Middle East and Africa Automotive Heat Exchanger Market Analysis and Insights

In the analysis of heat exchangers, it is often convenient to work with an overall heat transfer coefficient, known as a U-factor. Heat exchangers are typically classified according to flow arrangement and type of construction. The different types of heat exchangers are parallel-flow arrangement and counter-flow arrangement.

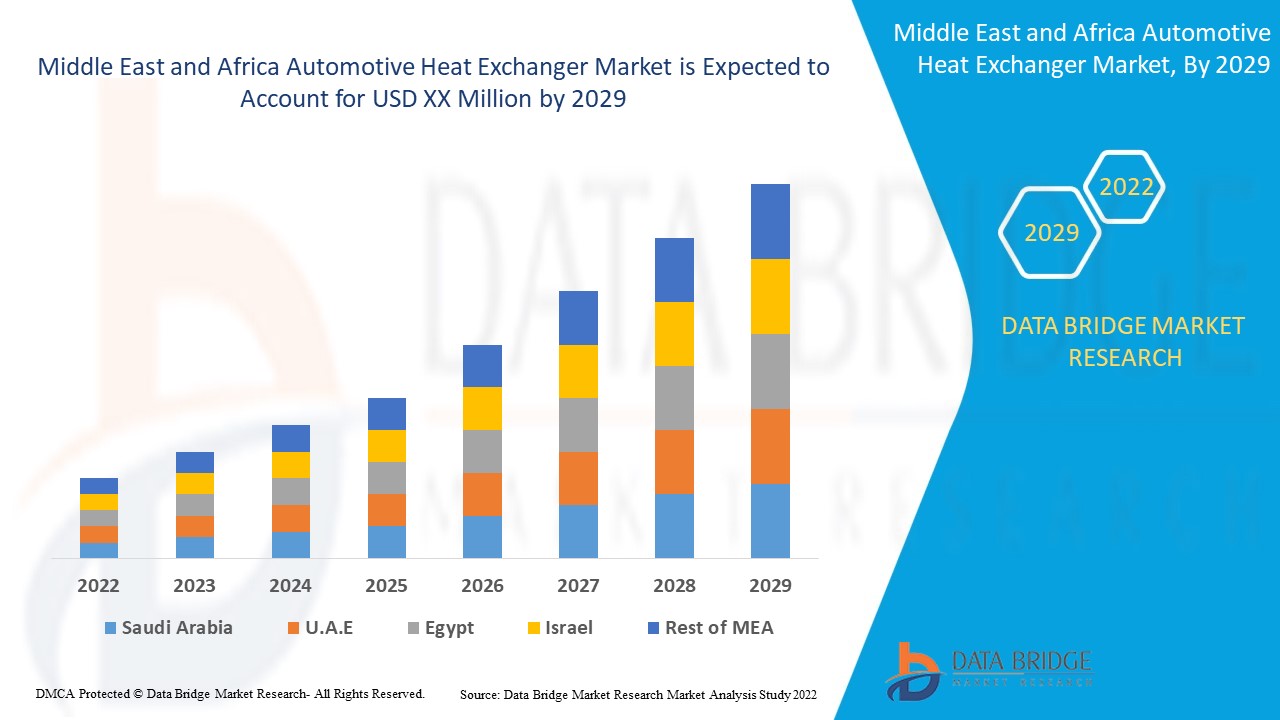

An increase in population, rapid urbanization and industrialization have a propositional impact on the growth and adoption of the automotive heat exchanger, as current automotive heat exchanger systems are widely used in improving vehicle dynamics and safety features. Data Bridge Market Research analyses that Middle East and Africa automotive heat exchanger market will grow at a CAGR of 5.3% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Application (Intercooler, Radiator, Air Conditioning, Oil Cooler, and Others), Design Type (Tube Fin, Plate Bar, Others), Material (Aluminium, Copper, and Others), Propulsion Type (Internal Combustion Engine (ICE) and Electric Vehicle (EV)), Vehicle Type (Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle). |

|

Countries Covered |

U.A.E., Saudi Arabia, Israel, South Africa, Egypt, and Rest of Middle East and Africa |

|

Market Players Covered |

Marelli Holdings Co., Ltd., Nissens Automotive A/S, Valeo, MODINE MANUFACTURING COMPANY, MAHLE GmbH, SANDEN CORPORATION., AKG Group. |

Market Definition

A heat exchanger is a heat transfer device that exchanges heat between two or more process fluids. Heat exchangers have widespread industrial and domestic applications. Many heat exchangers have been developed in steam power plants, chemical processing plants, building heat and air conditioning systems, transportation power systems, and refrigeration units. Heat transfer in a heat exchanger usually involves convection in each fluid and thermal conduction through the wall separating the two fluids.

Middle East and Africa Automotive Heat Exchanger Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

-

INCREASE IN POPULATION, RAPID URBANIZATION, AND INDUSTRIALIZATION

Over a decade, industrialization and urbanization have played a significant role in the emergence and growth of the automotive industry. With a growing population across the globe and the majority of the population shifting towards urban areas for better opportunities and living standards, it plays a vital role in shaping the automotive industry sector.

-

EMERGENCE OF ELECTRIC VEHICLES (EV’S)

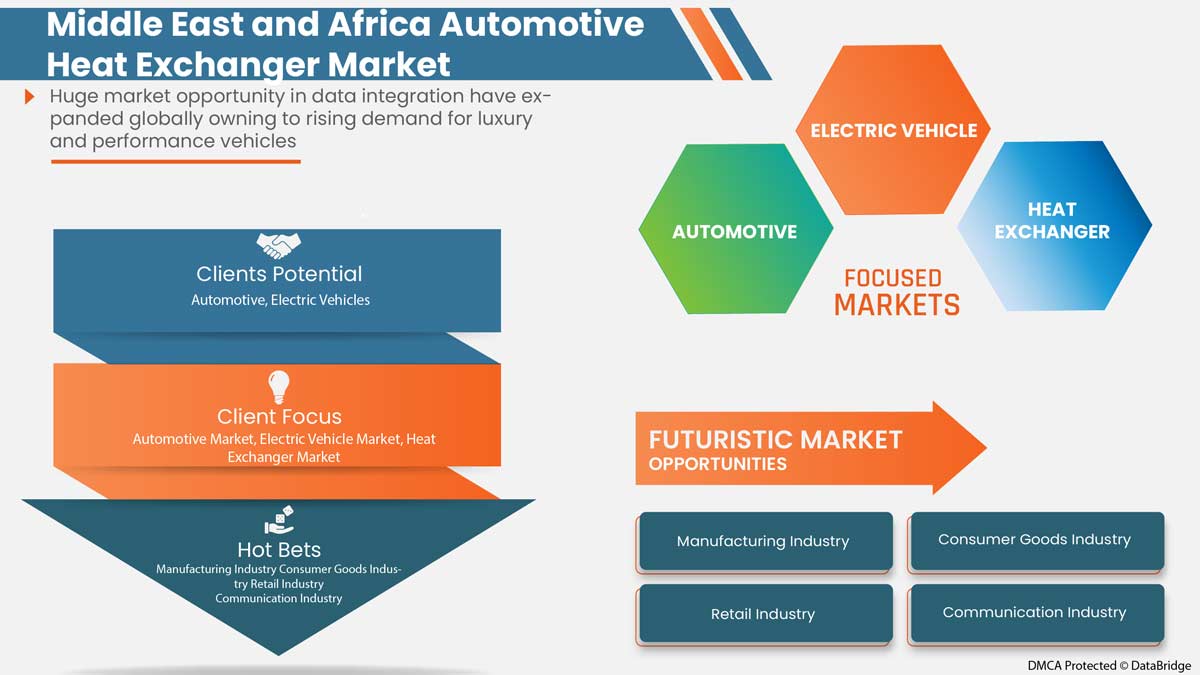

The automotive industry has grown enormously due to the rising demand for luxurious electric vehicles. All-electric vehicles (EVs) are called battery electric vehicles, which use a battery to store the electrical energy that powers the vehicles. Some of the factors driving the sales of electric vehicles include stringent government regulations towards vehicle emissions and increasing demand for fuel-efficient, high-performance, and low-emission vehicles. This adds to the adoption of all-electric vehicles as zero-emission, effectively minimizing carbon emissions.

-

GROWTH IN THE DEMAND FOR ADAS VEHICLES AND ITS SUBSCRIPTION MODEL

Advanced driver-assistance systems (ADAS) are electronic systems implanted in automobiles to assist driving vehicles or self-driving cars. This system uses sensors such as radars and cameras for analysis and takes automatic action based on the vehicle's surroundings. This system implemented in automobiles enables enhancement of safety systems in terms of driving by avoiding collisions, adopting cruise control, anti-locking of brakes, automation in lighting, pedestrian crash avoidance mitigation (PCAM), and many others.

-

UPSURGE IN DEMAND FOR LUXURY AND PERFORMANCE VEHICLES

A luxury vehicle is one with advanced luxury features such as higher-quality interior materials, efficient engines, transmissions, sound systems, telematics, and safety features. These vehicles have features that aren't available on lower-priced models of vehicles.

Opportunity

-

EMERGENCE OF SMART CONNECTED AUTOMOTIVE

A connected vehicle is capable of connecting wireless networks to nearby devices. The concept of connected vehicles is possible due to technological advancements such as AI, Big Data, advanced network connectivity, and IoT. The connected vehicle is becoming popular among consumers for various applications and uses cases. One such use case can be for connected entertainment systems, which allow the consumers' mobile phones to Internet-connected vehicles with bi-directional communication with various other vehicles and mobile devices.

Restraint/Challenge

- HIGH CARBON FOOTPRINT OF THE AUTOMOTIVE SECTOR AND DESIGN COMPLEXITIES, AND HIGH UPFRONT COST

However, the high carbon footprint of the automotive sector will force government bodies to take strict government actions and regulations to control emission levels, which may reduce the adoption of automotive heat exchanger solutions. Moreover, design complexities and high upfront costs directly correlate with the sales and availability of new automotive heat exchanger systems.

Covid-19 Impact on Middle East and Africa Automotive Heat Exchanger Market

COVID-19 has negatively affected the market. In Middle East and Africa, automotive heat exchanger systems were in high demand companies such Marelli Holdings Co., Ltd., Hanon Systems, Nissens, Griffin Thermal Products, TYC Brother Industrial Co., Ltd., Dana Limited, and others face absolute difficulty in providing advanced systems for new vehicles and old vehicles due to shortage of semiconductor control chips and controllers. This was due to strict regulations imposed by the government. Moreover limited supply of semiconductor chips and gadgets has significantly affected the supply of vehicles in the market.

Recent Development

- In March 2022, T.RAD Co., Ltd. launched non-domestic cooling and ventilation equipment (NACE2 2825) in North America. The key feature of such products in the region was to launch its multiple products in the region, for instance, radiator, oil-cooler, inter-cooler, EGR-cooler, evaporator, condenser, water-coils, and recuperator. Through this company expanded its revenue and its sales in the region.

Middle East and Africa Automotive Heat Exchanger Market Scope

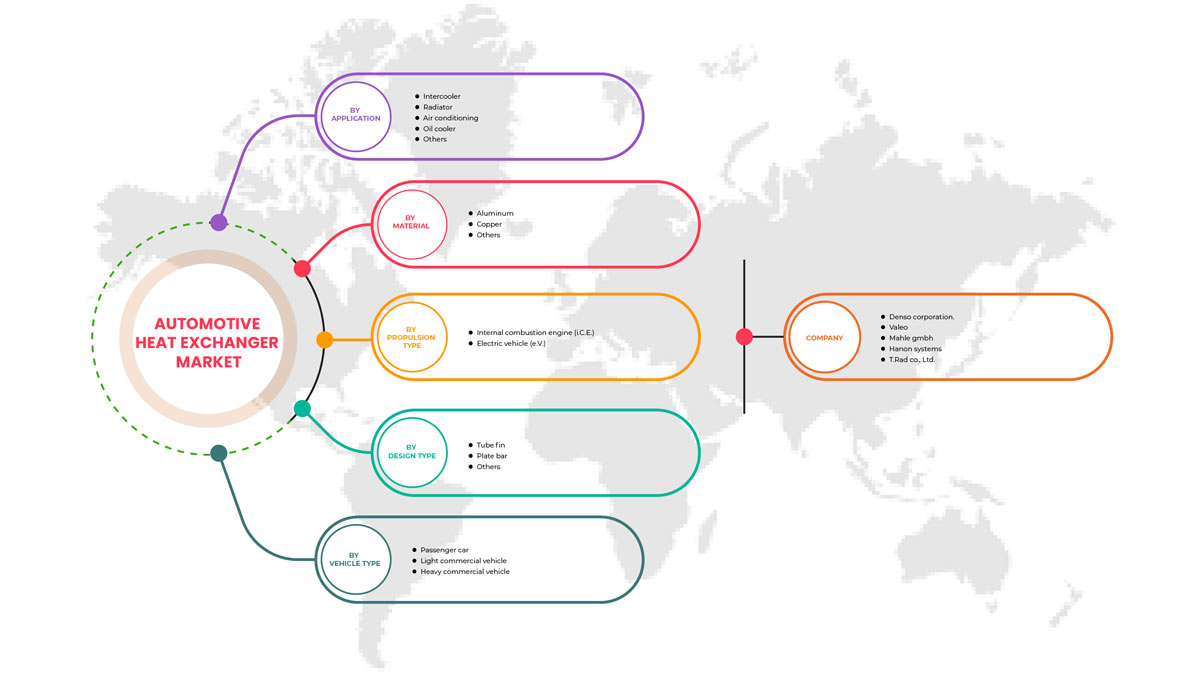

Middle East and Africa automotive heat exchanger market is segmented based on application, vehicle type, material design type, and propulsion type. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Application

- Intercooler

- Radiator

- Air Conditioning

- Oil Cooler

- Others

On the basis of application, Middle East and Africa automotive heat exchanger market is segmented into intercooler, radiator, air conditioning, oil cooler, and others.

Design Type

- Tube Fin

- Plate Bar

- Others

On the basis of design type, Middle East and Africa automotive heat exchanger market is segmented into tube fin, plate bar, and others.

Material

- Aluminum

- Copper

- Others

On the basis of material, Middle East and Africa automotive heat exchanger market is segmented into aluminium, copper, and others.

Propulsion Type

- Internal Combustion Engine (ICE)

- Electric Vehicle (EV)

On the basis of propulsion type, Middle East and Africa automotive heat exchanger market is segmented into internal combustion engine (ICE) and electric vehicle (EV).

Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

On the basis of vehicle type, Middle East and Africa automotive heat exchanger market is segmented into passenger car, light commercial vehicle, and heavy commercial vehicle.

Middle East and Africa Automotive Heat Exchanger Market Regional Analysis/Insights

Middle East and Africa automotive heat exchanger market is analyzed, and market size insights and trends are provided by country, application, design type, material, propulsion type, and vehicle type as referenced above.

The countries covered in Middle East and Africa automotive heat exchanger market report are U.A.E., Saudi Arabia, Israel, South Africa, Egypt, and the rest of the Middle East and Africa.

U.A.E. dominates in the Middle East and Africa region due to increased government regulations for efficient use of fuel and energy, boosting the market growth.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands impact sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Automotive Heat Exchanger Market Share Analysis

Middle East and Africa automotive heat exchanger market competitive landscape provide details by a competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to Middle East and Africa automotive heat exchanger market.

Some major players operating in the Middle East and Africa automotive heat exchanger market are Marelli Holdings Co., Ltd., Nissens Automotive A/S, Valeo, MODINE MANUFACTURING COMPANY, MAHLE GmbH, SANDEN CORPORATION., AKG Group.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 APPLICATION TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN POPULATION & RAPID URBANIZATION

5.1.2 EMERGENCE OF ELECTRIC VEHICLES (EVS)

5.1.3 GROWING ADOPTION OF ADAS ASSISTED VEHICLES

5.1.4 UPSURGE IN DEMAND FOR LUXURY AND PERFORMANCE VEHICLES

5.2 RESTRAINTS

5.2.1 HIGH CARBON FOOTPRINT OF AUTOMOTIVE SECTOR

5.3 OPPORTUNITIES

5.3.1 STRATEGIC PARTNERSHIP, SOLUTIONS LAUNCHES, AND ACQUISITIONS AMONG MAJOR PLAYERS

5.3.2 EMERGENCE OF SMART CONNECTED AUTOMOTIVE

5.3.3 GROWING ADOPTION OF CONVENIENCE FEATURES SUCH AS HVAC SYSTEMS IN AUTOMOTIVES

5.4 CHALLENGES

5.4.1 UPCOMING EMISSION NORMS COULD POSE A CHALLENGE FOR AUTOMOTIVE HEAT EXCHANGERS

5.4.2 DESIGN COMPLEXITIES AND HIGH UPFRONT COST

6 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION

6.1 OVERVIEW

6.2 INTERCOOLER

6.3 RADIATOR

6.4 AIR CONDITIONING

6.5 OIL COOLER

6.6 OTHERS

7 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE

7.1 OVERVIEW

7.2 TUBE FIN

7.3 PLATE BAR

7.4 OTHERS

8 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 ALUMINUM

8.3 COPPER

8.4 OTHERS

9 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE

9.1 OVERVIEW

9.2 INTERNAL COMBUSTION ENGINE (ICE)

9.3 ELECTRIC VEHICLE (EV)

10 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE

10.1 OVERVIEW

10.2 PASSENGER CAR

10.3 LIGHT COMMERCIAL VEHICLE

10.4 HEAVY COMMERCIAL VEHICLE

10.4.1 ON-HIGHWAY VEHICLE

10.4.2 OFF-HIGHWAY VEHICLE

10.4.2.1 CONSTRUCTION

10.4.2.2 AGRICULTURE

10.4.2.3 OTHERS

11 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 U.A.E.

11.1.2 SAUDI ARABIA

11.1.3 ISRAEL

11.1.4 SOUTH AFRICA

11.1.5 EGYPT

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 DENSO CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 VALEO

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 BUSINESS PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 MAHLE GMBH

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 HANON SYSTEMS

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 BUSINESS PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 T.RAD CO., LTD.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCTS PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 AKG GROUP

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT0

14.7 BANCO PRODUCTS (I) LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 CLIZEN INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCTS PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 CONSTELLIUM

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 DANA LIMITED.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 BUSINESS PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 G&M RADIATOR

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 GRIFFIN THERMAL PRODUCTS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCTS PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MARELLI HOLDINGS CO., LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCTS PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 MISHIMOTO AUTOMOTIVE

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 MODINE MANUFACTURING COMPANY

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 NISSENS AUTOMOTIVE A/S

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCTS PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 PWR CORPORATE

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 SANDEN CORPORATION.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 TYC BROTHER INDUSTRIAL CO., LTD.

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 BUSINESS PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 CARBON EMISSION LEVEL OF VARIOUS TYPES OF CARS, SUVS &TRUCK

TABLE 2 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA INTERCOOLER IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA RADIATOR IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA AIR CONDITIONING IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA OIL COOLER IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA OTHERS IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA TUBE FIN IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA PLATE BAR IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA OTHERS IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA ALUMINUM IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA COPPER IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA INTERNAL COMBUSTION ENGINE (ICE) IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA ELECTRIC VEHICLE (EV) IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PASSENGER CAR IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 35 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 36 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.A.E. HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.A.E. OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 42 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 43 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 44 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 45 SAUDI ARABIA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 SAUDI ARABIA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 49 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 50 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 51 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 52 ISRAEL HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 ISRAEL OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 56 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 57 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 58 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 63 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 64 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 65 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 66 EGYPT HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 EGYPT OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: SEGMENTATION

FIGURE 10 GROWING ADOPTION OF ADAS ASSISTED VEHICLES IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INTERCOOLER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET FROM 2022 TO 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET

FIGURE 13 URBANIZED REGIONS IN THE GLOBE

FIGURE 14 AVAILABILITY OF ADAS TECHNOLOGY IN NEW VEHICLE MODELS

FIGURE 15 ROAD TRANSPORT EMISSIONS

FIGURE 16 BENEFITS OF SMART TELEMATICS FOR FLEET MANAGEMENT

FIGURE 17 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION, 2021

FIGURE 18 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY DESIGN TYPE, 2021

FIGURE 19 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY MATERIAL, 2021

FIGURE 20 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY PROPULSION TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY VEHICLE TYPE, 2021

FIGURE 22 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: SNAPSHOT (2021)

FIGURE 23 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021)

FIGURE 24 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY SHARE 2021 (%)

Middle East And Africa Automotive Heat Exchanger Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Automotive Heat Exchanger Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Automotive Heat Exchanger Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.