North America Chronic Disease Management Market

Market Size in USD Billion

CAGR :

%

USD

4.37 Billion

USD

13.93 Billion

2025

2033

USD

4.37 Billion

USD

13.93 Billion

2025

2033

| 2026 –2033 | |

| USD 4.37 Billion | |

| USD 13.93 Billion | |

|

|

|

|

North America Chronic Disease Management Market Size

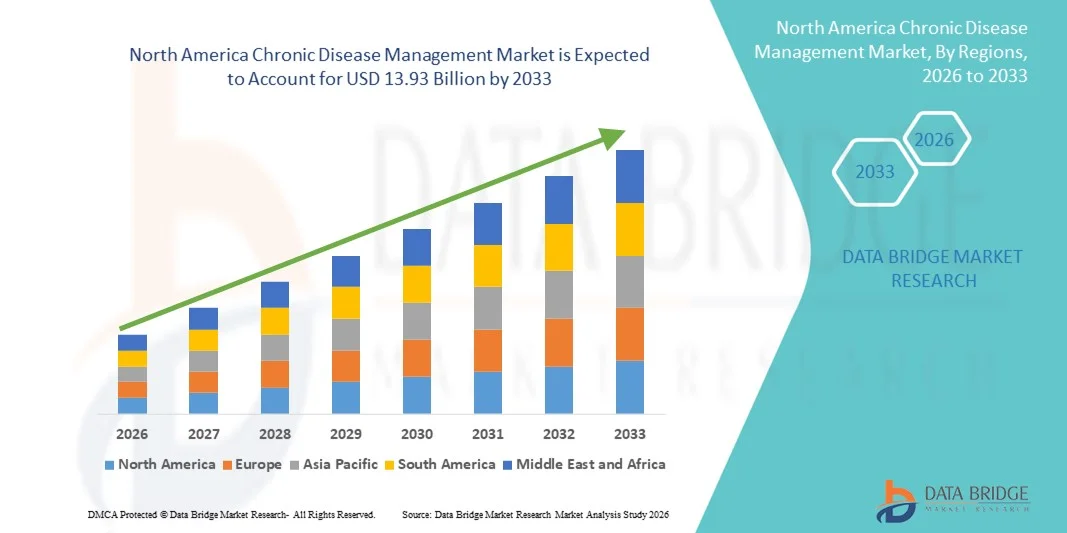

- The North America chronic disease management market size was valued at USD 4.37 billion in 2025 and is expected to reach USD 13.93 billion by 2033, at a CAGR of 15.60% during the forecast period

- The market growth is primarily driven by the increasing adoption of digital health technologies, remote patient monitoring systems, and connected medical devices, which are transforming chronic care delivery across both home-based and clinical settings. Growing healthcare digitalization enables continuous monitoring, real-time data sharing, and proactive disease management

- Furthermore, rising demand from patients, healthcare providers, and payers for cost-effective, user-friendly, and integrated care solutions is positioning chronic disease management platforms as a preferred approach for managing long-term conditions. These combined factors are accelerating the adoption of Chronic Disease Management solutions, thereby significantly enhancing overall market growth

North America Chronic Disease Management Market Analysis

- Chronic Disease Management solutions, which include digital platforms, remote monitoring tools, and care coordination systems, are becoming integral to modern healthcare delivery across both home-based and clinical settings due to their ability to improve patient outcomes, enhance care continuity, and reduce long-term healthcare costs

- The growing demand for Chronic Disease Management solutions is primarily driven by the rising prevalence of chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders, along with increasing adoption of digital health technologies, telehealth services, and patient-centric care models

- The U.S. dominated the chronic disease management market with the largest revenue share of 42.7% in 2025, supported by advanced healthcare infrastructure, high healthcare spending, strong adoption of digital health solutions, and growing focus on value-based care and remote patient monitoring across hospitals and homecare settings

- Canada is expected to be the fastest-growing region in the chronic disease management market during the forecast period, driven by rising chronic disease prevalence, increasing healthcare digitalization, expanding telehealth adoption, and government initiatives aimed at improving patient outcomes and reducing healthcare costs through technology-enabled chronic care management

- The solution segment dominated the largest market revenue share of 61.8% in 2025, driven by the rising adoption of digital health platforms that enable continuous patient monitoring and data-driven care delivery

Report Scope and Chronic Disease Management Market Segmentation

|

Attributes |

Chronic Disease Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Chronic Disease Management Market Trends

Shift Toward Digital, Patient-Centric, and Integrated Care Models

- A significant and accelerating trend in the global chronic disease management (CDM) market is the transition from episodic, hospital-centric care toward continuous, patient-centric management models. Healthcare systems worldwide are increasingly focusing on long-term disease monitoring, early intervention, and personalized care pathways to improve outcomes for patients with chronic conditions such as diabetes, cardiovascular diseases, respiratory disorders, and cancer

- The widespread adoption of digital health platforms, remote patient monitoring tools, and electronic health records is enabling continuous tracking of patient health parameters beyond traditional clinical settings

- For instance, healthcare providers in North America and North America are using remote glucose monitoring programs for diabetes patients and connected cardiac monitoring solutions to track heart failure patients at home, allowing clinicians to intervene early when risk indicators rise

- Integrated care approaches are gaining traction globally, emphasizing collaboration among hospitals, primary care providers, pharmacies, payers, and home-care services. Such integration helps streamline care coordination, minimize treatment gaps, and ensure continuity of care across different stages of disease progression

- Another notable trend is the growing emphasis on preventive care and early diagnosis within chronic disease management programs. Governments and healthcare organizations are investing in screening initiatives, lifestyle management programs, and population health management strategies to reduce disease burden and long-term healthcare costs

- In addition, value-based care models are reshaping chronic disease management worldwide, with providers increasingly incentivized to improve patient outcomes rather than the volume of services delivered. This shift is encouraging the adoption of outcome-oriented CDM solutions that focus on long-term disease control and quality of life improvement

- Overall, this evolution toward more holistic, coordinated, and patient-focused care is redefining global expectations for chronic disease management and driving sustained market growth across both developed and emerging economies

North America Chronic Disease Management Market Dynamics

Driver

Rising Global Burden of Chronic Diseases and Aging Population

- The increasing prevalence of chronic diseases worldwide is a primary driver fueling the growth of the global Chronic Disease Management market. Conditions such as diabetes, cardiovascular disorders, chronic respiratory diseases, and cancer are rising steadily due to sedentary lifestyles, unhealthy dietary habits, urbanization, and increased life expectancy

- The global aging population significantly contributes to this trend, as older adults are more susceptible to long-term conditions requiring continuous monitoring and management

- For instance, countries such as Japan, Germany, and Italy, which have a high proportion of elderly citizens, are expanding chronic care programs focused on long-term management of cardiovascular disease, arthritis, and neurodegenerative disorders

- Healthcare systems across regions are under mounting pressure to manage the growing clinical and economic burden associated with chronic illnesses. Effective CDM programs help reduce hospital admissions, lower readmission rates, and improve long-term patient outcomes, making them a strategic priority for both public and private healthcare providers

- Furthermore, increasing awareness among patients about the importance of proactive disease management and adherence to treatment plans is supporting market growth. Employers and insurers are also promoting chronic care programs to reduce productivity losses and long-term healthcare expenditures

- Collectively, these factors are driving sustained global demand for comprehensive chronic disease management solutions across hospitals, clinics, home-care settings, and community health programs

Restraint/Challenge

High Implementation Costs and Inequitable Access to Care

- Despite strong growth prospects, the global chronic disease management market faces challenges related to high implementation and operational costs. Comprehensive CDM programs often require significant investment in infrastructure, digital platforms, trained healthcare professionals, and ongoing patient support services, which can strain healthcare budgets

- In low- and middle-income regions, limited healthcare funding and resource constraints hinder the widespread adoption of structured chronic disease management solutions

- For instance, parts of Africa, Southeast Asia, and Latin America continue to face gaps in access to long-term diabetes and hypertension management programs due to shortages of healthcare professionals and limited reimbursement coverage

- In addition, variations in healthcare policies, reimbursement frameworks, and regulatory environments across countries create complexity for providers and solution developers seeking to scale CDM programs internationally

- Patient-related challenges, such as low health literacy, poor treatment adherence, and resistance to long-term lifestyle changes, can also limit the effectiveness of chronic disease management initiatives

- Addressing these barriers through cost-effective care models, supportive reimbursement policies, workforce training, and patient education will be essential to ensure equitable access and sustained growth of the global chronic disease management market

North America Chronic Disease Management Market Scope

The market is segmented on the basis of type, solution type, service type, disease indication, and end user.

- By Type

On the basis of type, the Chronic Disease Management market is segmented into solution and services. The solution segment dominated the largest market revenue share of 61.8% in 2025, driven by the rising adoption of digital health platforms that enable continuous patient monitoring and data-driven care delivery. Chronic disease management solutions integrate patient data, analytics, and clinical decision-support tools to improve treatment outcomes. Healthcare organizations increasingly prefer comprehensive software solutions that streamline care coordination and reduce hospital readmissions. The growing prevalence of chronic diseases and demand for real-time health insights further support dominance. Integration with electronic health records (EHRs) enhances workflow efficiency. Solutions also support personalized care plans and population health management. The scalability of digital platforms contributes to higher adoption across healthcare systems. Increasing investments in digital health infrastructure reinforce market leadership. Regulatory support for digital therapeutics also benefits this segment. Advancements in AI and predictive analytics add value. High recurring licensing revenue boosts market share. Strong adoption in developed healthcare markets sustains dominance.

The services segment is anticipated to witness the fastest CAGR of 22.4% from 2026 to 2033, fueled by the growing need for implementation, training, and consulting services associated with chronic disease management platforms. As healthcare providers adopt complex digital systems, demand for professional services rises. Services support system customization, integration, and compliance with regulatory standards. Increasing outsourcing of IT and operational services by hospitals accelerates growth. Smaller healthcare facilities rely heavily on third-party service providers. Continuous system upgrades and maintenance drive recurring service demand. Expansion of cloud-based platforms increases reliance on managed services. Growth in emerging markets further supports service adoption. Patient engagement programs also require service expertise. The shortage of in-house IT professionals boosts service utilization. Consulting services help optimize care models. These factors collectively drive rapid CAGR.

- By Solution Type

On the basis of solution type, the Chronic Disease Management market is segmented into on-premise solution, cloud-based solution, and web-based solution. The cloud-based solution segment accounted for the largest market revenue share of 48.6% in 2025, driven by its scalability, cost efficiency, and ease of deployment. Cloud platforms enable real-time access to patient data across care settings. Healthcare providers benefit from reduced infrastructure costs and faster implementation. Cloud solutions support remote patient monitoring and telehealth integration. Automatic updates and data backups enhance operational reliability. Interoperability with third-party systems strengthens adoption. Cloud-based analytics improve clinical decision-making. Security enhancements and compliance certifications increase trust. Subscription-based pricing supports long-term revenue generation. Increasing acceptance of SaaS models in healthcare reinforces dominance. Large healthcare networks favor centralized cloud platforms. Government initiatives supporting digital health further drive adoption.

The web-based solution segment is expected to register the fastest CAGR of 21.1% from 2026 to 2033, driven by its accessibility and minimal hardware requirements. Web-based platforms allow easy access through standard browsers, improving usability. They are particularly attractive to small and mid-sized healthcare providers. Faster deployment timelines support adoption. Growing internet penetration in emerging markets accelerates growth. Web solutions enable seamless patient engagement through portals. Lower upfront investment appeals to budget-constrained organizations. Integration with mobile applications enhances functionality. Increased use in outpatient and homecare settings supports expansion. Continuous feature upgrades improve performance. Ease of training reduces adoption barriers. These advantages drive rapid CAGR.

- By Service Type

On the basis of service type, the Chronic Disease Management market is segmented into educational service, implementation service, consulting service, and others. The implementation service segment held the largest market revenue share of 39.4% in 2025, driven by the complexity of deploying chronic disease management platforms. Healthcare providers require expert support for system integration, data migration, and workflow customization. Implementation services ensure minimal disruption to clinical operations. Demand is strong among hospitals transitioning from legacy systems. Compliance with healthcare regulations necessitates professional implementation. Large-scale deployments increase service scope. Vendor-led implementation improves system performance. Increasing adoption of multi-module platforms supports growth. Implementation services reduce time-to-value. High service fees contribute to revenue dominance. Expansion of enterprise-level deployments reinforces leadership. Strong repeat demand sustains market share.

The educational service segment is projected to grow at the fastest CAGR of 23.6% from 2026 to 2033, driven by the need to train healthcare professionals and patients. Effective use of digital platforms requires structured training programs. Rising adoption among non-technical users increases demand. Educational services improve patient engagement and adherence. Healthcare organizations prioritize upskilling staff for digital workflows. Remote training solutions expand reach. Continuous software updates require ongoing education. Government initiatives supporting digital literacy boost growth. Patient self-management programs rely heavily on education services. Increasing use in homecare settings supports expansion. Multilingual training content enhances adoption. These factors collectively drive high CAGR.

- By Disease Indication

On the basis of disease indication, the Chronic Disease Management market is segmented into cardiovascular diseases (CVD), diabetes, COPD, arthritis, asthma, cancer, and others. The diabetes segment dominated the largest market revenue share of 34.9% in 2025, driven by the high global prevalence of diabetes and the need for continuous monitoring. Diabetes management requires regular tracking of glucose levels, medication, and lifestyle factors. Digital platforms improve patient adherence and outcomes. Strong adoption of remote monitoring devices supports growth. Integration with wearable devices enhances data accuracy. Healthcare providers prioritize diabetes due to its long-term complications. Reimbursement support for diabetes management programs boosts adoption. High patient volume generates recurring revenue. AI-driven insights improve glycemic control. Strong focus on preventive care supports dominance. Pharmaceutical partnerships further expand usage. These factors sustain leadership.

The cardiovascular diseases (CVD) segment is expected to witness the fastest CAGR of 20.9% from 2026 to 2033, driven by rising incidence of heart-related disorders. Increasing focus on preventive cardiology supports adoption. Remote monitoring of blood pressure and heart rate drives demand. Integration with wearable ECG devices enhances care delivery. Post-hospitalization monitoring reduces readmissions. Government initiatives targeting heart disease management boost growth. Aging populations increase patient base. Data analytics improve risk prediction. Telecardiology adoption accelerates growth. Increased awareness of lifestyle-related risks supports expansion. Hospitals invest in long-term cardiac care platforms. These drivers result in rapid CAGR.

- By End User

On the basis of end user, the Chronic Disease Management market is segmented into healthcare providers, healthcare payers, and others. The healthcare providers segment accounted for the largest market revenue share of 52.7% in 2025, driven by widespread adoption across hospitals, clinics, and specialty care centers. Providers use chronic disease management platforms to improve care coordination. Digital tools enhance patient monitoring and treatment adherence. Providers benefit from reduced operational costs and improved outcomes. Integration with clinical workflows supports efficiency. High patient engagement improves satisfaction. Providers leverage analytics for population health management. Increasing value-based care models support adoption. Strong investment capacity drives platform deployment. Large provider networks generate significant revenue. Regulatory incentives encourage usage. Continuous innovation sustains dominance.

The healthcare payers segment is anticipated to grow at the fastest CAGR of 21.8% from 2026 to 2033, driven by the focus on cost containment and outcome-based reimbursement models. Payers use chronic disease management platforms to reduce long-term healthcare costs. Data analytics enable risk stratification and early intervention. Increasing adoption of preventive care programs supports growth. Payers collaborate with providers for integrated care delivery. Rising chronic disease burden increases payer involvement. Digital platforms improve claims management efficiency. Government-backed insurance programs drive adoption. Expansion of managed care models supports growth. Payers invest in patient engagement tools. Improved ROI attracts investments. These factors drive rapid CAGR.

North America Chronic Disease Management Market Regional Analysis

- The North America chronic disease management market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strong regulatory frameworks supporting digital healthcare adoption and the increasing burden of chronic diseases across the region. Rising aging populations, coupled with growing prevalence of diabetes, cardiovascular diseases, and respiratory disorders, are accelerating demand for long-term care management solutions

- North American healthcare systems are increasingly focused on preventive care, remote patient monitoring, and value-based care models, which significantly support market growth. Technological advancements in telehealth, AI-based analytics, and interoperable health platforms further enhance adoption. Government-backed digital health initiatives and reimbursement support also contribute to sustained growth

- The market is witnessing strong uptake across hospitals, outpatient clinics, and homecare settings. Integration of chronic disease management platforms into national healthcare systems is becoming more prevalent. Increasing patient awareness and self-management practices further support expansion. Overall, North America remains a key contributor to global market growth

U.S. Chronic Disease Management Market Insight

The U.S. chronic disease management market dominated North America with the largest revenue share of 42.7% in 2025, supported by advanced healthcare infrastructure and high healthcare spending. Strong adoption of digital health solutions, including remote patient monitoring and telehealth, is driving growth across hospitals and homecare settings. The country’s focus on value-based care models promotes investment in chronic disease management platforms. High penetration of smartphones and connected devices enhances patient engagement and self-management. The U.S. healthcare system’s emphasis on data-driven decision-making supports adoption of AI and analytics-based solutions. Increasing prevalence of diabetes, cardiovascular diseases, and chronic respiratory conditions boosts demand. Strong private-sector innovation and large-scale health IT deployments further strengthen market leadership. Additionally, robust reimbursement frameworks encourage adoption of digital care solutions. The presence of leading technology and healthcare companies accelerates market development. Overall, the U.S. remains the largest revenue-generating market in North America.

Canada Chronic Disease Management Market Insight

The Canada chronic disease management market is expected to be the fastest-growing region in North America during the forecast period, driven by rising chronic disease prevalence and increasing healthcare digitalization. Expansion of telehealth services and remote patient monitoring is accelerating market adoption, particularly in remote and rural areas. Government initiatives aimed at improving patient outcomes and reducing healthcare costs through technology-enabled chronic care management are supporting growth. Canada’s strong emphasis on preventive care and population health management further drives demand. Increasing investments in health IT infrastructure and digital health platforms strengthen adoption. Growing awareness of self-management and remote monitoring among patients boosts engagement. Integration of chronic disease management solutions into provincial healthcare programs is becoming more common. The rising demand for interoperable and secure digital platforms supports growth. Overall, Canada represents a high-growth market within North America.

North America Chronic Disease Management Market Share

The Chronic Disease Management industry is primarily led by well-established companies, including:

• Medtronic (Ireland)

• Philips Healthcare (Netherlands)

• Oracle (U.S.)

• IBM Watson Health (U.S.)

• Epic Systems Corporation (U.S.)

• Veradigm LLC (U.S.)

• McKesson Corporation (U.S.)

• Oracle Health (U.S.)

• ResMed (U.S.)

• Omada Health (U.S.)

• Livongo Health (U.S.)

• Health Catalyst (U.S.)

• Teladoc Health (U.S.)

• BioTelemetry (U.S.)

• WellDoc (U.S.)

• iRhythm Technologies (U.S.)

• Lumeon (U.K.)

• Siemens Healthineers (Germany)

• GE HealthCare (U.S.)

Latest Developments in North America Chronic Disease Management Market

- In February 2023, Cloud DX launched its first remote patient monitoring (RPM) program for Type 2 diabetes patients, introducing a dedicated digital care pathway to support diabetes management through connected health technologies with a target operational rollout in Canadian primary care settings

- In February 2023, Lark Health and Smart Meter announced a collaboration on a digital diabetes management program for health systems, combining Lark’s AI-driven care coaching with Smart Meter’s cellular-enabled glucose monitoring devices to improve remote care and patient engagement for Type 2 diabetes

- In October 2024, Glooko and Cerner announced a formal collaboration to integrate continuous glucose monitoring (CGM) and diabetes data into Cerner’s electronic health record systems, enabling clinicians across health networks to access integrated chronic care data for better patient monitoring

- In October 2024, the global chronic disease management market was forecast to reach USD 17.28 billion by 2033, driven by accelerated adoption of cloud-based solutions, telemedicine, and remote monitoring technologies for conditions such as diabetes and cardiovascular disease

- In October 2024, StrideMD expanded its strategic partnerships with Dexcom and Advanced Diabetes Supply (ADS) to enhance its remote patient monitoring and virtual care offerings for diabetes care, enabling integrated continuous glucose data sharing and 24/7 specialist support for patients managing diabetes

- In January 2025, the U.S. Food and Drug Administration approved Novo Nordisk’s Ozempic (semaglutide) for treatment of chronic kidney disease in adults with type 2 diabetes, expanding its clinical use to reduce disease progression and kidney failure risk in this high-burden patient population

- In March 2025, Eli Lilly launched its diabetes and weight-loss drug Mounjaro in India following regulatory approval, expanding global access to a key dual-indication therapy for diabetes and obesity, which is a major chronic disease risk factor in emerging markets

- In June 2025, AstraZeneca signed a major collaboration deal valued up to USD 5.2 billion with CSPC Pharmaceuticals to co-develop new chronic disease therapies using AI drug discovery platforms, particularly targeting immunological and cardiovascular disease treatments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.