North America Kickboxing Equipment Market

Market Size in USD Million

CAGR :

%

USD

61.78 Million

USD

85.20 Million

2025

2033

USD

61.78 Million

USD

85.20 Million

2025

2033

| 2026 –2033 | |

| USD 61.78 Million | |

| USD 85.20 Million | |

|

|

|

|

North America Kickboxing Equipment Market Size

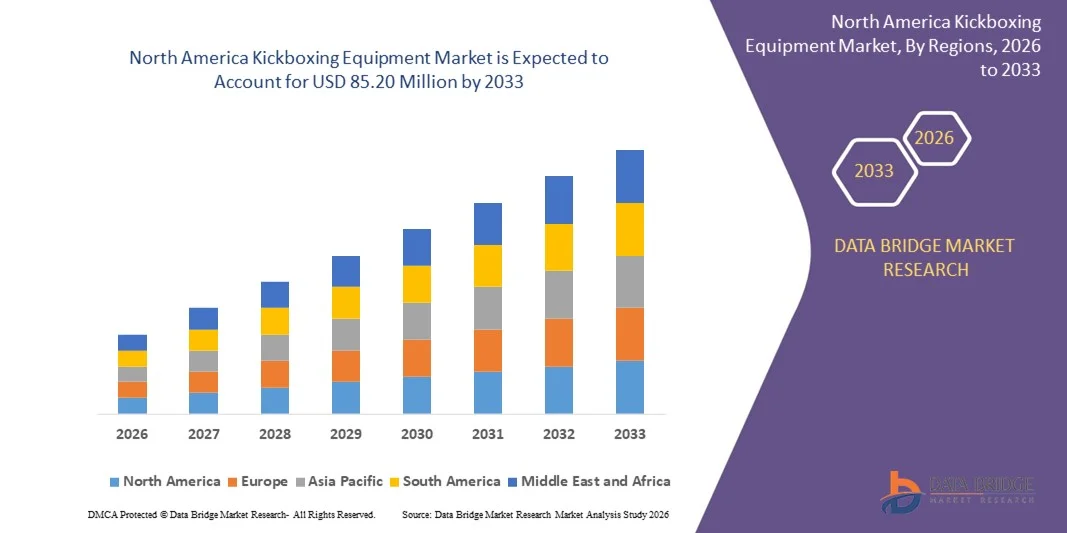

- The North America kickboxing equipment market size was valued at USD 61.78 million in 2025 and is expected to reach USD 85.20 million by 2033, at a CAGR of 4.1% during the forecast period

- The market growth is largely fueled by the rising popularity of kickboxing as a fitness activity and competitive sport, supported by increasing health awareness and growing participation across different age groups

- Furthermore, expanding gym infrastructure, the influence of professional combat sports events, and growing consumer focus on safety and performance-oriented training gear are accelerating demand for high-quality kickboxing equipment, thereby significantly boosting overall market growth

North America Kickboxing Equipment Market Analysis

- Kickboxing equipment, including gloves, protective gear, pads, and training accessories, plays a critical role in ensuring athlete safety, performance enhancement, and effective training in both recreational and professional settings

- The increasing demand for kickboxing equipment is primarily driven by the expansion of fitness clubs and training academies, rising interest in combat sports for fitness and self-defense, and continuous product innovation focused on comfort, durability, and injury prevention

- U.S. dominated kickboxing equipment market in 2025, due to a strong fitness culture, high participation in combat sports, and widespread adoption of kickboxing across commercial gyms, training academies, and home fitness settings

- Canada is expected to be the fastest growing region in the kickboxing equipment market during the forecast period due to growing health awareness, rising participation in martial arts, and expanding adoption of kickboxing-based fitness programs

- Gloves segment dominated the market with a market share of 44.2% in 2025, due to their mandatory use in both training and competitive kickboxing. Gloves are essential for hand protection and impact absorption, leading to consistent replacement demand. Rising participation in fitness-oriented kickboxing and combat sports has increased glove adoption among beginners and professionals. Manufacturers continue to enhance padding quality, durability, and ergonomic design to improve performance. Wide availability across price ranges further strengthens glove sales

Report Scope and Kickboxing Equipment Market Segmentation

|

Attributes |

Kickboxing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Kickboxing Equipment Market Trends

Rising Popularity of Fitness-Oriented and Hybrid Combat Training Programs

- A key trend in the kickboxing equipment market is the rising popularity of fitness-oriented and hybrid combat training programs, driven by increasing consumer focus on functional fitness, endurance building, and stress reduction. Kickboxing is being widely adopted across gyms, fitness studios, and training academies as it combines cardiovascular conditioning with strength and self-defense skills

- For instance, organizations such as UFC Gym and Title Boxing Club have expanded structured kickboxing-based fitness programs that require standardized gloves, pads, punching bags, and protective gear. This has increased consistent demand for high-quality equipment designed for both performance training and group fitness sessions

- The integration of kickboxing into mixed training formats such as HIIT, cross-training, and martial arts conditioning is broadening the end-user base beyond professional athletes. This trend is supporting demand for versatile equipment that can withstand high-intensity, repetitive workouts in commercial fitness environments

- Home fitness adoption is also contributing to this trend as consumers seek combat-inspired workouts that can be practiced in limited spaces. Compact punching bags, freestanding targets, and training gloves are gaining traction among individual users looking for immersive fitness routines

- Sports academies and combat training centers are increasingly standardizing equipment to ensure training consistency and safety across different skill levels. This is influencing manufacturers to focus on durability, ergonomic design, and impact-absorbing materials

- The continued expansion of fitness-driven combat programs is reinforcing the role of kickboxing equipment as essential fitness infrastructure. This trend is strengthening long-term demand across professional training facilities, gyms, and home fitness segments

North America Kickboxing Equipment Market Dynamics

Driver

Growing Participation in Kickboxing for Health, Fitness, and Self-Defense

- Growing participation in kickboxing for health, fitness, and self-defense is a major driver for the kickboxing equipment market, supported by rising awareness of active lifestyles and personal safety. Kickboxing is increasingly recognized for its benefits in weight management, flexibility, cardiovascular health, and mental well-being

- For instance, companies such as Everlast Worldwide supply gloves, punching bags, and protective gear to professional gyms, amateur training centers, and fitness chains worldwide. Their widespread presence reflects the steady rise in participation across both recreational and competitive kickboxing communities

- The increasing number of fitness clubs and martial arts academies offering kickboxing classes is generating sustained demand for training equipment in bulk quantities. This expansion supports repeat purchases of gloves, pads, shin guards, and protective accessories

- Self-defense awareness programs and youth training initiatives are further encouraging participation, particularly among women and young adults. This is driving demand for beginner-friendly and safety-focused equipment designs

- The continuous rise in global participation is reinforcing this driver as a stable growth foundation for the kickboxing equipment market. Increased engagement across age groups and skill levels is supporting long-term market expansion

Restraint/Challenge

High Risk of Injuries and Safety Concerns Limiting Beginner Adoption

- The kickboxing equipment market faces challenges due to the high risk of injuries associated with improper training techniques and inadequate protective gear. Concerns around sprains, fractures, and impact-related injuries can discourage beginners from adopting kickboxing as a fitness or sport activity

- For instance, organizations such as the American Orthopaedic Society for Sports Medicine have highlighted combat sports as having elevated injury risks without proper supervision and protective equipment. These safety concerns influence participation levels and indirectly affect equipment demand

- Inadequate use of certified gloves, headgear, and padding increases the likelihood of training-related injuries, especially among first-time users. This places pressure on gyms and training centers to invest in higher-quality protective equipment, increasing operational costs

- Beginners often perceive kickboxing as physically intense and injury-prone, which can limit enrollment in training programs. This perception slows the conversion of potential participants into active equipment consumers

- These safety-related concerns collectively restrain market growth by limiting beginner adoption and emphasizing the need for education, certified equipment, and controlled training environments

North America Kickboxing Equipment Market Scope

The market is segmented on the basis of product type, distribution channel, and application.

- By Product Type

On the basis of product type, the kickboxing equipment market is segmented into gloves, protective gear, hand wraps, punching bags, boxing pads, athletic tapes, clothing, ankle/knee/elbow wraps, shin guards, mouth guards, hand gear, kettle bell, and others. The gloves segment dominated the market with the largest share of 44.2% in 2025, driven by their mandatory use in both training and competitive kickboxing. Gloves are essential for hand protection and impact absorption, leading to consistent replacement demand. Rising participation in fitness-oriented kickboxing and combat sports has increased glove adoption among beginners and professionals. Manufacturers continue to enhance padding quality, durability, and ergonomic design to improve performance. Wide availability across price ranges further strengthens glove sales.

The protective gear segment is expected to witness the fastest growth from 2026 to 2033, supported by increasing emphasis on athlete safety and injury prevention. Equipment such as shin guards, headgear, and mouth guards is increasingly required during training sessions. Growing participation from youth and female athletes is encouraging the use of comprehensive protective solutions. Gyms and academies are enforcing stricter safety norms during practice. Product innovations using lightweight and high-impact materials are also improving adoption rates.

- By Distribution Channel

On the basis of distribution channel, the kickboxing equipment market is segmented into sports outlets, e-commerce, and others. The sports outlets segment held the largest revenue share in 2025, driven by consumer preference for physical evaluation of equipment before purchase. Athletes often rely on in-store experts to ensure proper fit, comfort, and quality, especially for gloves and protective gear. Immediate product availability and trusted brand presence support offline sales. Sports outlets also benefit from partnerships with gyms and training centers. These factors contribute to their continued dominance.

The e-commerce segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising digital adoption and convenience-driven purchasing. Online platforms offer a wide range of brands, product comparisons, and user reviews that support informed buying decisions. Competitive pricing and frequent discounts attract cost-conscious consumers. The expansion of direct-to-consumer sales by manufacturers is strengthening this channel. Improved logistics and easy return policies further enhance online growth.

- By Application

On the basis of application, the kickboxing equipment market is segmented into individual, commercial, and institutional. The individual segment dominated the market in 2025, driven by the growing popularity of kickboxing for fitness, weight management, and self-defense. Home training setups and personal ownership of equipment are becoming more common. Social media fitness trends and online coaching programs have encouraged individual investments in quality gear. Consumers prefer personalized equipment tailored to comfort and skill level. This sustained demand supports segment leadership.

The commercial segment is anticipated to register the fastest growth from 2026 to 2033, supported by rapid expansion of gyms, fitness studios, and specialized kickboxing academies. Group training programs and professional coaching services require bulk procurement of durable equipment. Rising adoption of kickboxing as part of mainstream fitness routines is increasing equipment demand in commercial settings. Frequent usage leads to shorter replacement cycles. These factors collectively drive strong growth in the commercial segment.

North America Kickboxing Equipment Market Regional Analysis

- U.S. dominated the kickboxing equipment market with the largest revenue share in 2025, driven by a strong fitness culture, high participation in combat sports, and widespread adoption of kickboxing across commercial gyms, training academies, and home fitness settings

- Increasing integration of kickboxing into group fitness programs, MMA training, and self-defense classes across national gym chains and independent studios continues to support sustained demand for gloves, punching bags, protective gear, and training accessories

- The strong presence of key market players such as Everlast Worldwide, Ringside, and Century Martial Arts, along with well-established fitness chains including UFC Gym, reinforces the U.S. leadership position. Continuous investments in sports infrastructure, professional training programs, and performance-focused equipment innovation are expected to maintain the country’s dominant role during the forecast period

Canada Kickboxing Equipment Market Insight

Canada is projected to register the fastest CAGR in the North America kickboxing equipment market from 2026 to 2033, supported by growing health awareness, rising participation in martial arts, and expanding adoption of kickboxing-based fitness programs. For instance, organizations such as GoodLife Fitness have incorporated boxing and kickboxing-inspired training formats across multiple locations, driving consistent demand for standardized training equipment. Increasing interest in structured combat fitness, strong penetration of home workout solutions, and rising youth participation in organized sports are accelerating market growth, positioning Canada as the fastest-growing market in the region.

Mexico Kickboxing Equipment Market Insight

Mexico is expected to grow steadily from 2026 to 2033, driven by expanding urban fitness centers, rising popularity of combat sports, and increasing exposure to professional boxing and kickboxing culture. Companies such as Everlast Worldwide support market growth through retail distribution of gloves, bags, and protective equipment across sports outlets and gyms. Growth in commercial gym memberships, rising disposable income among urban consumers, and increasing participation in self-defense and fitness-oriented training programs continue to support consistent adoption of kickboxing equipment throughout the forecast period.

North America Kickboxing Equipment Market Share

The kickboxing equipment industry is primarily led by well-established companies, including:

- Everlast Worldwide, Inc. (U.S.)

- Venum (France)

- RDX Sports (U.K.)

- Century LLC (U.S.)

- Budoland (Germany)

- Combat Brands, LLC (U.S.)

- Fairtex (Thailand)

- Fujian Weizhixing Sports Goods Co., Ltd (China)

- Hayabusa Fightwear Inc. (Canada)

- Paffen Sport GmbH & Co. KG (Germany)

- Revgear (U.S.)

- Rival Boxing Gear USA (U.S.)

- ADVANTEST CORPORATION (Japan)

- SMAI USA (Australia)

- TWIN SPECIAL (Thailand)

Latest Developments in North America Kickboxing Equipment Market

- In December 2022, Adidas AG launched its latest range of kickboxing equipment, including gloves, headgear, shin guards, and other protective gear, all designed with cutting-edge technology and advanced materials to maximize user comfort and safety. The product range focuses on improved shock absorption, lightweight construction, and enhanced durability to meet the demands of both professional athletes and fitness enthusiasts. This launch further reinforces Adidas’ commitment to innovation and excellence in the combat sports segment and strengthens its competitive positioning in the kickboxing equipment market

- In July 2022, Combat Sports International introduced a new collection of kickboxing pads and bags, featuring durable construction and ergonomic design tailored to enhance training performance and athlete protection. These products are designed to withstand high-impact training sessions, making them suitable for commercial gyms and professional training centers. This release strengthens the brand’s presence in the premium kickboxing gear category and supports its focus on delivering high-quality training equipment

- In April 2022, Fairtex, a globally recognized combat sports brand, entered a multi-year partnership with the Muay Thai Grand Prix to develop co-branded equipment and merchandise aimed at boosting global recognition of the sport. The collaboration allows Fairtex to align its products with a high-profile competitive platform and reach a broader international audience. This strategic alliance highlights Fairtex’s efforts to expand its market influence through event-based collaborations and brand-driven partnerships

- In July 2021, Fairtex partnered with Cage Warriors to supply gloves and other gear for the organization, enhancing the brand’s visibility and credibility across the combat sports landscape. Supplying equipment for a professional fighting organization positions Fairtex as a trusted provider of competition-grade gear. This move supports Fairtex’s strategic expansion into professional fighting circuits and strengthens its reputation among elite athletes and training institutions

- In April 2021, Everlast Worldwide, Inc. introduced its latest line of kickboxing gloves featuring enhanced padding and ergonomic design for superior comfort and safety during both training and competition. The gloves are engineered to reduce hand fatigue and improve impact distribution during prolonged use. This innovation underscores Everlast’s continued leadership in high-performance combat gear and its focus on meeting evolving athlete performance and safety requirements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.