North America Medical Carts Market

Market Size in USD Million

CAGR :

%

USD

378.12 Million

USD

1,102.95 Million

2022

2030

USD

378.12 Million

USD

1,102.95 Million

2022

2030

| 2023 –2030 | |

| USD 378.12 Million | |

| USD 1,102.95 Million | |

|

|

|

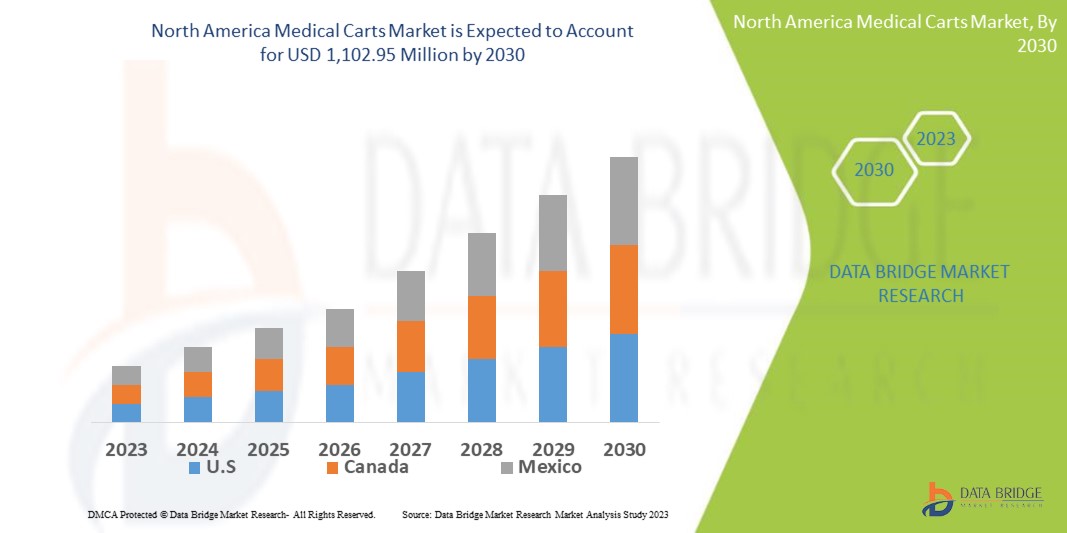

North America Medical Carts Market Analysis and Size

North America medical carts market is expected to gain market growth due to improving healthcare facilities and infrastructures and the adoption of electronic medical records at the hospital, which can drive the growth of the market. The other factors which are anticipated to propel the growth of the medical carts market include the rising cases of musculoskeletal injuries and surgeries.

The other factors, such as the lack of skilled professionals and the high cost of customized medical carts, hamper the growth of the North America medical carts market. On the other hand, the increased healthcare expenditure and emerging countries with developed hospitals act as an opportunity for the growth of the North America medical carts market.

Data Bridge Market Research analyses that the medical carts market which was USD 378.12 million in 2022, and would rocket up to USD 1,102.95 million by 2030, and is expected to undergo a CAGR of 14.3% during the forecast period. This indicates the market value. “Hospitals” dominates the end user segment of the medical carts market owing to the growing demand for medical carts in hospitals as well as increase in focus toward patient engagement and promotion of EHR incentives programs in hospitals that encourage patient involvement. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

North America Medical Carts Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2014-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Mobile Computing Carts, Medical Storage Columns, Cabinets and Accessories, Medication Carts, Wall-Mounted Workstations and Others), Type (Computer Medical Cart, Emergency Cart, Procedure Cart, Anaesthesia Cart, Medical Laboratory Utility Cart, and Others), Application (Medical, Medical Imaging, Laboratory, and Others), Material Type (Plastic, Wood, Stainless Steel, Metal and Others), Payload (50 kg, 65 kg, 80 kg, 150 kg, 180 kg and Others), End User (Hospitals, Clinics, Ambulatory Surgical Centers, Trauma Centers, and Others), Distribution Channel (Direct Tender, Third Party Distributors and Others) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

AFC Industries (U.S.), Capsa Healthcare (U.S.), Omnicell Inc. (U.S.), Harloff Manufacturing Company(U.S.), Jaco Inc. (U.S.), Humanscale (U.S.), Midmark Corporation (U.S.), Bergmann Group (U.S.), Intermetro Industries Corporation (U.S.), Mckesson Medical-Surgical Inc. (U.S.), Pedigo Products Inc. (U.S.), Ergotron, Inc. (U.S.), Enovate Medical. (U.S.), Performance Health (U.S.), Herman Miller, Inc. (U.S.), Altus, Inc. (U.S.), AMD Telemedicine (U.S.) |

|

Market Opportunities |

|

Market Definition

Medical carts are light weighted mobile carts that are used in the medical facility for various applications. They are widely used for storing and transporting medications, emergency equipment, and medical supplies. Medication carts are typically rectangular or square units with swivel caster wheels and specific compartments for holding numerous medical supplies. They are made to be convenient for nurses, doctors, and healthcare professionals to constantly administer patients' medication routine during their hospital stay. Their frame is mostly made of stainless steel or steel alloy. Crash carts are positioned throughout hospitals, enabling access at any time of emergency. Each cart drawer is properly labelled for healthcare personnel to find the equipment easily in a hurry. Some other medical carts include anesthesia carts, medical utility carts, procedure carts, and wall-mounted carts. Some medical carts, like portable ultrasound machine mobile carts, feature advanced technologies like a pneumatic lever for easy height adjustment. They are enabled with holders for ultrasound probes, clinical wipes, ultrasound gel dispensers, and hygienic gloves dispensers, and come with a heavy-duty caster.

North America Medical Carts Market Dynamics

Drivers

- Improving healthcare facilities and infrastructure

Healthcare facilities, hospitals, clinics, outpatient care centers, specialized care centers, birthing centers, and psychiatric care centers are increasing in North America due to rising cases of chronic diseases and infectious diseases with their hospital admissions and stay requirements. The pandemic condition significantly increased the demand for medical carts, with Intensive Care Units (ICUs) for the treatment of patients. Many developing countries are taking various solutions and strategies to improve the healthcare facilities of their countries.

- Increasing adoption of Electronic Medical Records (EMR) at hospitals

Many healthcare sectors are informed to mandatorily set EMRs in their hospitals or clinics to convert all medical charts into digital format, primarily incorporated in medical carts for easy access. Any hospital that doesn’t enable EMR will be considered to have data or record illegible and incomplete.

- Rising number of advanced medical carts application

The recently manufactured medical carts are incorporated with numerous IT solutions to enable easy medical storage and access. Most devices come with touch panels with slim designs for easy usage. They are lightweight with smooth wheels enabling easy mobility with significantly little pressure by nurses to prevent muscular pains. These touch panels can improve the quality of care and eliminate disastrous human consequences, which can cause an error in treatment dosage and supply. Many manufacturers are trying to innovate new advancements in their medical carts.

Opportunities

- Rising healthcare expenditure

The amount of money used by a country on its healthcare and its growth rate over time is inclined by a wide variety of economic and social factors, including the financing arrangements and structure of the health system organization. In particular, there is a strong association between the whole income level and how much the population of that country spends on health care.

According to the statistics mentioned in the Harvard Business Review in the U.S. healthcare system around USD 1.0 trillion is spent on healthcare delivery. According to these figures, preventable medical errors are the third leading cause of death in the U.S. Electronic Medical Records (EMR) can help in correcting these systemic errors.

Healthcare expenditure has increased across developed countries, and emerging economies as the disposable income of people are growing. Moreover, to accomplish the population requirements, the government bodies and healthcare organizations in different regions are taking the initiative by virtue of accelerating healthcare expenditure. The rise in healthcare expenditure helps healthcare organizations improve their facilities and equipment, including medical carts.

- Strategic initiatives by key market players

Strategic initiatives such as acquisition, partnership, contract agreement, and conference participation provide opportunities to flourish their customer base. Moreover, through such initiative strategies, both companies expand their reach through new geographic or industry markets, access to new products or services, or new types of customers. Both the market players open the door to additional or new resources such as technology and talent.

- Convenience of carts

The medical carts are helping the medical and surgical staff to be hustle-free with the convenient application. Many healthcare providers have shifted to medical carts with EMR systems to store medical data and maintain on-spot to have continuous vision over the treatment progress. These have helped healthcare providers eliminate the mountain of paper works of medical data. The burden has been reduced with one touch panel to store and access multiple data on EMR medical carts. In cases of emergency, these carts with EMR allow rapid search and visualization of records instantly.

Restraints/Challenges

- Risk of Post-Surgery Infection

One of the main factors limiting the demand for medical carts is the risk of infection that can be caused after surgery. All types of surgery involving skin cuts, incisions, or other interventions can cause infections in the patient's body. In most cases, infections in surgical wounds are seen one month after surgery. Postoperative infections can cause a variety of problems with wounds and the patient's body. For instance, surgical wound infections can ejaculate pus through the incision. In addition, these infections are very painful and cause swelling and inflammation of the wound.

- Stringent regulatory framework

The use of medical carts with numerous specificity and advancements across hospitals is rapidly increasing, with the growth of the aged population and several carcinogenic diseases requiring long hospital stays and routine medical maintenance. At the same time, the players of the medical cart manufacturers in the market have to follow specific regulations to get approval from the upper authorities to launch the product in the market. These stringent guidelines need to be followed, and this is one of the most challenging tasks among all the steps. The pre-market approval of various medical devices varies from one country to another. The U.S. FDA regulates the medical carts in the U.S. However, the rapid development of privacy policies and regulations is being made in North America.

- Heavy workstation on wheels

Most medical carts used in hospitals or medical wards must be ergonomically designed to prevent weightage issues for any healthcare professional who uses them. Heavy workstation on wheels always takes a toll on nurses who push the cart.

This medical carts market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the medical carts market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In June 2022, Atlas announced the expansion of their Cameo telehealth cart line to fulfill rising demand and the quick uptake of telehealth solutions in healthcare facilities. The newly designed Cameo tablet carts provide improved virtual interactions such as teleconsultations, physician rounding, and translation services. This expansion will increase the demand for the company products and help in increasing the growth of the company worldwide

- In June 2022, Ergotron Inc. launched a new product CareFit Combo System. This is wall mounted solution that makes the documentation efficient and comfortable. The CareFit Combo System adds to Ergotron's CareFit product line. It offers more alternatives to meet various workflows in the healthcare industry, facilitating patient relationships and lowering the chance of error. This launch covers the requirement of nurses, manage the space requirement, comfortable documentation, and flexible workflow

North America Medical Carts Market Scope

North America medical carts market is segmented on the basis of product, type, application, material type, payload, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Mobile Computing Carts

- Medical storage Columns

- Cabinets and Accessories

- Medication Carts

- Wall-Mounted Workstations

- Others

Type

- Computer Medical Cart

- Emergency Cart

- Procedure Cart

- Anesthesia Cart

- Medical Laboratory Utility Cart

- Others

Application

- Medical

- Medical Imaging

- Laboratory

- Others

Material Type

- Plastic

- Wood

- Stainless Steel

- Metal

- Others

Payload

- 50 kg

- 65 kg

- 80 kg

- 150 kg

- 180 kg

- Others

End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Trauma Centers

- Others

Distribution Channel

- Direct Tender

- Third-Party Distributors

- Others

North America Medical carts Market Regional Analysis/Insights

The North America medical carts market is analysed and market size insights and trends are provided by country, product, type, application, material type, payload, end user, and distribution channel as referenced above.

The countries covered in the medical carts market report are U.S., Canada and Mexico.

The U.S. dominates the North America medical carts market due to the rising cases of musculoskeletal injuries, surgeries, and the adoption electronic medical records at the hospital.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The North America medical carts market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for medical carts market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the medical carts market. The data is available for historic period 2010-2021.

Competitive Landscape and Medical carts Market Share Analysis

The North America medical carts market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to medical carts market.

Some of the major players operating in the North America medical carts market are:

- AFC Industries (U.S.)

- Capsa Healthcare (U.S.)

- Omnicell Inc. (U.S.)

- Harloff Manufacturing Company (U.S.)

- Jaco Inc. (U.S.)

- Humanscale (U.S.)

- Midmark Corporation(U.S.)

- Bergmann Group (U.S.)

- Intermetro Industries Corporation (U.S.)

- Mckesson Medical-Surgical Inc. (U.S.)

- Pedigo Products Inc (U.S.)

- Ergotron, Inc. (U.S.)

- Enovate Medical. (U.S.)

- Performance Health(U.S.)

- Herman Miller, Inc. (U.S.)

- Altus, Inc. (U.S.)

- AMD Telemedicine(U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.