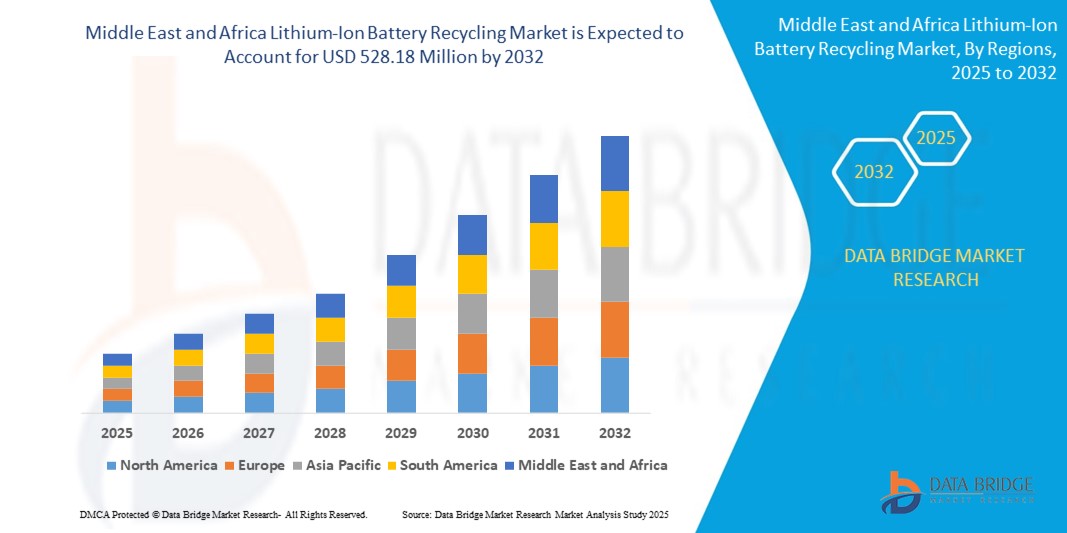

Middle East And Africa Lithium Ion Battery Recycling Market

Market Size in USD Million

CAGR :

%

USD

108.33 Million

USD

528.18 Million

2024

2032

USD

108.33 Million

USD

528.18 Million

2024

2032

| 2025 –2032 | |

| USD 108.33 Million | |

| USD 528.18 Million | |

|

|

|

|

What is the Middle East and Africa Lithium-Ion Battery Recycling Market Size and Growth Rate?

- The Middle East and Africa lithium-ion battery recycling market size was valued at USD 108.33 million in 2024 and is expected to reach USD 528.18 million by 2032, at a CAGR of21.90% during the forecast period

- The lithium-ion battery recycling market plays a vital role in sustainability efforts by recovering valuable materials such as lithium, cobalt, and nickel from used batteries. These recycled materials can be reused in various applications, including the manufacturing of new batteries, reducing dependency on raw materials, and minimizing environmental impact

What are the Major Takeaways of Lithium-Ion Battery Recycling Market?

- Lithium-ion battery recycling plays a crucial role in resource conservation by recovering valuable materials such as lithium, cobalt, and nickel. Through reintroducing these resources into the supply chain, recycling reduces the need for raw materials extraction, mitigating environmental impact, promoting sustainability, and ensuring a more efficient use of finite resources in the production of new batteries

- U.A.E. is expected to dominate the Middle East and Africa lithium-ion battery recycling market with a market share of 45.87% in 2024, driven by government-backed sustainability initiatives and a growing volume of EV and energy storage system waste

- Saudi Arabia is projected to record the fastest growth rate of 7.12% from 2025 to 2032, owing to its rising investment in electric mobility, renewable energy storage, and domestic battery manufacturing

- The Automotive segment dominated the market with the largest revenue share of 58.4% in 2024, driven by the massive growth in electric vehicle (EV) adoption and government regulations mandating battery recycling

Report Scope and Lithium-Ion Battery Recycling Market Segmentation

|

Attributes |

Lithium-Ion Battery Recycling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Lithium-Ion Battery Recycling Market?

“Integration of Circular Economy Practices and Urban Mining”

- A defining trend in the lithium-ion battery recycling market is the growing shift toward circular economy frameworks, emphasizing the recovery and reuse of valuable materials such as lithium, cobalt, and nickel. With battery demand surging from electric vehicles (EVs) and renewable storage systems, urban mining extracting metals from used batteries—has become both an environmental and economic imperative

- For instance, Li-Cycle Corp. (Canada) has deployed a "hub-and-spoke" model enabling decentralized battery collection and centralized resource recovery, achieving up to 95% material recovery. Similarly, Redwood Materials (U.S.) is scaling closed-loop recycling systems to supply battery-grade materials directly back to EV manufacturers

- Advanced hydrometallurgical techniques are replacing traditional pyrometallurgy, offering lower emissions, reduced waste, and higher material yield. These processes also make it possible to recover a broader range of metals, including manganese and graphite, with lower environmental impact

- Circular design partnerships between battery makers and recyclers are influencing product design for recyclability, ensuring easier disassembly, material separation, and reuse of modules and cells

- Companies such as Umicore (Belgium), Glencore (Switzerland), and GEM Co. Ltd. (South Korea) are investing in infrastructure that links battery collection, refining, and reintegration into supply chains, creating resilient sourcing alternatives amid geopolitical tensions over raw material supply

- This trend is redefining the end-of-life (EOL) value chain, turning waste into a revenue stream and helping industries meet sustainability mandates and ESG compliance goals

What are the Key Drivers of Lithium-Ion Battery Recycling Market?

- The rapid expansion of EV adoption, supported by government mandates and subsidies, is fueling demand for recycled materials to meet growing lithium-ion battery production needs, especially in regions with limited raw material reserves

- For instance, in February 2024, CATL (China) signed a strategic agreement with Brunp Recycling to secure a steady supply of secondary raw materials and reduce carbon emissions across its battery lifecycle

- Stringent environmental regulations such as the EU Battery Directive 2023/1542 require manufacturers to ensure minimum recycled content in new batteries, accelerating investment in scalable recycling technologies

- The rising cost and volatility of critical battery metals such as cobalt and nickel have made recycling a cost-saving and supply-stabilizing strategy, pushing OEMs and battery producers to localize recycling operations

- The shift toward next-generation battery chemistries such as LFP (Lithium Iron Phosphate) still necessitates recycling infrastructure to recover lithium and eliminate waste, reinforcing long-term market viability

- Enhanced tracking systems and digital platforms are also improving battery traceability, aiding in efficient collection, regulatory reporting, and closed-loop process optimization

Which Factor is challenging the Growth of the Lithium-Ion Battery Recycling Market?

- A persistent challenge is the technical and economic complexity of recycling diverse battery chemistries, which vary in shape, material composition, and state of charge. This complicates disassembly, sorting, and safe handling

- For instance, thermal runaway incidents during transportation or processing have led to stricter regulations and raised insurance and operational costs for recyclers, impacting profitability

- Despite advancements, recycling technologies remain capital-intensive, with high energy requirements for material separation and purification. The cost of recycled metals often exceeds mined equivalents when economies of scale are not achieved

- Infrastructure gaps especially in emerging markets limit the collection and logistics needed to supply recyclers with consistent battery feedstock, creating bottlenecks in the supply chain

- Moreover, low consumer awareness and lack of standardized labeling systems for batteries hinder proper disposal and retrieval, leaving many batteries in landfills or informal channels

- Addressing these challenges will require global coordination on policy, extended producer responsibility (EPR) programs, innovation in automation and AI-driven sorting, and incentives to foster investment in scalable, efficient recycling ecosystems

How is the Lithium-Ion Battery Recycling Market Segmented?

The market is segmented on the basis of source, component, chemistry, and recycling process.

- By Source

On the basis of source, the lithium-ion battery recycling market is segmented into Automotive, Marine, Power, and Non-Automotive. The Automotive segment dominated the market with the largest revenue share of 58.4% in 2024, driven by the massive growth in electric vehicle (EV) adoption and government regulations mandating battery recycling. The growing penetration of EVs and hybrid vehicles is contributing significantly to spent lithium-ion battery volumes.

The Power segment is projected to witness the fastest CAGR from 2025 to 2032, as the demand for grid-scale energy storage systems rises across renewable power projects and industrial backup systems.

- By Component

On the basis of component, the market is segmented into Active Material and Non-Active Material. The Active Material segment held the highest revenue share of 67.2% in 2024, due to its critical role in battery performance and value recovery. Recyclers focus on extracting high-value metals such as lithium, cobalt, and nickel from cathode and anode materials.

The Non-Active Material segment, comprising plastics, electrolytes, and casings, is also gaining attention as companies develop circular strategies to recover and reuse packaging and separators, aiding in reducing landfill waste.

- By Chemistry

On the basis of chemistry, the market is segmented into Lithium-Nickel Manganese Cobalt (Li-NMC), Lithium Cobalt Oxide (LCO), Lithium-Manganese Oxide (LMO), Lithium-Iron Phosphate (LFP), Lithium-Nickel Cobalt Aluminum Oxide (NCA), and Lithium-Titanate Oxide (LTO). The Lithium-Nickel Manganese Cobalt (Li-NMC) segment accounted for the largest revenue share of 41.6% in 2024, attributed to its widespread use in EVs and energy storage systems due to high energy density and long cycle life.

The LFP segment is expected to register the fastest CAGR, supported by its increasing deployment in electric buses, commercial vehicles, and stationary storage due to its safety, thermal stability, and longer lifecycle.

- By Recycling Process

On the basis of recycling process, the market is segmented into Hydrometallurgical Process, Pyrometallurgy Process, and Physical/Mechanical Process. The Hydrometallurgical Process dominated the market with the highest revenue share of 52.9% in 2024, due to its high metal recovery efficiency and low environmental impact. This process involves the use of aqueous solutions to extract metals, making it ideal for recovering lithium and cobalt with minimal emissions.

The Physical/Mechanical Process segment is anticipated to grow at the fastest rate during the forecast period, fueled by its ability to pre-process batteries at lower costs before applying chemical treatments.

Which Region Holds the Largest Share of the Lithium-Ion Battery Recycling Market?

- U.A.E. is expected to dominate the Middle East and Africa lithium-ion battery recycling market with a market share of 45.87% in 2024, driven by government-backed sustainability initiatives and a growing volume of EV and energy storage system waste

- The country’s strong focus on building a circular economy and adopting clean technologies supports large-scale battery recycling infrastructure development

- U.A.E.’s leadership in regional green transition efforts positions it as a central hub for lithium-ion battery recovery and reuse across the Middle East and North Africa

Which Region is the Fastest Growing Region in the Lithium-Ion Battery Recycling Market?

Saudi Arabia is projected to record the fastest growth rate of 7.12% from 2025 to 2032, owing to its rising investment in electric mobility, renewable energy storage, and domestic battery manufacturing. The Vision 2030 framework and Public Investment Fund (PIF) initiatives support the development of closed-loop battery ecosystems. As local EV adoption accelerates and recycling regulations become more stringent, Saudi Arabia is emerging as a promising market for lithium-ion battery recyclers and technology providers..

Which are the Top Companies in Lithium-Ion Battery Recycling Market?

The lithium-ion battery recycling industry is primarily led by well-established companies, including:

- ANDRITZ (Austria)

- Contemporary Amperex Technology Co., Limited (CATL) (China)

- Dubatt (Dubai, U.A.E.)

- ECOBAT (U.K.)

- GEM Co., Ltd. (South Korea)

- Greenland Recycling Solutions (U.A.E.)

- Lithion Technologies (Canada)

- Nickelhütte Aue GmbH (Germany)

- Tata Chemicals Ltd. (India)

- Veolia (France)

- GSYuasa Energy Solutions (Japan)

- Li-Cycle Corp. (Canada)

- Glencore (Switzerland)

- Umicore (Belgium)

- GP Batteries International Limited (U.K.)

- Battery Recycling Made Easy (U.S.)

- Guangdong Brunp Recycling Technology Co., Ltd. (China)

- ECOBAT (U.K.)

What are the Recent Developments in Middle East and Africa Lithium-Ion Battery Recycling Market?

- In February 2023, Umicore partnered with Automotive Cells Company (ACC) to provide battery recycling services for ACC's pilot plant in France, expanding its advanced recycling technology across the market

- In February 2023, Glencore formed a strategic partnership with Britishvolt to develop a leading ecosystem for battery recycling, aiming to advance recycling activities such as refining black mass into battery-grade materials

- In February 2023, CATL, Mercedes-Benz, and GEM signed an MOU to recycle cobalt, nickel, manganese, and lithium from Mercedes-Benz's spent EV batteries, repurposing them into battery cathode materials

- In March 2022, Retriev Technologies strengthen its lithium-ion battery recycling and logistics capabilities by acquiring Battery Solutions. This strategic move enhances the company's capacity to manage and recycle lithium-ion batteries effectively, contributing to sustainable resource management and supporting the growth of green energy technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Lithium Ion Battery Recycling Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Lithium Ion Battery Recycling Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Lithium Ion Battery Recycling Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.