North America Plant Breeding and CRISPR Plant Market Analysis and Insights

Plant breeding & CRISPR plants are important to create new variety plants with better germplasm and which offer superior traits such as high yield, better quality crop, disease resistance and others. Plant breeding & CRISPR plants are important for farmers in Latin America in order to produce high yield crops to fulfil the growing demand of population. Also, plant breeding & CRISPR plants are required to fulfil the growing demand of increasing population in Latin America is the main factor driving the market. Thus many company are expanding their manufacturing facilities to fulfil the higher demand of new variety products among Latin America farmers.

The factors driving the growth of the market are growing awareness regarding the benefits of plant breeding & CRISPR plants in agricultural sector and also high adoption rate of plant breaded crop in Latin America region. The factors which are restraining the growth of the plant breeding & CRISPR plants are the increase in awareness regarding the presence of undesired toxins present in plant breeding crops which can potentially hazardous to the human health.

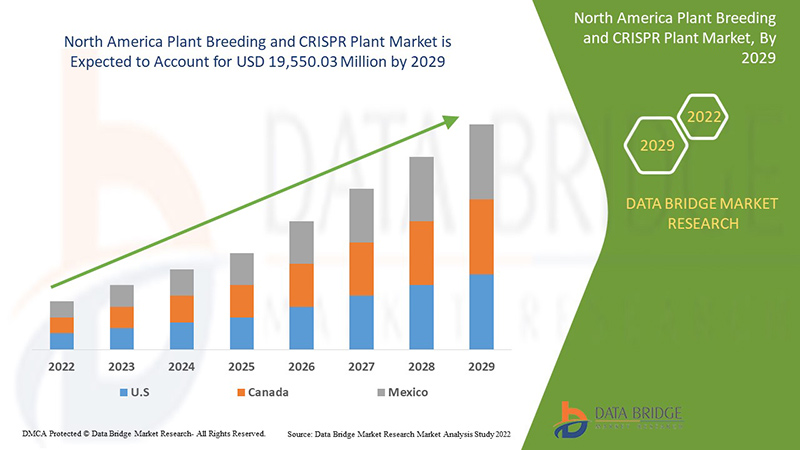

Data Bridge Market Research analyzes that the North America plant breeding and CRISPR plant market is expected to reach the value of USD 19,550.03 million by 2029, at a CAGR of 17.3% during the forecast period. Type accounts for the largest type segment in the market due to rapid demand of plant breeding & CRISPR plants North America. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Type (Conventional Method, Biotechnological Method and Genetic Engineering), Trait (Herbicide Tolerance, Disease Resistance, Yield Improvement, Temperature Tolerance, Grain Size Improvement, Stress Tolerance, Drought Resistance and Others), Application (Cereals & Grains, Oilseed & Pulses, Fruits & Vegetables, Cash crops, Turf & Ornamental, Herbs & Microgreens, Medicinal Crops and Others) |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

BAYER AG, Syngenta Crop Protection AG, Corteva, BASF SE, Limagrain, DLF, Bioceres Crop Solutions, KWS SAAT SE & Co. KGaA, Stine Seed Company. (A subsidiary of Stine Seed Farm, Inc), RAGT, InVivo, pairwise, TMG Tropical Improvement & Genetics SA, SAKATA SEED CORPORATION, DONMARIO, UPL, Benson Hill Inc. , Yield10 Bioscience, Inc., Tropic among others. |

North America Plant Breeding and CRISPR Plant Market Definition

Plant breeding is technique used by cultivator to develop or improve the crop variety and to increase its yield by manipulating the plant genome with the help of conservatory or molecular tools in order to get the desired gene or trait. Plant breeding technique uses site directed nucleases to transform or target the DNA into desired DNA with extreme perfection. CRISPR is a technology used in plant breeding, where a CRISPR-Cas gene derived from the prokaryote is use to alter the plant genome in order to create the germplasm with superior and beneficial traits. The crop produced by plant breeding or CRISPR technology possess traits such as high yield, better quality than traditional crop, disease resistance, herbicide tolerance, climatic tolerance and others. Additionally, the plant breeding methods are used to create crop which offer variety of benefits such as, higher yield, better quality disease resistance and others. Also, plant breeding and CRISPR technique is the best option for the sustainable crop production.

North America Plant Breeding and CRISPR Plant Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rise In R&D For Plant Breeding & CRISPR Plants

Plant breeding is a technique to change the traits of plants by introducing the desired traits in the plants by targeting and transforming the DNA with extreme perfection. Plant breeding is used to enhance the crop production and to improve the nutritional quality of crop for human or animal consumption. CRISPR is one of the main and important technology used in plant breeding as it offers applications such as improved quality, yield, provide disease and herbicide resistance. With the increase in demand of modified crops in order to increase the yield and enhance the quality of crop and to reduce the crop damage, there is in increase in the research and development for plant breeding & CRISPR plants in region. The growing demand of crops or plants produced by plant breeding or CRISPR technique among farmers in to produce high quality crop is leading to the growth of research & development for plant breeding & CRISPR plants.

The increase in the research and developments activity for plant breeding and CRISPR plants is increasing the growth of plant breeding & CRISPR plants in region.

- Surge In Population Leading To Increase The Demand Of Food Production

The growing population is one of the main driving factor for the plant breeding & CRISPR plants. As with the growing population the demand for the food is increasing and there are more number of people to feed which is increasing the need for new technology i.e. plant breeding. The increased demand of food can be fulfilled by increasing the yield of the crop and also by improving the quality, which is only possible with the plant breeding and CRISPR technology. The demand for improved plant varieties is increasing among farmers as well as people to eliminate the food scarcity problem with growing population in North America. The plant breeding & CRISPR plants is the only way to increase the production of crop with better quality to feed more number of mouths in North America. Thus, rising population is increasing the demand of plant breeding & CRISPR plants market.

Therefore, the increase in population is creating the demand of more crop production which leads to the growth of the plant breeding & CRISPR plants market in North America.

Restraint

- High Costs Associated With The Modern Breeding Techniques As Compared To Conventional Breeding Techniques

Conventional breeding relies on mixing traits from different populations within a species and then selecting the entire natural plant for genetic elements. Modern breeding methods often involve in vitro techniques and/or molecular biology in one or more stages of the breeding process. This article describes several techniques including embryo rescue, in vitro selection, somaclonal variation, double haploids and chromosome elimination, and transformation/genetic engineering. Plant breeding is often referred to as a numbers game, and major competitive commodity programs invest heavily in efficient seed treatment, planting, grading, and harvesting methods. As genetic gains accumulate, the bar is gradually raised, and greater and greater investment is required to keep genetic development stable.

Opportunity

-

Fluctuating Whether Condition Will Increase The Opportunity For Plant Breeding & CRISPR Technique

Fluctuating whether conditions is damaging the crop and results in major crop loss which is creating the opportunity for plant breeding & CRISPR plants in North America. As with the help of plant breeding & CRISPR technique the tolerance against the climatic condition such as drought, heavy rainfall and others could be developed which will help resisting the climatic loss to crops. The demand of new variety of crop which offers resistance against harsh climatic condition is on rise which is creating the opportunities for plant breeding & CRISPR plants in North America. The increase in loss of crop due to harsh climatic condition is creating the major opportunities for the market.

Therefore, the increase in number of crop damage due to harsh climatic condition is increasing the demand of plant breeding & CRISPR plants and creating the opportunity for the plant breeding & CRISPR plants market.

Challenge

- Unorganized Retail Network

The retail network of agriculture has witnessed a drastic transformation over the period of time. It has grown from a short cycle to complicated and complex chain. With is fast growth in agriculture retail sector, it has created gaps in the supply chain and leave them ineffective. The unorganized retail network includes

- Poor management quality

- Exhausting procurement process

- Highly developed technologies

- Poor assortment & high pricing

- Lack of understanding of high technology instruments

Retail network contributes to the larger segment of agriculture and this unorganized and high developed retail sector is affecting the small farmers and local farmers as well. The highly developed equipment and lack of knowledge about them makes it hard for the small farmers.

Post-COVID-19 Impact on North America Plant Breeding and CRISPR Plant Market

The COVID-19 pandemic has had little impact on the plant breeding and CRISPR Plants market, owing primarily to transportation constraints. The government has exempted all types of agricultural activities from the impact of lockdowns or disruptions, so there has been no such effect of the corona outbreak. Indeed, agrochemical companies have made double-digit profits compared to last year, owing to farmers' panic buying. Growing farmer awareness of the benefits of plant breeding has resulted in government support. Multiple seed banks are managed by developing-country governments at the national and village levels in order to store seeds that have been properly treated with seed treatment chemicals, preventing seed rotting.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launch and strategic partnerships to improve the technology and test results involved in the pharmaceutical medical display market.

Recent Developments

- In August 2022, Bayer expanded existing investment to acquire majority stake in sustainable low-carbon oilseed producer CoverCress Inc. This investment fulfilled Bayer's sustainability commitments and can help reduce agricultural carbon emissions and reduce dependence on nitrogen fertilizers by leveraging the expertise of existing investors, Bunge and Chevron/farmers to gain new revenue streams through the potential commercialization of oilseeds into renewable fuels and animal feed that deliver ecosystem benefits through cover crops, leveraging Bayer's existing investment in CoverCress Inc.. This has helped company to expand its business.

North America Plant Breeding and CRISPR Plant Market Scope

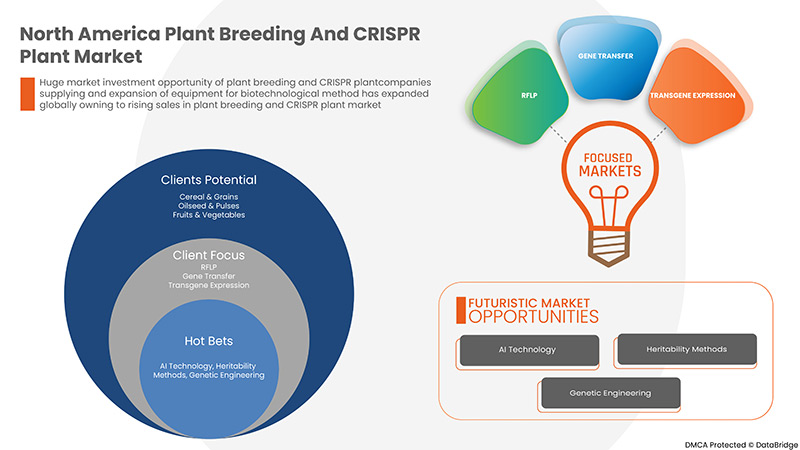

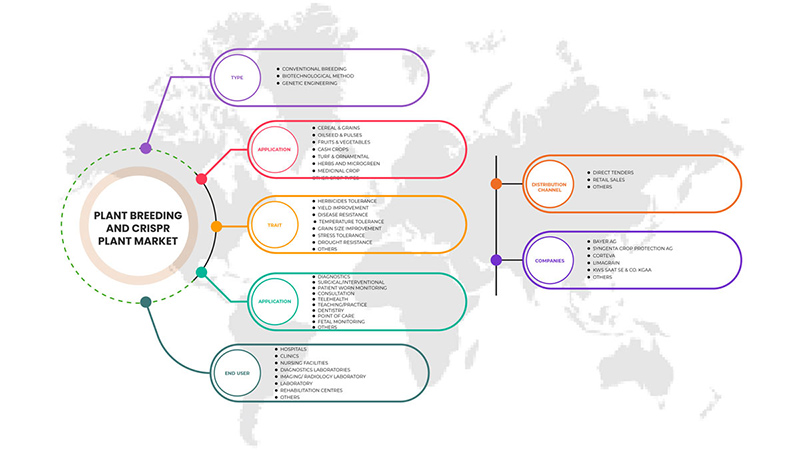

North America plant breeding and CRISPR plant market is segmented into type, trait and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE

- CONVENTIONAL BREEDING

- BIOTECHNOLOGICAL METHOD

- GENETIC ENGINEERING

On the basis of type, the North America plant breeding and CRISPR plant market is segmented into conventional breeding, biotechnological method and genetic engineering.

NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT

- HERBICIDES TOLERANCE

- YIELD IMPROVEMENT

- DISEASE RESISTANCE

- TEMPERATURE TOLERANCE

- GRAIN SIZE IMPROVEMENT

- STRESS TOLERANCE

- DROUGHT RESISTANCE

- OTHERS

On the basis of traits, the plant breeding & CRISPR plants market is segmented into herbicides tolerance, disease resistance, yield improvement, temperature tolerance, grain size improvement, stress tolerance, drought resistance, others

- NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION

- CEREALS & GRAINS

- OILSEED & PULSES

- FRUITS & VEGETABLES

- CASHCROPS

- TURF & ORNAMENTAL

- HERBS AND MICROGREENS

- MEDICINAL CROPS

- OTHERS CROP TYPES

On the basis of application, plant breeding & CRISPR plants market is segmented into cereals & grains, oilseeds & pulses, fruits and vegetables, cashcrops, turf and ornamental, herbs and microgreens, medicinal crops and others.

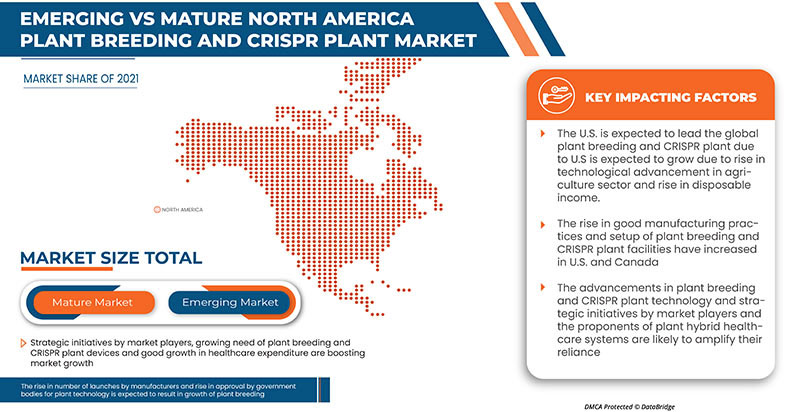

North America Plant Breeding and CRISPR Plant Market Regional Analysis/Insights

The North America plant breeding and CRISPR plant market is analyzed and market size information is provided type, trait and application.

The countries covered in this market report are U.S., Canada, and Mexico.

In 2022, U.S. is dominating due to the presence of key market players in the largest consumer market with high GDP.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Plant Breeding and CRISPR Plant Market Share Analysis

North America plant breeding and CRISPR plant market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the North America plant breeding and CRISPR plant market.

Some of the key players operating in the North America plant breeding and CRISPR plant market are BAYER AG, Syngenta Crop Protection AG, Corteva, BASF SE, Limagrain, DLF, Bioceres Crop Solutions, KWS SAAT SE & Co. KGaA, Stine Seed Company. (A subsidiary of Stine Seed Farm, Inc), RAGT, InVivo, pairwise, TMG Tropical Improvement & Genetics SA, SAKATA SEED CORPORATION, DONMARIO, UPL, Benson Hill Inc. , Yield10 Bioscience, Inc., Tropic among others.

Research Methodology: North America Plant Breeding and CRISPR Plant Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America vs Regional, and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET: CONSUMER BUYING BEHAVIOUR

3.1.1 RECOMMENDATIONS FROM FAMILY & FRIENDS-

3.1.2 RESEARCH

3.1.3 IMPULSIVE

3.1.4 ADVERTISEMENT:

3.1.5 TELEVISION ADVERTISEMENT

3.1.6 ONLINE ADVERTISEMENT

3.1.7 IN-STORE ADVERTISEMENT

3.1.8 OUTDOOR ADVERTISEMENT

4 SUPPLY CHAIN OF NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET

4.1 BAYER

4.1.1 PROCUREMENT

4.1.2 SUSTAINABILITY IN THE SUPPLY CHAIN

4.1.3 BAYER TRANSPORTATION AND ENVIRONMENT SAFETY IN SUPPLY CHAIN-

4.2 SYNGENTA GROUP

4.2.1 WORKING WITH SUPPLIERS

4.2.2 KEY PERFORMANCE INDICATORS AND BASIS OF PREPARATION-

4.3 UPCOMING TRENDS

5 BRAND COMPETITIVE ANALYSIS NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET

6 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN R&D FOR PLANT BREEDING & CRISPR PLANTS

7.1.2 THE SURGE IN THE NORTH AMERICA POPULATION LED TO AN INCREASE IN THE DEMAND FOR FOOD PRODUCTION

7.1.3 RISE IN AWARENESS ABOUT PLANT BREEDING & CRISPR PLANTS THROUGH VARIOUS PROGRAMMES

7.1.4 RISING IN NUMBER OF LAUNCHES BY MANUFACTURERS FOR PLANT BREEDING & CRISPR PLANTS

7.2 RESTRAINTS

7.2.1 HIGH COSTS ARE ASSOCIATED WITH THE MODERN BREEDING TECHNIQUES AS COMPARED TO CONVENTIONAL BREEDING TECHNIQUES

7.2.2 POTENTIAL HAZARD TO HUMAN HEALTH DUE TO UNDESIRED TOXIN GENERATED FROM CROPS PRODUCED BY BREEDING METHOD

7.3 OPPORTUNITIES

7.3.1 FLUCTUATING WEATHER CONDITIONS WILL INCREASE THE OPPORTUNITY FOR PLANT BREEDING & CRISPR TECHNIQUE

7.3.2 INCREASE IN NUMBER OF APPROVAL BY GOVERNMENTAL BODIES FOR PLANT BREEDING

7.4 CHALLENGE

7.4.1 UNORGANIZED RETAIL NETWORK

8 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 CONVENTIONAL BREEDING

8.2.1 HYBRIDIZATION

8.2.2 SELECTION

8.2.3 MUTATION BREEDING

8.3 BIOTECHNOLOGICAL METHOD

8.3.1 CELL AND TISSUE CULTURE

8.3.2 MOLECULAR MARKERS

8.3.3 PHENO TYPING

8.4 GENETIC ENGINEERING

8.4.1 RFLP

8.4.2 GENE TRANSFER

8.4.3 TRANSGENE EXPRESSION

8.4.4 SELECTION AND PLANT REGENERATION

9 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT

9.1 OVERVIEW

9.2 HERBICIDES TOLERANCE

9.3 YIELD IMPROVEMENT

9.4 DISEASE RESISTANCE

9.5 TEMPERATURE TOLERANCE

9.6 GRAIN SIZE IMPROVEMENT

9.7 STRESS TOLERANCE

9.8 DROUGHT RESISTANCE

9.9 OTHERS

10 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CEREAL & GRAINS

10.2.1 MAIZE

10.2.2 WHEAT

10.2.3 RICE

10.2.4 OATS

10.2.5 OTHERS

10.3 OILSEED & PULSES

10.3.1 SOYBEAN

10.3.2 SUNFLOWER

10.3.3 PEA

10.3.4 GRAM

10.3.5 OTHERS

10.4 FRUITS & VEGETABLES

10.4.1 BANANA

10.4.2 POTATO

10.4.3 TOMATO

10.4.4 APPLE

10.4.5 ORANGE

10.4.6 GRAPEFRUIT

10.4.7 BERRIES

10.4.8 CUCUMBERS

10.4.9 CARROTS

10.4.10 EGGPLANT

10.4.11 BROCCOLI

10.4.12 LEAFY GREEN

10.4.12.1 SPINACH

10.4.12.2 LETTUCE

10.4.12.3 CABBAGE

10.4.12.4 KALE

10.4.12.5 OTHERS

10.4.13 OTHERS

10.5 CASH CROPS

10.5.1 COFFEE & TEA

10.5.2 COTTON

10.5.3 SUGARCANE

10.5.4 OTHERS

10.6 TURF & ORNAMENTAL

10.7 HERBS AND MICROGREENS

10.7.1 HERBS

10.7.2 BASIL

10.7.3 WHEATGRASS

10.8 MEDICINAL CROP

10.9 OTHER CROP TYPES

11 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET, BY GEOGRAPHY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA PLANT BREEDING AND CSIPR PLANT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 BAYER AG

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 SYNGENTA CROP PROTECTION AG

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 CORTEVA (2021)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 LIMAGRAIN

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 KWS SAAT SE & CO. KGAA (2021)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 BASF SE

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 BENSON HILL INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BIOCERES CROP SOLUTIONS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 DLF

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 DONMARIO ( 2021)

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 INVIVO.( 2021)

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 PAIRWISE ( 2021)

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 PLANASA ( 2021)

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 RAGT (2021)

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 SAKATA SEED CORPORATION ( 2021)

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 STINE SEED COMPANY. (A SUBSIDIARY OF STINE SEED FARM, INC) (2021)

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 TMG TROPICAL IMPROVEMENT & GENETICS SA ( 2021)

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 TROPIC

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 UPL (2021)

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 YIELD10 BIOSCIENCE, INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 LABELING REQUIREMENTS FOR GMOS IN THE EUROPEAN UNION

TABLE 2 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA HERBICIDES TOLERANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA YIELD IMPROVEMENT IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DISEASE RESISTANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA TEMPERATURE TOLERANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA GRAIN SIZE IMPROVEMENT IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA STRESS TOLERANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DROUGHT RESISTANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA CEREALS & GRAINS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CEREALS & GRAINS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OILSEED & PULSES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OILSEEDS & PULSES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA FRUITS & VEGETABLES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA FRUITS & VEGETABLES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA LEAFY GREEN IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA CASH CROPS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA CASH CROPS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA TURF & ORNAMENTAL IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA HERBS AND MICROGREENS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA HERBS AND MICROGREENS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA MEDICINAL CROP IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA OTHER CROP TYPES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CEREAL & GRAIN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OILSEED & PULSES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA FRUITS & VEGETABLES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA LEAFY GREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA CASH CROPS IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA HERBS AND MICROGREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 U.S. PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.S. PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 51 U.S. PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 U.S. CEREAL & GRAIN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 U.S. OILSEED & PULSES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 U.S. FRUITS & VEGETABLES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 U.S. LEAFY GREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 U.S. CASH CROPS IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 U.S. HERBS AND MICROGREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 CANADA PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 CANADA CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 63 CANADA PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CANADA CEREAL & GRAIN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 CANADA OILSEED & PULSES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 CANADA FRUITS & VEGETABLES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 CANADA LEAFY GREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 CANADA CASH CROPS IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 CANADA HERBS AND MICROGREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 MEXICO PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 75 MEXICO PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 MEXICO CEREAL & GRAIN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 MEXICO OILSEED & PULSES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 MEXICO FRUITS & VEGETABLES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 MEXICO LEAFY GREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 MEXICO CASH CROPS IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 MEXICO HERBS AND MICROGREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: SEGMENTATION

FIGURE 11 INCREASING IMPORTANCE FOR SUSTAINABLE CROP PRODUCTION IS EXPECTED TO DRIVE THE NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 CONVENTIONAL BREEDING ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET IN 2022 & 2029

FIGURE 13 SOME OF THE FACTORS THAT AFFECT THE BUYING BEHAVIOR OF CONSUMERS BEFORE PURCHASING-

FIGURE 14 THE WORKFLOW MANUFACTURING PROCESS-

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE NORTH AMERICA ANT BREEDING & CRISPR PLANT MARKET

FIGURE 16 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET : BY TYPE, 2021

FIGURE 17 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET : BY TYPE, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET : BY TYPE, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET : BY TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET : BY TRAIT, 2021

FIGURE 21 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET : BY TRAIT, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET : BY TRAIT, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET : BY TRAIT, LIFELINE CURVE

FIGURE 24 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY APPLICATION, 2021

FIGURE 25 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY TYPE (2022-2029)

FIGURE 33 NORTH AMERICA PLANT BREEDING AND CSIPR PLANT MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.