North America Accounts Payable Automation Market Analysis and Size

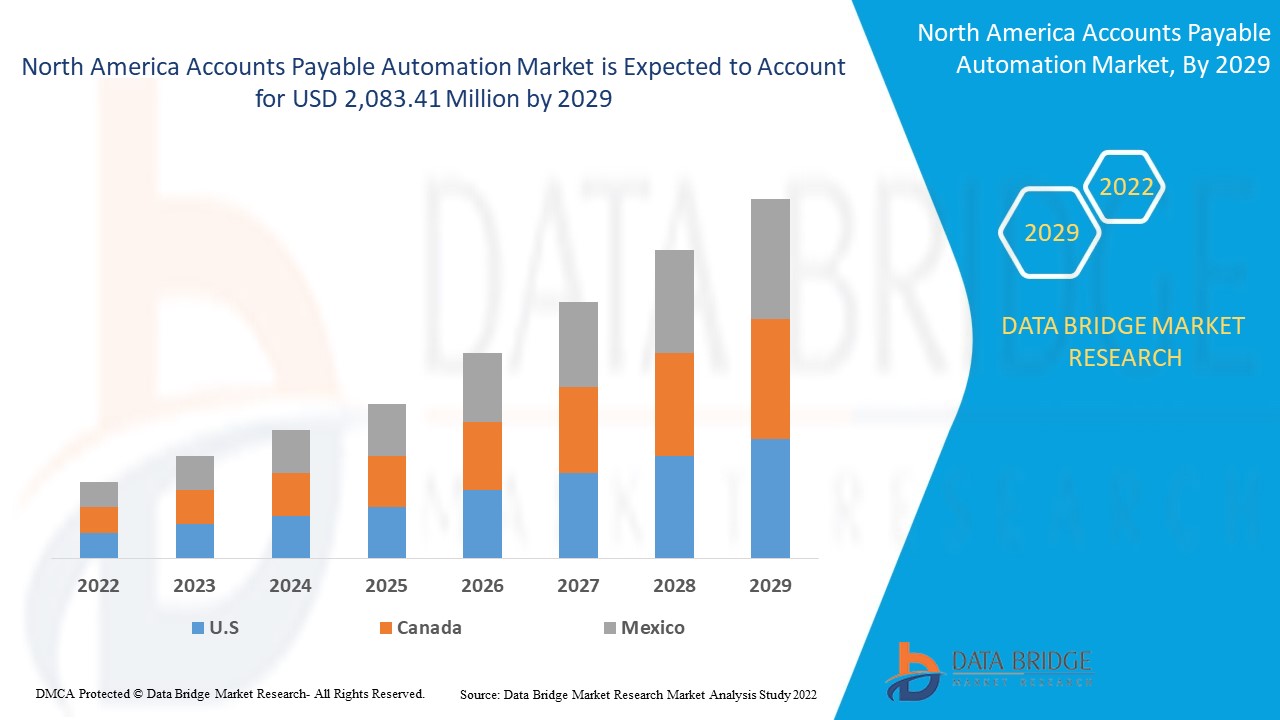

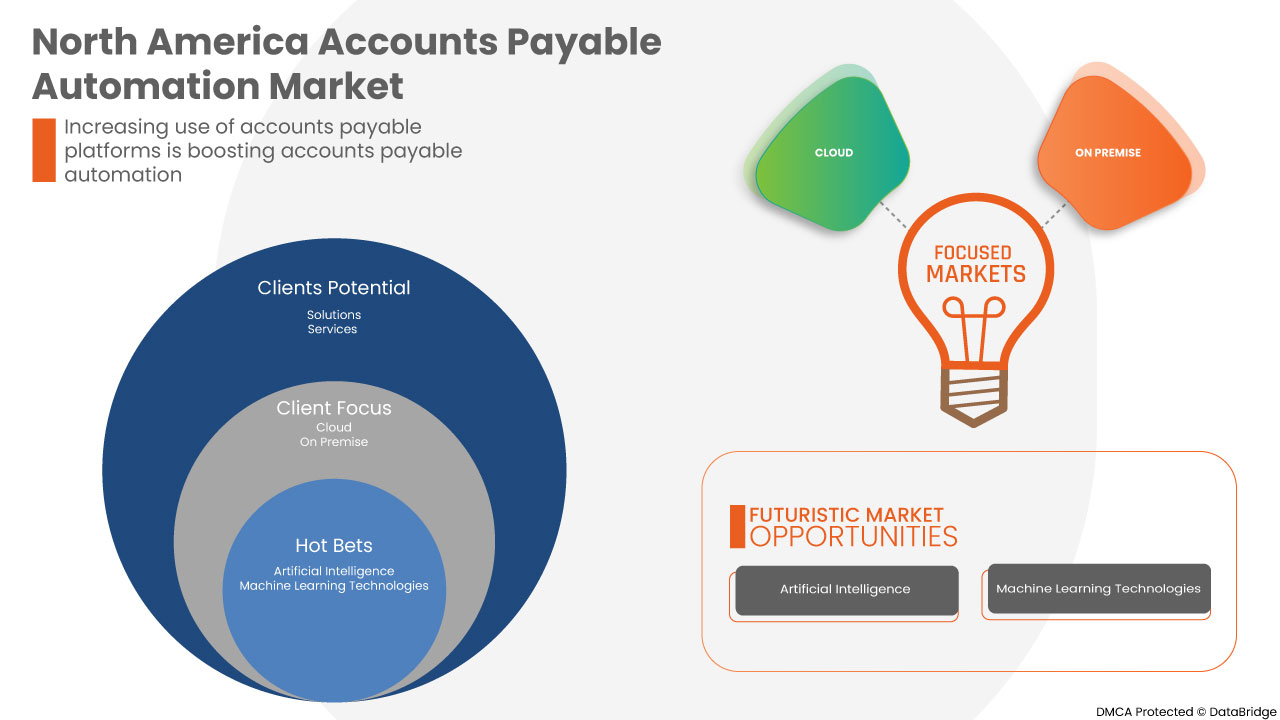

The North America accounts payable automation market is primarily driven by the growing need to digitize payment processes and reduce invoice processing time. Additionally, the increasing use of accounts payable platforms across the region is hoisting the market growth of accounts payable automation. Data Bridge Market Research analyses that the accounts payable automation market is expected to reach the value of USD 2,083.41 million by 2029, at a CAGR of 11.5% during the forecast period of 2022 to 2029. "Solutions" accounts for the most prominent modules mode segment. The North America accounts payable automation market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

USD Million |

|

Segments Covered |

By Components (Solution and Services), Organization Size (Large Enterprise, Small and Medium Enterprise), Process (Invoice Capture, Invoice Approval, Payment Authorization, Payment Execution and Export), Deployment Mode (Cloud and On-Premise), Vertical (Manufacturing, Consumer Goods and Retail, Energy and Utilities, Healthcare, Banking, Financial Services, and Insurance, IT and Telecom, Government, Automotive, and Others). |

|

Countries Covered |

U.S, Canada, and Mexico. |

|

Market Players Covered |

SAP SE, Oracle, Sage Group plc, Tipalti Inc., FreshBooks, Zycus Inc., Airbase Inc., FIS, Coupa Software Inc., Comarch SA, FinancialForce, MHC Automation, Procurify Technologies Inc., Zoho Corporation Pvt. Ltd., MineralTree, Kofax Inc., AvidXchange, Bottomline Technologies, Inc., FLEETCOR TECHNOLOGIES, INC., and Bill.com, among others. |

Market Definition

Accounts Payable (AP) automation is the act of processing invoices in a digital format and through a touchless process by using an AP automation solution. In an ideal situation, 100% of invoices a company receives can be processed automatically without any human intervention. AP automation is more than just Optical Character Recognition (OCR). It is automation across the entire AP process, from data capture using OCR or digital invoice formats (such as EDI and e-invoices), through AP workflow, such as routing, coding, reviewing and approving invoices and automatically matching them to Purchase Orders (PO), to the seamless integration with your Enterprise Resource Planning system.

North America Accounts Payable Automation Market Dynamics

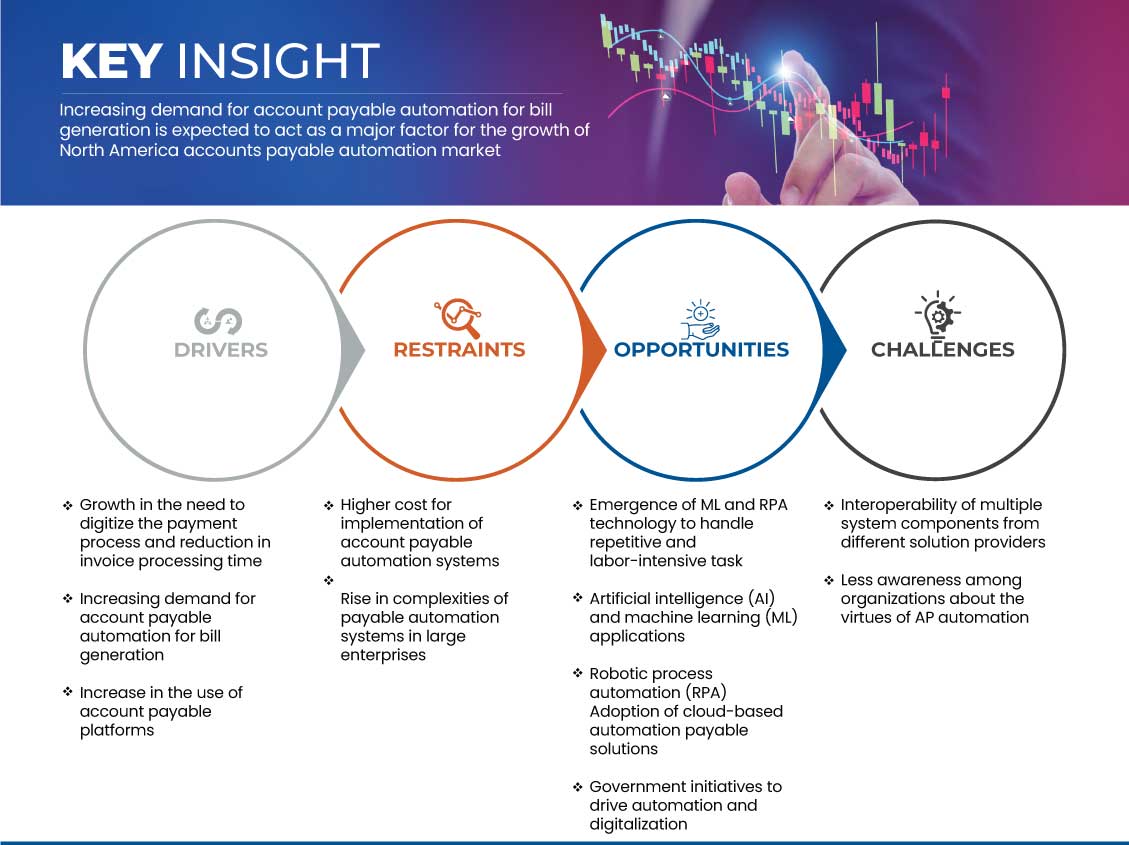

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growth in the Need to Digitize the Payment Process and Reduction in Invoice Processing Time

The growth of digitalization is revolutionizing the interaction between customer and business and building a new platform for interaction of ideas. Digitalization is the process of converting information into digital information by using various data and software. Since 2009 there has been a transformation of financial institutions towards digitalization by integrating digital technologies. Digital transformation has provided with automation, better services and efficiency to financial processes. Even the customers are inclined more towards digital platforms for the transaction of their financial assets; this has even boosted up more during this pandemic. The increasing need to digitize payment process and reduction in invoice time is thus leading to the increase in the growth of North America account payable automation market.

- Increased Demand For Account Payable Automation For Bill Generation

Account payable is important to ensure payment of bills on timely basis which in turn improves the credit rating of the company. This increasing demand for account payable bill generation are due to timely payment of invoices ensures uninterrupted flow of supplies and services, timely payment avoids overdue payments, penalties and other late fee among organizations is thus creating huge growth for the North America account payable automation market.

The automation demand is increasing due to the company's decision to procure goods and services on a credit system, e a supplier who offers credit facilities, compare the supplier's credit policies in terms of credit days allowed, and delay payment charges, and cash discounts.

Opportunity

- Emergence of ML and RPA Technology to Handle Repetitive and Labor-Intensive Task

Preventing fraud, and managing vendor relationships. Accounts payable has become a key area of attention for process improvement in small to mid-sized firms due to advancements in automation technologies. The capacity of robotic process automation (RPA) and artificial intelligence (AI) to automate manual, time-consuming operations that hinder the overall effectiveness of the accounts payable procedures is attracting attention. AP procedures are repetitive, time-consuming, and frequently involve a high employee involvement. RPA is a perfect fit for automating AP procedures as a result. However, a recent study by basware and MasterCard found that only 20% of businesses employ internal automation tools to ease their accounts. Companies can use technology to improve their financial processes for greater operational control and efficiency. RPA in versions payable refers to using technology to manage rule-based activities, such as automated cash application, collections, and deduction management, without human participation. Most payment delays and human errors can be removed when manual processes are automated using RPA and AI. RPA and AI can be used in various contexts, including intelligent data capture from many forms of invoices (physical, scanned, emailed, faxed, electronic data interchange – EDI).

Restraints/Challenges

- Higher Cost for Implementation Of Account Payable Automation Systems

Generally, the cost of account payable automation depends on the specific needs and application. However, the prospect of purchasing and implementing automation software in various systems for streamlining the transaction processes can seem daunting and expensive. Hence the higher cost can raise an issue in some companies, where the budget allocated for the system setup by the company remains unvaried.

Hence, the higher cost of implementing accounts payable automation systems across the verticals is expected to hinder the growth of North America account payable automation market significantly.

- Rise in Complexities of Payable Automation Systems in Large Enterprises

Payable automation system and software have been implemented across the globe to benefit from decreasing the necessity for human staff and to perform repetitive tasks by implementing automated machine processes instead. But the higher the complexity of the system, the greater the risk that a system failure would generate serious consequences on payable related functioning. Many critical system failures, especially involving the assembly lines, would require restoring manual procedures for managing data, payment information of different clients. Although in most companies, it is found that resources are a limiting factor for development. A traditional way to manage the bills and coordinate schedules of payments to the supplier’s connections manually.

Post COVID-19 Impact on North America Accounts Payable Automation Market

The confinement and lockdown period during the COVID-19 crisis has shown the importance of good, reliable internet connectivity at large industry. A high-speed connection at large industry has opened up the possibility of efficient teleworking, maintaining entertainment habits and keeping close contacts. Data traffic in all networks has increased significantly during the pandemic period. COVID-19 has increased the demand of data integration in the market. Fixed broadband networks has gain immense popularity for keeping the world connected. Traffic grew 30-40% overnight, driven primarily by working from large industry (video conferencing and collaboration, VPNs), learning from large industry (video conferencing and collaboration, e-learning platforms) and entertainment (online gaming, video streaming, social media). Moreover, limited supply and shortage of software has significantly affected data integration in the market. The flow of new equipment’s, such as computers, servers, switches, and Customer Premise Equipment (CPE) has either fully stopped or is delayed, with lead times of up to 12 months for different items.

Manufacturers are making various strategic decisions to bounce back post COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the data integration. With this, the companies will bring advanced data integration to the market.

Recent Development

- In January 2022, SAP SE entered into partnership with Icertis to deliver enterprise contract intelligence. The partnership took place to expand solution portfolio of contract management. The partnership will leverage company’s technology to deliver more value services to their customer base.

- In November 2021, Oracle Corporation launched an oracle fusion ERP analytics instrument for financial insights. This solution was designed to enable data process easier. This solution was a reliable solution for large-sized and mid-sized business thereby helping the company to expand its market.

North America Accounts Payable Automation Market Scope

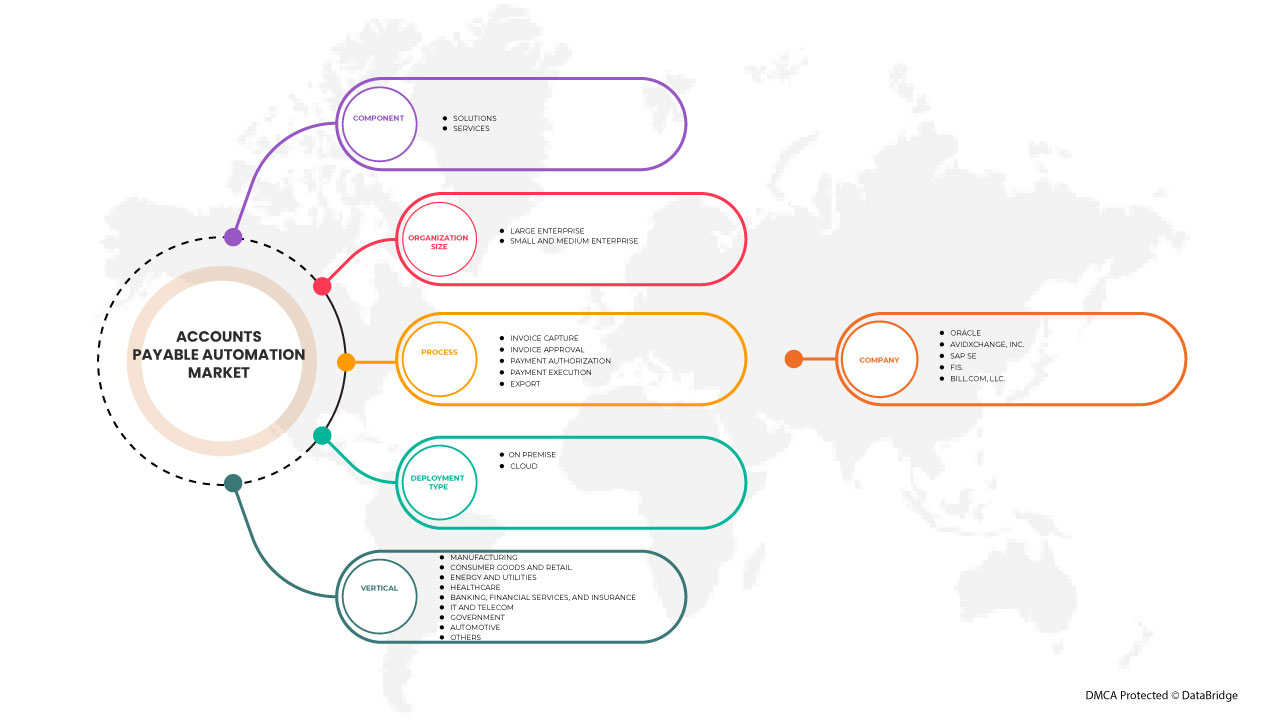

The North America accounts payable automation market is segmented on the basis of components, organization size, process, deployment mode and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Components

- Solution

- Services

On the basis of components, the North America accounts payable automation market is segmented into solution and services.

By Organization Size

- Large Enterprise

- Small And Medium Enterprise

On the basis of by organization size, the North America accounts payable automation market has been segmented into large enterprise and small and medium enterprise.

By Process

- Invoice Capture,

- Invoice Approval

- Payment Authorization

- Payment Execution

- Export

On the basis of process, the North America accounts payable automation market has been segmented into invoice capture, invoice approval, payment authorization, payment execution, export.

By Deployment Mode

- Cloud

- On-Premise

On the basis of deployment mode, the North America accounts payable automation market has been segmented into cloud and on-premise.

By Vertical

- Manufacturing

- Consumer Goods And Retail

- Energy And Utilities

- Healthcare

- Banking, Financial Services, And Insurance

- IT And Telecom

- Government

- Automotive

- Others

On the basis of vertical, the North America accounts payable automation market has been segmented into manufacturing, consumer goods and retail, energy and utilities, healthcare, banking, financial services, and insurance, IT and telecom, government, automotive, others.

North America Accounts Payable Automation Market Regional Analysis/Insights

The North America accounts payable automation market is analysed and market size insights and trends are provided by country, components, organization size, process deployment mode and vertical as referenced above.

The countries covered in the North America accounts payable automation market report are U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America accounts payable automation market due to the increasing use of accounts payable platforms across the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Accounts Payable Automation Market Share Analysis

The North America accounts payable automation market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to North America accounts payable automation market.

Some of the major key players in the North America accounts payable automation market are SAP SE, Oracle, Sage Group plc, Tipalti Inc., FreshBooks, Zycus Inc., Airbase Inc., FIS., Coupa Software Inc., Comarch SA., FinancialForce, MHC Automation, Procurify Technologies Inc., Zoho Corporation Pvt. Ltd., MineralTree, Kofax Inc., AvidXchange, Bottomline Technologies, Inc., FLEETCOR TECHNOLOGIES, INC., and Bill.com among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET VERTICAL COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 COMPONENT CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 DBMR ANALYSIS

5.1 STRENGTH:

5.2 THREAT:

5.3 OPPORTUNITY:

5.4 WEAKNESS:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN THE NEED TO DIGITIZE THE PAYMENT PROCESS AND REDUCTION IN INVOICE PROCESSING TIME

6.1.2 INCREASED DEMAND FOR ACCOUNTS PAYABLE AUTOMATION FOR BILL GENERATION

6.1.3 INCREASE IN THE USE OF ACCOUNTS PAYABLE PLATFORMS

6.2 RESTRAINTS

6.2.1 HIGHER COST FOR IMPLEMENTATION OF ACCOUNTS PAYABLE AUTOMATION SYSTEMS

6.2.2 RISE IN COMPLEXITY OF PAYABLE AUTOMATION SYSTEMS IN LARGE ENTERPRISES

6.3 OPPORTUNITIES

6.3.1 EMERGENCE OF AI, ML, AND RPA TECHNOLOGY TO HANDLE REPETITIVE AND LABOR-INTENSIVE TASK

6.3.2 ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML) APPLICATIONS

6.3.3 ROBOTIC PROCESS AUTOMATION (RPA)

6.3.4 ADOPTION OF CLOUD-BASED AUTOMATION PAYABLE SOLUTIONS

6.3.5 GOVERNMENT INITIATIVES TO DRIVE AUTOMATION AND DIGITALIZATION

6.4 CHALLENGES

6.4.1 INTEROPERABILITY OF MULTIPLE SYSTEM COMPONENTS FROM DIFFERENT SOLUTION PROVIDERS

6.4.2 LESS AWARENESS AMONG ORGANIZATIONS ABOUT THE VIRTUES OF AP AUTOMATION

7 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SOLUTIONS

7.3 SERVICES

7.3.1 MANAGED SERVICES

7.3.2 IMPLEMENTATION AND INTEGRATION

7.3.3 PROFESSIONAL SERVICES

7.3.4 SUPPORT AND MAINTENANCE

7.3.5 ADVISORY

8 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISE

8.3 SMALL AND MEDIUM ENTERPRISE

9 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY PROCESS

9.1 OVERVIEW

9.2 INVOICE CAPTURE

9.2.1 OPTICAL CHARACTER RECOGNITION (OCR)

9.2.2 COMPUTER VISION

9.2.3 INTELLIGENT DOCUMENT PROCESSING (IDP)

9.2.4 OTHERS

9.3 INVOICE APPROVAL

9.4 PAYMENT AUTHORIZATION

9.5 PAYMENT EXECUTION

9.6 EXPORT

10 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY DEPLOYMENT TYPE

10.1 OVERVIEW

10.2 ON PREMISE

10.3 CLOUD

10.3.1 PUBLIC

10.3.2 PRIVATE

11 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 MANUFACTURING

11.3 CONSUMER GOODS AND RETAIL

11.4 ENERGY AND UTILITIES

11.5 HEALTHCARE

11.6 BANKING, FINANCIAL SERVICES, AND INSURANCE

11.7 IT AND TELECOM

11.8 GOVERNMENT

11.9 AUTOMOTIVE

11.1 OTHERS

12 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA ACCOUNT PAYABLE AUTOMATION MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 AVIDXCHANGE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 ORACLE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 FIS.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 SOLUTION PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 SAP SE

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 FLEETCOR TECHNOLOGIES, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AIRBASE INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BILL.COM

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 BOTTOMLINE TECHNOLOGIES, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 COMARCH SA.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 SOLUTION & PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 COUPA SOFTWARE INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 SOLUTION & PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 FINANCIALFORCE

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 FRESHBOOKS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 KOFAX INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 MINERALTREE

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 MHC AUTOMATION

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 PROCURIFY TECHNOLOGIES INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SAGE GROUP PLC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 SOLUTION PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 TIPALTI INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 SOLUTION PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 ZOHO CORPORATION PVT. LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 ZYCUS INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 SOLUTION PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SERVICES IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA INVOICE CAPTURE IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CLOUD IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA SERVICES IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA INVOICE CAPTURE IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA CLOUD IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 18 U.S. ACCOUNTS PAYABLE AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 19 U.S. SERVICES IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.S. ACCOUNTS PAYABLE AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 21 U.S. ACCOUNTS PAYABLE AUTOMATION MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 22 U.S. INVOICE CAPTURE IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 23 U.S. ACCOUNTS PAYABLE AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2020-2029 (USD MILLION)

TABLE 24 U.S. CLOUD IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 U.S. ACCOUNTS PAYABLE AUTOMATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 26 CANADA ACCOUNTS PAYABLE AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 27 CANADA SERVICES IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 CANADA ACCOUNTS PAYABLE AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 29 CANADA ACCOUNTS PAYABLE AUTOMATION MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 30 CANADA INVOICE CAPTURE IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 31 CANADA ACCOUNTS PAYABLE AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2020-2029 (USD MILLION)

TABLE 32 CANADA CLOUD IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 CANADA ACCOUNTS PAYABLE AUTOMATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 34 MEXICO ACCOUNTS PAYABLE AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 35 MEXICO SERVICES IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MEXICO ACCOUNTS PAYABLE AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 37 MEXICO ACCOUNTS PAYABLE AUTOMATION MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 38 MEXICO INVOICE CAPTURE IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 39 MEXICO ACCOUNTS PAYABLE AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2020-2029 (USD MILLION)

TABLE 40 MEXICO CLOUD IN ACCOUNTS PAYABLE AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 MEXICO ACCOUNTS PAYABLE AUTOMATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: MARKET VERTICAL COVERAGE GRID

FIGURE 10 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: SEGMENTATION

FIGURE 11 GROWING NEED TO DIGITIZE PAYMENT PROCESS AND REDUCTION IN INVOICE PROCESSING TIME IS EXPECTED TO BE KEY DRIVER OF THE MARKET FOR NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SOLUTION SEGMENT IS EXPECTED TO ACCOUNTS FOR THE LARGEST SHARE OF THE NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET FROM 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET

FIGURE 14 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: BY COMPONENT, 2021

FIGURE 15 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 16 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: BY PROCESS, 2021

FIGURE 17 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 18 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: BY VERTICAL, 2021

FIGURE 19 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 20 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 21 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: BY COMPONENT (2022-2029)

FIGURE 24 NORTH AMERICA ACCOUNTS PAYABLE AUTOMATION MARKET: COMPANY SHARE 2021 (%)

North America Accounts Payable Automation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Accounts Payable Automation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Accounts Payable Automation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.