Middle East Online Payment Gateway Market

Market Size in USD Billion

CAGR :

%

USD

8.19 Billion

USD

28.66 Billion

2021

2029

USD

8.19 Billion

USD

28.66 Billion

2021

2029

| 2022 –2029 | |

| USD 8.19 Billion | |

| USD 28.66 Billion | |

|

|

|

Market Analysis and Size

Government organisations all over the world are supporting digital transaction systems, which in turn is supporting the growth of credit and debit card infrastructure, such as the online payment gateway market. Another factor driving growth in the global online payment gateway market in the near future is the increasing use of credit and debit cards for shopping.

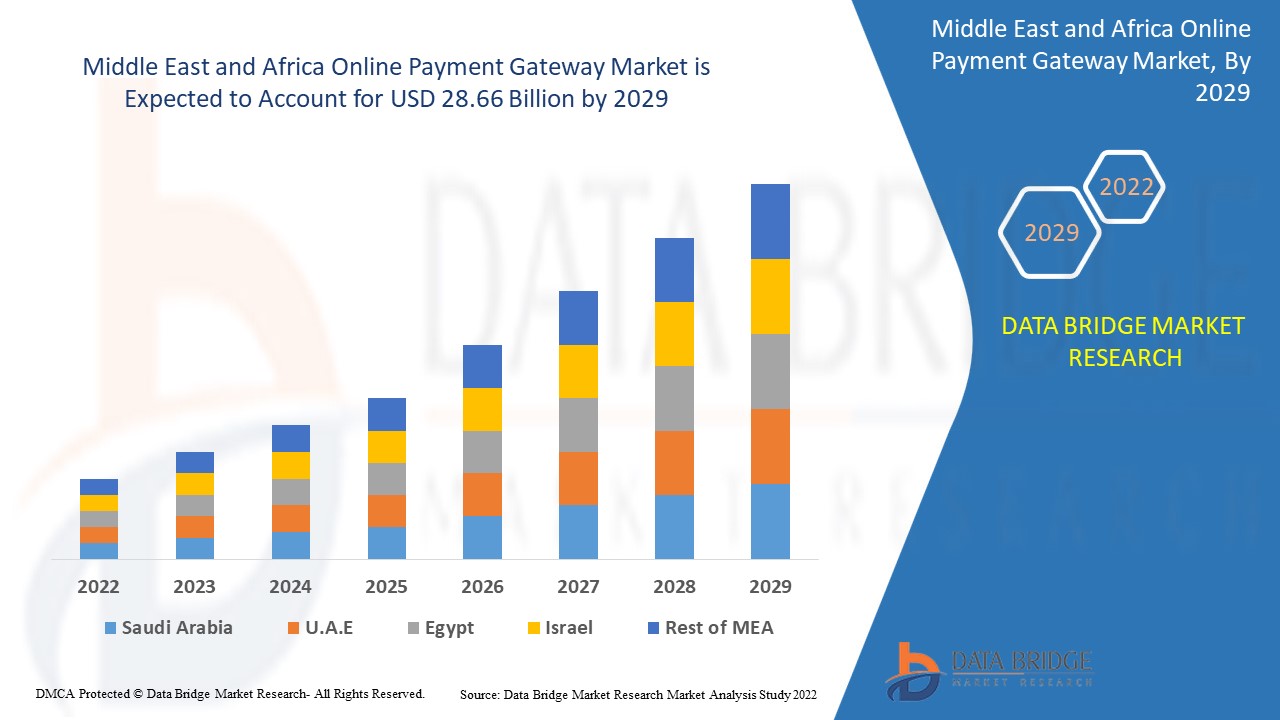

Data Bridge Market Research analyses that the online payment gateway market was valued at USD 8.19 billion in 2021 and is expected to reach the value of USD 28.66 billion by 2029, at a CAGR of 16.95% during the forecast period of 2022 to 2029.

Market Definition

In layman's terms, a payment gateway is a network that allows your customers to transfer funds to you. Payment gateways are very similar to the point-of-sale terminals found in most physical stores. Customers and businesses must collaborate to complete a transaction when using a payment gateway. Payment gateways are the "checkout" portals used in online stores to enter credit card information or credentials for services such as PayPal.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Interaction Mode (Pro/Self-Hosted Payment Gateways, Local Bank Integrates, Platform Based Payment Gateway Solution, Hosted Payment Gateways, Api/Non-Hosted Payment Gateways, Direct Payment Gateway), Organisation Size (Micro and Small Enterprise, Large Enterprise, Mid- Sized Enterprise), End User (BFSI, Retail, Travel, Media & Entertainment, Others) |

|

Countries Covered |

Saudi Arabia, U.A.E., South Africa, Israel, Egypt, Rest of Middle East and Africa |

|

Market Players Covered |

Wirecard AG (Germany), Global Payments Inc. (US), Worldpay Inc. (U.S.), Naspers Ltd. (South Africa), PayPal Holding(U.S.), SecurePay Pty Ltd. (Australia), Tencent Holdings Ltd. (China), CCBill LLC (U.S., Visa Inc. (U.S.), Alibaba Group Holding Ltd. (China), Verizon Communications Inc. (U.S.), GMO Payment Gateway Inc. (Japan), Stripe (U.S.), CASHU (UAE), Adyen NV (Netherlands), First Data Corp. (U.S.) |

|

Opportunities |

|

Online Payment Gateway Market Dynamics

Drivers

- Intervention and rapid adoption of emerging technologies

Emerging technologies like artificial intelligence and the internet of things can perform specific tasks while also automating the entire transaction process. For example, artificial intelligence (AI) can be used to gain better insights into analytics and feedback at payment gateways. This has the potential to boost market growth over the forecast period.

- Rising penetration of e-commerce and internet

Rising e-commerce sales, increasing internet penetration, use of contactless payments globally, evolving customer expectations, advances in mobile payment technology, increasing use of mobile wallets, increase in online transactions, growing inclination of customers towards card less and cashless payments, smartphone penetration, the emergence of smaller denomination payments, and demand for bees are all factors contributing to the online payment gateway market share.

Opportunity

Rapid expansion of large enterprises with online services is one of the key factors driving the growth of the global online payment gateway market. One of the key trends supporting the growth of the global online payment gateway market during the forecast period is the increasing popularity of mobile-commerce. Attractive online offers and time-saving shopping with simple payment methods are just a few of the factors that will help the global market grow in the near future. Furthermore, the decline in the number of ATM branches as a result of increased net banking usage and card usage is another factor driving growth in the global online payment gateway market.

Restraints

As a result of an increase in hacking cases, security concerns about online transactions may act as a market restraint over the forecast period. In order to complete the transaction using online payment methods, the customer and the enterprise must share their credit card and banking information with online payment companies. The disclosure of these details may result in security issues.

This online payment gateway market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the online payment gateway market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Online Payment Gateway Market

The COVID-19 pandemic has had a positive effect on market growth. This is due to the increasing consumer preference for e-commerce, digital payments, quick payments, and the cash displacement trend. During the pandemic, the e-commerce space grew significantly, with a 13 percent -20 percent increase in the number of customers preferring to make purchases online. Furthermore, as the pandemic connects people to payment gateways and other online platforms, people's reliance on mobile and internet services has grown.

Recent Development

- PayU announced the acquisition of a controlling stake in PaySense, a digital credit platform, in January 2020. PayU's consumer lending businesses, LazyPay and PaySense, will merge their operations as part of the transaction to create a full-stack digital lending platform in India.

- PayPal Holding Inc partnered with UnionPay International (UPI) in January 2020, and the two companies will collaborate to accelerate the growth of their networks. As part of the agreement, PayPal has agreed to support UPI acceptance wherever PayPal is accepted, giving UnionPay cardholders more options when shopping.

Middle East and Africa Online Payment Gateway Market Scope

The online payment gateway market is segmented on the basis of interaction mode, organisation size, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Interaction mode

- Pro/Self-Hosted Payment Gateways

- Local Bank Integrates

- Platform Based Payment Gateway Solution

- Hosted Payment Gateways

- Api/Non-Hosted Payment Gateways

- Direct Payment Gateway

Organization size

- Micro and Small Enterprise

- Large Enterprise

- Mid-Sized Enterprise

Vertical

- BFSI

- Retail

- Travel

- Media & Entertainment

- Others

Online Payment Gateway Market Regional Analysis/Insights

The online payment gateway market is analysed and market size insights and trends are provided by country, interaction mode, organisation size, and end user as referenced above.

The countries covered in the online payment gateway market report are Saudi Arabia, U.A.E., South Africa, Israel, Egypt, Rest of Middle East and Africa.

The United Arab Emirates dominates the Middle East online payment gateway market as a result of the government's increasing initiatives for digitisation and e-transactions.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Online Payment Gateway Market Share Analysis

The online payment gateway market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to online payment gateway market.

Some of the major players operating in the online payment gateway market are:

- Wirecard AG (Germany)

- Global Payments Inc. (US)

- Worldpay Inc. (U.S.)

- Naspers Ltd. (South Africa)

- PayPal Holding(U.S.)

- SecurePay Pty Ltd. (Australia)

- Tencent Holdings Ltd. (China)

- CCBill LLC (U.S.)

- Visa Inc. (U.S.)

- com Inc. (U.S.)

- Alibaba Group Holding Ltd. (China)

- Verizon Communications Inc. (U.S.)

- GMO Payment Gateway Inc. (Japan)

- Stripe (U.S.)

- CASHU (UAE)

- Adyen NV (Netherlands)

- First Data Corp. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.