Middle East and Africa Shipping Container Liner Market Analysis and Insights

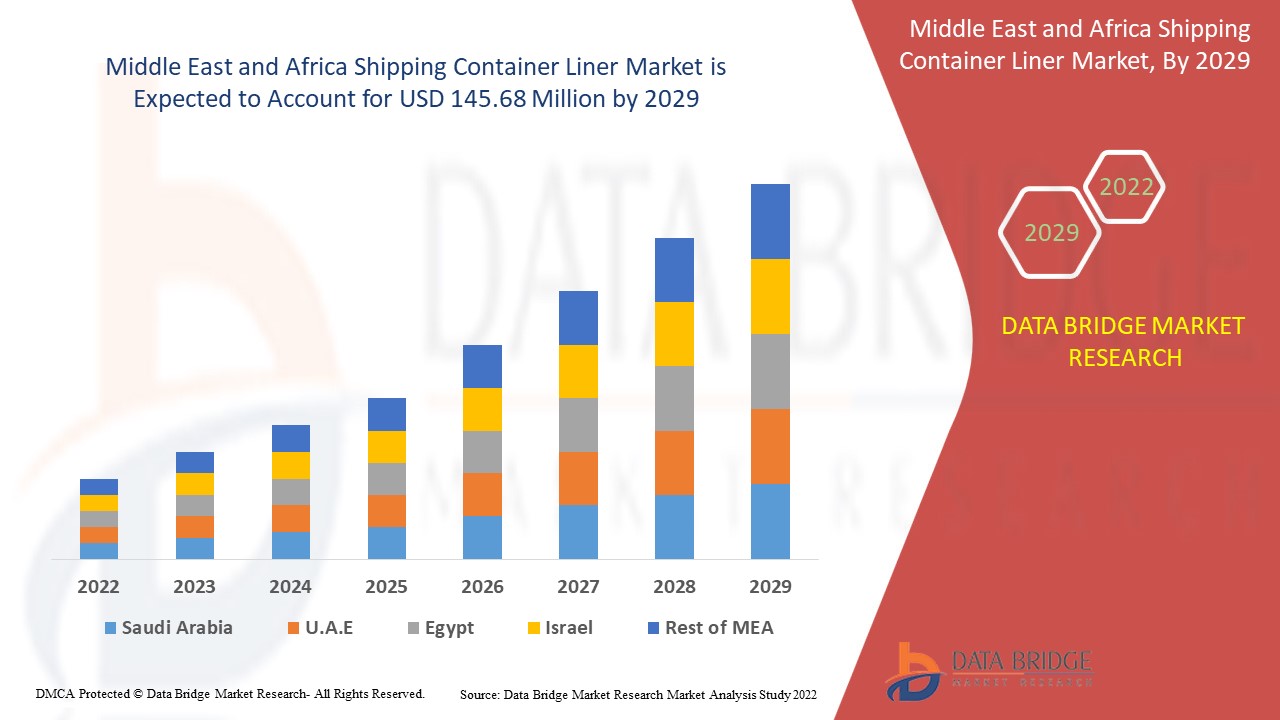

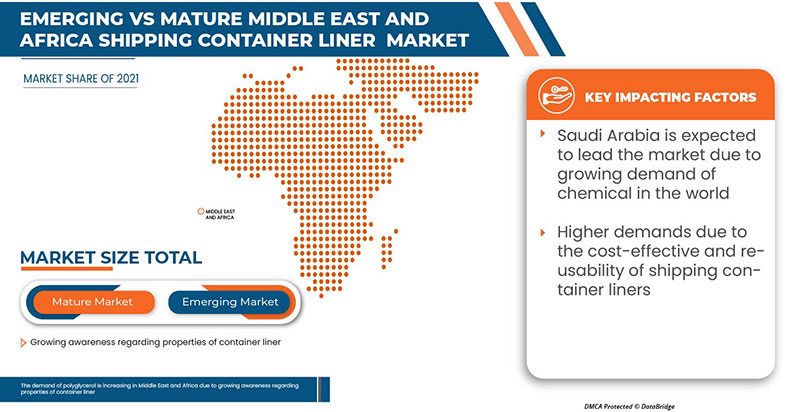

Middle East and Africa shipping container liner market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.1% in the forecast period of 2022 to 2029 and is expected to reach USD 145.68 million by 2029. The major factor driving the growth of the shipping container liner market is the inclination towards food additive consumption in the food & beverage industry, rising popularity of shipping container liners in the chemical and agricultural industry, and growing awareness regarding the properties of shipping container liners.

Container liners can be used to pack all kinds of dry food such as wheat, rice, coffee, legumes, sugar and other foods. For safe, contamination-free packaging, container liners offer a cost-effective, protective and valuable packaging solution. Rising prevalence of container liners in food and agriculture industry and increased transportation activities are expected to drive the Middle East and Africa shipping container liner market Moreover, reusability and cost effectiveness of shipping container liners will propel the growth of the Middle East and Africa shipping container liner market. However, high transportation costs and increasing freight rates may hamper the growth of the market.

The Middle East and Africa shipping container liner market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type (Polypropylene (PP) Container Liners, Polyethylene (PE) Container Liners, And Others), Application (Food And Beverages, Chemicals, Minerals, Agricultural And Others) |

|

Countries Covered |

Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and Rest of the Middle East and Africa |

|

Market Players Covered |

UNITED BAGS, INC., Bulk Corp International, Nier Systems Inc., Rishi FIBC Solutions PVT. Ltd., Dev Ventures India Pvt. Ltd., Ven Pack, BERRY MIDDLE EAST AND AFRICA INC., Bulk Handling Australia, Eceplast, Greif., LC Packaging, Thrace Group, CDF Corporation, Composite Containers, LLC, INTERTAPE POLYMER GROUP, and BULK FLOW among others. |

Market Definition

Container liners are the most economical means of packaging and transporting bulk dry, free-flowing products. They are of primary importance regarding packaging requirements for bulk deliveries of goods and other materials. When goods are moved from one geographical location to another, they naturally come into contact with natural elements such as oil, dust, air and soil, all of which can ruin or degrade the quality of the goods. There is a possibility that excessive contamination often renders goods unsuitable. Transported goods being rejected by the authorities, it is very important that the goods meet the quality standards set by the relevant government of the destination country. To prevent all these situations, bulk container liners are used as a protective layer. By using bulk container liners for transportation, goods are kept safe and contamination is completely avoided.

Middle East and Africa Shipping Container Liner Market Dynamics

Drivers

- Rising Prevalence Of Container Liners In The Food And Agriculture Industry

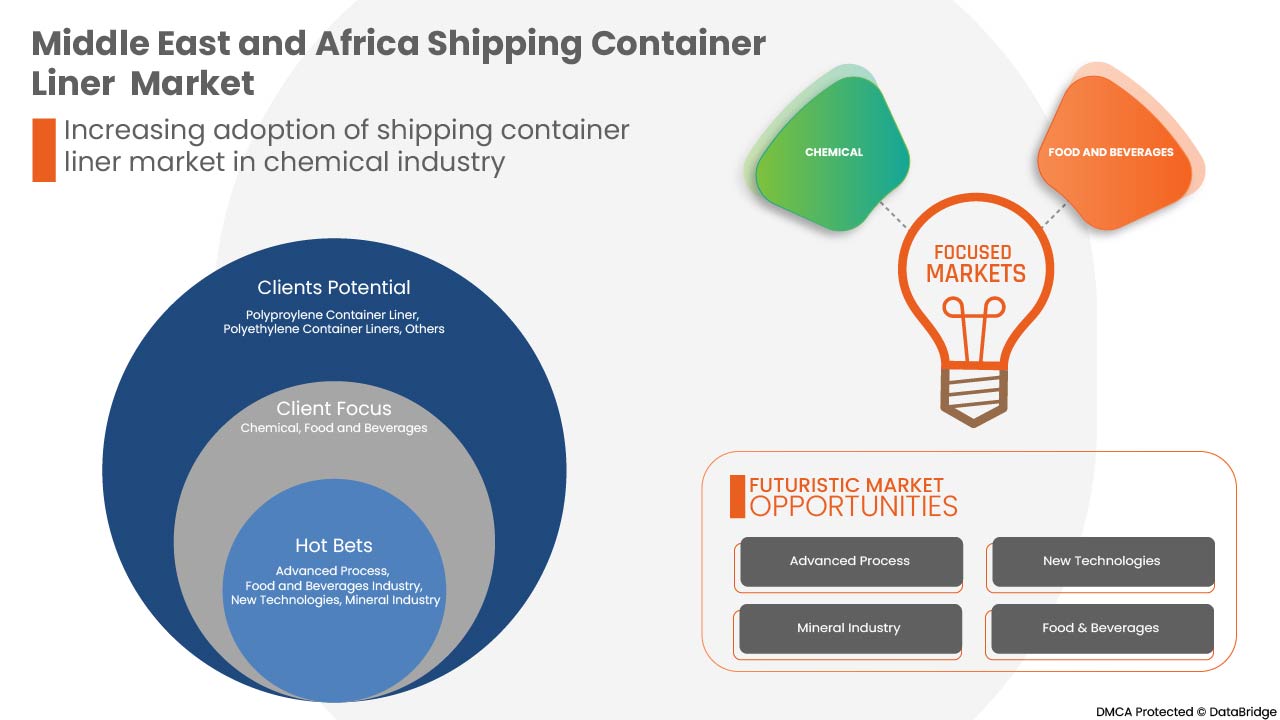

Shipping container liners have become increasingly popular in the shipping industry, especially in food and agriculture. Food products and items must be transported with well-maintained chains and precautions to maintain their quality and food security. Similarly, in the agriculture industry, transportation of seeds, fertilizers, and various chemicals must be transported with proper care and handled cautiously. Container liners prevent moisture, temperature, and other contamination in the commodity. Various manufacturers are providing such container liners as per the need of end users for varying applications. The wide applicability of container liners in food and agriculture leads to higher demands and is expected to drive market growth

- Increased Transportation Activities Requiring Shipping Container Liners

The upsurge in the transportation of goods across the globe has led to the industry's higher demand for shipping container liners. The liners provide safety to the commodities and are highly efficient in loading and unloading. With this increasing transportation, the demand for container liners is also increasing and is expected to drive the market's growth.

- Higher Demands Due To The Cost-Effective And Reusability Of Shipping Container Liners

Container liners are composed of high-density polyethylene and polypropylene, enabling end users to use them again. The container liners can be used many times, resulting in cost-effectiveness. Manufacturers provide shipping container liners in various materials, which aids in their cost-effectiveness and quality. Hence, container liners are in high demand due to their cost-effectiveness and reusability, which is expected to drive market growth.

Opportunities

- Strategic Initiatives By Leading Organizations

The acceptance and high usage of shipping container liners in the market have increased the demand for the product. To fulfill such demands as per the need of end users related to various applications, it is used for; manufacturers are taking strategic decisions and provide new and innovative products in the market.

- Increasing Demands For Large Packaging For Bulk Cargo Commodities

Container liners prevent the contamination of cargo and other products transported after packaging. It shields the bulk cargo from moisture and ensures that the cargo is shipped securely and hygienically. With container liners, very little handling is required in shipping, making all the operations easy. Manufacturers provide container liners in different designs and sizes to transport bulk cargo while ensuring product safety. Hence, the increasing demand for large packaging for bulk cargo commodities might create opportunities for the Middle East and Africa shipping container liner market.

Restraints/Challenges

- High Costs For Transportation

Due to this increased pricing in the transportation of goods, the shipping industry gets affected overall. Empirical evidence underlines that raising transport costs by 10% reduces trade volumes by more than 20%. High transportation costs impact the structure of economic activities and international trade, ultimately affecting the demand for shipping container liners

- Shortage In Shipping Containers For Transportation

To mitigate these losses, new shipping containers are to be made to resume the efficient supply chain worldwide, but still, the number of containers present is much smaller than the actual number required. This difference in the number and shortage of shipping containers significantly affects the demand for container liners

Hence, this shortfall in shipping containers will negatively affect the container liner market and is expected to hamper the market's growth.

- Stringent Environmental Regulations

Due to many stringent rules and regulations, manufacturers think twice before indulging in such a business where many rules and regulations are to be followed while maintaining the proper guidelines. This serves as a major challenge for the shipping industry and ultimately affects the Middle East and Africa shipping container liner market

Recent Development

United Bags Inc. has partnered with a recycling company which sets up baling machines, and periodically picks up the used FIBCs at no cost from the customers. Participants in this initiative receive certification stating that all their FIBCs have been recycled, causing no harm to the environment

Middle East and Africa Shipping Container Liner Market Scope

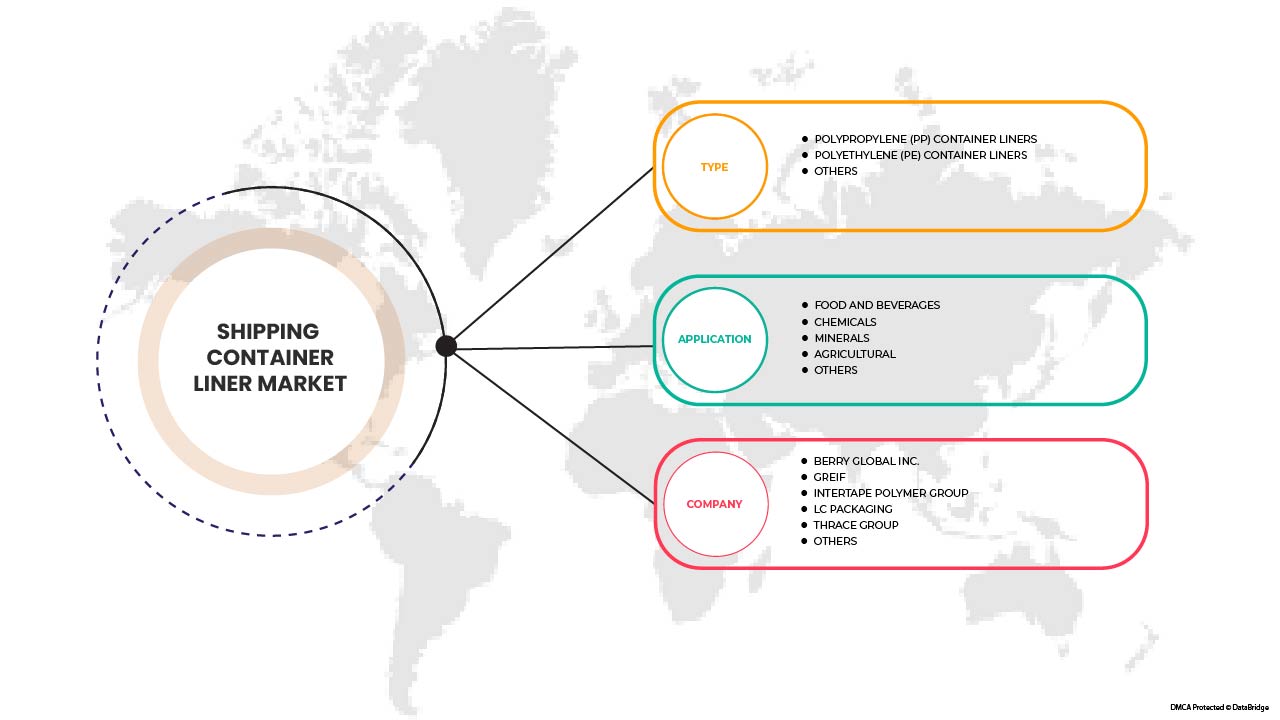

Middle East and Africa shipping container liner market is categorized based on type, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Polypropylene (PP) Container Liners

- polyethylene (PE) Container Liners

- Others

Based on type, the Middle East and Africa shipping container liner market is classified into two segments polypropylene (PP) container liners, polyethylene (PE) container liners, and others.

Application

- Food and Beverages

- Chemicals

- Minerals

- Agricultural

- Others

Based on application, the Middle East and Africa shipping container liner market is classified into five segments food and beverages, chemicals, minerals, agricultural and others.

Middle East and Africa Shipping Container Liner Market Regional Analysis/Insights

The Middle East and Africa shipping container liner market is segmented on the basis of type, and application.

The countries in the Middle East and Africa shipping container liner market are Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and Rest of the Middle East and Africa. Saudi Arabia is dominating the Middle East and Africa shipping container liner market in terms of market share and market revenue due to the growing use in pharmaceutical industry in the region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Shipping Container Liner Market Share Analysis

Middle East and Africa shipping container liner market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies focus on the Middle East and Africa shipping container liner market.

Some of the prominent participants operating in the Middle East and Africa shipping container liner market are UNITED BAGS, INC., Bulk Corp International, Nier Systems Inc., Rishi FIBC Solutions PVT. Ltd., Dev Ventures India Pvt. Ltd., Ven Pack, BERRY MIDDLE EAST AND AFRICA INC., Bulk Handling Australia, Eceplast, Greif., LC Packaging, Thrace Group, CDF Corporation, Composite Containers, LLC, INTERTAPE POLYMER GROUP, and BULK FLOW among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Middle East and Africa Vs. Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CONSUMER BUYING BEHAVIOR

4.1.1 OVERVIEW

4.1.1.1 COMPLEX BUYING BEHAVIOR

4.1.1.2 DISSONANCE-REDUCING BUYING BEHAVIOR

4.1.1.3 HABITUAL BUYING BEHAVIOR

4.1.1.4 VARIETY-SEEKING BEHAVIOR

4.1.1.5 CONCLUSION

4.2 FACTORS INFLUENCING BUYING DECISION

4.3 PORTER'S FIVE ANALYSIS FOR THE MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET

4.3.1 BARGAINING POWER OF BUYERS/CONSUMERS

4.3.2 BARGAINING POWER OF SUPPLIERS

4.3.3 THE THREAT OF NEW ENTRANTS

4.3.4 THREAT OF SUBSTITUTES

4.3.5 RIVALRY AMONG EXISTING COMPETITORS

4.4 PRICING INDEX

4.4.1 FOB & B2B PRICES –MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET

4.4.2 B2B PRICES – MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET

4.5 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: RAW MATERIAL SOURCING ANALYSIS

4.5.1 POLYETHYLENE (PE)

4.5.2 POLYPROPYLENE (PP)

4.5.3 HIGH DENSITY POLYETHYLENE(HDPE) AND LOW DENSITY POLYETHYLENE (LDPE)

4.6 TRADE ANALYSIS

4.6.1 MIDDLE EAST & AFRICA EXPORTERS OF SHIPPING CONTAINER LINERS, HS CODE OF PRODUCT: 392321

4.6.2 MIDDLE EAST & AFRICA IMPORTERS OF SHIPPING CONTAINER LINER, HS CODE OF PRODUCT: 392321

4.6.3 IMPORTS BY RUSSIAN FEDERATION, HS CODE OF PRODUCT: 392321

4.6.4 EXPORTS BY RUSSIAN FEDERATION, HS CODE OF PRODUCT: 392321

4.7 PRODUCT ADOPTION SCENARIO

4.7.1 OVERVIEW

4.7.2 PRODUCT AWARENESS

4.7.3 PRODUCT INTEREST

4.7.4 PRODUCT EVALUATION

4.7.5 PRODUCT TRIAL

4.7.6 PRODUCT ADOPTION

4.7.7 CONCLUSION

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

6 REGULATION COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF CONTAINER LINERS IN THE FOOD AND AGRICULTURE INDUSTRY

7.1.2 INCREASED TRANSPORTATION ACTIVITIES REQUIRING SHIPPING CONTAINER LINERS

7.1.3 HIGHER DEMANDS DUE TO THE COST-EFFECTIVE AND REUSABILITY OF SHIPPING CONTAINER LINERS

7.1.4 WIDE APPLICABILITY OF CONTAINER LINERS IN CHEMICAL AND MINERAL TRANSPORTATION

7.2 RESTRAINTS

7.2.1 HIGH COSTS FOR TRANSPORTATION

7.2.2 SHORTAGE IN SHIPPING CONTAINERS FOR TRANSPORTATION

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVES BY LEADING ORGANIZATIONS

7.3.2 INCREASING DEMANDS FOR LARGE PACKAGING FOR BULK CARGO COMMODITIES

7.4 CHALLENGES

7.4.1 LACK OF EMPLOYEES ON PORTS

7.4.2 STRINGENT ENVIRONMENTAL REGULATIONS

8 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET, BY TYPE

8.1 OVERVIEW

8.2 POLYETHYLENE

8.3 POLYPROPYLENE

8.4 OTHERS

9 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 FOOD AND BEVERAGE

9.2.1 POLYPROPYLENE

9.2.2 POLYETHYLENE

9.2.3 OTHERS

9.3 CHEMICAL

9.3.1 POLYPROPYLENE

9.3.2 POLYETHYLENE

9.3.3 OTHERS

9.4 AGRICULTURAL

9.4.1 POLYPROPYLENE

9.4.2 POLYETHYLENE

9.4.3 OTHERS

9.5 MINERAL

9.5.1 POLYPROPYLENE

9.5.2 POLYETHYLENE

9.5.3 OTHERS

9.6 OTHERS

9.6.1 POLYPROPYLENE

9.6.2 POLYETHYLENE

9.6.3 OTHERS

10 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SAUDI ARABIA

10.1.2 UNITED ARAB EMIRATES

10.1.3 SOUTH AFRICA

10.1.4 EGYPT

10.1.5 ISRAEL

10.1.6 REST OF MIDDLE EAST & AFRICA

11 COMPANY LANDSCAPE, MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 COMPANY PROFILES

12.1 BERRY MIDDLE EAST & AFRICA INC.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SWOT

12.1.5 PRODUCT PORTFOLIO

12.1.6 RECENT UPDATES

12.2 GREIF

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 SWOT

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT UPDATE

12.3 INTERTAPE POLYMER GROUP

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 SWOT

12.3.5 RECENT UPDATE

12.4 LC PACKAGING

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 SWOT

12.4.5 RECENT UPDATES

12.5 BULK HANDLING AUSTRALIA

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT

12.5.5 RECENT UPDATE

12.6 BULK CORP INTERNATIONAL

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 SWOT

12.6.4 RECENT UPDATES

12.7 BULK FLOW

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 SWOT

12.7.4 RECENT UPDATES

12.8 COMPOSITE CONTAINERS, LLC

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 SWOT

12.8.4 RECENT UPDATE

12.9 CDF CORPORATION

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 SWOT

12.9.4 RECENT UPDATE

12.1 DEV VENTURES INDIA PVT. LTD.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 SWOT

12.10.4 RECENT DEVELOPMENT

12.11 ECEPLAST

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 SWOT

12.11.4 RECENT UPDATES

12.12 NIER SYSTEMS INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 SWOT

12.12.4 RECENT UPDATES

12.13 RISHI FIBC SOLUTIONS PVT. LTD.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 SWOT

12.13.4 RECENT UPDATE

12.14 THRACE GROUP

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 SWOT

12.14.4 PRODUCT PORTFOLIO

12.14.5 RECENT UPDATE

12.15 UNITED BAGS, INC

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 SWOT

12.15.4 RECENT UPDATE

12.16 VEN PACK

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 SWOT

12.16.4 RECENT UPDATES

13 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 FREE ON BOARD (FOB) OF SCREEN PRINTING MESH

TABLE 2 EXPORTERS OF SHIPPING CONTAINER LINERS UNIT: USD THOUSAND

TABLE 3 IMPORTERS OF SHIPPING CONTAINER LINER , UNIT: USD THOUSAND

TABLE 4 IMPORTS BY RUSSIAN FEDERATION , UNIT: USD THOUSAND

TABLE 5 EXPORTS BY RUSSIAN FEDERATION UNIT: USD THOUSAND

TABLE 6 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA POLYETHYLENE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA POLYPROPYLENE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA FOOD AND BEVERAGE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA FOOD AND BEVERAGE IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 IDDLE EAST AND AFRICA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 SAUDI ARABIA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 SAUDI ARABIA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 SAUDI ARABIA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 SAUDI ARABIA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 SAUDI ARABIA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 SAUDI ARABIA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 SAUDI ARABIA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 UNITED ARAB EMIRATES SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 UNITED ARAB EMIRATES SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 UNITED ARAB EMIRATES FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 UNITED ARAB EMIRATES CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 UNITED ARAB EMIRATES AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 UNITED ARAB EMIRATES MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 UNITED ARAB EMIRATES OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 EGYPT SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 EGYPT SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 EGYPT FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 EGYPT CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 EGYPT AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 EGYPT MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 EGYPT OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 ISRAEL SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 ISRAEL SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 ISRAEL FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 ISRAEL CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 ISRAEL AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 ISRAEL MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 ISRAEL OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 REST OF MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: SEGMENTATION

FIGURE 10 RISING PREVALANCE OF SHIPPING CONTAINER LINER IN FOOD AND AGRICULTURE INSUTRY IS DRIVING THE MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET IN THE FORECAST PERIOD

FIGURE 11 XXX SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET IN 2022 & 2029

FIGURE 12 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: TYPES OF CONSUMER BUYING BEHAVIOR

FIGURE 13 PORTER'S 5 ANALYSIS

FIGURE 14 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET

FIGURE 16 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: BY TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: BY APPLICATION, 2021

FIGURE 18 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 19 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021)

FIGURE 20 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: BY TYPE (2022 - 2029)

FIGURE 23 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET: COMPANY SHARE 2021 (%)

Middle East And Africa Shipping Container Liner Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Shipping Container Liner Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Shipping Container Liner Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.