North America Frozen Fruit And Vegetables Mix Market

Market Size in USD Billion

CAGR :

%

USD

1.13 Billion

USD

1.19 Billion

2024

2032

USD

1.13 Billion

USD

1.19 Billion

2024

2032

| 2025 –2032 | |

| USD 1.13 Billion | |

| USD 1.19 Billion | |

|

|

|

|

North America Frozen Fruit and Vegetable Mix Market Size

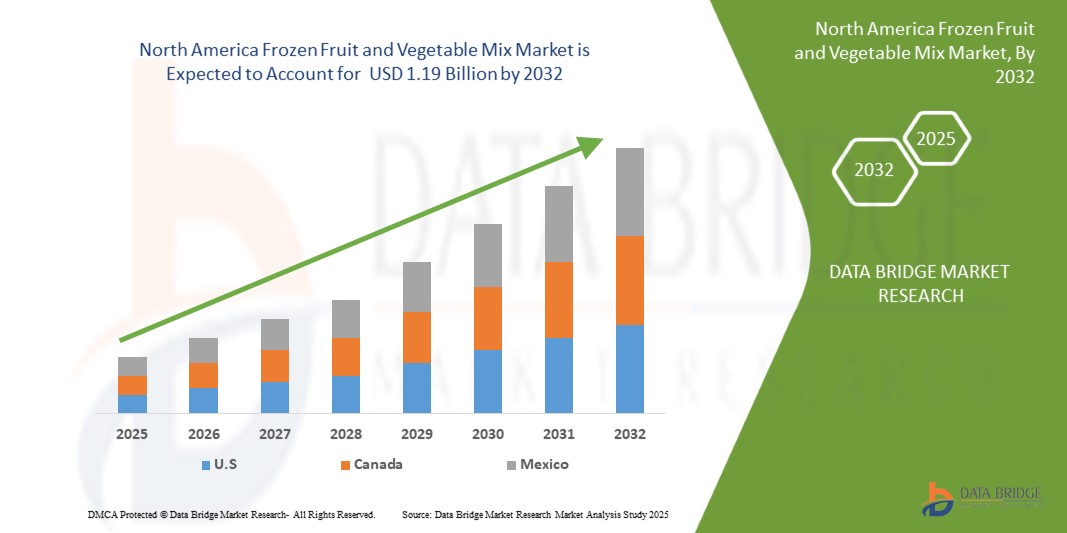

- The North America Frozen Fruit & Vegetable Mix Market size was valued at USD 1.13 billion in 2024 and is expected to reach USD 1.19 billion by 2032, at a CAGR of 6.8% during the forecast period

- The market growth is largely fueled by rising demand for convenient, ready-to-cook meal options due to busy lifestyles and dual-income households

- Furthermore, the increasing awareness of seasonal availability, reduced food waste, and preservation of nutritional value further supports the shift towards frozen alternatives

North America Frozen Fruit and Vegetable Mix Market Analysis

- Rising health consciousness and demand for quick-prep meal solutions have fueled the popularity of frozen fruit and vegetable mixes. These products offer extended shelf life and retain nutritional value, aligning with consumer preferences for clean-label, non-GMO, and minimally processed foods.

- The foodservice and retail sectors are key growth drivers, leveraging frozen mixes for operational efficiency and seasonal consistency. Increasing adoption across restaurants, cafeterias, and supermarkets—especially with private-label offerings—is expanding market reach and supporting consistent demand throughout the year

- U.S. dominated the North America frozen fruits and vegetables market due to its advanced cold chain infrastructure, high consumer demand for convenience foods, and rising preference for year-round availability of seasonal produce, driving strong market growth across the region

- U.S. is the fastest growing country in the North America frozen fruits and vegetables market, driven by increasing demand for ready-to-eat foods, busy lifestyles, and strong distribution networks supporting product availability and accessibility

- The fruit mixes segment is expected to dominate the frozen fruit & vegetable mix market with a 76.47% share in 2025, driven by its superior ion-exchange capacity, controlled drug delivery potential, and ability to enhance therapeutic efficacy, supporting its increasing adoption in advanced treatment formulations and research applications

Report Scope and North America Frozen Fruit and Vegetable Mix Market Segmentation

|

Attributes |

North America Frozen Fruit & Vegetable Mix Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Frozen Fruit & Vegetable Mix Market Trends

Busy Lifestyles Increase Preference for Convenient Meal Solutions

- In today's fast-paced world, consumers are increasingly juggling demanding work schedules, family responsibilities, and social obligations, leaving limited time for meal planning and preparation. As a result, there is a rising preference for convenient, time-saving food options that do not compromise on nutrition or taste. Frozen fruits and vegetables fit perfectly into this lifestyle shift, offering a quick and easy solution to maintain healthy eating habits without the need for washing, peeling, chopping, or frequent grocery shopping

- Frozen produce helps consumers eliminate preparation time while ensuring year-round availability of seasonal fruits and vegetables. Whether added to smoothies, used in stir-fries, or incorporated into soups and salads, frozen options offer versatility, consistency, and minimal waste. This convenience factor is particularly appealing to urban dwellers, working professionals, college students, and young families who seek efficient meal solutions aligned with their health goals

- In addition, frozen fruits and vegetables are often flash-frozen at their peak ripeness, preserving nutrients andflavor, which appeals to health-conscious individuals seeking nutritious alternatives to processed or takeout foods. The growth of single-serve packs and pre-mixed blends further supports quick meal assembly and portion control, aligning with the demand for on-the-go and ready-to-use formats

North America Frozen Fruit & Vegetable Mix Market Dynamics

Driver

Advancements In Freezing Technology Improve Product Quality Preservation

- Technological advancements in freezing methods have significantly improved the quality, shelf life, and consumer perception of frozen fruits and vegetables. Earlier concerns about nutrient loss, mushy textures, and poor color have been addressed with innovations such as Individual Quick Freezing (IQF), which freezes produce rapidly and separately, preventing clumping and preserving natural texture, flavor, and nutritional content

- In addition, cryogenic freezing using liquid nitrogen or carbon dioxide offers ultra-fast freezing that protects the cellular structure of delicate items like berries and herbs. These methods reduce ice crystal formation, ensuring that the frozen product remains visually and texturally close to fresh produce. Improvements in blanching—the pre-treatment before freezing—have also helped retain higher levels of nutrients like vitamin C and antioxidants by using controlled steam rather than traditional boiling

- Moreover, advanced packaging solutions such as resealable pouches and moisture-resistant films further enhance product quality by preventing freezer burn and maintaining freshness. These innovations allow frozen fruits and vegetables to cater to health-conscious and busy consumers who prioritize convenience without compromising nutritional value

Restraint/Challenge

Perception Of Frozen Foods Being Less Fresh

- Despite advancements in freezing technology and rising demand for convenient food solutions, the perception that frozen foods—especially fruits and vegetables—are less fresh than their fresh counterparts continues to restrain market growth. Many consumers still associate frozen produce with lower nutritional value, altered taste, and poor texture, even though these concerns are increasingly outdated

- This perception stems from longstanding habits and assumptions that "fresh" equals healthier and higher quality. For decades, frozen fruits and vegetables were considered a second-tier option, often used only when fresh produce was unavailable. Although modern freezing techniques such as Individual Quick Freezing (IQF) and cryogenic freezing now preserve most nutrients and prevent texture degradation, the mindset of many consumers remains unchanged, especially among older demographics or those less informed about food technology

- Moreover, packaging appearance, freezer burn, or clumping of frozen products may reinforce the belief that such foods are overly processed or artificially preserved. Misconceptions are further amplified by the preference for visually vibrant fresh produce in markets or grocery displays, which are often prioritized in marketing and retail layouts over frozen sections

North America Frozen Fruit & Vegetable Mix Market Scope

The market is segmented on the basis of type, technology, product category, form, category, source, labelling and certifications, packaging format, packaging size, shelf life, application and distribution channel.

By Product Type

On the basis of product type, the market is segmented into Vegetable Mixes, Fruit Mixes and Mixed Fruit & Vegetable Blends. In 2025, the Vegetable Mixes segment is expected to dominate the market with a 76.67% market share, driven by increasing demand for convenience, longer shelf-life, and enhanced flavor and nutrition retention.

The Vegetable Mixes segment is projected to witness the fastest growth at a 6.8% CAGR from 2025 to 2032, driven by increasing consumer preference for healthy, ready-to-cook meals, rising vegetarian and vegan trends, and the growing popularity of nutrient-rich frozen food alternatives.

By Technology

On the basis of technology, the market is segmented into IQF, Blast Frozen, Cryogenic Frozen, Fluidized Bed, Isochoric Freezing, and Others. In 2025, the IQF segment is expected to dominate the market, driven by superior product quality, extended shelf life, reduced spoilage, and growing demand for individually quick frozen fruits and vegetables in both retail and foodservice sectors.

The IQF segment is expected to grow at the fastest CAGR of 7.0% during 2025–2032 due to rising demand for high-quality frozen produce, better preservation of texture and nutrients, and increasing use in ready-to-eat and processed foods.

By Product Category

On the basis of product category, the market is segmented into Raw Frozen, Steam Blanched then IQF, Raw IQF, Grilled then IQF, Roasted then IQF, Marinated or Coated Frozen, Sauce Included Frozen Mixes, Parboiled then Frozen, Rehydrated then Frozen, Pre-Seasoned then IQF, and Others. In 2025, the Raw IQF segment is expected to dominate, attributed to its use in prepared meal solutions and rising home cooking trends.

The Raw IQF segment is projected to grow at the highest CAGR of 7.9% during 2025–2032 due to increasing consumer preference for minimally processed foods, better nutrient retention, and rising applications in health-focused and ready-to-cook meal products.

By Form

On the basis of form, the North America frozen fruit and vegetable mix market is segmented into whole, sliced, diced, halves, pureed, minced, mashed, crumbled, spiralized, julienned, crushed, zested, granulated, coated, and others. In 2025, the whole segment is expected to dominate the North America frozen fruit and vegetable mix market due to growing consumer preference for natural, unprocessed products, better texture retention, and suitability for diverse culinary applications.

The whole segment is projected to grow at the highest CAGR of 7.9% during 2025–2032 is due to the established large-scale farming infrastructure, lower production costs, and widespread consumer and industry acceptance for conventional sources in frozen fruit and vegetable processing across the region.

By Category

On the basis of category, the North America frozen fruit and vegetable mix market is segmented into conventional and organic. In 2025, The conventional segment is expected to dominate the North America frozen fruit and vegetable mix market with a significant market share, driven by its widespread availability, lower cost compared to organic options, and high consumer acceptance across all distribution channels.

The conventional segment is projected to grow at the highest CAGR i.e 6.9% during 2025–2032 is due to the established large-scale farming infrastructure, lower production costs, and widespread consumer and industry acceptance for conventional sources in frozen fruit and vegetable processing across the region.

By Source

On the basis of source, the North America frozen fruit and vegetable mix market is segmented into conventional, hydroponic, regenerative agriculture sourced, vertical farm based, biodynamic, and others. In 2025, the conventional segment is expected to dominate the North America frozen fruit and vegetable mix market due to its affordability, wide consumer acceptance, greater availability in retail stores, and strong demand across both household and foodservice applications.

The conventional segment is projected to grow at the highest CAGR of 7.1% during 2025–2032 is due to the established large-scale farming infrastructure, lower production costs, and widespread consumer and industry acceptance for conventional sources in frozen fruit and vegetable processing across the region.

By Labeling & Certification

On the basis of labeling & certification, the market is segmented into Non-GMO Verified, Gluten Free, Kosher, Halal, Vegan, Fair Trade Certified, Clean Label, Pesticide Free, Allergen Free, and Others In 2025, the Non-GMO Verified segment is expected to dominate the market due to rising consumer awareness about food safety, preference for clean-label products, and growing demand for transparency in sourcing and ingredient quality across North America.

The Non-GMO Verified segment is expected to expand rapidly from 2025 to 2032 at a CAGR of 8.7%, supported by growing consumer demand for sustainable, ethically sourced products and increasing awareness regarding health and clean-label certifications.

By Packaging Format

On the basis of packaging format, the market is segmented into Pouch, Vacuum Sealed, Single Serve Cubes, Bulk Institutional Pack, Multi Compartment Tray, Bag in Box, Club Store Bulk Bag, Retail Brick Pack, Pouch with Window, and Plastic Tubs. In 2025, the pouch segment is expected to dominate the market due to its lightweight, resealable design, extended shelf life, ease of storage, and rising consumer preference for convenient and sustainable packaging solutions.

The Pouch segment is projected to grow the fastest from 2025 to 2032 due to increasing demand for lightweight, portable, and eco-friendly packaging, along with growing consumer preference for resealable and easy-to-use formats in frozen food products.

By Packaging Size

On the basis of packaging size, the market is segmented into Retail Packaging Sizes and Foodservice/Institutional Packaging Sizes. In 2025, the Retail Packaging Sizes segment is expected to dominate with a market share due to household consumption trends.

The Retail Packaging Sizes segment is anticipated to grow rapidly from 2025 to 2032 i.e 6.90% due to the increasing demand from restaurants and meal service providers.

By Shelf Life

On the basis of shelf life, the market is segmented into ≤6 Months, 6–9 Months, 9–12 Months, 12–15 Months, 15–24 Months, and >24 Months. In 2025, the ≤6 Months segment is expected to dominate the market with a share due to retail logistics and freshness perception.

The ≤6 Months segment is expected to grow the fastest from 2025 to 2032 i.e 7.2% due to shelf life between product freshness, quality retention, and inventory management flexibility, which aligns with the operational preferences of retailers and consumer purchasing patterns within the frozen fruit and vegetable mix market.

By Application

On the basis of application, the market is segmented into Retail Consumer Use, Foodservice (HORECA), Meal Kit Companies, Foodservice Industry, Baby Food Manufacturers, Nutritional Supplements Manufacturers, Institutional Kitchens, Retail Fresh Frozen Combo Packs, and Others. In 2025, the Retail Consumer Use segment is expected to dominate the market with a market share, driven by increasing consumer demand for convenient, time-saving, and nutritious frozen fruit and vegetable mixes for home consumption, supported by rising health awareness, busy lifestyles, and the expansion of e-commerce and supermarket retail channels across the region.

The Retail Consumer Use segment is projected to grow at the fastest CAGR during 2025–2032 i.e 7.0% due to growing demand in personalized nutrition and food tech.

By Distribution Channel

On the basis of distribution channel, the market is segmented into B2B and B2C (Store-Based, Non-Store-Based). In 2025, the B2B segment is expected to dominate the market with a owing to wide retail reach and consumer penetration.

The B2B segment is anticipated to witness the fastest growth rate during the forecast period, i.e 6.80% supported by consumer preference for purchasing frozen fruit and vegetable mixes directly through retail stores, supermarkets, and online grocery platforms, driven by the demand for convenient and healthy food options and the increasing penetration of organized retail across the region.

North America Frozen Fruit & Vegetable Mix Market Regional Analysis

- U.S. is expected to dominate the Frozen Fruit & Vegetable Mix market with the largest revenue share and is projected to grow at the fastest CAGR of 6.8% in 2025, driven by increasing prevalence of venous disorders, high awareness of compression therapy, and strong demand from both medical and athletic segments.

- The region’s rich healthcare infrastructure, favorable reimbursement policies, and rising geriatric population further support market expansion. Additionally, growing fitness trends and preventive wellness awareness contribute to non-medical demand.

- Major economies such as the U.S. and Canada play a significant role in market growth, with the U.S. accounting for the lion’s share due to its advanced medical system, higher healthcare spending, and widespread product availability across both offline and online channels.

U.S Frozen Fruit & Vegetable Mix Market Insight

The U.S. accounted for the largest market revenue share in the North America region in 2025, attributed to a high prevalence of chronic venous diseases, advanced healthcare infrastructure, increasing adoption of compression therapy in post-operative care, and strong presence of key market players offering technologically advanced compression solutions.

Canada. Frozen Fruit & Vegetable Mix Market Insight

The U.S. is expected to register the fastest CAGR in the region from 2025 to 2032, driven by rising awareness of preventive healthcare, growing demand for compression wear among aging and active populations, expanding e-commerce penetration, and continuous innovations in material technology and product design.

North America Frozen Fruit & Vegetable Mix Market Share

The Frozen Fruit & Vegetable Mix industry is primarily led by well-established companies, including:

- Ardo (Belgium)

- Wawona Frozen Foods (U.S.)

- Titan Frozen Fruit (U.S.)

- Earthbound Farm (U.S.)

- Dole Packaged Foods LLC (U.S.)

- Nature’s Touch (Canada)

- SunOpta (U.S.)

- JR Simplot Company (U.S.)

- Oregon Fruit Company (U.S.)

- Greenyard (Belgium)

- Scenic Fruit Company (U.S.)

- Stahlbush Island Farms (U.S.)

- Milne Fruit Products (U.S.)

- Alasko (Canada)

- Fruit d'Or (Canada)

Latest Developments in North America Frozen Fruit & Vegetable Mix Market

- In October 2024, SunOpta announced the expansion of its Dream Oatmilk to 6,700 additional stores through a partnership with a large coffee chain. This development significantly increases Dream Oatmilk’s retail presence and aligns with rising demand for plant-based beverages in coffee channels. It strengthens SunOpta’s position in the competitive oatmilk segment while supporting growth in its plant-based beverage portfolio across North America.

- In June 2024, SunOpta invested USD 26 Billion to expand its plant-based beverage processing facility in Modesto, California. This development increases production capacity for oat, almond, and soy beverages to meet rising demand for plant-based products. The expansion supports operational efficiency and scalability while reinforcing SunOpta’s commitment to serving the growing North American plant-based beverage market with high-quality, clean-label products.

- In March 2025, Sligro Food Group and Greenyard have entered a strategic partnership for the supply of fresh fruit, vegetables, and potatoes in Belgium. Greenyard Fresh Belgium will handle sourcing and delivery for over 5.1 Billion items annually, prioritizing local, sustainable produce and shorter supply chains. This collaboration strengthens Sligro’s foodservice offerings while aligning with Greenyard’s vision of integrated, long-term customer relationships.

- In February 2025, Oregon Fruit Company collaborated with Xicha Brewing to launch an aseptic fruit puree tailored for craft beverage applications. This development enables brewers to incorporate high-quality fruit flavor while maintaining product safety and consistency. It supports Oregon Fruit’s growth in the craft beverage segment and enhances Xicha Brewing’s offerings with innovative, fruit-forward beverages, aligning with rising consumer demand for unique, clean-label flavors in the competitive

- In May 2025, Dot Foods Announces New All-In-One Product Content Solution that helps suppliers author and enhance data to comply with GDSN standards and serve their customers. Dot Data Services also provides distributors and operators access to product content and tools to maintain it.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.4.1 RAW MATERIAL COSTS AND SUPPLY CHAIN DYNAMICS

4.4.2 MARKET DEMAND AND CONSUMER PREFERENCES

4.4.3 COMPETITIVE LANDSCAPE AND PRICING STRATEGIES

4.4.4 TECHNOLOGICAL ADVANCEMENTS AND PRODUCTION EFFICIENCY

4.4.5 REGULATORY INFLUENCES AND ENVIRONMENTAL CONSIDERATIONS

4.5 VALUE CHAIN ANALYSIS

4.5.1 RAW MATERIAL SOURCING

4.5.2 PROCESSING & MANUFACTURING

4.5.3 PACKAGING & LABELING

4.5.4 DISTRIBUTION & COLD CHAIN LOGISTICS

4.5.5 RETAIL & FOODSERVICE CHANNELS

4.6 VENDOR SELECTION CRITERIA

4.6.1 QUALITY AND CONSISTENCY

4.6.2 TECHNICAL EXPERTISE

4.6.3 SUPPLY CHAIN RELIABILITY

4.6.4 COMPLIANCE AND SUSTAINABILITY

4.6.5 COST AND PRICING STRUCTURE

4.6.6 FINANCIAL STABILITY

4.6.7 FLEXIBILITY AND CUSTOMIZATION

4.6.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.7 BRAND OUTLOOK

4.7.1 BRAND COMPARITIVE ANALYSIS OF NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET

4.7.2 PRODUCT VS BRAND OVERVIEW

4.7.2.1 PRODUCT OVERVIEW

4.7.2.2 BRAND OVERVIEW

4.8 CLIMATE CHANGE SCENARIO

4.8.1 ENVIRONMENTAL CONCERNS

4.8.2 INDUSTRY RESPONSE

4.8.3 GOVERNMENT’S ROLE

4.8.4 ANALYST RECOMMENDATIONS

4.9 CONSUMERS BUYING BEHAVIOUR

4.9.1 HEALTH-CONSCIOUS PURCHASING

4.9.2 CONVENIENCE-DRIVEN DECISIONS

4.9.3 PRICE VS. VALUE CONSCIOUSNESS

4.9.4 SUSTAINABILITY AND ETHICAL SOURCING

4.9.5 DIGITAL INFLUENCE AND BRAND TRANSPARENCY

4.1 COST ANALYSIS BREAKDOWN

4.11 INDUSTRY ECO-SYSTEM ANALYSIS

4.11.1 PROMINENT COMPANIES

4.11.2 SMALL & MEDIUM SIZE COMPANIES

4.11.3 END USERS

4.12 THE USA TARIFFS (TRUMP) WILL HAVE AN IMPACT ON SUPPLY CHAINS. WILL CANADIAN CARGO BE DIVERTED AWAY FROM THE USA TO EUROPEAN COUNTRIES

4.12.1 U.S. TARIFFS AND SUPPLY‑CHAIN DISRUPTION

4.12.2 LIMITATIONS TO REROUTING CANADIAN EXPORTS TO EUROPE

4.13 PRODUCTION CONSUMPTION ANALYSIS

4.14 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.14.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.14.1.1 JOINT VENTURES

4.14.1.2 MERGERS AND ACQUISITIONS

4.14.1.3 LICENSING AND PARTNERSHIP

4.14.1.4 TECHNOLOGY COLLABORATIONS

4.14.1.5 STRATEGIC DIVESTMENTS

4.14.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.14.3 STAGE OF DEVELOPMENT

4.14.4 TIMELINES AND MILESTONES

4.14.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.14.6 RISK ASSESSMENT AND MITIGATION

4.14.7 FUTURE OUTLOOK

4.15 PROFIT MARGINS SCENARIO

4.15.1 MARGIN RANGE BY PRODUCT TYPE

4.15.2 KEY FACTORS INFLUENCING MARGINS

4.15.3 DOMESTIC VS. EXPORT MARKET MARGINS

4.16 RAW MATERIAL COVERAGE

4.16.1 KEY RAW MATERIALS AND GROWING REGIONS

4.16.2 COLD CHAIN & PROCESSING INFRASTRUCTURE

4.16.3 ORGANIC, NON-GMO, AND SUSTAINABILITY SOURCING

4.16.4 IMPORT DEPENDENCY AND DIVERSIFIED SOURCING

4.16.5 CLIMATE RISK AND AGRONOMIC INNOVATIONS

4.17 SUPPLY CHAIN ANALYSIS

4.17.1 OVERVIEW

4.17.2 LOGISTICS COST SCENARIO

4.17.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.18 TECHNOLOGICAL ADVANCEMENTS

4.18.1 INDIVIDUAL QUICK FREEZING (IQF) TECHNOLOGY EVOLUTION

4.18.2 AI AND MACHINE VISION IN SORTING AND QUALITY CONTROL

4.18.3 COLD CHAIN MONITORING AND IOT INTEGRATION

4.18.4 SUSTAINABLE PACKAGING INNOVATIONS

4.18.5 DATA-DRIVEN DEMAND FORECASTING AND INVENTORY MANAGEMENT

4.19 IMPORT ANALYSIS FROM FROZEN CARGOS, BY COAST (FROZEN FRUITS & VEGETABLES)

4.19.1 EAST COAST

4.19.2 WEST COAST

5 TARIFFS AND THEIR IMPACT ON MARKET

5.1 CURRENT TARIFF RATES IN TOP COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCE ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUT

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING HEALTH AWARENESS BOOSTS DEMAND FOR NUTRITIOUS OPTIONS

7.1.2 BUSY LIFESTYLES INCREASE PREFERENCE FOR CONVENIENT MEAL SOLUTIONS

7.1.3 ADVANCEMENTS IN FREEZING TECHNOLOGY IMPROVE PRODUCT QUALITY PRESERVATION

7.2 RESTRAINTS

7.2.1 PERCEPTION OF FROZEN FOODS BEING LESS FRESH

7.2.2 FLUCTUATING RAW MATERIAL PRICES IMPACT PRODUCTION STABILITY

7.3 OPPORTUNITIES

7.3.1 RISING DEMAND FROM SMOOTHIE & JUICE BARS

7.3.2 EXPANSION OF ONLINE GROCERY PLATFORMS

7.3.3 INNOVATIVE BLENDS CATER TO EVOLVING CONSUMER TASTE PREFERENCES

7.4 CHALLENGES

7.4.1 COLD CHAIN LOGISTICS REQUIRE HIGH INFRASTRUCTURE AND INVESTMENT

7.4.2 WASTE AND SUSTAINABILITY CONCERNS

8 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE

8.1 OVERVIEW

8.2 VEGETABLE MIXES

8.2.1 ROOT VEGETABLES

8.2.2 LEAFY GREENS

8.2.3 CRUCIFEROUS MIXES

8.2.4 NIGHTSHADE MIXES

8.2.5 LEGUME MIXES

8.2.6 ALLIUM MIXES

8.2.7 SQUASH MIXES

8.2.8 OTHERS

8.3 FRUIT MIXES

8.3.1 BERRIES ONLY MIX

8.3.1.1 TRIPLE BERRY

8.3.2 CITRUS FRUIT MIX

8.3.2.1 CITRUS FRUIT

8.3.2.2 IQF CITRUS

8.3.2.3 CITRUS PEEL

8.3.2.4 CITRUS JUICE CUBED INCLUSIONS

8.3.3 APPLE BASED MIX

8.3.4 TROPICAL FRUIT MIX

8.3.5 MELON MIX (CANTALOUPE HONEYDEW)

8.3.6 WATERMELON BASED MIX

8.3.7 STONE FRUIT MIX

8.3.8 POMEGRANATE MIX

8.3.9 OTHERS

8.4 MIXED FRUIT & VEGETABLE BLENDS

8.4.1 SMOOTHIE BLENDS

8.4.2 SALAD MIXES

8.4.3 BREAKFAST BOWL MIX

8.4.4 BABY FOOD BLENDS

8.4.5 SUPERFOOD MIXES

8.4.6 SEASONAL/ HOLIDAY MIXES

8.4.7 OTHERS

9 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 IQF

9.3 BLAST FROZEN

9.4 CRYOGENIC FROZEN

9.5 ISOCHORIC FREEZING

9.6 FLUIDIZED BED

9.7 OTHERS

10 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY

10.1 OVERVIEW

10.2 RAW IQF

10.3 STEAM BLANCHED THEN IQF

10.4 ROASTED THEN IQF

10.5 GRILLED THEN IQF

10.6 MARINATED OR COATED FROZEN

10.7 RAW FROZEN

10.8 PRE SEASONED THEN IQF

10.8.1 HERB SEASONED MIXES

10.8.2 SPICED MIXES

10.8.3 ASIAN INSPIRED SEASONING

10.8.4 MEDITERRANEAN BLEND

10.8.5 SWEET GLAZED MIXES

10.8.6 INDIAN STYLE MIX

10.9 SAUCE INCLUDED FROZEN MIXES,

10.1 PARBOILED THEN FROZEN

10.11 REHYDRATED THEN FROZEN

10.12 OTHERS

11 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY FORM

11.1 OVERVIEW

11.2 WHOLE

11.3 SLICED

11.4 DICED

11.5 HALVES

11.6 PUREED

11.7 MINCED

11.8 MASHED

11.9 CRUMBLED

11.1 SPIRALIZED

11.11 JULIENNED

11.12 CRUSHED

11.13 ZESTED

11.14 GRANULATED

11.15 COATED

11.16 OTHERS

12 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY

12.1 OVERVIEW

12.2 CONVENTIONAL

12.3 ORGANIC

13 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SOURCE

13.1 OVERVIEW

13.2 CONVENTIONAL

13.3 HYDROPONIC

13.4 REGENERATIVE AGRICULTURE SOURCED

13.5 VERTICAL FARM BASED

13.6 BIODYNAMIC

13.7 OTHERS

14 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY LABELING & CERTIFICATION

14.1 OVERVIEW

14.2 CLEAN LABEL

14.3 NON GMO VERIFIED

14.4 VEGAN

14.5 GLUTEN FREE

14.6 PESTICIDE FREE

14.7 ALLERGEN FREE

14.8 KOSHER

14.9 HALAL

14.1 FAIR TRADE CERTIFIED

14.11 OTHERS

15 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT

15.1 OVERVIEW

15.2 POUCH

15.3 VACUUM SEALED

15.4 BULK INSTITUTIONAL PACK

15.5 MULTI COMPARTMENT TRAY

15.6 BAG IN BOX

15.7 SINGLE SERVE CUBES

15.8 CLUB STORE BULK BAG

15.9 RETAIL BRICK PACK

15.1 POUCH WITH WINDOW

15.11 PLASTIC TUBS

16 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE

16.1 OVERVIEW

16.2 RETAIL PACKAGING SIZES

16.3 FOODSERVICE/INSTITUTIONAL PACKAGING SIZES

17 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SHELF LIFE

17.1 OVERVIEW

17.2 9–12 MONTHS

17.3 6–9 MONTHS

17.4 12–15 MONTHS

17.5 15–24 MONTHS

17.6 24 MONTHS

17.7 ≤6 MONTHS

18 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION

18.1 OVERVIEW

18.2 RETAIL CONSUMER USE

18.3 FOODSERVICE (HORECA)

18.4 FOODSERVICE INDUSTRY

18.5 MEAL KIT COMPANIES

18.6 BABY FOOD MANUFACTURERS

18.7 INSTITUTIONAL KITCHENS

18.8 NUTRITIONAL SUPPLEMENTS MANUFACTURERS

18.9 RETAIL FRESH FROZEN COMBO PACKS

18.1 OTHERS

19 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL

19.1 OVERVIEW

19.2 B2B

19.2.1 STORE BASED

19.2.2 NON STORE BASED

19.3 B2C

20 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET BY COUNTRIES

20.1 OVERVIEW

20.1.1 U.S.

20.1.2 CANADA

20.1.3 MEXICO

21 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

22 SWOT ANALYSIS

23 COMPANY PROFILES MANUFACTURERS

23.1 J.R. SIMPLOT COMPANY.

23.1.1 COMPANY SNAPSHOT

23.1.2 PRODUCT PORTFOLIO

23.1.3 RECENT DEVELOPMENT

23.2 SUNOPTA

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 PRODUCT PORTFOLIO

23.2.4 RECENT DEVELOPMENT

23.3 ALASKO

23.3.1 COMPANY SNAPSHOT

23.3.2 PRODUCT PORTFOLIO

23.3.3 RECEENT DEVELOPMENT

23.4 STAHLBUSH ISLAND FARMS.

23.4.1 COMPANY SNAPSHOT

23.4.2 PRODUCT PORTFOLIO

23.4.3 RECENT UPDATES

23.5 GREENYARD

23.5.1 COMPANY SNAPSHOT

23.5.2 RECENT FINANCIALS

23.5.3 PRODUCT PORTFOLIO

23.5.4 RECENT UPDATES

23.6 ARDO

23.6.1 COMPANY SNAPSHOT

23.6.2 PRODUCT PORTFOLIO

23.6.3 RECENT DEVELOPMENTS

23.7 DOLE PACKAGED FOODS, LLC

23.7.1 COMPANY SNAPSHOT

23.7.2 PRODUCT PORTFOLIO

23.7.3 RECENT DEVELOPMENT

23.8 EARTHBOUND FARM

23.8.1 COMPANY SNAPSHOT

23.8.2 PRODUCT PORTFOLIO

23.8.3 RECENT DEVELOPMENTS

23.9 FRUIT D'OR

23.9.1 COMPANY SNAPSHOT

23.9.2 PRODUCT PORTFOLIO

23.9.3 RECENT DEVELOPMENT

23.1 MILNE FRUIT PRODUCTS, INC.

23.10.1 COMPANY SNAPSHOT

23.10.2 PRODUCT PORTFOLIO

23.10.3 RECENT DEVELOPMENT

23.11 NATURE’S TOUCH

23.11.1 COMPANY SNAPSHOT

23.11.2 PRODUCT PORTFOLIO

23.11.3 RECENT DEVELOPMENT

23.12 OREGON FRUIT COMPANY

23.12.1 COMPANY SNAPSHOT

23.12.2 PRODUCT PORTFOLIO

23.12.3 RECENT DEVELOPMENT

23.13 PACIFIC COAST PRODUCERS

23.13.1 COMPANY SNAPSHOT

23.13.2 PRODUCT PORTFOLIO

23.13.3 RECENT DEVELOPMENT

23.14 SCENIC FRUIT COMPANY

23.14.1 COMPANY SNAPSHOT

23.14.2 PRODUCT PORTFOLIO

23.14.3 RECENT UPDATES

23.15 TITAN FROZEN FRUIT

23.15.1 COMPANY SNAPSHOT

23.15.2 PRODUCT PORTFOLIO

23.15.3 RECENT DEVELOPMENTS

23.16 WAWONA FROZEN FOODS

23.16.1 COMPANY SNAPSHOT

23.16.2 PRODUCT PORTFOLIO

23.16.3 RECENT DEVELOPMENTS

23.17 WYMAN'S

23.17.1 COMPANY SNAPSHOT

23.17.2 PRODUCT PORTFOLIO

23.17.3 RECENT DEVELOPMENT

24 COMPANY PROFILES DISTRIBUTORS

24.1 COASTAL SUNBELT PRODUCE

24.1.1 COMPANY SNAPSHOT

24.1.2 PRODUCT PORTFOLIO

24.1.3 RECENT DEVELOPMENT

24.2 DOT FOOD

24.2.1 COMPANY SNAPSHOT

24.2.2 PRODUCT PORTFOLIO

24.2.3 RECENT DEVELOPMENT

24.3 GET FRESH PRODUCE

24.3.1 COMPANY SNAPSHOT

24.3.2 PRODUCT PORTFOLIO

24.3.3 RECENT DEVELOPMENT

24.4 GORDON FOOD SERVICE

24.4.1 COMPANY SNAPSHOT

24.4.2 PRODUCT PORTFOLIO

24.4.3 RECENT DEVELOPMENT

24.5 KEHE DISTRIBUTORS LLC

24.5.1 COMPANY SNAPSHOT

24.5.2 PRODUCT PORTFOLIO

24.5.3 RECENT DEVELOPMENT

24.6 ROBINSON

24.6.1 COMPANY SNAPSHOT

24.6.2 PRODUCT PORTFOLIO

24.6.3 RECENT DEVELOPMENT

24.7 SNOW CAP LTD.

24.7.1 COMPANY SNAPSHOT

24.7.2 PRODUCT PORTFOLIO

24.7.3 RECENT DEVELOPMENT

24.8 SYSCO CORPORATION

24.8.1 COMPANY SNAPSHOT

24.8.2 REVENUE ANALYSIS

24.8.3 PRODUCT PORTFOLIO

24.8.4 RECENT DEVELOPMENT

24.9 UNFI

24.9.1 COMPANY SNAPSHOT

24.9.2 REVENUE ANALYSIS

24.9.3 PRODUCT PORTFOLIO

24.9.4 RECENT DEVELOPMENT

24.1 US FOODS INC

24.10.1 COMPANY SNAPSHOT

24.10.2 REVENUE ANALYSIS

24.10.3 PRODUCT PORTFOLIO

24.10.4 RECENT DEVELOPMENT

25 QUESTIONNAIRE

26 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (THOUSAND TONS)

TABLE 4 NORTH AMERICA VEGETABLE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (THOUSAND TONS)

TABLE 5 NORTH AMERICA ROOT VEGETABLES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA LEAFY GREENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA CRUCIFEROUS MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA NIGHTSHADE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA LEGUME MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA ALLIUM MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SQUASH MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA FRUIT MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA BERRIES ONLY MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA TRIPLE BERRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA CITRUS FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA CITRUS FRUIT IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA IQF CITRUS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA CITRUS PEEL IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA CITRUS JUICE CUBED INCLUSIONS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA APPLE BASED MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA TROPICAL FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA STONE FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA POMEGRANATE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA MIXED FRUIT & VEGETABLE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA SMOOTHIE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA SALAD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA BREAKFAST BOWL MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA BABY FOOD BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA SUPERFOOD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA SEASONAL/ HOLIDAY MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA PRE SEASONED THEN IQF IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA HERB SEASONED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA SPICED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA ASIAN INSPIRED SEASONING IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA MEDITERRANEAN BLEND IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA SWEET GLAZED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA INDIAN STYLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY LABELING & CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA POUCH IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA RETAIL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA FOODSERVICE/INSTITUTIONAL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA FOODSERVICE IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA FOODSERVICE INDUSTRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA INSTITUTIONAL KITCHENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA NUTRITIONAL SUPPLEMENTS MANUFACTURERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA NON-STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 60 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 62 U.S. VEGETABLE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. ROOT VEGETABLES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. LEAFY GREENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. CRUCIFEROUS MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. NIGHTSHADE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. LEGUME MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. ALLIUM MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. SQUASH MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. FRUIT MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. BERRIES ONLY MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. TRIPLE BERRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. CITRUS FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. CITRUS FRUITS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. IQF CITRUS SEGMENTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. CITRUS PEEL IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. CITRUS JUICE CUBED INCLUSIONS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. APPLE BASED MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. TROPICAL FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 U.S. STONE FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. POMEGRANATE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 U.S. MIXED FRUIT & VEGETABLE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. SMOOTHIE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 U.S. SALAD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 U.S. BREAKFAST BOWL MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. BABY FOOD BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. SUPERFOOD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 U.S. SEASONAL/HOLIDAY MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 90 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 91 U.S. PRE SEASONED THEN IQF IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 92 U.S. HERB SEASONED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 93 U.S. SPICED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 94 U.S. ASIAN INSPIRED SEASONING IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 95 U.S. MEDITERRANEAN BLEND IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 96 U.S. SWEET GLAZED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 97 U.S. INDIAN STYLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 98 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 99 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 100 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 101 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY LABELING & CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 102 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 103 U.S. POUCH IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 104 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 105 U.S. RETAIL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 106 U.S. FOODSERVICE/INSTITUTIONAL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 107 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 108 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 109 U.S. FOODSERVICE (HORECA) IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 110 U.S. FOODSERVICE INDUSTRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 U.S. INSTITUTIONAL KITCHENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 U.S. NUTRITIONAL SUPPLEMENTS MANUFACTURERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 113 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 114 U.S. B2C IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 115 U.S. STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 116 U.S. NON-STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 117 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 119 CANADA VEGETABLE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 CANADA ROOT VEGETABLES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 CANADA LEAFY GREENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 CANADA CRUCIFEROUS MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 CANADA NIGHTSHADE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 CANADA LEGUME MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 CANADA ALLIUM MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 CANADA SQUASH MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 CANADA FRUIT MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 CANADA BERRIES ONLY MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 CANADA TRIPLE BERRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 CANADA CITRUS FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 CANADA CITRUS FRUITS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 CANADA IQF CITRUS SEGMENTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 CANADA CITRUS PEEL IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 CANADA CITRUS JUICE CUBED INCLUSIONS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 CANADA APPLE BASED MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 CANADA TROPICAL FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 CANADA STONE FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 CANADA POMEGRANATE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 CANADA MIXED FRUIT & VEGETABLE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 CANADA SMOOTHIE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 CANADA SALAD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 CANADA BREAKFAST BOWL MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 CANADA BABY FOOD BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 CANADA SUPERFOOD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 CANADA SEASONAL/HOLIDAY MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 147 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 148 CANADA PRE-SEASONED THEN IQF IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 149 CANADA HERB SEASONED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 150 CANADA SPICED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 151 CANADA ASIAN INSPIRED SEASONING IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 152 CANADA MEDITERRANEAN BLEND IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 153 CANADA SWEET GLAZED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 154 CANADA INDIAN STYLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 155 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 156 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 157 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 158 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY LABELING & CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 159 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 160 CANADA POUCH IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 161 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 162 CANADA RETAIL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 163 CANADA FOODSERVICE/INSTITUTIONAL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 164 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 165 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 166 CANADA FOODSERVICE (HORECA) IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 167 CANADA FOODSERVICE INDUSTRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 168 CANADA INSTITUTIONAL KITCHENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 169 CANADA NUTRITIONAL SUPPLEMENTS MANUFACTURERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 171 CANADA B2C IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 172 CANADA STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 173 CANADA NON STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 174 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 176 MEXICO VEGETABLE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 MEXICO ROOT VEGETABLES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 MEXICO LEAFY GREENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 MEXICO CRUCIFEROUS MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 MEXICO NIGHTSHADE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 MEXICO LEGUME MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 MEXICO ALLIUM MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 MEXICO SQUASH MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 MEXICO FRUIT MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MEXICO BERRIES ONLY MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 MEXICO TRIPLE BERRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 MEXICO CITRUS FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 MEXICO CITRUS FRUITS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 MEXICO IQF CITRUS SEGMENTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 MEXICO CITRUS PEEL IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 MEXICO CITRUS JUICE CUBED INCLUSIONS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 MEXICO APPLE BASED MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 MEXICO TROPICAL FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 MEXICO STONE FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 MEXICO POMEGRANATE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 MEXICO MIXED FRUIT & VEGETABLE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 MEXICO SMOOTHIE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 MEXICO SALAD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 MEXICO BREAKFAST BOWL MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 MEXICO BABY FOOD BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 MEXICO SUPERFOOD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 MEXICO SEASONAL/HOLIDAY MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 204 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 205 MEXICO PRE SEASONED THEN IQF IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 206 MEXICO HERB SEASONED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 207 MEXICO SPICED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 208 MEXICO ASIAN INSPIRED SEASONING IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 209 MEXICO MEDITERRANEAN BLEND IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 210 MEXICO SWEET GLAZED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 211 MEXICO INDIAN STYLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 212 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 213 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 214 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 215 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY LABELING & CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 216 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 217 MEXICO POUCH IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 218 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 219 MEXICO RETAIL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 220 MEXICO FOODSERVICE/INSTITUTIONAL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 221 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 222 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 223 MEXICO FOODSERVICE (HORECA) IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 224 MEXICO FOODSERVICE INDUSTRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 225 MEXICO INSTITUTIONAL KITCHENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 226 MEXICO NUTRITIONAL SUPPLEMENTS MANUFACTURERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 227 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 228 MEXICO B2C IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 229 MEXICO STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 230 MEXICO NON STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: NORTH AMERICA VS GLOBAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET : DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET : VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET : EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 TWO SEGMENTS COMPRISE THE NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE

FIGURE 15 RISING HEALTH AWARENESS BOOSTS DEMAND FOR NUTRITIOUS OPTIONS IS EXPECTED TO DRIVE THE NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 VEGETABLE MIXES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET IN 2025 & 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, 2018-2032, AVERAGE SELLING PRICE (USD/TONS)

FIGURE 21 VALUE CHAIN OF NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NON-ALCOHOLIC BEVERAGES MARKET

FIGURE 25 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY TYPE, 2024

FIGURE 26 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY CROP TYPE, 2024

FIGURE 27 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY PRODUCT CATEGORY, 2024

FIGURE 28 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY FORM, 2024

FIGURE 29 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY CATEGORY, 2024

FIGURE 30 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY SOURCE, 2024

FIGURE 31 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY LABELING & CERTIFICATION, 2024

FIGURE 32 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY PACKAGING FORMAT, 2024

FIGURE 33 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY PACKAGING SIZE, 2024

FIGURE 34 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY SHELF LIFE, 2024

FIGURE 35 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY APPLICATION, 2024

FIGURE 36 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY DISTRIBUTION CHJANNEL, 2024

FIGURE 37 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, SNAPSHOTS

FIGURE 38 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: COMPANY SHARE 2024 (%)

North America Frozen Fruit And Vegetables Mix Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Frozen Fruit And Vegetables Mix Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Frozen Fruit And Vegetables Mix Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.