North America At-Home Testing Kits Market Analysis and Insights

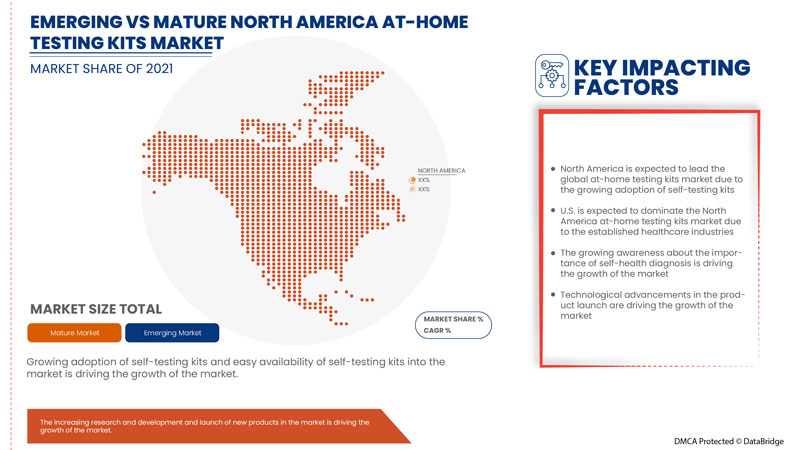

North America at-home testing kits market is expected to grow as earlier, people used to visit hospitals often, even for basic problems, but due to the rising awareness regarding several products, this behavior has changed and has turned the trend. At-home or self-testing kits are easily available at pharmacies, and it has become extremely easy to procure them. Various medical companies are venturing into this space as they rapidly manufacture self-test kits.

This widespread availability can also be attributed to online pharmacies' medical start-ups, making availability easier by clicking a button. In addition, these self-testing kits are available without any prescription which can easily drive the at-home testing kits market. At-home testing kits allow end-users to collect their specimen at home and then either perform the tests at home or send that specimen to the lab for testing. At-home testing kits have undoubtedly eased the process of confirming the person's concern, whether it is a home pregnancy test or HIV, or any other infectious diseases test.

These at-home testing kits are easy to use and are affordable too. However, there is always a doubt about the accuracy of the results that has become a restraint for the North America at-home testing kits market. A false positive result of a test may cause anxiety and stress to the person, even if they do not have it. It is very upsetting and disturbing to the person to receive false positive or negative results. Today, many companies produce rapid diagnostic test kits for COVID-19, which can be performed at home. But there are various accuracy-related issues due to which the distribution of those at-home test kits that has been suspended from verifying their reliability.

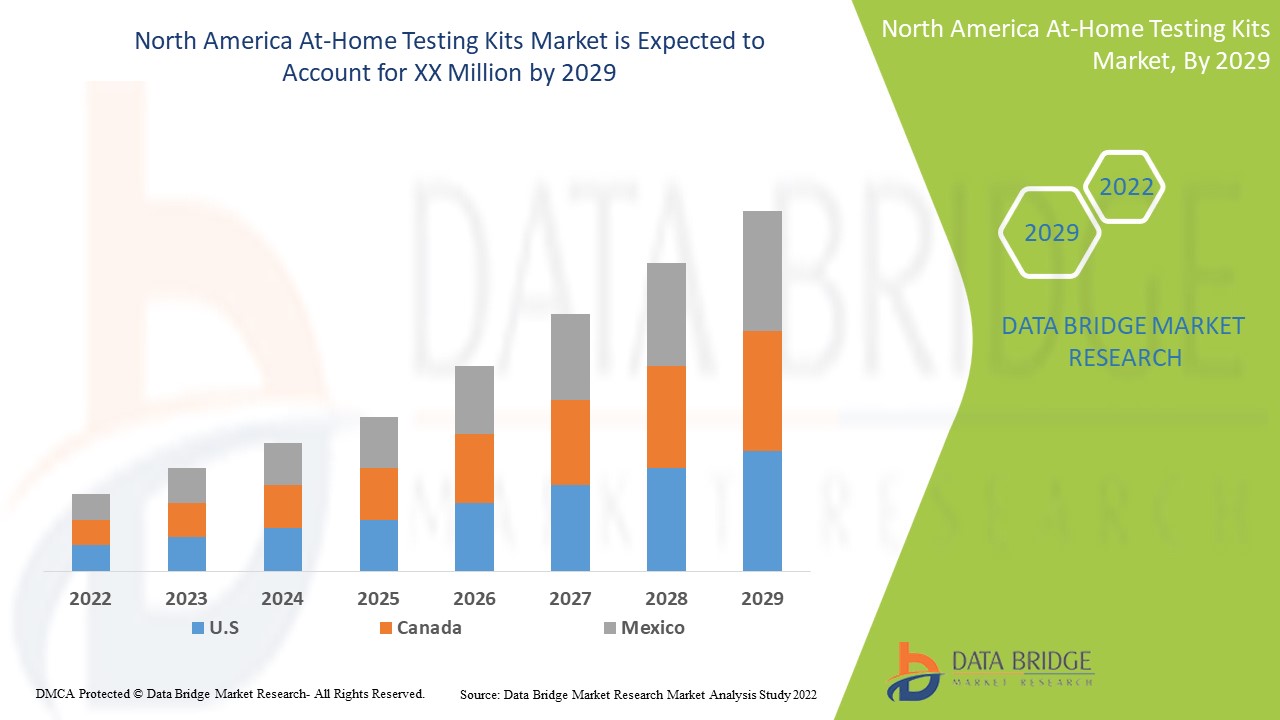

Data Bridge Market Research analyzes that the North America at-home testing kits market will grow at a CAGR of 6.3% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Test Type (Pregnancy Test, HIV Test Kit, Diabetes, Infectious Diseases, Glucose Tests, Ovulation Predictor Test Kit, Drug Abuse Test Kit, and Others), Type (Cassette, Strip, Midstream, Test Panel, Dip Card and Others), Age (Pediatric, Adult and Geriatric), Sample Type (Urine, Blood, Saliva and Other Sample Types), Usage (Disposable and Reusable), Distribution Channels (Retail Pharmacies, Drug Store, Supermarket/Hypermarket and Online Pharmacies) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Abbott, Siemens Healthcare GmbH, F. Hoffmann-La Roche Ltd, BD, Drägerwerk AG & Co. KGaA, LifeScan IP Holdings, LLC, Ascensia Diabetes Care Holdings AG., Nectar Lifesciences Ltd. (Rapikit), ACON Laboratories, Inc., Quidel Corporation., ARKRAY USA, Inc., BTNX INC., Atomo Diagnostics, Eurofins Scientific, Piramal Enterprises Ltd., Bionime Corporation., Nova Biomedical, Cardinal Health., OraSure Technologies, Biolytical Laboratories Inc., Everlywell, Inc., SA Scientific Ltd., Clearblue (a subsidiary of Swiss Precision Diagnostics GmbH), Biosynex, PRIMA Lab SA, MP BIOMEDICALS., Sterilab Services, Chembio Diagnostics, Inc., BioSure, Selfdiagnostics OU among others |

North America At-Home Testing Kits Market Definition

At-home testing kits means testing instruments which help people to perform tests at home and give them rapid results in a minute. It also includes health monitoring equipment to continuously check and control the health of the diabetic patient. At-home tests are very convenient to perform with comfort at home and are available at very affordable rate. Self-tests are usually the advance versions of rapid, point-of-care test kits that were originally designed for healthcare professionals and can be performed by common person. Their processes, packaging and instructions have been simplified so as to guide person through the steps of taking a test. Various at-home test kits are available including HIV tests, pregnancy test, diabetes, ovulation test, infectious diseases such as malaria, COVID-19 and others. For performing these rapid at-home tests blood, urine and oral fluid can be taken as a sample.

North America At-Home Testing Kits Market Dynamics

Drivers

- Growing adoption of self-testing kits

Earlier, people used to visit hospitals often, even for basic problems. However, as awareness has grown regarding several products, this behavior has changed and has turned the trend. Nowadays, people prefer to get their basic tests done using test kits at home before visiting a doctor.

This has become even more prominent due to this pandemic as people are adopting more self-help testing kits due to several restrictions in place. It has turned out to be a boon in disguise for both hospitals and patients as hospitals are already stretched thin and can entirely focus on COVID-19 patients, and the patients can save hefty costs of doctor visits and medicine fees. It has become highly convenient for consumers as they can quickly know their tests' results at their fingertips.

- Easy availability of self-testing kits at pharmacies

At-home or self-testing kits are easily available at pharmacies, and it has become effortless to procure them. Various medical companies are venturing into this space as they rapidly manufacture self-test kits.

This widespread availability can also be attributed to online pharmacies' medical start-ups, making availability easier by clicking a button. In addition, these self-testing kits are available without any prescription.

Opportunity

- Advent of advanced technologies

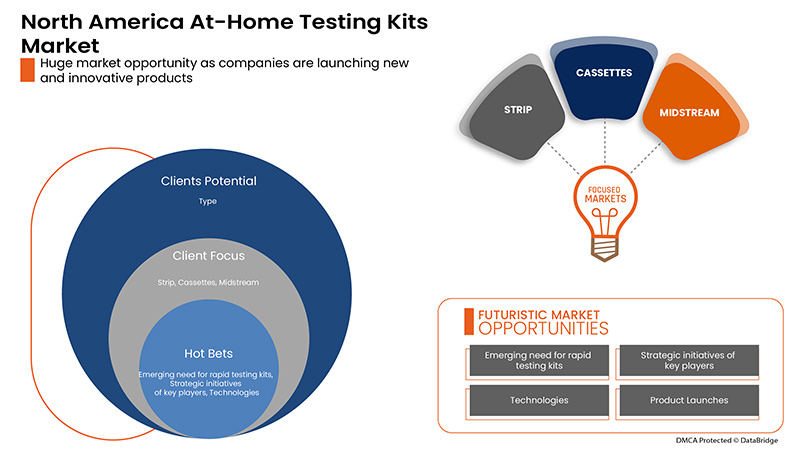

The latest technologies are crucial in making medical products very advanced and reliable to trust. In different medical devices, Artificial Intelligence (AI) and Machine Learning (ML) are important aspects of the healthcare sector with the ability to enhance patient safety and administrative processes by work automation and quicker performance.

It is certain that, by default, AI-powered diagnostic instruments will continue to develop. AI has only taken modest moves into a huge and multi-dimensional opportunity in the healthcare sector.

Restraint/Challenge

- Inaccuracy of results by self-testing kits

At-home testing kits allow end-users to collect their specimen at home and perform the tests at home or send that specimen to the lab for testing. At-home testing kits have undoubtedly eased the process of confirming the person's concern, whether it is a home pregnancy test, HIV test, or any other infectious diseases test.

These at-home testing kits are easy to use and are affordable too. However, there is always a doubt about the accuracy of the results. COVID-19 home monitoring can be more comfortable than going to a hospital or doctor's office. It will also help reduce the risk of the coronavirus being spread or acquired when you are screened.

However, a false positive test result may cause anxiety and stress to the person, even if they do not have it. It is very upsetting and disturbing to the person to receive false positive or negative results. Today, many companies produce rapid diagnostic test kits for COVID-19 which can be performed at home, but there are various accuracy-related issues due to which the distribution of those at-home test kits has been suspended from verifying their reliability.

Post COVID-19 Impact on North America At-Home Testing Kits Market

COVID-19 created a great impact on the at home testing kits market. The market for at-home testing kits is expanding as a consequence of the increased popularity of self-help and Do-It-Yourself (DIY) test kits due to their convenience and quick results. Consumers have concerns about the dependability of rapid home testing kits, which could impede the market's expansion for at-home testing kits. Rapid testing kits for COVID-19 are now urgently needed by companies in order to reduce patient deaths and boost patient recovery rates and also increased rate for the at home testing kits market for Diabetic patients and patients having heart problems. This is creating a major market opportunity for at-home testing kits.

Recent Development

- In March 2022, LifeScan IP Holdings, LLC announced that the company’s product, OneTouch Verio Flex topped the Forbes Health Best Standard Glucose Meters based on price, affordable test strips, colour range indicator, small sample of blood and compact design. This had helped the company to increase their global presence in the market

North America At-Home Testing Kits Market Scope

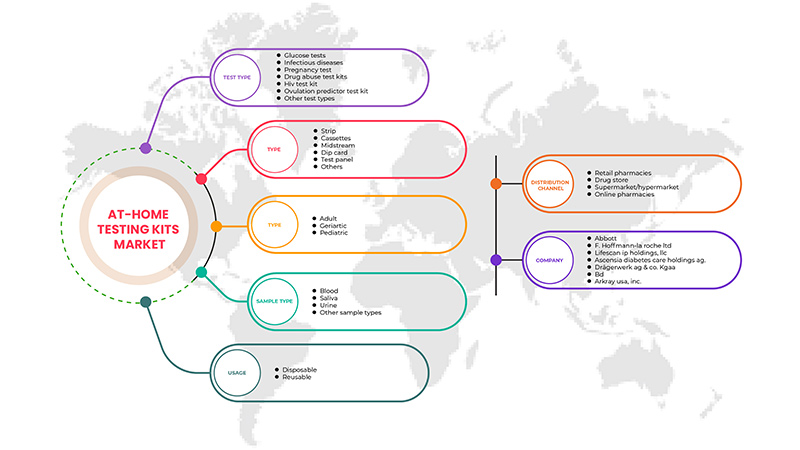

North America at-home testing kits market is categorized into six notable segments based on test type, type, age, sample type, usage, and distribution channels. The growth amongst these segments will help you analyze market growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Test Type

- Pregnancy Test

- HIV Test Kit

- Diabetes

- Infectious Diseases

- Glucose Tests

- Ovulation Predictor Test Kit

- Drug Abuse Test Kit

- Others

Based on test type, the North America at-home testing kits market is segmented into pregnancy test, HIV test kit, diabetes, infectious diseases, glucose tests, ovulation predictor test kit, drug abuse test kit, and others.

Type

- Cassette

- Strip

- Midstream

- Test Panel

- Dip Card

- Others

Based on type, the North America at-home testing kits market is segmented into cassette, strip, midstream, test panel, dip card, and others.

Age

- Pediatric

- Adult

- Geriatric

Based on age, the North America at-home testing kits market is segmented into pediatric, adult, and geriatric.

Sample Type

- Urine

- Blood

- Saliva

- Others

Based on sample type, the North America at-home testing kits market is segmented into urine, blood, saliva, and others.

Usage

- Disposable

- Reusable

Based on usage, the North America at-home testing kits market is segmented into disposable and reusable.

Distribution Channels

- Retail Pharmacies

- Drug Store

- Supermarket/Hypermarket

- Online Pharmacies

Based on distribution channels, the North America at-home testing kits market is segmented into retail pharmacies, drug store, supermarket/hypermarket, and online pharmacies.

North America At-Home Testing Kits Market Regional Analysis/Insights

North America at-home testing kits market is analyzed and market size insights and trends are provided based on test type, type, age, sample type, usage and distribution channels.

The regions covered in the North America at-home testing kits market report are U.S., Canada and Mexico.

The U.S. dominates the North America at-home testing kits market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the country's high healthcare expenditure and the increasing awareness about the North America at-home testing kits market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America At-Home Testing Kits Market Share Analysis

North America at-home testing kits market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the North America at-home testing kits market.

Some of the major players operating in the North America at-home testing kits market are Abbott, ACON Laboratories, Inc., Rapikit, BD, Cardinal Health, B. Braun Melsungen AG, Piramal Enterprises Ltd., Siemens Healthcare GmbH, Quidel Corporation, Bionime Corporation, SA Scientific, ARKRAY USA, Inc., Nova Biomedical, AdvaCare Pharma, AccuBioTech Co., Ltd., Atlas Medical UK, TaiDoc Technology Corporation, Drägerwerk AG & Co. KGaA, F. Hoffmann-La Roche Ltd, Sensing Self, PTE. Ltd, Atomo Diagnostics, RUNBIO BIOTECH CO.,LTD., Mylan N.V. (a subsidiary of Viatris, Inc.), MP BIOMEDICALS, VedaLab, Shanghai Chemtron Biotech Co.Ltd., and Ascensia Diabetes Care Holdings AG among other domestic players.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AT-HOME TESTING KITS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TEST TYPE

2.8 MARKET POSITION COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 DISTRIBUTOR CHANNEL ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 NORTH AMERICA AT- HOME TESTING KITS MARKET: REGULATIONS

5.1 REGULATION IN U.S

5.2 GUIDELINES FOR SELF-TESTING KITS

5.3 REGULATION IN EUROPE

5.4 GUIDELINES FOR TESTING KITS

5.5 REGULATION IN INDONESIA:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING ADOPTION OF SELF-TESTING KITS

6.1.2 EASY AVAILABILITY OF SELF-TESTING KITS AT PHARMACIES

6.1.3 INCREASE IN AWARENESS ABOUT THE IMPORTANCE OF HIV DIAGNOSIS

6.1.4 EASE OF USE AND LOW COSTS OF RAPID SELF-TEST KITS

6.2 RESTRAINTS

6.2.1 INACCURACY OF RESULTS BY SELF-TESTING KITS

6.2.2 STRINGENT GOVERNMENT REGULATIONS FOR MANUFACTURING AND DISTRIBUTION OF TESTING KITS

6.3 OPPORTUNITIES

6.3.1 ADVENT OF ADVANCED TECHNOLOGIES

6.3.2 EMERGING NEED FOR RAPID TESTING KITS FOR COVID-19 PANDEMIC

6.3.3 STRATEGIC INITIATIVES OF KEY PLAYERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION IN THE MEDICAL TECHNOLOGY INDUSTRY

6.4.2 REDUCTION IN RESEARCH & DEVELOPMENT BUDGETS

7 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TEST TYPE

7.1 OVERVIEW

7.2 GLUCOSE TESTS

7.3 INFECTIOUS DISEASES

7.4 PREGNANCY TEST

7.5 DRUG ABUSE TEST KITS

7.6 HIV TEST KIT

7.7 OVULATION PREDICTOR TEST KIT

7.8 OTHERS TEST TYPES

8 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TYPE

8.1 OVERVIEW

8.2 CASSETTES

8.2.1 RETAIL PHARMACIES

8.2.2 ONLINE PHARMACIES

8.2.3 DRUG STORE

8.2.4 SUPERMARKET/HYPERMARKET

8.3 STRIP

8.3.1 RETAIL PHARMACIES

8.3.2 ONLINE PHARMACIES

8.3.3 DRUG STORE

8.3.4 SUPERMARKET/HYPERMARKET

8.4 MIDSTREAM

8.4.1 RETAIL PHARMACIES

8.4.2 ONLINE PHARMACIES

8.4.3 DRUG STORE

8.4.4 SUPERMARKET/HYPERMARKET

8.5 DIP CARD

8.5.1 RETAIL PHARMACIES

8.5.2 ONLINE PHARMACIES

8.5.3 DRUG STORE

8.5.4 SUPERMARKET/HYPERMARKET

8.6 TEST PANEL

8.6.1 RETAIL PHARMACIES

8.6.2 ONLINE PHARMACIES

8.6.3 DRUG STORE

8.6.4 SUPERMARKET/HYPERMARKET

8.7 OTHERS

9 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY AGE

9.1 OVERVIEW

9.2 ADULT

9.3 GERIATRIC

9.4 PEDIATRIC

10 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE

10.1 OVERVIEW

10.2 BLOOD

10.3 URINE

10.4 SALIVA

10.5 OTHER SAMPLE TYPES

11 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY USAGE

11.1 OVERVIEW

11.2 DISPOSABLE

11.3 REUSABLE

12 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS

12.1 OVERVIEW

12.2 RETAIL PHARMACIES

12.3 ONLINE PHARMACIES

12.4 DRUG STORE

12.5 SUPERMARKET/HYPERMARKET

13 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA AT-HOME TESTING KITS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ABBOTT

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUS ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 SIEMENS HEALTHCARE GMBH

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUS ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 F. HOFFMANN- LA ROCHE LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 BD

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 DRÄGERWERK AG & CO. KGAA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 LIFESCAN IP HOLDINGS, LLC

16.6.1 COMPANY SNAPSHOT

16.6.2 COMPANY SHARE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 ASCENSIA DIABETES CARE HOLDINGS AG.

16.7.1 COMPANY SNAPSHOT

16.7.2 COMPANY SHARE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 NECTAR LIFESCIENCES LTD. (RAPIKIT)

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 ACON LABORATORIES, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 QUIDEL CORPORATION.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 ARKRAY USA, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 BTNX INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 ATOMO DIAGNOSTICS

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 EUROFINS SCIENTIFIC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 PIRAMAL ENTERPRISES LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 BIONIME CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NOVA BIOMEDICAL

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 CARDINAL HEALTH.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 ORASURE TECHNOLOGIES

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 BIOLYTICAL LABORATORIES INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 EVERLYWELL, INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SA SCIENTIFIC LTD.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 CLEARBLUE (A SUBSIDIARY OF SWISS PRECISION DIAGNOSTICS GMBH)

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 BIOSYNEX

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 PRIMA LAB SA

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 MP BIOMEDICALS.

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENTS

16.27 STERILAB SERVICES

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

16.28 CHEMBIO DIAGNOSTICS, INC.

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENTS

16.29 BIOSURE

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENTS

16.3 SELFDIAGNOSTICS OU

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA GLUCOSE TESTS IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA INFECTIOUS DISEASES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA PREGNANCY TEST IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA DRUG ABUSE TEST KITS IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA HIV TEST KIT IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA OVULATION PREDICTOR TEST KIT IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA OTHERS TEST TYPES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA CASSETTES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA STRIP IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA STRIP IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DIP CARD IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA TEST PANEL IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA OTHERS IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ADULT IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA GERIATRIC IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA PEDIATRIC IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA BLOOD IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA URINE IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SALIVA IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA OTHER SAMPLE TYPES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA DISPOSABLE IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA REUSABLE IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA RETAIL PHARMACIES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA ONLINE PHARMACIES IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA DRUG STORE IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA SUPERMARKET/HYPERMARKET IN AT-HOME TESTING KITS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA STRIPS IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 50 U.S. AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. STRIPS IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 53 U.S. CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 54 U.S. MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 55 U.S. DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 56 U.S. TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 57 U.S. AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 58 U.S. AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.S. AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 60 U.S. AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 61 CANADA AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 CANADA STRIPS IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 64 CANADA CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 65 CANADA MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 66 CANADA DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 67 CANADA TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 68 CANADA AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 69 CANADA AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 70 CANADA AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 71 CANADA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 72 MEXICO AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO AT-HOME TESTING KITS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO STRIPS IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 75 MEXICO CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 76 MEXICO MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 77 MEXICO DIP CARD IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 78 MEXICO TEST PANEL IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

TABLE 79 MEXICO AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 80 MEXICO AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2020-2029 (USD MILLION)

TABLE 81 MEXICO AT-HOME TESTING KITS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 82 MEXICO AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA AT-HOME TESTING KITS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AT-HOME TESTING KITS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AT-HOME TESTING KITS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AT-HOME TESTING KITS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AT-HOME TESTING KITS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AT-HOME TESTING KITS MARKET: MARKET POSITION COVERAGE GRID

FIGURE 7 NORTH AMERICA AT-HOME TESTING KITS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA AT-HOME TESTING KITS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA AT-HOME TESTING KITS MARKET: DISTRIBUTOR CHANNEL ANALYSIS

FIGURE 10 NORTH AMERICA AT-HOME TESTING KITS MARKET: SEGMENTATION

FIGURE 11 GROWING ADOPTION OF SELF-TESTING KITS IS EXPECTED TO DRIVE NORTH AMERICA AT-HOME TESTING KITS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 GLUCOSE TEST IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA AT-HOME TESTING KITS MARKET, BY TEST TYPE IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST GROWING REGION IN THE NORTH AMERICA AT-HOME TESTING KITS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA AT-HOME TESTING KITS MARKET

FIGURE 15 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TEST TYPE, 2021

FIGURE 16 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TEST TYPE, 2022-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TEST TYPE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TYPE, 2021

FIGURE 20 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY AGE, 2021

FIGURE 24 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY AGE, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY AGE, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY AGE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, 2021

FIGURE 28 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, 2022-2029 (EURO MILLION)

FIGURE 29 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, LIFELINE CURVE

FIGURE 31 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY USAGE, 2021

FIGURE 32 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY USAGE, 2022-2029 (EURO MILLION)

FIGURE 33 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY USAGE, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY USAGE, LIFELINE CURVE

FIGURE 35 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 36 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 37 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 38 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 39 NORTH AMERICA AT-HOME TESTING KITS MARKET: SNAPSHOT (2021)

FIGURE 40 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY COUNTRY (2021)

FIGURE 41 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 NORTH AMERICA AT-HOME TESTING KITS MARKET: BY TEST TYPE (2022-2029)

FIGURE 44 NORTH AMERICA AT-HOME TESTING KITS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.