North America Molecular Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

14.85 Billion

USD

23.49 Billion

2025

2033

USD

14.85 Billion

USD

23.49 Billion

2025

2033

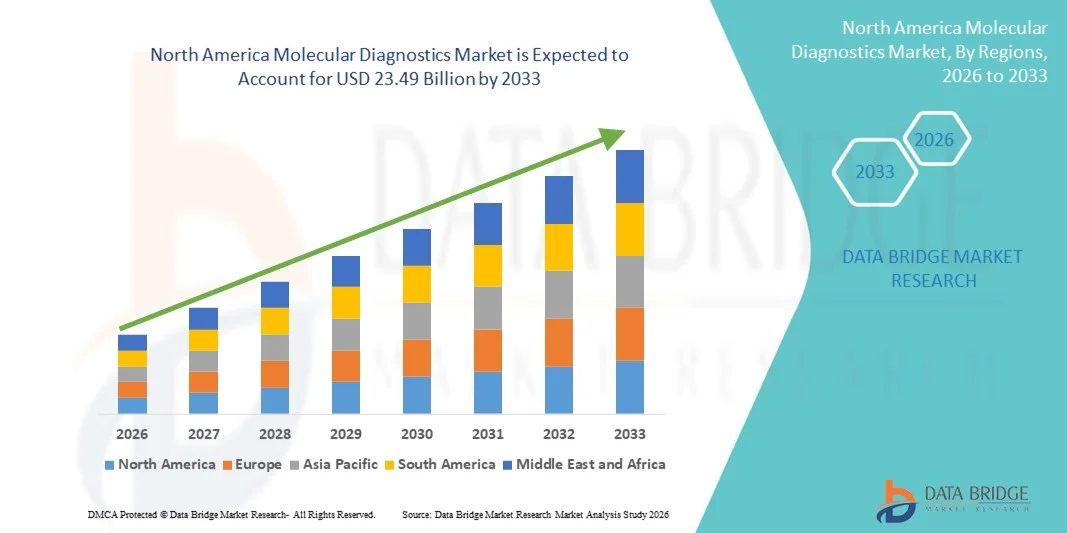

| 2026 –2033 | |

| USD 14.85 Billion | |

| USD 23.49 Billion | |

|

|

|

|

North America Molecular Diagnostics Market Size

- The North America molecular diagnostics market size was valued at USD 14.85 billion in 2025 and is expected to reach USD 23.49 billion by 2033, at a CAGR of 5.9% during the forecast period

- The market growth is primarily driven by increasing prevalence of infectious diseases, rising demand for personalized medicine, and advancements in molecular testing technologies such as PCR, NGS, and CRISPR-based diagnostics

- Moreover, growing adoption of point-of-care molecular diagnostic devices, favorable government initiatives, and expanding healthcare infrastructure in the region are boosting market penetration, making molecular diagnostics an essential component of modern clinical decision-making and disease management

North America Molecular Diagnostics Market Analysis

- Molecular diagnostics, encompassing technologies such as PCR, NGS, FISH, and CRISPR-based assays, are increasingly essential in modern healthcare for early disease detection, personalized treatment, and infectious disease monitoring across clinical and research settings

- The rising demand for molecular diagnostics is primarily fueled by growing prevalence of chronic and infectious diseases, increasing adoption of precision medicine, and advancements in automated and point-of-care testing platforms

- The U.S. dominated the North America molecular diagnostics market with the largest revenue share of 91.1% in 2025, driven by well-established healthcare infrastructure, early adoption of advanced diagnostic technologies, strong R&D investments, and a high presence of key industry players, leading in innovations, regulatory approvals, and commercialization of cutting-edge molecular assays

- Canada is expected to be the fastest growing country in the North America molecular diagnostics market during the forecast period due to expanding healthcare infrastructure, rising awareness of early diagnostics, and increasing government initiatives supporting molecular testing

- Polymerase Chain Reaction (PCR)-based methods segment dominated the North America molecular diagnostics market with a market share of 38.7% in 2025, driven by their high sensitivity, specificity, and widespread use in detecting infectious diseases, genetic disorders, and oncology biomarkers

Report Scope and North America Molecular Diagnostics Market Segmentation

|

Attributes |

North America Molecular Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Molecular Diagnostics Market Trends

Advancements in AI-Driven Molecular Diagnostics and Integrated Testing Platforms

- A significant and accelerating trend in the North America molecular diagnostics market is the integration of artificial intelligence (AI) and machine learning algorithms into diagnostic platforms, enhancing predictive accuracy and workflow efficiency

- For instance, Thermo Fisher Scientific’s Ion Torrent Genexus System utilizes AI to automate sequencing and analysis, reducing turnaround time for actionable results

- AI-enabled diagnostics can identify patterns in large datasets, predict disease susceptibility, and assist clinicians in selecting personalized therapies. For instance, some Bio-Rad laboratories employ AI to optimize PCR assay interpretation and flag abnormal results for rapid review

- Integration with hospital information systems and laboratory information management systems (LIMS) allows centralized monitoring of multiple molecular assays, streamlining operations and reducing human error

- This trend towards intelligent, automated, and interconnected diagnostic solutions is reshaping expectations in clinical laboratories. Consequently, companies such as QIAGEN are developing AI-enhanced platforms with automated sample-to-result workflows and predictive analytics

- The demand for AI-driven, integrated molecular diagnostics is growing rapidly across hospitals, reference labs, and research centers, as healthcare providers increasingly prioritize faster, more accurate, and cost-effective testing

- Increasing collaborations between molecular diagnostics providers and tech companies are driving innovation in cloud-based data analysis, enabling real-time decision-making and remote monitoring of lab operations

North America Molecular Diagnostics Market Dynamics

Driver

Rising Demand Due to Increased Disease Prevalence and Personalized Medicine Adoption

- The increasing prevalence of infectious diseases, cancer, and genetic disorders, coupled with the growing adoption of precision medicine, is a significant driver for the heightened demand for molecular diagnostics

- For instance, in March 2025, Roche Diagnostics announced the expansion of its PCR-based infectious disease testing portfolio to include multi-pathogen detection panels, aimed at improving rapid diagnosis in hospitals

- As healthcare providers seek early and accurate detection, molecular diagnostics offer high sensitivity and specificity, enabling targeted treatment plans and better patient outcomes

- Furthermore, the adoption of personalized medicine approaches and companion diagnostics is making molecular testing an essential tool for therapeutic decision-making

- The convenience of rapid testing, point-of-care molecular assays, and automated laboratory workflows are key factors propelling adoption in hospitals, clinical labs, and research facilities. The trend towards expanded testing menus and integration with electronic health records further contributes to market growth

- For instance, Abbott Laboratories has introduced multiplex assays that allow simultaneous detection of multiple pathogens, reducing testing time and improving clinical efficiency

- Growing government funding and private investment in molecular diagnostic R&D is accelerating innovation, supporting new assay development and wider adoption across healthcare settings

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- The relatively high cost of advanced molecular diagnostic instruments and consumables poses a challenge to broader adoption, particularly in smaller labs and community hospitals

- For instance, reports of expensive NGS-based oncology panels have limited uptake among budget-conscious laboratories despite their clinical utility

- Strict regulatory requirements from the FDA and CLIA, along with the need for extensive validation of new assays, can delay product launches and increase operational complexity

- Companies such as Abbott and Hologic emphasize compliance and rigorous quality control, but navigating evolving regulatory frameworks remains a barrier for new entrants

- While technological advancements are improving affordability, the premium cost of highly automated or AI-integrated platforms can hinder adoption, especially for labs with limited budgets

- Overcoming these challenges through cost-effective assay development, streamlined regulatory pathways, and increased awareness of molecular testing benefits will be crucial for sustained market expansion

- For instance, delays in FDA approval for new companion diagnostics have slowed the market entry of some innovative cancer tests, impacting growth timelines

- Limited trained personnel and expertise in advanced molecular techniques also restrict adoption in smaller clinical labs, creating a need for workforce training and technical support programs

North America Molecular Diagnostics Market Scope

The market is segmented on the basis of products, technology, application, and end user.

- By Products

On the basis of products, the molecular diagnostics market is segmented into reagents & kits, instruments, and services & software. Reagents & Kits segment dominated the market with the largest market revenue share of 47.6% in 2025, driven by the recurring need for consumables in diagnostic testing. Reagents and kits are critical for performing PCR, NGS, and other molecular assays, ensuring laboratories can handle increasing test volumes. Hospitals and clinical labs prioritize kits for their reliability and validated protocols. The segment’s dominance is reinforced by continuous innovations to improve sensitivity, specificity, and ease of use. For instance, companies frequently launch ready-to-use multiplex kits to simplify workflow. Reagents & kits also form a key revenue stream for manufacturers, as they are consumable items used repeatedly across multiple tests.

Instruments segment is anticipated to witness the fastest growth rate of 19.4% from 2026 to 2033, driven by rising adoption of automated and high-throughput molecular testing platforms. Hospitals and reference labs are investing in advanced sequencers, PCR machines, and microarray instruments to meet growing testing demand. AI-enabled instruments are increasingly used to improve result interpretation and workflow efficiency. For instance, automated sample-to-result platforms reduce human error and turnaround time. Government initiatives and R&D funding further accelerate instrument adoption. Compact, integrated, and cloud-connected instruments also support expansion in smaller labs and specialty clinics.

- By Technology

On the basis of technology, the molecular diagnostics market is segmented into Mass Spectrometry (MS), Capillary Electrophoresis, Next Generation Sequencing (NGS), Chips and Microarray, PCR-Based Methods, Cytogenetics, In Situ Hybridization (ISH or FISH), Molecular Imaging, and Others.

PCR-Based Methods segment dominated the market with the largest revenue share of 38.7% in 2025, owing to their high sensitivity, specificity, and widespread clinical application. PCR is extensively used in infectious disease detection, oncology, and genetic disorder screening. Hospitals and labs favor PCR for its cost-effectiveness and rapid turnaround. Continuous innovations such as real-time PCR and multiplex assays increase throughput and accuracy. For instance, PCR panels now allow simultaneous detection of multiple pathogens. Its versatility and integration into routine workflows solidify PCR’s dominance in molecular diagnostics.

Next Generation Sequencing (NGS) is expected to witness the fastest growth rate of 22.1% from 2026 to 2033, driven by its ability to perform comprehensive genomic profiling. NGS supports oncology, rare disease, and pharmacogenomic applications. AI-powered platforms improve data interpretation and speed up clinical decision-making. For instance, Illumina’s automated NGS systems reduce hands-on time while increasing accuracy. Decreasing sequencing costs and increasing reimbursement support wider adoption. Hospitals, reference labs, and research centers are rapidly implementing NGS to enable precision medicine initiatives.

- By Application

On the basis of application, the molecular diagnostics market is segmented into oncology, pharmacogenomics, microbiology, prenatal tests, tissue typing, blood screening, cardiovascular diseases, neurological diseases, infectious diseases, and others. Oncology segment dominated the market with the largest revenue share of 41.2% in 2025, driven by the growing prevalence of cancer and the importance of molecular testing in early detection and treatment planning. Hospitals increasingly adopt PCR, NGS, and FISH for tumor profiling and companion diagnostics. Liquid biopsy and biomarker identification further boost demand. For instance, companies are offering multi-gene panels for actionable mutation detection. Continuous innovations in personalized therapies reinforce oncology’s leading position. The critical need for timely and accurate results ensures oncology remains the largest application segment.

Infectious Diseases segment is expected to witness the fastest growth rate of 23.3% from 2026 to 2033, fueled by heightened awareness of outbreaks and rapid testing needs. Molecular tests such as multiplex PCR and point-of-care assays are increasingly used for viral and bacterial detection. For instance, Roche and Abbott expanded COVID-19 testing panels, demonstrating rapid deployment capabilities. Government initiatives for disease surveillance drive further adoption. The convenience of fast, sensitive testing enhances clinical decision-making. Increasing demand in hospitals and public health labs supports rapid market growth.

- By End User

On the basis of end user, the molecular diagnostics market is segmented into hospitals, clinical laboratories, and academics. Hospitals segment dominated the market with the largest revenue share of 44.5% in 2025, owing to high patient volumes and in-house testing adoption. Hospitals prioritize rapid diagnostics for oncology, infectious diseases, and prenatal testing. Automated instruments and integrated workflows reduce turnaround time and improve clinical outcomes. For instance, large hospital networks deploy PCR and NGS platforms to support routine diagnostics. Continuous investment in AI-enabled instruments strengthens hospitals’ dominance. Hospitals also benefit from combining molecular diagnostics with electronic health records to enhance patient management.

Clinical Laboratories segment is expected to witness the fastest growth rate of 21.8% from 2026 to 2033, driven by outsourcing of complex tests by smaller hospitals and clinics. Reference labs adopt high-throughput NGS and multiplex PCR platforms to expand service offerings. For instance, laboratories use AI-assisted interpretation to increase efficiency and accuracy. Growing physician and patient awareness boosts molecular test demand. Regulatory support for laboratory-developed tests encourages adoption. Expansion of clinical labs in urban and suburban areas further accelerates growth.

North America Molecular Diagnostics Market Regional Analysis

- The U.S. dominated the North America molecular diagnostics market with the largest revenue share of 91.1% in 2025, driven by well-established healthcare infrastructure, early adoption of advanced diagnostic technologies, strong R&D investments, and a high presence of key industry players, leading in innovations, regulatory approvals, and commercialization of cutting-edge molecular assays

- Healthcare providers in the region prioritize rapid and accurate molecular testing for oncology, infectious diseases, prenatal screening, and pharmacogenomics, ensuring timely diagnosis and personalized treatment planning

- The widespread adoption is further supported by a well-established network of hospitals, reference laboratories, and academic research centers, combined with regulatory support for innovative diagnostic solutions, establishing molecular diagnostics as a critical component of modern clinical workflows

The U.S. Molecular Diagnostics Market Insight

The U.S. molecular diagnostics market captured the largest revenue share of 91.1% in 2025 within North America, fueled by the widespread adoption of advanced molecular testing technologies such as PCR, NGS, and multiplex assays. Healthcare providers increasingly prioritize rapid and accurate diagnostics for oncology, infectious diseases, and prenatal testing. The growing demand for personalized medicine, coupled with well-established hospital and reference lab infrastructure, further propels market growth. Moreover, strong R&D investments, regulatory support for innovative diagnostic solutions, and the presence of leading industry players are significantly contributing to the market’s expansion.

Canada Molecular Diagnostics Market Insight

The Canada molecular diagnostics market is expected to expand at a substantial CAGR throughout the forecast period, primarily driven by government initiatives to improve healthcare infrastructure and expand access to molecular testing. Rising awareness of early disease detection, increasing adoption of point-of-care molecular assays, and investments in laboratory modernization are fostering market growth. Canadian healthcare providers are also integrating molecular diagnostics into hospitals and clinical laboratories to enhance personalized treatment and population health management. The market growth is further supported by collaborations between domestic laboratories and global diagnostic technology companies.

Mexico Molecular Diagnostics Market Insight

The Mexico molecular diagnostics market is poised to grow at a notable CAGR during the forecast period, driven by the increasing prevalence of infectious diseases and rising demand for early diagnosis and personalized healthcare solutions. Investments in molecular testing infrastructure, the introduction of affordable diagnostic kits, and the expansion of private healthcare services are boosting market adoption. Mexican laboratories and hospitals are adopting PCR, NGS, and multiplex testing platforms to improve diagnostic accuracy and turnaround time. Furthermore, rising awareness among physicians and patients about molecular diagnostics is stimulating demand across clinical and research applications.

North America Molecular Diagnostics Market Share

The North America Molecular Diagnostics industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- BIOMÉRIEUX (France)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Meridian Bioscience, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- Hologic, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- BD (U.S.)

- DiaSorin S.p.A. (Italy)

- Quidel Corporation (U.S.)

- SD Biosensor, Inc. (South Korea)

- Mindray Medical International (China)

- Astragene (U.A.E.)

- Euroimmun Medizinische Labordiagnostika AG (Germany)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- QIAGEN (Netherlands)

- Danaher (U.S.)

What are the Recent Developments in North America Molecular Diagnostics Market?

- In October 2025, molecular diagnostics firm BillionToOne filed for a U.S. IPO, planning to list on Nasdaq under the ticker “BLLN,” highlighting strong revenue growth and expansion in precision diagnostics including prenatal screening and liquid biopsy tests signaling heightened investor interest in U.S. molecular diagnostics innovation and commercialization

- In July 2025, Waters Corp announced plans to merge with Becton, Dickinson & Company’s Biosciences & Diagnostic Solutions division in a USD 17.5 billion Reverse Morris Trust deal, which is expected to accelerate expansion into multiplex diagnostics and bolster combined capabilities in disease identification tools used across North America

- In May 2025, the U.S. Food and Drug Administration cleared the first blood test to detect Alzheimer’s disease, developed by Fujirebio Diagnostics, which can identify Alzheimer’s biomarkers via a simple blood draw a significant milestone for molecular diagnostics beyond infectious disease and oncology

- In February 2023, Thermo Fisher Scientific partnered with MyLab to procure RT‑PCR kits for several infectious diseases (e.g., tuberculosis and HIV) across the U.S. and Canada, enhancing availability of molecular diagnostics tests for priority global health conditions

- In March 2021, QIAGEN launched the QIAcube Connect MDx, an automated platform for sample processing in molecular diagnostic labs (including in the U.S. and Canada), improving workflow efficiency and consistency in molecular testing reinforcing early adoption of automation in North American lab

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.