North America Ipm Pheromones Market

Market Size in USD Million

CAGR :

%

USD

979.39 Million

USD

3,300.50 Million

2022

2030

USD

979.39 Million

USD

3,300.50 Million

2022

2030

| 2023 –2030 | |

| USD 979.39 Million | |

| USD 3,300.50 Million | |

|

|

|

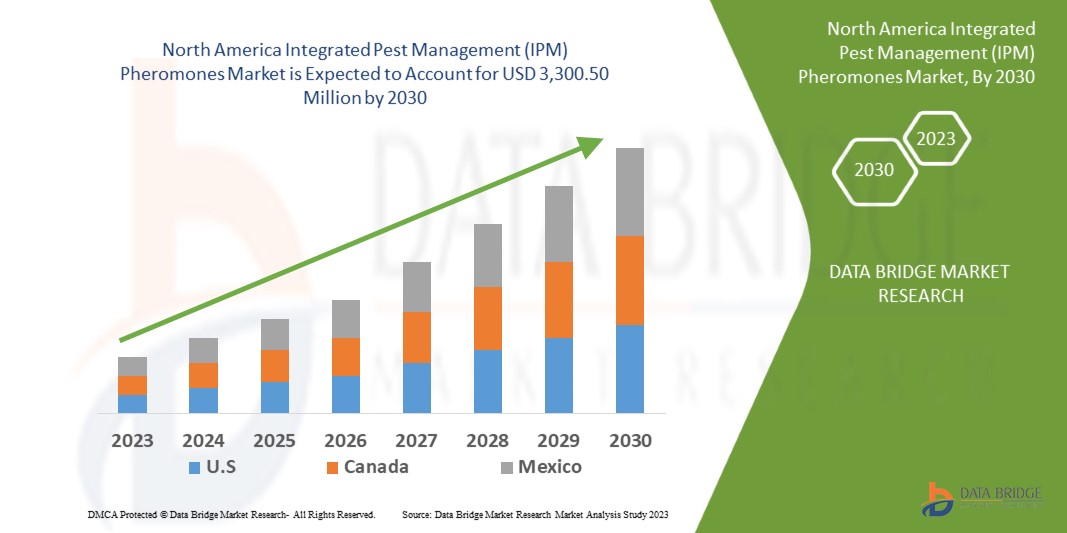

North America Integrated Pest Management (IPM) Pheromones Market Analysis and Size

The agricultural pheromones market is accelerating at a rapid pace, provided the rise in demand for sustainable, environmental friendly, and less impactful pest control solutions. According to estimates, the integrated pest control pheromones market is dominated by the sex pheromones segment. The recent advances in pheromone research and the growing knowledge of pheromone applications in integrated pest control are primarily responsible for the huge proportion of this market.

Data Bridge Market Research analyses that the integrated pest management (IPM) pheromones market, valued at USD 979.39 million in 2022, will reach USD 3,300.50 million by 2030, growing at a CAGR of 16.40% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

North America Integrated Pest Management (IPM) Pheromones Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Sex Pheromones, Aggregation Pheromones, Ovioposition-Dettering Pheromones, Alarm Pheromones, Trail Pheromones and Others), Usage (Pheromone Traps and Pheromone Lures), Pest Type (Moths, Fruit Flies, Beetles and Others), Function (Mating, Disruption, Detection, Monitoring and Mass Trapping), Applications (Residential, Commercial, Agriculture, Horticulture, Forestry, Storage Facilities and Others) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Hercon Environmental (U.S.), Harmony Ecotech Pvt. Ltd. (U.S.), AgBiTech (U.S.), AgroChem. (U.S.), Suterra. (U.S.), and Trécé Inc., (U.S.) |

|

Market Opportunities |

|

Market Definition

An environmentally friendly method of managing pests is integrated pest management (IPM). It makes use of a variety of techniques to effectively manage pest populations while posing the fewest risks to people, property, and the environment. IPM pheromones are crucial tools for tracking and controlling specific pests in crops. Mechanical control, physical control, cultural control, and biological control are the four general approaches of using IPM pheromones.

Integrated Pest Management (IPM) Pheromones Market Dynamics

Drivers

- Growing support by the government will bolster the market growth

Many farmers have adopted integrated pest management programmes for crop protection due to the increased demand for efficient pest management approaches to develop specialised crops. Over the course of the forecast period, it is anticipated that the adoption of precision farming by the Canadian federal government's drive to create methods that are both economical and environmentally beneficial would present opportunities for the market.

- Growing demand for crop protection tools and technologies is a major driver

Increased demand, production, and supply of agricultural tools and technology that support the growth of healthier, insect- and pest-free crops are shown by the growth and expansion of the agricultural industry. Increasing access to agricultural chemicals like IPM pheromones is a key factor in the market's expansion. Additionally, the business will make more money overall because of the growing number of IPM pheromones products that the government has approved.

Opportunities

- Bright future of IPM system is a promising opportunity

Integrative pest management is a productive and environmentally responsible method of pesticide management (IPM). It entails using pesticides responsibly and employing other effective pesticide control strategies. IPM pheromones are a safe and environmentally friendly alternative to the risky and extremely damaging technologies that are typically included in pesticides. Therefore, the principles of IPM system will directly promote the demand for IPM pheromones products.

Restraints/Challenges

- High costs will derail the market growth rate

The expansion of the global IPM pheromone products market is constrained by high cost of IPM pheromone products. Fluctuations or volatility in the prices of raw materials is the major factor influencing the cost of IPM pheromone products. In addition, high farmland maintenance costs will further create discrepancies for the growth of the market.

This integrated pest management (IPM) pheromones market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the integrated pest management (IPM) pheromones market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact

The market for integrated pest management pheromones has been adversely affected by the COVID-19 outbreak. The production and supply of integrated pest control pheromones were impacted, and crop protection activities were hampered globally as a result of the global lockdown and quarantine measures taken to combat the COVID-19 pandemic. In most cases, manpower is needed to apply integrated pest management pheromones. However, China has recovered in the post-pandemic period to become one of the only significant manufacturers and suppliers of plant protection goods to several industrialised and developing nations.

Recent Developments

- In 2021, Koppet took a step towards expanding its Horiver sticky trap. The idea was to expand by introducing four new traps. These traps, namely, Horiver wet, Horiver dry, Horiver disc, and Horiver delta help to trap pests such as leaf miners, asphids, whiteflies, and other harmful insects.

- In 2022, Biobest made an acquisition of acquiring 60% stake of Biopartner. The idea behind the acquisition of was to strengthen Biobest’s presence in Poland.

North America Integrated Pest Management (IPM) Pheromones Market Scope

The integrated pest management (IPM) pheromones market is segmented on the basis of type, usage, pest type, function, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Sex Pheromones

- Aggregation Pheromones

- Ovioposition-Dettering Pheromones

- Alarm Pheromones

- Trail Pheromones

- Others

Usage

- Pheromone Traps

- Pheromone Lures

Pest Type

- Moths

- Fruit Flies

- Beetles

- Others

Function

- Mating

- Disruption

- Detection

- Monitoring

- Mass Trapping

Application

- Residential

- Commercial

- Agriculture

- Horticulture

- Forestry

- Storage Facilities

- Others

Integrated Pest Management (IPM) Pheromones Market Regional Analysis/Insights

The integrated pest management (IPM) pheromones market is analyzed and market size insights and trends are provided by country, type, usage, pest type, function, and application as referenced above.

The countries covered in the integrated pest management (IPM) pheromones market report are U.S., Canada and Mexico in North America.

Given its enormous arable landmass, agricultural sector breakthroughs and technical upgrades, rising demand for food safety, presence of important players, and rising demand for high-quality food items, U.S. in North America is predicted to have the largest share of the global market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Integrated Pest Management (IPM) Pheromones Market Share Analysis

The integrated pest management (IPM) pheromones market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to integrated pest management (IPM) pheromones market.

Some of the major players operating in the integrated pest management (IPM) pheromones market are:

- Hercon Environmental (U.S.)

- Harmony Ecotech Pvt. Ltd. (U.S.)

- AgBiTech (U.S.)

- AgroChem. (U.S.)

- Suterra. (U.S.)

- Trécé Inc., (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.