North America Biotechnology Market

Market Size in USD Billion

CAGR :

%

USD

706.71 Billion

USD

1,724.94 Billion

2025

2033

USD

706.71 Billion

USD

1,724.94 Billion

2025

2033

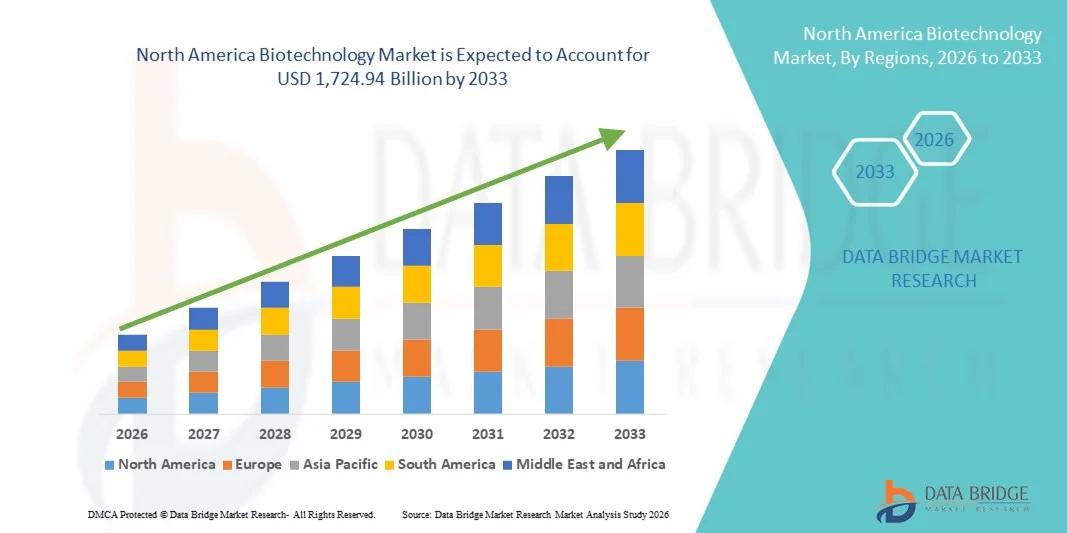

| 2026 –2033 | |

| USD 706.71 Billion | |

| USD 1,724.94 Billion | |

|

|

|

|

North America Biotechnology Market Size

- The North America biotechnology market size was valued at USD 706.71 billion in 2025 and is expected to reach USD 1,724.94 billion by 2033, at a CAGR of 11.80% during the forecast period

- The market growth is primarily driven by advancements in genomics, biopharmaceuticals, and precision medicine, coupled with increasing investment in research and development by both government and private sectors

- In addition, rising prevalence of chronic and genetic diseases, along with growing demand for innovative therapies and personalized medicine, is positioning biotechnology solutions as key tools in improving healthcare outcomes. These combined factors are accelerating the adoption of biotechnological innovations, thereby substantially propelling the market’s expansion

North America Biotechnology Market Analysis

- Biotechnology, encompassing genetic engineering, biopharmaceuticals, and molecular diagnostics, is increasingly central to advancing healthcare, agriculture, and industrial applications in both therapeutic and research domains due to its potential for precision, efficiency, and innovation

- The rising demand for novel therapies, personalized medicine, and advanced diagnostics is primarily fueled by increasing prevalence of chronic and genetic diseases, growing investment in R&D, and strong government and private sector support for biotechnology initiatives

- The United States dominated the North America biotechnology market with the largest revenue share of 67.2% in 2025, driven by a robust ecosystem of biotech startups, leading pharmaceutical companies, advanced research infrastructure, and early adoption of cutting-edge technologies, with significant growth in biopharmaceutical development, gene therapies, and synthetic biology applications

- Canada is expected to be the fastest growing country in the North America biotechnology market during the forecast period due to expanding healthcare infrastructure, increasing biotech research investments, and supportive regulatory frameworks for innovative therapies

- Instruments segment dominated the North America biotechnology market with a market share of 42.3% in 2025, driven by high demand for laboratory equipment, diagnostic devices, and advanced analytical instruments critical for research, development, and quality control across multiple biotech applications

Report Scope and North America Biotechnology Market Segmentation

|

Attributes |

North America Biotechnology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Biotechnology Market Trends

Advancements Through Genomics and Personalized Medicine

- A significant and accelerating trend in the North America biotechnology market is the increasing focus on genomics, gene editing, and personalized medicine, enabling tailored therapies based on individual genetic profiles and improving patient outcomes

- For instance, CRISPR-based therapies such as CTX001 for sickle cell disease are being developed to target specific genetic mutations, allowing highly personalized treatment approaches. Similarly, gene therapy advancements by Spark Therapeutics are providing new options for rare inherited disorders

- Integration of bioinformatics and AI-driven analytics in biotechnology research allows faster drug discovery, predictive modeling of treatment responses, and identification of novel therapeutic targets. For instance, companies such as Tempus leverage AI to analyze genomic and clinical data to optimize cancer treatment strategies

- The seamless application of precision medicine across healthcare systems enables clinicians to deliver targeted therapies while reducing trial-and-error in treatments, creating more efficient and effective patient care pathways

- This trend towards more personalized, data-driven, and precision-focused biotechnology is fundamentally reshaping treatment paradigms and patient expectations. Consequently, companies such as Editas Medicine are developing gene-editing solutions combined with AI-based predictive tools for disease management

- The demand for genomic and personalized therapy solutions is growing rapidly across both clinical and research settings, as healthcare providers increasingly prioritize efficacy, safety, and individualized treatment options

- Collaborative innovation between biotech firms, academic institutions, and pharmaceutical companies is accelerating product development, reducing time-to-market for novel therapies, and fostering the commercialization of advanced biotechnologies. For instance, the partnership between Pfizer and Beam Therapeutics is aimed at developing precision base-editing therapies for genetic diseases

North America Biotechnology Market Dynamics

Driver

Increasing Demand Due to Rising Prevalence of Chronic and Genetic Diseases

- The increasing prevalence of chronic, rare, and genetic diseases, coupled with rising investment in biotechnology R&D, is a significant driver for the heightened demand for biopharmaceuticals and gene-based therapies

- For instance, in March 2025, Vertex Pharmaceuticals advanced its CFTR modulator pipeline to address cystic fibrosis mutations, demonstrating strong market growth potential in genetic disease therapeutics. Such strategies by leading biotech firms are expected to propel the North America biotechnology market during the forecast period

- As patients and healthcare providers seek more effective treatment options, biotechnology solutions offer targeted therapies, gene editing, and regenerative medicine approaches, providing substantial improvements over conventional treatments

- Furthermore, increasing funding from both government agencies such as NIH and private investors is enabling the rapid development of innovative therapeutics and research tools, supporting commercialization and adoption of cutting-edge biotechnology

- The growing focus on preventive, personalized, and precision medicine, coupled with expanding clinical trial activities and strategic collaborations among biotech firms, further contributes to the North America market’s growth trajectory

- Rising awareness and adoption of advanced diagnostics, such as companion diagnostics, is driving demand for biotechnology solutions that enable early detection and optimized treatment strategies. For instance, Foundation Medicine offers genomic profiling to guide targeted therapies

- Expansion of biologics and biosimilars pipelines is fueling market growth, as increasing demand for cost-effective therapeutic alternatives complements innovation in complex biologic drugs. For instance, Amgen and Samsung Biologics are collaborating on biosimilar development projects

Restraint/Challenge

High Development Costs and Regulatory Compliance Hurdles

- The high costs associated with biotechnology R&D, manufacturing, and clinical trials pose a significant challenge to broader market penetration, as extensive resources are required for bringing novel therapies to market

- For instance, complex CAR-T cell therapies such as Kymriah involve high production and operational costs, limiting accessibility and adoption, particularly in smaller healthcare facilities

- Regulatory compliance in North America requires stringent approvals from the FDA and other agencies, which can prolong time-to-market and increase costs for biotech companies. For instance, delays in IND or BLA approvals can slow commercialization of promising therapeutics

- Addressing these challenges through optimized production processes, scalable manufacturing technologies, and strategic partnerships is crucial for sustaining growth. In addition, pricing and reimbursement hurdles for innovative therapies can restrict adoption despite clinical efficacy

- While new funding models and support programs are emerging, the perceived financial and regulatory burden can still hinder smaller biotech startups, making strategic planning and efficient resource allocation vital for market expansion

- Market entry barriers due to intellectual property protection and patent disputes pose challenges, as legal complexities can delay product launches or increase costs for innovation. For instance, ongoing patent litigation in CRISPR technologies has affected some companies’ R&D timelines

- Limited skilled workforce in advanced biotechnology fields, such as synthetic biology and bioinformatics, can constrain growth, as specialized expertise is required for R&D, manufacturing, and regulatory compliance. For instance, demand for trained gene therapy technicians exceeds current supply in many U.S. biotech hubs

North America Biotechnology Market Scope

The market is segmented on the basis of product type, technology, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the North America biotechnology market is segmented into instruments, reagents & services, and software. The instruments segment dominated the market with the largest revenue share of 42.3% in 2025, driven by the high demand for laboratory equipment, diagnostic devices, and analytical instruments critical for research and development. Instruments such as PCR machines, sequencers, and chromatography systems are essential across biopharmaceutical development, academic research, and clinical testing. The dominance of this segment is further reinforced by the continuous innovation in automated and high-throughput instrumentation that increases laboratory efficiency. Strong investments by biotech companies and research institutes to upgrade infrastructure also boost the demand for instruments. Moreover, instruments are often a long-term investment, ensuring recurring revenue from maintenance and upgrades.

The reagents & services segment is expected to witness the fastest growth rate of 19.5% from 2026 to 2033, fueled by the increasing number of research projects, contract research outsourcing, and rising adoption of molecular diagnostics and precision medicine. Reagents, kits, and consumables are recurring requirements for laboratories, ensuring consistent demand. Biotechnology service providers, such as contract labs, support companies in performing complex experiments without heavy capital investment, making this segment highly attractive. In addition, innovations in reagent formulations and custom assay development further accelerate adoption.

- By Technology

On the basis of technology, the market is segmented into nanobiotechnology, PCR technology, DNA sequencing, chromatography, tissue engineering and regeneration, cell-based assays, fermentation, and others. The PCR technology segment dominated with a market share of 38.9% in 2025, owing to its widespread use in diagnostics, research, and clinical applications. PCR instruments and kits are essential for detecting genetic disorders, infectious diseases, and monitoring research projects. The accuracy, speed, and scalability of PCR methods make them integral in laboratories across North America. High demand for COVID-19 testing and other molecular diagnostics further reinforced the dominance of this segment. Advanced PCR platforms with multiplexing and real-time capabilities also drive revenue growth.

The DNA sequencing segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, supported by the surge in genomics research, personalized medicine, and large-scale sequencing projects. Next-generation sequencing (NGS) technologies are increasingly used for disease research, biomarker discovery, and precision therapeutics. Falling sequencing costs, automation, and better bioinformatics integration are driving adoption. Government initiatives and private investments in genomics also fuel rapid growth in this segment.

- By Application

On the basis of application, the biotechnology market is segmented into biopharmaceutical, bio-industrial, bio-services, bioinformatics, and bio-agriculture. The biopharmaceutical segment dominated with a revenue share of 41.5% in 2025, driven by the rising demand for targeted therapies, monoclonal antibodies, and recombinant protein-based drugs. Growth is supported by increasing prevalence of chronic diseases, government support for innovative therapies, and strong R&D investment. Biopharmaceutical applications are critical for developing novel treatments, vaccines, and regenerative therapies. Partnerships between biotech firms and pharmaceutical companies further enhance pipeline development. The segment also benefits from advanced manufacturing facilities and regulatory approvals in North America.

The bioinformatics segment is expected to witness the fastest growth rate of 23.1% from 2026 to 2033, fueled by the integration of AI, machine learning, and big data analytics in drug discovery, genomics, and personalized medicine. Bioinformatics platforms help analyze complex biological data, improve clinical decision-making, and optimize research outcomes. Increasing demand for precision medicine and data-driven healthcare is accelerating adoption. In addition, cloud-based bioinformatics services provide scalable solutions for both research institutions and biopharma companies.

- By End User

On the basis of end user, the market is segmented into pharmaceutical & biotechnology companies, contract research organizations (CROs), academic & research institutes, and others. The pharmaceutical & biotechnology companies segment dominated with the largest market share of 45.2% in 2025, driven by continuous R&D investments, clinical trials, and development of innovative therapies. Companies rely on biotechnology solutions for drug discovery, biologics manufacturing, and genomic research. The strong presence of leading biotech firms in the U.S. further boosts this segment. In addition, collaborations with research institutes and CROs support pipeline acceleration and innovation.

The contract research organizations (CROs) segment is expected to witness the fastest growth rate of 21.8% from 2026 to 2033, owing to outsourcing trends in research and clinical trials. CROs provide cost-effective, flexible, and specialized services for drug development, reducing the burden on pharmaceutical companies. Rising demand for clinical trials, especially in precision medicine and rare disease therapies, supports segment growth. CROs also adopt advanced biotech instruments and reagents to meet high-quality standards and accelerate timelines.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, third-party distributors, and others. The direct tender segment dominated with a revenue share of 47.1% in 2025, as large pharmaceutical and biotech companies prefer procuring instruments, reagents, and software directly from manufacturers to ensure authenticity, receive technical support, and maintain supply reliability. Direct tender agreements also allow bulk procurement at negotiated prices, supporting long-term R&D operations. Companies benefit from training, warranty services, and software updates provided by manufacturers.

The third-party distributors segment is expected to witness the fastest CAGR of 20.6% from 2026 to 2033, driven by the need for easier access to biotechnology products in smaller laboratories, research institutes, and emerging biotech hubs. Distributors offer convenience, variety, and localized support for instruments, reagents, and consumables. Growth is fueled by rising biotech research activities across secondary cities, increasing demand for affordable procurement channels, and expansion of distributor networks by manufacturers.

North America Biotechnology Market Regional Analysis

- The United States dominated the North America biotechnology market with the largest revenue share of 67.2% in 2025, driven by a robust ecosystem of biotech startups, leading pharmaceutical companies, advanced research infrastructure, and early adoption of cutting-edge technologies, with significant growth in biopharmaceutical development, gene therapies, and synthetic biology applications

- Stakeholders in the region highly value advanced research infrastructure, access to cutting-edge instruments, and innovations in genomics, personalized medicine, and molecular diagnostics

- This widespread adoption is further supported by a well-established regulatory framework, high healthcare expenditure, and a collaborative ecosystem of academia, contract research organizations, and industry players, establishing biotechnology solutions as a preferred choice for clinical, research, and industrial applications across the region

The U.S. Biotechnology Market Insight

The U.S. biotechnology market captured the largest revenue share of 67.2% in 2025 within North America, fueled by strong investments in R&D, advanced infrastructure, and a well-established ecosystem of biotech and biopharmaceutical companies. Researchers and healthcare providers are increasingly prioritizing the development and adoption of gene therapies, precision medicine, and advanced diagnostics. The growing trend of personalized healthcare, combined with robust demand for biopharmaceutical innovations and biologics, further propels the biotechnology industry. Moreover, the integration of AI, bioinformatics, and high-throughput technologies in research and clinical applications is significantly contributing to the market's expansion.

Canada Biotechnology Market Insight

The Canada biotechnology market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by government support for innovation, increasing funding for genomics and molecular biology research, and the rising prevalence of chronic and genetic diseases. The country’s well-developed healthcare system and emphasis on clinical trials are fostering the adoption of biotechnology solutions. Canadian researchers and companies are also drawn to the collaborative opportunities with U.S. and international biotech firms. The market is experiencing significant growth across biopharmaceutical, bio-services, and bio-industrial applications, with advanced technologies being incorporated into both research institutions and commercial enterprises.

Mexico Biotechnology Market Insight

The Mexico biotechnology market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding healthcare infrastructure, increasing government initiatives for biotech innovation, and a growing focus on affordable biologics and vaccines. Rising awareness of modern therapeutics and molecular diagnostics is encouraging both private and public healthcare providers to adopt biotechnology solutions. Mexico’s growing collaborations with international biotech firms, alongside the strengthening of local research capabilities, are expected to continue stimulating market growth. The country is also witnessing increased investment in bio-agriculture and industrial biotechnology, contributing to broader adoption.

North America Biotechnology Market Share

The North America Biotechnology industry is primarily led by well-established companies, including:

- Lonza Group (Switzerland)

- BioNTech SE (Germany)

- Genmab A/S (Denmark)

- AstraZeneca (U.K.)

- Sanofi (France)

- Novartis AG (Switzerland)

- UCB S.A. (Belgium)

- GSK plc (U.K.)

- Merck KGaA (Germany)

- Bayer AG (Germany)

- Ipsen (France)

- QIAGEN (Netherlands)

- Oxford Nanopore Technologies (U.K.)

- Novo Nordisk A/S (Denmark)

- CSL Behring (Switzerland)

- Morphosys AG (Germany)

- Genfit (France)

- Bio Rad Laboratories (Switzerland)

- Evotec SE (Germany)

What are the Recent Developments in North America Biotechnology Market?

- In January 2026, the U.S. Food and Drug Administration (FDA) approved Zycubo, developed by Fortress Biotech and Zydus Lifesciences, as the first treatment for Menkes disease, a rare genetic disorder affecting copper absorption in infants. This approval marks a significant milestone in pediatric genetic disease therapy, showing a nearly 80% reduction in mortality with early treatment and expanding biotech innovation in rare diseases

- In June 2025, Eli Lilly agreed to acquire gene‑editing biotech Verve Therapeutics for up to USD 1.3 billion, significantly bolstering its portfolio in CRISPR‑based therapies targeting cardiovascular disease and exemplifying large‑scale strategic biotech M&A activity

- In May 2025, Regeneron Pharmaceuticals revealed plans to acquire 23andMe for USD 256 million following the latter’s Chapter 11 filing, a move expected to enhance Regeneron’s capabilities in genetics and personal health research

- In April 2025, Amgen announced a USD 900 million expansion of its biotech manufacturing facility in Ohio, boosting U.S. biomanufacturing capacity and creating approximately 750 new jobs, reflecting continued investment in domestic biotech production infrastructure

- In October 2023, Gilead Sciences and Assembly Biosciences entered a 12‑year partnership to co‑develop next‑generation antiviral therapies targeting serious viral diseases (including hepatitis and herpes), representing a major long‑term collaborative effort in biotech innovation

- https://www.reuters.com/business/healthcare-pharmaceuticals/amgen-expand-ohio-biotech-manufacturing-plant-2025-04-25/

- https://apnews.com/article/65490338bd5863231af6aa87ea426326?

- https://www.ft.com/content/53d021c9-d15f-4471-86ef-e9abfc3ae7db

- https://www.gilead.com/news/news-details/2023/gilead-and-assembly-biosciences-establish-partnership-to-develop-next-generation-therapeutics-for-serious-viral-diseases?u

- https://www.reuters.com/business/healthcare-pharmaceuticals/us-fda-approves-fortress-bio-zydus-treatment-rare-pediatric-disease-2026-01-13/

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.