North America Contrast Media Injectors Market

Market Size in USD Billion

CAGR :

%

USD

872.99 Billion

USD

1,444.79 Billion

2025

2033

USD

872.99 Billion

USD

1,444.79 Billion

2025

2033

| 2026 –2033 | |

| USD 872.99 Billion | |

| USD 1,444.79 Billion | |

|

|

|

|

North America Contrast Media Injectors Market Size

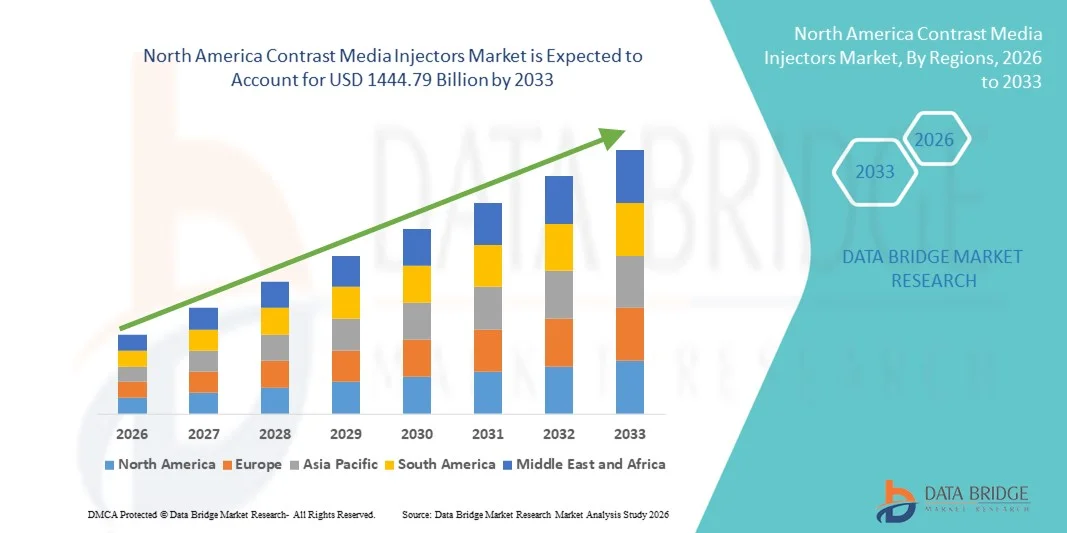

- The North America Contrast Media Injectors market size was valued at USD 872.99 billion in 2025 and is expected to reach USD 1444.79 billion by 2033, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within advanced imaging systems and hospital automation, leading to increased efficiency and accuracy in diagnostic procedures

- Furthermore, rising demand for precise, safe, and user-friendly contrast media delivery systems in both diagnostic and interventional imaging procedures is establishing contrast media injectors as essential tools in radiology and cardiology. These converging factors are accelerating the uptake of Contrast Media Injectors solutions, thereby significantly boosting the industry's growth

North America Contrast Media Injectors Market Analysis

- Contrast media injectors, providing precise and automated delivery of contrast agents during imaging procedures, are increasingly vital components in modern radiology, cardiology, and interventional imaging settings due to their enhanced accuracy, safety, and integration with imaging systems

- The escalating demand for contrast media injectors is primarily fueled by the growing adoption of advanced imaging technologies, rising patient volumes, and a preference for automated, reproducible injection protocols that improve diagnostic outcomes

- U.S. dominated the Contrast Media Injectors market with the largest revenue share of 38% in 2025, characterized by advanced healthcare infrastructure, high procedural volumes, and a strong presence of key industry players, with the U.S. experiencing substantial growth in Contrast Media Injectors adoption, particularly in hospitals and diagnostic centers, driven by innovations in automated and smart injector systems

- Canada is expected to be the fastest-growing region in the Contrast Media Injectors market with a CAGR during the forecast period, driven by increasing healthcare investments, rising diagnostic imaging procedures, and expanding hospital infrastructure

- The Injector Systems segment dominated the largest revenue share of 58.2% in 2025, supported by increasing investments in advanced imaging equipment and hospital expansion

Report Scope and Contrast Media Injectors Market Segmentation

|

Attributes |

Contrast Media Injectors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Contrast Media Injectors Market Trends

Technological Advancements in Injector Systems

- Continuous innovations in contrast media injector technology, such as dual-head injectors, automated bolus tracking, and programmable injection protocols, are improving patient safety and imaging accuracy

- For instance, in September 2024, Ulrich Medical introduced its FlowSafe dual-head injector for MRI applications, offering precise injection timing and integrated monitoring, which enhances diagnostic reliability

- Integration of injector systems with imaging modalities allows synchronized contrast delivery, improving scan quality

- Automated safety features, such as air bubble detection and pressure monitoring, reduce complications during imaging procedures

- Enhanced software platforms for injector control are improving workflow efficiency and reducing operator dependency

North America Contrast Media Injectors Market Dynamics

Driver

Rising Investments in Healthcare Infrastructure and Imaging Centers

- Expansion of hospitals, diagnostic imaging centers, and outpatient clinics in North America is driving higher adoption of advanced contrast media injectors

- For instance, the opening of a new diagnostic center in Texas in January 2025 reported deploying multiple next-generation injector systems to handle increased patient throughput

- Government initiatives to improve imaging accessibility and diagnostic accuracy in rural and urban areas are encouraging procurement of modern injector devices

- Increasing clinical research activities and clinical trials requiring repeated imaging procedures are also contributing to market growth

- Growing collaborations between injector manufacturers and hospital networks to provide training, maintenance, and service support enhance market penetration

Restraint/Challenge

High Cost and Maintenance Requirements

- The relatively high cost of advanced contrast media injector systems, coupled with ongoing maintenance and consumable requirements, can limit adoption, particularly in smaller diagnostic centers or budget-constrained hospitals

- For instance, mid-sized imaging centers in Canada have reported delays in procuring dual-head injector systems due to budget limitations and high upfront costs

- Complex operation and the need for trained personnel can also hinder adoption in regions with limited specialized staff

- Regulatory approvals and compliance with safety standards for contrast media injectors may delay market entry of new products

- Concerns about contrast-induced nephropathy in high-risk patients may limit the frequency of certain procedures, indirectly affecting injector utilization

- To overcome these challenges, manufacturers are focusing on cost-optimization, operator training programs, and developing devices with reduced maintenance needs to ensure broader market access

North America Contrast Media Injectors Market Scope

The market is segmented on the basis of type, product, application, and end-user.

- By Type

On the basis of type, the Contrast Media Injectors market is segmented into Single Head, Dual-Head, and Syringeless Injectors. The Single Head segment dominated the largest market revenue share of 46.8% in 2025, driven by its wide adoption in standard radiology procedures and compatibility with most imaging equipment. Hospitals and diagnostic centers prefer single-head injectors for routine contrast delivery due to their ease of use and cost-effectiveness. High reliability and lower maintenance requirements make them ideal for high-volume imaging facilities. Strong presence in emerging markets further contributes to revenue dominance. Integration with automated workflow systems enhances operational efficiency. High availability of consumables and standardized calibration protocols reinforce trust among radiology professionals. Single-head injectors also offer precision dosing, reducing contrast waste. Leading manufacturers continue to improve design ergonomics and safety features. Clinical familiarity and proven performance support continued preference. Support and service networks ensure smooth adoption in hospitals. Training programs for radiology staff improve utilization efficiency. Overall, these factors ensured the Single Head segment’s leadership in 2025.

The Dual-Head segment is expected to witness the fastest CAGR of 13.4% from 2026 to 2033, driven by increasing demand for simultaneous multi-agent injections and advanced interventional procedures. Dual-head injectors allow for higher flexibility, enabling radiologists to perform complex imaging tasks efficiently. Rising adoption in interventional cardiology and advanced radiology suites strengthens growth. Improved safety features, including contrast dose management and automated monitoring, encourage hospital adoption. Growing preference for enhanced workflow efficiency in high-volume facilities fuels expansion. Technological upgrades and integration with digital imaging systems make dual-head injectors attractive. Increasing availability of compatible consumables supports continuous operation. Positive feedback from early adopters in specialty hospitals accelerates market penetration. Expanding clinical applications beyond radiology drive demand. Vendor support and extended warranties improve purchase confidence. Overall, these advantages position dual-head injectors as the fastest-growing type segment.

- By Product

On the basis of product, the Contrast Media Injectors market is segmented into Injector Systems and Consumables. The Injector Systems segment dominated the largest revenue share of 58.2% in 2025, supported by increasing investments in advanced imaging equipment and hospital expansion. High reliability, precision dosing, and integration with imaging software make injector systems the preferred choice for hospitals. Extensive use in radiology, interventional cardiology, and interventional radiology procedures contributes to strong revenue. Standardized protocols and training support ease of adoption. Regular maintenance contracts and service availability enhance system longevity. Integration with automated contrast delivery workflows increases operational efficiency. Positive clinical outcomes from accurate dosing reinforce hospital confidence. Strong presence of key players ensures wide distribution and support. Growing hospital budgets for imaging infrastructure underpin segment dominance. Equipment upgrades in diagnostic centers further enhance demand. Advanced safety mechanisms reduce procedural risks, strengthening adoption.

The Consumables segment is expected to witness the fastest CAGR of 12.6% from 2026 to 2033, fueled by rising procedural volumes and increasing use of single-use tubing, syringes, and contrast kits. Hospitals and diagnostic centers prefer consumables for infection control and to ensure consistent performance. Expanding interventional procedures drive higher consumption of syringes and tubing sets. Compatibility with multiple injector models supports widespread adoption. Growing awareness of patient safety and hygiene accelerates usage. Improved distribution networks and e-commerce availability increase accessibility. Demand from ambulatory surgical centers and diagnostic clinics enhances segment growth. Continuous introduction of cost-effective consumables attracts smaller facilities. Adoption in emerging markets with expanding imaging infrastructure strengthens CAGR. Vendor support for reliable consumables ensures repeat purchases. Streamlined supply chains reduce downtime in imaging departments. These factors collectively position consumables as the fastest-growing product segment.

- By Application

On the basis of application, the Contrast Media Injectors market is segmented into Radiology, Interventional Cardiology, and Interventional Radiology. The Radiology segment dominated the largest revenue share of 52.5% in 2025, owing to high procedural volumes and widespread adoption in diagnostic centers and hospitals. Routine imaging examinations, including CT scans and MRIs, heavily rely on contrast injectors. Hospitals prefer standardized radiology procedures for efficiency and reliability. Integration with PACS and imaging software supports operational accuracy. High patient throughput and repeat imaging requirements reinforce segment dominance. Safety mechanisms in injectors ensure precise contrast delivery, reducing complications. Extensive training programs for radiology staff improve utilization. Availability of compatible consumables enhances workflow efficiency. Established service networks strengthen adoption. Proven reliability and familiarity with equipment promote continued use. Clinical studies demonstrating improved imaging quality further reinforce market preference.

The Interventional Radiology segment is expected to witness the fastest CAGR of 13.1% from 2026 to 2033, driven by increasing minimally invasive procedures and complex therapeutic interventions. Rising adoption of image-guided therapies in oncology, vascular, and cardiology procedures supports segment growth. Dual-head and advanced injector systems allow simultaneous multi-agent delivery, improving procedural efficiency. Enhanced safety and dose-monitoring features increase physician confidence. Expansion of specialty interventional centers further fuels demand. Increasing preference for outpatient and ambulatory procedures accelerates adoption. Continuous training for interventional radiologists improves operational proficiency. Integration with hybrid operating rooms enhances precision. Rising prevalence of cardiovascular and oncological diseases boosts procedural volumes. Favorable reimbursement policies for interventional therapies encourage hospital investments. Technological innovations in injector design support improved workflow. These combined drivers make interventional radiology the fastest-growing application segment.

- By End-User

On the basis of end-user, the Contrast Media Injectors market is segmented into Hospitals, Ambulatory Surgical Centres, and Diagnostics Centres. The Hospitals segment dominated the largest revenue share of 61.4% in 2025, driven by large-scale imaging facilities, high patient volumes, and investment in advanced equipment. Hospitals conduct both routine and complex imaging procedures, requiring reliable injectors. High adoption of dual-head and syringeless systems enhances procedural efficiency. Integration with hospital IT systems improves workflow and patient record management. Regular maintenance and service agreements support equipment longevity. Training and support programs for radiology staff enhance operational reliability. Regulatory compliance ensures safe contrast delivery. Hospital budgets and insurance reimbursements strengthen procurement capacity. Standardized imaging protocols across hospital networks reinforce adoption. Expansion of hospital chains increases injector deployment. Overall, these factors ensure hospitals remain the dominant end-user.

The Ambulatory Surgical Centres segment is expected to witness the fastest CAGR of 12.9% from 2026 to 2033, fueled by the growing number of outpatient imaging procedures and minimally invasive interventions. These centers prefer compact, efficient injector systems for high-throughput operations. Increasing adoption of dual-head and advanced injector models improves operational flexibility. Rising patient awareness and preference for outpatient care support growth. Integration with PACS and remote monitoring enhances procedural accuracy. Expansion of diagnostic networks and standalone imaging centers boosts market penetration. Improved affordability and cost-effective consumables facilitate adoption. Vendor support and training for small facilities enhance confidence. Technological upgrades and simplified workflow systems attract new entrants. Positive clinical outcomes drive repeat adoption. Telehealth-enabled follow-ups increase patient throughput. Collectively, these factors make ambulatory centers the fastest-growing end-user segment.

North America Contrast Media Injectors Market Regional Analysis

- North America dominated the contrast media injectors market with the largest revenue share in 2025, driven by advanced healthcare infrastructure, high procedural volumes, and the strong presence of key industry players

- In March 2025, GE Healthcare deployed its automated CT and MRI injector systems across multiple hospitals in the U.S., enhancing procedural efficiency and accuracy

- The high adoption of contrast media injectors in hospitals, diagnostic centers, and outpatient clinics, combined with increasing demand for precise imaging and supportive reimbursement policies, is fueling regional growth

U.S. Contrast Media Injectors Market Insight

The U.S. contrast media injectors market captured the largest revenue share of 38% in 2025, fueled by high procedural volumes, robust healthcare infrastructure, and rapid adoption of automated and smart injector systems. For instance, in January 2024, Bracco Imaging introduced dual-head injector systems in several U.S. hospital networks, optimizing contrast delivery for CT and MRI procedures. Innovations from leading medical device companies, growing focus on patient safety, and increasing diagnostic imaging requirements are driving market expansion in the country.

Canada Contrast Media Injectors Market Insight

The Canada contrast media injectors market is experiencing steady growth due to rising diagnostic imaging procedures, expansion of hospital and diagnostic center infrastructure, and increasing healthcare investments. For instance, in September 2024, Siemens Healthineers installed automated injector systems in major Canadian hospitals, improving workflow efficiency and ensuring accurate contrast media delivery. The market is further supported by government initiatives to modernize healthcare facilities and increase access to advanced imaging technologies.

North America Contrast Media Injectors Market Share

The Contrast Media Injectors industry is primarily led by well-established companies, including:

- Bracco Imaging (Italy)

- GE Healthcare (U.S.)

- Siemens Healthineers (Germany)

- Canon Medical Systems (Japan)

- Bayer (Germany)

- Medrad (U.S.)

- Liebel-Flarsheim (U.S.)

- Nemoto Kyorindo (Japan)

- Ulrich Medical (Germany)

- Civco Medical Solutions (U.S.)

- ACIST Medical Systems (U.S.)

- Hitachi Medical Systems (Japan)

- Imaxeon (France)

- Intraject (U.S.)

- TomTec Imaging Systems (Germany)

- Vital Images (U.S.)

- Hologic (U.S.)

- Polaris Medical (U.S.)

- Radimetrics (U.S.)

- Accutron (Germany)

Latest Developments in North America Contrast Media Injectors Market

- In November 2023, Bracco Imaging and ulrich GmbH & Co. KG announced a long‑term strategic partnership to introduce a Bracco‑branded MRI contrast injector in the U.S. market, marking a key expansion of advanced injector options designed to improve workflow efficiency and imaging quality in MR procedures. A 510(k) premarket notification was submitted to the U.S. FDA under this collaboration

- In November 2024, Bayer’s MEDRAD Centargo CT Injection System received 510(k) clearance from the U.S. Food and Drug Administration, enabling its commercial use in hospitals and imaging centers across North America. The platform is designed to streamline contrast media delivery in high‑throughput CT suites by automating workflow steps, integrating with imaging systems, and supporting simultaneous contrast and saline delivery

- In December 2024, Bracco Diagnostics Inc. announced that its Max 3™ Rapid Exchange and Syringeless Injector received FDA 510(k) clearance, authorizing a new generation of MRI contrast injector systems in the U.S. This syringeless design allows direct injection from contrast vials, reducing operational steps, disposable waste, and overall preparation time for MRI exams

- In July 2025, Guerbet unveiled its Contrast&Care 2.0 injector platform at the Radiological Society of North America (RSNA) meeting in Chicago. This connected platform integrates with CT and MRI systems to enhance workflow efficiency, automate documentation, and support safer contrast administration practices across radiology departments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.