Middle East And Africa Dermal Fillers Market

Market Size in USD million

CAGR :

%

USD

205.75 million

USD

450.76 million

2022

2030

USD

205.75 million

USD

450.76 million

2022

2030

| 2023 –2030 | |

| USD 205.75 million | |

| USD 450.76 million | |

|

|

|

Middle East and Africa Dermal Fillers Market Analysis and Size

The dermal fillers market is estimated to increase rapidly over the forecast period. Because of the need to cut costs and improve efficiency, tracking systems are becoming more popular among healthcare providers. Stronger inventory and asset management methods will aid this goal. End-users are concerned with preventing the loss of important assets and ensuring that workflows go smoothly. Surgical instrument monitoring systems make it easier to comply with the FDA's new unique device identification (UDI) tracking standards by automating medical equipment identification, including tools. The demand for solutions that enable compliance, such as surgical tool tracking systems, is projected to increase as the number of devices covered by UDI continues to grow.

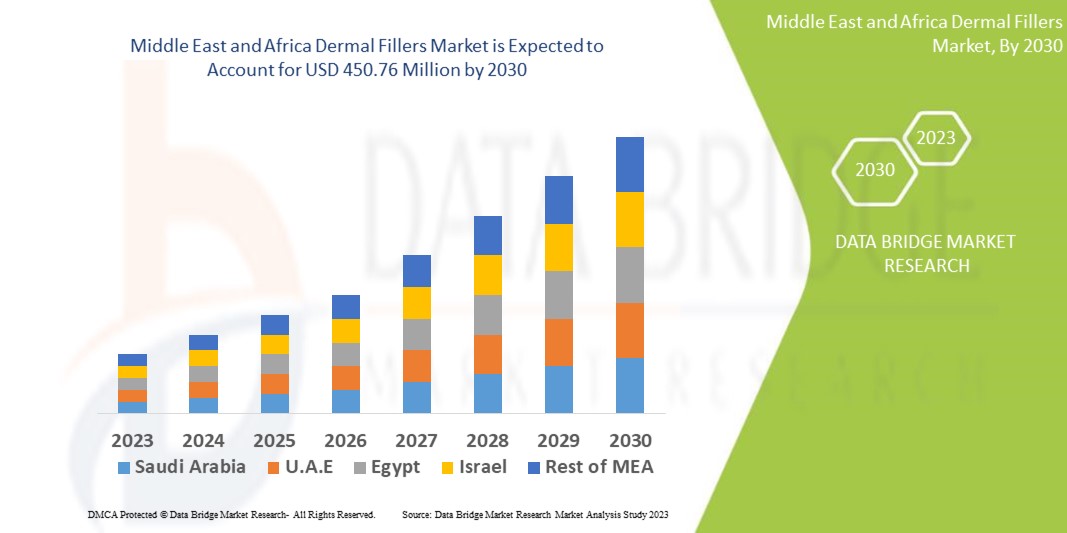

Data Bridge Market Research analyses that the Middle East and Africa dermal fillers market which was USD 205.75 million in 2022, is expected to reach up to USD 450.76 million by 2030, and is expected to undergo a CAGR of 10.3 % during the forecast period. This indicates that the market value. “Hospitals” dominates the end user segment of the market owing to the advancements in cosmetic procedures. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Middle East and Africa Dermal Fillers Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Biodegradable Dermal Fillers, Non-Biodegradable Dermal Fillers), Material Type (Natural Dermal Fillers, Synthetic Dermal Fillers), Application (Face Lift, Rhinoplasty, Reconstructive Surgery, Facial Line Correction, Lip Enhancement, Sagging Skin, Cheek Depression, Skin Smoothing, Dentistry, Aesthetic Restoration, Lip Plum, Scar Treatment, Chin Augmentation, Lipoatrophy Treatment, Earlobe Rejuvenation and Others), Drug Type (Branded, Generic), End-User (Dermatology Clinics, Ambulatory Surgical Centers, Hospitals, Academic Research Institutes And Others), Distribution Channel (Direct Tender, Drug Stores, Retail Pharmacy, Online Pharmacy and Others) |

|

Countries Covered |

South Africa, Saudi Arabia, U.A.E., Israel, Egypt, Rest of Middle East and Africa (MEA) in Middle East and Africa |

|

Market Players Covered |

Allergan (A Subsidiary of Abbvie, Inc.) (U.S.), Prollenium Medical Technologies (Canada) Suneva Medical (U.S.) Revance Therapeutics, Inc. (U.S.), FillMed Laboratories (France) Anika Therapeutics, Inc. (U.S.) Ipsen Pharma (France) BIOXIS Pharmaceuticals (Switzerland) Zimmer Aesthetic (Switzerland), Zhejiang Jingjia Medical Technology Co. Ltd. (China), Medytox (South Korea), Contura International Ltd. (U.S.) Shanghai Reyoungel Medical Technology Company Limited (China) Humedix (A subsidiary of HUONS GLOBAL) (South Korea), Galderma Laboratories, L.P. (Switzerland), Merz North America, Inc. (A Subsidiary of Merz Pharma) (Germany), Parent company Merz Pharma (Germany), Croma-Pharma GmbH (Austria) among Others |

|

Market Opportunities |

|

Market Definition

Dermal fillers are injectable substances used to rejuvenate the skin, reduce wrinkles, and restore volume. In the Middle East and Africa (MEA) region, the dermal fillers market is influenced by various factors, including cultural attitudes towards beauty, increasing aging population, and advancements in cosmetic procedures

Middle East and Africa Dermal Fillers Market Dynamics

Drivers

- Growing Aging Population

The MEA region is witnessing a rise in the aging population. With age, skin loses its elasticity and volume, leading to wrinkles and sagging. Dermal fillers address these concerns, making them popular among the elderly, thereby driving market growth.

- Changing Beauty Standards

There is a shift in societal attitudes towards cosmetic procedures. As the acceptance of non-surgical treatments increases, more people are opting for dermal fillers to enhance their appearance, boosting the market.

- Increasing Disposable Income

Economic growth in several MEA countries has led to a rise in disposable income. Individuals with higher income are more likely to invest in cosmetic procedures, creating a substantial market demand for dermal fillers.

- Advancements in Cosmetic Procedures

Technological advancements in the formulation of dermal fillers have led to safer and more effective products. Newer fillers offer longer-lasting results, encouraging more people to opt for these procedures.

Opportunities

- Rising Awareness

Increasing awareness campaigns about the safety and effectiveness of dermal fillers can dispel myths and encourage more people to consider these treatments, creating a broader market base.

- Partnerships with Healthcare Providers

Collaborations between dermal filler manufacturers and healthcare providers can ensure safe and professional administration of these products. Partnerships can build trust among consumers and drive market growth

Restraints/Challenges

- Cultural and Religious Factors

Cultural norms and religious beliefs in some MEA countries discourage cosmetic enhancements. These factors can limit market expansion, particularly in conservative societies.

- Lack of Skilled Professionals

The availability of trained and skilled professionals for administering dermal fillers is limited in certain regions. Lack of expertise can lead to improper procedures, affecting market growth negatively.

- Side Effects and Safety Concerns

Despite advancements, dermal fillers carry the risk of side effects and complications if not administered correctly. Safety concerns and adverse events can deter potential clients, impacting market growth.

This dermal fillers market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the dermal fillers market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In April 2022, Sinclair Pharma announced the company has received European CE mark for Perfectha Lidocaine in the treatment of wrinkle correction, facial contouring and volume restoration. This CE certificate results in launch of Perfectha Lidocaine in the U.K. and all major european markets.

Middle East and Africa Dermal Fillers Market Scope

The dermal fillers market is segmented on the basis of product type, material type, application, drug type, end-user and distribution channel. The growth among segments helps you analyses niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Product Type

- Biodegradable Dermal Fillers

- Non-Biodegradable Dermal Fillers

Material Type

- Natural Dermal Fillers

- Synthetic Dermal Fillers

Application

- Face Lift

- Rhinoplasty

- Reconstructive Surgery

- Facial Line Correction

- Lip Enhancement

- Sagging Skin

- Cheek Depression

- Skin Smoothing

- Dentistry

- Aesthetic Restoration

- Lip Plum

- Scar Treatment

- Chin Augmentation

- Lipoatrophy Treatment

- Earlobe Rejuvenation

- Others

Drug Type

- Branded

- Generic

End-User

- Direct Tender

- Third Party Distributor

Distribution Channel

- Direct Tender

- Drug Stores

- Retail Pharmacy

- Online Pharmacy

- Others

Middle East and Africa Dermal Fillers Market Regional Analysis/Insights

The dermal fillers market is analysed and market size insights and trends are provided by product type, material type, application, drug type, end-user and distribution channel as referenced above.

The countries covered in the dermal fillers market report are South Africa, Saudi Arabia, U.A.E., Israel, Egypt, Rest of Middle East and Africa.

South Africa is expected to dominate the market with highest CAGR due to the increasing prevalence of non-surgical or minimally invasive procedures.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and up-stream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed Base and New Technology Penetration

The dermal fillers market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for dermal fillers market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the dermal fillers market. The data is available for historic period 2015 to 2020.

Competitive Landscape and Dermal Fillers Market Share Analysis

The dermal fillers market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the company's focus related to dermal fillers market.

Some of the major players operating in the dermal fillers market are:

- Allergan (A Subsidiary of Abbvie, Inc.) (U.S.)

- Prollenium Medical Technologies (Canada)

- Suneva Medical (U.S.)

- Revance Therapeutics, Inc. (U.S.)

- FillMed Laboratories (France)

- Anika Therapeutics, Inc. (U.S.)

- Ipsen Pharma (France)

- BIOXIS Pharmaceuticals (Switzerland)

- Zimmer Aesthetic (Switzerland)

- Zhejiang Jingjia Medical Technology Co. Ltd. (China)

- Medytox (South Korea)

- Contura International Ltd. (U.S.)

- Shanghai Reyoungel Medical Technology Company Limited (China)

- Humedix (A subsidiary of HUONS GLOBAL) (South Korea)

- Galderma Laboratories, L.P. (Switzerland)

- Merz North America, Inc. (A Subsidiary of Merz Pharma) (Germany)

- Parent company Merz Pharma (Germany)

- Croma-Pharma GmbH (Austria)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.