North America Outdoor Led Lighting Market

Market Size in USD Billion

CAGR :

%

USD

10.85 Billion

USD

21.54 Billion

2024

2032

USD

10.85 Billion

USD

21.54 Billion

2024

2032

| 2025 –2032 | |

| USD 10.85 Billion | |

| USD 21.54 Billion | |

|

|

|

|

North America Outdoor LED (Light-Emitting Diode) Lighting Market Size

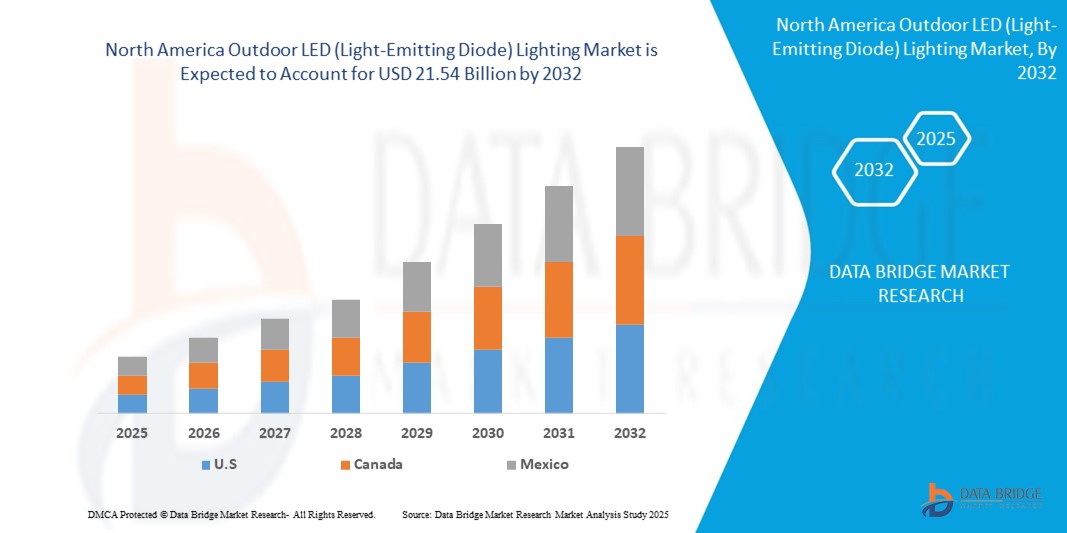

- The North America Outdoor LED (Light-Emitting Diode) Lighting market size was valued at USD 10.85 Billion in 2024 and is expected to reach USD 21.54 Billion by 2032, at a CAGR of8.95% during the forecast period

- The increasing demand for LED lighting due to the modernization and development of infrastructures such as economic corridors and smart cities will influence the growth of the outdoor LED (light-emitting diode) lighting market.

North America Outdoor LED (Light-Emitting Diode) Lighting Market Analysis

- Outdoor LED (light-emitting diode) lighting can be defined as light sources that illuminate or illuminate an outdoor space. Consumers or cities are deploying these lighting solutions in outdoor applications to enhance the beauty and safety of their environment.

- The requirement of improving the visibility and safety of drivers and pedestrians, decrement in the prices of LED, high demand for smart controls in street lighting systems and rising need for energy-efficient lighting systems for highways will enhance the market growth rate.

- U.S. dominates the North America Outdoor LED (Light-Emitting Diode) Lighting market with the largest revenue share of 54.98% in 2025, This significant market dominance is being driven by increasing consumer interest in electric LED light vehicles, coupled with governmental initiatives that actively support green mobility.

- Canada is expected to be the fastest growing region in the North America Outdoor LED (Light-Emitting Diode) Lighting market during the forecast period due a rapid urbanization, rising disposable incomes, and the strengthening of automotive manufacturing hubs within the region. The escalating demand for fuel-efficient and environmentally sustainable light is significantly accelerating market development in Canada.

- The hardware segment is anticipated to hold the largest market share of 61.23% in the North America Outdoor LED (Light-Emitting Diode) Lighting Market during the forecast period. This dominance can be primarily attributed to the enhanced performance and improved fuel efficiency offered by lightweight frames, particularly in diesel-powered commercial and utility LED light, even amidst the ongoing shift towards cleaner energy alternatives.

Report Scope and North America Outdoor LED (Light-Emitting Diode) Lighting Market Segmentation

|

Attributes |

North America Outdoor LED (Light-Emitting Diode) Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Outdoor LED (Light-Emitting Diode) Lighting Market Trends

“Driving Efficiency and Sustainability in Outdoor Infrastructure”

- A key trend shaping the North America Outdoor LED Lighting market is the growing focus on energy efficiency and carbon footprint reduction, with municipalities and commercial entities rapidly replacing traditional lighting systems with LED alternatives.

- The integration of smart lighting technologies, such as motion sensors, adaptive brightness, and remote monitoring, is expanding, offering both energy savings and improved urban safety and security.

- Rising urbanization and smart city initiatives across North America are accelerating the demand for intelligent outdoor lighting systems capable of real-time control and data collection.

- Architectural and landscape lighting applications are increasingly utilizing color-changing and programmable LED solutions to enhance visual appeal while minimizing energy use.

- Continuous innovation in LED chip technology is improving luminosity, durability, and efficiency, further driving adoption across streets, highways, parking areas, and public spaces.

- Government incentives and regulatory mandates for sustainable infrastructure are also influencing procurement and modernization efforts in the public lighting sector.

North America Outdoor LED (Light-Emitting Diode) Lighting Market Dynamics

Driver

“Rising Demand for Energy-Efficient Lighting and Smart City Infrastructure”

- The transition toward energy-efficient and long-lasting lighting solutions is a major driver of market growth in North America, where LED lights offer significant operational cost savings over traditional lighting technologies.

- Growing investments in smart city projects are increasing the deployment of connected outdoor LED lighting systems with IoT integration, enabling automated control and real-time monitoring.

- Environmental sustainability goals and EU directives targeting reductions in energy consumption and CO₂ emissions further support LED lighting adoption across public and private sectors.

- Public safety improvements through better nighttime visibility and adaptive lighting in urban areas contribute to broader acceptance and government funding of outdoor LED projects.

Restraint/Challenge

“High Initial Investment and Infrastructure Compatibility Issues”

- The substantial initial investment required for LED installations and smart lighting systems remains a major barrier, especially for smaller municipalities. Limited financial resources often prevent these communities from adopting modern lighting solutions despite the long-term benefits of energy efficiency and cost savings.

- Challenges also arise from the need to retrofit or replace existing lighting infrastructure, which can be labor-intensive and require significant capital investment.

- Integrating advanced smart lighting technologies with older infrastructure often demands tailored technical solutions. These integrations can be complex and time-consuming, increasing overall project difficulty. Legacy systems may also require significant modifications, raising implementation costs and slowing down deployment timelines.

- Additionally, ensuring cybersecurity and data privacy in connected outdoor lighting systems presents a growing concern, particularly with the expansion of IoT networks.

North America Outdoor LED (Light-Emitting Diode) Lighting Market Scope

The market is segmented on the offering, installation type, wattage and application.

|

Segmentation |

Sub-Segmentation |

|

By Offering |

|

|

By Installation Type |

|

|

By Wattage |

|

|

By Application |

|

North America Outdoor LED (Light-Emitting Diode) Lighting Market Scope

The market is segmented on the basis offering, installation type, wattage and application.

- By Offering

On the basis of offering, the North America Outdoor LED (Light-Emitting Diode) Lighting market is segmented into hardware, software, and services. The hardware segment dominates the largest market revenue share of 61.23% in 2025, the increasing demand for energy-efficient and durable lighting solutions for various outdoor applications. This includes the growing adoption of LED luminaires in street lighting, public spaces, and architectural lighting due to their longevity and reduced energy consumption. Technological advancements in LED chips and materials are also enhancing performance and driving market growth.

The software segment is anticipated to witness the fastest growth rate of 22.31% from 2025 to 2032, smart city initiatives and the demand for connected lighting systems are driving the need for sophisticated software for remote monitoring, control, and energy management. Software solutions allow for dynamic lighting adjustments, predictive maintenance, and integration with other smart infrastructure, optimizing efficiency and reducing operational costs for outdoor LED installations.

- By Installation Type

On the basis of Installation type, the North America Outdoor LED (Light-Emitting Diode) Lighting market is segmented into retrofit installation and new installation. The retrofit installation held the largest market revenue share in 2025 of, driven by the urgent need to replace outdated and energy-inefficient traditional lighting systems. Government regulations promoting energy conservation and the compelling cost savings offered by LEDs are key drivers for this segment. Municipalities and businesses are increasingly undertaking retrofit projects in street lighting, public spaces, and industrial areas to reduce energy consumption, lower maintenance costs, and improve lighting quality, contributing substantially to market volume.

The new installation segment is expected to witness the fastest CAGR from 2025 to 2032, driven by expanding infrastructure development, smart city initiatives, and the construction of new commercial and residential spaces. The inherent energy efficiency, design flexibility, and long lifespan of LED technology make it the preferred choice for modern outdoor lighting projects. Growing awareness of sustainability and the integration of smart lighting features in new developments further fuel the demand for innovative LED solutions in this segment, shaping future urban landscapes.

- By Wattage

On the basis of Wattage, the North America Outdoor LED (Light-Emitting Diode) Lighting market is segmented into Less than 50 watt, 50-150 Watt, More than 150 Watt). The Less than 50 watt in white held the largest market revenue share in 2025, driven by applications requiring lower illumination levels and energy consumption, such as pathway lighting, landscape lighting, and bollards. The increasing focus on aesthetic appeal and energy efficiency in residential and commercial outdoor spaces fuels demand for these lower-wattage LEDs. Advancements in LED technology allow for compact and stylish designs with sufficient light output, making them ideal for decorative and ambient lighting while minimizing energy usage and light pollution in urban and suburban environments.

The 50-150 Watt segment held a significant market share in 2025. This power range offers a balance between adequate illumination and energy efficiency for larger outdoor spaces. Government initiatives promoting energy-efficient public infrastructure and the long-term cost benefits of LEDs are key factors propelling the adoption of these mid-power LED fixtures for enhanced visibility, safety, and reduced operational expenses in urban and industrial settings across North America.

- By Application

On the basis of application, the North America Outdoor LED (Light-Emitting Diode) Lighting market is segmented into highway and roadway, architectural and public places, Others. The highway and roadway segment accounted for the largest market revenue share in 2024 and it is expected to witness the fastest CAGR from 2025 to 2032. The highway and roadway segment is a major driving force in the North America Outdoor LED Lighting market. The critical need for enhanced visibility and safety on roadways, coupled with the substantial energy savings and reduced maintenance offered by LEDs, is fueling widespread adoption. Government mandates and initiatives focused on improving road infrastructure and reducing energy consumption are accelerating the replacement of traditional lighting with energy-efficient LED luminaires. This transition not only improves driving conditions but also contributes significantly to lowering carbon emissions and operational costs for transportation authorities across North America.

U.S. North America Outdoor LED (Light-Emitting Diode) Lighting Market Insight

The U.S. North America Outdoor LED (Light-Emitting Diode) Lighting market captured the largest revenue share and dominates the market with 54.98% within North America in 2025, fueled by the strong government support for energy efficiency and smart city initiatives. A high adoption rate of outdoor led (light-emitting diode) lighting further drives demand for advanced lighting solutions. Robust infrastructure development and stringent energy regulations favor the deployment of long-lasting, energy-saving LED technologies in public spaces, roadways, and industrial areas, solidifying U.S. leading position.

Canada North America Outdoor LED (Light-Emitting Diode) Lighting Market Insight

The Canada North America Outdoor LED (Light-Emitting Diode) Lighting market is poised to grow at the fastest CAGR of over 22.61% in 2025, driven by increasing investments in smart city infrastructure and a strong commitment to energy efficiency, Canada is actively upgrading its public lighting systems with LED technology. Furthermore, the preparation for major international sporting events like the Olympics spurred significant investments in modernizing stadiums and public spaces with advanced LED lighting solutions, contributing to market expansion..

North America Outdoor LED (Light-Emitting Diode) Lighting Market Share

The North America Outdoor LED (Light-Emitting Diode) Lighting industry is primarily led by well-established companies, including:

- Signify (Philips Lighting) (Netherlands)

- Osram GmbH (Germany)

- Cree Lighting (U.S.)

- Zumtobel Group (Austria)

- Acuity Brands, Inc. (U.S.)

- Hubbell Incorporated (U.S.)

- Dialight PLC (U.K.)

- Syska LED (India)

- Nichia Corporation (Japan)

- Samsung LED (South Korea)

- Everlight Electronics (Taiwan)

- Delta Electronics, Inc. (Taiwan)

- Halco Lighting Technologies (U.S.)

- Evluma (U.S.)

- Virtual Extension (Israel)

Latest Developments in North America Outdoor LED (Light-Emitting Diode) Lighting Market

- In April 2025, Signify (formerly Philips Lighting) introduced its new range of Smart Solar LED Street Lights in North America. The product line combines high efficiency LED modules with intelligent controls and solar power integration, designed for sustainable urban infrastructure and energy-saving initiatives. The lights feature remote monitoring, adaptive brightness controls, and durable weather resistant casings, targeting municipalities focused on reducing carbon footprints and operational costs. This launch directly addresses rising urbanization and government initiatives promoting smart cities and clean energy adoption.

- In March 2025, Acuity Brands announced the acquisition of Archipelago Lighting, a California-based manufacturer known for innovative commercial and industrial LED solutions. This acquisition strengthens Acuity's position in the outdoor LED segment, enabling it to broaden its product offerings for parking lots, street lighting, and large outdoor venues. Archipelago's established distribution channels and strong presence in the western U.S. are expected to enhance Acuity’s geographic reach and market share. The move aligns with Acuity’s strategy of combining innovation with sustainability in outdoor lighting systems.

- In February 2025, Cree Lighting launched its new AI-powered adaptive LED outdoor lighting system designed for public parks and campuses. The system utilizes sensors and AI algorithms to adjust brightness levels in real-time based on pedestrian movement, ambient light, and weather conditions. This innovation enhances public safety, extends product life, and reduces energy usage by up to 40%. The solution positions Cree as a front-runner in intelligent lighting, responding to increasing demand for smart and connected outdoor environments in North America.

- In January 2025, GE Current entered into a partnership with Ameresco, a leading clean tech integrator, to implement large-scale municipal outdoor LED lighting projects across North America. The collaboration focuses on providing turnkey solutions that include energy audits, lighting design, installation, and long-term maintenance. Targeted cities include those in New York, Texas, and California with aggressive energy efficiency goals. The partnership is aimed at accelerating LED adoption and helping municipalities transition to sustainable, cost-efficient outdoor lighting infrastructures.

- In December 2024, Hubbell Lighting announced a strategic distribution agreement with Rexel Canada to expand the availability of its outdoor LED products across Canadian provinces. The partnership will include the distribution of commercial-grade LED area lights, floodlights, and pathway lighting products. This move is intended to meet growing demand in the Canadian market, driven by infrastructure upgrades and green building incentives. The expanded distribution enhances Hubbell’s competitive edge in the North American outdoor LED lighting segment by ensuring broader product accessibility and faster delivery times.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Outdoor Led Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Outdoor Led Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Outdoor Led Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.