Middle East And Africa Bag In Box Packaging Machine Market

Market Size in USD Million

CAGR :

%

USD

455.27 Million

USD

731.13 Million

2024

2032

USD

455.27 Million

USD

731.13 Million

2024

2032

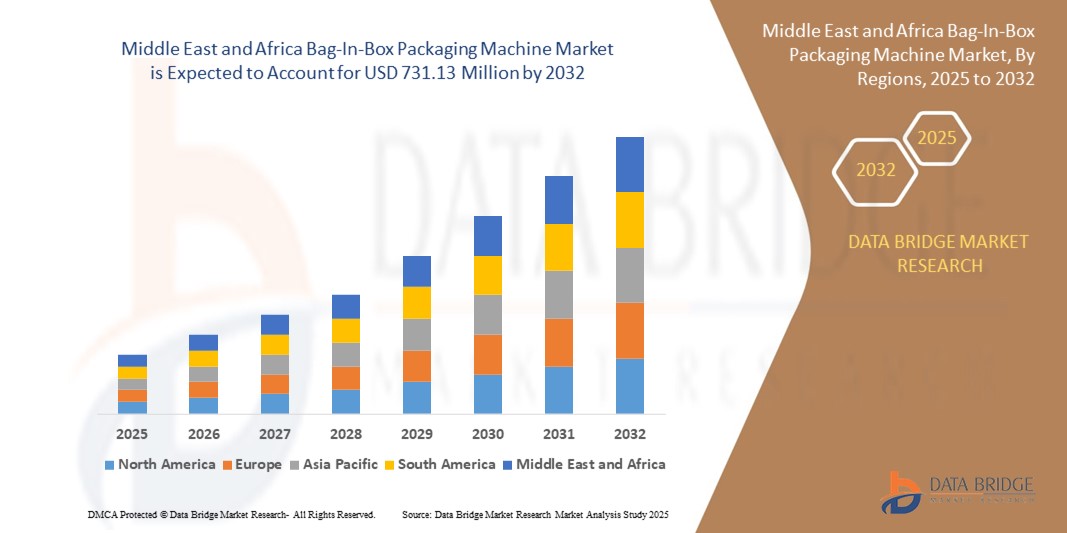

| 2025 –2032 | |

| USD 455.27 Million | |

| USD 731.13 Million | |

|

|

|

|

Bag-In-Box Packaging Machine Market Size

- The Middle East and Africa bag-in-box packaging machine market size was valued at USD 455.27 million in 2024 and is expected to reach USD 731.13 million by 2032, at a CAGR of 6.1% during the forecast period

- The market growth is largely fueled by rising demand for sustainable, cost-efficient, and space-saving liquid packaging solutions across the food, beverage, household, and industrial sectors, prompting manufacturers to adopt automated bag-in-box packaging machines for improved efficiency and reduced waste

- Furthermore, increasing focus on product safety, hygiene, and extended shelf life is accelerating the use of aseptic and high-speed filling technologies integrated into bag-in-box machines, thereby significantly boosting the industry’s growth trajectory

Bag-In-Box Packaging Machine Market Analysis

- Bag-in-box packaging machines are automated systems designed for filling and sealing liquids or semi-liquids into flexible bags housed within corrugated boxes, offering advantages such as minimized oxygen exposure, reduced packaging material, and easy dispensing for end users

- The escalating demand for these machines is primarily driven by the beverage, dairy, personal care, and lubricant industries, where bulk liquid handling, operational cost savings, and sustainable packaging formats are increasingly prioritized by both manufacturers and consumers

- Saudi Arabia dominated the bag-in-box packaging machine market in 2024, due to the country's expanding food and beverage manufacturing sector, rising demand for efficient liquid packaging, and strong investments in industrial automation

- South Africa is expected to be the fastest growing region in the bag-in-box packaging machine market during the forecast period due to the growing demand for cost-effective, flexible, and scalable liquid packaging systems across food, beverage, personal care, and agrochemical sectors

- Aseptic segment dominated the market with a market share of 63.6% in 2024, due to growing demand for extended shelf life and contamination-free packaging, especially in dairy, juice, and medical-grade solutions. Aseptic machines allow sterile filling conditions, reducing the need for preservatives and refrigeration, thus lowering distribution costs

Report Scope and Bag-In-Box Packaging Machine Market Segmentation

|

Attributes |

Bag-In-Box Packaging Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bag-In-Box Packaging Machine Market Trends

“Increasing Need for Sustainable and Cost-Effective Packaging Solution”

- The Middle East and Africa bag-in-box packaging machine market is expanding as industries across food, beverage, and household products seek packaging solutions that minimize waste, reduce environmental footprint, and deliver operational cost savings through efficient use of materials

- For instance, major producers in the region such as Smurfit Kappa and DS Smith have scaled up bag-in-box packaging innovations that use recyclable materials and require less secondary packaging, helping customers meet sustainability goals and regulatory directives

- Flexible bag-in-box formats are gaining popularity due to their suitability for transporting and storing liquids, offering space efficiency, product protection against oxidation, and reduced transportation costs compared to rigid containers

- Regional manufacturers are leveraging advanced automation and modular machine designs to enhance the adaptability and throughput of bag-in-box packaging lines, addressing the growing need for speed, product variety, and customization

- As end users become increasingly aware of environmental issues, the demand for bag-in-box packaging with improved recyclability and low-carbon manufacturing processes is rising—spurring R&D investment from both domestic and global packaging firms

- Integration of bag-in-box solutions across emerging FMCG and industrial segments is increasing, with companies capitalizing on cost savings, product shelf-life extension, and the ability to efficiently serve bulk and retail channels in the Middle East and Africa

Bag-In-Box Packaging Machine Market Dynamics

Driver

“Growing Demand for Aseptic Packaging”

- The push for longer shelf life and strict food safety standards is amplifying demand for aseptic bag-in-box packaging machines, especially among beverage, dairy, and pharmaceutical manufacturers seeking contamination-free logistics and extended product freshness

- For instance, SIG Group AG has launched aseptic filling machines such as SIG SmileSmall 24 Aseptic in the United Arab Emirates, enabling F&B producers to run tests and increase efficiencies with an aseptic bag-in-box solution that meets market requirements for hygiene and innovation

- Food and pharma sectors in the region are shifting towards aseptic processing and packaging to minimize preservative use, retain natural quality, and access export markets with stringent quality controls

- Rapid population growth and rising urbanization are leading to higher consumption of packaged foods, necessitating scalable, sanitary packaging that maintains safety through extended supply chains

- Technological advances in aseptic filling, material sterilization, and smart process automation are supporting new product launches and regional business expansion in sectors reliant on safe, long-lasting liquid and semi-liquid goods

Restraint/Challenge

“Required High Initial Investment”

- Bag-in-box packaging machinery often involves substantial upfront costs for automated systems, advanced controls, and aseptic integration, presenting barriers for small and mid-sized manufacturers in capital-constrained markets

- For instance, many MEA-based producers have highlighted that the capital outlay required for high-speed or fully aseptic bag-in-box lines from suppliers such as SIG or Smurfit Kappa is difficult to justify, slowing machine adoption especially among local SMEs

- The need for skilled operators, ongoing maintenance, and periodic upgrades further adds to lifetime ownership expenses, impacting return on investment and favoring large firms with scale economies

- Access to affordable financing and government incentives remains limited in some markets, making it challenging for businesses to transition from manual or semi-automated operations to high-performance aseptic packaging lines

- Volatility in raw material and import costs for specialized machine components—such as steel, automation controls, and aseptic equipment—further increases average investment requirements and slows technology penetration across the region

Bag-In-Box Packaging Machine Market Scope

The market is segmented on the basis of machine type, automation type, packaging material, output capacity, filling technology, and end user.

• By Machine Type

On the basis of machine type, the market is segmented into standalone and integrated systems. The standalone segment accounted for the largest revenue share in 2024, largely attributed to its widespread use in small to mid-sized production facilities where modularity, cost efficiency, and operational simplicity are highly valued. These machines offer dedicated functionality for filling and sealing operations, making them ideal for companies aiming to enhance specific stages of the packaging line without investing in a fully automated system.

The integrated segment is expected to record the fastest CAGR from 2025 to 2032, driven by rising demand for streamlined, end-to-end packaging solutions. Integrated machines, which combine multiple packaging functions within a single system, are gaining traction in high-output environments such as beverage or lubricant manufacturing, where reducing manual intervention and optimizing line efficiency are top priorities.

• By Automation Type

On the basis of automation type, the market is divided into semi-automatic, automatic, and manual. The automatic segment dominated the market in 2024 due to its ability to deliver high-speed operations, consistency in fill volume, and reduced human error—essential features in food, beverage, and healthcare sectors where hygiene and precision are critical. Increased investment in industrial automation has further propelled the adoption of fully automated systems.

The semi-automatic segment is anticipated to grow at the fastest pace over the forecast period, primarily benefiting small- and medium-sized enterprises (SMEs) looking for a balance between efficiency and capital expenditure. These systems offer greater flexibility and user control while minimizing the operational complexity associated with manual packaging setups.

• By Packaging Material

On the basis of packaging material, the market is segmented into plastic, paper and paperboard, metal, and others. The plastic segment led the market in 2024, owing to its durability, barrier properties, and widespread use across multiple industries such as beverages, personal care, and paints. Its compatibility with aseptic filling technologies and recyclability when designed appropriately further reinforce its dominant position.

The paper and paperboard segment is expected to witness the fastest growth from 2025 to 2032, as sustainability concerns and government regulations push end users toward eco-friendly alternatives. Brands are increasingly adopting paper-based bag-in-box solutions to meet consumer demand for low-impact packaging, especially in food and household product applications.

• By Output Capacity

On the basis of output capacity, the market is categorized into 10 bags/min, 11–50 bags/min, 51–100 bags/min, and above 100 bags/min. The 11–50 bags/min segment captured the largest share in 2024, favored by medium-scale production environments that prioritize output efficiency while retaining manageable machine footprint and cost.

The above 100 bags/min segment is expected to exhibit the fastest CAGR, driven by expansion in high-volume production sectors such as packaged beverages and industrial lubricants. These machines cater to large manufacturing plants where speed, automation, and uninterrupted operation are essential to meet surging demand and cost efficiency.

• By Filling Technology

On the basis of technology, the market is segmented into aseptic and non-aseptic filling technology. The aseptic segment dominated the market with a share of 63.6% in 2024, supported by growing demand for extended shelf life and contamination-free packaging, especially in dairy, juice, and medical-grade solutions. Aseptic machines allow sterile filling conditions, reducing the need for preservatives and refrigeration, thus lowering distribution costs.

The non-aseptic segment is projected to grow at a significant rate during the forecast period, supported by increased adoption in industries such as paints, lubricants, and cleaning products where sterility is less critical, and cost-effective, rapid filling is prioritized.

• By End User

On the basis of end user, the market is segmented into food and beverages, paints and lubricants, personal care, household products, healthcare, and others. The food and beverages segment held the largest revenue share in 2024 due to widespread use of bag-in-box packaging for juices, wine, syrups, and liquid dairy. The packaging format offers superior portion control, product preservation, and transportation efficiency, making it a preferred solution for both retail and bulk distribution.

The personal care segment is expected to grow at the fastest CAGR from 2025 to 2032, spurred by increased demand for sustainable and refillable packaging in shampoos, lotions, and liquid soaps. Manufacturers are embracing bag-in-box systems to reduce plastic consumption, optimize product shelf life, and meet consumer preferences for eco-conscious brands.

Bag-In-Box Packaging Machine Market Regional Analysis

- Saudi Arabia dominated the bag-in-box packaging machine market with the largest revenue share in 2024, driven by the country's expanding food and beverage manufacturing sector, rising demand for efficient liquid packaging, and strong investments in industrial automation

- Demand is particularly strong in the beverage and dairy sectors, where bag-in-box packaging is preferred for its ability to extend shelf life, reduce spillage, and enable bulk distribution. The technology is also gaining ground in institutional catering, lubricant packaging, and homecare product segments due to its cost efficiency and ease of storage

- The market benefits from Saudi Arabia’s growing focus on sustainable packaging solutions, advanced logistics infrastructure, and increasing adoption of hygienic, high-throughput filling technologies to meet evolving industry standards

South Africa Bag-In-Box Packaging Machine Market Insight

South Africa is poised to register the fastest CAGR in the Middle East and Africa region from 2025 to 2032, driven by the growing demand for cost-effective, flexible, and scalable liquid packaging systems across food, beverage, personal care, and agrochemical sectors. The country’s mid-sized producers are increasingly investing in standalone and semi-automatic machines to enhance operational efficiency without incurring high capital costs. Rising urbanization, growth in supermarket retailing, and increased consumption of ready-to-drink beverages and household liquids are fueling market expansion. Furthermore, the bag-in-box format is gaining popularity in rural and peri-urban areas where logistics and cold chain limitations favor compact, lightweight, and durable packaging solutions

Egypt Bag-In-Box Packaging Machine Market Insight

Egypt is emerging as a promising market due to its rising processed food output, growing beverage consumption, and strategic efforts to modernize its manufacturing sector. The government’s push to enhance domestic industrial capacity and reduce packaging waste is encouraging local producers to adopt bag-in-box technology, especially in juice, edible oil, and cleaning product applications. The format’s advantages—such as reduced material usage, efficient storage, and superior product protection—align well with the country's sustainability goals and packaging modernization efforts. Supportive economic policies and foreign direct investments into food and household product manufacturing are expected to boost adoption of both semi-automatic and fully integrated bag-in-box packaging machines through 2032

Bag-In-Box Packaging Machine Market Share

The bag-in-box packaging machine industry is primarily led by well-established companies, including:

- TORR Industries (U.S.)

- ABCO Automation (U.S.)

- IC Filling Systems (U.K.)

- Kreuzmayr Maschinenbau GmbH (Austria)

- Innovative Packaging Company (U.S.)

- Triangle Package Machinery Company (U.S.)

- Quadrant Equipment (U.S.)

- voran Maschinen GmbH (Austria)

- Smurfit Kappa (Ireland)

- Liquibox (U.S.)

- DS Smith (U.K.)

- Robert Bosch GmbH (Germany)

- ALFA LAVAL (Sweden)

- Engi-O (U.K.)

- Pattyn (Belgium)

- SACMI IMOLA S.C Via Selice (Italy)

- SIG (Switzerland)

- Technibag (France)

- Franz Haniel & Cie. GmbH (Germany)

- ProXES GmbH (Germany)

- Flexifill Ltd. (U.K.)

- Amcor plc (Switzerland)

Latest Developments in Middle East and Africa Bag-In-Box Packaging Machine Market

- In February 2024, Smurfit Kappa Group announced plans to open a new bag-in-box machine plant in Alicante, Spain, with an investment of USD 58.2 million. The facility aims to double the company’s production capacity and expand its product portfolio to meet rising demand across the food, beverage, and industrial liquid sectors. Strategically located in Spain, the plant will enhance supply chain efficiency and reduce lead times for European clients. This investment reflects Smurfit Kappa’s continued focus on automated, high-performance, and sustainable liquid packaging solutions, reinforcing its leadership in the flexible packaging market

- In February 2024, Aran Group completed the acquisition of a majority stake in IBA Germany from Liquid Concept GmbH. This acquisition strengthens Aran Group’s technological capabilities and market presence in Europe by integrating IBA’s expertise in precision-engineered filling systems. The move enhances Aran’s product development pipeline while expanding its customer base in key European markets. It also supports the company’s long-term growth strategy of delivering advanced, scalable, and energy-efficient bag-in-box solutions for industrial and commercial applications

- In January 2024, WestRock Company unveiled plans to construct a new corrugated box plant in Pleasant Prairie, Wisconsin, with a project value of USD 140 million. Designed to support increasing demand in the Great Lakes region, the facility will enhance WestRock’s packaging capacity and operational efficiency. Although focused on corrugated packaging, the expansion complements the broader ecosystem of bulk and flexible packaging formats, including bag-in-box, by enabling integrated supply solutions. Partial funding from property sales demonstrates WestRock’s capital optimization approach while investing in infrastructure aligned with sustainable packaging trends

- In October 2023, Amcor introduced a circular connector as part of its sustainable packaging solutions, offering a 70% lower carbon footprint than conventional alternatives. This innovation supports eco-friendly bag-in-box systems, particularly in the retail and institutional sectors, by enhancing recyclability and reducing environmental impact. Retailers such as Walmart have started adopting this technology to meet sustainability goals and regulatory standards. Amcor’s development illustrates how component-level improvements can significantly contribute to the environmental performance of flexible liquid packaging systems

- In April 2022, TORR Industries launched a new bag-in-box wine packaging machine featuring an advanced filling head designed to reduce oxygen exposure to less than 2 ppm. This ensures superior preservation of wine quality, aroma, and shelf life, making it ideal for high-value and export-oriented production. With the capacity to fill 20 three-liter bags per minute, the machine balances speed and precision, addressing growing demand in the wine and beverage industry for efficient, oxygen-controlled packaging solutions. TORR’s innovation reinforces the shift toward specialized equipment tailored for sensitive liquid products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Bag In Box Packaging Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Bag In Box Packaging Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Bag In Box Packaging Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.