North America Pharmaceutical Packaging Testing Equipment Market

Market Size in USD Million

CAGR :

%

USD

1,921.43 Million

USD

4,573.60 Million

2024

2032

USD

1,921.43 Million

USD

4,573.60 Million

2024

2032

| 2025 –2032 | |

| USD 1,921.43 Million | |

| USD 4,573.60 Million | |

|

|

|

|

Pharmaceuticals Packaging Testing Equipment Market Size

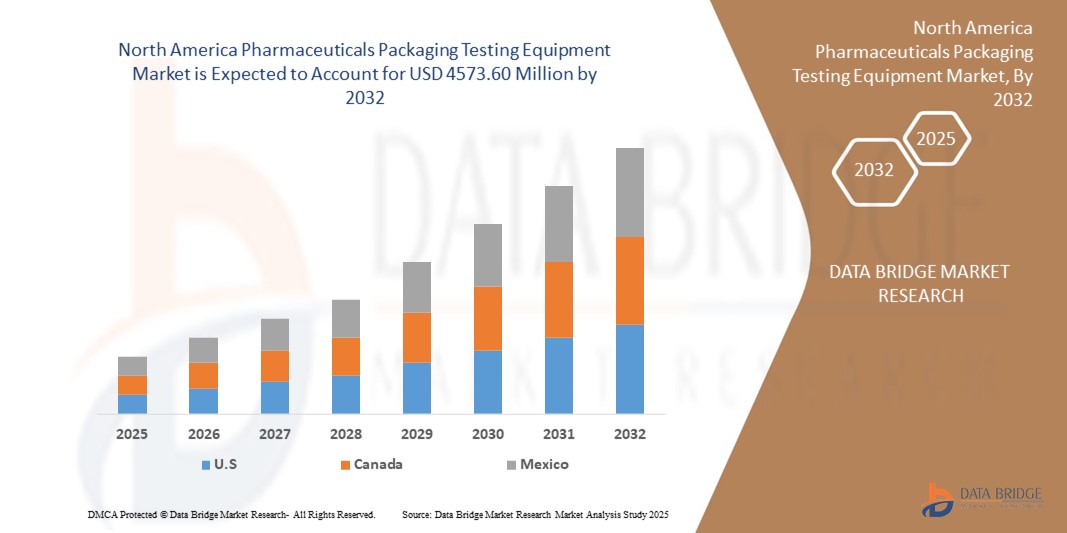

- The North-America Pharmaceuticals Packaging Testing Equipment Market was valued at USD 1,921.43 Million in 2024 and is expected to reach USD 4,573.60 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 11.50%, primarily driven by rise in demand for Pharmaceuticals Packaging Testing Equipment by the chemical and petrochemical industry in developed and developing economies

- This growth is driven by factors such as rise in the generics and biopharmaceuticals sectors across the globe

Pharmaceuticals Packaging Testing Equipment Market Analysis

- Pharmaceuticals Packaging Testing Equipment are critical tools used to ensure the integrity, durability, and compliance of packaging materials with pharmaceutical industry standards, focusing on parameters such as seal strength, leak detection, and material resistance

- The market growth in North-America is driven by stringent regulatory frameworks such as the EU’s Falsified Medicines Directive (FMD) and increased emphasis on patient safety, which necessitate robust packaging validation processes across pharmaceutical manufacturing

- U.S., U.S., and the U.K. are key contributors to the region's growth, owing to their strong pharmaceutical sectors, advancements in testing technologies, and growing investment in healthcare infrastructure

- For instance, in November 2023, U.S.’s Federal Institute for Drugs and Medical Devices introduced updated packaging validation protocols for sterile products, fueling the demand for advanced Pharmaceuticals Packaging Testing Equipment across manufacturing facilities.

Report Scope and Pharmaceuticals Packaging Testing Equipment Market Segmentation

|

Attributes |

Pharmaceuticals Packaging Testing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North-America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pharmaceuticals Packaging Testing Equipment Market Trends

“Emphasis on Compliance, Data Integrity, and Automation in Testing Processes”

- Growing regulatory pressure from agencies such as the EMA (North-Americaan Medicines Agency) and MHRA is driving demand for advanced packaging testing solutions that ensure data integrity, repeatability, and compliance with Good Manufacturing Practice (GMP) standards

- Increasing adoption of fully automated and integrated packaging testing equipment enables real-time monitoring, traceability, and consistent quality across pharmaceutical production lines

- Innovations in non-destructive testing (NDT) technologies, such as vacuum decay, laser-based leak detection, and high-resolution imaging, are improving test accuracy without damaging packaging

- For instance, in February 2024, Sepha Ltd. launched a new generation of vacuum decay testers in the EU market, compliant with USP <1207> standards and equipped with digital data logging systems to support regulatory audits

- This trend reflects the industry’s broader shift toward digitized, standardized, and highly compliant testing infrastructure to meet stringent pharmaceutical packaging validation requirements

Pharmaceuticals Packaging Testing Equipment Market Dynamics

Driver

“Stringent Regulatory Compliance and Increasing Product Safety Requirements”

- North-Americaan pharmaceutical companies face rigorous packaging validation protocols under EU regulations such as FMD, GDP, and MDR, necessitating high-precision testing equipment

- Rising public and regulatory focus on preventing counterfeit drugs and ensuring product stability across the supply chain is further fueling demand

- The region’s strong pharmaceutical R&D and manufacturing base, especially in U.S., Switzerland, and Belgium, supports continued investments in testing technologies

- For instance, the North-Americaan Medicines Verification System (EMVS) mandates serialization and tamper-evident features on packaging, driving adoption of inspection and seal integrity testing systems

- These compliance-driven factors are crucial in sustaining market growth across North-America

Opportunity

“Digital Transformation and Customization of Packaging Testing Systems”

- The push toward Industry 4.0 is creating opportunities for integrating IoT, AI, and cloud-based platforms in packaging test equipment, enabling predictive maintenance and real-time performance tracking

- Increased demand for customized, application-specific testing equipment to support biologics, vaccines, and sterile injectables presents lucrative opportunities for manufacturers

- Expanding biopharmaceutical production and investments in smart manufacturing by companies in the EU are boosting the demand for technologically advanced and adaptive equipment

For instance

- In January 2024, Bosch Packaging Technology introduced an AI-enabled modular testing platform tailored for EU-based vaccine manufacturers, offering adaptive testing for varied container types

- This shift toward intelligent, flexible systems positions North-America as a hub for innovation in pharmaceutical testing solutions

Restraint/Challenge

“High Equipment Costs and Complex Integration into Legacy Systems”

- The advanced nature of pharmaceuticals packaging testing equipment results in high capital investment, which may deter small and mid-sized enterprises (SMEs) from adoption

- Integration of new testing technologies into older production lines often requires significant customization, system upgrades, and training, increasing operational complexity

- Compliance with evolving EU and international standards often involves costly revalidation of equipment and test methods

For instance,

- According to a 2023 report by the North-Americaan Federation of Pharmaceutical Industries and Associations (EFPIA), over 60% of mid-sized firms cited cost and integration complexity as major barriers to equipment modernization

- These factors emphasize the need for scalable, cost-effective solutions tailored to both large enterprises and SMEs in the North-Americaan pharmaceutical landscape

Pharmaceuticals Packaging Testing Equipment Market Scope

The market is segmented on the basis of type and end users.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By End User |

|

Pharmaceuticals Packaging Testing Equipment Market Regional Analysis

“U.S. is the Dominant Region in the Pharmaceuticals Packaging Testing Equipment Market”

- U.S. dominates the Pharmaceuticals Packaging Testing Equipment market, driven by its status as a hub for pharmaceutical manufacturing, research, and regulatory compliance

- The country’s strong presence of global pharmaceutical firms, advanced healthcare infrastructure, and commitment to GMP standards drive demand for high-precision packaging testing solutions

- U.S.’s emphasis on serialization, anti-counterfeiting measures, and sustainability in pharmaceutical packaging aligns with increasing investments in non-destructive and automated testing technologies

- Additionally, the presence of leading equipment manufacturers and active government support for pharmaceutical innovation reinforce U.S.’s market dominance in the region

“U.S. is Projected to Register the Highest Growth Rate”

- U.S. is anticipated to record the fastest growth in the Pharmaceuticals Packaging Testing Equipment market, driven by expanding biologics production and rising domestic pharmaceutical exports

- Increasing regulatory scrutiny under the North-Americaan Medicines Agency (EMA) and growing adoption of eco-friendly and recyclable packaging solutions are pushing demand for advanced testing systems

- Government initiatives promoting innovation in pharmaceutical technologies, combined with the growth of contract manufacturing organizations (CMOs), are accelerating equipment uptake

- The country's focus on digital transformation in pharmaceutical manufacturing—including real-time monitoring and traceability—further fuels the adoption of smart, integrated testing equipment across production lines

Pharmaceuticals Packaging Testing Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- LABTHINK (China)

- UNION PARK CAPITAL (United States)

- WEST PHARMACEUTICAL SERVICES INC. (United States)

- Qualitest International Inc. (United States)

- AMETEK Sensors, Test & Calibration (STC) (United States)

- TEN-E (United States)

- PTI Packaging Technologies and Inspection (United States)

- AMRI (United States)

- Westpak Inc. (United States)

- Eurofins Scientific (Luxembourg)

- Intertek Group plc (United Kingdom)

- Cryopak (Canada)

- SGS (Switzerland)

- TASI Group (United States)

- Edwards Analytical (United Kingdom)

- NSF International (United States)

- LLC (United States)

Latest Developments in North-America Pharmaceuticals Packaging Testing Equipment Market

- In February 2024, Mecmesin Ltd. (UK) introduced a next-generation automated packaging seal integrity tester designed specifically for pharmaceutical blister packs and sachets. The system features improved precision, real-time data logging, and compliance with EU GMP Annex 1 standards, supporting stringent quality control requirements for pharmaceutical manufacturers across North-America.

- In March 2024, Shimadzu North-America GmbH launched its enhanced i-Series Plus testing platform featuring ultra-high sensitivity for leak and seal strength testing in pharmaceutical blister and pouch packaging. The platform integrates with digital audit trail systems to ensure compliance with EU Annex 11 and FDA 21 CFR Part 11 regulations

- In January 2024, Sepha Ltd. (UK) unveiled a new non-destructive leak detection system named VisionScan 3D, utilizing 3D sensor technology and machine learning algorithms to detect micro-leaks in pharmaceutical blister packs. This innovation is aimed at improving testing efficiency while reducing product waste

- In December 2023, Labthink Instruments Co., Ltd. opened a North-Americaan service and demo center in U.S. to expand its footprint and offer localized support for its pharmaceuticals packaging testing solutions, including gas permeability testers and burst testers. The expansion reflects increasing demand for high-precision quality control equipment in the North-Americaan pharma sector

- In November 2023, Mocon North-America (a division of AMETEK) introduced a revamped series of oxygen and moisture vapor transmission rate (OTR/MVTR) analyzers for pharmaceutical films and foils. The new units offer faster testing cycles and enhanced sensitivity, addressing the needs of North-Americaan pharmaceutical firms adhering to stringent stability and shelf-life standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Pharmaceutical Packaging Testing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Pharmaceutical Packaging Testing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Pharmaceutical Packaging Testing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.