North America Digital Health Monitoring Devices Market

Market Size in USD Million

CAGR :

%

USD

178.06 Million

USD

206.56 Million

2024

2032

USD

178.06 Million

USD

206.56 Million

2024

2032

| 2025 –2032 | |

| USD 178.06 Million | |

| USD 206.56 Million | |

|

|

|

|

Digital Health Monitoring Devices Market Size

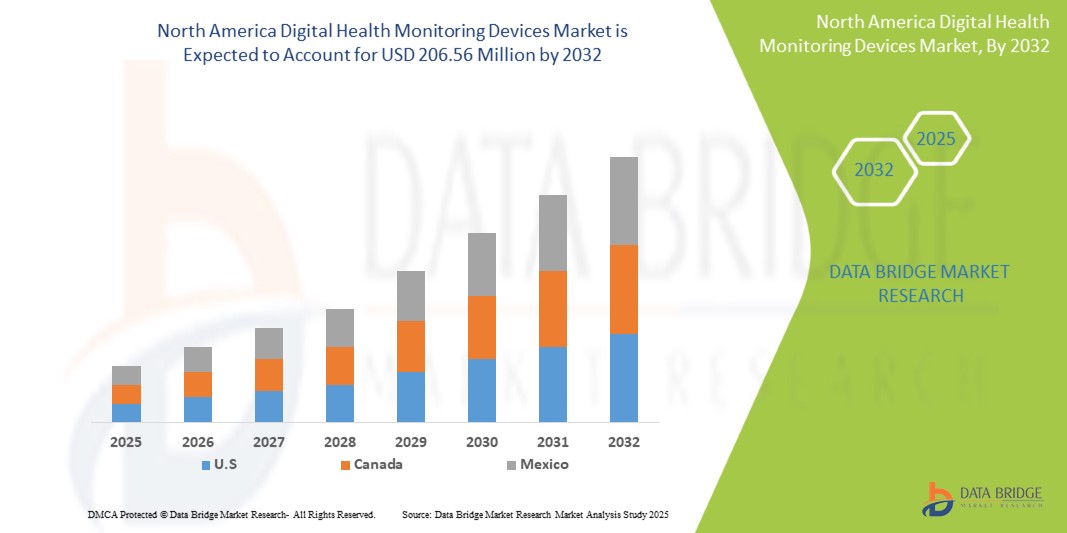

- The North America Digital Health Monitoring Devices Market was valued at USD 178.06 million in 2024 and is expected to reach USD 206.56 million by 2032, at a CAGR of 5.2% During the forecast period.

- The North America Digital Health Monitoring Devices Market is primarily driven by several key factors. These include the rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions, which are increasing the demand for continuous and remote health monitoring solutions. Additionally, the aging population—more susceptible to chronic conditions—along with growing interest in preventive healthcare and wellness tracking, is significantly contributing to the adoption of digital health monitoring devices across the region.

North America Digital Health Monitoring Devices Market Analysis

- Digital Health Monitoring Devices play a critical role in the management of various chronic conditions, including diabetes, cardiovascular diseases, and respiratory conditions. These devices enable continuous tracking of vital signs, offering real-time data to both patients and healthcare providers, significantly improving early diagnosis and treatment outcomes. Digital health devices are widely used in hospitals, outpatient clinics, home care settings, and for personal wellness monitoring.

- The demand for Digital Health Monitoring Devices in North America is primarily driven by the increasing prevalence of chronic diseases that require constant monitoring, such as diabetes, hypertension, and obesity-related conditions. Furthermore, the rising geriatric population, which is more prone to chronic illnesses, and the growing awareness about preventive healthcare and remote monitoring are contributing to market growth. Technological advancements, including wearable sensors and AI-powered analytics, are also boosting the adoption of these devices across various healthcare settings.

- North America is a leading region in the global Digital Health Monitoring Devices market, supported by a robust healthcare system, early adoption of innovative technologies, and favorable reimbursement policies. The United States holds a dominant share of the market, driven by high healthcare spending, widespread usage of digital health devices, and a large base of patients requiring chronic disease management.

- The U.S. Digital Health Monitoring Devices market is also influenced by regulatory approvals, such as FDA clearances, ensuring the safety and efficacy of new devices. Increased healthcare expenditure, the demand for portable, user-friendly solutions, and integration with smart technologies—such as sensors for real-time health data collection—are enhancing the patient experience. Moreover, a shift towards personalized care models focused on long-term disease management is improving quality of life for patients across the region.

Report Scope Digital Health Monitoring Devices Market Segmentation

|

Attributes |

Digital Health Monitoring Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Digital Health Monitoring Devices Market Trends

“Integration of Smart Technology and AI-Driven Health Insights”

- A key trend in the Digital Health Monitoring Devices market is the integration of smart technology, including sensors and AI-driven analytics, to provide real-time health data and predictive insights. These devices are increasingly using machine learning algorithms to analyze collected data and offer personalized health recommendations, improving disease management and allowing for more proactive care.

- For instance, the U.S. has witnessed an increase in the use of wearable devices that offer features like continuous glucose monitoring, blood pressure tracking, and heart rate analysis, which improve patient outcomes and foster better disease management.

- Another emerging trend is the growing focus on seamless integration with other health monitoring platforms, such as mobile apps and electronic health records (EHRs). This allows patients and healthcare providers to have continuous access to comprehensive health data, facilitating better communication and more informed decision-making for chronic disease management. Furthermore, the use of cloud-based solutions for data storage and remote monitoring is increasing, enabling efficient, long-term patient tracking.

Digital Health Monitoring Devices Market Dynamics

Driver

“Growing Adoption of Home Healthcare Solutions and Increased Focus on Preventive Care”

- The North America Digital Health Monitoring Devices Market is experiencing significant growth due to the rising demand for home healthcare solutions, as patients increasingly seek to manage their health conditions independently and comfortably at home. This trend is particularly fueled by the rising prevalence of chronic conditions such as diabetes, hypertension, and cardiovascular diseases.

- The growing focus on preventive care, early diagnosis, and cost-effective management options is driving the demand for convenient and user-friendly digital health monitoring devices. Technological advancements, including wearable devices that track vital signs in real-time, are improving patient outcomes by facilitating early intervention and personalized care.

- As the aging population increases, along with the rising number of patients requiring chronic disease management, healthcare providers are turning to home-based solutions to reduce hospital readmissions and optimize treatment costs. This has led to an increased demand for reliable and efficient digital health monitoring devices for both clinical and home care settings

For instance,

- According to the Centers for Disease Control and Prevention (CDC), nearly 50% of adults in the U.S. have at least one chronic condition, increasing the need for continuous monitoring.

- In 2024, Fitbit launched an advanced wearable device with integrated ECG and blood oxygen monitoring, aimed at helping users manage chronic conditions in home care settings.

- The integration of home healthcare programs and personalized patient care plans is accelerating the adoption of Digital Health Monitoring Devices, as patients increasingly seek non-hospital, self-managed alternatives.

Opportunity

“Advancements in Product Personalization and Increased Focus on Patient Comfort”

- A significant opportunity in the North America Digital Health Monitoring Devices Market lies in the growing demand for personalized healthcare products that cater to individual patient needs. Devices that can be customized to monitor specific health conditions, provide real-time alerts, and integrate with other medical devices are becoming increasingly popular.

- With rising recognition of the importance of patient comfort, manufacturers are developing devices with enhanced features, such as ergonomic designs, better wearability, and long-lasting battery life, contributing to improved user experiences. This trend is expected to drive the growth of high-quality digital health monitoring devices that offer greater convenience, discretion, and effectiveness.

- Additionally, the rise of patient-centered care models and increased patient involvement in treatment decisions present opportunities for companies to innovate with products that focus on improving comfort, usability, and overall satisfaction.

For instance,

- In February 2024, Philips introduced a personalized wearable ECG monitor with adaptive design and custom settings, specifically tailored to patients with heart conditions, improving comfort and ease of use.

- Companies like Garmin and Apple are integrating advanced health sensors and customizable interfaces to provide patients with real-time health data, ensuring comfort and increased compliance with treatment plans.

Restraint/Challenge

“Limited Insurance Coverage and High Cost of Advanced Health Monitoring Devices”

- A key challenge in the North America Digital Health Monitoring Devices Market is the high cost of advanced monitoring products, especially those with integrated sensors, AI analytics, and multi-function capabilities. These products require substantial investment in research and development, resulting in higher retail prices that may not be affordable for all patients.

- Limited insurance coverage for digital health devices, particularly those used in non-hospital settings or home care, poses a barrier to widespread adoption. Many patients face difficulties securing reimbursement for these devices, which can delay their entry into the market.

For instance,

- According to a 2024 study by the National Health Insurance Association, many private insurers impose restrictions on coverage for digital health monitoring devices, especially wearables used for chronic disease management, which limits access for some patients.

- In Canada, a lack of consistent provincial coverage for advanced monitoring devices leads to unequal access, especially for patients in rural or underserved regions.

- The complexity of regulatory approval processes and certification requirements for new digital health monitoring devices can result in market delays, further increasing the financial burden for both manufacturers and patients.

Digital Health Monitoring Devices Market Scope

The market is segmented on the basis, three notable segments based on By Product, Type, End User .

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By type

|

|

|

By end user |

|

In 2025, the Devices is projected to dominate the market with a largest share in the product segment

The Devices is expected to lead the North America Digital Health Monitoring Devices Market with the largest share of 41.42% in 2025. This dominance is driven by the increasing demand for continuous, real-time health tracking and the growing adoption of smartwatches and fitness trackers for chronic disease management.

The Wireless Health is expected to account for the largest share during the forecast period in type market

In 2025, the Wireless Health segment is expected to dominate the market with the largest market share of 41.11% due to its high prevalence and demand for precision. This is attributed to the growing demand for remote patient monitoring solutions and the widespread adoption of wireless technologies for continuous health data transmission and real-time tracking.

Digital Health Monitoring Devices Market Regional Analysis

“U.S. is the Dominant Country in the Digital Health Monitoring Devices Market”

- The United States dominates the North America Digital Health Monitoring Devices Market, accounting for the largest share due to its advanced healthcare infrastructure, high healthcare expenditure, and early adoption of medical innovations, particularly in health monitoring technologies.

- The growing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and hypertension, alongside a large aging population, is driving the demand for digital health devices that enable remote monitoring and early diagnosis in both clinical and homecare settings.

- Major players like Fitbit, Apple, and Medtronic are headquartered in the U.S., offering a broad range of FDA-approved wearable devices and health tracking solutions designed to meet the needs of diverse patient groups.

- Government initiatives aimed at enhancing healthcare access, promoting preventive care, and implementing favorable reimbursement policies further solidify the U.S.'s leadership in the North American Digital Health Monitoring Devices Market.

“Canada is Projected to Register the Highest Growth Rate”

- Canada is expected to register the fastest growth in the North America Digital Health Monitoring Devices Market, driven by its publicly funded healthcare system and an increasing focus on chronic disease prevention and remote patient monitoring solutions.

- The rise in government investments in managing chronic conditions like diabetes, hypertension, and obesity, coupled with an aging population, is fueling the demand for home-based digital health monitoring devices.

- The expansion of multidisciplinary healthcare clinics, rehabilitation centers, and home healthcare services is further propelling the need for accessible, cost-effective health monitoring solutions tailored to diverse patient needs.

- Collaborative efforts between provincial health authorities, patient advocacy groups, and research institutions are fostering innovation and broadening the availability of advanced digital health monitoring technologies across Canada.

Digital Health Monitoring Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Fitbit (U.S.)

- Apple Inc. (U.S.)

- Medtronic (U.S.)

- Samsung Electronics (South Korea)

- Garmin Ltd. (U.S.)

- Philips Healthcare (Netherlands/U.S.)

- Withings (France)

- Omron Healthcare, Inc. (Japan/U.S.)

- AliveCor, Inc. (U.S.)

- Boston Scientific (U.S.)

Latest Developments in Global Digital Health Monitoring Devices Market

- in April 2024, OMRON Healthcare acquired Luscii Healthtech, a digital health company, to advance its digital health services.

- in March 2023, Koninklijke Philips N.V. announced the launch of Philips Virtual Care Management, which would offer a complete telehealth method to individuals.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.