North America Organic Rankine Cycle (ORC) Waste Heat to Power Market Analysis and Size

The role of organic rankine cycle (ORC) waste heat to power convert the thermal heat of liquids or gases to produce carbon-neutral power efficiently. Heat is generated from geothermal sources or industrial or commercial waste heat. The organic rankine cycle (ORC) waste heat to power help companies to produce more electricity to meet the increasing demand. The rising adoption of organic rankine cycle (ORC) technology reduces fuel used for power generation, and various large-scale companies use these technologies to generate power from waste heat recovery.

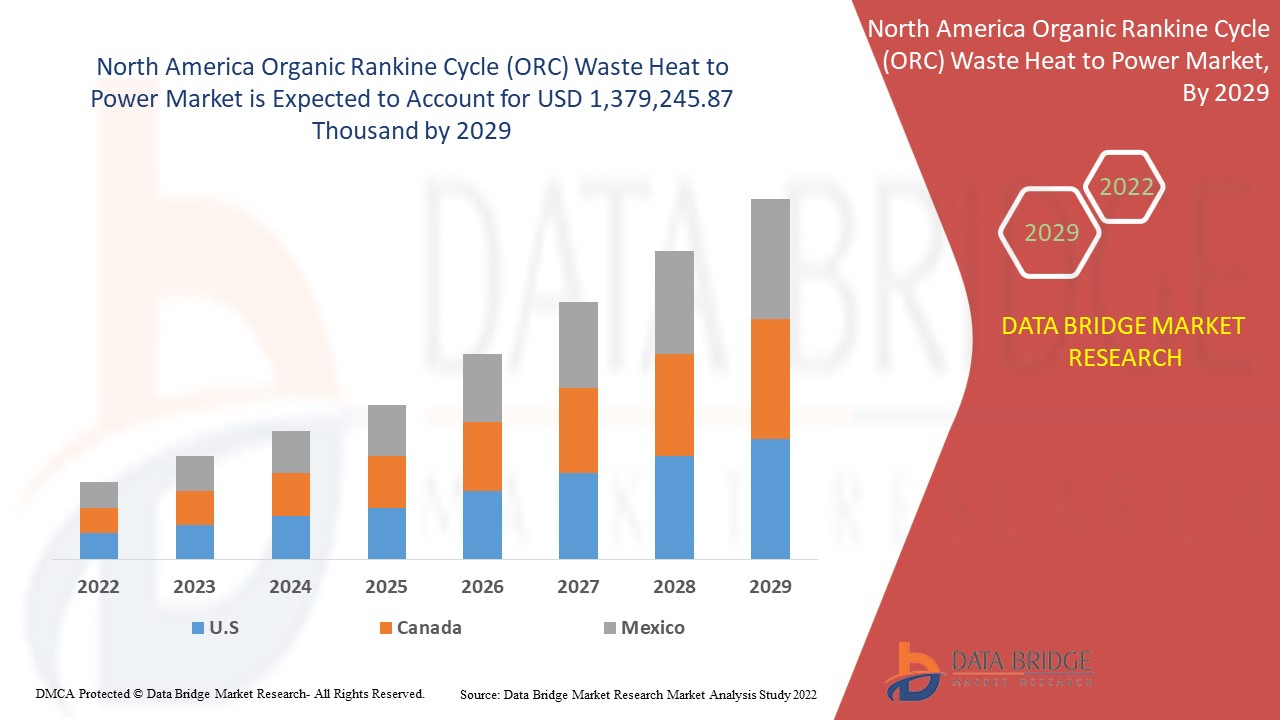

Data Bridge Market Research analyses that the North America organic rankine cycle (ORC) waste heat to power market is expected to reach the value of USD 1,379,245.87 thousand by 2029, at a CAGR of 9.2% during the forecast period. The organic rankine cycle (ORC) waste heat to power market report also comprehensively covers pricing analysis, patent analysis, and technological advancements.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

Segments Covered |

By Size (Small, Medium, Large), Capacity (Less Than 1000 kW, 1001-4000 kW, 4001-7000 kW, More than 7000 kW), Model (Steady-State, Dynamic), Application (ICE or Gas Turbine, Waste to Energy, Metal Production, Cement and Lime Industry, Glass Industry, Petroleum Refining, Chemical Industry, Landfill ICE, Others). |

|

Countries Covered |

U.S., Canada, and Mexico in North America. |

|

Market Players Covered |

MITSUBISHI HEAVY INDUSTRIES, LTD., Kaishan USA, Strebl Energy Pte Ltd, ORCAN ENERGY AG, ALFA LAVAL, Fujian Snowman Co., Ltd., Ormat, Rank, TMEIC, Triogen, ABB, Siemens Energy (Siemens AG), Dürr Group, ElectraTherm Inc. (BITZER Group), Enerbasque, Enertime, Enogia, EXERGY, CLIMEON, INTEC Engineering GmbH, Zuccato Energia srl., Opel Energy Systems Pvt. Ltd., Corycos Group, CTMI - Steam Turbines, BorgWarner Inc. |

Market Definition

Organic rankine cycle (ORC) systems are used for power production from low to medium-temperature heat sources at 80 to 350 °C and for small-medium applications at any temperature. This technology allows for the exploitation of low-grade heat that otherwise would be wasted. The working principle of an organic rankine cycle power plant is similar to the most widely used process for power generation, the clausius-rankine cycle.

The main difference is using organic substances instead of water (steam) as a working fluid. The organic working fluid has a lower boiling point and a higher vapor pressure than water and is, therefore, able to use low-temperature heat sources to produce electricity. The organic fluid is chosen to best fit the heat source according to their differing thermodynamic properties, thus obtaining higher efficiencies of both cycle and expander.

North America Organic Rankine Cycle (ORC) Waste Heat to Power Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Upsurge in the reduction of usage of primary energy in industrial operations

Waste heat to power is one of the adoptable renewable sources to generate electricity. This technique is found to be the most efficient resource to generate power as it helps to reduce the usage of energy or fuels for industrial processes, and the waste heat generated is used to generate emission-free electricity, which is further used in the normal industrial process or sold to the grid for distribution.

The waste heat generated is considered a by-product in most industries, such as steel paper manufacturing, refineries, chemical, and general manufacturing, as the waste heat is produced in industrial operations. Thus, the energy or the cost involved in running the main industrial operation will also generate waste heat that can be dumped into the environment.

- Increased focus on improving the power plant efficiency

The world's electricity generation is majorly dependent on the fossil fuel resources such as coal, natural gas, and oil. The number of installed fossil-fired power generation plants has increased in North America, and the development of such power plants is trending across the globe. However, waste heat is discharged in a power plant and can be dumped in the environment. How recovering the waste heat is the main approach to improve thermal efficiencies further and reduce greenhouse gas emissions for fossil-fired power plants.

Moreover, it is found that adopting technologies to recover waste heat is gaining importance to improve power plant efficiency. Thus, a waste heat ORC system is applied, based on a closed loop thermodynamic cycle for generating electricity and thermal power, which is suitable for plant operations. This system has been found to support various power plant functions such as economizer, heat pump, rotary heat exchanger, regenerator, and many others. This will support the functioning of the power plant and improves its efficiency.

Opportunities

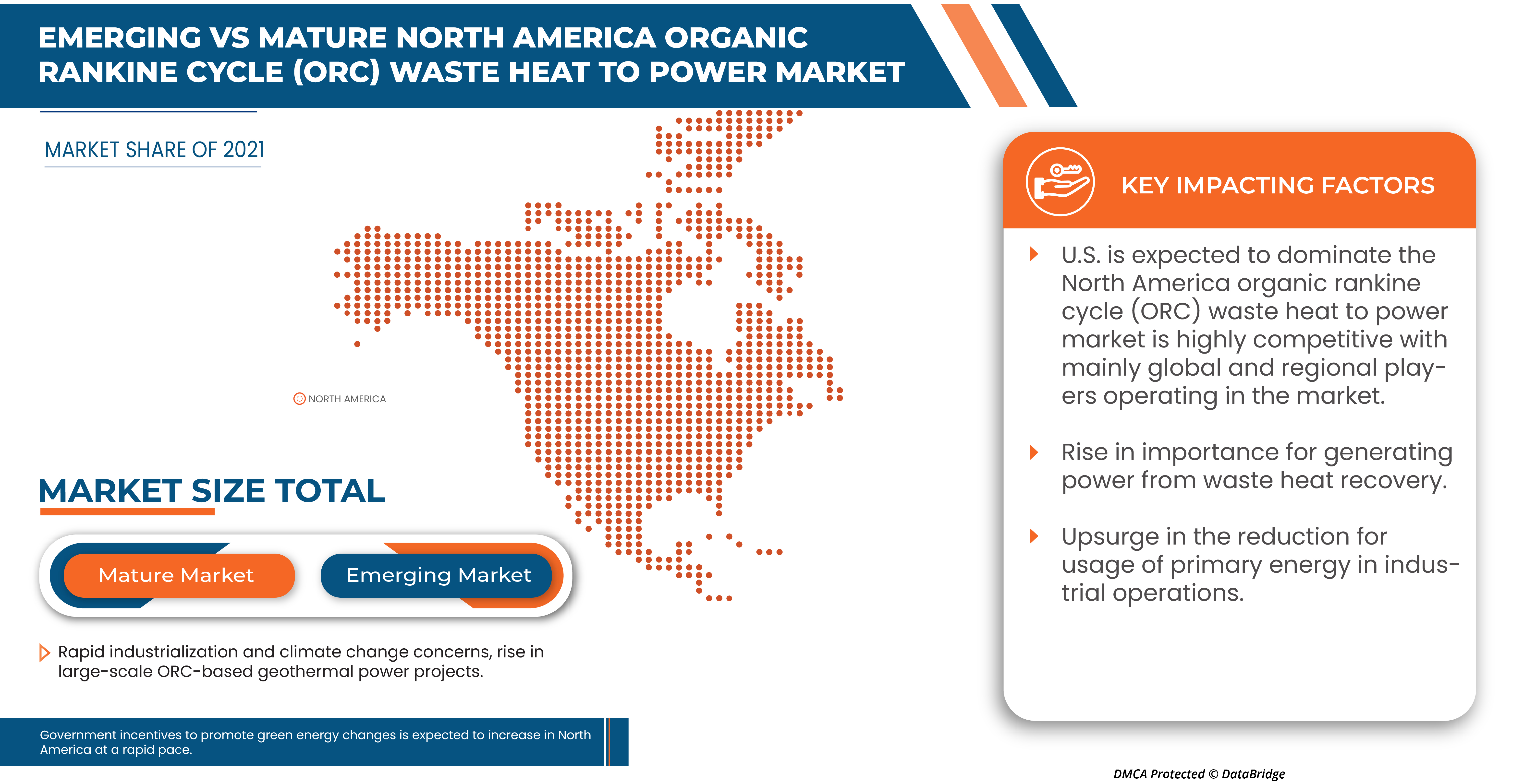

- Rapid industrialization and climate change concerns

Industrialization is a process of adopting an economy based on manufacturing. This step involves many changes that help the society's economy grow and prosper. Industrialization does not seem to have a sudden change, but it takes a gradual change that happens over a period. Thus, indirectly there will be a large number of fossil fuels, which in turn generate the climate.

The cause of climate change has been a serious issue that has been changing with the rapid increase in industrialization. However, industrialization is the route to economic development, but climate change is one of the major concerns that must be controlled. This will lead to adopting sustainable and efficient technologies in the industrial process, including the WHP system. The adoption of such technologies with the increase in industrialization along with the climate change concerns will help to protect the environment.

Restraints/Challenges

- High cost of installation and maintenance

Although waste heat recovery systems have significant advantages, installation costs limit the market growth. The waste heat recovery can be done through various techniques such as steam rankine cycle (SRC), organic rankine cycle (ORC), or kalina cycle. These technologies will cost differently based on the production and industrial sector scale.

Moreover, the total cost to install or adopt the waste heat to power (WHP) systems in any industry includes various factors and equipment such as waste heat recovery equipment, power generation equipment, and power conditioning and interconnection equipment. The total cost would also include the soft costs associated with designing, permitting, and constructing the system. However, the maintenance requirements of the heat recovery boilers and balancing the plant are also included, which can vary according to technology and site conditions.

- Lack of awareness about the technology

The need for waste heat recovery is gaining importance, but knowledge about the awareness, technology, and financial aspects of WHP systems is essential for decision-making. The ultimate goal is to optimize the overall energy efficiency and, thus, maximize the economic and environmental benefits.

However, most industries are adopting the WHP system in industrial operations as most of the industry professionals are unaware of the technical aspects, leading to a misconception, perception, and wrong method implementation, resulting in inefficiency and negative results.

Post COVID-19 Impact on North America Organic Rankine Cycle (ORC) Waste Heat to Power Market

COVID-19 created a negative impact on the organic rankine cycle (ORC) waste heat to power market due to lockdown regulations and rules at manufacturing facilities.

The COVID-19 pandemic has impacted the organic rankine cycle (ORC) waste heat to power market to an extent in a negative manner. However, increasing adoption of organic rankine cycle (ORC) waste heat to power in the energy sector has helped the market grow after the pandemic. Also, the growth has been high since the market opened after COVID-19, and it is expected that there will be considerable growth in the sector.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the organic rankine cycle (ORC) waste heat to power. With this, the companies will bring advanced technologies to the market. In addition, government initiatives for the use of recycling technologies have led to the market's growth

Recent Development

- In September 2020, BorgWarner Inc. entered into a partnership with Plug and Play. The main objective behind this strategic partnership was to enhance inventive ideas in the automotive and tech sector to boost the sector's capabilities to new heights. Through this company expanded its automotive and tech sector market.

- In December 2018, Corycos Group partnered with Clean Energy Technologies, Inc. The partnership aimed to develop an innovative organic rankine cycle (ORC) heat recovery generator for the biogas industry. Through this partnership, both companies strengthen their market and regional presence.

North America Organic Rankine Cycle (ORC) Waste Heat to Power Market Scope

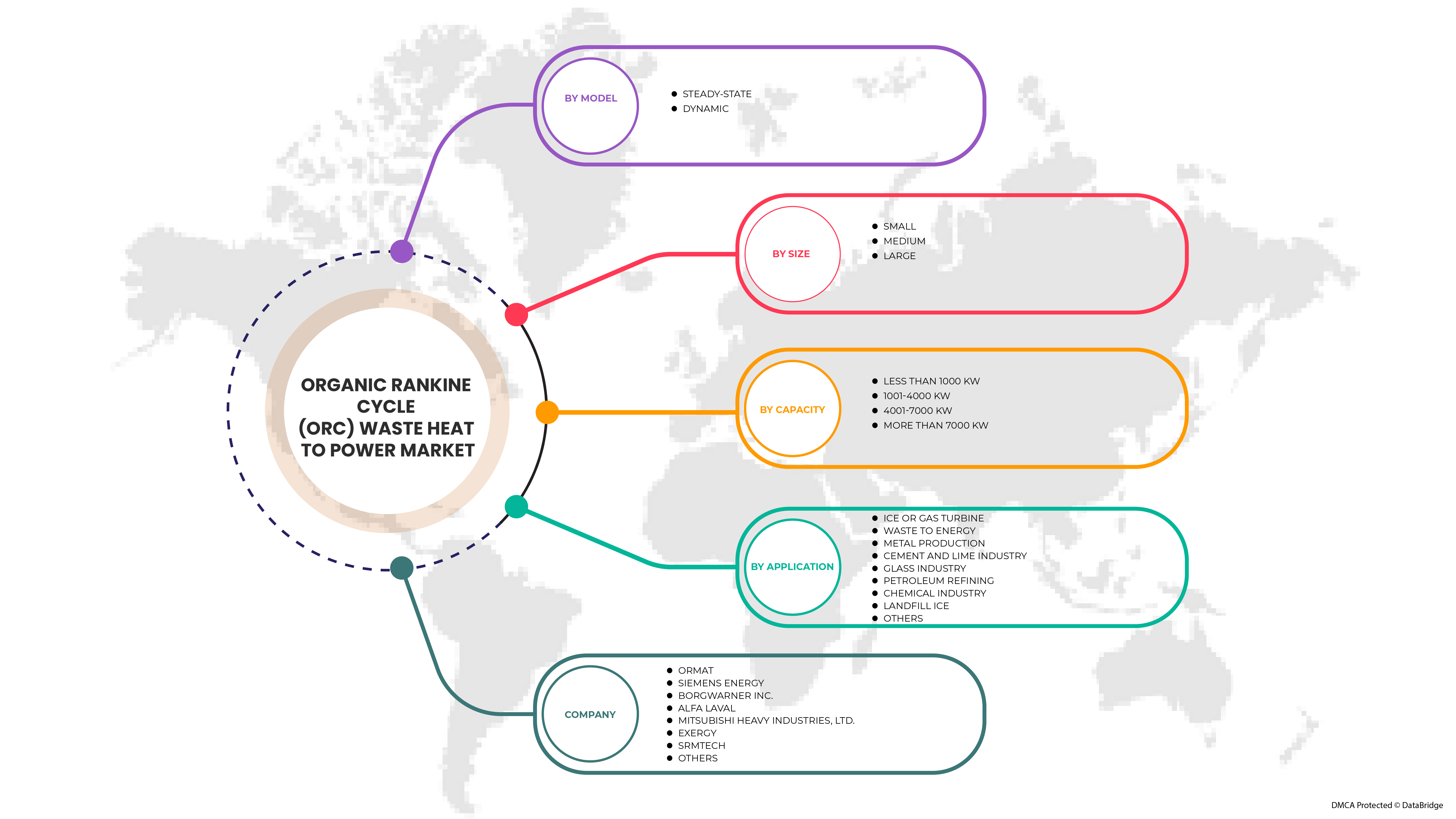

North America organic rankine cycle (ORC) waste heat to power market is segmented on the basis of size, capacity, model, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Size

- Small

- Medium

- Large

On the basis of size, the North America organic rankine cycle (ORC) waste heat to power market is segmented into small, medium, and large.

Capacity

- Less Than 1000 kW

- 1001-4000 kW

- 4001-7000 kW

- More than 7000 kW

On the basis of capacity, the North America organic rankine cycle (ORC) waste heat to power market has been segmented into less than 1000 kW, 1001-4000 kW, 4001-7000 kW, and more than 7000 kW.

Model

- Steady-State

- Dynamic

On the basis of the model, the North America organic rankine cycle (ORC) waste heat to power market has been segmented into steady-state and dynamic.

Application

- ICE or Gas Turbine

- Waste to Energy

- Metal Production

- Cement and Lime Industry

- Glass Industry

- Petroleum Refining

- Chemical Industry

- Landfill ICE

- Others

On the basis of application, the North America organic rankine cycle (ORC) waste heat to power market is segmented into ICE or gas turbine, waste to energy, metal production, cement and lime industry, glass industry, petroleum refining, chemical industry, landfill ICE, and others.

North America Organic Rankine Cycle (ORC) Waste Heat to Power Market Regional Analysis/Insights

North America organic rankine cycle (ORC) waste heat to power market is analyzed, and market size insights and trends are provided by country, size, capacity, model, and application as referenced above.

The countries covered in the organic rankine cycle (ORC) waste heat to power market report are the U.S., Canada, and Mexico.

U.S. dominates the organic rankine cycle (ORC) waste heat to power market owing to the rise in importance of generating power from waste heat recovery.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Organic Rankine Cycle (ORC) Waste Heat to Power Market Share Analysis

North America organic rankine cycle (ORC) waste heat to power market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the organic rankine cycle (ORC) waste heat to the power market.

Some of the major players operating in the North America organic rankine cycle (ORC) waste heat to power market are MITSUBISHI HEAVY INDUSTRIES, LTD., Kaishan USA, Strebl Energy Pte Ltd, ORCAN ENERGY AG, ALFA LAVAL, Fujian Snowman Co., Ltd., Ormat, Rank, TMEIC, Triogen, ABB, Siemens Energy (Siemens AG), Dürr Group, ElectraTherm Inc. (BITZER Group), Enerbasque, Enertime, Enogia, EXERGY, CLIMEON, INTEC Engineering GmbH, Zuccato Energia srl., Opel Energy Systems Pvt. Ltd., Corycos Group, CTMI - Steam Turbines, BorgWarner Inc.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 SIZE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN IMPORTANCE FOR GENERATING POWER FROM WASTE HEAT RECOVERY

5.1.2 UPSURGE IN THE REDUCTION OF USAGE OF PRIMARY ENERGY IN INDUSTRIAL OPERATIONS

5.1.3 INCREASED FOCUS ON IMPROVING THE POWER PLANT EFFICIENCY

5.1.4 RISING STRINGENT EMISSION NORMS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSTALLATION AND MAINTENANCE

5.2.2 SUPPLY DEFICIT OF RAW MATERIALS

5.3 OPPORTUNITIES

5.3.1 RAPID INDUSTRIALIZATION AND CLIMATE CHANGE CONCERNS

5.3.2 RISE IN LARGE-SCALE ORC-BASED GEOTHERMAL POWER PROJECTS

5.3.3 GOVERNMENT INCENTIVES TO PROMOTE GREEN ENERGY CHANGES

5.3.4 INCREASE IN THE ADOPTION OF SUSTAINABLE TECHNOLOGIES ACROSS INDUSTRIES

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS ABOUT THE TECHNOLOGY

6 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE

6.1 OVERVIEW

6.2 MEDIUM

6.3 SMALL

6.4 LARGE

7 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY

7.1 OVERVIEW

7.2 LESS THAN 1000 KW

7.3 1001-4000 KW

7.4 4001 - 7000 KW

7.5 MORE THAN 7000 KW

8 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL

8.1 OVERVIEW

8.2 STEADY-STATE

8.3 DYNAMIC

9 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ICE OR GAS TURBINE

9.2.1 MEDIUM

9.2.2 SMALL

9.2.3 LARGE

9.3 WASTE TO ENERGY

9.3.1 MEDIUM

9.3.2 SMALL

9.3.3 LARGE

9.4 METAL PRODUCTION

9.4.1 MEDIUM

9.4.2 SMALL

9.4.3 LARGE

9.5 CEMENT AND LIME INDUSTRY

9.5.1 MEDIUM

9.5.2 SMALL

9.5.3 LARGE

9.6 GLASS INDUSTRY

9.6.1 MEDIUM

9.6.2 SMALL

9.6.3 LARGE

9.7 PETROLEUM REFINING

9.7.1 MEDIUM

9.7.2 SMALL

9.7.3 LARGE

9.8 CHEMICAL INDUSTRY

9.8.1 MEDIUM

9.8.2 SMALL

9.8.3 LARGE

9.9 LANDFILL ICE

9.9.1 MEDIUM

9.9.2 SMALL

9.9.3 LARGE

9.1 OTHERS

10 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ORMAT

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCTS PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 SIEMENS ENERGY

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SOLUTION PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 BORGWARNER INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCTS PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 ALFA LAVAL

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCTS PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 MITSUBISHI HEAVY INDUSTRIES, LTD

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCTS PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCTS PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 CLIMEON

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCTS PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 CORYCOS GROUP

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCTS PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CTMI - STEAM TURBINES

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCTS PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 DÜRR GROUP

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCTS PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 ENERBASQUE

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 ENERTIME

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCTS PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 ENOGIA

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCTS PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 EXERGY INTERNATIONAL SRL

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCTS PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 ELECTRATHERM (ACQUIRED BY BITZER)

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 INTEC ENGINEERING GMBH

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 KAISHAN USA

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCTS PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 OPEL ENERGY SYSTEMS PVT. LTD.

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCTS PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 ORCAN ENERGY AG

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCTS PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 RANK ORC, S.L.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCTS PORTFOLIO

13.20.3 RECENT DEVELOPMENT

13.21 STREBL ENERGY PTE LTD

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCTS PORTFOLIO

13.21.3 RECENT DEVELOPMENT

13.22 SRMTEC

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENTS

13.23 TMEIC

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCTS PORTFOLIO

13.23.3 RECENT DEVELOPMENTS

13.24 TRIOGEN

13.24.1 COMPANY SNAPSHOT

13.24.2 PRODUCT PORTFOLIO

13.24.3 RECENT DEVELOPMENTS

13.25 ZUCCATO ENERGIA SRL.

13.25.1 COMPANY SNAPSHOT

13.25.2 PRODUCTS PORTFOLIO

13.25.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 EXISTING WHP PROJECTS AND POWER GENERATION CAPACITY BY DIFFERENT INDUSTRIES IN THE U.S.

TABLE 2 ENERGY GENERATION POTENTIAL THROUGH WASTE HEAT IN DIFFERENT SECTORS IN INDIA

TABLE 3 WHP COST COMPARISON

TABLE 4 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA MEDIUM IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA SMALL IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA LARGE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA LESS THAN 1000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA 1001-4000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA 4001-7000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA MORE THAN 7000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA STEADY-STATE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA DYNAMIC IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA LANDFILL ICE INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA OTHERS IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 47 U.S. ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 48 U.S. ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 49 U.S. ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 50 U.S. ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 U.S. ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 52 U.S. WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 53 U.S. METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 54 U.S. CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 55 U.S. GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 56 U.S. PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 57 U.S. CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 58 U.S. LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 59 CANADA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 60 CANADA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 61 CANADA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 62 CANADA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 64 CANADA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 65 CANADA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 66 CANADA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 67 CANADA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 68 CANADA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 69 CANADA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 70 CANADA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 71 MEXICO ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 72 MEXICO ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 73 MEXICO ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 74 MEXICO ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 75 MEXICO ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 76 MEXICO WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 77 MEXICO METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 78 MEXICO CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 79 MEXICO GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 80 MEXICO PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 81 MEXICO CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 82 MEXICO LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: MULTIVARIATE MODELING

FIGURE 11 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SIZE TIMELINE CURVE

FIGURE 12 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SEGMENTATION

FIGURE 13 RISE IN IMPORTANCE FOR GENERATING POWER FROM WASTE HEAT RECOVERY IS EXPECTED TO DRIVE THE NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET IN THE FORECAST PERIOD 2022-2029

FIGURE 14 MEDIUM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET

FIGURE 16 REAL GROSS DOMESTIC PRODUCT (GDP) GROWTH RATE OF INDIA

FIGURE 17 GEOTHERMAL POWER GENERATION IN THE NET ZERO SCENARIO, 2000-2030

FIGURE 18 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET : BY SIZE, 2021

FIGURE 19 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET : BY CAPACITY, 2021

FIGURE 20 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET : BY MODEL, 2021

FIGURE 21 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY APPLICATION, 2021

FIGURE 22 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY SIZE (2022-2029)

FIGURE 27 NORTH AMERICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: COMPANY SHARE 2021 (%)

North America Organic Rankine Cycle Orc Waste Heat To Power Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Organic Rankine Cycle Orc Waste Heat To Power Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Organic Rankine Cycle Orc Waste Heat To Power Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.