North America Collagen Market

Market Size in USD Million

CAGR :

%

USD

790.67 Million

USD

1,204.26 Million

2021

2029

USD

790.67 Million

USD

1,204.26 Million

2021

2029

| 2022 –2029 | |

| USD 790.67 Million | |

| USD 1,204.26 Million | |

|

|

|

Market Analysis and Size

The increasing use of collagen in food industries, rising interest in protein consumption and nutricosmetics, rising application in healthcare, and rising use of collagen based on biomaterials are the key factors driving the North America collagen market's growth. Furthermore, rising per capita income and the expanding food processing industry present significant growth opportunities for collagen manufacturers.

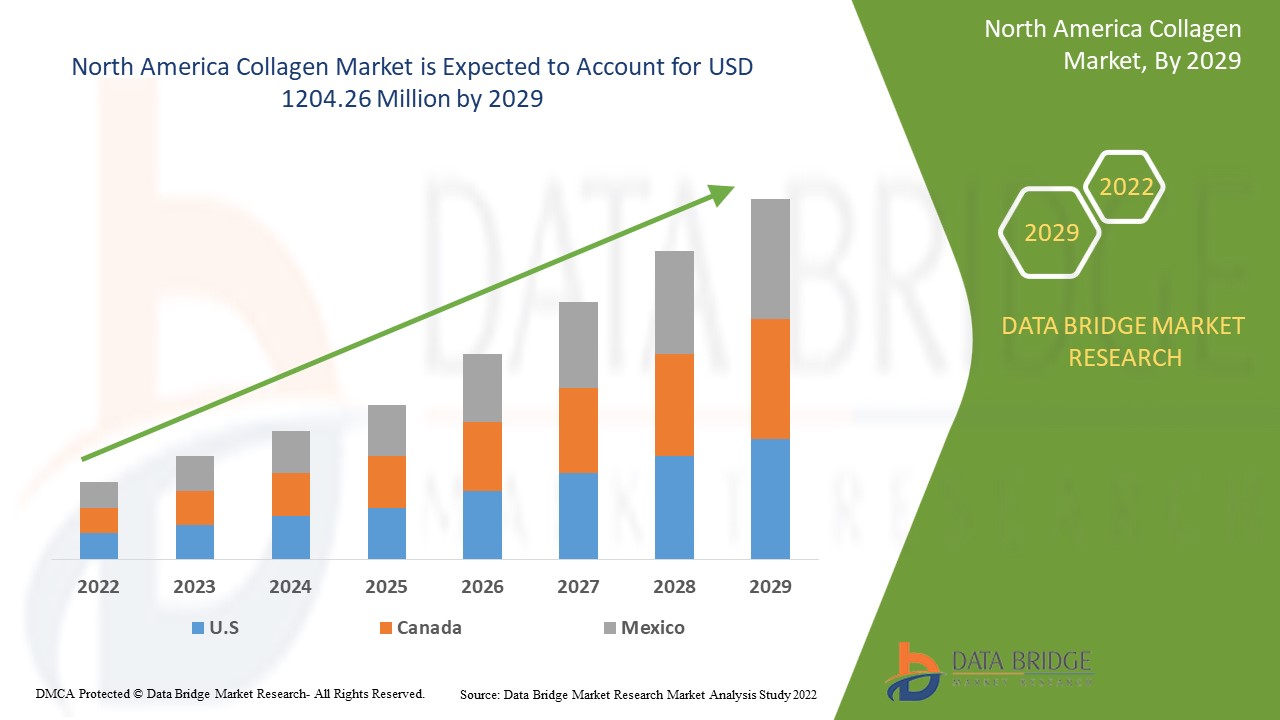

Data Bridge Market Research analyses that the collagen market was valued at USD 790.67 million in 2021 and is expected to reach the value of USD 1204.26 million by 2029, at a CAGR of 5.4% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and consumer behaviour.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Gelatine, Hydrolysed Collagen, Native Collagen, Collagen Peptide, Others), Type (Type I, Type II, Type III, Type IV), Form (Powder, Liquid), Source (Bovine, Poultry, Porcine, Marine, Others), Product Category (GMO, Non-GMO), Function (Texture, Stabilizer, Emulsifier, Finding, Others), Application (Food Products, Beverages, Nutraceuticals and Dietary Supplements, Cosmetics and Personal Care, Animal Feed, Laboratory Tests, Others) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Rousselot (Netherlands), GELITA AG (Germany), Weishardt (France), Tessenderlo Group NV (Belgium), Nitta Gelatin Inc. (Japan), LAPI GELATINE S.p.a. (Italy), ITALGELATINE S.p.A. (Italy), Ewald-Gelatine GmbH (Germany), REINERT GRUPPE Ingredients GmbH (Germany), TrobasGelatine B.V. (Netherlands), GELNEX (Brazil), JuncàGelatines SL (Spain), HolistaCollTech Ltd. (Australia), Collagen Solutions Plc (U.K.), and Advanced BioMatrix, Inc. (U.S.) |

|

Opportunities |

|

Market Definition

Collagen is an insoluble fibrous structural protein that is found in the extracellular matrix and several tissues throughout the body. It is synthesised from amino acids, glycine, hydroxyproline, and arginine. It promotes brain health, prevents bone loss, relieves joint pain, increases muscle mass, improves hair and nail growth, and improves skin strength and elasticity.

Collagen Market Dynamics

Drivers

- The numerous benefits offered by collagen in the food and beverage industry

Collagen is used in confectionery products to improve chewiness, foam stability, and texture. It is used as a texturizing and stabilising agent in dairy products. Furthermore, it acts as a binding agent for nutritional bar ingredients and improves the softness and flexibility of nutritional bars. As a result of the numerous functionalities provided by collagen, its use in the food industry has increased. It is also used to treat malnutrition and specific absorption and digestion disorders. In terms of value sales, these factors are expected to drive the growth of the collagen market.

- Growing application of collagen in the personal care industry

Collagen fibres in human skin deteriorate over time, losing its thickness and strength, resulting in skin ageing. Collagen is used in cosmetic creams as a nutritional supplement for bone regeneration, cartilage regeneration, vascular and cardiac reconstruction, skin replacement, and soft skin augmentation, among other things. Collagen is an ingredient found in many soaps, shampoos, facial creams, body lotions, and other cosmetics. Hydrolysed collagen is a key component in skin and hair care products. In the personal care industry, hydrolysed collagen is combined with surfactants and active washing agents in shampoos and shower gels.

Opportunity

Changing lifestyles, food habits, adoption of Western food habits, an increase in demand for functional ingredients in food products, and an increase in industrial activity necessitating process enhancement have contributed to the collagen market's growth in emerging economies. Emerging economies offer excellent opportunities for market growth. Due to rising North America consumption, market stakeholders from various countries have been working tirelessly to increase production of collagen. Manufacturing companies in the food and beverage sector are using a strategic approach to generate lucrative revenue opportunities.

Restraints

Cultural prohibitions on the consumption of animal-sourced food and beverages may act as a restraint to the market growth. Furthermore, insufficient processing technologies in the developing region will further challenge the market growth.

This collagen market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the collagen market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Collagen Market

The COVID-19 pandemic significantly impacts the food and beverage industry as a whole. The isolation rules have resulted in a lack of supply and disruption in the supply chain, which has hampered the market's domestic players. On the other hand, there is an increase in demand for products with a high nutritive value that provide multiple health benefits. Collagen is commonly found in supplements aimed to assist elderly population. The aging population's demand for collagen-based supplements is expected to boost health, immunity, and overall wellness. Furthermore, as consumers' health concerns grow as a result of pandemics, they are paying more attention to food and beverage product labels. This is expected to create numerous opportunities for food and beverage manufacturers to increase their market share.

Recent developments

- Darling Ingredients' EnviroFlight brand opened a new R&D and Corporate Center in Apex, North Carolina, in April 2021. This new R&D facility will allow for a greater focus on specific research areas, such as expanding the knowledge base for alternative uses of black soldier fly larvae (BSFL) in animal health, animal nutrition, cosmetics, and other product development.

- GELITA USA opened its new collagen peptide unit in March 2021, a 30,000-square-foot production unit at the complex's southeastern end in the Port Neal industrial area near Sioux City, Iowa. This expansion is primarily driven by GELITA's collagen peptides' double-digit market growth, particularly in the health and beauty markets, which shows no signs of abating in the near future.

North America Collagen Market Scope

The collagen market is segmented on the basis of product type, type, form, source, product category, function and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product type

- Gelatine

- Hydrolysed Collagen

- Native Collagen

- Collagen Peptide

- Others

Type

- Type 1

- Type 2

- Type 3

- Type 4

Form

- Powder

- Liquid

Source

- Bovine

- Cattle

- Buffaloes

- Yak

- Others

- Poultry

- Porcine

- Marine

- Others

Product category

- GMO

- NON-GMO

Function

- Texture

- Stabilizer

- Emulsifier

- Finding

- Others

Application

- Pharmaceuticals

- Cosmetics

- Nutraceuticals

- Sport Supplements

- Food Products

- Beverages

- Dietary Supplements

- Cosmetics and Personal Care

- Animal Feed

- Laboratory Tests

- Others

Collagen Market Regional Analysis/Insights

The collagen market is analysed and market size insights and trends are provided by country, product type, type, form, source, product category, function and application as referenced above.

The countries covered in the collagen market report are U.S., Canada and Mexico.

The United States is expected to dominate the market due to the growing acceptance of collagen in a variety of applications as dietary supplements. Furthermore, Canada is dominant due to the country's expanding food industry, which uses collagen extensively as a food ingredient.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Collagen Market Share Analysis

The collagen market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to collagen market.

Some of the major players operating in the collagen market are:

- Rousselot (Netherlands)

- GELITA AG (Germany)

- Weishardt (France)

- Tessenderlo Group NV (Belgium)

- Nitta Gelatin Inc. (Japan)

- LAPI GELATINE S.p.a. (Italy)

- ITALGELATINE S.p.A. (Italy)

- Ewald-Gelatine GmbH (Germany)

- REINERT GRUPPE Ingredients GmbH (Germany)

- TrobasGelatine B.V. (Netherlands)

- GELNEX (Brazil)

- JuncàGelatines SL (Spain)

- HolistaCollTech Ltd. (Australia)

- Collagen Solutions Plc (U.K.)

- Advanced BioMatrix, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA COLLAGEN MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION METHOD COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT ANALYSIS

4.2 NORTH AMERICA COLLAGEN MARKET: LIST OF SUBSTITUTES

4.3 NORTH AMERICA COLLAGEN MARKET: MARKETING STRATEGIES

4.3.1 LAUNCHING NEW INNOVATIVE PRODUCTS

4.3.2 PROMOTION OF THEIR PRODUCTS BY EMPHASIZING DIFFERENT APPLICATIONS

4.3.3 A VAST NETWORK OF DISTRIBUTION

4.3.4 LAUNCHING CLEAN, SUSTAINABLE AND ORGANIC PRODUCTS FOR HEALTH-CONSCIOUS CONSUMERS

4.3.5 POPULARITY OF PLANT-BASED MEAT ALTERNATIVE

4.4 NORTH AMERICA COLLAGEN MARKET: PATENT ANALYSIS

4.4.1 DBMR ANALYSIS

4.4.2 COUNTRY-LEVEL ANALYSIS

4.4.3 YEARWISE ANALYSIS

4.4.4 PATENT ANALYSIS BY COMPANY

4.5 NORTH AMERICA COLLAGEN MARKET: PRODUCTION & CONSUMPTION PATTERN

4.6 NORTH AMERICA COLLAGEN MARKET: RAW MATERIAL PRICING ANALYSIS

5 REGULATORY FRAMEWORK

6 IMPACT OF COVID-19 IMPACT ON THE NORTH AMERICA COLLAGEN MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA COLLAGEN MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA COLLAGEN MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING USAGE OF COLLAGEN PRODUCTS IN THE COSMETIC INDUSTRY

7.1.2 SUBSTANTIAL DEMAND FOR THE COLLAGEN PRODUCTS AS FOOD STABILIZER

7.1.3 RISING COLLAGEN AS INGREDIENTS IN SUPPLEMENTS FOR SPORTS ATHLETES

7.1.4 GROWTH IN THE USE OF COLLAGEN PROTEINS IN THE MEDICAL AND PHARMACEUTICAL INDUSTRY

7.1.5 GROWTH OF FISHING INDUSTRY TO USE FISH AS A RAW MATERIAL FOR GELATIN PRODUCTION

7.2 RESTRAINTS

7.2.1 INCREASING STRINGENT REGULATIONS REGARDING THE USE OF FOOD ADDITIVES

7.2.2 REGULATIONS OVER THE IMPORTS OF RAW MATERIAL FOR THE PRODUCTION OF GELATIN AND COLLAGEN PRODUCTS IN EUROPEAN UNION

7.2.3 RISK OF DISEASE TRANSFER FROM ANIMAL SOURCES

7.2.4 REGULATIONS UPON THE SLAUGHTERING OF FARM AND POULTRY ANIMALS

7.3 OPPORTUNITIES

7.3.1 RISING COLLAGEN APPLICATION AS BIOMATERIALS IN THE LABORATORIES

7.3.2 RECENT TECHNOLOGICAL ADVANCEMENTS, INCLUDING THE FORMATION OF COLLAGEN-BASED PELLET AS GENE DELIVERY CARRIER

7.3.3 RISING COLLAGEN AS INGREDIENTS IN SUPPLEMENTS FOR SPORTS ATHLETES

7.4 CHALLENGES

7.4.1 LACK OF ADVANCED PROCESSING TECHNOLOGIES FOR COLLAGEN EXTRACTION

7.4.2 HIGH PROCESSING COSTS IN THE COLLAGEN INDUSTRY

7.4.3 COMPLICATED GMO CERTIFICATION PROCESS FOR COLLAGEN PRODUCTS LABELLING

8 NORTH AMERICA COLLAGEN MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 GELATIN

8.3 HYDROLYZED COLLAGEN

8.4 NATIVE COLLAGEN

8.5 COLLAGEN PEPTIDE

8.6 OTHERS

9 NORTH AMERICA COLLAGEN MARKET, BY TYPE

9.1 OVERVIEW

9.2 TYPE I

9.3 TYPE II

9.4 TYPE III

9.5 TYPE IV

10 NORTH AMERICA COLLAGEN MARKET, BY FORM

10.1 OVERVIEW

10.2 POWDER

10.3 LIQUID

11 NORTH AMERICA COLLAGEN MARKET, BY SOURCE

11.1 OVERVIEW

11.2 BOVINE

11.3 POULTRY

11.4 PORCINE

11.5 MARINE

11.6 OTHERS

12 NORTH AMERICA COLLAGEN MARKET, BY PRODUCT CATEGORY

12.1 OVERVIEW

12.2 GMO

12.3 NON-GMO

13 NORTH AMERICA COLLAGEN MARKET, BY FUNCTION

13.1 OVERVIEW

13.2 TEXTURE

13.3 STABILIZER

13.4 EMULSIFIER

13.5 FINDING

13.6 OTHERS

14 NORTH AMERICA COLLAGEN MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 FOOD PRODUCTS

14.3 BEVERAGES

14.4 NUTRACEUTICALS AND DIETARY SUPPLEMENTS

14.5 COSMETICS AND PERSONAL CARE

14.6 ANIMAL FEED

14.7 LABORATORY TESTS

14.8 OTHERS

15 NORTH AMERICA COLLAGEN MARKET, BY REGION

15.1 NORTH AMERICA

16 NORTH AMERICA COLLAGEN MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 GELITA AG

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 RECENT DEVELOPMENTS

18.2 ROUSSELOT

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 RECENT DEVELOPMENTS

18.3 DSM

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 ASHLAND

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 WEISHARDT

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 RECENT DEVELOPMENTS

18.6 AMICOGEN

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 ITALGELATINE S.P.A.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 ADVANCED BIOMATRIX, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 COBIOSA

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 COLLAGEN SOLUTIONS PLC

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 CONNOILS LLC

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 ET-CHEM

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 EWALD-GELATINE GMBH

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 GELNEX

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 HOLISTA COLLTECH

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 JELLAGEN

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 JUNCÀ GELATINES SL

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 KENNEY & ROSS LIMITED MARINE GELATIN

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 LAPI GELATINE S.P.A.

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 NIPPI COLLAGEN NA INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 NORLAND PRODUCTS INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 PB LEINER (A PART OF TESSENDERLO GROUP)

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 SMPNUTRA

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 TITAN BIOTECH

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENT

18.25 VITAL PROTEINS LLC

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF PRODUCT: 3503 GELATIN …HS CODE: 3503 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: 3503 GELATIN …HS CODE: 3503 (USD THOUSAND)

TABLE 3 IMPORT DATA OF PRODUCT: 3504 PEPTONES AND THEIR DERIVATIVES; OTHER PROTEIN SUBSTANCES AND THEIR DERIVATIVES, N.E.S.; HIDE…HS CODE: 3504 (USD THOUSAND)

TABLE 4 EXPORT DATA OF 3504 PEPTONES AND THEIR DERIVATIVES; OTHER PROTEIN SUBSTANCES AND THEIR DERIVATIVES, N.E.S.; HIDE…HS CODE: 3504 (USD THOUSAND)

TABLE 5 COLLAGEN RAW MATERIAL PRICE ANALYSIS IN 2020 (PER KGS)

TABLE 6 PERCENTAGE OF COLLAGEN YIELD FROM DIFFERENT SOURCES

TABLE 7 FOUR COMMON TYPES OF COLLAGEN AND THEIR RESPECTIVE LOCATION

List of Figure

FIGURE 1 NORTH AMERICA COLLAGEN MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COLLAGEN MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COLLAGEN MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COLLAGEN MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COLLAGEN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COLLAGEN MARKET: THE PRODUCT TYPE LIFELINE CURVE

FIGURE 7 NORTH AMERICA COLLAGEN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 NORTH AMERICA COLLAGEN MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA COLLAGEN MARKET: SEGMENTATION

FIGURE 13 ASIA PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA COLLAGEN MARKET, AND EUROPE IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 GROWTH IN THE USE OF COLLAGEN PROTEINS IN THE MEDICAL AND PHARMACEUTICAL INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA COLLAGEN MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 COLLAGEN DEVICES IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COLLAGEN MARKET IN 2021 & 2028

FIGURE 16 PATENT REGISTERED FOR COLLAGEN BY COUNTRY (2016 - 2021)

FIGURE 17 PATENT REGISTERED YEAR (2016 - 2021)

FIGURE 18 CONCENTRATION OF EACH AMINO ACID IN HYDROLYSED COLLAGEN (IN %)

FIGURE 19 NORTH AMERICA COLLAGEN MARKET BY PRODUCTION (USD MILLION)

FIGURE 20 CONSUMPTION OF COLLAGEN BY REGION (USD MILLION)

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA COLLAGEN MARKET

FIGURE 22 ESTIMATED PRODUCTION OF COSMETICS IN THAILAND (2017-2020) (USD BILLION)

FIGURE 23 PERCENTAGE OF SPORTS NUTRITION NEW PRODUCT LAUNCHES TRACKED WITH COLLAGEN NORTH AMERICALY (2012-2016)

FIGURE 24 NORTH AMERICA COLLAGEN MARKET: BY PRODUCT TYPE, 2020

FIGURE 25 NORTH AMERICA COLLAGEN MARKET: BY TYPE, 2020

FIGURE 26 NORTH AMERICA COLLAGEN MARKET: BY FORM, 2020

FIGURE 27 NORTH AMERICA COLLAGEN MARKET: BY SOURCE, 2020

FIGURE 28 NORTH AMERICA COLLAGEN MARKET: BY PRODUCT CATEGORY, 2020

FIGURE 29 NORTH AMERICA COLLAGEN MARKET: BY FUNCTION, 2020

FIGURE 30 NORTH AMERICA COLLAGEN MARKET: BY APPLICATION, 2020

FIGURE 31 NORTH AMERICA COLLAGEN MARKET: SNAPSHOT, 2020

FIGURE 32 NORTH AMERICA COLLAGEN MARKET: BY COUNTRY, 2020

FIGURE 33 NORTH AMERICA COLLAGEN MARKET: BY COUNTRY, 2020

FIGURE 34 NORTH AMERICA COLLAGEN MARKET: BY COUNTRY, 2020

FIGURE 35 NORTH AMERICA COLLAGEN MARKET: BY PRODUCT TYPE, 2020

FIGURE 36 NORTH AMERICA COLLAGEN MARKET: COMPANY SHARE 2020 (%)

North America Collagen Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Collagen Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Collagen Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.