North America Newborn Screening Market

Market Size in USD Million

CAGR :

%

USD

477.30 Million

USD

1,345.38 Million

2024

2032

USD

477.30 Million

USD

1,345.38 Million

2024

2032

| 2025 –2032 | |

| USD 477.30 Million | |

| USD 1,345.38 Million | |

|

|

|

|

North America Newborn Screening Market Size

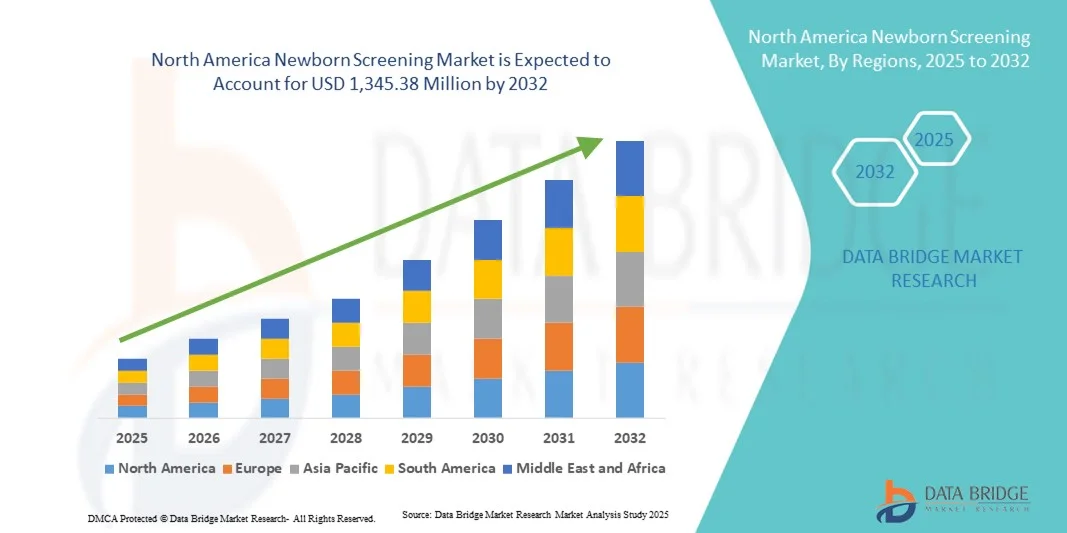

- The North America newborn screening market size was valued at USD 477.30 million in 2024 and is expected to reach USD 1,345.38 million by 2032, at a CAGR of 13.83% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced screening technologies and rising awareness about early detection of congenital disorders, leading to improved neonatal care outcomes across healthcare systems

- Furthermore, supportive government policies, rising healthcare expenditure, and growing demand for timely and accurate diagnosis are establishing newborn screening as a critical component of public health programs. These converging factors are accelerating the uptake of newborn screening solutions, thereby significantly boosting the industry's growth

North America Newborn Screening Market Analysis

- Newborn Screening, involving early testing of infants for a variety of genetic, metabolic, and congenital disorders, is increasingly recognized as a vital public health initiative due to its role in enabling timely diagnosis and intervention, thereby reducing infant mortality and long-term healthcare burdens

- The rising demand for newborn screening is primarily fueled by increasing government initiatives, growing awareness among parents, and technological advancements in screening methods such as tandem mass spectrometry and DNA-based assays

- U.S. dominated the North America newborn screening market with the largest revenue share of 80.5% in 2024, supported by strong healthcare infrastructure, mandatory state screening programs, and the presence of advanced diagnostic laboratories

- Canada is expected to be the fastest growing country in the North America newborn screening market during the forecast period, driven by expanding healthcare investments, rising adoption of next-generation sequencing technologies, and growing emphasis on national screening guidelines

- Instruments dominated the North America newborn screening market with a share of 48.2% in 2024, driven by hospitals and diagnostic laboratories investing in high-throughput platforms such as tandem mass spectrometry analyzers, pulse oximeters, and automated hearing screening devices

Report Scope and Newborn Screening Market Segmentation

|

Attributes |

Newborn Screening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Newborn Screening Market Trends

Enhanced Convenience Through AI and Digital Integration

- A significant and accelerating trend in the newborn screening market is the growing adoption of artificial intelligence (AI), machine learning algorithms, and digital health platforms to enhance the speed, efficiency, and accuracy of diagnostic testing

- For instance, in March 2023, Baebies Inc. introduced its AI-powered Seeker platform for newborn screening, which leverages digital microfluidics to deliver rapid and more accurate results. This development exemplifies how AI integration is transforming newborn screening into a faster, smarter, and more patient-centric process

- These advanced tools enable laboratories and hospitals to analyze large volumes of newborn blood samples more effectively, reducing turnaround times and ensuring that infants with genetic or metabolic disorders are diagnosed at the earliest possible stage

- AI-driven decision-support systems are also helping clinicians interpret complex datasets and identify subtle indicators that may be missed through traditional methods, thereby improving diagnostic confidence and clinical outcomes

- Moreover, integration with electronic health records (EHRs) and cloud-based platforms allows for seamless communication between screening centers, pediatricians, and public health authorities, streamlining the entire care pathway

North America Newborn Screening Market Dynamics

Driver

Growing Need Due to Rising Prevalence of Genetic Disorders and Mandatory Screening Programs

- The global burden of genetic, metabolic, and endocrine disorders continues to rise, highlighting the critical importance of newborn screening as a preventive public health measure

- For instance, in April 2024, the U.S. Department of Health and Human Services expanded its Recommended Uniform Screening Panel (RUSP) by adding Mucopolysaccharidosis type II (Hunter syndrome), reinforcing the role of mandatory policies in driving the newborn screening market forward

- Government-mandated screening programs across North America, Europe, and parts of Asia-Pacific are ensuring near-universal coverage of newborns, thereby creating consistent demand for advanced screening solutions

- Healthcare authorities are also increasingly expanding the number of conditions included in standard screening panels, boosting demand for more comprehensive testing technologies such as tandem mass spectrometry (TMS) and next-generation sequencing (NGS)

- Parents are becoming more aware of the benefits of early detection, leading to increased advocacy and community support for nationwide screening programs, particularly in developing regions

Restraint/Challenge

Concerns Regarding High Costs and Limited Infrastructure in Developing Regions

- While newborn screening is well established in developed countries, its adoption in developing and low-resource regions is hindered by high equipment costs, recurring consumables, and the need for advanced laboratory infrastructure

- For instance, in June 2022, the World Health Organization (WHO) reported that coverage of newborn screening across sub-Saharan Africa remained below 10%, citing insufficient funding, inadequate laboratory infrastructure, and lack of trained personnel as major barriers. This continues to restrain the global market from achieving uniform adoption

- Many hospitals in low-income nations face shortages of trained professionals, limited access to modern diagnostic instruments, and delays in transporting blood samples to centralized labs, which collectively restrict the scalability of newborn screening programs

- The relatively high upfront investment required for implementing screening technologies such as tandem mass spectrometry discourages smaller hospitals and rural facilities from offering comprehensive testing

- In addition, disparities in healthcare budgets and competing public health priorities often push newborn screening lower on the list of government-funded initiatives, especially in regions struggling with infectious disease burdens

North America Newborn Screening Market Scope

The market is segmented on the basis of test type, product type, technology, disease type, and end user.

- By Test Type

On the basis of test type, the North America newborn screening market is segmented into Dried Blood Spot (DBS) Test, Hearing Screen Test, and Critical Congenital Heart Diseases (CCHD) Test. The Dried Blood Spot (DBS) Test dominated the market with a revenue share of 45.6% in 2024, owing to its established reliability, cost-effectiveness, and ability to detect multiple metabolic and genetic disorders from a single blood sample. Hospitals and pediatric clinics widely adopt DBS testing because it allows for large-scale screening with minimal sample volume, providing timely results for early intervention. Its compatibility with automated laboratory instruments ensures high accuracy and throughput, while integration with electronic health records facilitates seamless data management and reporting. The method is also supported by national public health programs, making it a cornerstone of newborn diagnostic strategies. DBS tests are favored for their minimal invasiveness and standardized procedures, which reduce errors and improve patient compliance. The test’s versatility across a wide range of disorders, combined with ease of sample transportation and storage, further strengthens its adoption. Growing awareness among parents and healthcare providers about the importance of early detection also contributes to its leading market position. Overall, the DBS test remains the preferred solution for hospitals and clinics across North America due to its effectiveness, efficiency, and scalability.

The Critical Congenital Heart Diseases (CCHD) Test segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, driven by increasing awareness of congenital heart defects, technological advances in pulse oximetry, and the implementation of government-mandated universal screening programs. Hospitals and clinics are rapidly adopting CCHD testing to prevent complications and reduce infant mortality, while rising parental awareness is further fueling growth. The adoption of portable and user-friendly pulse oximetry devices allows smaller facilities and pediatric clinics to implement the test efficiently. The development of automated data recording systems and integration with electronic health platforms enhances accuracy and streamlines reporting. In addition, training programs for healthcare professionals are expanding, ensuring proper implementation and interpretation of results. Research initiatives highlighting early detection benefits for survival and treatment outcomes further boost adoption. Partnerships between public health authorities and private diagnostic companies are also encouraging wider rollout. The increasing prevalence of congenital heart diseases and emphasis on early diagnosis as a preventive measure continues to drive the segment’s growth. The CCHD test is becoming an integral part of comprehensive newborn care programs, making it the fastest-growing test type in the region.

- By Product Type

On the basis of product type, the North America newborn screening market is segmented into instruments and reagents & assay kits. Instruments dominated the market with a share of 48.2% in 2024, driven by hospitals and diagnostic laboratories investing in high-throughput platforms such as tandem mass spectrometry analyzers, pulse oximeters, and automated hearing screening devices. These instruments enable faster and more accurate testing of large newborn populations while minimizing human error and ensuring consistent results. Instruments are favored because they allow seamless integration with laboratory information systems and electronic health records, facilitating efficient data collection, management, and reporting. Public health programs rely on these platforms for nationwide screening initiatives, while hospitals benefit from economies of scale when testing hundreds of infants daily. The flexibility of instruments to perform multiple test types from a single sample further enhances their adoption. Their reliability, durability, and ease of maintenance make them essential tools for modern newborn screening workflows. The increasing emphasis on early detection of genetic and metabolic disorders ensures that instruments remain the backbone of the North America newborn screening market.

The Reagents & Assay Kits segment is projected to witness the fastest CAGR of 20.4% from 2025 to 2032, as healthcare providers increasingly rely on ready-to-use kits for various newborn screening tests. These kits are preferred for their convenience, reproducibility, and ability to complement existing laboratory instruments, providing an efficient solution for high-volume testing. Reagents and assay kits allow for quick preparation of samples and are adaptable across multiple testing platforms, reducing the need for specialized laboratory infrastructure. The growth of this segment is also supported by innovations in kit formulation, improving sensitivity, specificity, and overall test accuracy. Community hospitals and pediatric clinics, particularly those without extensive laboratory setups, increasingly adopt these kits to expand their screening capabilities. Partnerships between kit manufacturers and healthcare providers help ensure continuous supply and training, enhancing reliability and ease of use. Overall, the reagent and assay kits segment is poised for strong growth due to its adaptability, user-friendliness, and ability to extend newborn screening coverage to a broader population.

- By Technology

On the basis of technology, the North America newborn screening market is segmented into Tandem Mass Spectrometry (TMS), Hearing Screen Technology, Pulse Oximetry Screening Technology, Immunoassays and Enzymatic Assays, Electrophoresis, and DNA-Based Assays. Tandem Mass Spectrometry (TMS) dominated the market with a share of 42.7% in 2024, owing to its ability to perform multiplex testing for multiple metabolic disorders using a single dried blood spot sample. TMS is widely adopted by public health laboratories for its high accuracy, efficiency, and capacity to handle large sample volumes. The technology enables early diagnosis and intervention, reducing long-term complications associated with metabolic disorders. Hospitals and laboratories value TMS for its automation potential, minimal sample requirements, and compatibility with high-throughput workflows. The method’s reproducibility and low error rate enhance reliability in screening programs. Integration with digital health systems facilitates real-time data analysis and reporting. The proven track record, versatility, and ability to screen for multiple conditions simultaneously ensure TMS remains the preferred choice for comprehensive newborn screening.

DNA-Based Assays are expected to witness the fastest CAGR of 23.5% from 2025 to 2032, driven by advances in next-generation sequencing, decreasing costs of genomic analysis, and rising demand for early detection of rare genetic disorders. Hospitals, pediatric clinics, and diagnostic laboratories are increasingly adopting DNA-based assays for their high sensitivity, specificity, and ability to detect previously undiagnosed conditions. The technology supports personalized healthcare strategies by identifying genetic predispositions and enabling targeted interventions. Integration with electronic health records and automated reporting systems enhances efficiency and reduces turnaround time. Increasing research collaborations, government funding initiatives, and awareness programs contribute to rapid adoption. DNA-based assays also support multiplex testing, allowing simultaneous evaluation of multiple genes or conditions from a single sample. Overall, DNA-based assays are becoming a critical component of modern newborn screening programs, driving the fastest growth among technological solutions.

- By Disease Type

On the basis of disease type, the North America newborn screening market is segmented into Critical Congenital Heart Diseases (CCHD), Newborn Hearing Loss, Sickle Cell Disease, Phenylketonuria (PKU), Cystic Fibrosis (CF), Maple Syrup Urine Disease, and Others. Phenylketonuria (PKU) dominated the market with a revenue share of 39.8% in 2024, driven by the critical importance of early detection and dietary management to prevent severe neurological complications. PKU testing is included in mandatory state screening panels, ensuring near-universal adoption in hospitals and pediatric clinics. The test’s accuracy, cost-effectiveness, and ability to provide actionable guidance to parents make it a cornerstone of newborn metabolic screening programs. Healthcare providers prefer PKU testing due to its reliability, minimal sample requirements, and compatibility with high-throughput laboratory instruments. Public health initiatives and awareness campaigns reinforce its adoption. Integration with digital health platforms allows streamlined data reporting and tracking of at-risk infants. Rising parental awareness, combined with regulatory mandates, supports consistent demand. Overall, PKU testing continues to be a foundational component of newborn screening programs in North America, maintaining its dominant position.

The Critical Congenital Heart Diseases (CCHD) segment is expected to witness the fastest CAGR of 21.8% from 2025 to 2032, fueled by increasing adoption of pulse oximetry screening in hospitals and clinics. Advancements in portable and automated CCHD screening devices allow rapid, non-invasive, and accurate detection of cardiac defects in newborns. Universal screening mandates and government support programs drive implementation across healthcare facilities. Training programs for clinicians and nurses ensure proper usage and interpretation of results, enhancing adoption. Partnerships between public health authorities and diagnostic companies further facilitate widespread deployment. The growing prevalence of congenital heart conditions and awareness of the importance of early diagnosis are key drivers. Integration with electronic health records enables efficient data management and monitoring of detected cases. Hospitals and pediatric clinics increasingly incorporate CCHD testing into routine newborn care, while parental advocacy encourages compliance. Rising investments in screening infrastructure and continuous technological improvements are expected to sustain high growth in this segment.

- By End User

On the basis of end user, the North America newborn screening market is segmented into hospitals, pediatric clinics, and clinics. Hospitals accounted for the largest market share of 51.3% in 2024, due to their advanced laboratory infrastructure, capacity to handle high volumes of newborn samples, and integration with electronic health records for efficient reporting and follow-up. Hospitals have dedicated staff trained in performing a range of newborn screening tests, enabling consistent and reliable results. They benefit from economies of scale, performing hundreds of tests daily, and can adopt multiple technologies, including tandem mass spectrometry and DNA-based assays, for comprehensive screening. Government-mandated screening programs are often implemented through hospital networks, reinforcing their dominant role. Hospitals also provide continuity of care, follow-up services, and counseling for affected families. Public health initiatives often prioritize hospital-based screening due to accessibility, reliability, and oversight capabilities. Overall, hospitals remain the key end users, leading the North America newborn screening market due to infrastructure, expertise, and high throughput capabilities.

The pediatric clinics segment is projected to witness the fastest CAGR of 20.9% from 2025 to 2032, driven by the increasing adoption of portable and easy-to-use screening devices that allow clinics to provide early testing in outpatient settings. Pediatric clinics benefit from flexible workflows, personalized care, and the ability to collaborate with diagnostic laboratories to perform tests efficiently. Growing awareness among parents about the benefits of early screening encourages clinics to expand their services. Integration of digital reporting systems and remote data submission facilitates timely result tracking and follow-up care. The availability of compact instruments and assay kits allows clinics to perform multiple tests with minimal infrastructure requirements. The increasing focus on preventive healthcare and early detection continues to drive growth in this segment, making pediatric clinics the fastest-growing end-user category in North America.

North America Newborn Screening Market Regional Analysis

- U.S. dominated the North America newborn screening market with the largest revenue share of 80.5% in 2024, supported by strong healthcare infrastructure, mandatory state screening programs, and the presence of advanced diagnostic laboratories

- Canada is expected to be the fastest growing country in the North America newborn screening market during the forecast period, driven by expanding healthcare investments, rising adoption of next-generation sequencing technologies, and growing emphasis on national screening guidelines

- Growing adoption of innovative screening technologies, such as tandem mass spectrometry, DNA-based assays, and automated immunoassays, is further accelerating market growth across the region

U.S. Newborn Screening Market Insight

The U.S. newborn screening market dominated the North American newborn screening market with the largest revenue share of 80.5% in 2024, supported by strong healthcare infrastructure, mandatory state screening programs, and the presence of advanced diagnostic laboratories. Widespread awareness of congenital disorders, high healthcare spending, and early adoption of next-generation screening technologies have contributed significantly to market growth. The integration of advanced diagnostic solutions, along with government-backed public health initiatives, continues to drive the uptake of newborn screening programs across hospitals and pediatric clinics.

Canada Newborn Screening Market Insight

Canada newborn screening market is expected to be the fastest-growing country in the North American newborn screening market during the forecast period, driven by expanding healthcare investments and growing emphasis on national screening guidelines. Rising adoption of next-generation sequencing technologies and other advanced screening solutions is enhancing the accuracy and efficiency of newborn diagnostics. Supportive government initiatives, increased funding for neonatal healthcare, and rising awareness among parents about early detection of congenital disorders are further propelling market growth in the country.

North America Newborn Screening Market Share

The Newborn Screening industry is primarily led by well-established companies, including:

- PerkinElmer (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Natus Medical Incorporated (U.S.)

- Trivitron Healthcare (India)

- Masimo (U.S.)

- Danaher Corporation (U.S.)

- Waters Corporation (U.S.)

- GE HealthCare (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Baebies, Inc. (U.S.)

- BioMarin (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- Illumina, Inc. (U.S.)

Latest Developments in North America Newborn Screening Market

- In August 2025, the state of Texas expanded its newborn screening program to include four new lysosomal storage disorders, bringing the total number of screened conditions to 59. This expansion enables early detection and intervention for these rare genetic disorders, potentially improving health outcomes for affected infants

- In January 2025, the state of Victoria, Australia, expanded its newborn screening program to include screening for galactosaemia, a rare genetic disorder affecting a baby's ability to process sugars found in milk. This addition brings the total number of conditions screened by the test to 32, enhancing early detection and treatment options for newborns

- In October 2025, GeneDx announced the launch of the first U.S. national genomic newborn screening initiative, supported by a USD 14.4 million grant from the National Institutes of Health (NIH). This initiative aims to integrate genomic sequencing into newborn screening programs across the country, enhancing early detection of genetic disorders

- In December 2024, the U.S. Food and Drug Administration (FDA) approved a new tandem mass spectrometry-based diagnostic tool for newborn screening. This device enhances the accuracy and efficiency of detecting metabolic disorders, supporting the broader adoption of advanced screening technologies in neonatal care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.