure are fostering adoption of wrist replacement procedures. European patients and surgeons are drawn to advanced implant designs and motion-preserving surgical options. The region is experiencing significant growth across public and private hospitals, with wrist replacement procedures being increasingly incorporated into both new orthopedic programs and existing treatment plans.

U.K. Wrist Replacement Orthopedic Devices Market Insight

The U.K. wrist replacement orthopedic devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for improved joint mobility and functional restoration among patients. Concerns regarding arthritis and post-traumatic wrist degeneration are encouraging patients and clinicians to adopt wrist replacement procedures. The U.K.’s strong healthcare system, supportive reimbursement policies, and skilled orthopedic workforce are expected to continue stimulating market growth. In addition, growing awareness of minimally invasive surgical techniques and patient-specific implants contributes to expanding procedure volumes in both public and private hospitals.

Germany Wrist Replacement Orthopedic Devices Market Insight

The Germany wrist replacement orthopedic devices market is expected to expand at a considerable CAGR during the forecast period, fueled by rising incidence of degenerative wrist conditions and trauma injuries. Germany’s advanced healthcare infrastructure, combined with high-quality orthopedic surgical expertise, promotes adoption of technologically advanced wrist implants. Increasing awareness of motion-preserving surgical solutions and emphasis on patient outcomes supports growth. Integration of wrist replacement procedures into both hospital and specialized clinic settings is also becoming prevalent, with preference for durable and biocompatible implants aligning with local clinical standards.

Asia-Pacific Wrist Replacement Orthopedic Devices Market Insight

The Asia-Pacific wrist replacement orthopedic devices market is poised to grow at the fastest CAGR of 23% during 2026–2033, driven by rising healthcare expenditure, urbanization, and expanding orthopedic surgery infrastructure in countries such as China, Japan, and India. The growing geriatric population and increasing incidence of wrist injuries are further accelerating demand. Government initiatives to improve access to advanced orthopedic care and rising private healthcare investment are supporting market growth. In addition, increasing awareness of wrist replacement procedures among patients and the availability of cost-effective implants are contributing to faster adoption in the region.

Japan Wrist Replacement Orthopedic Devices Market Insight

The Japan wrist replacement orthopedic devices market is gaining momentum due to the country’s high-quality healthcare system, aging population, and demand for improved post-operative mobility. Patients are increasingly opting for wrist replacement procedures to manage arthritis and trauma-related injuries. Integration of advanced implant designs, minimally invasive techniques, and rehabilitation protocols is fueling market growth. Japan’s healthcare focus on long-term functional outcomes and patient-centric care is further driving adoption across hospitals and specialty orthopedic centers.

India Wrist Replacement Orthopedic Devices Market Insight

The India wrist replacement orthopedic devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expanding healthcare infrastructure, and rising patient awareness of advanced orthopedic treatments. India’s growing geriatric population and rising incidence of trauma-related wrist injuries are contributing to increased procedure volumes. Availability of cost-effective implants, domestic orthopedic device manufacturers, and government initiatives promoting access to orthopedic surgeries are key factors propelling the market. Moreover, both public and private hospitals are increasingly performing wrist replacement procedures, expanding overall market adoption.

Wrist Replacement Orthopedic Devices Market Share

The Wrist Replacement Orthopedic Devices industry is primarily led by well-established companies, including:

- Zimmer Biomet (U.S.)

- Stryker (U.S.)

- Smith+Nephew (U.K.)

- Integra LifeSciences Corporation (U.S.)

- Acumed LLC (U.S.)

- Medartis AG (Switzerland)

- Exactech, Inc. (U.S.)

- Arthrex, Inc. (U.S.)

- CONMED Corporation (U.S.)

- Enovis Corporation (U.S.)

- MicroPort Orthopedics, Inc. (China)

- Orthofix Medical Inc. (U.S.)

- Aesculap Implant Systems, LLC (U.S.)

- Corin Group (U.K.)

- KLS Martin Group (Germany)

- Skeletal Dynamics, LLC (U.S.)

- Small Bone Innovations, Inc. (U.S.)

- LimaCorporate S.p.A. (Italy)

- Beijing Chunlizhengda Medical Instruments Co., Ltd. (China)

- Meril Life Sciences (India)

What are the Recent Developments in Global Wrist Replacement Orthopedic Devices Market?

- In July 2025, Medartis Holding AG completed the full acquisition of KeriMedical SA, which holds FDA clearance for the TOUCH® implant used in thumb and hand joint reconstruction, strengthening Medartis’ upper‑extremity arthroplasty portfolio and enhancing its wrist replacement and hand joint solutions

- In August 2024, Extremity Medical announced that it would present real‑world clinical results from its KinematX Total Wrist Arthroplasty device registry at the American Society for Surgery of the Hand meeting, highlighting its implant’s motion‑preserving performance and growing surgeon interest

- In April 2024, Extremity Medical announced that surgeons had completed the 100th total wrist replacement procedure using its KinematX® Total Wrist Arthroplasty system, underscoring clinical adoption of its midcarpal implant designed to better replicate natural wrist motion and expand motion‑preserving options beyond traditional fusion surgery

- In September 2021, Anika Therapeutics launched its WristMotion® Total Wrist Arthroplasty System at the American Society for Surgery of the Hand annual meeting, offering a modular implant focused on preserving carpal stability and restoring motion for patients with arthritic wrists

- In July 2021, Anika Therapeutics completed the first surgical procedure using its WristMotion® Total Wrist Arthroplasty System, marking the clinical introduction of this next‑generation motion‑preserving wrist implant in the U.S. market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.