Middle East And Africa Medical Imaging Market

Market Size in USD million

CAGR :

%

USD

21.30 million

USD

33.96 million

2022

2030

USD

21.30 million

USD

33.96 million

2022

2030

| 2023 –2030 | |

| USD 21.30 million | |

| USD 33.96 million | |

|

|

|

Middle East and Africa Medical Imaging Market Analysis and Size

The growing demand for early diagnosis is anticipated to create a huge demand for medical imaging in the upcoming years, further accelerating the market. Measurement and recording techniques such as magnetoencephalography (MEG) and electroencephalography (EEG) are the primary examples of medical imaging as they create data that can be represented as maps rather than images. Using varied technologies that can help in medical imaging enhances market growth.

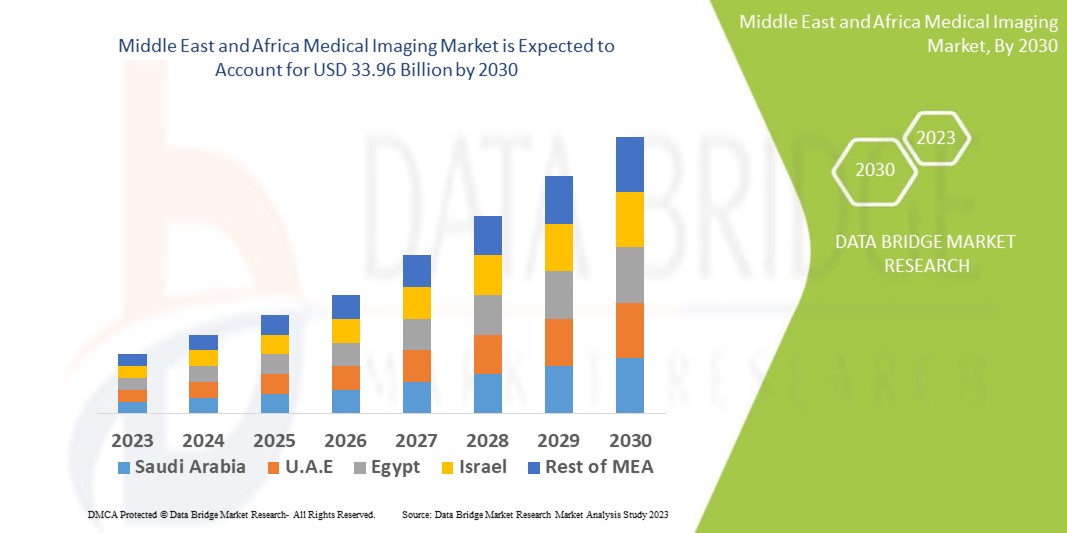

Data Bridge Market Research analyses a growth rate in the Middle East and Africa medical imaging market in 2023-2030. The expected CAGR of the Middle East and Africa medical imaging market is around 6% in the mentioned forecast period. The market was valued at USD 21.30 billion in 2022 and would grow to USD 33.96 billion by 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Middle East and Africa Medical Imaging Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Services, Product), Modality (Stationary, Portable), Procedure (Computed Tomography (CT) Scan, X-Ray Imaging, Magnetic Resonance Imaging (MRI), Ultrasound, Nuclear Imaging (SPECT/PET), Others), Technology (Direct Digital Radiology, Computed Radiology), Patient Age (Adults, Pediatric), Application (Cardiology, Pelvic And Abdominal, Oncology, Mammography, Gynecology, Neurology, Urology, Musculoskeletal, Dental, Others), End Users (Hospitals, Diagnostic Centers, Imaging Centers, Specialty Clinics, Ambulatory Surgical Centers, Academic and Research Institutes, Others) |

|

Countries Covered |

Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA) |

|

Market Players Covered |

Koninklijke Philips N.V. (Netherlands), RamSoft, Inc.(Canada), InHealth Group (U.K), Siemens (Germany), Sonic Healthcare Limited (Australia), RadNet, Inc. (U.S), General Electric (U.S), Akumin Inc. (U.S), Hologic Inc. (U.S), Shimadzu Corporation (Japan), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), Carl Zeiss Ag (Germany), Hitachi, Ltd. (Japan), MEDNAX Services, Inc. (U.S), Carestream Health (U.S), Teleradiology Solutions (U.S), UNILABS (Switzerland), ONRAD, Inc. (U.S) |

|

Market Opportunities |

|

Market Definition

Medical imaging is a type of method for the generation of different inside images of the body for disease diagnosis and therapy. This technique is typically important in enhancing people's health as it can help in the early detection of some inside ailments and properly treat those disorders. Medical imaging includes various radiological imaging techniques such as fluoroscopy, magnetic resonance imaging (MRI), X-ray radiography, medical ultrasonography, endoscopy, tactile imaging, medical photography, thermography, and nuclear medicine functional imaging techniques.

Middle East and Africa Medical Imaging Market Dynamics

Drivers

- Growing Demand For Innovative Imaging Modalities

Several surgical suits with imaging technology are helping in boosting the market growth. The number of new hospitals in this region has increased drastically. Several private players dominate the healthcare sector in these countries. Imaging modalities are generally given particular space in new hospitals. Increasing competition and growing demand for world-class healthcare services will likely expand the market growth in the upcoming years. Thus, this factor boosts market growth.

- The Rise in Chronic Diseases

This region's growing prevalence of chronic diseases is anticipated to increase the market growth. The prevalence of self-reported chronic diseases was around 23.0%. Obesity, diabetes, and asthma/allergies were the most prevalent (12.5%, 4.2% & 3.2%, respectively). Furthermore, about 34.8% of the students were either overweight or obese. Thus, growing cancer incidence surged the need for medical imaging systems as it will help in diagnosing the conditions and help in faster recovery of the patients. Thus, this factor boosts market growth.

Opportunities

- Increased Technological Advancements Associated with Medical Imaging

Technological developments and government investments will most likely contribute to market expansion, mainly in developing countries such as India and China. For instance, in 2020, Allengers launched India's first locally produced 32-slice CT scanner. Canon Medical Systems also collaborated in the system's development. Teaching, hospitals, and universities are projected to surge their need for state-of-the-art imaging modalities to offer advanced technology training, which will majorly impact market growth in the upcoming years. Thus, this factor boosts market growth.

Restraints/Challenges

- High Cost Associated with Medical imaging

The high cost associated with medical imaging systems hampers the market growth. There are several imaging systems such as MRI, CT, ultrasound machines and many others that are very expensive, which becomes unaffordable for many developing countries. Many market players are investing in huge expenditure for maintaining these systems, and the cost is increased in return. Thus, this factor hampers the market growth.

This Middle East and Africa medical imaging market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Middle East and Africa medical imaging market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2021, Esaote North America launched the MyLab X8 Ultrasound System in Canada. MyLab X8 is a fully featured premium imaging system that includes the latest and advanced technologies and offers greater image quality without compromising workflow or efficiency.

Middle East and Africa Medical Imaging Market Scope

The Middle East and Africa medical imaging market is segmented on the basis of type, modality, procedure, technology, patient age, application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Services

- Product

Modality

- Stationary

- Portable

Procedure

- Computed Tomography (CT) Scan

- X-Ray Imaging

- Magnetic Resonance Imaging (MRI)

- Ultrasound, Nuclear Imaging (SPECT/PET)

- Others

Technology

- Direct Digital Radiology

- Computed Radiology

Patient Age

- Adults

- Pediatric

Application

- Cardiology

- Pelvic And Abdominal

- Oncology

- Mammography

- Gynecology

- Neurology

- Urology

- Musculoskeletal

- Dental

- Others

End Users

- Hospitals

- Diagnostic Centers

- Imaging Centers

- Specialty Clinics

- Ambulatory Surgical Centers

- Academic and Research Institutes

- Others

Middle East and Africa Medical Imaging Market Regional Analysis/Insights

The Middle East and Africa medical imaging market is analysed and market size insights and trends are provided by product, type, modality, procedure, application, end-user, and distribution channel as referenced above.

The major countries covered in the medical imaging market report are Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

South Africa is anticipated to lead the market because of technological developments healthcare industry and increasing healthcare expenditure in this country. Furthermore, the growing incidence of diseases, along with the increasing elderly population and research studies, are anticipated to increase the market growth

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The medical imaging also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for medical imaging market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the medical imaging market. The data is available for historic period 2011-2021.

Competitive Landscape and Middle East and Africa Medical Imaging Market Share Analysis

The Middle East and Africa medical imaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Middle East and Africa medical imaging market

Key players operating in the Middle East and Africa medical imaging market include:

- Koninklijke Philips N.V. (Netherlands)

- RamSoft, Inc.(Canada)

- InHealth Group (U.K)

- Siemens (Germany)

- Sonic Healthcare Limited ( Australia)

- RadNet, Inc. (U.S)

- General Electric (U.S)

- Akumin Inc. (U.S)

- Hologic Inc. (U.S)

- Shimadzu Corporation (Japan)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Carl Zeiss Ag (Germany)

- Hitachi, Ltd. (Japan)

- MEDNAX Services, Inc. (U.S)

- Carestream Health (U.S)

- Teleradiology Solutions (U.S)

- UNILABS (Switzerland)

- ONRAD, Inc. (U.S)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTLE ANALYSIS

5.2 PORTER’S FIVE FORCES

5.3 KEY STRATEGIC INITIATIVES

6 INDUSTRY INSIGHTS

6.1 DEMOGRAPHIC TRENDS

6.2 INTERVIEWS WITH MANUFACTURING COMPANIES

6.3 INTERVIEWS WITH TECHNICIANS

6.4 OTHER KOL SNAPSHOTS

6.5 MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET ANALYSIS

7 REGULATORY FRAMWORK

8 MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET, BY PRODUCT AND SERVICES

8.1 OVERVIEW

8.2 PRODUCT

8.2.1 X-RAY SYSTEM

8.2.1.1. BY TYPE

8.2.1.1.1. COMPUTED RADIOGRAPHY (CR)

8.2.1.1.1.1 MARKET VALUE (USD MILLION)

8.2.1.1.1.2 MARKET VOLUME (UNIT)

8.2.1.1.1.3 AVERAGE SELLING PRICE (USD)

8.2.1.1.2. DIRECT RADIOGRAPHY (DR)

8.2.1.1.2.1 MARKET VALUE (USD MILLION)

8.2.1.1.2.2 MARKET VOLUME (UNIT)

8.2.1.1.2.3 AVERAGE SELLING PRICE (USD)

8.2.1.1.3. OTHERS

8.2.1.2. BY APPLICATION

8.2.1.2.1. GENRAL RADIOGRAPHY

8.2.1.2.2. MAMMOGRAPHY

8.2.1.2.3. DENTISTRY

8.2.1.2.4. OTHERS

8.2.1.3. BY MODALITY

8.2.1.3.1. STATIONARY

8.2.1.3.2. PORTABLE/MOBILE

8.2.2 MRI SYSTEM

8.2.2.1. BY TYPE

8.2.2.1.1. OPEN

8.2.2.1.1.1 LOW FIELD

8.2.2.1.1.2 HIGH FIELD

8.2.2.1.1.3 ULTRA HIGH FIELD

8.2.2.1.2. CLOSED

8.2.2.1.2.1 LOW FIELD

8.2.2.1.2.2 HIGH FIELD

8.2.2.1.2.3 ULTRA HIGH FIELD

8.2.2.2. BY MODALITY

8.2.2.2.1. STATIONARY

8.2.2.2.2. PORTABLE/MOBILE

8.2.3 ULTRASOUND SYSTEM

8.2.3.1. BY TYPE

8.2.3.1.1. DIAGNOSTIC ULTRASOUND

8.2.3.1.1.1 2D ULTRASOUND

8.2.3.1.1.2 3D AND 4D ULTRASOUND

8.2.3.1.1.3 DOPPLER ULTRASOUND

8.2.3.1.2. THERAPEUTIC ULTRASOUND

8.2.3.1.2.1 SHOCKWAVE LITHOTRIPSY

8.2.3.1.2.2 HIGH INTENSITY FOCUSED ULTRASOUND

8.2.3.2. BY DISPLAY

8.2.3.2.1. BLACK AND WHITE

8.2.3.2.2. COLORED

8.2.3.3. BY MODALITY

8.2.3.3.1. STATIONARY

8.2.3.3.2. PORTABLE/MOBILE

8.2.4 CT SYSTEM

8.2.4.1. BY TYPE

8.2.4.1.1. CONVENTIONAL CT SCANNERS

8.2.4.1.2. SPECTRAL CT SCANNERS

8.2.4.2. BY TECHNOLOGY

8.2.4.2.1. HIGH-SLICE CT

8.2.4.2.2. MID-SLICE CT

8.2.4.2.3. LOW-SLICE CT

8.2.4.2.4. CONE BEAM CT (CBCT)

8.2.4.3. BY MODALITY

8.2.4.3.1. STATIONARY

8.2.4.3.2. PORTABLE/MOBILE

8.2.5 NUCLEAR IMAGING

8.2.5.1. SINGLE PHOTON-EMISSION COMPUTED TOMOGRAPHY (SPECT)

8.2.5.1.1. HYBRID SPECT SYSTEMS

8.2.5.1.2. STANDALONE SPECT SYSTEMS

8.2.5.2. HYBRID PET

8.2.5.3. PLANAR SCINTIGRAPHY

8.2.6 OTHERS

8.3 SERVICES

8.3.1 X-RAY

8.3.2 MAGNETIC RESONANCE IMAGING

8.3.3 ULTRASOUND

8.3.4 COMPUTED TOMOGRAPHY

8.3.5 NUCLEAR IMAGING

8.3.6 OTHERS

9 MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET, BY VISUALIZATION

9.1 OVERVIEW

9.2 2D

9.3 3D/4D

9.4 OTHERS

10 MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 DIAGNOSTICS

10.2.1 MAGNETIC RESONANCE IMAGING (MRI)

10.2.1.1. OPEN MRI SYSTEMS

10.2.1.2. CLOSED MRI SYSTEMS

10.2.2 COMPUTED TOMOGRAPHY (CT)

10.2.2.1. HIGH-SLICE

10.2.2.2. MID-SLICE

10.2.2.3. LOW-SLICE

10.2.3 X-RAY

10.2.4 ULTRASOUND SYSTEM

10.2.5 MOLECULAR IMAGING

10.2.5.1. SPECT SYSTEMS

10.2.5.2. PET SYSTEMS

10.2.6 OTHERS

10.3 INTERVENTIONAL

10.3.1 X-RAY

10.3.2 ULTRASOUND SYSTEMS

10.3.3 COMPUTED TOMOGRAPHY

10.3.4 MAGNETIC RESONANCE IMAGING

10.3.5 NUCLEAR IMAGING

11 MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET, BY MODALITY

11.1 OVERVIEW

11.2 STATIONARY

11.3 PORTABLE/MOBILE

12 MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET, BY INDICATION

12.1 OVERVIEW

12.2 CARDIOLOGY

12.2.1 X-RAY

12.2.2 MRI

12.2.3 ULTRASOUND

12.2.4 CT

12.2.5 NUCLEAR IMAGING

12.2.6 OTHERS

12.3 ONCOLOGY

12.3.1 X-RAY

12.3.2 MRI

12.3.3 ULTRASOUND

12.3.4 CT

12.3.5 NUCLEAR IMAGING

12.3.6 OTHERS

12.4 MAMMOGRAPHY

12.4.1 X-RAY

12.4.2 MRI

12.4.3 ULTRASOUND

12.4.4 CT

12.4.5 OTHERS

12.5 GYNECOLOGY

12.5.1 X-RAY

12.5.2 MRI

12.5.3 ULTRASOUND

12.5.4 CT

12.5.5 NUCLEAR IMAGING

12.5.6 OTHERS

12.6 NEUROLOGY

12.6.1 X-RAY

12.6.2 MRI

12.6.3 ULTRASOUND

12.6.4 CT

12.6.5 NUCLEAR IMAGING

12.6.6 OTHERS

12.7 UROLOGY

12.7.1 X-RAY

12.7.2 MRI

12.7.3 ULTRASOUND

12.7.4 CT

12.7.5 NUCLEAR IMAGING

12.7.6 OTHERS

12.8 MUSCULOSKELETAL

12.8.1 X-RAY

12.8.2 MRI

12.8.3 ULTRASOUND

12.8.4 CT

12.8.5 NUCLEAR IMAGING

12.8.6 OTHERS

12.9 DENTAL

12.9.1 X-RAY

12.9.2 MRI

12.9.3 ULTRASOUND

12.9.4 CT

12.9.5 NUCLEAR IMAGING

12.9.6 OTHERS

12.1 OTHERS

13 MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.3 IMAGING CENTERS

13.4 SPECIALTY CLINICS

13.5 AMBULATORY SURGICAL CENTERS

13.6 ACADEMIC & RESEARCH INSTITUTES

13.7 OTHERS

14 MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT TENDER

14.3 THIRD PARTY DISTRIBUTOR

14.4 RETAIL SALES

15 MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET, BY GEOGRAPHY

MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1 SAUDI ARABIA

15.2 UAE

15.3 QATAR

15.4 KUWAIT

15.5 ISRAEL

15.6 IRAN

15.7 IRAQ

15.8 NIGERIA

15.9 SOUTH AFRICA

15.1 EGYPT

15.11 ALGERIA

15.12 REST OF MIDDLE EAST AND AFRICA

16 MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET, SWOT AND DBMR ANALYSIS

17 MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS

17.2 MERGERS & ACQUISITIONS

17.3 NEW PRODUCT DEVELOPMENT & APPROVALS

17.4 EXPANSIONS

17.5 REGULATORY CHANGES

17.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 MIDDLE EAST AND AFRICA MEDICAL IMAGING MARKET, COMPANY PROFILE

18.1 KONINKLIJKE PHILIPS N.V.

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHIC PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 SIEMENS HEALTHCARE GMBH

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHIC PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 GE HEALTHCARE.

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHIC PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 CARESTREAM HEALTH

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 TELERADIOLOGY SOLUTIONS

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 HOLOGIC, INC.

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHIC PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHIC PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 HITACHI, LTD.

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 MEDTRONIC

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.1 CANON MEDICAL SYSTEMS CORPORATION

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 SAMSUNG ELECTRONICS CO., LTD

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 KARL STORZ SE & CO. KG

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHIC PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 STRYKER

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHIC PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 OLYMPUS

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHIC PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 CARL ZEISS AG

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHIC PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 SHIMADZU CORPORATION

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHIC PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 ALLENGERS

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHIC PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 NEUSOFT CORPORATION

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHIC PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 KONICA MINOLTA, INC.

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHIC PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

18.2 NP JSC AMICO

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHIC PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

18.21 STERNMED GMBH

18.21.1 COMPANY OVERVIEW

18.21.2 REVENUE ANALYSIS

18.21.3 GEOGRAPHIC PRESENCE

18.21.4 PRODUCT PORTFOLIO

18.21.5 RECENT DEVELOPMENTS

18.22 TRIVITRON HEALTHCARE

18.22.1 COMPANY OVERVIEW

18.22.2 REVENUE ANALYSIS

18.22.3 GEOGRAPHIC PRESENCE

18.22.4 PRODUCT PORTFOLIO

18.22.5 RECENT DEVELOPMENTS

18.23 PLANMED OY

18.23.1 COMPANY OVERVIEW

18.23.2 REVENUE ANALYSIS

18.23.3 GEOGRAPHIC PRESENCE

18.23.4 PRODUCT PORTFOLIO

18.23.5 RECENT DEVELOPMENTS

18.24 SONOSCAPE MEDICAL CORP.

18.24.1 COMPANY OVERVIEW

18.24.2 REVENUE ANALYSIS

18.24.3 GEOGRAPHIC PRESENCE

18.24.4 PRODUCT PORTFOLIO

18.24.5 RECENT DEVELOPMENTS

18.25 IDETEC MEDICAL IMAGING

18.25.1 COMPANY OVERVIEW

18.25.2 REVENUE ANALYSIS

18.25.3 GEOGRAPHIC PRESENCE

18.25.4 PRODUCT PORTFOLIO

18.25.5 RECENT DEVELOPMENTS

18.26 CEFLA S.C

18.26.1 COMPANY OVERVIEW

18.26.2 REVENUE ANALYSIS

18.26.3 GEOGRAPHIC PRESENCE

18.26.4 PRODUCT PORTFOLIO

18.26.5 RECENT DEVELOPMENTS

19 RELATED REPORTS

20 CONCLUSION

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.