Middle East And Africa Trauma Devices Market

Market Size in USD Billion

CAGR :

%

USD

13.66 Billion

USD

26.24 Billion

2022

2030

USD

13.66 Billion

USD

26.24 Billion

2022

2030

| 2023 –2030 | |

| USD 13.66 Billion | |

| USD 26.24 Billion | |

|

|

|

Middle East and Africa Trauma Devices Market Analysis and Size

As trauma devices have repeatedly demonstrated their high rates of effectiveness for treating fractures, dislocations, sprains, and strains, their market value is rising. Various research studies are currently underway, which are expected to provide manufacturers with a competitive advantage in developing new and innovative trauma devices and a variety of other opportunities in the trauma devices market.

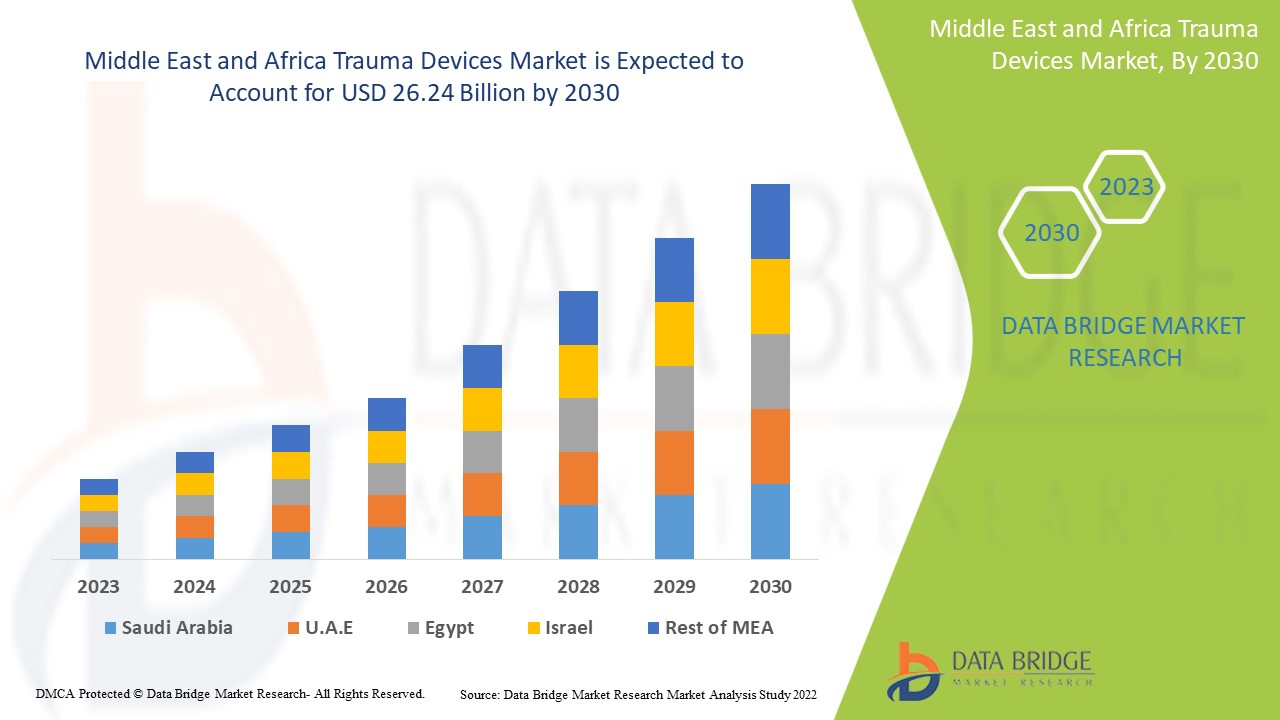

Data Bridge Market Research analyses that the trauma devices market which was USD 13.66 billion in 2022, would rocket up to USD 26.24 billion by 2030, and is expected to undergo a CAGR of 8.50% during the forecast period 2022 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Trauma Devices Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Internal Fixators Devices, External Fixators Devices and Others), Surgical Site (Lower Extremities and Upper Extremities), Tissue Type (Hard Tissue and Soft Tissue), Material Type (Non-Absorbable and Bio-Absorbable), Patient Age (Adults and Paediatric), End User (Hospitals, Trauma Centres, Ambulatory Surgical Centres and Other), Distribution Channel (Direct Tender and Retail Sales) |

|

Countries Covered |

Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA) |

|

Market Players Covered |

Shanghai Kinetic Medical Co. Ltd (China), Weigao group (China), MicroPort Scientific Corporation (China), Orthofix US LLC (U.S.), CONMED Corporation (U.S.), Wright Medical Group N.V. (U.S.), NuVasive, Inc (U.S.), Corin Group (U.S.), Enovis (U.S.), OsteoMed (U.S.), Invibio Ltd. (U.S.), gpcmedical.com (U.S.), Medtronic (Ireland), Smith & Nephew (U.S.), Integra LifeSciences (U.S.), B. Braun SE (Germany), Stryker (U.S.) |

|

Market Opportunities |

|

Market Definition

Trauma devices are a clinical procedure used in trauma care. Traumatic injuries caused by an external source include fractures, dislocations, sprains and strains, and burns. These tools are especially useful in cases involving long bones, such as fractures. The trauma devices also include upper and lower extremity components such as the knee, joint, leg, spine, and others.

Trauma Devices Market Dynamics

Drivers

- Dramatic rise in geriatric population across the globe

The primary driver is the increase in traffic accidents. The number of serious fractures among the elderly brought on by accidents and falls is expected to increase, requiring the usage of fracture fixators which will propel the market growth.

- Increase in the aging population

An ageing population that is more susceptible to osteoarthritic fractures, an increase in the prevalence of osteoporosis, and technological advancements like the use of orthobiologic products and biodegradable materials will all drive the market. Additionally, the sector will advance due to an increase in the incidence of traffic accidents, sports-related injuries, and people's changing lifestyles..

- Injuries caused by trauma

Trauma includes bone fractures or breakage as well as tissue injuries. These injuries are treated with trauma devices, which replace the damaged body part. Motor vehicle accidents cause a large number of trauma injuries. The market has been driven by an increase in the frequency of incidents in emerging countries.

Opportunities

- Increased government attention on new medication discovery and development

The factors that are most important for driving market revenue growth are the rapid spread of COVID-19 throughout the world, a rapidly expanding patient pool, significant alterations in the demand for and supply of healthcare solutions during the COVID-19 outbreak, rising telehealth and telemedicine trends, and a growing requirement for advanced point-of-care diagnostics. Increased government funding for COVID-19 vaccine development, increased government focus on new medication discovery and development, and increased government focus on improving the healthcare supply chain system all contribute to revenue growth in the market.

Restraints/Challenges

- High cost of trauma devices

The high cost of trauma devices, allergies associated with internal fixation devices, and the risk of infection, as well as price fluctuations and a scarcity of experienced experts, are expected to hamper the market expansion. Furthermore, due to patient compatibility and allergy concerns, government authorities do not quickly approve the materials used to manufacture trauma devices. These implants' materials are expected to be biocompatible and highly inert. As a result, obtaining approval for these devices is difficult for businesses.

This trauma devices market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the trauma devices market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Trauma Devices Market

The COVID-19 pandemic has had a significant impact on global economies, with all industries experiencing significant declines by 2020. The business has suffered significantly as a result of the pandemic's strain on healthcare institutions to contain illness transmission. Many treatments and surgical procedures were documented to be halted or postponed permanently throughout the pandemic due to the non-essential nature of trauma fixation operations. As a result, demand for trauma fixation devices was low during the first few months of the epidemic, limiting the industry's growth. Furthermore, the expansion of multispecialty hospitals to provide proper trauma care, particularly in emerging markets such as India, will increase industry income. Similarly, low-cost therapies provided by various government organizations will act as a significant market expansion stimulus in low-income countries.

Recent Developments

- In 2019, Colfax Corporation acquired DJO Global, Inc, a private equity firm with multiple divisions, including bracing and supports, surgical, footcare, healthcare solutions, recovery, and consumer. This acquisition will help the company earn more profit by increasing revenue.

- In 2019, Medtronic acquired Titan Spine. Medtronic's titanium spine interbody implant and surface technology portfolio was expanded as a result of this acquisition. This also aided the company's offering of trauma devices.

Middle East and Africa Trauma Devices Market Scope

The trauma devices market is segmented on the basis of type, surgical site and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Internal Fixators

- Plates and Screws

- Rods and Pins

- Others

- External Fixators

- Uniplanar and Biplanar Fixators

- Circular Fixators

- Hybrid Fixators

Surgical Site

- Upper Extremity

- Hand and Wrist

- Shoulder

- Arm

- Elbow

- Lower Extremity

- Hip and Pelvis

- Lower Leg

- Foot and Ankle

- Knee

- Thigh

End-user

- Hospitals

- Ambulatory Surgical Centres

Trauma Devices Market Regional Analysis/Insights

The trauma devices market is analyzed and market size insights and trends are provided by country, type, surgical site and end-user as referenced above.

The countries covered in the trauma devices market report are Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Saudi Arabia dominates the Middle East and Africa trauma devices market due to the large number of companies, R&D capabilities, and growing adoption of minimally invasive surgical procedures.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The trauma devices market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for trauma devices market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the trauma devices market. The data is available for historic period 2011-2021.

Competitive Landscape and Trauma Devices Market Share Analysis

The trauma devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to trauma devices market.

Some of the major players operating in the trauma devices market are:

- Shanghai Kinetic Medical Co. Ltd (China)

- Weigao group (China)

- MicroPort Scientific Corporation (China)

- Orthofix US LLC (U.S.)

- CONMED Corporation (U.S.)

- Wright Medical Group N.V. (U.S.)

- NuVasive, Inc (U.S.)

- Corin Group (U.S.)

- Enovis (U.S.)

- OsteoMed (U.S.)

- Invibio Ltd. (U.S.)

- gpcmedical.com (U.S.)

- Medtronic (Ireland)

- Smith & Nephew (U.S.)

- Integra LifeSciences (U.S.)

- B. Braun SE (Germany)

- Stryker (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA (MEA) TRAUMA DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE MIDDLE EAST AND AFRICA (MEA)TRAUMA DEVICES MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 MIDDLE EAST AND AFRICA (MEA)TRAUMA DEVICES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 COST ANALYSIS BREAKDOWN

8 TECHNONLOGY ROADMAP

9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

9.1.1 JOINT VENTURES

9.1.2 MERGERS AND ACQUISITIONS

9.1.3 LICENSING AND PARTNERSHIP

9.1.4 TECHNOLOGY COLLABORATIONS

9.1.5 STRATEGIC DIVESTMENTS

9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

9.3 STAGE OF DEVELOPMENT

9.4 TIMELINES AND MILESTONES

9.5 INNOVATION STRATEGIES AND METHODOLOGIES

9.6 RISK ASSESSMENT AND MITIGATION

9.7 FUTURE OUTLOOK

10 REGULATORY COMPLIANCE

10.1 REGULATORY AUTHORITIES

10.2 REGULATORY CLASSIFICATIONS

10.3 REGULATORY SUBMISSIONS

10.4 INTERNATIONAL HARMONIZATION

10.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

10.6 REGULATORY CHALLENGES AND STRATEGIES

11 REIMBURSEMENT FRAMEWORK

12 VALUE CHAIN ANALYSIS

13 HEALTHCARE ECONOMY

13.1 HEALTHCARE EXPENDITURE

13.2 CAPITAL EXPENDITURE

13.3 CAPEX TRENDS

13.4 CAPEX ALLOCATION

13.5 FUNDING SOURCES

13.6 INDUSTRY BENCHMARKS

13.7 GDP RATION IN OVERALL GDP

13.8 HEALTHCARE SYSTEM STRUCTURE

13.9 GOVERNMENT POLICIES

13.1 ECONOMIC DEVELOPMENT

14 MIDDLE EAST AND AFRICA (MEA)TRAUMA DEVICES MARKET, BY PRODUCT TYPE

14.1 OVERVIEW

NOTE: MARKET VALUE, VOLUME AND ASP ANALYSIS WOULD BE PROVIDED FOR ALL SEGMENTS AND SUB-SEGMENTS OF PRODUCT)

14.2 CORE TRAUMA DEVICES

14.2.1 INTERNAL FIXATOR DEVICES

14.2.1.1. SCREW

14.2.1.1.1. BY TYPE

14.2.1.1.1.1 COMPRESSION BONE SCREWS

14.2.1.1.1.1.1. MARKET VALUE (USD MILLION)

14.2.1.1.1.1.2. MARKET VOLUME (UNITS)

14.2.1.1.1.1.3. AVERAGE SELLING PRICE (USD)

14.2.1.1.1.2 ARTHRODESIS SCREWS

14.2.1.1.1.2.1. MARKET VALUE (USD MILLION)

14.2.1.1.1.2.2. MARKET VOLUME (UNITS)

14.2.1.1.1.2.3. AVERAGE SELLING PRICE (USD)

14.2.1.1.1.3 BONE SCREW WASHERS

14.2.1.1.1.3.1. MARKET VALUE (USD MILLION)

14.2.1.1.1.3.2. MARKET VOLUME (UNITS)

14.2.1.1.1.3.3. AVERAGE SELLING PRICE (USD)

14.2.1.1.2. BY LENGTH

14.2.1.1.2.1 1.5 MM

14.2.1.1.2.2 2 MM

14.2.1.1.2.3 2.7 MM

14.2.1.1.2.4 3.5 MM

14.2.1.1.2.5 OTHERS

14.2.1.1.3. BY MATERIAL

14.2.1.1.3.1 BIOABSORBABLE SCREWS

14.2.1.1.3.2 NON- BIOABSORBABLE SCREWS

14.2.1.1.4. OTHERS

14.2.1.2. NAILING

14.2.1.2.1. TIBIA NAILING SYSTEM

14.2.1.2.1.1 MARKET VALUE (USD MILLION)

14.2.1.2.1.2 MARKET VOLUME (UNITS)

14.2.1.2.1.3 AVERAGE SELLING PRICE (USD)

14.2.1.2.2. FEMUR NAILING SYSTEM

14.2.1.2.2.1 MARKET VALUE (USD MILLION)

14.2.1.2.2.2 MARKET VOLUME (UNITS)

14.2.1.2.2.3 AVERAGE SELLING PRICE (USD)

14.2.1.2.3. OTHERS

14.2.1.2.3.1 MARKET VALUE (USD MILLION)

14.2.1.2.3.2 MARKET VOLUME (UNITS)

14.2.1.2.3.3 AVERAGE SELLING PRICE (USD)

14.2.1.3. PLATES

14.2.1.3.1. COMPRESSION PLATES

14.2.1.3.1.1 MARKET VALUE (USD MILLION)

14.2.1.3.1.2 MARKET VOLUME (UNITS)

14.2.1.3.1.3 AVERAGE SELLING PRICE (USD)

14.2.1.3.2. OSTEOTOMY PLATES

14.2.1.3.2.1 MARKET VALUE (USD MILLION)

14.2.1.3.2.2 MARKET VOLUME (UNITS)

14.2.1.3.2.3 AVERAGE SELLING PRICE (USD)

14.2.1.3.3. ARTHRODESIS PLATES

14.2.1.3.3.1 MARKET VALUE (USD MILLION)

14.2.1.3.3.2 MARKET VOLUME (UNITS)

14.2.1.3.3.3 AVERAGE SELLING PRICE (USD)

14.2.1.3.4. OTHERS

14.2.1.4. STAPLES

14.2.1.4.1. MARKET VALUE (USD MILLION)

14.2.1.4.2. MARKET VOLUME (UNITS)

14.2.1.4.3. AVERAGE SELLING PRICE (USD)

14.2.1.5. WIRES

14.2.1.5.1. MARKET VALUE (USD MILLION)

14.2.1.5.2. MARKET VOLUME (UNITS)

14.2.1.5.3. AVERAGE SELLING PRICE (USD)

14.2.1.6. RODS & PINS

14.2.1.6.1. MARKET VALUE (USD MILLION)

14.2.1.6.2. MARKET VOLUME (UNITS)

14.2.1.6.3. AVERAGE SELLING PRICE (USD)

14.2.1.7. OTHERS

14.2.2 EXTERNAL FIXATOR DEVICES

14.2.2.1. UNILATERAL & BILATERAL EXTERNAL FIXATORS

14.2.2.1.1. MARKET VALUE (USD MILLION)

14.2.2.1.2. MARKET VOLUME (UNITS)

14.2.2.1.3. AVERAGE SELLING PRICE (USD)

14.2.2.2. CIRCULAR FIXATORS

14.2.2.2.1. MARKET VALUE (USD MILLION)

14.2.2.2.2. MARKET VOLUME (UNITS)

14.2.2.2.3. AVERAGE SELLING PRICE (USD)

14.2.2.3. HYBRID FIXATORS

14.2.2.3.1. MARKET VALUE (USD MILLION)

14.2.2.3.2. MARKET VOLUME (UNITS)

14.2.2.3.3. AVERAGE SELLING PRICE (USD)

14.2.2.3.4. OTHERS

14.2.3 INTRAOSSEOUS DEVICES

14.2.3.1. MANUAL

14.2.3.1.1. MARKET VALUE (USD MILLION)

14.2.3.1.2. MARKET VOLUME (UNITS)

14.2.3.1.3. AVERAGE SELLING PRICE (USD)

14.2.3.2. SEMI-AUTOMATED

14.2.3.2.1. MARKET VALUE (USD MILLION)

14.2.3.2.2. MARKET VOLUME (UNITS)

14.2.3.2.3. AVERAGE SELLING PRICE (USD)

14.2.3.3. AUTOMATED

14.2.3.3.1. MARKET VALUE (USD MILLION)

14.2.3.3.2. MARKET VOLUME (UNITS)

14.2.3.3.3. AVERAGE SELLING PRICE (USD)

14.3 SHOULDER ARTHROPLASTY DEVICES

14.3.1 BY TYPE

14.3.1.1. SHOULDER ARTHROPLASTY RESURFACING IMPLANTS

14.3.1.1.1. RESURFACING HEAD

14.3.1.1.1.1 MARKET VALUE (USD MILLION)

14.3.1.1.1.2 MARKET VOLUME (UNITS)

14.3.1.1.1.3 AVERAGE SELLING PRICE (USD)

14.3.1.1.2. SHOULDER CUP

14.3.1.1.2.1 MARKET VALUE (USD MILLION)

14.3.1.1.2.2 MARKET VOLUME (UNITS)

14.3.1.1.2.3 AVERAGE SELLING PRICE (USD)

14.3.1.1.3. HUMERAL STEM

14.3.1.1.3.1 MARKET VALUE (USD MILLION)

14.3.1.1.3.2 MARKET VOLUME (UNITS)

14.3.1.1.3.3 AVERAGE SELLING PRICE (USD)

14.3.1.1.4. ECCENTER

14.3.1.1.4.1 MARKET VALUE (USD MILLION)

14.3.1.1.4.2 MARKET VOLUME (UNITS)

14.3.1.1.4.3 AVERAGE SELLING PRICE (USD)

14.3.1.1.5. GLENOID

14.3.1.1.5.1 MARKET VALUE (USD MILLION)

14.3.1.1.5.2 MARKET VOLUME (UNITS)

14.3.1.1.5.3 AVERAGE SELLING PRICE (USD)

14.3.1.1.6. SHELL SCREWS

14.3.1.1.6.1 MARKET VALUE (USD MILLION)

14.3.1.1.6.2 MARKET VOLUME (UNITS)

14.3.1.1.6.3 AVERAGE SELLING PRICE (USD)

14.3.1.1.7. OTHER

14.3.1.2. SHOULDER ARTHROPLASTY TRAUMA DEVICES

14.3.1.2.1. STEM INSTRUMENTS

14.3.1.2.1.1 MARKET VALUE (USD MILLION)

14.3.1.2.1.2 MARKET VOLUME (UNITS)

14.3.1.2.1.3 AVERAGE SELLING PRICE (USD)

14.3.1.2.2. PRESS INSTRUMENTS

14.3.1.2.2.1 MARKET VALUE (USD MILLION)

14.3.1.2.2.2 MARKET VOLUME (UNITS)

14.3.1.2.2.3 AVERAGE SELLING PRICE (USD)

14.3.1.2.3. GLENOID INSERTION INSTRUMENTS

14.3.1.2.3.1 MARKET VALUE (USD MILLION)

14.3.1.2.3.2 MARKET VOLUME (UNITS)

14.3.1.2.3.3 AVERAGE SELLING PRICE (USD)

14.3.1.2.4. OTHER

14.3.1.3. SHOULDER ARTHROPLASTY PLATFORM SYSTEMS

14.3.2 BY PROCEDURE

14.3.2.1. PARTIAL SHOULDER ARTHROPLASTY

14.3.2.1.1. PARTIAL RESURFACING

14.3.2.1.2. HEMI RESURFACING

14.3.2.1.3. PARTIAL-MID HEAD

14.3.2.1.4. STEMMED HEMI

14.3.2.2. TOTAL SHOULDER ARTHROPLASTY

14.3.2.2.1. TOTAL-MID HEAD

14.3.2.2.2. TOTAL CONVENTIONAL

14.3.2.2.3. TOTAL REVERSE

14.3.2.3. REVIION SHOULDER ARTHROPLASTY

14.4 FOOT AND ANKLE ARTHROPLASTY DEVICES

14.4.1 INTERANL FIXATION DEVICES

14.4.1.1. PLATES

14.4.1.1.1. MARKET VALUE (USD MILLION)

14.4.1.1.2. MARKET VOLUME (UNITS)

14.4.1.1.3. AVERAGE SELLING PRICE (USD)

14.4.1.2. SCREW

14.4.1.2.1. MARKET VALUE (USD MILLION)

14.4.1.2.2. MARKET VOLUME (UNITS)

14.4.1.2.3. AVERAGE SELLING PRICE (USD)

14.4.1.3. FUSION NAILS

14.4.1.3.1. MARKET VALUE (USD MILLION)

14.4.1.3.2. MARKET VOLUME (UNITS)

14.4.1.3.3. AVERAGE SELLING PRICE (USD)

14.4.1.4. WIRE & PINS

14.4.1.4.1. MARKET VALUE (USD MILLION)

14.4.1.4.2. MARKET VOLUME (UNITS)

14.4.1.4.3. AVERAGE SELLING PRICE (USD)

14.4.1.5. INTRAMEDULLARY IMPLANT

14.4.1.5.1. MARKET VALUE (USD MILLION)

14.4.1.5.2. MARKET VOLUME (UNITS)

14.4.1.5.3. AVERAGE SELLING PRICE (USD)

14.4.1.6. HAMMERTOE FIXATION SYSTEM

14.4.1.6.1. MARKET VALUE (USD MILLION)

14.4.1.6.2. MARKET VOLUME (UNITS)

14.4.1.6.3. AVERAGE SELLING PRICE (USD)

14.4.1.7. STAPLE FIXATION SYSTEM

14.4.1.7.1. MARKET VALUE (USD MILLION)

14.4.1.7.2. MARKET VOLUME (UNITS)

14.4.1.7.3. AVERAGE SELLING PRICE (USD)

14.4.1.8. OTHER

14.4.2 EXTERNAL FIXATION DEVICES

14.4.2.1. RING ANKLE FIXATORS

14.4.2.1.1. MARKET VALUE (USD MILLION)

14.4.2.1.2. MARKET VOLUME (UNITS)

14.4.2.1.3. AVERAGE SELLING PRICE (USD)

14.4.2.2. UNILATERAL FIXATORS

14.4.2.2.1. MARKET VALUE (USD MILLION)

14.4.2.2.2. MARKET VOLUME (UNITS)

14.4.2.2.3. AVERAGE SELLING PRICE (USD)

14.4.2.3. HYBRID FIXATORS

14.4.2.3.1. MARKET VALUE (USD MILLION)

14.4.2.3.2. MARKET VOLUME (UNITS)

14.4.2.3.3. AVERAGE SELLING PRICE (USD)

14.4.2.4. OTEHR

14.4.3 JOINT IMPLANT

14.4.3.1. ANKLE IMPLANT

14.4.3.1.1. MARKET VALUE (USD MILLION)

14.4.3.1.2. MARKET VOLUME (UNITS)

14.4.3.1.3. AVERAGE SELLING PRICE (USD)

14.4.3.2. SUBTALAR JOINT IMPLANT

14.4.3.2.1. MARKET VALUE (USD MILLION)

14.4.3.2.2. MARKET VOLUME (UNITS)

14.4.3.2.3. AVERAGE SELLING PRICE (USD)

14.4.3.3. PHALANGEAL IMPLANTS

14.4.3.3.1. MARKET VALUE (USD MILLION)

14.4.3.3.2. MARKET VOLUME (UNITS)

14.4.3.3.3. AVERAGE SELLING PRICE (USD)

14.4.3.4. OTHER

14.4.4 PROSTHESES

14.4.4.1. SOLID ANKLE CUSHION HEEL PROSTHESES

14.4.4.1.1. MARKET VALUE (USD MILLION)

14.4.4.1.2. MARKET VOLUME (UNITS)

14.4.4.1.3. AVERAGE SELLING PRICE (USD)

14.4.4.2. SINGLE ANKLE PROSTHESES

14.4.4.2.1. MARKET VALUE (USD MILLION)

14.4.4.2.2. MARKET VOLUME (UNITS)

14.4.4.2.3. AVERAGE SELLING PRICE (USD)

14.4.4.3. MULTIAXIAL PROSTHESES

14.4.4.3.1. MARKET VALUE (USD MILLION)

14.4.4.3.2. MARKET VOLUME (UNITS)

14.4.4.3.3. AVERAGE SELLING PRICE (USD)

14.4.4.4. DYNAMIC RESPONSE ENERGY STORING PROSTHESES

14.4.4.4.1. MARKET VALUE (USD MILLION)

14.4.4.4.2. MARKET VOLUME (UNITS)

14.4.4.4.3. AVERAGE SELLING PRICE (USD)

14.4.4.5. MICROPROCESSOR CONTROLLED PROSTHESES

14.5 BIOLOGICS

14.5.1 BONE GRFTS

14.5.1.1. ALLOGRAFT

14.5.1.1.1. DEMINERALIZED BONE MATRIX

14.5.1.1.1.1 MARKET VALUE (USD MILLION)

14.5.1.1.1.2 MARKET VOLUME (UNITS)

14.5.1.1.1.3 AVERAGE SELLING PRICE (USD)

14.5.1.1.2. VIABLE BONE MATRIX

14.5.1.1.2.1 MARKET VALUE (USD MILLION)

14.5.1.1.2.2 MARKET VOLUME (UNITS)

14.5.1.1.2.3 AVERAGE SELLING PRICE (USD)

14.5.1.1.3. OTHER

14.5.1.2. SYNTHETIC

14.5.1.2.1. CERAMICS

14.5.1.2.1.1 HAP

14.5.1.2.1.1.1. MARKET VALUE (USD MILLION)

14.5.1.2.1.1.2. MARKET VOLUME (UNITS)

14.5.1.2.1.1.3. AVERAGE SELLING PRICE (USD)

14.5.1.2.1.2 Β-TCP

14.5.1.2.1.2.1. MARKET VALUE (USD MILLION)

14.5.1.2.1.2.2. MARKET VOLUME (UNITS)

14.5.1.2.1.2.3. AVERAGE SELLING PRICE (USD)

14.5.1.2.1.3 Α-TCP

14.5.1.2.1.3.1. MARKET VALUE (USD MILLION)

14.5.1.2.1.3.2. MARKET VOLUME (UNITS)

14.5.1.2.1.3.3. AVERAGE SELLING PRICE (USD)

14.5.1.2.1.4 BI-PHASIC CALCIUM PHOSPHATES (BCP)

14.5.1.2.1.4.1. MARKET VALUE (USD MILLION)

14.5.1.2.1.4.2. MARKET VOLUME (UNITS)

14.5.1.2.1.4.3. AVERAGE SELLING PRICE (USD)

14.5.1.2.1.5 OTHERS

14.5.1.2.2. COMPOSITES

14.5.1.2.2.1 MARKET VALUE (USD MILLION)

14.5.1.2.2.2 MARKET VOLUME (UNITS)

14.5.1.2.2.3 AVERAGE SELLING PRICE (USD)

14.5.1.2.3. POLYMERS

14.5.1.2.3.1 MARKET VALUE (USD MILLION)

14.5.1.2.3.2 MARKET VOLUME (UNITS)

14.5.1.2.3.3 AVERAGE SELLING PRICE (USD)

14.5.1.2.4. BONE MORPHOGENIC PROTEINS (BMP)

14.5.1.2.4.1 MARKET VALUE (USD MILLION)

14.5.1.2.4.2 MARKET VOLUME (UNITS)

14.5.1.2.4.3 AVERAGE SELLING PRICE (USD)

14.5.1.2.5. OTHER

14.5.2 ACELLULAR DERMAL MATRIX

14.5.2.1. MARKET VALUE (USD MILLION)

14.5.2.2. MARKET VOLUME (UNITS)

14.5.2.3. AVERAGE SELLING PRICE (USD)

14.5.3 ALLOGRAFT BONE WEDGE

14.5.3.1. UNICORTAL

14.5.3.1.1. MARKET VALUE (USD MILLION)

14.5.3.1.2. MARKET VOLUME (UNITS)

14.5.3.1.3. AVERAGE SELLING PRICE (USD)

14.5.3.2. TRICORTAL

14.5.3.2.1. MARKET VALUE (USD MILLION)

14.5.3.2.2. MARKET VOLUME (UNITS)

14.5.3.2.3. AVERAGE SELLING PRICE (USD)

14.5.4 NERVE CONDUIT & WRAPS

14.5.4.1. MARKET VALUE (USD MILLION)

14.5.4.2. MARKET VOLUME (UNITS)

14.5.4.3. AVERAGE SELLING PRICE (USD)

14.5.5 SHAFT

14.5.5.1. MARKET VALUE (USD MILLION)

14.5.5.2. MARKET VOLUME (UNITS)

14.5.5.3. AVERAGE SELLING PRICE (USD)

14.5.6 CHIPS

14.5.6.1. MARKET VALUE (USD MILLION)

14.5.6.2. MARKET VOLUME (UNITS)

14.5.6.3. AVERAGE SELLING PRICE (USD)

14.5.7 OTHER

14.6 OTHER

14.6.1 BONE ADHESIVES

14.6.1.1. BONE CEMENT

14.6.1.1.1. BY TYPE

14.6.1.1.1.1 POLYMETHYL METHACRYLATE (PMMA) CEMENT

14.6.1.1.1.1.1. MARKET VALUE (USD MILLION)

14.6.1.1.1.1.2. MARKET VOLUME (UNITS)

14.6.1.1.1.1.3. AVERAGE SELLING PRICE (USD)

14.6.1.1.1.2 CALCIUM PHOSPHATE CEMENT (CPC)

14.6.1.1.1.2.1. MARKET VALUE (USD MILLION)

14.6.1.1.1.2.2. MARKET VOLUME (UNITS)

14.6.1.1.1.2.3. AVERAGE SELLING PRICE (USD)

14.6.1.1.1.3 GLASS POLYALKENOATE CEMENT (GPC)

14.6.1.1.1.3.1. MARKET VALUE (USD MILLION)

14.6.1.1.1.3.2. MARKET VOLUME (UNITS)

14.6.1.1.1.3.3. AVERAGE SELLING PRICE (USD)

14.6.1.1.1.4 OTHERS

14.6.1.1.2. BY LOADING

14.6.1.1.2.1 ANTIBIOTIC-LOADED BONE CEMENT

14.6.1.1.2.2 NON-ANTIBIOTIC-LOADED BONE CEMENT

14.6.1.2. BONE GLUE

14.6.1.2.1. NATURAL BONE GLUE

14.6.1.2.1.1 MARKET VALUE (USD MILLION)

14.6.1.2.1.2 MARKET VOLUME (UNITS)

14.6.1.2.1.3 AVERAGE SELLING PRICE (USD)

14.6.1.2.2. SYNTHETIC BONE GLUE

14.6.1.2.2.1 MARKET VALUE (USD MILLION)

14.6.1.2.2.2 MARKET VOLUME (UNITS)

14.6.1.2.2.3 AVERAGE SELLING PRICE (USD)

15 MIDDLE EAST AND AFRICA (MEA) TRAUMA DEVICES MARKET MARKET, BY MATERIAL

15.1 OVERVIEW

15.2 BIO-ABSORBABLE

15.2.1 OLYLACTIC ACID POLYMER

15.2.2 POLYGLYCOLIC ACID POLYMERS

15.2.3 OTHERS

15.3 NON- ABSORBABLE

15.3.1 TITANIUM

15.3.2 STAINLESS STEEL

15.3.3 OTHERS

16 MIDDLE EAST AND AFRICA (MEA) TRAUMA DEVICES MARKET MARKET, BY SURGICAL SITE

16.1 OVERVIEW

16.2 UPPER EXTRIMITIES

16.2.1 SHOULDER

16.2.2 HAND AND WRIST

16.2.3 MAXILLOFACIAL

16.2.4 ELBOW

16.2.5 ARM

16.2.6 OTHERS

16.3 LOWER EXTREMETIES

16.3.1 HIP

16.3.2 THIGH

16.3.3 KNEE

16.3.4 LEG

16.3.5 ANKLE

16.3.6 FOOT

16.3.7 OTHERS

17 MIDDLE EAST AND AFRICA (MEA) TRAUMA DEVICES MARKET MARKET, BY TRAUMA TYPE

17.1 OVERVIEW

17.2 DISLOCATIONS

17.3 JOINT REPLACEMENT AND FRACTURES

17.4 NERVE DISEASES AND SOFT TISSUE INJURIES

17.5 OTHERS

18 MIDDLE EAST AND AFRICA (MEA) TRAUMA DEVICES MARKET MARKET, BY PATIENT TYPE

18.1 OVERVIEW

18.2 PEDIATRIC

18.2.1 MALE

18.2.2 FEMALE

18.3 ADULT

18.3.1 MALE

18.3.2 FEMALE

18.4 GERIATRIC

18.4.1 MALE

18.4.2 FEMALE

19 MIDDLE EAST AND AFRICA (MEA) TRAUMA DEVICES MARKET MARKET, BY END USER

19.1 OVERVIEW

19.2 HOSPITALS

19.2.1 BY TYPE

19.2.1.1. PUBLIC

19.2.1.2. PRIVATE

19.2.2 BY TIER

19.2.2.1. TIER 1

19.2.2.2. TIER 2

19.2.2.3. TIER 3

19.3 TRAUMA CENTRES

19.4 AMBULATORY SURGICAL CENTRES

19.5 SPECIALITY CLINICS

19.6 OTHER

20 MIDDLE EAST AND AFRICA (MEA) TRAUMA DEVICES MARKET MARKET, BY DISTRIBUTION CHANNEL

20.1 OVERVIEW

20.2 DIRECT TENDERS

20.3 RETAIL SALES

20.3.1 ONLINE SALES

20.3.2 OFFLINE SALES

20.4 OTHERS

21 MIDDLE EAST AND AFRICA (MEA) TRAUMA DEVICES MARKET MARKET, SWOT AND DBMR ANALYSIS

22 MIDDLE EAST AND AFRICA (MEA) TRAUMA DEVICES MARKET MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA (MEA)

22.2 MERGERS & ACQUISITIONS

22.3 NEW PRODUCT DEVELOPMENT & APPROVALS

22.4 EXPANSIONS

22.5 REGULATORY CHANGES

22.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

23 MIDDLE EAST AND AFRICA (MEA) TRAUMA DEVICES MARKET MARKET, BY REGION

MIDDLE EAST AND AFRICA (MEA) TRAUMA DEVICES MARKET MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.1 MIDDLE EAST AND AFRICA

23.1.1 SOUTH AFRICA

23.1.2 EGYPT

23.1.3 BAHRAIN

23.1.4 UNITED ARAB EMIRATES

23.1.5 KUWAIT

23.1.6 OMAN

23.1.7 QATAR

23.1.8 SAUDI ARABIA

23.1.9 REST OF MEA

23.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

24 MIDDLE EAST AND AFRICA (MEA) TRAUMA DEVICES MARKET MARKET, COMPANY PROFILE

24.1 GLOBAL COMPANIES

24.1.1 STRYKER

24.1.1.1. COMPANY OVERVIEW

24.1.1.2. REVENUE ANALYSIS

24.1.1.3. GEOGRAPHIC PRESENCE

24.1.1.4. PRODUCT PORTFOLIO

24.1.1.5. RECENT DEVELOPMENTS

24.1.2 DEPUY SYNTHES(JOHNSON & JOHNSON)

24.1.2.1. COMPANY OVERVIEW

24.1.2.2. REVENUE ANALYSIS

24.1.2.3. GEOGRAPHIC PRESENCE

24.1.2.4. PRODUCT PORTFOLIO

24.1.2.5. RECENT DEVELOPMENTS

24.1.3 ZIMMER BIOMET

24.1.3.1. COMPANY OVERVIEW

24.1.3.2. REVENUE ANALYSIS

24.1.3.3. GEOGRAPHIC PRESENCE

24.1.3.4. PRODUCT PORTFOLIO

24.1.3.5. RECENT DEVELOPMENTS

24.1.4 MEDTRONICS

24.1.4.1. COMPANY OVERVIEW

24.1.4.2. REVENUE ANALYSIS

24.1.4.3. GEOGRAPHIC PRESENCE

24.1.4.4. PRODUCT PORTFOLIO

24.1.4.5. RECENT DEVELOPMENTS

24.1.5 ARTHREX, INC

24.1.5.1. COMPANY OVERVIEW

24.1.5.2. REVENUE ANALYSIS

24.1.5.3. GEOGRAPHIC PRESENCE

24.1.5.4. PRODUCT PORTFOLIO

24.1.5.5. RECENT DEVELOPMENTS

24.1.6 SMITH+NEPHEW

24.1.6.1. COMPANY OVERVIEW

24.1.6.2. REVENUE ANALYSIS

24.1.6.3. GEOGRAPHIC PRESENCE

24.1.6.4. PRODUCT PORTFOLIO

24.1.6.5. RECENT DEVELOPMENTS

24.1.7 GLOBUS MEDICAL

24.1.7.1. COMPANY OVERVIEW

24.1.7.2. REVENUE ANALYSIS

24.1.7.3. GEOGRAPHIC PRESENCE

24.1.7.4. PRODUCT PORTFOLIO

24.1.7.5. RECENT DEVELOPMENTS

24.1.8 ORTHOMED

24.1.8.1. COMPANY OVERVIEW

24.1.8.2. REVENUE ANALYSIS

24.1.8.3. GEOGRAPHIC PRESENCE

24.1.8.4. PRODUCT PORTFOLIO

24.1.8.5. RECENT DEVELOPMENTS

24.1.9 DJO, LLC

24.1.9.1. COMPANY OVERVIEW

24.1.9.2. REVENUE ANALYSIS

24.1.9.3. GEOGRAPHIC PRESENCE

24.1.9.4. PRODUCT PORTFOLIO

24.1.9.5. RECENT DEVELOPMENTS

24.1.10 B. BRAUN SE

24.1.10.1. COMPANY OVERVIEW

24.1.10.2. REVENUE ANALYSIS

24.1.10.3. GEOGRAPHIC PRESENCE

24.1.10.4. PRODUCT PORTFOLIO

24.1.10.5. RECENT DEVELOPMENTS

24.1.11 ZIMED MEDIKAL

24.1.11.1. COMPANY OVERVIEW

24.1.11.2. REVENUE ANALYSIS

24.1.11.3. GEOGRAPHIC PRESENCE

24.1.11.4. PRODUCT PORTFOLIO

24.1.11.5. RECENT DEVELOPMENTS

24.1.12 INTEGRA LIFESCIENCES CORPORATION

24.1.12.1. COMPANY OVERVIEW

24.1.12.2. REVENUE ANALYSIS

24.1.12.3. GEOGRAPHIC PRESENCE

24.1.12.4. PRODUCT PORTFOLIO

24.1.12.5. RECENT DEVELOPMENTS

24.1.13 BIORETEC GMBH

24.1.13.1. COMPANY OVERVIEW

24.1.13.2. REVENUE ANALYSIS

24.1.13.3. GEOGRAPHIC PRESENCE

24.1.13.4. PRODUCT PORTFOLIO

24.1.13.5. RECENT DEVELOPMENTS

24.1.14 ORTHOFIX MEDICAL INC.

24.1.14.1. COMPANY OVERVIEW

24.1.14.2. REVENUE ANALYSIS

24.1.14.3. GEOGRAPHIC PRESENCE

24.1.14.4. PRODUCT PORTFOLIO

24.1.14.5. RECENT DEVELOPMENTS

24.2 LOCAL COMPANIES

24.2.1 RENISHAW PLC.

24.2.1.1. COMPANY OVERVIEW

24.2.1.2. REVENUE ANALYSIS

24.2.1.3. GEOGRAPHIC PRESENCE

24.2.1.4. PRODUCT PORTFOLIO

24.2.1.5. RECENT DEVELOPMENTS

24.2.2 TST

24.2.2.1. COMPANY OVERVIEW

24.2.2.2. REVENUE ANALYSIS

24.2.2.3. GEOGRAPHIC PRESENCE

24.2.2.4. PRODUCT PORTFOLIO

24.2.2.5. RECENT DEVELOPMENTS

24.2.3 SURGIPHARM LIMITED

24.2.3.1. COMPANY OVERVIEW

24.2.3.2. REVENUE ANALYSIS

24.2.3.3. GEOGRAPHIC PRESENCE

24.2.3.4. PRODUCT PORTFOLIO

24.2.3.5. RECENT DEVELOPMENTS

24.2.4 BAIRDMED

24.2.4.1. COMPANY OVERVIEW

24.2.4.2. REVENUE ANALYSIS

24.2.4.3. GEOGRAPHIC PRESENCE

24.2.4.4. PRODUCT PORTFOLIO

24.2.4.5. RECENT DEVELOPMENTS

24.2.5 ORTHO-SOL DEVELOPMENT (PTY) LTD

24.2.5.1. COMPANY OVERVIEW

24.2.5.2. REVENUE ANALYSIS

24.2.5.3. GEOGRAPHIC PRESENCE

24.2.5.4. PRODUCT PORTFOLIO

24.2.5.5. RECENT DEVELOPMENTS

25 REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.